Page added on November 18, 2013

The Coming Bust Of The Great Bakken Oil Field

There has been a lot of Fanfare on the huge increase of oil production coming from the Bakken Field located in North Dakota. There are many stories of people moving to the state to take advantage of the new OIL BOOM. It seems like everyone is going there to start a new life and make it rich in one of the coldest areas in the United States.

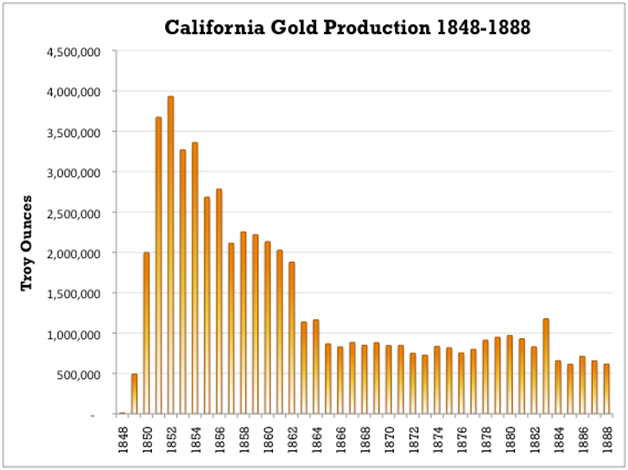

However, with all BOOMS, comes the inevitable BUST. This was true shown by the famous example of the 1800′s California gold rush:

According to the article, “The Bakken Boom: The Modern Day Gold Rush”:

Despite the low productivity of the labor-intensive process of gold panning, annual production grew from just over 1,400 ounces in 1848 to more than 3.9 million ounces by 1852. To put this into perspective, prior to 1848, cumulative U.S. gold production amounted to just over 1 million ounces.

Of course nuggets are easier to find than flakes, and the great majority were discovered in the first few years. By 1852, only four years after gold was first discovered, California gold production began a rapid descent. Production declined 50% by 1862 and 80% by 1872.

The decline was only barely checked by the adoption of ‘hydraulic mining’ – a process by which massive amounts of water under intense pressure is used to disintegrate entire hillsides. At the North Bloomfield mine, for example, 60 million gallons of water per day eroded more than 41 million cubic yards of debris between 1866 and 1884. (http://www.sierranevadavirtualmuseum.com/docs/galleries/history/mining/hydraulic.htm)

Typical of all BOOMS, production increases exponentially, peaks and then declines in the same fashion. However, Even with high-tech hydraulic water mining techniques, the industry could never produce more gold than it did in 1852 when it reached nearly 4 million ounces.

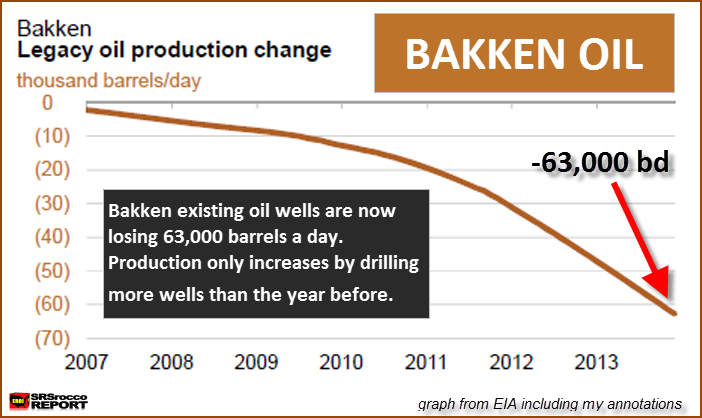

BAD NEWS FOR THE BAKKEN: Decline Rate of 63,000 Barrels A Day

The EIA – U.S. Energy Information Agency is now putting out data on the individual shale oil and gas plays in the country. While the American public and world have been made aware of the huge increase in oil production coming from the Bakken, few are privy to the dark side of the equation. The Bakken’s daily decline rate from their existing oil wells has reached a staggering 63,000 barrels a day.

This means, that every day the Bakken pumps oil, its existing wells are now declining 63,000 (bd) barrels a day. As you can see from the chart above, the rate really started to decline in a big way after 2011 when the average daily decline was only 20,000 bd. In less than 3 years, this rate has increased more than 3 times (63,000 bd).

