Page added on June 27, 2019

TROUBLE AT THE BAKKEN: Oil Production Finally Peaking?

Is the mighty Bakken Shale Oil Field finally peaking? Well, according to the data from the folks at the North Dakota Department of Mineral Resources, oil production in the Bakken has been flat for the past six months. And, to make matters worse, production has been flat even though oil prices increased from a low of $42 in January to the mid $60’s in April.

So, something seriously wrong is going on in North Dakota. What a difference in the Bakken’s recent oil supply compared to the field’s heyday when production surged from 300,000 barrels per day in 2011 to over 1.1 million barrels per day in 2014. Furthermore, the oil price the shale companies in the Bakken are receiving is now $48 a barrel versus the West Texas Intermediate price of $57.

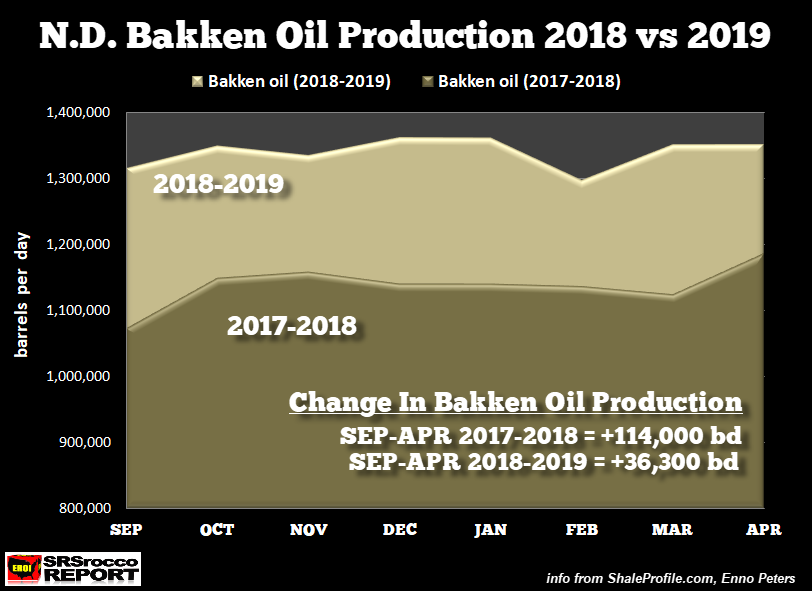

If we look at the past seven months, the North Dakota Bakken has only added 36,000 barrels per day (bd) of new oil production compared to 114,000 bd during the same period last year:

As we can see in the chart above, the output from Sep 2017 to Apr 2018 enjoyed an upward trend, while the Sep 2018-Apr 2019 has been flat. You can see this better in Enno Peters chart from ShaleProfile.com. I highly recommend followers check out his site as he provides updates on the top shale oil and gas fields in the United States using state data from over 100,000 wells.

These charts from ShaleProfile.com show the annual change production by different colors. Here we can see that Bakken oil production increased steadily from 2011 to 2014, plateaued in late 2014 and 2015, declined in 2016, raised in 2017-2018, and has plateaued once again in 2019. The likely culprit for the plateau in Bakken oil production has to do with the lower oil price and the reduction of investment funds available to the shale companies that continue to spend more money than they make.

And if you remember this chart from my previous article, most of the shale companies suffered negative free cash flow in the first quarter of 2019:

Numbers don’t lie, and according to this new article, Shale Pioneer: Fracking Is An “Unmitigated Disaster,” the situation for the U.S. Shale Bubble is about to go from BAD to WORSE. This is not good news because the increase in U.S. shale oil production has accounted for nearly three-quarters of total global oil supply growth over the past decade:

Once U.S. shale oil production peaks, then it’s highly likely that Global GDP will peak as well. Thus, if the Fed and central banks really start to print money, then the results will resemble more like what is taking place in Venezuela. Furthermore, as Venezuela’s oil supply plummeted over the past few years, it has impacted other energy sources. For example, according to the data in the BP 2019 Statistical Review, Venezuela’s electric generation dropped 15% last year versus 2017.

Unfortunately, most people have no idea what happens to an economy when oil production peaks and declines. Peak oil will impact the supply of all other energy sources such as natural gas and coal. And, the notion that going green and using electric cars are going to save us is pure FOLLY when we realize Solar and Wind are nothing more than fossil fuel derivatives. Without the burning of fossil fuels, the world cannot produce Solar and Wind power plants, or electric cars.

Moreover, the amount of plastic in the manufacture of an electric car by 2020 is forecasted to increase to 772 lbs (source: IHS Chemical). Plastic comes from petroleum, mostly natural gas plant liquids. While some plastic is recycled, the car manufacturing industry will need even more plastic to produce gasoline and electric vehicles in the future.

So, it seems as if the “Green Energy Advocates” fail to consider “ALL ASPECTS” of the global supply chain when they state that switching to renewable energy is the answer. Again, when U.S. and global oil production finally peaks, the public has no clue how disruptive it will be to the economy.

