Page added on October 26, 2015

Dispelling The Oil Storage Myth

Summary

One concern hitting many investors recently has been the possibility that the U.S. is approaching full oil storage capacity.

If true, this would certainly result in firesale energy prices at some point, throwing oil and other products down much lower than they are today.

Upon digging into this, however, I discovered something that should dispel the concerns investors have regarding peak storage capacity that should allow long-term oil bulls to sleep at night.

One thing that some of my readers have brought up on a regular basis has been the question of how much of this nation’s oil storage capacity is full since commercial crude inventories are at 80-year highs. At first glance, this may not seem like an important topic but it’s actually exceedingly important to oil investors for one particular reason; if we were to max out our storage capacity, the price of crude and other petroleum products would plummet since it would create a scenario where companies in this space would need to sell off their products at firesale prices since new output would continue (you can’t just turn off the tap in this environment if you want to survive).

Under this nightmare scenario, it wouldn’t be unthinkable to see oil drop to $10 per barrel or lower and many businesses in this industry, like Linn Energy (NASDAQ:LINE) / LinnCo (NASDAQ:LNCO), BreitBurn Energy Partners (NASDAQ:BBEP) and Approach Resources (NASDAQ:AREX), would have next to no chance of survival. In order to soothe the concerns of readers who may be worried about this outcome, I decided to dig into the numbers in order to show that the inventory concerns (from a storage side) are nothing to lose any sleep over.

Some notes of importance

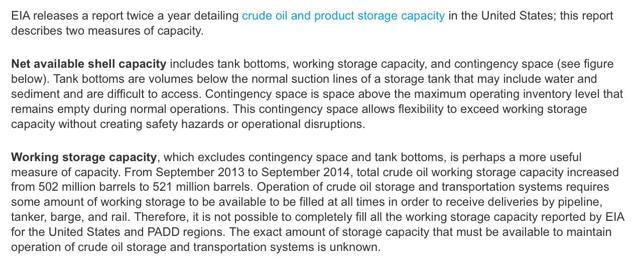

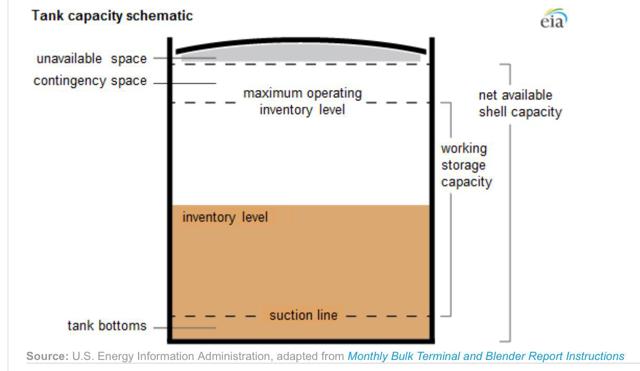

Before I begin, I should inform you how I’m looking at capacity. According to the EIA, they keep track of two types of storage capacity in the U.S.; net available shell capacity and working storage capacity. The first type, net available shell capacity, includes the capacity provided by tank bottoms, working capacity, and contingency space, while the latter looks solely at working storage space. A detailed description of these differences, courtesy of the EIA, can be seen in the image below:

In the next image, you can see a visualization of the two types of capacity in the U.S. While it may not seem like a big difference on the image, the numbers are quite staggering. If you use net available storage capacity for crude plus petroleum products in the U.S., as opposed to the more conservative working storage capacity, the potential storage space soars by 303.36 million barrels (plus an extra 72.80 million barrels if you consider idle capacity that could be brought on within 90 days). While net available shell capacity could be used if push came to shove, I like to remain conservative in my analysis so I’m opting to use the working storage capacity, which will result in less available space than the other approach would.

Looking at the big picture

At this moment, the EIA believes that there’s about 476.6 million barrels of oil in commercial storage in the U.S. This is well above the 359.8 million barrels that constitute “normal” inventory levels but is also lower than the 490.9 million barrels the organization estimated earlier this year. Despite the fact that inventories have been declining since peaking, the trend these past couple weeks has been toward slightly higher inventories, driven by refinery shutdowns and a slight uptick in production. All of this may sound scary but when you look at how much capacity the U.S. has, the probability of a firesale-like scenario is unbelievably slim.

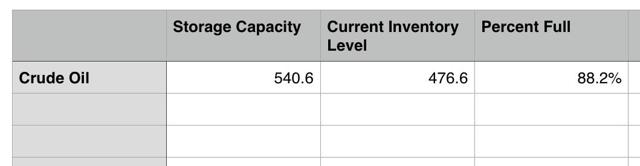

In the table below, you can see what the current storage capacity is for crude. Using storage data from September of 2014 (the most recent that’s available but updated numbers are coming out in November), you can see that capacity in the U.S. stood at about 540.6 million barrels. With oil inventories at 476.6 million barrels, this implies that storage in the U.S. is about 88.2% full. This may seem alarming, but the EIA also reminds us that about 120 million barrels of crude is being held in pipelines or some other form of transit, so they shouldn’t be factored into storage figures (the EIA follows this mindset in their analysis). Adjusting for this, crude held in storage should be about 356.6 million barrels, which implies that storage capacity is at about 66%.

