Just wait 'till tomorrow, I'll likely be predicting doom by afternoon!

Just wait 'till tomorrow, I'll likely be predicting doom by afternoon!The Economy Appears To Be On Solid Ground

Re: The Economy Appears To Be On Solid Ground

Just wait 'till tomorrow, I'll likely be predicting doom by afternoon!

Just wait 'till tomorrow, I'll likely be predicting doom by afternoon!The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: The Economy Appears To Be On Solid Ground

Pops wrote:The Bloomberg Commodity index, which tracks the prices of 22 different commodity prices such as gold, natural gas and oil, fell 0.3pc to 99.84 in early trading, the lowest point since August 2002.

Come on ralfy, we know the price of oil is down, but the demand is up so where is the deflation?

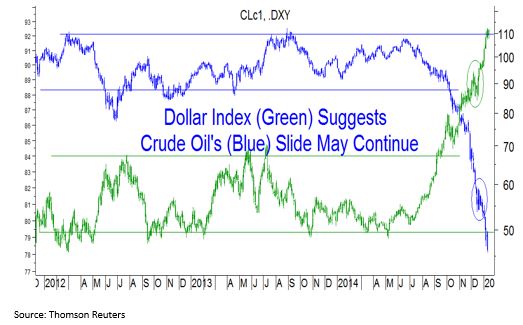

When everything is priced in dollars and the dollar is strong, everything is going to be cheaper:

--

Here is Dollar Index vs commodities index, notice the correlation?

Now if all currencies were strengthening and not just the dollar, that would be a good deflation argument.

But as it is the dollar is super strong, because

we QE'd and it helped compared to the EU austerity,

we fracked and that lowered our imports, which raised our trade balance

now the EU is gonna QE so their paper is cheaper and the US$ higher

our gov budget deficit is even lower.

You all act like it pains you that Mad Max ain't knocking, take advantage.

I don't know about deflation. I shared that to show that it's not just oil prices that are being affected. At the same time, the dollar is getting stronger because speculators are running for it because of problems with commodities.

Next, my understanding is that QE is not a good idea. That is, it's the same type of credit creation that led to the U.S. crash. Will EU and other economies experience similar?

Third, I think "solid ground" means a steady but slow increase in prices as demand steadily increases, met by steadily increasing production, and all three going on indefinitely. That's not what we've been seeing the past decade, at least that's what I've been gathering from information shared in this forum.

Given that, I don't understand why it has to be either a "solid ground" or "Mad Max." Why not something between the two?

-

ralfy - Light Sweet Crude

- Posts: 5606

- Joined: Sat 28 Mar 2009, 11:36:38

- Location: The Wasteland

Re: The Economy Appears To Be On Solid Ground

A close Real Estate friend of mine says Warren Buffett just bought out Prudential Real Estate. Plans are already rolling to rebrand it as Berkshire Hathaway Real Estate by May 1st.

Obviously Buffett thinks there is money to bed made in Real Estate for the next few years.

Skeptical scrutiny in both Science and Religion is the means by which deep thoughts are winnowed from deep nonsense-Carl Sagan

-

SILENTTODD - Tar Sands

- Posts: 928

- Joined: Sat 06 May 2006, 03:00:00

- Location: Corona, CA

Re: The Economy Appears To Be On Solid Ground

Buffet accidentally acquired a bunch of real estate brokerages back in 1999 when he bought an energy company of all things. He has been buying up brokerages ever since. This story says they had 75,000 agents as of 2012 when they bought Prudential!

http://www.usatoday.com/story/money/bus ... e/1668649/

http://www.usatoday.com/story/money/bus ... e/1668649/

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: The Economy Appears To Be On Solid Ground

Thanks Pops for the article. Referred it to my friend who had been a Prudential realtor for the last 15 years. She's one of her office's top producers and she's impressed with the way they are making the change over now.

Skeptical scrutiny in both Science and Religion is the means by which deep thoughts are winnowed from deep nonsense-Carl Sagan

-

SILENTTODD - Tar Sands

- Posts: 928

- Joined: Sat 06 May 2006, 03:00:00

- Location: Corona, CA

Re: The Economy Appears To Be On Solid Ground

Come on ralfy, we know the price of oil is down, but the demand is up so where is the deflation?

Of course demand is up? They are pumping almost a million barrels per day into storage, and that oil gets counted into demand. With Cushing now over 80% full things are likely to change real fast in the demand department real soon!

http://www.thehillsgroup.org/

Of course demand is up? They are pumping almost a million barrels per day into storage, and that oil gets counted into demand. With Cushing now over 80% full things are likely to change real fast in the demand department real soon!

http://www.thehillsgroup.org/

-

shortonoil - False ETP Prophet

- Posts: 7132

- Joined: Thu 02 Dec 2004, 04:00:00

- Location: VA USA

Re: The Economy Appears To Be On Solid Ground

shortonoil wrote:Come on ralfy, we know the price of oil is down, but the demand is up so where is the deflation?