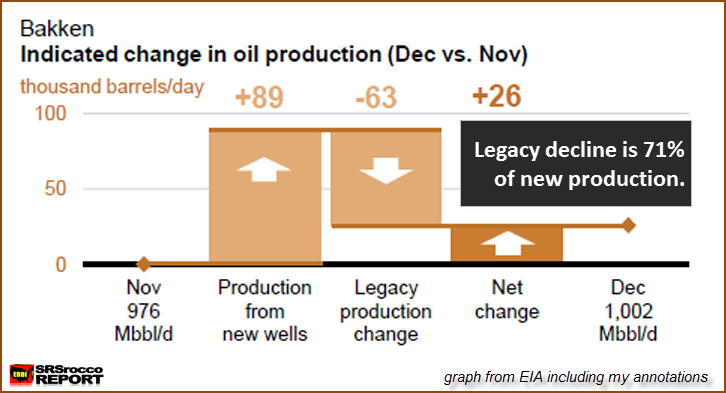

This next chart gives us the total as well as net oil production increases month over month:

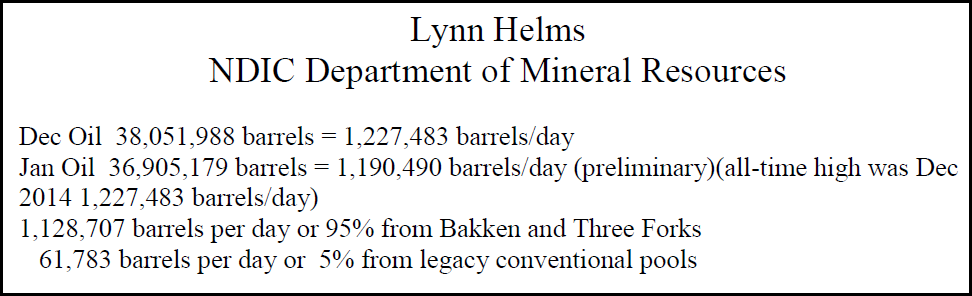

The EIA is showing what is indicated to take place in December over November. If we look at the actual data that comes out of the North Dakota Department of Mineral Resources, Bakken oil field production in September hit 867,123 bd. The difference to reach that 1 million barrels a day is coming from the Montana portion of the Bakken.

Here is an actual screenshot of the ND DMR’s monthly report released November 5th:

Moreover, if we look at total production, again using the North Dakota DMR’s data, their total oil production data for the state in September was 931,940 bd. This includes oil production outside the Bakken and Three Forks (data for Bakken in the EIA charts includes Three Forks).

Astonishingly, 93% of North Dakota’s oil production comes from the Bakken region alone.

The Bakken Drilling Frenzy Gives The Illusion of Sustainable Growth

The typical American believes the United States has all this hidden oil and gas resources that we can easily tap into. I just had a conversation with a neighbor yesterday who told me that he couldn’t understand why we weren’t “ENERGY INDEPENDENT.” Gosh, if I had a dollar for every time someone said that…

Again, the public is only told about all the huge increases in production, but for some strange reason, MSM tends to omit the negative side. The only way oil production is increasing in the Bakken is due to the massive amount of new wells that have been added. The chart below reveals the illusion of this sustainable growth:

First, the figures in white represent North Dakota’s total wells producing for their production of the Bakken. Even though the graph includes Montana’s production, it still gives us a good idea of the huge increase in oil wells it takes to grow production.

Second, in 2008, the Bakken in North Dakota only had 479 producing wells, however at last count in September when then Bakken was producing 867,123 barrels of oil a day, it took 6,447 wells to do so. Thus, the energy companies drilling and producing oil in the Bakken have to keep increasing wells each month (and year) to offset the huge 63,000 bd decline.

For example, there were an additional 135 new wells (ND) producing in Sept. over Aug. which added 20,589 bd of production. If there were only say 100-105 new wells added that month, production would have remained flat or possibly declined for Sept.

Lastly, the best and most productive wells are exploited first leaving the dead-beats for last. This will make things even more fun as the peak and subsequent bust finally arrives.

The Coming Bust of The Great Bakken Field

As with all oil fields, there are only so many sweet spots and areas to drill. The 63,000 bd decline rate at the Bakken only has one way to go — and that’s higher. If the present trend continues (highly likely) then we are going to see a daily decline rate of 75-85,000 barrels a day by the end of 2014.

