Page added on September 17, 2014

World Oil Production According to the EIA

A few days ago the EIA published the latest update to its International Energy Statistics. The data is updated through May 2014. The data on all charts below is through May unless otherwise stated and is in thousand barrels per day. Also, all data is Crude + Condensate.

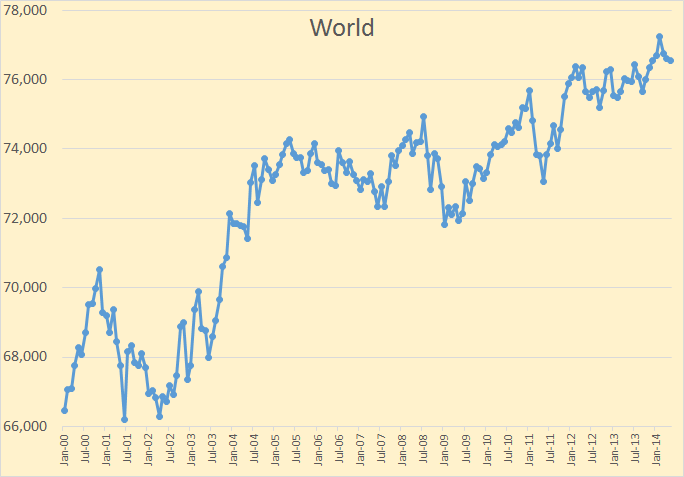

World C+C production was down 72,000 barrels per day in May to 76,540,000 bpd. It was down 708,000 barrels per day since reaching a new all time peak in February of 77,247,000 bpd.

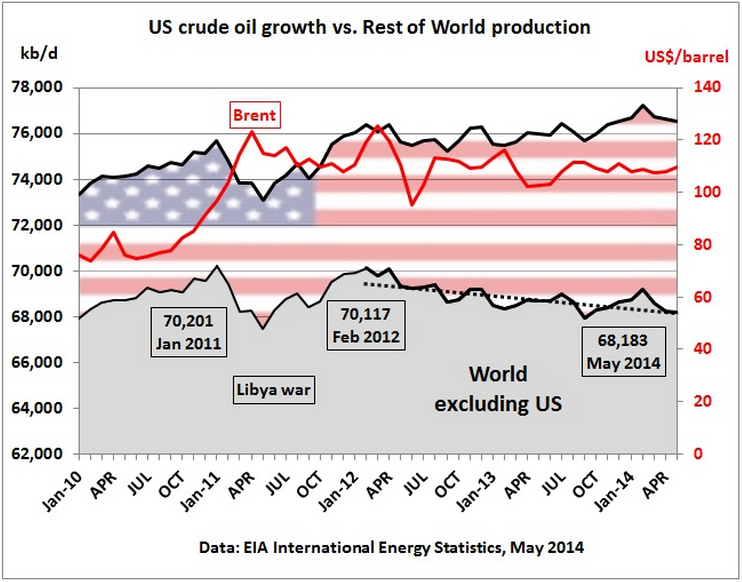

Matt, on his blog Crude Oil Peak, is saying the same thing I have been saying for months. That is US shale oil growth covers up production drop in rest-of-world.

The trend is clearly down and is going to get worse. Below is my graph using the same data.

World C+C production, less USA, is down about 2 million barrels per day since the all time peak. In the past decade world less USA has been up and down many times but I have reason to believe that this time it will not be up again. There are several reasons for this and it involves the peaking of several other countries that have shown considerable increase in the last few years. Not the least of which is Russia.

Russia, the world’s largest crude oil producer, has peaked. Russia is now in decline. Russian C+C production increased about 2,300,000 barrels per day 2005, the year that World conventional oil peaked.

Without sanctions Russia peaked in November 2013 and would have likely started dropping at 1 to 2 percent per year. But with sanctions the drop is likely to be much faster than that. We had this headline just this morning:

Russian crude oil exports seen down 6pc in Q4

MOSCOW: Exports of seaborne Russian Urals and ESPO crude oil blends were seen declining by 6.2 percent to 50.17 million tonnes in the last three months of the year from the previous quarter, traders said on Monday, citing a quarterly loading schedule.

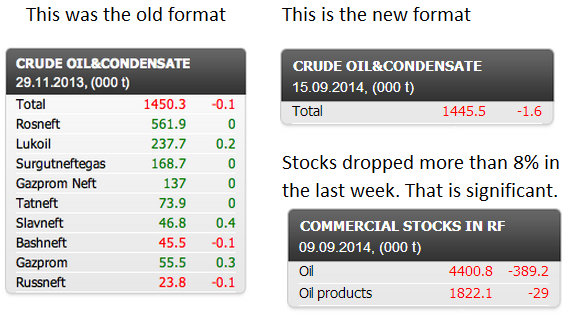

Some of the decline was due to increased input to Russian refineries but it is likely much of it is due to reduced Russian production. And speaking of Russian Production I am getting suspicious of their reporting. They have completely changed the format at their site CDU TEK.