Of course demand is up? They are pumping almost a million barrels per day into storage, and that oil gets counted into demand. With Cushing now over 80% full things are likely to change real fast in the demand department real soon! /

Oh that's right, your premiss is that gasoline no longer has value so consumers don't want it. So someone is storing all that oil - to do what?

Let's look, here is Gasoline "product supplied"

Definitely more folks drove to Granny's for Christmas

Here are gasoline stocks:

Gasoline storage is definitely down, doesn't look good for the "peak demand" contingent.

Crude storage on the other hand is up a bunch:

Obviously demand fell on high price, but price is down 50% on increased production (see the crude storage chart) Consumption looks like it might be increasing already which would be a surprise considering the EIA thinks a 50% drop in price only gives a 1% increase in consumption - eventually.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: The Economy Appears To Be On Solid Ground

Gasoline is now blended at the end of the pipeline. This has been a structure change in the last decade and that is why the finished gasoline chart is down.

Total gasoline stocks are not influenced by the change in delivery:

http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WGTSTUS1&f=W

Total gasoline stocks are not influenced by the change in delivery:

http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WGTSTUS1&f=W

- GoghGoner

- Heavy Crude

- Posts: 1827

- Joined: Thu 10 Apr 2008, 03:00:00

- Location: Stilłwater subdivision

Re: The Economy Appears To Be On Solid Ground

Thanks G, I wondered what I did wrong, missed it by "that much"!

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: The Economy Appears To Be On Solid Ground

GHung wrote:Using the stock market to assess overall conditions is a bit like saying the cancer patient is doing better because he's gained weight due to the giant watery tumor growing in his abdomen.

Since when is GDP and the overall economic outlook the stock market? If you're going to criticize a post, if you don't refer to the actual data/points being discussed, what is the point? (Hint, only the link talked about the stock market. The main body of the post said nothing about that -- only the overall economy or GDP).

Given the track record of the perma-doomer blogs, I wouldn't bet a fast crash doomer's money on their predictions.

-

Outcast_Searcher - COB

- Posts: 10142

- Joined: Sat 27 Jun 2009, 21:26:42

- Location: Central KY

Re: The Economy Appears To Be On Solid Ground

Fishman wrote:Hey, now that's funny. Baltic Dry Index at absolute bottom numbers. Enough said

The BDI again? Always with the BDI. First, the BDI says little about the actual economy. Doomers on this site have been proclaiming economic doom since early 2009 citing that -- and yet it's (as a trend) all growth, all the time. Second, if you read the news about the BDI, the major factor hitting the BDI recently has been a sustained overbuilding in shipping. (It takes a long time to build big cargo ships, so such ships well into the building process tend to get finished even if freight prices have dropped).

The BDI is more about supply/demand vs. available shipping in the short term than anything else. Many more new large ships available -- lower prices for the freight. It's really not that complex. It also explains how so many other factors about the economy manage to point solidly upward pretty consistently in spite of the "doom" the BDI is proclaiming. (facepalm)

Given the track record of the perma-doomer blogs, I wouldn't bet a fast crash doomer's money on their predictions.

-

Outcast_Searcher - COB

- Posts: 10142

- Joined: Sat 27 Jun 2009, 21:26:42

- Location: Central KY

Re: The Economy Appears To Be On Solid Ground

ralfy wrote:Pops wrote:The Bloomberg Commodity index, which tracks the prices of 22 different commodity prices such as gold, natural gas and oil, fell 0.3pc to 99.84 in early trading, the lowest point since August 2002.

Come on ralfy, we know the price of oil is down, but the demand is up so where is the deflation?

When everything is priced in dollars and the dollar is strong, everything is going to be cheaper:

--

Here is Dollar Index vs commodities index, notice the correlation?

Now if all currencies were strengthening and not just the dollar, that would be a good deflation argument.

That's one hell of a negative correlation Pops!

Of course since the prices are being measured IN dollars, that explains much of it, of course.

OTOH, doomers have been proclaiming the weak dollar to be a major source of economic hand wringing since quite often since early 2009. For people with a long time horizon or concerned about long term inflation / inability of the US to pay its debts, it seems like a hedge into solid commodities like gold, oil, building materials like copper, etc. would make sense WHILE THEY ARE LOW.

I'll hold my hand up and say this is exactly what I'm steadily doing via dollar cost averaging. I figure:

A). If all is economic goodness and the US does great, then my traditional investments valued in dollars will do just fine in my old age, thank you very much.

B). If, as I fear, the policy of pandering to whining but not making fundamental investments in things like great education and good infrastructure has very bad longer term implications for the US economy, then I'll be very glad to have inflation hedges (as well as a good chunk of ex-US investments in stocks as a hedge against Capitol Hill stupidity).

Obviously I could be wrong. I figure these scenarios cover a lot of the probable ground though, and with investments "good enough" over the long term is plenty good for me. (I want to be reasonably safe and comfortable, not have caviar and yachts).

Given the track record of the perma-doomer blogs, I wouldn't bet a fast crash doomer's money on their predictions.