Thus, the shale oil players are going to have to make those drilling hamsters work even harder as they will need to increase more wells each month just to grow production. At some point in time (sooner rather than later), the daily decline rate will reach a figure that these companies will be unable to offset.

There are only so many drilling locations available and once they run out, the Great Bakken Field will become a BUST as the high decline rates will push overall oil production down the very same way it came up.

Those who moved to the frigid state of North Dakota with Dollar signs in their eyes and images of sugar-plums dancing in their heads will realize firsthand the negative ramifications of all BOOM & BUST cycles. At this time, the word “Cold” will have more than one meaning.

Once the Bakken and Ealge Ford oil fields peak and decline, the United States has no other “ENERGY RABBIT” in its hat. This is precisely why investors need to understand energy and why its important to own physical assets such as gold and silver.

17 Comments on "The Coming Bust Of The Great Bakken Oil Field"

rollin on Mon, 18th Nov 2013 1:49 pm

Nice article, a more graphic way to represent what we all knew already.

The peak may be only 5 to 10 years away in the Bakken but one must temper the panic with knowledge. The actual descent of the Bakken will not be a linear 63% drop, it will be a long tailed drop with reduced fall in production each year from older wells.

Although more wells are being drilled each year, the real story is underground with an exponential rise in footage drilled and increased fracking rates per length of horizontal run.

Eventually the region will be nearly saturated and less productive drilling may control the turn-over point and descent rate in the region. It will still produce oil for a long time but will no longer be one of the “stars” of US oil production.

The real shame in all this was that continuous oil fields provided extra energy needed to start transistion away from oil. Instead it has just been burned for BAU.

Oil is only one source of energy.

Prepare for liquid fuels from coal and natural gas as well as more bio-fuels. BAU will not go down without a fight.

mo on Mon, 18th Nov 2013 2:00 pm

A reiteration of a lot of other reports with a commercial at the end.

solarity on Mon, 18th Nov 2013 4:09 pm

Excellent Article. The trend in California gold production is revealing, especially when analyzed over a 100 year period. It probably represents a realistic idea about the future of both bakken and world oil. Rollin is right: it will be a long tailed slow drop, rather than an abrupt cliff.

I understand that virtually all drilling rigs available in the US (a few thousand) are now in ND (and less-so Texas). The 2013 jump can be explained by the relocation of about 100 rigs per month into these areas. Because no more existing rigs are available, additional drilling capacity must be built-up. But, I estimate that manufacturers can only produce about 50 new rigs a year.

SRSrocco on Mon, 18th Nov 2013 4:18 pm

The internet is quite fascinating. One never knows how things spread.. but they do.

This post-article was meant for my site which explores how energy will impact the precious metals, mining and overall economy.

I have no control in the distribution of my articles to sites such as PeakOil.com. I am well aware that the folks at the peak oil sites are much more educated and savvy than the typical American public or investor.

However, the majority of the public has no clue about these energy details. I happen to believe the precious metals have been a store of “Economic Energy” for thousands of years.. and the 40+ year Fiat Monetary Experiment will end badly.

It is my contention that the $100 trillion of global conventional assets under management will lose a great deal of their value in a peak energy environment.

I look at the precious metals as a far superior store of wealth than most paper assets. While some may see my stance on owning precious metals as a “Commercial”, others may find it as a very credible common sense way to protect wealth.

steve

J-Gav on Mon, 18th Nov 2013 4:56 pm

Thanks for intervening Steve, that clarified a few things.

One question though: when you’ve got gold and/or silver (and it had better be physical), where are you going to store it? In a Swiss bank? Will you be able to access it there when you neeed it? In an American bank vault? Will that bank still be alive in 10 years? Will they have used your gold to pay off their first-in-line creditors? Or maybe the U.S. Govt. will have just confiscated it at a bargain basement price like in 1934?

Apart from that, the ‘drilling hamsters’ image is a very apt one for our present situation.

shortonoil on Mon, 18th Nov 2013 5:06 pm

The underlying, and inescapable problem with tight oil is that these are primarily gas drive, condensate wells. They are pressurized vessels with a hole drilled in them. As the gas escapes the pressure, and the temperature falls, and the heavier fractions condense out around the lower pressure/ temperature well bore area. Increased lateral lengths, and/or fracking stages does not affect the basic physics that drives these wells. The heavier fractions are the first to condense out, leaving mostly methane toward the end of the wells life span. Because the rock has very low permeability there is limited migrations of gasses from outside the frack’ed area. The well’s total production is dependent of the fissure length of the fracking, and the well bore’s lateral lengths. In brecciated shales, and schists, where these deposits are usually found, these are limited to fairly short distances. Unlike conventional wells where the injector is fracked, fractures in the shale oil/gas producer do not grow, they shrink over time.

