Page added on April 4, 2018

The Problem with EIA Shale Gas and Tight Oil Forecasts

Each year the U.S. Energy Information Administration (EIA) produces forecasts of U.S. oil and gas production in its Annual Energy Outlook (AEO), which is widely viewed as an authoritative assessment of what to expect for future U.S. oil and gas output (the EIA prefers the term “projection” to “forecast”). The EIA’s reference case is considered as the most likely scenario by industry, policy makers, and the media.

Considering that AEO reference case forecasts for shale gas and tight oil production in recent releases are remarkably optimistic when considered at the play-level in terms of well productivity, decline rates and prospective areas, I find this baffling and worrisome. It’s one thing for industry to paint a rosy picture of future production, but something altogether different when a government agency—tasked with providing the American public with objective information—does it.

AEO2018, for example, projects that shale gas production will be 130% higher in 2050 than in 2016, while tight oil production will grow by 74%, all at relatively low prices. This despite the fact that average production from individual wells falls 70–90% in the first three years and entire fields would decline 20-40% a year if new wells weren’t constantly drilled.

I recently assessed the EIA’s AEO2017 forecasts and assumptions for all major shale gas and tight oil plays using a proprietary commercial database of well production data—a database that the EIA itself uses for its own analysis. The study revealed that the EIA has overestimated the likely future production of shale gas and tight oil for most plays by a wide margin. This is a result of overestimating the size of the prospective area and hence the number of wells that can be drilled, and underestimating future declines in well productivity. These declines in productivity are due to well interference (as sweet spots become saturated with wells) and from drilling lower quality rock outside of the limited sweet spot areas. The EIA’s estimates are also much higher than those of the U.S. Geological Survey and the University of Texas Bureau of Economic Geology.

If the AEO2018 reference case projections are compared to the EIA’s most recent assumptions of proven reserves plus unproven resources, tight oil production would extract 96% of remaining tight oil and shale gas production would extract 77% of remaining shale gas by 2050, even though unproven resources (which are 86% of remaining potential) have not been demonstrated to be economically recoverable and are based on unrealistically large estimates of productive area for most plays. Furthermore, as the EIA projections assume that production will be at much higher levels in 2050 than today, they imply that there are vastly more additional resources to be recovered after 2050 than suggested by the EIA’s own estimates. Indeed, in several plays the EIA’s projections assume that more than 100% of its estimates of proven reserves plus unproven resources will be recovered before 2050. In essence, the EIA is banking on recovering resources that do not exist according to its current best estimates.

In the weeks following the release of AEO2018, the EIA published a report on the methodology behind its projections. Using the Eagle Ford play as an example, this report provided a reasonable overview of the evolution of shale plays—from discovery to full development to infill drilling of sweet spots and moving on to lower quality rock outside of sweet spots. This part of the report built on an assessment done by the same author in 2014. To my knowledge, the Eagle Ford play is the only county level assessment the EIA has ever published.

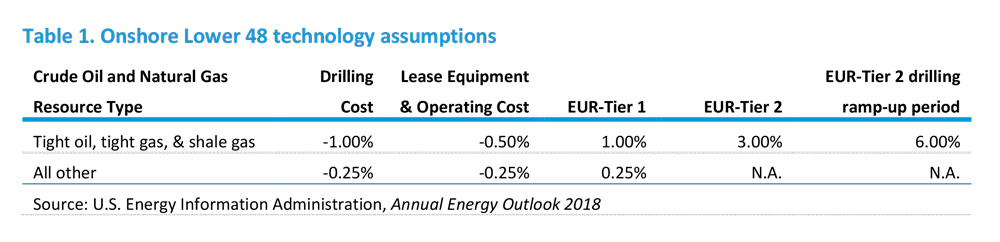

The report goes on, however, to dispel any confidence that the Eagle Ford example is actually how the EIA comes up with its projections. The EIA apparently assumes that the estimated ultimate recovery (EUR) of wells will continue to increase for the foreseeable future due to better technology, and that drilling and operating costs will decrease for the foreseeable future, given this table of assumptions of annual changes in costs and EURs from the report:

By overestimating prospective play areas and hence the number of available drilling locations, by assuming well EURs will continue to increase indefinitely, and by assuming drilling and operating costs will continue to fall, the EIA can come up with whatever forecast it wants. This is amply illustrated by the wild fluctuations from year to year in the EIA’s play-level forecasts pointed out in my study (the play-level forecasts are not published in the AEO—they are only provided if a special request is made to the EIA).

