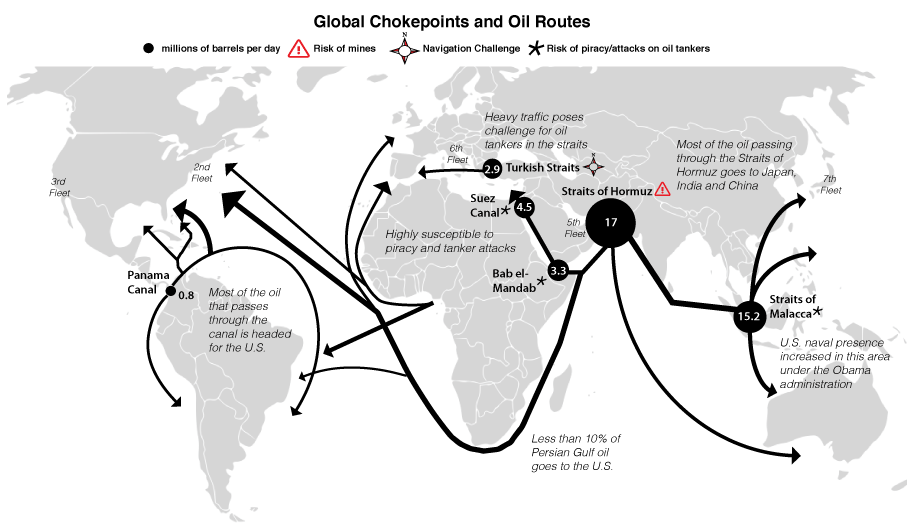

Due to the narrowness of the straits all of them can be disrupted with relative ease by piracy, terrorism, wars, or shipping accidents, affecting the supply of oil and world prices.

The strong dependence of the U.S. economy on oil has made it of the utmost importance to guarantee the free flow of shipments through these straits. For this reason policing has fallen mainly on the U.S. Navy with the help of some allies. Cost estimates of maritime patrolling for the U.S. have been calculated to range between $68 and $83 billion per year, or 12 to 15 percent of conventional military spending. The rest of the world has benefited freely from this security provided by the U.S.

As long as the U.S. economy continues to depend heavily on oil it will have to incur in the high maritime patrolling costs to guarantee the free flow of oil through these critical straits.

Attack on Abqaiq

The National Commission on Energy Policy and Securing America’s Energy Future conducted a simulation called Oil Shock Wave to explore the potential security and economic consequences of an oil supply crisis. The event started by assuming that political unrest in Nigeria combined with unseasonably cold weather in North America contributed to an immediate global oil supply shortfall. The simulation then assumed that 3 terrorist attacks occur in important ports and processing plants in Saudi Arabia and Alaska which sent oil prices immediately soaring to $123 a barrel and $161 barrel 6 months later. At these prices, the country goes into a recession and millions of jobs are lost as a result of sustained oil prices. This simulation almost became reality with the failed attack on Abqaiq in Saudi Arabia in February 2006. Had the attack been successful, it would have removed 4to 6 million barrels per day from the global market sending prices soaring around the world and would likely have had a devastating impact on our economy. (Indiana Senator Evan Bayh, U.S. SENATE March 7, 2006. Energy independence S. HRG. 109-412)

Sixty percent of America’s oil arrives on vessels. Read these for details:

Musings: The Challenges Facing Saudi Arabia Include More Than Oil

by G. Allen Brooks March 21, 2014 rigzone.com

Choke Points: Our Energy access points.

Dana Ballout. 2013. http://oilchangeproject.nationalsecurityzone.org

Ras Tanura port in Saudi Arabia: 10% of the world’s oil

Peter Maass. The Breaking Point. August 21, 2005 The New York Times

Saudi Arabia had 22% of the world’s oil reserves (in 2005) The largest oil terminal in the world is Ras Tanura, on the east coast of Saudi Arabia, along the Persian Gulf. Ras Tanura is the funnel through which nearly 10 percent of the world’s daily supply of petroleum flows. In the control tower, you are surrounded by more than 50 million barrels of oil, yet not a drop can be seen.

