Page added on April 4, 2018

The Problem with EIA Shale Gas and Tight Oil Forecasts

Each year the U.S. Energy Information Administration (EIA) produces forecasts of U.S. oil and gas production in its Annual Energy Outlook (AEO), which is widely viewed as an authoritative assessment of what to expect for future U.S. oil and gas output (the EIA prefers the term “projection” to “forecast”). The EIA’s reference case is considered as the most likely scenario by industry, policy makers, and the media.

Considering that AEO reference case forecasts for shale gas and tight oil production in recent releases are remarkably optimistic when considered at the play-level in terms of well productivity, decline rates and prospective areas, I find this baffling and worrisome. It’s one thing for industry to paint a rosy picture of future production, but something altogether different when a government agency—tasked with providing the American public with objective information—does it.

AEO2018, for example, projects that shale gas production will be 130% higher in 2050 than in 2016, while tight oil production will grow by 74%, all at relatively low prices. This despite the fact that average production from individual wells falls 70–90% in the first three years and entire fields would decline 20-40% a year if new wells weren’t constantly drilled.

I recently assessed the EIA’s AEO2017 forecasts and assumptions for all major shale gas and tight oil plays using a proprietary commercial database of well production data—a database that the EIA itself uses for its own analysis. The study revealed that the EIA has overestimated the likely future production of shale gas and tight oil for most plays by a wide margin. This is a result of overestimating the size of the prospective area and hence the number of wells that can be drilled, and underestimating future declines in well productivity. These declines in productivity are due to well interference (as sweet spots become saturated with wells) and from drilling lower quality rock outside of the limited sweet spot areas. The EIA’s estimates are also much higher than those of the U.S. Geological Survey and the University of Texas Bureau of Economic Geology.

If the AEO2018 reference case projections are compared to the EIA’s most recent assumptions of proven reserves plus unproven resources, tight oil production would extract 96% of remaining tight oil and shale gas production would extract 77% of remaining shale gas by 2050, even though unproven resources (which are 86% of remaining potential) have not been demonstrated to be economically recoverable and are based on unrealistically large estimates of productive area for most plays. Furthermore, as the EIA projections assume that production will be at much higher levels in 2050 than today, they imply that there are vastly more additional resources to be recovered after 2050 than suggested by the EIA’s own estimates. Indeed, in several plays the EIA’s projections assume that more than 100% of its estimates of proven reserves plus unproven resources will be recovered before 2050. In essence, the EIA is banking on recovering resources that do not exist according to its current best estimates.

In the weeks following the release of AEO2018, the EIA published a report on the methodology behind its projections. Using the Eagle Ford play as an example, this report provided a reasonable overview of the evolution of shale plays—from discovery to full development to infill drilling of sweet spots and moving on to lower quality rock outside of sweet spots. This part of the report built on an assessment done by the same author in 2014. To my knowledge, the Eagle Ford play is the only county level assessment the EIA has ever published.

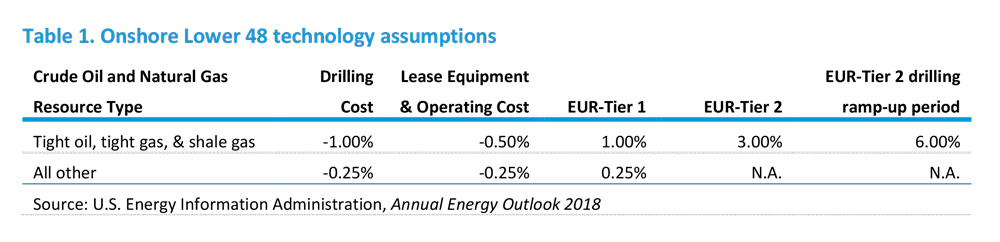

The report goes on, however, to dispel any confidence that the Eagle Ford example is actually how the EIA comes up with its projections. The EIA apparently assumes that the estimated ultimate recovery (EUR) of wells will continue to increase for the foreseeable future due to better technology, and that drilling and operating costs will decrease for the foreseeable future, given this table of assumptions of annual changes in costs and EURs from the report:

By overestimating prospective play areas and hence the number of available drilling locations, by assuming well EURs will continue to increase indefinitely, and by assuming drilling and operating costs will continue to fall, the EIA can come up with whatever forecast it wants. This is amply illustrated by the wild fluctuations from year to year in the EIA’s play-level forecasts pointed out in my study (the play-level forecasts are not published in the AEO—they are only provided if a special request is made to the EIA).

An example from AEO2018 is the Wolfcamp Play in the Permian Basin below. The EIA projects 148% more oil will be recovered in the AEO2018 projection than it projected in AEO2017, just one year earlier (22.1 billion barrels recovered by 2050 in AEO2018 compared to 8.9 billion barrels in AEO2017). This is 87% more oil than the total of Wolfcamp proven reserves plus unproven resources that the EIA estimated in 2017 (11.8 billion barrels).