They no longer report production from individual companies, just total production. I think it may be possible that they are doing the same thing as Iran after their sanctions. Iran showed no decline whatsoever in their production numbers for almost a year after sanctions were imposed. And they still show about a quarter of a million barrels per day more than the rest of the world sees as Iran’s production.

Perhaps Russia has the same motivation but don’t want to bring individual companies into their deception… so they just dropped them from their reporting page. I just threw in the “Commercial Stocks in RF” block because I found it interesting.

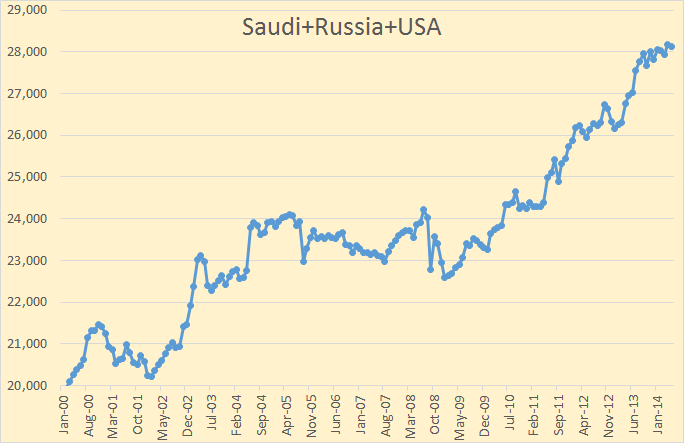

Anyway, let’s look at the world’s three largest oil producers.

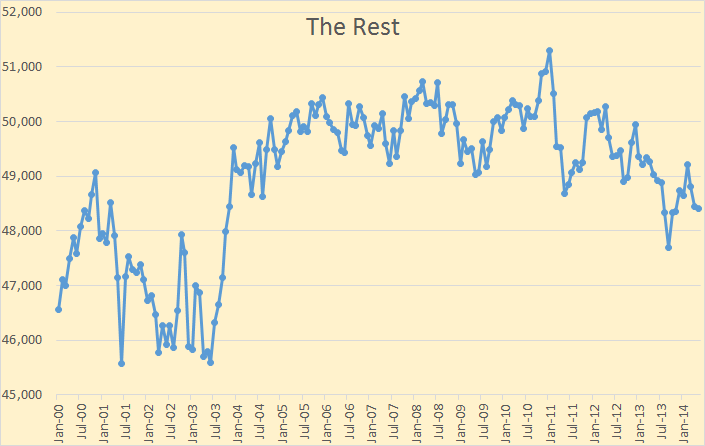

Saudi + Russia + the USA has been on a real five year tear since early 2009. But the combined growth in C+C production has slowed in the last ten months or so. And, I believe, it will peak next year and turn down rather significantly in 2016. Meanwhile the rest of the world….

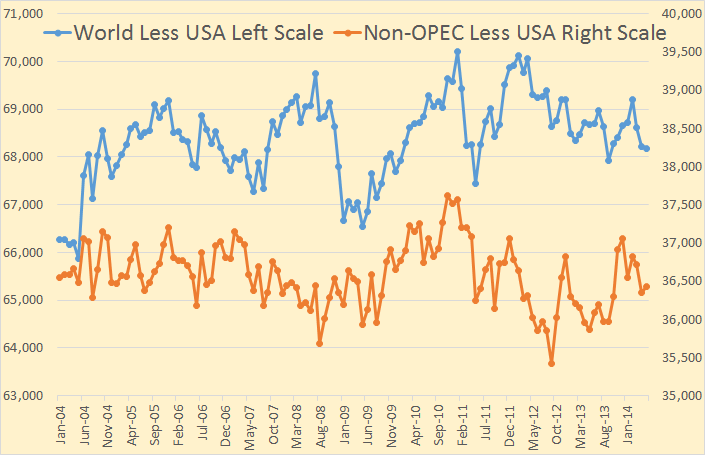

This is a graph of World oil production less Saudi, Russia and the USA. World less these three top producers peaked at 51,292,000 barrels per day and have dropped by 2,884,000 barrels per day in the 40 months since that date.

