Permian Basin operators are successfully coaxing more crude to the surface, and the Energy Information Agency is forecasting the region will raise its output to 2.4 million barrels a day in May.

The Permian will produce 662 barrels per rig next month, unchanged from April, according to the agency’s Drilling Productivity Report. Production from new wells will increase 205,000 barrels per day, offsetting a 129,000-barrel-per-day decline from legacy wells by 76,000 barrels per day.

“The rise in Permian oil production is remarkable,” Faouzi Aloulou, industry economist with the EIA said in an email. “In addition to increases in drilling activity, production has benefited from improvements in drilling efficiency and drilling and completion technology.”

Jesse I. Esparza, petroleum engineer in the agency’s Office of Petroleum, Natural Gas & BioFuels, listed four specific moves producers have made that have increased production.

“First, tighter well spacing,” he said in an email. “Tighter well spacing has resulted in an increase in the number of wells being drilled per pad and thus reduced the cost and time of moving rigs and completion equipment.”

Second, he cited improved production design and operations efficiency.

“By working in conjunction with completions, reservoir and drilling teams, the production team has improved well designs and target zones to maximize production,” he said.

Third, there is the operators’ trend toward drilling and recompleting vertical wells to offset natural declines.

“Rather than spending capital on drilling new horizontal wells, companies are focusing on drilling and recompleting older vertical wells at a cost of around $1 million per well, compared to new horizontal wells at $5 million to $9 million,” Esparza said.

Finally, he said the drop in oil prices prompted oil and natural gas companies to focus on their best assets — “i.e. areas with higher production rates and, more importantly, high rates of return.”

Aloulou and Esparza, along with Naser Ameen, were the principal contributors to the EIA’s report on Permian production.

Aloulou pointed to the agency’s short- and long-term outlooks for domestic production, which anticipate continued growth for Permian production.

In January, the EIA predicted domestic production would rise from 8.9 million barrels per day in 2016 to 9.3 million barrels per day in 2018, led largely by tight oil-producing states, primarily Texas and North Dakota. The agency said Permian production rose 5 percent in 2016 over 2015 levels to average 2 million barrels a day, and that increase is expected to increase into 2018, when it should average 2.5 million barrels a day.

In its Annual Energy Outlook 2017 issued in February, the agency said Permian production will remain relatively high through 2040.

“The biggest challenge facing Permian producers, in addition to oil prices, is midstream infrastructure additions that will limit production. According to Drillinginfo’s forecast, it is expected that production will exceed current takeaway capacity by the end of this year. Presently, Permian takeaway and refining capacity stands at 2.6 million barrels a day,” Esparza said.

Aloulou, Esparza and Ameen noted that between January 2016 and March 2017, oil production in the Permian rose in all but three months, providing a growing share of domestic production, while production in other regions fell amid low oil prices.

As of April 21, the number of rigs in the Permian Basin reached 340, or 40 percent of the 857 total oil- and natural gas-directed rigs operating in the United States. The Permian rig count reached as high as 568 in late 2014 before falling to a low of 134 in spring 2016.