An example from AEO2018 is the Wolfcamp Play in the Permian Basin below. The EIA projects 148% more oil will be recovered in the AEO2018 projection than it projected in AEO2017, just one year earlier (22.1 billion barrels recovered by 2050 in AEO2018 compared to 8.9 billion barrels in AEO2017). This is 87% more oil than the total of Wolfcamp proven reserves plus unproven resources that the EIA estimated in 2017 (11.8 billion barrels).

How can this be? Most major shale plays have now been extensively drilled so the dimensions of the plays and location of sweet spots are well known. Over 400,000 wells have been drilled in the Permian Basin over many decades. Geology doesn’t change year to year and technology doesn’t improve at those rates over a single year (in fact average well productivity in 2017 declined in the Wolfcamp—see Figure 48).

Given an analysis of play fundamentals based on current drilling data, there is no credible basis for the highly to extremely optimistic forecasts offered by the EIA. Actual production is likely to be far less. Assuming the EIA forecasts are accurate in a long-term energy plan is likely to end very badly. And yet these forecasts are uncritically accepted by policy makers and the media, the consequences of which will be borne by all of us.

135 Comments on "The Problem with EIA Shale Gas and Tight Oil Forecasts"

Plantagenet on Wed, 4th Apr 2018 2:31 pm

EIA forecasts in the past have mostly been wrong. The current EIA forecast predicting decades of growth in tight oil shale production will almost certainly also be wrong.

Cheers!

adamb on Wed, 4th Apr 2018 3:56 pm

And when it comes to the shale revolution, overly pessimistic. The idea that they are now coming close, predicting when the US becomes a net exports of natural gas and such, is not only encouraging, but better than any peaker that ever lived!

Outcast_Searcher on Wed, 4th Apr 2018 4:13 pm

The “problem”, of course, is that such forecasts aren’t what pessimists want to hear.

rockman on Wed, 4th Apr 2018 5:09 pm

No one’s forecast into the future is worth a crap. NO ONE’S. And for a very easy to understand reason: no one’s forecast of oil prices decades into the future is worth a crap. NO ONE’S.

Same story repeated one more time: had oil prices not boomed the shales would not have boomed. The tech existed as well as the knowledge of the oil in the shales long before the boom. And when prices collapsed so di the count.

Again the math is butt simple: the shale will be a direct function of the rig count. And the rig count (as was proven over the last 10 years) will be a function of the oil price.

And no one, NO ONE, has ever been able to CONSISTANTLY been able to correctly predict the long term price of oil. The best anyone (EIA, etc) can do is predict that IF the price of oil is $X/bbl then the rig count will increase to Y and oil will increase to Z bopd. But even the accuracy of that prediction will have to take into account potential geologic limittions.

Anonymouse1 on Wed, 4th Apr 2018 5:24 pm

In 2050, I predict plantatard will still continue to attribute anything that happens in his retard world, to someone called ‘obama’. No matter how trivial, banal, or just plain stupid, whatever little nuggets of wisdom plantadope deems worthy of sharing, its ultimate cause, the prime mover as it were, will always be ‘obama.’

That is a good prediction, and it is worth a crap. I have consistently, and correctly predicted that the dumbass plantatard, will always blame ‘obama’ in all instances regardless of whether that happens to be remotely true, or even relevant. I even predicted this would be the case long after a new figure-head in chief ass started warming the ceremonial WH throne.

MASTERMIND on Wed, 4th Apr 2018 7:12 pm

,

MASTERMIND on Wed, 4th Apr 2018 7:13 pm

The Collapse of Civilization Manifesto

https://imgur.com/a/pYxKa

Irrefutable!

MASTERMIND on Wed, 4th Apr 2018 11:26 pm

UN Population Division Immigration Replacement Plan for US, Europe, and Japan.

https://imgur.com/a/6Vr7P

Sorry Whitey you are being replaced! LOL

Anonymous on Wed, 4th Apr 2018 11:55 pm

David, David, David. You’ve been wrong often in the past.