* numbers are in millions of barrels

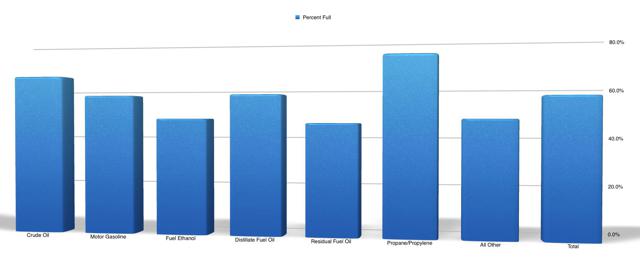

Now that we have crude figured out, what about the other petroleum products? If crude is at a level that isn’t even near critical while the products it makes are, it’s still very possible that we could see a firesale for crude. In the graph below, I show what the picture looks like for motor gasoline, fuel ethanol, distillate fuel oil, residual fuel oil, propane/propylene, and the “All Other” categories. Using this data, it becomes clear that there really aren’t any concerns anywhere.

The category with the highest amount of free space available is residual fuel oil, which stands at just 46.3% full, while propane/propylene is the worst at 74.1%. In aggregate, total crude plus petroleum products is just 57.4% full at 1.19 billion barrels (1.31 billion if you add back the pipeline fill and other product that is in transit). With nearly 2.06 billion barrels of total storage available in this country (excluding the strategic petroleum reserve) and another 376.16 million barrels if push came to shove, there’s still so much capacity in the market that investors don’t need to worry about firesale any time soon.

Takeaway

I certainly understand the concerns of investors who are worried about the oil market when it comes to storage capacity. In theory, a move much higher that would leave tanks around the nation flooded with crude and other petroleum products would be disastrous for the energy sector but the fact of the matter is that we don’t look even remotely close to critical mass at this point in time. This, in my opinion, isn’t bullish for energy by itself but it definitely does dispel the fear and paranoia that is plaguing the minds of many investors.

35 Comments on "Dispelling The Oil Storage Myth"

Cloud9 on Mon, 26th Oct 2015 12:00 pm

World overcapacity and demand destruction, reminds me of dairy farmers pouring out their milk during the great depression in an effort to drive up prices. Debt has pulled all the demand forward for the next decade. Welcome to the great contraction.

Plantagenet on Mon, 26th Oct 2015 12:11 pm

If we’re within 70 million bbls of full capacity in the US, and the current oil glut has resulted from overproduction of ca. 0.5-1 mm bbl/day, then the US will top out in ca. 70-140 days.

On the other hand, TOS drilling has fallen dramatically and US oil production appears to have topped out in the near term.

Its gonna be tight. IF oil prices stay low, we probably won’t top out, but if oil prices jump up and US TOS drilling resumes, we may see a storage shortfall.

Cheers!

shortonoil on Mon, 26th Oct 2015 12:46 pm

In actuality the situation is probably a 100 times more complicated than the author portrays. For instance, Texas may have considerable storage capacity remaining while Illinois has none. This situation is a very complex Queuing Theory problem, not a volumetric problem. It may appease investors to count barrels, but that is not going to inform them as to what is actually happening. Not all storage capacity has to be utilized before serious problems are likely to arise.

BC on Mon, 26th Oct 2015 1:22 pm

http://www.dallasfed.org/microsites/research/surveys/tmos/2015/1510/tmos1510.cfm

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2j85

short and all, speaking of Texas, the state and US mfg. sector have been in recession since late 2014 or early this year.

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2jgm

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2jgx

US orders and mfg. are back to where they were when the Fed went “all in” and at the onset of past recessions.

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2jgP

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2jgX

The US housing market entered another bubble in 2012-13 that is just as big as the bubble in 2004-07, but the bubble is now showing signs of deflating as the bubbles deflated in 2006-07, 1990, and 1979.

This time around the high-end, buy-up homes’ prices will be hit disproportionately harder. Anyone who bought a house with less than 20% down in the past 2-3 years will be underwater in the years ahead, requiring yet another gov’t/Fed bailout of Fannie, Freddie, Ginnie, and mortgage lenders.

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2f8R

Another housing bust will coincide with a bear market that is demonstrably already underway for the broader equity market.

Result: Demand destruction, deflation, liquidity trap, more QEternity, a further decline in money velocity and deeper contraction of acceleration, long rates continuing to decline, the yield curve flattening further, and the increasing probability of negative interest rates (NIRP).

The TBTE banks pulled the plug on the bubbles in 2000-01 and 2008, precipitating the Dotcom and unreal estate CDO crashes. It’s not a matter of if they pull the plug this time but when and how.