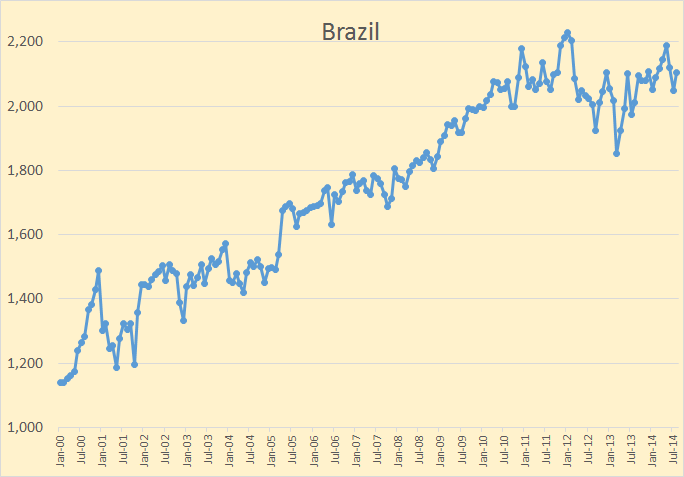

In other news there is Brazil: Petrobras Monthly Update: August Oil and Gas Production From Brazil Rises By 2.9% Over July.

Its domestic crude oil production grew by 2.7% from 2,049 thousand barrels per day in July to 2,105 MBD last month.

I have used the above figures to update my Brazil chart through August. (Assuming their numbers are C+C and not crude only.)

But in other news things don’t look so rosy for Brazil.

Brazil “falling off the world oil map” over failed policies

RIO DE JANEIRO – Investors are losing interest in Brazil’s oil industry as the country’s energy policies raise costs, reduce efficiency and increase risk, Brazil’s oil industry association, the IBP, said on Monday.

Without changes Brazil will likely lose out to places such as Mexico, Iran, Iraq and Algeria where policies are becoming more open to private sector investment.

“I went to the three largest oil conventions in the world this year and you hardly heard Brazil’s name mentioned,” Milton Costa Filho, Executive Secretary of the IBP told reporters at an industry event in Rio de Janeiro.

“Brazil is falling off the world oil map.”

The pages Non-OPEC Charts and World Crude Oil Production by Geographical Area have been updated with the data for May 2014.

16 Comments on "World Oil Production According to the EIA"

Plantagenet on Wed, 17th Sep 2014 10:55 am

Its peak oil, baby. Fracking is keeping us afloat for now, but don’t look away because things can change fast.

jjhman on Wed, 17th Sep 2014 3:32 pm

I have seen the “this is it” line so many times in the past 9 or 10 years that I’m getting a little cynical. Call that tiny drrop in russian production The peak just isn’t credible. When they are down more than 10% for more than a year get back to me.

JuanP on Wed, 17th Sep 2014 4:00 pm

I always like reading what Ron Patterson writes and looking at his graphs. It makes me nostalgic for the good old TOD days when we could read stuff like these daily, and those amazing comment threads I could never finish reading and catch up with.

This very clear graphs and info presented by Ron here spell a truth that is hard to deny. Well past the Crude Oil Peak, we seem now to be facing the global Crude + Condensate Peak. Next in line would be the Total Liquid Fuels Peak, coming to a gas station near you soon!

Northwest Resident on Wed, 17th Sep 2014 4:16 pm

JuanP — I like reading the comments on Ron’s blog/forum as much as the articles. I read this article on his site a couple days ago. If you read the comments, I believe you’ll find one where Ron seems to be rather confidently predicting that we will see peak oil next year — brought on by irreversible declines in shale oil output. Or maybe that was on the article before this one regarding Bakken output update. If that happens, then my predictions of SHTF in 2015 might just come true.

Plantagenet on Wed, 17th Sep 2014 4:39 pm

Yes, Ron Patterson’s website is good, but he does have a bit of a blind spot when it comes to fracking and oil production from tight shales. For instance, in his “What is Peak Oil” discussion on his website he discusses the 1970 peak in US oil production predicted by Hubbert, and then says: “US oil production had peaked, and has fallen ever since.”

Of course this isn’t true. US oil production has been going up for most of the last decade thanks to fracking of shales. Its even possible US oil production will soon exceed the 1970 record— the US government EIA has recently predicted the US will hit a new all time “high” in oil production in the next couple of years.

Harquebus on Wed, 17th Sep 2014 5:13 pm

“US oil production has been going up for most of the last decade”. So has its debt.

JuanP on Wed, 17th Sep 2014 5:24 pm

NWR, thx for reminding me of the comments thread over at Ron’s. Several TOD people there who’ve been at it for a while, well worth reading. I subscribed to Ron’s feed, among others, for a while until I settled down here.

