Page added on June 6, 2018

USA And World Oil Production

All data below is from various sources. All US data is from the EIA. Unless otherwise noted is in thousand barrels per day.

US C+C production through April 2018. For the last 8 months, the average increase in US production has been 168,000 bpd. Most of this has come from the Permian.

This chart is through February 2018. US net imports peaked in 2006 and have dropped about 9.5 million barrels per day since then.

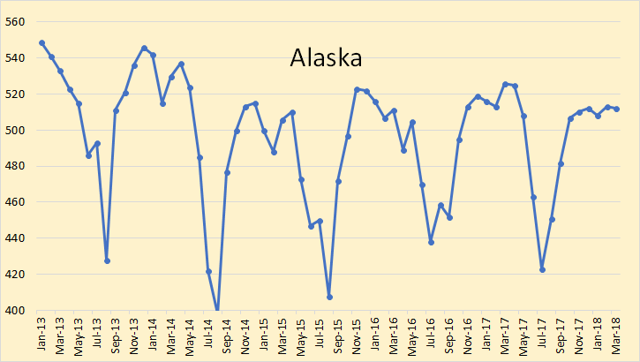

Alaska through March 2018. Alaska’s decline has definitely slowed.

GOM through March. The resurgence in GOM production seems to have petered out about a year and a half ago and is now holding at about 1.7 million barrels per day.

North Dakota through March. Has shale production peaked in North Dakota? It does appear that they are having trouble increasing production in the last six months.

Texas through March. All that increase in US production has come from Texas, primarily from the Permian. For how long and for how much will this increase continue? I have no idea but guesses will be welcome in the comments below.

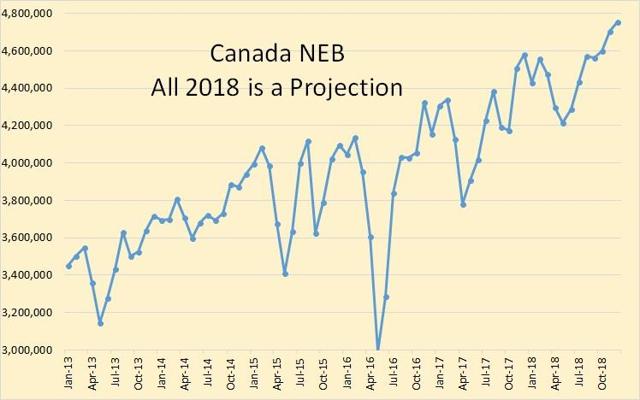

This data is from the Canadian National Energy Board and is through December 2018. They say all data from September 2017 through December 2018 is an estimate. They are expecting production to bottom out in May 2018 and then increase for the remainder of the year.

This data is from the Russian Minister of Energy and is through May 2018. Russian production has been almost flat for the last three months. Data from the Russian Minister of Energy averages about 400,000 barrels per day higher than the EIA’s estimate.

China through February 2018. China is clearly in decline though the decline seems to have slowed.

Mexico through February 2018. Mexico is in a slow decline though the decline has slowed in the last few months.

Norway + U.K. through February 2018. I have combined the two to show what is happening in the North Sea, with the exception of Denmark of course. But I find this a little shocking. The decline in North Sea production seems to have completely halted with even a slight increase.