Widening risk spreads, a mfg. recession, and bank C&I loan charge-offs and delinquencies rising YoY are all good coincident markers for incipient recession and risk of a bear market. But it’s not obvious to me which sectors or instruments the TBTE banksters will target (are targeting), although emerging market debt, junk debt, and biobubbletech, dis-ease care, and social mania stocks are excellent candidates.

green_achers on Mon, 26th Oct 2015 1:50 pm

Yeah, those oil companies will be happy to keep pumping it out of the ground and then putting a bunch into storage. No problem, they didn’t really want to sell it, anyway. Not like their cash flows need it, or anything.

Boat on Mon, 26th Oct 2015 3:42 pm

No green,

Storage costs money. Money flowing out in a down market is not good for oil producers. The big concern is not so much not having storage but an easy indicator of how much oil is being overproduced. Cushing in the US was very low and now filling fast. The market is always way ahead of and prices will recover some as the filling process lessons. That is what is happening now.

shortonoil on Mon, 26th Oct 2015 5:38 pm

The storage problem is not just isolated to crude, finished products are also getting into trouble. The increased demand from lower prices has not materialized, just like we predicted.

http://www.zerohedge.com/news/2015-10-26/operational-financial-stress-unavoidable-energy-names-goldman-warns-distillate-stora

http://www.thehillsgroup.org/

MrNoItAll on Mon, 26th Oct 2015 7:27 pm

BC said: “It’s not a matter of if they pull the plug this time but when and how.”

Question for you BC. When you write that “The TBTE banks pulled the plug on the bubbles in 2000-01 and 2008…”, how exactly did they pull the plug.

I also strongly suspect that “TPTB” — which of course includes those elites calling the shots at TBTE/F banks — will “pull the plug” at some point, and have often speculated on that assumption in posts on this forum. It doesn’t make sense to ride this lousy economy out to the bitter end because then all control is lost. By pulling the plug, they maintain some control — timing, location, preparedness, etc…

I’m just hoping you’ll elaborate a little more on how/when/why the TBTE banks will JUST DO IT!

BC on Mon, 26th Oct 2015 10:54 pm

MrNo, good question. To put it delicately, the principals and their confederates shorted the bloody bleeping bleep out of Dotcom stocks (that they had pumped to their own clients) and then did the same thing with unreal estate CDOs (loading up their own clients, if you recall, with the junk).

When the prices began falling, as they inevitably and mathematically had to (as in the case today with nosebleed valuations and low volatility, until very recently), the margin calls followed with the panic selling and GS and gang net short and backslapping each other all the way down.

The lopsided short positions create first a vacuum of nearby bids that contributes to the cascading declines during margin selling, but at some point provide the impetus for the characteristic V-shaped bottom when the major shorts begin covering, i.e., buying back the shares they borrowed to sell.

But since 2009-10 with the increasing influence of QEternity and high-frequency trading (HFT), a growing share of the marginal price making is via largely unregulated TBTE banks’ offshore shadow banks’ pass-through entities in the Caribbean banking centers, Channels, and “Belgium” that are levered 50-80:1 carry trade against US Treasuries and MBS for equity index futures.

This is where the plug is to the global bubble machine today, and the likes of GS, JPM, MS, C, BAC, BCS, RBS, DB, and HSBC are the ones with the fat-fingered hands on the plug, with GS, JPM, and MS with their hands closest to the outlet.

C, BAC, DB, RBS, and BCS are likely take-down targets for GS, JPM, and MS this time around, as were Bear Stearns and Lehman in 2007 and 2008.

As to when they will “pull it”, bank C&I loan charge-offs and delinquencies are beginning to rise YoY and risk spreads continue to widen, which occurred in 2008 and 2001 leading up to 9/11 and Lehman, and prior to the 1987 Crash, Continental Illinois collapse (largest bank failure in US history up to that point), and prior to the recessions in the early 1980s and mid-1970s.

Moreover, concurrently with the foregoing, the acceleration of money velocity to private GDP is contracting at the fastest rate since 2008, 2001, and the early 1980s. That is, the market is already “tightening” liquidity and its acceleration before the Fed even begins to raise rates.

So, the conditions are already rather well established for another 2008-like panic, wipeout, and Fed/TBTE bank/gov’t intervention, only this time the reserve printing could exceed 2008-14 because the global debt levels are higher and the leverage larger.

Jamie Dimon of JPM not longer ago said in a rather frank, self-satisfied manner that financial crises occur about every seven years, and he’s right, as it is largely a result of bank lending accelerating to a rate that far exceeds the growth of wages and GDP for 2-3 years or more, saddling firms and households with a level of debt that can’t continue growing; but when it decelerates sufficiently, it exposes the scale of leverage and misallocation of credit, requiring asset prices to “correct” and the debts underlying the assets to be written or run off.

But the scale of leverage and misallocation today is unprecedented and disproportionately in the corporate and emerging market debt markets, as well as fixed-income markets used as primary collateral for the unspeakable leverage for the equity index futures carry trade.

When it blows, well, there is no precedent for it in history, save for 1929-33 and 1937-42, and in Japan since the early 2000s.