*2006 peak gas call.

*2014 peak Marcellus call.

*Your 2011 shale critique of EIA (you scoffed at their projctions for 2030, which were eclipsed by 2014!).

*Your 2014 report ignoring the Utica (not in document) and putting the Permian down (less important than EF or Bakken) and ignoring the Anadarko (SCOOP/STACK).

Cloggie on Thu, 5th Apr 2018 12:29 am

Better late than never: US to build fleet of jack-up vessels for offshore wind farm projects of 10-12 MW turbines:

https://www.offshorewind.biz/2018/04/04/us-om-firm-launches-offshore-wind-foray/

GregT on Thu, 5th Apr 2018 1:31 am

“David, David, David. You’ve been wrong often in the past.”

Nony, Nony, Nony. It isn’t in your best interests, from a survivability standpoint, to keep cheerleading fossil fuels.

Short term gain, for medium to long term extreme pain and suffering, and very likely premature death.

Davy on Thu, 5th Apr 2018 4:16 am

“Short term gain, for medium to long term extreme pain and suffering, and very likely premature death.”

Stay on topic, this about the validity of the article. Nony is expressing a point that many of us doomers were wrong on and he was right. Don’t cloud the issues with your emotional positions.

Davy on Thu, 5th Apr 2018 4:17 am

“Better late than never:”

neder, I thought the US couldn’t compete with the Europeans? I imagine the US will do it cheaper and more cost effective without government support.

Davy on Thu, 5th Apr 2018 4:52 am

Underwater shale deposits that one should wonders if it is economic or not.

“Bahrain Discovers Largest Oil Field With 80 Billion Barrels In Reserves”

https://tinyurl.com/y7q6h6ra

“Bahrain officials have revealed that the tiny gulf kingdom has discovered some 80 billion barrels of shale (otherwise known as tight) oil – the kingdom’s largest oil and gas find ever. The field also discovered 14 trillion cubic feet of natural gas beneath an existing field.”

“The oil fields were discovered in the offshore Khalij al-Bahrain Basin, which covers some 770 square miles in the shallow waters off Bahrain’s west coast.”

deadly on Thu, 5th Apr 2018 4:58 am

If you keep track of the number of active rigs, you can total the number of wells drilled and completed.

Not that difficult to make a reasonable projection from there.

If there are no wells drilled, you will have zero production.

If you drill one well and strike oil, then it gushes one hundred thousand barrels per day for a month, you’ll have some oil.

You’ll also have a mess to clean up, so you will be busy collecting the pooling oil.

If it still is gushing oil after a month’s time, you will be hauling it away with pipelines.

Don’t have to use the oil, you can let it just sit there. Unused energy is not wasted if it hasn’t been expended.

What good will that do? Making projections of how much oil is being pooled and unused will be easy. The amount will continue to increase all of the time.

Of course, that isn’t done, everybody uses oil.

You can make projections with the knowledge of how much is used, burned, products, and those can work.

Drilling has to continue and wells that have oil is a must.

If there was no use for oil, nobody would want to do anything about oil.

As it is, oil does a lot of work and work that will be next to impossible without oil to make it all go.

Without those hundred million barrels of oil and twenty million metric tons of coal consumed each day, the wheels of industry will stop, grind to a halt.

Fossil fuels contain usable energy in dense forms and their use will continue far into the future.

Easy to project that, how much doesn’t really matter as long as it is there, not too much to worry about.

No oil in the crankcase, you’ll have a problem. No fuel in the tank, you go nowhere fast.

You can knock oil all you want, beat it down hard, however, once it is gone and can’t be had, a plethora of problems will begin.