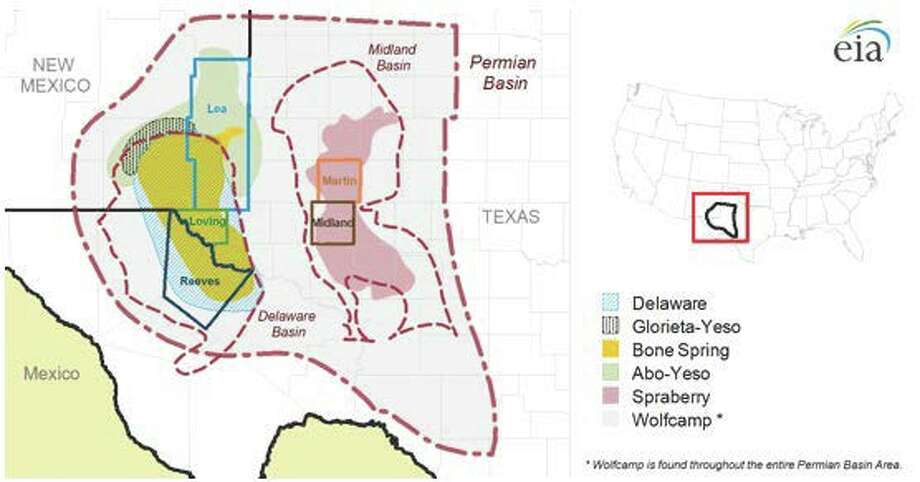

The land area over the Permian Basin covers more than 75,000 square miles in 43 counties of western Texas and southeastern New Mexico, the EIA analysts said. However, they pointed out that more than half of the rigs that have been added in the Permian are concentrated in just five counties: Reeves, Loving, Midland, and Martin in Texas and Lea County in New Mexico. Oil production from these five counties averaged 882,000 barrels a day as of November and accounted for approximately 42 percent of total Permian Basin oil production, which was 2.1 million barrels a day that month. As more rigs continue to be moved to these counties, production from these areas is expected to continue to increase, which will drive the increases in total Permian production.

They also cite last November’s report from the U.S. Geological Survey that estimated technically recoverable oil and shale gas resources in the Midland subbasin — specifically the Wolfcamp — could exceed 20 billion barrels of oil, 16 trillion cubic feet of natural gas and 1.6 billion barrels of hydrocarbon gas liquids.

The International Energy Agency said that even those riches may not be enough to meet future demand.

The agency reported global oil discoveries fell to a record low of 2.4 billion barrels in 2016, compared to an average 9 billion barrels per year over the past 15 years. Conventional resource development fell to 4.7 billion barrels, down 30 percent from 2015 levels as the number of projects that received funding dropped to the lowest level since the 1940s. Exploration spending is expected to fall again this year.

Even as conventional projects were declining, U.S. shale investments and production rose as production costs have fallen 50 percent since 2014. Of the 85 million barrels per day of global oil output, conventional oil production is 69 million barrels, accompanied by 6.5 million barrels per day from U.S. shale plays and the remainder from other natural gas liquids and unconventional sources such as oil sands and heavy oil.

The IEA said that as global demand is forecast to grow 1.2 million barrels a day per year over the next five years, that decline in investment could lead to tight supplies.

The agency puts the average break-even price in the Permian at $40 to $45 per barrel, with production from U.S. shale plays expected to rise by 2.3 million barrels a day by 2022 at current oil prices. It could be a larger increase if prices are higher.

“The key question for the future of the oil market is for how long can a surge in U.S. shale supplies make up for the slow pace of growth elsewhere in the oil sector,” Fatih Birol, IEA executive director, said in a statement.

twocats on Sun, 30th Apr 2017 6:40 am

that first sentence ends with May. But I think the author meant May of 2022. and he has other typos or misstatements that put the articles credibility in doubt.

BUT Dennis Coyne also thinks this (2.4 mbd # at some point after 2019) is in the realm of possibility. Considering Permian went from 100k to 1.1 mbd in 5 years, it’s not crazy to think it could double again in another 5 years.

three questions.

1) can it double at $40 a barrel? on one hand – that “break-even price at $40” is total and utter bullshit. otoh – debt financing continues a-ho.

2) can it double a third time to 4 mbd? because that’s what the world will need.

3) why did the article bury the lead at the very end of the article? when Fatih Birol says, “the key questions is blah” you’d think you’d want to focus on blah. not your baloney.

John on Sun, 30th Apr 2017 7:20 am

“The rise in production is remarkable” Just as remarkable but glossed over is the decline rate which will continue to grow along with faster depletion.

rockman on Sun, 30th Apr 2017 10:36 am

Twocats – “Considering Permian went from 100k to 1.1 mbd in 5 years, it’s not crazy to think it could double again in another 5 years.”