GregT on Mon, 26th Oct 2015 11:24 pm

Geez,

I guess I know now where I stand in the big scheme of things in the world of BC. I’ve asked the same question twice, with no response. Then some guy comes along who claims that he no’s it all, and you BC answer right away. Go figure. Maybe it’s an anti-Canadian thing? 🙂

Anyhow BC, I’m sure that you would prefer to not make predictions, and I would concur with that preference. (for obvious reasons) So, if you would be willing to take an entirely non-professional wild stab in the dark, what sort of timeline would you be wrongly guessing at here?

Thanks

MrNoItAll on Mon, 26th Oct 2015 11:33 pm

BC — Thanks for that info. Fascinating!

In the past, when I have speculated about “pulling the plug”, I have envisioned TPTB inducing a major global economic meltdown, one which leaves the last remnants of BAU in ruins — replaced by command economy, nearly 100% unemployment, near total shutdown of private transport, rationing, the works.

That makes sense to me because I see BAU is a world-eating monster from hell that is wasting the last of our vital resources. It has to be stopped before it consumes all remaining accessible energy and other finite natural resources. At least, that’s how I would probably view it if I were an elite.

But maybe those in control have a plan to just gradually squeeze more and more people out of the “good life”, pushing increasing numbers out of jobs and to the fringes of ongoing BAU. And in this way, over time, perhaps they’ll maintain a more sustainable form of BAU, one that leaves the majority of people wherever they are to live of scraps and hand-outs. But that doesn’t seem like it would work because there must be a certain point where enough fringe people get together and start raising serious trouble.

Maybe what you’re outlining will be just another big step down. They’ll scale down and cannibalize, and suck another fat slice of wealth out of the bottom 90%. More and much bigger QE. That will buy another year or two. But what then?

Pulling the plug, in my mind, is shutting it down and rebooting with a new operating system. Anything else is just a big waste of resources, and just putting off the inevitable pain for a little while longer, making it exponentially worse when it finally has to be faced.

Big and like you say unprecedented events are unfolding. Major shocks are on the way is what it feels like to me.

Thanks again for the perspective.

MrNoItAll on Mon, 26th Oct 2015 11:36 pm

GregT — You gotta catch BC at the right time. I saw your questions to BC and replied to one, but I think you may have posted a little late and by next day, your question/comment was long gone. We all have questions for BC — but we need to get those questions filed early for an chance of getting an answer. What? More questions for BC? Hey, get in line!

GregT on Tue, 27th Oct 2015 12:00 am

NWR,

Maybe we need to dedicate a thread entirely for BC. I’d heard enough from him long ago, to come to the realization that he deserves our utmost attention. I’m all ears for what he has to contribute here.

apneaman on Tue, 27th Oct 2015 12:40 am

BC, WHY DAMMIT WHY!!!!!!

GregT on Tue, 27th Oct 2015 1:11 am

Apnea,

The why part should be self explanatory. It is after all, human nature.

peakyeast on Tue, 27th Oct 2015 4:25 am

One of my friends asked me what what the defining quality of humans…

I responded: The ability to turn everything into every type of shit as fast as possible.

Davy on Tue, 27th Oct 2015 6:03 am

Here is some sobering news from Marc Faber my favorite financial doomer. When reading this keep in mind how China is connected at the hip to the US and to the EM’s through a global trade network of commodities, exports, and imports. There is the currency trades and other investments. China will likely bring the entire global system down.

The US and Europe have a handle on their systems. They are repressed and in complete manipulation with a cooperation of industry, political establishment, and central banks. China does not have complete manipulation but for different reasons. It has lost control of its bubble. It grew too fast and excessively. There are never any good ways to deflate a bubble especially one the size of China. We should all be watching China because when it snaps we snap.

“Marc Faber Fears No Soft-Landing Of China’s “Credit Bubble Of Epic Proportions”

http://www.zerohedge.com/news/2015-10-26/marc-faber-fears-no-soft-landing-chinas-credit-bubble-epic-proportions

“Investors should (and most don’t) realize China is a credit bubble of epic proportions,” warns an anxious Marc Faber during a brief Bloomberg TV interview. “China is not just a country, it’s an empire,” Faber adds, and warns that while some sectors may have growth (“just ask Yum Brands” he jokes), “but other very important sectors like industrial production aren’t growing at the present time.” In fact, Faber warns “I don’t think China’s economy is growing at all,” and while policy-makers may be able to “cushion the downturn somewhat,” he warns that achieving any soft-landing will be “very difficult,” even as he expects China to continue devaluing the Yuan.

shortonoil on Tue, 27th Oct 2015 9:41 am

@BC

“This is where the plug is to the global bubble machine today, and the likes of GS, JPM, MS, C, BAC, BCS, RBS, DB, and HSBC are the ones with the fat-fingered hands on the plug, with GS, JPM, and MS with their hands closest to the outlet.

C, BAC, DB, RBS, and BCS are likely take-down targets for GS, JPM, and MS this time around, as were Bear Stearns and Lehman in 2007 and 2008.”