As Aref al-Ali, my escort from Saudi Aramco, the giant state-owned oil company, pointed out, ”One mistake at Ras Tanura today, and the price of oil will go up.” This has turned the port into a fortress; its entrances have an array of gates and bomb barriers to prevent terrorists from cutting off the black oxygen that the modern world depends on. Yet the problem is far greater than the brief havoc that could be wrought by a speeding zealot with 50 pounds of TNT in the trunk of his car. Concerns are being voiced by some oil experts that Saudi Arabia and other producers may, in the near future, be unable to meet rising world demand. The producers are not running out of oil, not yet, but their decades-old reservoirs are not as full and geologically spry as they used to be, and they may be incapable of producing, on a daily basis, the increasing volumes of oil that the world requires. ”One thing is clear,” warns Chevron, the second-largest American oil company, in a series of new advertisements, ”the era of easy oil is over.”

If consumption begins to exceed production by even a small amount, the price of a barrel of oil could soar to triple-digit levels. This, in turn, could bring on a global recession, a result of exorbitant prices for transport fuels and for products that rely on petrochemicals — which is to say, almost every product on the market. The impact on the American way of life would be profound: cars cannot be propelled by roof-borne windmills. The suburban and exurban lifestyles, hinged to two-car families and constant trips to work, school and Wal-Mart, might become unaffordable or, if gas rationing is imposed, impossible.

Ghawar is the treasure of the Saudi treasure chest. It is the largest oil field in the world and has produced 55 billion barrels of oil the past 50 years, more than half of Saudi production in that period. The field currently produces more than five million barrels a day, about half of the kingdom’s output. If Ghawar is facing problems, then so is Saudi Arabia and, indeed, the entire world.

Simmons found that the Saudis are using increasingly large amounts of water to force oil out of Ghawar. “Someday the remarkably high well flow rates at Ghawar’s northern end will fade, as reservoir pressures finally plummet. Then, Saudi Arabian oil output will clearly have peaked Simmons says that there are only so many rabbits technology can pull out of its petro-hat.

Strait of Hormuz

Any military action in the Strait of Hormuz in the Gulf would knock out oil exports from OPEC’s biggest producers, cut off the oil supply to Japan and South Korea and knock the booming economies of Gulf states.

Roger Stern, a professor at the University of Tulsa National Energy Policy Institute, estimates we’ve spent $8 trillion protecting oil resources in Persian Gulf since 1976, when the Navy first began increasing its military presence in the region following the first Arab oil embargo. We did this because we feared oil supplies would run out, and that the Soviets would march to the Persian gulf to get oil when they ran low themselves (Stern). We import very little of this oil, yet Japan, Europe, India, and the nations that do don’t pay us to do this. Admiral Greenert plans to shift 10% of our navy from the East Coast to the Pacific Coast to protect the South china seas (from China).

Here are some key facts on what passes through the international waterway and some of the direct economic consequences of any attack on merchant shipping.

- 20 percent of the world’s oil traded worldwide (35% of all seaborne oil), and 20% of the global liquefied natural gas (EIA).

- 2.9 billion deadweight tons passes through the strait every year.

- Crude oil exported through the Strait rose to 750 million tons in 2006.

- 27 percent of transits carry crude on oil tankers, rising to 50 percent if petroleum products, natural gas and Liquefied Petroleum Gas transits are included.

- Transits for dry commodities like grains, iron ore and cement account for 22 percent of transits.

- Container trade accounts for 20% of transits, carrying finished goods to Gulf countries.