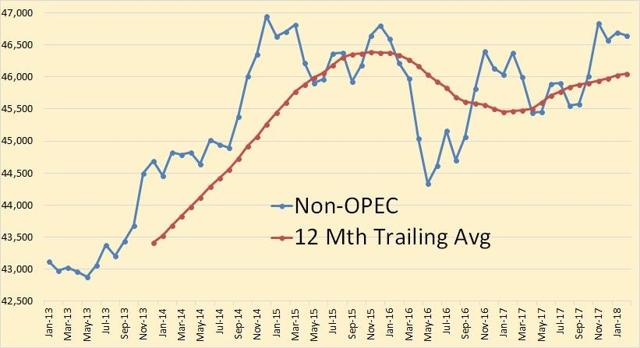

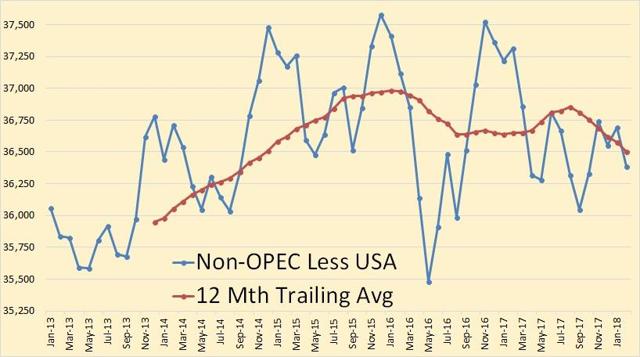

Non-OPEC C+C through February 2018. Non-OPEC production, even with the increase in US production peaked, so far, in December of 2014. The 12-month average peaked, again, so far, in 2015. But there is no denying that Non-OPEC production is on that preverbal bumpy plateau.

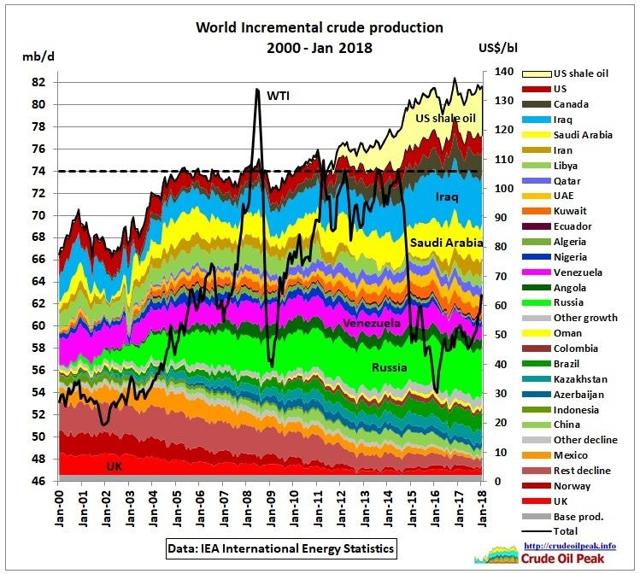

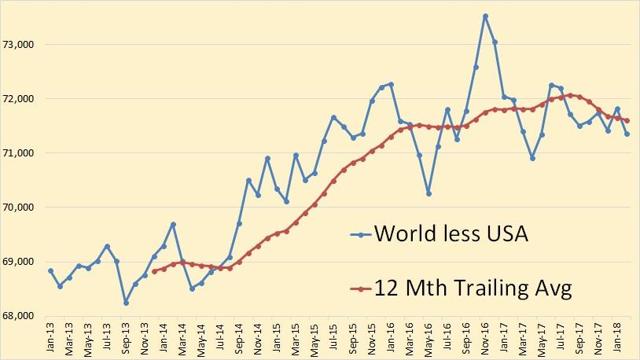

World C+C production through February 2018. World production seems to have been on a slow steady three-year increase in production after making a huge jump in 2013 and 2014.

This data is through February 2018. Just out of curiosity I thought I would show the US’s part in keeping peak oil at bay. Significant I would say.

And the US contribution to Non-OPEC production is even more significant. Again, the data is through February 2018.

Thanks to Mushalik for the above graph.

15 Comments on "USA And World Oil Production"

twocats on Wed, 6th Jun 2018 4:04 pm

Sure there is a chance this spinning plate act could fall apart in colossal fashion any day, but you have to admire the spunk of the humans to keep going in the face of the bleak facts of climate chaos, environmental degradation, water shortages, peak oil dynamics.

You know people decry the “one global government” thing as an instrument of oppression and terror against Freedom (registered trademarked), but the global actions taken thus far which have been coordinated (at a minimum in the sense that almost every country has done extensive easing) and it has definitely saved our asses.

This could be “calling the top” capitulation – but you have to give the global economy at least a small amount of applause for such an achievement to keep producing oil AT A LOSS – while continuing to grow the “Economy” (whatever that means), equity markets, asset prices, and on and on. Its quite an achievement to just suspend all the rules of former business cycles and completely destroy the boom bust cycle.

You have to wonder – why didn’t we do this centuries ago?

roccman on Wed, 6th Jun 2018 4:51 pm

If the agenda were to populate the planet with billions of more “believers”. There is no mystery in why the bailing wire and duct tape are working – as designed.

To grasp this one needs to accept that all “materially relevant” countries are working together…that is Iran is on the same team as Israel.

That I believe is the case.