I looks to me like these guys are playing general in the school sand box, while the real war is in the Sahara. They are trying for a rerun of 2008 simply because it worked last time. It looks to me like these dam fools don’t have a clue?

From our vantage point the only thing that is keeping the show on the road is the cannibalization of our present capital stock. Oil has lost too much of its capacity to power the economy to go it alone. If these nit wits destroy the monetary system that makes that self feeding program possible, they are going to pull the temple down on their own heads. Like Samson, GS is really going to be doing God’s work. Like him they are going to die in the process.

Maybe bankers have a latent death wish; if they do ,what you think they are going to do, they are going to get it.

shortonoil on Tue, 27th Oct 2015 10:03 am

@BC

The last time the Good Ship World Banking System almost sank it took $13 trillion in funny money to keep her off the reefs. That drove the price of oil down $20 to $25 more than it should have fallen. Another $13 trillion, and oil is going be visiting Davy Jones Locker. These guys must be a combination of incredibly stupid, and mind bogglingly greedy. If they pull the plug they are going right down the drain with all the rest of the bilge water.

BC on Tue, 27th Oct 2015 11:30 am

Thanks, gents, for the kind gestures.

Sorry GregT for missing your questions. I probably spend too much time on this site as it is, but it’s not that easy to find a kind of virtual philosophical/intellectual community of like-minded deviants as we are to share insights. 😀

short, good points, as always. It’s instructive to keep in mind that the bankster oligarchs are dominated by a top tier of individuals and institutions that are the definition of sociopathic and parasitic. They have unquestionably become a net cost to the economy and society, and arguably the civilization, such as it is.

But their blood funnel (credit Matt Taibbi) has been so deeply inserted into the heart of the global financial and economic systems that extracting them risks death of the host by massive hemorrhage, so to speak. These bloodsuckers are keenly aware of their symbiotic role and use it to their supreme advantage.

Moreover, they already have extracted enough blood to last them and theirs lifetimes, if they can keep it. Their sociopathic, self-superior nature compels them to yield not an inch, and they would prefer that the system collapse rather than give up any of their power.

Mind you, the bankster and top-tier CEO/managerial caste principals are NOT “the ultimate” power behind the curtain. The Power Elite top 0.001% (or 0.000001%) are largely unknown and unseen, preferring the shadows to avoid the light of public scrutiny. They are made up of primarily Americans, Brits, Canadians, Germans, French, Dutch, Swiss, and Milanese, and a few Danes, Swedes, and Belgians. Individually their wealth would appear modest compared to Gates, Buffett, and Wall St., The City, and other billionaires; but they can make a few phone calls to their peers and ruin careers, stop a corporate merger, vet and affirm a political candidate, bring down gov’ts, and start and end wars. Their primary motivation is “keeping” their power that they have enjoyed for centuries. “Keeping score” via their balance sheets, as the oligarchs do, is secondary (amateurish) to using their collective wealth and social, professional, and political networks to assert and maintain their power.

To reiterate from the past, the Power Elite’s long-term objective, evolving in iterations over time, has been to merge the US, Canada, UK, and EU into a Transatlantic Confederation or Fortress Europa (akin to the eastern Roman Empire after the decline of the western empire and before the Ottomans), including essentially a bankster-run privatized corporate-state in which the top 0.001-1% own virtually everything of economic value, the social-democratic welfare state is gradually phased out, and wages are “normalized” between the “West and the rest” via “The Great Leveling”.

Among the larger objectives is merging the financial, regulatory, customs, and trade systems, as well as eventually making the IMF the reserve-clearing bank for the new world reserve currency, with the BIS as the “central bank of central banks”.

Also, China was to be a mfg. colony for the West and Japan to mitigate the effects of US peak oil production per capita and deindustrialization, and then a military rival to further justify maintaining military spending for the Anglo-American imperial war machine, including rearming Japan and the “Pivot to Asia” (actually first conceived over a century ago with the influence seen today in the Philippines).

Israel was established as a kind of imperial garrison-state in the Middle East to do the dirty work of empire against the hostile Arab populations before the Soviets after WW II could do the same. The Saudis were co-opted and capitalized by the West’s petrobanksters and oil companies in exchange for allowing the imperial military to protect the oil fields and shipping lanes.

There is a modern-day “Scramble for Africa” between the US and China, but the US has the imperial jump on China with the Africa Command. The US military has countless contingencies to blockade/embargo and expel Chinese interests from Africa at the opportune time.

One of the more seemingly sinister aspects of the Power Elite’s global vision was their acceptance of the inevitability of mass human die-off this century, particularly in Africa and SE Asia from famine, disease, ethnic/religious conflict, genocide, and war.

Most of us err in perceiving the Power Elite- and oiligarch-vetted and -installed politicos and technocrats has having power and authority when, in fact, their power and authority to speak and act is totally conferred on them; and they are obliged to placate the oligarchs but are accountable to the Power Elite via two and three degrees of separation.

