Page added on September 7, 2017

The Shale Party Is Going To End Badly Google Alert

Summary

Despite Wall Street’s love for shale, the industry has not been able to support itself through internal cash generation.

If Wall Street’s love affair with shale fades, the party is over and production levels will implode.

Sentiment towards shale producers relative to offshore producers is completely polarized and will likely reverse in the future.

The point of this article is two-fold. I would like to comment on the poor economics of the shale oil producers, and I would also like to point out the wildly different valuations between shale oil producers and offshore oil producers, two subsectors of the same industry. On one hand, you have shale, which is quite popular and priced for perfection yet seems incapable of producing free cash flow. On the other hand, you have offshore, which is priced for failure yet has a long history of producing and returning cash to shareholders under normal market conditions.

Most investors are aware of the classic valuation methods that include discounted cash flow analysis, dividends, and free cash flow. We all understand that the ability of an asset to produce cash for its owner is the reason to own it. Somehow, the momentum and excitement surrounding new technologies can suck large amounts of investors into cash burning companies that do not, and likely will not, produce meaningful amounts of cash that can ever be returned to shareholders. As has always been the case, Wall Street will underwrite anything it can sell, but once it realizes it cannot sell something, funds dry up. Should investors in these shale companies no longer find themselves willing to buy newly issued shares or lend money to companies that have a terrible history of sustaining profits or returning cash to shareholders, chances are the industry will struggle. To make matters worse, most shale wells suffer from enormous depletion rates, meaning that if the companies in the industry are not generating cash and cannot access new cash, they cannot replace reserves, in which case, they die. I believe it’s time for investors to walk away from shale while prices are high, and reallocate into offshore, where the opportunity to make a ton of money now exists.

Pick a fracker, any fracker. Chances are the company has a market valuation that exceeds the market value of all of the offshore drillers combined. To highlight this I point out Pioneer Natural Resources (NYSE: PXD) which has a market value of $22 billion, and Diamondback Energy (NASDAQ: FANG) which has a market value of $8.9 billion. For comparison’s sake, let’s look at the combined market values of all the major offshore drilling companies. Transocean (NYSE:RIG), Ensco (NYSE: ESV), Diamond Offshore (NYSE:DO), Noble Corp (NYSE: NE), Rowan (NYSE: RDC), and Atwood Oceanics (NYSE:ATW) . These companies combined market values total $8.6 billion. In other words, one could acquire nearly the entire offshore drilling industry for less than the cost of one average fracking company.

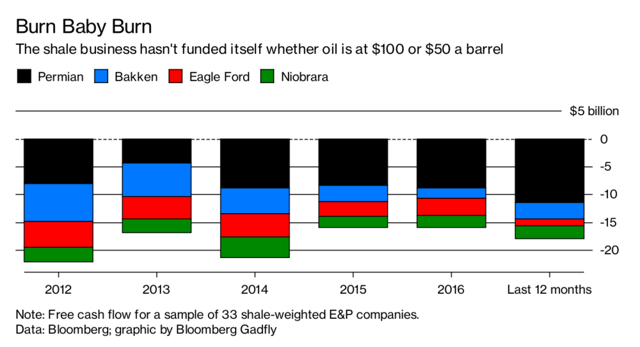

Where it gets really fascinating is when you take a look at the ability of these companies to produce free cash flow and to pay dividends. After all, let’s be honest, the only thing that should matter in the life of a company is its ability to produce cash and distribute cash to its owners. Bloomberg recently published an article highlighting the fact that fracking companies have been unable to produce free cash flow no matter the price of oil. The chart below shows the cumulative cash burn of 33 oil companies focusing on shale.

Source: Bloomberg

Let’s not forget that in 2014, oil prices were more than double their current levels.

Now let’s look at a couple specific companies.

Pioneer Natural Resources is a good example. This is a company that is purely involved in US oil production, with a focus on shale. This company has a market value of $22 billion, yet they have reported negative cumulative free cash flow over the past three calendar years totaling $3.247 billion.