It’ll be time to drink by then, so there is hope. lol

Davy on Thu, 5th Apr 2018 5:18 am

Most of us still feel a habituation of an average yearly economic growth with a faint recollection of a 08 crisis. Much of what is happening now has this new normal economy as its basis. The renewable revolution and shale oil and gas are two that come quickly to mind. These are economic driven activity. They must have a strong economy to be realized. It is hard to understand the economy anymore since all the changes following the 08 crisis but one thing is certain anytime a system of such size is micro managed we can expect eventually mistakes. We can expect cycling and it is this cycling that is very dangerous for the current system that has developed as circumstanced present themselves. What central are doing is not proven. It comes down to confidence of very few players plus the bread and circus of the masses. Does that sound healthy? We may be on the cusp of change and not the change the techno optimist like to paint. Maybe this can go on for some time and I hope it will because life is going to be rough for everyone once a global economy unravels.

“Playing For All The Marbles”

https://tinyurl.com/yax6l52n

“Global Plunge Protection Teams must be ordering take-out food; every night is a long one now. The current stocks/bonds game is for all the marbles, by which I mean the status quo now depends on valuations and interest rates remaining near their current levels for the system to function.”

“Let’s scan a few relevant charts to understand why this game is for all the marbles. Given the systemic fragility of the global economy, a crash in one asset class or a rise in interest rates trigger defaults, sell-offs, etc. that forcibly revalue other assets. So the Powers That Be can’t afford to let any asset crash, as a crash will bring down the entire system. Why is this so? The resiliency of the system has been eroded by permanent central bank/central state intervention/stimulus. Withdrawing the stimulus means markets have to go cold turkey, and they’ve lost the ability to do so. Permanent stimulus creates dependencies and distortions, and both the distortions and the dependencies introduce a host of unintended consequences. What’s the “market price” of assets? You must be joking: the “market” prices assets based on policies of permanent stimulus and asset purchases by central banks. In effect, markets have been hijacked to function as signaling mechanisms (everything’s great because your IRA account balance keeps going up) and as floors supporting pensions, insurance companies, IRAs/401Ks, etc.: all these financial promises are only plausible if asset valuations keep rising.”

twocats on Thu, 5th Apr 2018 8:54 am

Exactly Davy – you can disregard most of the other comments – yours is the primary important one. all other issues are second.

i think most people did not believe the global economic system could be so distorted in such a coordinated fashion for even a little while let alone a decade – but that’s what we’ve gotten. It gave us The Glut (trademark Planturd), its given us Lower for Longer, Bitcoin, BC. This is on top of a completely digitized world that has accelerated existing corruption to the core: Big Pharma, Gerrymandering, HFT, MSM, and on and on.

It’s wobbling a bit now – Playing for all the Marbles. Will it stabilize for a bit longer? Peak Oil and Climate Chaos never rest – festering up issues left and right into the foreseeable future.

GregT on Thu, 5th Apr 2018 11:17 am

“Maybe this can go on for some time and I hope it will because life is going to be rough for everyone once a global economy unravels.”

Not everyone in the world is as tied into the ‘economy’ as we are in the west, and the longer the facade is maintained, the rougher life will become, especially for those of us who are entirely dependant on the drive, shop, consume lifestyle.

GregT on Thu, 5th Apr 2018 11:18 am

And, IMA, JIT delivery systems.

Davy on Thu, 5th Apr 2018 12:11 pm

Sure greggie, overpopulation doesn’t matter. Lol,

GregT on Thu, 5th Apr 2018 12:38 pm

“Sure greggie, overpopulation doesn’t matter. Lol,”

Sorry Davy, but overpopulation does matter. The longer we keep adding another 83 million people to the planet each and every year, the bigger the eventual die off will be. Up to, and very likely including, a global mass extinction event.

It isn’t exactly something to be laughing about.

Cloggie on Thu, 5th Apr 2018 12:43 pm

neder, I thought the US couldn’t compete with the Europeans? I imagine the US will do it cheaper and more cost effective without government support.

They can’t, they are lagging behind in almost every field.

Why do you think Trump began a trade war? Because he no longer can compete on world markets.

Europe has 300 or more offshore installation vessels.

http://www.4coffshore.com/windfarms/vessels.aspx

The US will never catch up with that. Besides, Europe has far more opportunity for offshore wind: superb wind conditions plus shallow water of the North Sea, Irish Sea and Baltic, 600,000 km2 in total, enough to supply the entire EU three times over with electricity.