Some have called the foregoing the New World Order, which is more often than not disparagingly dismissed as “conspiracy nutterism”, but it is happening virtually right before our eyes (wide shut in most cases). The Power Elite and their bankster and CEO oligarchs await the next global crisis to further consolidate their financial, economic, political, and institutional power.

So, when the oligarchs again pull the plug on the bubble machine, they will do so with the blessing of the Power Elite who perceive the event as but another in the further evolution of the consolidation of their unrivaled global power.

Okay, back to work. 🙂

Davy on Tue, 27th Oct 2015 12:05 pm

BC, you do realize this global system has morphed out of direct control by anyone especially a few power elites. These elites still command significant control sure but increasingly it is marginalized by destructive change. We have trillions of decisions going on in a course of a day making the global system self-organizing and an ecosystem like organization both biological and technical. We are on a descending energy gradient that will destroy further the control of the elites. Just as artificial intelligence has no future per declining net energy so to the new world order. It will all crash down soon by chaos of deflation. Your story sounds plausible during the growth phase of industrial man but the paradox of control will destroy them. We are at that point now.

“The Paradox of control and chaos”

http://www.krauthammer.com/articles/the-paradox-of-control-and-chaos

“To what extent can leaders adapt an organisation to fit with their wishes? Can the leader control and shape it at will? Or is the natural state of the organisation one of chaos, with dynamics all of its own, a state that can even shape the leader? This is one of a major set of paradoxes identified by Bob de Wit and Ron Meyer in their benchmark work ‘Strategy Synthesis – Resolving Strategy Paradoxes to Create Competitive Advantage’ [1]”

http://www.cengagebrain.com/content/dewit32236_1408032236_02.01_chapter01.pdf

apneaman on Tue, 27th Oct 2015 12:33 pm

Don’t these people have names?

GregT on Tue, 27th Oct 2015 1:54 pm

Thanks BC. There used to be a guy that posted regularly here under the name of Arthur. He is a history aficionado who resides in the Netherlands. He often wrote long posts about these ‘bloodlines’, their control over empires and wars, how they shaped history, and their multigenerational plans to control the world. Many here rejected Arthur’s views, I think mainly because they fly in the face of our own indoctrination, but from what I have read, and understand, both yourself and Arthur are absolutely correct.

The true power does not lie in “wealth” but rather in control over the people. Give them a flag, and an identity, and they will fight against their own freedoms, and they will fight against each other. The oldest strategy in the book, divide and conquer. Create hatred between different groups, or nationalities, and then when the time is right, bring them all to their knees. Amazing that so many people still don’t get it, they’ve been doing the same shit for centuries.

I believe that the time is drawing near, when the drums of war will be beaten once again, and both sides will be yelling at the top of their lungs; We are right, They are wrong, Let’s kill them!, but in reality, both sides are fighting for the same cause, and against even themselves. The human being is very easily manipulated, and will probably never learn.

The only reasons that our standards of living have risen so high in some regions, is a cheap, concentrated form of energy, and the weapons, and the useful idiots that are willingly to deploy them. When that energy source becomes problematic, soon, we will revert back to slavery, and serfdom. We are all nothing more than livestock to them. I have found this short video to be of particular significance:

“The Story of Your Enslavement”

https://www.youtube.com/watch?v=Xbp6umQT58A

shortonoil on Tue, 27th Oct 2015 2:38 pm

“Don’t these people have names?”

Yes they do, but although I can only name two to them for sure, the last thing that I’m going to do is put those names up on the Ethernet. One was an American, and one was from Singapore. The American I knew the best of the two. He and his wife had a summer home about 15 miles from where I lived in Vermont. If you met him you would have taken him for an older upper Middle Class gentlemen of substantial means. It was several years before I realized that he ran an empire behind the scenes.

BC on Tue, 27th Oct 2015 3:48 pm

GregT, yes, the narrative I shared, and presumably similar to that of Arthur, is not so far fetched or unreachable to Europeans who have lived with the “bloodlines” and the consequences for centuries. We are duped by self-interested “stories” used by the elites to rationalize their hierarchical control and imposition of the structural effects on “the ruled”. This is not news, of course, but the precise means and whose interests are served would be news to most of us.

But what can be done about it at this stage is as, or more, important than who rules us, how, and what they are prepared to do to retain their power.

Davy, I don’t disagree. I would say that as the descent progresses and hardship spreads and intensifies among the bottom 90%+, the elites will respond to the increasing risk of mass-social instability and challenge to their legitimacy by further consolidating their power and efforts to control a larger proportion of vital resources and co-opt techno-scientific, managerial, bureaucratic, and military elites and leaders. The rest of us will be simply on our own as faith will be increasingly lost in public institutions to serve us.

And consider the archetypal corporate and political leaders that the Power Elite have selected, vetted, and appointed for us to affirm in recent decades. Imperial decadence captures the situation rather well. One can envision corporate-state CEOs not hestitating to drone bomb to Batcave, KY any popular uprisings to express mass-social grievance and seek redress on a national scale. Occupy Wall St. was a laudable attempt, but the gov’t and withering mass-media propaganda, police-state tactics, and dismissive (terrified) national political leadership was more than up to the task of quickly discrediting and diffusing any such attempts at collective challenge to the power structure.