How can this be? Most major shale plays have now been extensively drilled so the dimensions of the plays and location of sweet spots are well known. Over 400,000 wells have been drilled in the Permian Basin over many decades. Geology doesn’t change year to year and technology doesn’t improve at those rates over a single year (in fact average well productivity in 2017 declined in the Wolfcamp—see Figure 48).

Given an analysis of play fundamentals based on current drilling data, there is no credible basis for the highly to extremely optimistic forecasts offered by the EIA. Actual production is likely to be far less. Assuming the EIA forecasts are accurate in a long-term energy plan is likely to end very badly. And yet these forecasts are uncritically accepted by policy makers and the media, the consequences of which will be borne by all of us.

135 Comments on "The Problem with EIA Shale Gas and Tight Oil Forecasts"

Davy on Fri, 6th Apr 2018 5:29 am

“Trade Is A Matter Of Survival For China”

https://tinyurl.com/y823mq33

“Up to half of China’s investment is a complete waste. It does produce jobs and utilize inputs like cement, steel, copper and glass. But the finished product, whether a city, train station or sports arena, is often a white elephant that will remain unused. What’s worse is that these white elephants are being financed with debt that can never be repaid. And no allowance has been made for the maintenance that will be needed to keep these white elephants in usable form if demand does rise in the future, which is doubtful. Chinese growth has been reported in recent years as 6.5–10% but is actually closer to 5% or lower once an adjustment is made for the waste. The Chinese landscape is littered with “ghost cities” that have resulted from China’s wasted investment and flawed development model. This wasted infrastructure spending is the beginning of the debt disaster that is coming soon. China is on the horns of a dilemma with no good way out. On the one hand, China has driven growth for the past eight years with excessive credit, wasted infrastructure investment and Ponzi schemes. The Chinese leadership knows this, but they had to keep the growth machine in high gear to create jobs for millions of migrants coming from the countryside to the city and to maintain jobs for the millions more already in the cities. The Communist Chinese leadership knew that a day of reckoning would come. The two ways to get rid of debt are deflation (which results in write-offs, bankruptcies and unemployment) or inflation (which results in theft of purchasing power, similar to a tax increase). Both alternatives are unacceptable to the Communists because they lack the political legitimacy to endure either unemployment or inflation. Either policy would cause social unrest and unleash revolutionary potential.”

“Instead of these unpalatable extremes, the Chinese leadership is trying to steer a middle course with gradual financial reform and gradual limits on shadow banking. I’ve previously predicted that this gradual policy would not work because the credit situation is so extreme that even modest reform would slow the economy too fast for comfort. That’s exactly what has happened. China has already flip-flopped and is easing up on financial reform. That works in the short run but just makes the credit bubble worse in the long run. China may soon resort to a combination of a debt cleanup and a maxi-devaluation of their currency to export the resulting deflation to the rest of the world. It is probably the best way to avoid the social unrest that terrifies China. When that happens, possibly later this year in response to Trump’s trade war, the effects will not be confined to China. A shock yuan maxi-devaluation will be the shot heard round the world as it was in August and December 2015 (both times, U.S. stocks fell over 10% in a matter of weeks). I hope President Trump knows what he’s getting into.”

MASTERMIND on Fri, 6th Apr 2018 5:44 am

his site tracks Trump’s golfing in real time. And shows how much it costs and compares it to Obama. lol

Trump’s golf count

http://www.trumpgolfcount.com/#services

“I’m going to be working for you. I’m not going to have time to go play golf.”

–Donald J. Trump, August, 2016

Davy on Fri, 6th Apr 2018 6:09 am

“Russians protest over ‘toxic’ landfill near Moscow”

https://tinyurl.com/y8rojsl4

“The crisis of rubbish landfill in the Moscow region has led the authorities in one town to declare “high alert” and hand out gas masks and respirators to local people.The Russian capital has no recycling programme and its expanding rubbish landfills are causing health problems to residents of many towns.”

Reporter: Nataliya Zotova

Producer: Dina Demrdash

Boat on Fri, 6th Apr 2018 10:07 am

Mm

A good relevant link with up to date stats. I am proud of you. Every 4.5 days. How does the cheeto find the time to be such an idiot. Lol

fmr-paultard on Fri, 6th Apr 2018 11:12 am

^mm^ why don’t you mention demise of traditionalist worker party? just tossing more info your way so you have more work.

work is good.

more work, less attention to luke 22:36 on your part. win-win

GregT on Fri, 6th Apr 2018 11:29 am

“Get yourself a real job, and pay off your debt.”