Cloggie on Wed, 6th Jun 2018 7:57 pm

“You know people decry the “one global government” thing as an instrument of oppression and terror against Freedom (registered trademarked), but the global actions taken thus far which have been coordinated (at a minimum in the sense that almost every country has done extensive easing) and it has definitely saved our asses.”

No need for global government. There are numerous examples of successful intergovernmental agreements, take the Paris Accords.

Interestingly, the only government that actively seeks to achieve global government, by attempting to subvert every country that matters into its empire, refused to participate in those accords.

Apparently, both the Trumpert (“America First”) as well as the (((Deep State)))…

https://www.japantimes.co.jp/opinion/2017/09/29/commentary/world-commentary/americas-new-world-order-dead/#.WxiBYYqxWfA

…have given up on the project. Good riddance to that.

Hey, altright.com is up and running again!

https://altright.com/2018/04/25/macron-comey-syria-enoch-powell-starbucks/

Spencer has the same ambivalence vis-a-vis Macron as I have and gives him the benefit of the doubt.

ziogoat on Wed, 6th Jun 2018 8:34 pm

Fuck your groups and movements. Groups murdered more than a few billion people. Neanderthals would have created heaven on earth you hadn’t genocided them. Homo sapiens are mentally ill, retarded, cancers.

JuanP on Wed, 6th Jun 2018 8:42 pm

“Has shale production peaked in North Dakota?”

It looks like Texas is the only game left. Alaska and the Gulf appear to have peaked. It looks like Texas’ peak will mean global peak. It can’t be too long; we are running out of time. I wonder how they will explain that away. Peak Oil is real and it is almost here. Long live Texas! Carpe diem!

Anonymous on Wed, 6th Jun 2018 11:18 pm

Good article. I have a bunch of critical comments but it is from engaging with the material. I especially like how Ron is starting to look at the individual states. US is a huge producer so it is worthwhile, looking at different parts of it for trends.

1. US data is slightly incorrect. Ron is using STEO. However, there is a 914 out that is later. The March and April that he is showing are from STEO and are modeled, not data (yes even though the STEO font makes it look like data…those are modeled–914 is real). There is an actual March out from the recent 914 and it is slightly different from what is shown.

2. Texas is at record levels. EIA only has monthly data to 1981, but RRC has annual data to earlier. Current monthlies are higher than any annual levels. It has now passed China as a “country”. Is possible, it passes Iran and/or Iraq this year. Perhaps even Canada, although Canada also has strong growth. Growth this year will be constrained by pipes but in an unconstrained transport situation, the Permian can probably grow 1 MM bopd/year. Most of it in Texas.

3. GOM has been impressive how it has hung in there around 1.7 MM bopd. This is better than what the peakers said in previous years (they always tend to estimate low). There is a huge liability danger that limits development of GOM. BP got killed with penalties (paid way more than what the damage was…spill was overblown…TV hype.) Total has said this is something that while it doesn’t stop them, lowers their appetite.

4. Other states that would be interesting to see are following (all in the vicinity of half million bpd, similar to AK):

a. New Mexico: stunning rise last few years, above 600,000 bpd, Permian producer, now the #3 state, (#4 if you call GOM a “state”).

b. Oklahoma: good rise also, above 600,000 bpd.

c. California: long, slow decline. Now under 500,000 bpd

d. Colorado: good growth, above 400,000 bpd.

4. ND is always low in winter. All the projections are that they break their old record this summer.

5. Russia has slowly gone up over the years (proving the peak oilers wrong again and again). Right now, they are cutting for quota compliance.

6. Mexico is Mexico. Long slow decline. Screwed up national oil company. Part of the quota but that is probably not meaningful (going down regardless). Moral support, I guess.

7. Brazil and Kazakhstan would be interesting non OPEC countries to add to the list.

8. I think China was impacted by price. They can maintain or even grow slowly at $100 oil, but below $50 was no go. Will be interesting to see how they do with prices in the 50-80 band. Donno.

Cloggie on Wed, 6th Jun 2018 11:53 pm

Impressive statistics indeed. Who would have thought that 6 years ago.

And Venezuela could contribute if they would manage to reverse that socialist folly that destroyed the country and economy.

And what about Iran, there is still upward potential.

And they can still frack the rest of the planet, if that would be necessary. As soon as prices will go up again, renewables will become attractive and help to offset declining fossil production.

There is no real energy problem.