And what do you mean “government support”? Developers are lining up to do it “for free”, provided they get the right to sell their kWh’s onshore. Wind is already the cheapest form of electricity in Europe and as soon as the oil prices will climb again (peak conventional oil), expect all these over-funded pension companies to line up to fund one profitable offshore wind farm after the other. And the more expensive oil will get, the faster the transition will be completed.

fmr-paultard on Thu, 5th Apr 2018 12:54 pm

we’re doomed no matter what. just yesterday eurotard’s PMBB “confederation” just grew out to include Turkey/Syria/Iran! It just keeps metasizing.

Davy on Thu, 5th Apr 2018 1:05 pm

Neder, how much more aggregate renewables does the EU have compared to the US? Pretty close wouldn’t you agree, so US will never catch up with that?

Davy on Thu, 5th Apr 2018 1:07 pm

Neder, you do realize Norway has a population of a large city, so bragging about their EV purchases is not what it appears.

Cloggie on Thu, 5th Apr 2018 2:34 pm

“Neder, you do realize Norway has a population of a large city, so bragging about their EV purchases is not what it appears.”

Norway has a comparable per capita income. The US is too much concerned with false priorities, like trying to subjugate the entire world… with a third world population.lol

The US could, but doesn’t want to be a “green frontrunner”. It doesn’t matter, the US is yesterday’s snow.

Cloggie on Thu, 5th Apr 2018 2:39 pm

“Neder, how much more aggregate renewables does the EU have compared to the US? Pretty close wouldn’t you agree, so US will never catch up with that?”

I was talking about offshore business, where Europe has a clear global lead.

https://deepresource.wordpress.com/?s=europe+offshore

Davy on Thu, 5th Apr 2018 3:02 pm

Neder, the US does not want to be green? Got any references because I am pretty sure I am more green than you and many others. So you are saying all Americans or are you just being extreme as usual?

GregT on Thu, 5th Apr 2018 3:14 pm

“Got any references because I am pretty sure I am more green than you and many others.”

You are not the US Davy.

The U.S. Is the Biggest Carbon Polluter in History. It Just Walked Away From the Paris Climate Deal.

The United States has emitted more planet-warming carbon dioxide into the atmosphere than any other country. Now it is walking back a promise to lower emissions.

https://www.nytimes.com/2017/06/01/world/europe/climate-paris-agreement-trump-china.html

Cloggie on Thu, 5th Apr 2018 3:16 pm

“Neder, the US does not want to be green? Got any references because I am pretty sure I am more green than you and many others. So you are saying all Americans or are you just being extreme as usual?”

I’m obviously refering to the US government:

https://www.independent.co.uk/news/world/middle-east/syria-paris-agreement-us-climate-change-donald-trump-world-country-accord-a8041996.html

Already sold your private plane?

GregT on Thu, 5th Apr 2018 3:27 pm

“Already sold your private plane?”

Jet.

Davy on Thu, 5th Apr 2018 3:40 pm

Greggie, China is the biggest emitter, you should know that.

Davy on Thu, 5th Apr 2018 3:44 pm

Thank you neder for clarifying your exaggeration. You have to be watched closely you are so worried about victory you make big claims that push the limit of honesty.

BTW, I sold my private plane,!Cessna 150, in 1996.

GregT on Thu, 5th Apr 2018 3:54 pm

The linked article was from the New York Times Davy. You should know that. You should also know that we in the west, especially the U.S. of A, are exporting our emissions to China.

Davy on Thu, 5th Apr 2018 3:58 pm

Greggie, the Chinese are adults. They could say no but instead they are busy getting rich. You know that don’t you?

Davy on Thu, 5th Apr 2018 4:01 pm

Greggie, NYT, I thought you didn’t source US MSM for references. I get it, unless, the article suits your agenda.

GregT on Thu, 5th Apr 2018 4:27 pm

If it wasn’t for big U.S. Corporations, offshoring production for greater profits, our economies would already be toast Davy.

Davy on Thu, 5th Apr 2018 4:34 pm

No they didn’t greggie. Where did you get that idea from? Your buddy neder days Europe is the world’s economic powerhouse. They did it greggie. Get your facts right..

GregT on Thu, 5th Apr 2018 4:35 pm

“, NYT, I thought you didn’t source US MSM for references. I get it, unless, the article suits your agenda.”