Not sure where you got that number but it’s very wrong. According to the TRRC between 2005 and 2012 just the Texas side of the PB (New Mexico has a portion) production ranged from 250 to 300 MILLION BBLS per year. IOW 5 years ago it was doing 855,000 bopd. Still a nice increase but not by 1 mm bopd.

http://www.rrc.state.tx.us/oil-gas/major-oil-gas-formations/permian-basin/

BTW the most telling part many may not have paid attention to: increasing number of vertical wells (which can’t produce at those high rates) compared to hz wells. IOW many of those high rate hz wells are reaching the necessary economic threshold.

KEnz300 on Sun, 30th Apr 2017 12:43 pm

The fossil fuels industry will do all they can to slow the transition away from fossil fuels.

The Kochs Are Plotting A Multimillion-Dollar Assault On Electric Vehicles

http://www.huffingtonpost.com/entry/koch-electric-vehicles_us_56c4d63ce4b0b40245c8cbf6

Inside the Koch Brothers’ Toxic Empire | Rolling Stone

http://www.rollingstone.com/politics/news/inside-the-koch-brothers-toxic-empire-20140924?page=2

How Exxon & The Koch Brothers Have Funded Climate Denial – YouTube

https://www.youtube.com/watch?v=qXm6ihnWN4A

twocats on Mon, 1st May 2017 6:31 am

rockman:

https://shaleprofile.com/index.php/2017/04/06/permian-update-through-december-2016/

rockman on Mon, 1st May 2017 7:31 am

twocats – Looks like folks have to decide who to believe: 855k bopd in 2012 from the Texas Rail Road Commission (the only entity every company reports production to) or Enno Peters (whoever the f*ck he is) that wants you to believe the PB was doing only 100k bopd in 2012.

Maybe you can contact Peter and find out where he got his data from…assuming that number didn’t come from vision dream he had. LOL. Then everyone here can decide for themselves to believe: Enno or the state of Texas.

twocats on Mon, 1st May 2017 7:42 am

rockman. peakoilbarrel has a lot more technical knowledge and credibility than the posters here. post your link and I’ll check it out, thanks.

twocats on Mon, 1st May 2017 7:44 am

http://www.rrc.state.tx.us/oil-gas/major-oil-gas-formations/permian-basin/

okay, this lines up with what you are saying. that’s interesting. i’ll bring it up on peakoilbarrel and see what I find. thanks.

Enno on Mon, 1st May 2017 7:46 am

I only cover horizontal wells, and in Texas only horizontal wells that started production since 2010. I get my data from the RRC, so there is no conflict.

rockman on Mon, 1st May 2017 7:57 am

Twocat – Just realized one source of the discrepancy: PB production in Texas vs Texas + New Mexico. But Enno still has a big problem especially since he like to reference the EIA: it shows the PB producing 1.1 million bopd in 2012 compared to his 100k bopd. Folks can see a great set of graphs from the EIA here:

https://www.eia.gov › drilling › pdf › per…

One obvious conclusion: the oil production boom in the PB didn’t just start: it began over 15 years ago with a very steady increase over that time period. It looks like Enno used some of the EIA data like new well and legacy well production since those match. Not sure where he got the total PB production curve from but it completely contradicts the EIA curve.

Apneaman on Mon, 1st May 2017 9:40 am

‘remarkable’

The Crazy Scale of Human Carbon Emission

Want some perspective on how much carbon dioxide human activity produces? Here it is

“But Earth has also been increasing its greenhouse gas concentration pretty steadily over the past couple of hundred years. This is almost entirely attributable to the burning of fossil fuels (we can tell because of the isotopic mix of carbon in those fuels).”

“Current data (from direct measurements of the atmosphere to historical records of industry) tells us that between 1751 and 1987 fossil fuels put about 737 billion tons of CO2 into the atmosphere. Between just 1987 and 2014 it was about the same mass: 743 billion tons. Total CO2 from industrialized humans in the past 263 years: 1,480 billion tons.

Now, let’s relate that to something a bit easier to visualize. A coniferous forest fire can release about 4.81 tons of carbon per acre. At the low end, about 80% of that carbon comes out as CO2. In other words, to release an equivalent CO2 mass to the past 263 years of human activity would require about 1.5 billion acres of forest to burn every year during that time.”