Oil exports passing through Hormuz: (2006 figures)

- Saudi Arabia — 88 percent

- Iran — 90 percent

- Iraq — 98 percent

- UAE — 99 percent

- Kuwait — 100 percent

- Qatar — 100 percent

Top 10 importers of crude oil through Hormuz (2006 figures)

- Japan — Takes 26% of crude oil moving through the strait (shipments meet 85% of country’s oil needs)

- Republic of Korea — 14 percent (meets 72 percent of oil needs)

- United States — 14 percent (meets 18 percent of oil needs)

- India — 12 percent (meets 65 percent of oil needs)

- Egypt — 8 percent (N.B. most transhipped to other countries)

- China — 8 percent (meets 34 percent of oil needs)

- Singapore — 7 percent

- Taiwan — 5 percent Thailand — 3 percent

- Netherlands — 3 percent (Source: Lloyd’s Marine Intelligence Unit)

U.S. Energy Security Strait of Hormuz Threat – All OPEC imports from the Persian Gulf region are shipped via marine tankers through the Strait of Hormuz. Due to Iran’s developing nuclear arms program, the pending threat to Israel, and U.S. sanctions to possibly curtail Iran’s nuclear arms development, Iran has threatened to the shutdown of the Strait of Hormuz in retaliation. If and when Iran carries out their threat to shutdown the Strait of Hormuz the U.S. would immediately lose about 2.2 MBD of crude oil imports or almost 12% of current total petroleum oil supplied (consumed); far greater than the 4% lost during the 1973 Arab OPEC oil embargo.

Strait of Hormuz Shutdown Impacts – The impact of losing all Persian Gulf imports could be substantial. Not only would the U.S. be subjected to a very quick loss of 2.2 MBD of imports, but the impact on world markets could also be devastating (up to 20% of all world market crude oil supplies currently flow through the Strait). World oil prices could directionally double almost overnight, sending world energy markets and economies into chaos. While the U.S. and UN conventional military forces should be able to readily take-on and neutralize Iran’s conventional forces, it’s Iran’s small-independent, unconventional forces that likely pose the greatest and longer term threat to Persian Gulf shipping and regional OPEC oil infrastructures.

Other Chokepoints (EIA)

Strait of Malacca with 17% of the world’s oil, most of it headed to China, Japan and South Korea.

Suez Canal / SUMED pipeline with 5% of world oil, key routes for oil destined for Europe and North America. A potential threat is the growing unrest in Egypt since their revolution in 2011.

Bab el-Mandab could keep tankers from the Persian gulf from reching the Suez canal and sumed pipeline

Turkish Straits. Increased oil exports from the Caspian Sea region make the Turkish Straits one of the most dangerous choke points in the world supplying Western and Southern Europe.

Danish Straits, an increasingly important route for Russian oil to Europe.

Plantagenet on Sun, 5th Jul 2015 6:55 pm

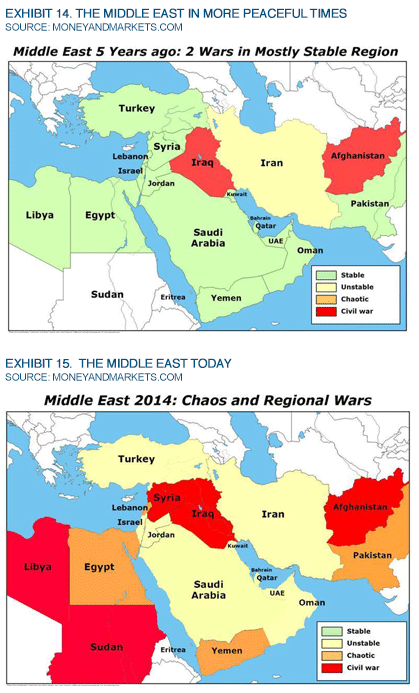

Obama’s oil wars are making the middle east LESS stable, not more stable.

HARM on Sun, 5th Jul 2015 7:06 pm

Peak Oil and overpopulation, as illustrated by the Land Export Model, is making the middle east LESS stable, not more stable.

There, fixed it for ya.

