Page added on January 17, 2011

Past, Present and Future Venezuelan oil production

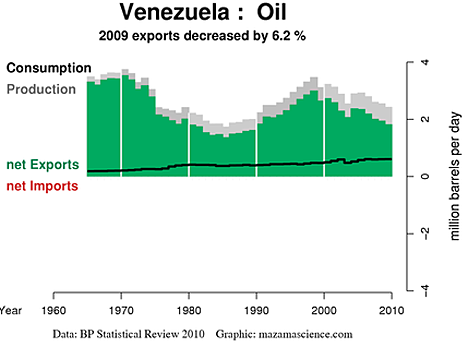

Last week I wrote a little about the planned production of heavy oil from the Orinoco Basin in Venezuela and used that as the basis for a discussion on API gravity and refinery gains. What I would like to do today is to revisit this area of Venezuela and discuss a little more of the region and the potential for increased production, and how it might be achieved. But let me start with overall production from Venezuela, for which (as my comment on Chinese imports last week exemplified) data is not always consistent.

Taking the curve developed at Energy Export Data Browser for the country, the initial impression is a classic example of a depleting system, with rising internal consumption having a negative impact on overall exports, which have already fallen below 2 mbd. The EIA note (and this has been a problem for a while) that it is difficult to assess the make-up of the production stream, but estimate that in 2008 about 250,000 bd came from condensate, NGLs and refinery gains. The United States has seen a steady decline in the amount of oil that it imports from Venezeula, with the daily rate falling below 1 mbd towards the end of last year. Within the past two weeks it has fallen as low as 650,000 bd.

The steady fall in Venezuelan imports to the USA (EIA)

Overall Venezuela was reported as producing 2.25 mbd in November with production falling over the course of the last year. This is somewhat less than the 3 million barrels that the Venezuelan Oil Minister claims that they are producing. Hopes for the future therefore rest on increased production from oil sands of the Orinoco that I briefly described last time. I should also clear up what may be a little confusion in nomenclature. This is a map of the Belt from a study done by the Baker Institute at Rice in 2002. (H/t KLR)

At that time production came from four strategic operations built around individual upgraders: Petrozuategui, Petromonagas, Petrocedeno, and Petropiar. As some of the references here note, the upgraders are beginning to suffer from a poor record of maintenance and are thus more difficult to maintain at the original levels of production.

More recently there has been a renaming (as in the table) and the bids relate to zones now defined by PdVSA as:

Different regions of the Orinoco Belt (Energy-pedia news)

To a degree Venezuela in the same situation as Canada, as conventional production of oil diminishes, so the rise in oil prices is making it more practical to produce the heavier oils of the Orinoco Basin, although almost all the oil from Venezuela is both heavy and sour. However this also may lead to volume calculation concerns since there is a reported 10% loss in volume as the heavy crude passes through the upgraders to be pipelined as a syncrude. Thus from the four major current producers there is a variation between 640,000 bd of raw crude (API gravity between 8 and 9.3 degrees) input; and the 579,000 pf syncrude (API gravity 16 to 32 degrees) that is produced. The heavier crude is also discounted in price, so that, with the OPEC basket at $90.38 at the end of last year, the Venezuelan basket was reported to be selling at $ 84.83. Heavy Oil Guy commented on this loss last week.

Any practical process will have to reject something like 20 wt% of the original crude as useless high-sulfur, high-metals coke or asphaltenes that must be stored forever (or dumped into a deep ocean trench ;-]). Also 10% by weight would come off as fuel gas, including ethylene, that would be burned as process fuel, not recovered as a liquid.

Because of the high specific gravity and viscosity of the oil, particularly when cold, conventional methods of production cannot rely on reservoir pressure to produce the oil. In some cases it is possible to use progressive cavity pumps (Moyno pumps) that are lowered down the wells, to pump the oil out of the reservoir.

The reservoir properties for the Hamaca wells are excellent, with porosity values of up to 36% and permeability values of up to 30 darcies. Hamaca crude is considered ‘foamy’ and is generally saturated with gas at reservoir conditions. Over the 35-year life of the field, more than 1,000 horizontal laterals are planned to deliver the required 190,000bpd to the upgrader facility.

Oil is produced under ‘cold production’ methods (no need for heated steam to mobilise the deposits) using progressing cavity pumps to bring oil to the surface. Cold production is possible because of the extended length of the horizontal wells (5,000ft), excellent reservoir properties, and the foamy-oil nature of Hamaca crude.

Once at the surface the crude is mixed with a chemical/diluent that allows it to be pumped to the upgrader. It was the use of the pumps to extract the oil with sand that led to the acronym CHOPS (Cold Heavy Oil Production with Sand), although in an earlier article I discussed the use of the technique in Canada, where higher reservoir pressures and lower viscosity allowed the oil to be produced without the pump, by allowing the well to flow freely.