“Hypocrite”

I’ve never had a more real job Davy, and not only do I have zero debt, I pay other people to work for me.

Davy on Fri, 6th Apr 2018 11:36 am

greggie, this was my actual comment which is valid.

“Get yourself a real job”

Hypocrite

You need a job. You need something to do you are growing more dysfunctional by the day.

We know you want to make sure everyone is aware you have no debt. Quit playing with comments in a dishonest way.

GregT on Fri, 6th Apr 2018 11:48 am

My original comment Davy, which you quoted out of context, was : “Get yourself a real job, and pay off your debt.”

Davy on Fri, 6th Apr 2018 11:49 am

demonstrating sliminess is more like the context.

GregT on Fri, 6th Apr 2018 11:53 am

You’re projecting again Davy.

MASTERMIND on Fri, 6th Apr 2018 2:22 pm

Boat

Here is some data for you, MM manifesto!

https://imgur.com/a/pYxKa

I am hitting autism levels that shouldn’t even be possible! I am like the collapse rainman!

GregT on Fri, 6th Apr 2018 2:49 pm

You’re a legend in your own mind MM.

If you were my kid, I’d take your internet away, and make you clean up your bedroom..

fmr-paultard on Fri, 6th Apr 2018 2:57 pm

^mm^ don’t grab luke 22:36 bro, please.

Carl Sagan was promoted like some tard who died recently who sits in a room of 4 walls and claim to know the universe LOL.

he thinks time is a fundamental property of nature. Really? so in ancient time if people measure time they were doing physics? And now atomic clock just improves on the precision measurement of this property?

Which experiment was conducted to discover this property of nature? ZERO, NONE.

I know this argument doens’t make me a supertard or useful …but one wouldn’t expect this from the smartest person who just passed away?

MASTERMIND on Fri, 6th Apr 2018 3:00 pm

Greg

Ridicule is the tribute paid to the genius by the mediocrities.

-Oscar Wilde

Cloggie on Fri, 6th Apr 2018 3:20 pm

We don’t call him Billy 3rd world for nothing!

Nobody calls mak “Billy 3rd world”, other than you, meathead.

Skip the “we”.

Davy on Fri, 6th Apr 2018 3:33 pm

We call you dumb and Dutch becuase you live in a fantasy world.

Davy on Fri, 6th Apr 2018 3:37 pm

Dumb n Dutch, are you pissed because I proved you wrong on the gold back petroyuan? Yea, just another dumb n Dutch fake news story crushed.

MASTERMIND on Fri, 6th Apr 2018 3:53 pm

A Cafe In This City Will Soon Serve Cannabis-Infused Lattes

https://hightimes.com/news/cafe-serve-cannabis-infused-lattes/

makati1 on Fri, 6th Apr 2018 5:59 pm

Cloggie, the Missouri mule likes to think he is someone important. Delusions of grandeur. just another symptom of his illness. Ignore.

Davy on Fri, 6th Apr 2018 6:25 pm

billy 3rd world, spit it out, is there a gold back petroyuan?

GregT on Fri, 6th Apr 2018 6:38 pm

“Ridicule is the tribute paid to the genius by the mediocrities.

-Oscar Wilde”

Great quote MM, but it wasn’t ridicule. I was dead serious.

GregT on Fri, 6th Apr 2018 6:46 pm

“Dumb n Dutch, are you pissed because I proved you wrong on the gold back petroyuan?”

I believe you have Cloggie and Makati1 mixed up with BobInget, Davy.

Not the least bit surprising. You come across as being more than just a little bit confused most of the time.

Davy on Fri, 6th Apr 2018 7:04 pm

nope, greggie, they both followed on with bumbling bob’s statement of a gold backed petroyuan. You saw it too you are just being your normal slimy self.

MASTERMIND on Fri, 6th Apr 2018 7:06 pm

Greg

Look at the second to last chart! That is how the collapse will look..It will be fast and it will be hard!

https://imgur.com/a/pYxKa

MASTERMIND on Fri, 6th Apr 2018 7:19 pm

Government Intervention is triggered by a Keynesian belief that aggregate demand can be increased by lower interest rates and by increasing government deficits thereby somehow spurring economic growth. Debt grows faster than income growth and eventually has to be restructured, i.e., everyone loses in the end. Since 2007, global debt has grown by US$57 trillion and it’s had disastrous results. Greece, Detroit, Puerto Richo, Venezuela are just the beginning of this trend. Soon, it will be followed by larger countries like China and United States.

https://www.perchingtree.com/return-of-great-depression/

https://imgur.com/a/pYxKa

makati1 on Fri, 6th Apr 2018 7:37 pm

I referenced five sources of info on the gold backed petroyuan. You chose to ignore them so why bother? The Us is going down. The only unknown is how soon. Some give it five years. I say before 2020. We shall see.