” Estimates of today’s CO2 production go as high as about 40 billion tons per year. That’d take something like ten billion acres of forest burning each year, which is about 42 million square kilometers. The entire continent of Africa is a mere 30 million square kilometers. So this, plus another third, on fire, each year:”

https://blogs.scientificamerican.com/life-unbounded/the-crazy-scale-of-human-carbon-emission/

Apneaman on Mon, 1st May 2017 10:54 am

Future World Economic Growth In Big Trouble As Oil Discoveries Fall To Historic Lows

“The world consumed 69 million barrels per day of conventional oil last year, which equaled a total of 25 billion barrels (source: IEA report above). Which means, conventional global oil discoveries of 2.4 billion barrels were less than 10% of total world conventional oil consumption. This is extremely bad news.”

https://srsroccoreport.com/future-world-economic-growth-in-big-trouble-as-oil-discoveries-fall-to-historic-lows/

Apneaman on Mon, 1st May 2017 11:02 am

Book Review | When Trucks Stop Running:

Energy and the Future of Transportation

“And as I also pointed out, the latter is just as often the work of PR agencies and other marketeers, the goal effectively being anything but conveying a clear understanding of our current energy situation. Friedemann perfectly explains why this is (italics mine):

In business, …analysis is essential to prevent bankruptcy. Yet when scientists find oil, coal, and natural gas production likely to peak within decades, rather than centuries, or that ethanol, solar photovoltaic, tar sands, oil shale, and other alternative energy resources have a low or even negative energy return on the energy invested, they are ignored and called pessimists, no matter how solid their findings. For every one of their peer-reviewed papers, there are thousands of positive press releases with breakthroughs that never pan out, and economists promising perpetual growth and energy independence. Optimism is more important than facts. And, it’s essential for attracting investors.”

http://fromfilmerstofarmers.com/blog/2017/april/book-review-when-trucks-stop-running-energy-and-the-future-of-transportation/

Hello on Mon, 1st May 2017 11:02 am

>>>>> Future World Economic Growth In Big Trouble As Oil Discoveries Fall To Historic Lows

Once oil price goes up, so will prospecting, causing another glut. For the system to become stable the phase margin must be sufficiently large.

I almost seems that Ape didn’t learn anyhting during the last 10 or 15 years.

Hello on Mon, 1st May 2017 11:08 am

Complex oil recovery exhibits large lag (from the market signal to change in output).

Lag pushes any closed-loop system towards instability.

Maybe the oil industry will be pushed into instability showing ever more wild fluctiations of high and low prices, a sign of system oscillation.

Wouldn’t that be funny?

Cloggie on Mon, 1st May 2017 11:31 am

In business, …analysis is essential to prevent bankruptcy. Yet when scientists find oil, coal, and natural gas production likely to peak within decades, rather than centuries, or that ethanol, solar photovoltaic, tar sands, oil shale, and other alternative energy resources have a low or even negative energy return on the energy invested, they are ignored and called pessimists, no matter how solid their findings.

Another uneducated punk trying to bluff his way into energy engineering.

rollin, rollin, rollin…

https://www.youtube.com/watch?v=XJ2C4_7bqrk

https://www.youtube.com/watch?v=R-QZoEBXzSk

(Heineken e-truck)

twocats on Mon, 1st May 2017 3:59 pm

rockman – so you were right in the sense that the article is talking about all wells (I thought they were just referring to horizontal), and that makes the article even more ridiculous because its basically saying “we’re just going to deplete the hell out of a very very well known reservoir.”

and they make the 2.4mbd sound like a lot, even though that’s lower than pretty much every year going back to 1993. so you are right, the author is an even bigger idiot than first anticipated. but at least he has his facts right.

tita on Tue, 2nd May 2017 2:01 am

Enno doesn’t report vertical wells, and only report production from Hz wells… which is why it is biased. It worked well for Eagle Ford and Bakken formations, but it is not accurate for the Permian, as a lot of wells are vertical.

His intention was to report the growth of shale production only.