In Venezuela, though it is thought to be used in many of the heavy oil deposits, it is estimated to be only able to produce 5 – 10% of the oil. Problems are then anticipated to arise in changing the well designs to use alternate means to go after the remaining 90%, and it is anticipated that by 2012 CHOPS will no longer, in consequence, be used in Canada.

With 80% to 90% of the resource still in the ground after cold production, the reservoir is in a disturbed state, perhaps with wormholes or channels that have found a way to water. It may, however, be a severely depleted reservoir with low pressure and a network of channels.

If CHOPS has not been used extensively in Venezuela there are a variety of ways that the heavy oil can be encouraged to flow to the production wells. More modern trends are to rely on such thermal techniques as Steam Assisted Gravity Drainage, (SAGD). These are necessary since the deposits are too deep to be mined using the surface mining techniques that are used in Canada. SAGD is where steam is injected into the formation from one horizontally drilled well, and the heated (and thus less viscous) oil then flows through the deposit to a second well where it is recovered.

Artist’s illustration of the SAGD process (Devon Canada Corp)

An alternate has been proposed, in which single horizontal wells can act both as an injection source for the steam, and then after the oil has been conditioned, they will serve to produce the lower viscosity, hotter fluid.

Kerosene can also be injected into the formation ahead of the steam, which then forces it through the oil. In this way it is claimed that production can be greatly enhanced. However, to be viable more than 70% of the solvent must be recovered for re-use. Canada is also investigating the JIVE process. (Joint Implementation Vapour Extraction)

(Source HeavyOilInfo.com)

However all this development will cost a considerable amount of investment, and as Robert Rapier noted last September, Hugo Chavez is not keen to make those investments himself, and the result has been seen in the declining levels of production.

However he is still trying to persuade others to make the investments that he will not, and the evidence, given the perceived coming shortage of oil, and the needs of countries to ensure a steady, stable supply, means that he is currently still able to negotiate deals to get those funds. The different alliances that have evolved for this development can be seen from this map from Petroleum World.

In conclusion there is one more factor that relates to the whole issue of overall Venezuelan production. Last week in this space I mentioned that there was a swap deal for oil involving Venezuela, Belarus and Azerbaijan. This is proving to be a little more complex than the original simple swap I mentioned, since it involved lighter crudes from Venezuela, particularly the Santa Barbara crude which has an API gravity of 39 degrees.

“We have to work with different blends, and in terms of its functional properties, the Santa Barbara blend is among the best. This blend can produce 20 percent more gasoline, kerosene, or diesel fuel than Russian blends, and these products are in high demand in Europe.”

Originally that was being shipped to Belarus in tankers from Venezuela, and my impression initially was that Venezuela was swapping production with Azerbaijan (Venezuelan crude would go to the USA and Azer crude would go to Belarus) as a way of reducing the shipping. However this week, it transpires that the problem apparently is that Venezuela cannot supply sufficient of the sweet crude to meet world demand, and in particular the 30 mb it sold Belarus. PdVSA is thus having to buy Azer crude to make up the difference between what it can send and what it contracted for.

Plans, stated recently by the Belarusian authorities, to use the swap scheme in oil supplies “do not deal with the substitution of Venezuelan oil with Azerbaijan,” the diplomat said. ”Oil company PDVSA will purchase an additional amount of oil in Azerbaijan to ensure the execution of the contract to supply up to ten million of oil a year to Belarus,” ambassador said. This oil will go to Belarus through “Odessa-Brody” pipeline. The Belarusian side will pay Azerbaijan not for the oil itself, but only for its delivery. “As you can see, this cooperation is beneficial for both parties and, in particular, for Belarus,” Americo Diaz Nunez said.

Belarus has now found it makes more money (about $30 a ton) doing it this way, since the pipeline is cheaper than the rail transport they would have to pay for in buying from Russia, which also charges a 100% duty. But the limited supplies of the sweet Santa Barbara crude have also been bought by the Japanese. However Venezuela may have a further problem, since in October they signed a deal with Belarus that will increase the amount shipped to 220 mb over the next three years. They are apparently getting $88 a barrel for it. (Though the price for Urals crude to Belarus was only $57 a barrel – that may have been before shipping and duty were added.)

So Venezuela has a global market, the question now becomes as to whether it can supply it.

One Comment on "Past, Present and Future Venezuelan oil production"

Irinavam on Tue, 24th Nov 2020 9:39 am

Рекомендую Вам аккауратно перебирать СМИ источники поиска информации. Очень много правительственных и заангажированных.

Хотела бы Вам предложить хорошее СМИ, где я часто ищу информацию. Информация по ссылке: https://russinfo.net/otdyh/deti/xarakteristika-detej-kotorye-rozhdeny-v-sentyabre-2016-goda.html

А где ищите Вы?