GregT on Tue, 27th Oct 2015 3:57 pm

“Occupy Wall St. was a laudable attempt, but the gov’t and withering mass-media propaganda, police-state tactics, and dismissive (terrified) national political leadership was more than up to the task of quickly discrediting and diffusing any such attempts at collective challenge to the power structure.”

Same as it ever was.

GregT on Tue, 27th Oct 2015 4:03 pm

So BC,

You mentioned that NOW would be a very good time to reallocate funds. I ask again; Why now? Why not one year from now, or two, or five? Or, given current events, do you believe that the whole can of worms could be blown wide open at any time?

BC on Tue, 27th Oct 2015 7:37 pm

GregT, another good question. Thanks. Well, it’s conceivable that it’s not a good time to reallocate because that is such a subjective decision, and it’s highly dependent upon the standard criteria, including risk tolerance, current allocation, time horizon, what one’s objectives are, when one needs to draw down assets, how much, and for how long, etc.

A good rule of thumb at this particular moment and going forward is that one should closely examine one’s allocation to assess the risk exposure to equities if there were to be another 50% bear market that takes 4-6 years to get back to even. Then add the implication from current valuations that the average total return to the S&P 500 or broader market is likely to be no higher than ~0-2% for the next 5-7 to 10 years.

Generally speaking, then, one’s equity risk at this point is a 0-2% average return for the foreseeable future vs. a possible cyclical drawdown risk in the meantime of 35-50% for equities.

So, a 50%-50% S&P 500 or Wilshire 5000 (or a cap-weighted domestic and int’l) fixed-income allocation with fixed-income YTM of 0-4% (T-bills out to 10-year Baa bonds) would be 0-2% and a drawdown for the total portfolio of 15% to 25%, give or take, with 4-6 years to get back to even.

For some people, that won’t cause them to lose sleep, and they can take the cyclical hit and accept the meager return to know that they can still meet their 5- to 10-year objective or longer.

For others who might be closer to retirement or who need to draw on assets, they might perceive the potential drawdown as too large and will want to reduce equity risk exposure and give up some marginal returm while trying to avoid a tax hit.

Different strokes for different folks.

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2ko0

BTW, my work suggests that a bear market has likely begun, but “it’s different this time” in that the hyper-interventionist (and hyper-ventilating) central and TBTE banks and the gov’ts they own are panicky, fat-CTRL-P-fingered paranoids, as they probably should be.

Still, it is not at all inconceivable that we get a repeat of the Dotcom crash and 2008-09 meltdown, or perhaps even worse.

By the progression of the Long Wave, we’re aligned with Japan in the early 2000s, the US in the late 1930s, 1890s, and late 1830s. But non-financial debt and total private debt to GDP is at the level of the late 1920s, and total public debt to GDP is at the level of WW II, i.e., another reason it’s “different (worse) this time”.

Also, the peak Boomer demographic drag effects are now set to weigh on equity returns and high-end, buy-up unreal estate prices hereafter into late decade to as long as the early to mid-2020s. This once-in-a-lifetime secular phenomenon is likely to contribute to deflation, as well as a shift in the composition of household spending from high-multiplier new housing, autos (eventually), and child rearing to low- or no-multiplier spending on rent, house maintenance, utilities, property taxes, insurance, and out-of-pocket costs for medical services and medications.

The standard disclaimer applies: This is NOT investment/trading/speculation advice. Past performance is no guarantee of future results. Your investments can, and will, lose value. Consult a professional advisor (if you must :-D).

FWIW.

MrNoItAll on Tue, 27th Oct 2015 8:00 pm

“4-6 years to get back to even”

Only if economic growth resumes after the sometime soon to happen big bust.

We’ve always had resumption of economic growth after the big economic busts, so sure, based on past performance, that 4-6 year break even looks on the surface like it might fly.

But, will the economy rebound after this upcoming bust? It takes a lot of oil/energy and giga-tons of other raw resources to power an economic growth spurt.

I’m doubtful about an economic recovery after the coming bust because, figuratively (and even perhaps literally) speaking, this clown car called BAU is out of friggin gas!

Davy on Tue, 27th Oct 2015 8:22 pm

MR, I feel we are goin down it is just the speed limit I am not sure about.

MrNoItAll on Tue, 27th Oct 2015 8:40 pm

Back to the “pulling the plug” topic.

BTW, I totally agree with the view expressed by BC above where he describes what GregT calls “blood lines” of elites who can trace their accumulation of wealth and power back through the centuries. It has seemed pretty clear to me for quite a while that there is a deeply embedded level of command/control that ties seemingly chaotic and unrelated events together. The fact that our “democracy” on the national level at least is a near total sham I hold to be self-evident. Somebody is in control of the puppets that we the people “elect” into representative office, but it certainly isn’t we the people who are exercising that control. Face it, there are mysterious and unseen powers behind the curtain, and they’ve got a dashboard with all kinds of buttons and levers on it that they are pushing and pulling, controlling events far and wide.