My agenda is for the world to reduce emissions ASAP Davy. The U.S. pulled out of the Paris Accords. That does not jive with my agenda. And Davy, honestly buddy, does it really matter where the article came from? The entire world is aware that the U.S. is the largest contributor to accumulative CO2 emissions globally, and that the U.S. and Nicaragua are the only two nations who have abstained from the Paris Accords.

GregT on Thu, 5th Apr 2018 4:38 pm

“No they didn’t greggie. Where did you get that idea from? Your buddy neder days Europe is the world’s economic powerhouse”

Now you’re just acting childish again Davy.

Davy on Thu, 5th Apr 2018 5:14 pm

Greggie, quit being simple. I think everyone here is well aware of the co2 situation so don’t bore us. China is the largest emitter you will agree?

You are always harping on sources like NYT but using them. What is the deal? Hypocrite?

Davy on Thu, 5th Apr 2018 5:18 pm

Greggie, your wrong about our economies being toast without offshoring. Our economies are toast today because of offshoring. You wouldn’t understand that because your agenda gets in the way.

makati1 on Thu, 5th Apr 2018 5:29 pm

Davy reverts to immaturity and delusions when he knows he cannot win the debate. The Us wastes over 24% of the world’s resources which is proof that it is also the largest polluter by far.

Not one water source in the Us is not polluted in some way. Not one, if they were tested thoroughly.

Their food is all chemically contaminated/GMO’d/medicated. The air they breath is full of carcinogens from unregulated corporations, old vehicle exhausts, burning sofas (lol), etc.

The Us panicked when China mentioned not allowing the Us to send its trash there to be “recycled”. Now the Us may have to deal with the 250+ million tons of stuff it wastes annually, in house.

Most of the Us population is drugged in one way or another, dumbed down, obese, socially distracted, deep in debt, and immature. Third world in so many ways. And most of them don’t even realize it …yet. Goeebels would be proud of the sucess of the Us’ propaganda system against it’s own people. It is truly Number One in that area. lol

The Us is drowning in shit so many ways…

GregT on Thu, 5th Apr 2018 5:29 pm

Our economies are going down the shitter Davy, mainly because of FIAT currencies, created out of thin air, loaned into existence, with interest attached.

GregT on Thu, 5th Apr 2018 5:33 pm

“China is the largest emitter you will agree?”

I have already answered that question. We in the west, are offshoring our emissions and industrial pollution to China.

“You are always harping on sources like NYT but using them. What is the deal? Hypocrite?”

Grow up Davy.

Davy on Thu, 5th Apr 2018 5:40 pm

Sorry, greggie, it is not becuase fiat currencies. It is for many reasons deeper than currencies. Quit being a simpleton greggie.

Cloggie on Thu, 5th Apr 2018 5:45 pm

Some real data to put things in perspective regarding emissions EU-US-East Asia:

https://goo.gl/images/hM61Yu

Note that the EU is 500 m, US 330 m, East Asia 1.4 b+

Europe maxed in 1978, the US in 2007 (Lehman-thingy). Asia wants to have its cake and eat it too. They suffer the most from their polution but at the same time want to catch up with the West.

Western Europe needs half of the amount of energy the US or China need to generate a million buck:

https://deepresource.wordpress.com/2014/10/04/energy-efficiency-country-ranking/

For us the transition is far easier to accomplish then elsewhere. Twice as easy. With two fingers in the nose, so to speak:

https://goo.gl/images/5EFxAt

makati1 on Thu, 5th Apr 2018 5:52 pm

Greg, Davy never has any reputable sources for his immature denials. Why? because there are none. There is no defense of the Us actions or situation. None.

Fiat is the major underlying cause of ALL of the Us ills today. Toilet paper money for a shithole country. Fits perfectly.

GregT on Thu, 5th Apr 2018 6:02 pm

“Sorry, greggie, it is not becuase fiat currencies.”

No reason to apologize Davy, it isn’t your fault that something so simple, is beyond your ability to grasp. It’s likely due to genetics.

Davy on Thu, 5th Apr 2018 6:13 pm

It doesn’t work that way neder. You have played this game before. You can’t equate making money to onl efficiency.