HARM on Sun, 5th Jul 2015 7:10 pm

On a side note, Volume #1 of Plantagenet’s “History of American Intervention in Middle East Wars” begins on January 21, 2009. Strangely, there’s no record of there having been an American President or military action in that part of the world prior to that date.

Jimmy on Sun, 5th Jul 2015 7:16 pm

As industrial civilization collapses due to overshoot and peak oil it will be the most unstable dominos that fall first. Not long ago the only failed state was Afghanistan. Then Somalia joined the list. Now the list grows with the additions of Iraq, Yemen, Libya and Ukraine. Soon Greece, Egypt, Italy, Portugal, Spain, Mexico and many more will be added to the list. The collapse of industrial civilization will proceed through the list of countries in order of fragility. The most fragile are well failed. The dominos will continue to fall.

Makati1 on Sun, 5th Jul 2015 7:47 pm

This is another rah-rah piece to justify the Empires wars of plunder and conquest in any region not under their domination. Piracy is not that common and certainly does not cover the globe like they would have you believe.

But they have made otherwise safe areas (Strait of Hormuz/Suez Canal)) unsafe by their aggressive actions. And they could do nothing to keep them open if the other side wanted to close them.

China is building pipelines to get around the US controls and is building bases in the straits important to them. But, self protection is called “aggression” unless the US is doing it.

Plantagenet on Sun, 5th Jul 2015 8:01 pm

@HARM

Your odd claim that history “begins on January 21, 2009” shows you to be an utter ignoramus.

History encompasses everything that has happened in the past, not just an artificially delimited interval that you pick to fit your own biases.

CHEERS!

Jimmy on Sun, 5th Jul 2015 9:31 pm

I think Harm is referring to plants obliviousness to the oil wars that were fought by America prior to Obama taking office. I seem to recall several. The most disasterous of which was started in Iraq by a Republican in 2003 because Saudis took out the twin towers.

dave thompson on Sun, 5th Jul 2015 11:23 pm

http://r.search.yahoo.com/_ylt=A0LEVjGCAppVPw0AW1UnnIlQ;_ylu=X3oDMTEzZzA5ZjJjBGNvbG8DYmYxBHBvcwM1BHZ0aWQDRkZHRUMwXzEEc2VjA3Ny/RV=2/RE=1436185347/RO=10/RU=http%3a%2f%2finvestmentwatchblog.com%2fyes-there-are-paid-government-trolls-on-social-media-blogs-forums-and-websites%2f/RK=0/RS=zULBN98Ml99whAcvbaPz5XUH55Y-

rockman on Mon, 6th Jul 2015 8:16 am

Mak…Mak…Mak: “…to justify the Empires wars of plunder and conquest…”. When are you going to understand we don’t need to justify nuthin to nobody…we’re AMERICANS. LOL.

Makati1 on Mon, 6th Jul 2015 8:31 am

rockman, when the first mushroom appears over DC. lol.

Davy on Mon, 6th Jul 2015 8:42 am

Mak, I hope you have a stroke from getting your rocks off at the moment you hear the news at your slum hole in Manila the US was NUK’d. Then I hope your death is longish and painful in the resulting NUK winter. Better yet, I hope you are eaten in a stew by your neighbors once your overpopulated mega city goes postal with hunger and chaos. How is that for a counter LOL you war pig!!

BobInget on Mon, 6th Jul 2015 10:32 am

a few questions;

Should not military protection expense be added on to oil price as taxes?

“Cost estimates of maritime patrolling for the U.S. have been calculated to range between $68 and $83 billion per year, or 12 to 15 percent of conventional military spending”

The article concerns itself with ‘choke points’ but neglects to mention highly visible land based collection and pumping stations.

I keep pounding the table, a single MERVED

missile (multi war-headed, individually targeted) can change history in a matter of hours.

Saudi Arabia by relentlessly bombing Yemen compromised its own security. It’s too late.

The Yemeni are clearly within their rights to

counter attack, and will.