Names? I’ll be one or more of those names starts with an “R”, ends with a “child” and has a candy bar of a similar name.

So, let’s just posit as fact for a moment that yes, there are these super elites whose wealth and power and control have extended and grown through the centuries, and who know pull all the big strings and push all the big buttons. And let’s assume for the sake of argument that yes, they DO see the end of the phase of human civilization coming to a rapid and ignominious end, and that right soon. What are they going to do?

Will the cling to BAU and desperately try to keep pushing this failed version of human civilization forward day by day, knowing that ultimately it is going to crash hard anyway? Or do they implement a plan to buy some time, during which time they make their own splendid and no doubt well-financed preparations. Those would be preparations to rise from the ashes and dust of the smoking ruin that this version of civilization is destined to become, and to possess the resources and the command authority needed to reassert their authority, within whatever limited geographical areas they choose to control.

If that is “the plan”, then as the clock winds down to the final count, they would want to produce and store as much oil, iron ore and other raw materials as possible for use AFTER the “big bang”. With a vastly reduced population, and with the needed machines and infrastructure existing within their area(s) of control, they could conceivably continue the high-tech good life far into the future, assuming they limit wasteful burning of oil/fossil fuels and create a sustainable mini-civilization within their areas of control.

If they aren’t planning to do just exactly that, then they’re truly stupid. And I don’t think they are stupid.

I suspect that post-collapse, after a year or two, there will be limited and highly protected areas scattered around planet earth where the elites are still in control of their own little kingdoms. And in between will be the wastelands, populated by whatever humans may have survived on their own, and they’ll be considered the “wild people” by the elites and their selected subjects, probably hunted in many cases as sport or for population control, but never exterminated because they’ll be some very tough survivors.

Welcome to MrNoItAll’s vision of the future!

MrNoItAll on Tue, 27th Oct 2015 8:41 pm

Ya Davy, me either. But it sure feels like we’re going fast!!

GregT on Tue, 27th Oct 2015 11:09 pm

Not positive, but I think it might have been Apnea that posted this a while back. I don’t normally watch made for TV series, (or TV at all for that matter) but this one is definitely worth the watch for anyone with the spare time. Some of the episodes are a bit difficult to find, but they are all out there in cyber space. Food for thought.

https://www.youtube.com/watch?v=Z4O0iF6RpGg

BC on Tue, 27th Oct 2015 11:35 pm

One of the aspects of considering such a narrative as “bloodlines” is that in the allegedly more egalitarian, humanist, “enlightened” West, it just can’t be so. We’re a democracy! We choose our leaders! We’re a capitalist economy? Anyone can be a gazillionaire if they are smart, work hard, and pray to the alter of growth and progress!

Anyone who thinks otherwise is a commie pinko or national socialist Nazi.

That suits the members of the “bloodlines” and their technocrats and oligarchs just swell.

But then you have the likes of transparent self-promoters and exploitative types who take the basis of the facts about the structure and then pander to the lowest base by claiming that the elites are descended from a reptilian race from the Earth’s core bent on ruling the world; or that the elites have conspired with extraterrestrials from the Rings of Uranus to abduct humans, conduct genetic experiments, and reproduce alien hybrids to take over the world at some point.

It’s possible that some are in the employ of the Power Elite in some capacity, but it’s just as likely that they are intelligent, creative charlatans who take advantage of the gullibility of the masses seeking a palatable explanation/rationalization for why they are not gazillionaires.

This kind of nonsense (as entertaining and humorous as it might be) obscures the facts and the machinations of the Power Elite, serving to distract and discredit legitimate inquiries and analyses of the workings of the hierarchical structure.

But even if any one of us were invited to the inner sanctum of “The Order” and provided the opportunity to share the close-in knowledge of the workings of the hierarchy and the details of “The Plan” with eyes wide shut, we would then return to our extraordinarily ordinary existence knowing that we can do nothing to change it for the better for ourselves or anyone else, and that we will “die like rotten cabbages” (line from “The Prisoner” from the episode, “Free for All”, which anyone who believes in democracy and “elections” should watch during each “election”) like everyone else in time.

So, I suspect given the choice of personal powerlessness in the face of knowing the truth or fantasy detachment from the mundanity of existence and creeping existential despair, most of us would prefer to believe in reptilian overlords, tribal desert sky gods for our team, or extraterrestrial invaders from the Rings of Uranus. 😀

GregT on Wed, 28th Oct 2015 12:22 am

“This kind of nonsense (as entertaining and humorous as it might be) obscures the facts and the machinations of the Power Elite, serving to distract and discredit legitimate inquiries and analyses of the workings of the hierarchical structure.”

And in general the masses are perfectly satisfied with the narrative that they have been spoon fed from an early age. For those that question whether the pablum was actually strained peas or pureed butternut squash, enter the likes of Alex Jones.