Lastly, if the oil price continues to increase due to geopolitics in the middle east on top of central bank money printing, we could see overall U.S. oil production rising in many of the shale oil fields. However, when the recession (depression) finally arrives, then the U.S. Shale Oil Bubble will likely POP for good.

15 Comments on "TROUBLE AT THE BAKKEN: Oil Production Finally Peaking?"

Duncan Idaho on Thu, 27th Jun 2019 12:46 pm

The Bakken and Eagle Ford will probably be in the rear view mirror shortly (Eagle Ford has already reached that).

That leaves the Permian– we shall see.

Anonymous on Thu, 27th Jun 2019 5:43 pm

Ah…the peak oilers. Back like moths to the flame.

1. Rhetorical question, what do we call NOV-MAY in the Bakken? What time of year is that? How MANY times have the peakers tried to equate a seasonal slowdown to a trend?

2. Bakken dropped after 2015 price crash, dramatically. And the peakers said it was over, over. And it has since then come back and risen 0.5 MM bopd from its recent trough and hitting new records. You would think the peakers would leanr from their last fuckup a few years ago.

Duncan Idaho on Thu, 27th Jun 2019 7:14 pm

Anonymous- don’t worry, you have a bit of time.

And if everything is slow enough, you won’t even notice.

Other issues will occupy your time.

Nostradamus on Thu, 27th Jun 2019 7:19 pm

Shale oil is presumably finite. It has to peak eventually.

Duncan Idaho on Thu, 27th Jun 2019 7:37 pm

Shale oil is presumably finite.

And a small faction of global oil supply.

So far Nov of 2018 has been the height of oil supply- not going to exceed it in 2019, but we shall see in 2020 or 2021.

Argentina also has a possible shale play, but that is about it.

print baby print on Fri, 28th Jun 2019 4:53 am

Again, when U.S. and global oil production finally peaks, the public has no clue how disruptive it will be to the economy.

They will find out hahahhahahha

ANAL REAPER on Fri, 28th Jun 2019 6:46 am

THE BAKKEN IS DONE! Just like DEMS!

MAGA 2020 NIGGERS!

joe on Fri, 28th Jun 2019 10:03 am

Tight oil will be just fine as long as money’s cheap. With the Fed rate lingering at a paltry 2-2.5% that means a) Government don’t have to do shit other than print more bucks to be able to pay off that debt, b) Risk shy, cheap money + trade wars will kill off global growth.

The Dems are finally starting to catch on. The banksters really are the enemy. Sadly not one of them is sincerely trying to do anything to stop them, not even Sanders.

Coffeeguyzz on Fri, 28th Jun 2019 5:24 pm

This Steve guy is almost as entertaining as Mr. Short.

New monthly production records are already being touted for June, certainly July as gas processing plants come online and operators will be able to produce more oil without exceeding gas flaring limits.

DAPL owners are almost doubling capacity from 570,000 bbld to 1.1 million bbld.

Peaking. sheesh. You guys seem to never learn.

BTW, Duncan, check out the Bazenhov.

Vaca Muerta has outstanding gas well profiles, but topside issues are dogging the Argentinians.

In the US, the Powder River is ramping up, SCOOP/STACK/MERGE are doing WAY better than recent doomster analysis would indicate.

Uinta is in very early stages.

Cowboyistan fo evuh!

marmico on Fri, 28th Jun 2019 6:22 pm

Didn’t that nutter Steve St. Angelo pen a blog post entitled “THE DEATH OF THE BAKKEN FIELD HAS BEGUN: Means Big Trouble For The U.S” 3 years ago.

Why, indeed he did.

https://srsroccoreport.com/the-death-of-the-bakken-field-has-begun-big-trouble-for-the-u-s/

Anonymous on Fri, 28th Jun 2019 9:04 pm

EIA 914 for April is out. US was up a quarter of a million bopd. Passing 12 MM in the rear view mirror. GOM kissingly close to 2MM bopd and Texas close to 5 MM bopd. One or both likely to cross next month.

Tough days to be peak oilers. What does The Oil Drum and ASPO have to say now?

Duncan Idaho on Fri, 28th Jun 2019 9:26 pm

Global production peaked in Nov 2018.

Things will be flat in 2019. 2020 or 2021 could be a rise.

We shall see if Nov 2018 can be surpassed. It won’t happen this year. Could in the future.

Davy on Sat, 29th Jun 2019 4:34 am

“Tough days to be peak oilers. What does The Oil Drum and ASPO have to say now?”

Nony, time is on the peakers side, Nony. While this growth is truly amazing compared to what many peaker thought. Strong headwinds are ahead.

Westexasfanclub on Wed, 3rd Jul 2019 5:27 am

“Tough days to be peak oilers. What does The Oil Drum and ASPO have to say now?”

Conventional production has been flat since 2005. All that insane unconventional drilling paid for with about zero interest money just means kicking down the can. We’ll see where it all gonna end up (probably in the next cyclic crisis).

Bruce Okso on Tue, 20th Aug 2019 12:02 am

North Dakota (the Bakken) hit an all-time production record in June, 2019, the most recent month for which data is available.