Page added on September 19, 2013

Tech Talk – changes in South American exports

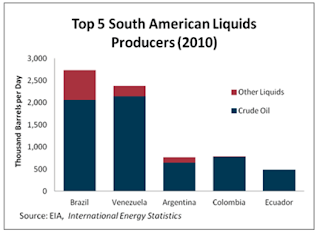

One of the large concerns that came up repeatedly over the years of discussions, both of the articles and of Drumbeat at The Oil Drum (TOD) was the subject of growth in domestic demand from some of the larger suppliers of oil and natural gas. This growth would be to the cost of the export market, and will, therefore, over time, reduce the amount available to importing nations. This becomes an even more painful reality to the rest of the world when the projections about future performance turn out to have been overly ambitious. Consider the countries of Latin America, where, back in 2010, the EIA drew the following baseline:

Figure 1. The largest producers of liquid fuels in South America in 2010 (EIA )

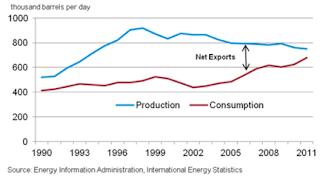

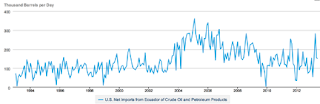

The EIA anticipated that Brazilian production would reach 2.8 mbd in 2012, and 3.0 mbd this year. However, as the latest MOMR from OPEC notes, Brazil will likely produce only 2.61 mbd this year, with the potential to rise to 2.67 mbd by the end of the year. However the rise in domestic consumption, and the failure to achieve the production goals expected has had an impact on the exports to the United States.

Figure 2. The changing volumes of US imports from Brazil (EIA )

The EIA reported that Venezuela produced some 2.47 million barrels a day in 2011, of which the USA imported roughly 1 mbd. That volume has, however, been declining for some time. (Note that in the plot below the Virgin Island imports should perhaps be included, because the crude that runs through the refineries on the islands originates in Venezuela, but they are not in this plot). At the same time a significant proportion (250 kbd in 2010) is now being shipped from Venezuela to China.

Figure 3. The changing picture of US imports from Venezuela over the years (EIA )

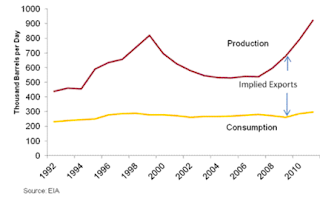

The situation in Argentina similarly shows that as with the other countries internal consumption is rising, while in this case overall production is falling and there is a consequent impact on exports.

Figure 4. The oil balance in Argentina (EIA )

China has been getting around 20% of Argentinian exports, while, in 2011, the USA got 40%, but the volumes of US imports have now turned negative.

Figure 5. The changing picture of oil imports to the USA from Argentina (EIA )

Of the five countries that were tabulated at the top of the post, Colombia is the exception. Production is still rising significantly, however it should be noted that, back in 2010 when the USA received some 422 kbd of crude and refined products from the country, China was financing a pipeline to carry 600 kbd to the Colombian Pacific Coast.

Figure 6. The increase in oil production with little increase in domestic production in Colombia (EIA )

The oil for the pipeline is anticipated to come from both Venezuela and Colombia, and the preliminary agreement for its construction was signed in May, 2012. Venezuelan agreement is still lacking to the deal and Venezuela, which was supposed by now to be sending natural gas to Colombia (after having received supplies for years) has still not made the switch. Volumes of exports to the USA from Colombia have fluctuated recently, while India and China have been acquiring oil wells and their production, which then ships to Asia.

Figure 7. The changing picture of oil exports to the USA from Colombia (EIA).

And that leaves Ecuador., which for those who might have forgotten, is also a member of OPEC. (It rejoined in 2007 ) It produces around 500 kbd, and with internal consumption running at around 200 kbd, exports the rest.

Figure 8. The changing picture of oil exports to the USA from Ecuador (EIA )

The recent news that the President of Ecuador is opening the rain forest to oil development, after trying to find funds for preservation of the forest without it and failing. Ecuador has an increasing debt with China (about $20 billion) and this is forcing it to use oil exports as a way of servicing that debt. One $2 billion loan, for example, carries a return agreement for some 130 million barrels of oil over six-years (60 kbd). Part of the loan from China will be spent on refineries in country.