Must be frustrating to be trapped in a devolving nation, headed for 3rd world level, or worse. I’m outside the box/gulag. You are not. Who is most free? LMAO

MASTERMIND on Fri, 6th Apr 2018 8:06 pm

Suppose now that you inherited $1 billion, and that you spent $1000 every day. It would take you more than 2700 years to run through your inheritance.

MASTERMIND on Fri, 6th Apr 2018 8:15 pm

Lusting After Armageddon

https://thereader.com/film/ClimateChangeMovies/

GregT on Fri, 6th Apr 2018 8:41 pm

“Look at the second to last chart! That is how the collapse will look..It will be fast and it will be hard!”

You obviously have way too much free time on your hands MM.

GregT on Fri, 6th Apr 2018 8:52 pm

“You saw it too you are just being your normal slimy self.”

More paranoid delusions Davy. If I had of seen that, I wouldn’t have typed what I did.

Cloggie on Sat, 7th Apr 2018 2:48 am

Lusting After Armageddon

That’s you alright.

I believe you have Cloggie and Makati1 mixed up with BobInget, Davy.

Nah, he was asking for references after Bob had referred to the “gold-backed yuan”, as meathead he is too lazy too look it up himself, so I gave in to the Albert Schweitzer in me and handed a link over to him as a sort of “development aid to poor whites in Missouri”.

In reality you can find sources that claim that the yuan is “gold-backed” and there are others that claim it is all fake.

I don’t care one way or the other.

https://mises.org/wire/what-gold-backed-yuan-and-cryptocurrencies-may-mean-dollar

I know that the American libertarian “right” (“sound currency for brown people”) makes a big deal out of fiat currencies and gold. Just to live up to my “national-socialist” reputation.lol… I believe more in the productive capacity of a nation (may I say “Volk”?) and have no problems with fiat money, as long as there is a sort of disciplined German-style independent central bank, issuing money at a rate that keeps inflation under 2%. No need for gold-backing.

US 10 year negative trade record:

https://tradingeconomics.com/united-states/balance-of-trade

This and demographics (strongly interconnected) is what could really collapse the US economy… and society… and empire.

Cloggie on Sat, 7th Apr 2018 3:02 am

This is what really counts:

http://www.spiegel.de/wirtschaft/soziales/deutschland-staatsverschuldung-sinkt-2019-unter-60-prozent-a-1201557.html

In 2019 German public debt under 60% GDP (official EU “Maastricht” criterium). Direct consequence booming economy in Europe.

https://de.statista.com/statistik/daten/studie/163692/umfrage/staatsverschuldung-in-der-eu-in-prozent-des-bruttoinlandsprodukts/

EU 82%

France 98%

Holland 57%

US 105%

https://tradingeconomics.com/united-states/government-debt-to-gdp

makati1 on Sat, 7th Apr 2018 3:22 am

Cloggie, I might add: Debt to GDP – WIKI

China – 57% IMF 2016

Russia – 11% IMF 2016

Philippines 42% CIA 2016

US 2017 = 108% – Statista

David on Sat, 7th Apr 2018 6:41 am

“In reality you can find sources that claim that the yuan is “gold-backed” and there are others that claim it is all fake. I don’t care one way or the other.”

Exactly dumb n Dutch because what you do is strictly propaganda related not reality related. You have little understanding of economics or finance so you will default to whatever is the most anti-American and fits your Eurotard agenda. The truth matters little to an extremist Nazi. This is a perfect character of how you operate, “I don’t care one way or the other” It is an example of how you lie, distort and embellish. You are a disgusting lying Nazi.

Davy on Sat, 7th Apr 2018 6:51 am

Dumb n dutch you forgot to consider all this debt in your rosy Eurotard presentation:

“ECB Finds €10 Billion In European Bank Loan “Miscalculations”

https://tinyurl.com/ybey7ffo

“By now it is, or should be, well-understood that the biggest deflationary virus at the heart of the European financial system is the ~€1 trillion mountain of bad loans (of which which over €230 billion is found in Germany and France) and which casts a giant shadow both over Europe and the ECB whose president is well aware that without the central bank’s bid, the liquidity and confidence vortex that is this massive monetary black hole, will promptly drag Europe’s economy back into depression. Well, as of today one can make it $1 trillion and €10 billion, because in a report published by the European Central Bank today, it announced its inspectors had found “shortcomings and miscalculations” worth more than €10 billion when going through euro zone banks’ loan books last year. Not surprisingly – after all the stinking pile of bad debt is arguably the biggest threat facing the European financial system once QE and NIRP is over – the ECB’s annual report showed some banks were found to be deficient in the way they identify problem customers and loans, set aside provisions and choose when to grant credit according to Reuters. In other words “some banks” lied about pretty much everything.”