The shale industry has put a huge amount into PR, and propaganda to promote this industry. In reality, in 2012, the industry put more money into drilling than it produced in product. The extremely low energy return on these projects guarantees they will be shut-in way before conventional sources are exhausted!

SRSrocco on Mon, 18th Nov 2013 5:12 pm

J-Gav… gosh, I don’t have all the answers and sure, there are no guarantees in owning precious metals as the threat of confiscation, high capital gains or etc are a real concern.

However, the U.S. Govt only received 25% of the public’s gold during the 1933 “Gold Confiscation Act.” I would imagine those who own the physical metals today will not part with it in the same fashion as before.

I think the best place to store precious metals if an individual does not feel comfortable storing it at their residence, would be a private vault such Brinks & Loomis.

If there is a Bank Holiday, the worst place to store anything is at a commercial bank vault.

It is really up to the decision of the individual. However, I believe assets based on digits in an account are much less of a guarantee than physical assets.

That’s my rule of thumb.

steve

mo on Mon, 18th Nov 2013 10:36 pm

Ive been hearing and reading about the US and world economy falling apart for many years now and it still hasn’t happened. Can someone out there with their crystal ball tell me why. And keep it simple I’m just a regular guy without much knowledge of such things

Dave Thompson on Mon, 18th Nov 2013 10:40 pm

Find a four season location to live with a community that you are a a part of. On a bit of land with a smallish home and space for a garden and a few chickens, a goat perhaps too. Learn to walk or ride a bike on a daily basis. Help your friends and neighbors, they in turn will do the same or you.

Enno on Tue, 19th Nov 2013 1:16 am

Great article, and I much agree with the sentiment. However, I found the description of the decline not so clear or even wrong.

“The Bakken’s daily decline rate from their existing oil wells has reached a staggering 63,000 barrels a day.”

What I see from the graphs is a MONTHLY decline rate of currently 63000 barrels a day in the Bakken. Thus, every month, the Bakken is losing an extraction speed of 63000 barrels a day.

Please correct me if I am wrong.

BillT on Tue, 19th Nov 2013 1:35 am

mo, the world’s money printing presses are running flat out. Consider them a monetary bicycle pump trying to re inflate a tire that has a nail hole. If they pump fast enough, they can maintain enough pressure to make the tire appear inflated, until the hole widens and it goes bust. That’s how I see it.

I see gold as the money of countries, not individuals. It CAN be confiscated by any government is they are determined. Would a death sentence for ownership be enough for you to hand yours over? A drone taking out your family as an example would work for others. Then there are roving gangs, etc.

Dave has the right idea…

mo on Tue, 19th Nov 2013 3:05 pm

Sorry guys I was just being facetious. I get pissed off when I read a long dissertation of something and then at the end someone trys to sell you something (it did seem that way to me). Unfortunatly it works on the vast majority of the people . Manipulation. Did anyone ever read Extraordinary Popular Delusions and the Maddness of Crouds?

Northwest Resident on Tue, 19th Nov 2013 4:50 pm

History is full of self-sustaining communities where gold and silver had no value whatsoever, other than as perhaps in the making of shiny trinkets. Some of those communities still exist today. The allure of storing gold and silver is to build and maintain WEALTH. And what good is wealth except as a means to gain power and control over others? The way I see the future shaping up, there won’t be a lot of use for gold/silver, except for shiny trinkets. Maybe when collapse first hits you’ll be able to use it good end, but just owning it for the sake of building/maintaining wealth — not so sure.

Mark_BC on Tue, 19th Nov 2013 6:37 pm

Does anyone have a source of reasonably up to date total US oil production? The BP Statistical Review is a bit lagged.

mo on Tue, 19th Nov 2013 9:32 pm

Whoever has a store of food and medicine will be the power broker

Norm on Tue, 19th Nov 2013 11:12 pm

Gasoline is down to $3 a gallon. Buy an Escalade.

mo on Wed, 20th Nov 2013 2:23 am

What the hell, buy a hummer