How has this been funded? Through $3.6 billion of equity and net debt issuance. Critics of this article will point out that the negative cash flow has been the result of investments in production growth and therefore they are not bad. To that point I would respond by asking “Where are all the GAAP profits then?” Pioneer has lost money in two of the past three years, and has cumulative GAAP profits over these three years of only $101 million. If we look at the first two quarters of 2017, Pioneer lost money in Q1, and made money in Q2. Finally, even if we isolate 2014, which was a good year for Pioneer, with profits of $930 million, the current market value would be almost 25 times that level of profits, and that is after the stock has declined 34%. For investors who think the stock will go back to $200 per share, those investors will be holding a stock that is at 42 times earnings even if Pioneer returned to its 2014 profit levels.

A quick glance at these figures would lead one to believe that the stock is outrageously overpriced. Amazingly, the stock, currently trading at $130, is down from $200 per share earlier this year, which gave the company a then market value of $33 billion.

Diamondback Energy is another shale producer that has cumulative cash burn over the past three fiscal years of $2.6 billion. Over those same three years Diamondback Energy has issued $3.6 billion of equity and $600 million of net debt. Year to date, Diamondback has had cumulative cash burn of $1.8 billion. To be fair, this is almost entirely due to the acquisition of a leasehold interest in 76,319 acres in the Delaware Basin. To replenish their depleted cash levels, Diamondback just last month announced the pricing of an additional 3 million shares of stock.

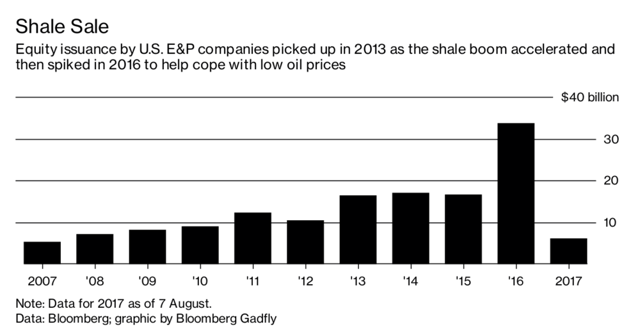

The graph below highlights the constant need for equity issuance over a ten year period.

Source: Bloomberg

With the constant need for equity issuance to fund drilling costs, there is little in the way of hope for any meaningful dividend or distribution of cash from these companies. Pioneer Natural Resources pays a semiannual dividend of just 4 cents per share, a level that has been the same since 2009. For their $130 per share investment, investors can expect to receive 8 cents annually back in cash. In other words, investors in Pioneer Natural Resources are making a bet purely on the price of the stock moving higher. Diamondback Energy pays no dividend at all.

For comparison’s sake, let’s look at a couple of offshore drilling companies. Diamond Offshore (NYSE:DO) and Noble Corp (NYSE:NE). These companies are involved in the ownership and leasing of offshore drilling rigs only. The actual drilling is performed by rig operators, who often rent these rigs for hundreds of thousands of dollars per day. One simple look at the dividend history of Diamond Offshore shows that while the company is currently struggling like so many others in the oil space, the company has flooded shareholders with cash over time. During the same time period that Pioneer Natural Resources has paid their 8 cents annual dividend, Diamond Offshore has distributed $27.75 per share in cash dividends to shareholders, more than double the current stock price. A quick look at Noble Corp’s dividend history shows that Noble paid dividends totaling nearly its entire current stock price in just the three year period between 2014-2016. To be fair, both companies have currently suspended cash dividends and are focusing on preserving cash and repaying debt. By doing so, they set themselves up for a brighter future. The most important thing to note is that both companies are very much free cash flow positive.

The fact that shale producers are unable to generate positive cash flow at today’s prices, and they were unable to generate positive cash flow at $100 oil prices tells us that at some point, investors are likely to give up on the sector. If investors give up on the sector, the companies will be cut off from the spigots of Wall Street cash they have become so used to tapping and they will be forced to cut spending to stay alive. Unfortunately, it’s not as simple as cutting spending with shale. Depletion rates are so high that these companies have to spend like crazy in order to maintain constant production levels. If they lose their funding from equity and debt issuance, they will crumble as high depletion rates eat them alive.