-

Outcast_Searcher - COB

- Posts: 10142

- Joined: Sat 27 Jun 2009, 21:26:42

- Location: Central KY

Re: The Economy Appears To Be On Solid Ground

I endorse this viewpoint.

Is This Powerful Indicator Signaling A Global Recession?

Is This Powerful Indicator Signaling A Global Recession?

A similar trend is underway in the oil industry. There, too, crashing prices have much to do with a supply glut (brought on mainly by soaring U.S. production), and the glut makes it harder to tell how much of the crash is due to falling demand. This dilutes oil's value as a leading economic indicator.

Because of the shipping glut, something similar is probably happening with the BDI.

That said, the BDI's plunge is likely giving a strong signal about the demand side of the equation. By now, most investors are well aware of the many drags on demand for commodities. European and Japanese economies are in turmoil, a recession is underway in Russia and Canada and Australia may also be entering into recession.

- GoghGoner

- Heavy Crude

- Posts: 1827

- Joined: Thu 10 Apr 2008, 03:00:00

- Location: Stilłwater subdivision

Re: The Economy Appears To Be On Solid Ground

How many times do people here have to point out that the BDI is not a good economic indicator?

Like, read the first page of this thread.

Like, read the first page of this thread.

Stuff for doomers to contemplate:

http://peakoil.com/forums/post1190117.html#p1190117

http://peakoil.com/forums/post1193930.html#p1193930

http://peakoil.com/forums/post1206767.html#p1206767

http://peakoil.com/forums/post1190117.html#p1190117

http://peakoil.com/forums/post1193930.html#p1193930

http://peakoil.com/forums/post1206767.html#p1206767

-

copious.abundance - Fission

- Posts: 9589

- Joined: Wed 26 Mar 2008, 03:00:00

- Location: Cornucopia

Re: The Economy Appears To Be On Solid Ground

It is a fine indicator. The shippers believed the economic forecasts and built ships accordingly. Three years ago, China's GDP was forecast to grow more each year. The GDP growth actually fell each year and, now, 2015 is looking even worse. The BDI and commodity prices reflect what happens when assumptions are wrong.

So they built all of these ships, mined for coal, mined for copper, fracked for oil, built pig farms, etc... that are not needed. All of that unnecessary expansion was a large part of abysmal growth. What happens now that all of that is curtailed? Global recession.

So they built all of these ships, mined for coal, mined for copper, fracked for oil, built pig farms, etc... that are not needed. All of that unnecessary expansion was a large part of abysmal growth. What happens now that all of that is curtailed? Global recession.

- GoghGoner

- Heavy Crude

- Posts: 1827

- Joined: Thu 10 Apr 2008, 03:00:00

- Location: Stilłwater subdivision

Re: The Economy Appears To Be On Solid Ground

Bump!

Pops wrote:The BDI isn't all that great as a crystal ball.

http://www.businessinsider.com/the-trut ... dex-2012-1

Stuff for doomers to contemplate:

http://peakoil.com/forums/post1190117.html#p1190117

http://peakoil.com/forums/post1193930.html#p1193930

http://peakoil.com/forums/post1206767.html#p1206767

http://peakoil.com/forums/post1190117.html#p1190117

http://peakoil.com/forums/post1193930.html#p1193930

http://peakoil.com/forums/post1206767.html#p1206767

-

copious.abundance - Fission

- Posts: 9589

- Joined: Wed 26 Mar 2008, 03:00:00

- Location: Cornucopia

Re: The Economy Appears To Be On Solid Ground

If they are targeting slower growth then why all of the stimulus this year? Obviously, this is out of their control and has been since 2011. Trillions of dollars by central banks and what happens - deflation.

China lowers growth target, promises to open industries

China lowers growth target, promises to open industries

The growth target of about 7 percent, down from last year's 7.5 percent, is in line with efforts to create a "moderately prosperous society," said Premier Li Keqiang in a report Thursday to China's ceremonial national legislature. Last year's actual growth was 7.4 percent, the lowest since 1990.

- GoghGoner

- Heavy Crude

- Posts: 1827

- Joined: Thu 10 Apr 2008, 03:00:00

- Location: Stilłwater subdivision

Re: The Economy Appears To Be On Solid Ground

Jobless claims unexpectedly rise again this week. Maybe they should start expecting them to rise?

U.S. jobless claims rise; Q4 productivity revised down

U.S. jobless claims rise; Q4 productivity revised down

- GoghGoner

- Heavy Crude

- Posts: 1827

- Joined: Thu 10 Apr 2008, 03:00:00

- Location: Stilłwater subdivision

Re: The Economy Appears To Be On Solid Ground

GoghGoner wrote:So they built all of these ships, mined for coal, mined for copper, fracked for oil, built pig farms, etc... that are not needed. All of that unnecessary expansion was a large part of abysmal growth. What happens now that all of that is curtailed? Global recession.

In the overall scheme of things, a typical business cycle recession that shakes out overproduction and over investment is about the best bad news possible.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

39 posts

• Page 2 of 2 • 1, 2

Return to North America Discussion

Who is online

Users browsing this forum: No registered users and 7 guests