A few years back, around 2007, after I had been chewing on PO info for a few years, I calculated that things would come to a head when consumption reached 91mbpd or 92mbpd, and we are now at 91.3mbpd. I reached that number by adding 3mbpd to my original results to allow for unforeseen events or unwarranted pessimism on my part, and then the US shale oil boom came along. I did not see the shale oil boom coming at all, I was completely surprised by it, so I was right to allow for some extra supply. I am hoping we can do something like that again, but based on my non specialist understanding of the situation, it seems highly unlikely.

I agree with Ron and you that the time is near.

JuanP on Wed, 17th Sep 2014 5:26 pm

By the way. I ordered Mini Farming. Thx for that recommendation, too. It’s next on my reading list.

Welch on Wed, 17th Sep 2014 5:33 pm

“When they are down more than 10% for more than a year get back to me.”

Bingo…and down without some obvious factor other than production constraints.

Nony on Wed, 17th Sep 2014 5:39 pm

It’s a nice site (even banned me), with very clear graphs. Ron does have some blind spots for basic math though. He spent several months not understanding that Texas RRC is several months out of date (he said only a single month of adjustment was significant). He also did not understand how the distribution of ages in a population of wells affects decline curve. Dennis Coyne was very diplomatic with Ron. I get the impression the better thing with him is to just let him crawl down over time from a misconception vice to straight out argue it.

Northwest Resident on Wed, 17th Sep 2014 9:29 pm

JuanP — I admire and respect the guys who actually know enough to do the math and to keep track of all the many physical variables that go into predicting peak oil. The real science type guys. I don’t aspire to be able to do any of that myself, but it is good to have scientific and mathematical confirmation of what I feel is the truth. There is enough circumstantial evidence for peak oil and the approaching collapse to be certain of it even without all the science and math that backs it up, but it is very confirming to know what I intuitively and logically believe has hard science behind it. The guys on Ron’s site, Ron included, engage in some fairly technical discussion which is a little above my head sometimes, but I get the drift, if you know what I mean. — I’m going to re-read Mini Farming myself once I get some time. That will be after I get all my rye planted, along with a few planters of kale which I believe will grow very well through the fall and probably be ready to harvest in December. I’m counting on the rye really breaking up this soil that I’ve got to work with. Where I planted crimson clover and alfalfa, I have discovered that the root systems of those plants totally broke up and granulated the hard soil, making it near perfect composition. If the rye does the same thing, and I suspect it will, then I’ll (finally) have some very good soil to work with. Four of my largest planters that I didn’t do adequate prep work on the first time around had to be dug up, chunked up and extreme effort made to remove all dirt clods. I mixed many bags of vermiculite into those planters, determined to never again let that soil compact back into hard-as-rock status. It was killer labor, but I got it done. I’m looking forward to planting next year, and I think I’ve got it down to a near science now. Re-reading Mini Farming will be sure to give me a few more tips. Oh yeah — I got a few thousand composting worms — red wigglers — and now I’ve got them making top grade fertilizer for me. After the rains get my soil nice and soaked, I’m going to order another few thousand night crawlers — the kind that dig deep down into the ground — and around December or January I’m going to give them a new home tunneling through my planters. That should add a whole new dimension to my soil quality. Hey — keep me posted on your progress with your mini-farming project, I can’t wait to learn how you’re doing, it is very interesting to me.

Northwest Resident on Wed, 17th Sep 2014 9:35 pm

Nony — Banned? No way!! From the many comments on different articles I have read on Ron’s site, I’d say that Dennis and Ron are pretty much in agreement almost all the time, just debating the minor specifics around the edges. I’m kind of glad you were banned from that site, to be honest, because if you weren’t banned then I know you’d be over there pushing your ideas on NG and fracking, and Nony, I shudder to think at the ass-kicking you would get over there. It’s better for you that you can’t post there — you might get hurt.

GregT on Wed, 17th Sep 2014 10:51 pm

“It’s a nice site (even banned me)”

Classic narcissism.

You have told us all here time and time again, that you would stop posting in these comment sections. Instead of wasting so much of your time and energy posting on a site with fundamentals that you so clearly do not agree with, why not move on? Or would it boost your EGO so much more if you could be banned from here as well? You are one strange individual.

Nony on Thu, 18th Sep 2014 2:42 pm

Good points. 🙁

marmico on Thu, 18th Sep 2014 5:32 pm

Classic narcissism

Ron Patterson is an old fart on Social Security and Medicare hoping his Mad Max bet pays off.

Davy on Thu, 18th Sep 2014 7:36 pm

M’s back folks cocky as ever.