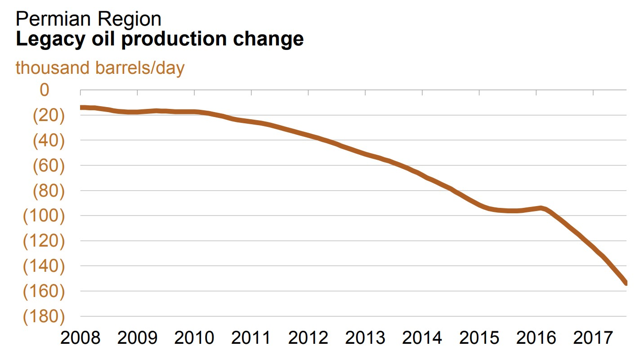

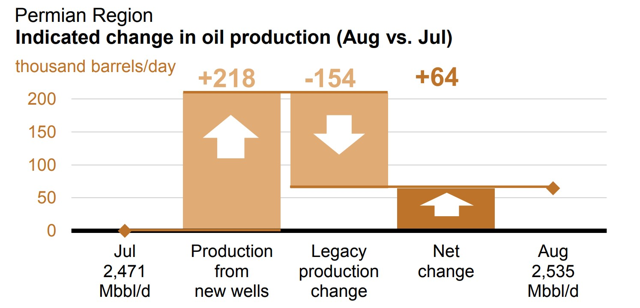

Source: OilPrice.com

Source: OilPrice.com

The charts above show that in the Permian Basin alone, the month to month decline in production is averaging around 154,000 barrels per day. In other words, drillers must replace that much production each month just to maintain production levels constant. Easy to do when billions of dollars are being thrown at you from Wall Street, but perhaps impossible to maintain if they lose their funding.

I believe that the market has priced the companies in the shale and fracking world at prices that are completely irrational when considering their cash burn, lack of dividends, as well as their ongoing need to dilute shareholders in order to fund their operations. Wall Street does this when they get excited about growth. Investors should remind themselves that all the growth in the world is meaningless if there is no ability to distribute the cash to shareholders. As a contrarian play, investors should consider buying into the most beaten down sector out there today. Offshore drilling is a perfect contrarian opportunity. At one-third of global production, the sector is vital to the global economy, and investors can select best of breed companies and buy them at severely distressed prices. In time, the popularity contest that is Wall Street will give way to true fundamentals, and investors could achieve spectacular returns by putting themselves in the appropriate companies.

15 Comments on "The Shale Party Is Going To End Badly Google Alert"

Go Speed Racer on Thu, 7th Sep 2017 6:52 am

It’s on the US money..

In Shale We Trust

In 1970, USA has Hi-Fi

By 2002, USA has Wi-Fi

By 2009, USA needs Re-Fi.

q on Thu, 7th Sep 2017 8:37 am

All that money created out of nothing must be burned somewhere.

MASTERMIND on Thu, 7th Sep 2017 9:21 am

But…But..The Wall Street Urinal and the EIA said we were going to become Saudi America!

Sissyfuss on Thu, 7th Sep 2017 10:41 am

If you’re looking for a Black Swan, there’s one that’s already circling for a landing.

onlooker on Thu, 7th Sep 2017 10:50 am

A Black Swan named Irma is set to break the FEMA bank and the US bank. And we have only just begun

onlooker on Thu, 7th Sep 2017 10:52 am

And the entire is facing similar problems. So let’s not only weep only for the US

MASTERMIND on Thu, 7th Sep 2017 11:16 am

Just wait till the massive worldwide oil shortages hit the world economy in a few years. People will turn into animals.