Speculawyer on Mon, 6th Jul 2015 4:55 pm

Yes, a military protection fee should be added to oil, IMHO.

Or maybe we should just not provide that protection instead. Force the oil exporters to take on costs of protecting their traffic lanes. If they want to sell their oil (which they do), they should be the ones ensuring that they can transport it successfully.

Heck, we don’t buy that oil these days anyway. We buy from ourselves, Canada, Mexico, Venezuela, Nigeria, and a tiny amount from other places. Europe, China, India, and Japan are the ones that get their oil from Gulf these days.

Yemeni counter-attack? LOL. A bunch of poor starving Yemeni people strung-out on Khat trying to take on Saudi Arabia with all the weapons we sold them? I don’t think so.

Makati1 on Mon, 6th Jul 2015 8:22 pm

Spec, maybe you need to look at this…?

http://www.eia.gov/dnav/pet/pet_move_impcus_a2_nus_ep00_im0_mbbl_m.htm

US oil imports in 2015, monthly, by country providing…

April 2015 Imports:

OPEC 82,000,000 bbls.

Russia 10,000,000 bbls.

Mexico 21,000,000 bbls.

Canada 114,000,000 bbls.

Others 52,000,000 bbls.

Granted, these are EIA numbers, but they are probably close. The US military is just another of many subsidies of the oil cartel.

Interesting isn’t it? How would the US survive without those 144,000,000 non-American oil barrels per mpnth? (~60% of the total imports) Answer: it would be 3rd world.

Boat on Tue, 7th Jul 2015 5:40 am

Spec,

I am with you on other countries paying for oil security. Figure the costs of security and pay by the barrell.

Boat on Tue, 7th Jul 2015 5:43 am

Mak, You would be surprised how fast we would have electric and nat gas cars.

Makati1 on Tue, 7th Jul 2015 6:35 am

Boat, you would be surprised how that would definitely NOT happen. The crash of the US economy would make most cars rust buckets by the side of the road where they ran out of gas. Many would become homes for their owners, but the car age would be dead.

Let’s do the math:

Nat Gas car/or electric @ $35,000 each for the 200,000,000+ cars on US roads equals about $7 TRILLION dollars, not to mention that it would take a decade, or two, to make those cars, with oil in every step of production and most parts and materials imported from other countries. Now, where do they get those Trillions? Remember, burger flipping is not even a living wage.

And, the last time I checked, you cannot patch the millions of miles of asphalt highways, parking lots, driveways, etc., with Nat Gas or electric. Not to mention the huge systems that would be needed to be built over decades to fuel those ‘alternates’.

And how about the millions of homes, and other buildings, that are roofed with asphalt shingles? Have you priced an alternate roofing material lately? How about shutting down all airlines/airports in the US? Then there are the diesel farm tractors that feed you. The diesel 16 wheelers that bring your food to your local store, not to mention toilet paper and beer. NOTHING stands alone in today’s globalized world.

charmcitysking on Tue, 7th Jul 2015 7:15 am

Iraq and Afghanistan in civil war and Iran unstable?

Can we put an asterisk next to these classifications, noting that all three were due to US intervention?

apneaman on Wed, 8th Jul 2015 3:25 am

The Anglo-American empire is preparing for resource war –

“The control of resources remains a core factor in US considerations for sustaining global US hegemony in the face of rising geopolitical influence of its major rivals

See more at: http://www.middleeasteye.net/columns/anglo-american-empire-preparing-resource-war-1170119289#sthash.PwpuTHHW.z7JiV7de.dpuf

Bob Owens on Sat, 11th Jul 2015 3:28 pm

This article makes clear that we need to move to solar/wind power ASAP. Even if the ME wars don’t affect oil shipping (yeah, right), at the end of the day all we will have left will be solar power. Everyone needs to move on this, even if it is only on an individual level. Don’t have a batch water heater? Get one. Do something. You will feel better and won’t have to post so many long blog conversations that consume your time.