DerHundistlos on Thu, 7th Jun 2018 1:46 am

The signs are everywhere…….

“Scientists Stunned by Severity of Bird Species Losses in Southern Africa:

https://www.eurekalert.org/pub_releases/2018-06/uoct-ssb060618.php

Anonymous on Thu, 7th Jun 2018 1:53 am

You know Art Berman has often made the point that the US is one of the most tired and worked over basins in the world. But this is actually a double edged sword. Instead of looking at that statement and assuming bad things for shale, you can take the opposite tack. Look at how strongly we were able to grow gas and oil production in one of the most overworked areas. That implies a HUGE amount of opportunity around the globe because the other areas have not yet been as heavily explored and drilled.

Newfie on Thu, 7th Jun 2018 2:44 am

“… you have to admire the spunk of the humans to keep going in the face of the bleak facts of climate chaos, environmental degradation, water shortages, peak oil dynamics.” — twocats.

It’s stupidity, not spunk, that keeps humans going.

Davy on Thu, 7th Jun 2018 5:02 am

Good comment above Nony. I want to see us leave fossil fuels or at least adapt away from them as best we can. I doubt we can go very far with renewables but I hope I am wrong for the sake of the kids of the world. There is too much emotional focus on oil. People want bad news about oil and American oil in particular. Nony has given us the straight news from the early days and people tried to crucify him, me included. Many of us downplayed and dismissed shale. That said I still feel it is a retirement party because there is nothing left after shale. Shale is also economic oil and if we every have a severe economic decline shale will surely decline.

We have no choice but to use fossil fuels to try to reduce our need for them. Renewables are not made by renewables. Take the emotions out of the oil discussion. If you want to be emotional then blame humans for wanting comfort and convenience over resilience and sustainability. Blame science from making our oil world possible but not understanding the consequences. Blame countries from trying to outcompete each other or be conquered. We are our own worst enemy not oil. Every person on this form that is anti-oil is covered in oil hypocrisy.

Davy on Thu, 7th Jun 2018 5:30 am

“Dollar Is King”: Indonesia Joins India In Begging Fed To Stop Shrinking Its Balance Sheet”

https://tinyurl.com/y9v4tnxj

“the pace of the Fed’s balance sheet reduction was a key issue for central bankers across emerging markets. As a reminder, the RBI Governor made exactly the same comments earlier this week, arguing that slowing the pace of stimulus withdrawal at a time when the US Treasury is doubling down on debt issuance, would support global growth, as the alternative would be an emerging markets crisis that would spill over into developed markets.”

“Unfortunately for all these central bankers, it’s about to get even more difficult as policy normalization in Japan and Europe will bring more uncertainty, further monetary tightening and more outflows from emerging markets.”

“And while rate hikes are great to stabilize EM currencies and capital outflows, if only briefly, there is a just as unpleasant tradeoff: they cripple economic growth, and the result – in virtually every single case – is a recession, which sooner or later shits into capital markets. Indeed, as Bloomberg’s Garfield Reynolds writes, “India’s rate hike was Asia’s latest forced policy action as USD strength and Fed tightening spur emerging-market central banks to follow suit to stop FX routs. The result has been a massive surge in the average 2-year swap rate for EM Asia, and that may make conditions tight enough to hold down the region’s equities relative to U.S. peers.” And once enough peripheral emerging markets tumble, it is only a matter of time before the contagion spills over into the core, and – eventually – the US.”

deadly on Thu, 7th Jun 2018 6:20 am

China has decided to buy oil from everybody who has some and decrease production of their own resources.

Let somebody else do what needs to be done that is already done instead of us.

Makes more sense to decrease production and increase imports.

The US did that in the late 60s and early 70s.

It’s deja vu all over again.

Outcast_Searcher on Thu, 7th Jun 2018 3:52 pm

Twocats says oil is being produced at a loss even as the big oil companies are producing near record profits. Funny how that works.

Anonymous on Sat, 16th Jun 2018 9:09 am

Per my (4) above, ND has now reported APR production. Up 60,000 bopd and in kissing distance of all time oil record.

http://themilliondollarway.blogspot.com/2018/06/wow-wow-wow-june-15-2018-bakken-is.html

Something psychological about it. Every winter, ND slows down because it is hard to produce oil in ND winter. And every year, peak oilers confuse the seasonal slowdown with a systemic one. And then the spring comes and proves them wrong. Once again, we see same thing.