Sissyfuss on Thu, 7th Sep 2017 12:55 pm

Meow.

onlooker on Thu, 7th Sep 2017 3:25 pm

maybe they should be saying the Oil age is goiing to end badly lol.

joe on Fri, 8th Sep 2017 8:18 am

Americans need to also understand that the price of a gallon of petrol in £ is 4.73 in 2016. The US average price is $2.6. America would never survive on what other countries are forced to pay. Driving is a privledge not a right, and we will soon learn that lesson. There is a real danger that allot of people will be stuck between the horns of a storm season from hell and on top of that is a national debt crisis and possibly a war with North Korea, Russia, Iran, as well as escalating war in Afghanistan because of losing to the Taliban and losing in Iraq and supporting kurdish seperatists in Syria and Iraq. Thats allot of pie to eat on. On bad day maybe one of those issues is a headache. Trump could face them all before Christmas this year! Congress is starting to reap the rewards for decades of inaction and blind allegence to the doctrines of crapitalism. Trickle down failed, no child left behind, failed, multiculturalism failed, all that’s left is to see how bad global warming really will be and hope that someday somehow that sombody will have the balls and support to face down global jihad pushed by the Arabs of all stripes and stop this silly idea that we can all get along.

makati1 on Fri, 8th Sep 2017 8:28 am

joe, gasoline here in the Ps has never been less than about $4/gallon and is usually around $4.50/gallon in the 9+ years I have been here. You are correct that America would not survive that cost for very long. I think the day is soon coming when they are going to find that out.

rockman on Fri, 8th Sep 2017 8:39 am

“Pick a fracker, any fracker. ” I haven’t seen it mentioned but hope everyone understands this incompetent starts off compareing apples to watermelons The onshore companies he references are OPERATORS who pay to drilll and frac wells. The “offshore companies” are DRILLING CONTRACTORS that get paid for drilling wells.

If you want to compare market caps of OPERATORS try Chevron at $208 BILLION to Pioneer Natural at $22 BILLION. But even that is pointless: Chevron is not just an offshore player. But that’s his problem: there are no significant offshore Deep Water players that drill only in that arena. OTOH a DRILLING CONTRACTOR that owns only offshore drill rigs does not make money drilling shale wells in south Texas or the Permian Basin.

Well double Dah! LOL.

PetroSnag on Fri, 8th Sep 2017 11:33 am

Why are there no authors listed for these analyses?

Jerome Purtzer on Fri, 8th Sep 2017 11:55 am

Hey Rockman, you are exactly right. This guy is trying to interest people in the contrarian play to invest in offshore players. Next will be gold futures in the Congo.

Paal S Dinessen on Sat, 9th Sep 2017 12:47 pm

Mind set altering!

The Energy of Slaves: Oil and the New Servitude by Andrew Nikiforuk (2012-09-18)

Sad but a brilliant un-put-down-able-gem!

This brilliant un-put-down-able-gem is I would emphasize apart from the book of your personal faith is the single most important book you will ever read. When reading the Sources reference section listed in the appendix you quickly appreciate the massive amount of objective facts that have been assimilated, categorized and subsequently laid out clear as crystal in understandable layman’s terms for your eye opening perusal by Mr. Nikiforuk. This book should be compulsory read by all, especially the powers that be and children. Our collective dark future is indeed coming upon us with the speed and mass of a runaway freight train. If only a fraction of the money used to advertise junk food, sodas and other detrimental substances were diverted to educate the “Less educated” of this impending stark reality there might have been a glimmer of light in the tunnel. Future desolate generations will wonder with horror how we became such a sordid race, infected with a combination of collective amnesia and rampant stupidity persistently continuing down a path of greed and such utter destruction when the repercussions of our actions are so irrefutable tragic….A Strong Handshake.

Paal S. Dinessen.

“Argentum et aurum comparenda sunt”.

“Ex scientia pecuniae libertas”.

“Want of foresight, unwillingness to act when action would be simple and effective, lack of clear thinking, confusion of counsel until the emergency comes, until self-preservation strikes its jarring gong – these are the features which constitute the endless repetition of history”~Winston Churchill.