The point to note in all five cases is that the imports to the United States have been declining. Given the increase in US domestic production that is not wholly surprising, nor is there yet any immediate cause for concern. But it is what is happening to whatever excess that these countries produce, over that consumed domestically and in the US that is significant. Because, increasingly it is going to China, and to Asia in general.

The concern that this raises is that, should US production not continue to rise at the rates that the more cornucopian of the main stream commentators suggest, then there will come a time when the US will have to go back to its suppliers from the last decade to ask for more. And at that time the odds are going to be high that either the countries won’t be able to meet the demand because their own domestic consumption has consumed the surplus, or that the surplus has been sold to China.

Given that China is making investments at the moment in the South American oil infrastructure, from wells to pipelines, means that it will control this production, and that removes a significant source of supply, at a time when it will be needed.

5 Comments on "Tech Talk – changes in South American exports"

bobinget on Thu, 19th Sep 2013 4:22 pm

This is really a story about China, not South America.

While US based multi nationals through US Armed forces were preoccupied protecting existing oil supplies in the MidEast, spending a billion dollars a week of borrowed money killing ‘bad guys’, China was in our back yard (and African) lending US dollars to

any oil producing nation willing to hock future production. Most of our ME deals fell flat leaving us with Mexico and Canada as our only secure suppliers.

While we take both for granted, China is making inroads in Canada buying oil companies and leases.

China to lend Mexico’s Pemex $1 billion for ships and offshore gear

Mexico City (Platts)–5Jun2013/556 am EDT/956 GMT

China agreed on Tuesday to provide a $1 billion credit line for the acquisition of ships and offshore equipment for Mexican state oil company Pemex.

The agreement was signed by the visiting Chinese President Xi Jinping and his Mexican counterpart Enrique Pena Nieto, Pemex said in a statement late Tuesday.

It marked a significant thaw in oil diplomacy between the two nations after years of a fraught relationship during the predecessors of their leaders, Hu Jintao and Felipe Calderon.

In a statement, Pemex said the credit line from the Chinese Export-Import Bank would “permit a major financial option for the renewal of the Pemex shipping fleet and the modernization of its offshore equipment.”

The facility is to run for three years and represents the Chinese institution’s first operation with the Mexican company, the statement added.

While China and its oil companies have developed a very close relationship with other Latin American oil powers such as Brazil, Venezuela and Argentina, Beijing has largely shied away from Mexico’s state monopoly.

However, Pena Nieto has promised to enact a major reform later this year that is expected to open foreign investment into the Mexican energy sector.

Pena Nieto, who took power at the end of last year, visited China in April. Then the first signs of a thaw began to emerge, when Pemex started supplying 30,000 b/d of Mexican crude to China’s Unipec — trading arm of the country’s largest refiner Sinopec — under a two-year contract agreement that started in April.

In addition, Pemex and the Xinxing Cathay International Group signed a memorandum of understanding to seek opportunities in joint development in pipelines. On Tuesday, the memorandum was followed up by an accord between the two companies.

CAM on Thu, 19th Sep 2013 4:37 pm

So! China is behaving as if “Peak Oil” is real, and is getting really close. Well Well!! How about that!!

Arthur on Thu, 19th Sep 2013 5:16 pm

Not all Chinese are acting as if PO is real:

http://www.businessweek.com/articles/2013-06-27/nicaraguas-canal-chinese-tycoon-wang-jing-wants-to-build-it

This guy apparently thinks that global trade is going to increase over the coming decades. And Americans want to invest in the project as well. Probably because it would shorten the route east-west seaboard considerably.

BillT on Fri, 20th Sep 2013 1:02 am

This is not news to those who read and think. It became obvious to me years ago that exporting countries domestic use was going to continually rise, causing exports to shrink until there was zero going out. The first time I read that domestic use in Saudi Arabia was growing at 7% annually, I saw that in less than 20 years, they would be at zero exports, if not a lot sooner due to contraction of production. Now it appears that 10 tears may be max.

Ditto for ALL other exporting countries, including Canada and Mexico. THAT is what the government people see, not today’s numbers.

Long before that day arrives, oil, and it’s products, will get too expensive for the average person to run their Western lifestyle. Those black swans are circling lowe4r and lower.

GregT on Fri, 20th Sep 2013 7:51 pm

“Long before that day arrives, oil, and it’s products, will get too expensive for the average person to run their Western lifestyle.”

Correct, and one of ‘oils products’ just happens to be food.

One in six in the US can’t afford $100 a barrel food, and one in eight in Canada. What happens when our governments run out of money to support food programs, and oil hits $200 a barrel?

Shit happens, bad shit……..