Page added on September 18, 2017

Global Oil Demand is Surging But That’s Still Not Enough to Fix the Oil Market

The oil industry just can’t seem to snap out of its doldrums this year. Crude remains stubbornly low, which has stalled the industry’s attempts at a recovery. However, while weaker prices have been bad for oil producers, they’ve been great for consumers because it has kept prices for refined products like gasoline down, which is fueling robust demand growth this year. That said, this accelerating demand hasn’t been enough to propel the oil market, due in part because shale drillers have unleashed a gusher of new production.

Drilling down into the latest numbers

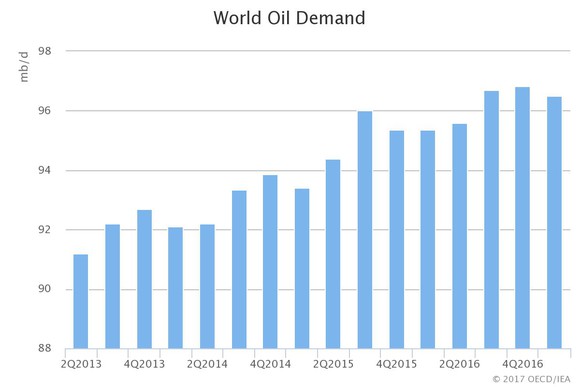

That give and take market was on display this week when the International Energy Agency (IEA) released its monthly commentary. One of the highlights of the report was recent data showing accelerated demand growth. Last quarter, for example, demand grew by 2.3 million barrels per day (Bpd), which is up 2.4% year over year thanks to higher than expected consumption in the U.S. and Europe. That strong showing drove the IEA to ratchet up its 2017 growth forecast once again. It now expects oil demand to grow by an average of 1.6 million Bpd this year, up from its view of a 1.4 million Bpd increase two months ago. That continues the trend of rising demand, which is now well above where it was a few years ago when crude was in the triple digits:

Image source: IEA.

Typically, accelerating oil demand like this would drive up crude prices, but that hasn’t been the case this year. That’s because the industry continues to battle two related headwinds that are counteracting the accelerating demand. First, after years of overproducing, oil stockpiles remain elevated at more than 3 billion barrels last month, which the IEA noted was 190 million barrels above the five-year average for this time of year. The reason there’s still so much oil sitting in storage is that production remains robust. While global output was 720,000 Bpd lower in August due to unplanned outages and scheduled maintenance, it’s up 1.2 million Bpd an average from last year according to the IEA even though OPEC is in the midst of a coordinated effort to reduce supplies.

Why in the world are we still awash in oil?

There’s a two-fold reason why global oil production still isn’t coming down even with OPEC’s best efforts. For starters, two of its members, Libya and Nigeria, are currently exempt from the production reduction agreements. Because of that, OPEC’s output had actually risen for five straight months before falling in August after renewed turmoil in Libya disrupted its production.

Image source: Getty Images.

The other issue is that shale drillers in the U.S. have delivered much higher production rates than expected due to efficiency gains and other innovations. Those improvements have fueled game-changing well results, with several shattering records this year. For example, this past spring EOG Resources (NYSE:EOG) reported monster well results in the Delaware Basin that straddles Texas and New Mexico. The company’s four-well Whirling Wind pad delivered an average 30-day initial rate of 5,060 barrels of oil equivalent per day (BOE/d) per well, which EOG’s CEO Bill Thomas said, “shattered industry records in the Permian Basin.” Thomas attributed the success to EOG’s “advanced technology and proprietary techniques” that are “leading to break-through well performance across our diverse portfolio of premium plays.”

Meanwhile, in Oklahoma, producers are smashing records one after the other. In July, Devon Energy (NYSE:DVN) unveiled a record-setting well in the STACK play that hit an initial peak rate of 6,000 BOE/d. Devon pointed out that it “achieved the highest initial production rate of any well by a wide margin” thanks in part to a new proprietary completion design. That said, rival Continental Resources (NYSE:CLR) topped it a few months later when its Tres C well hit 7,442 BOE in its first day of production.

What’s also worth noting is that even the wells that aren’t setting records have been exceptional. In the STACK, Continental Resources expects an average well to deliver 2.4 million BOE over its lifetime and generate a stunning 80% rate of return at $50 oil. Meanwhile, EOG Resources’ premium-return wells are producing twice as much oil in their first year as non-premium ones while Devon has delivered a 450% improvement in the initial 90-day production rates of its wells since 2012. Add to that the fact that EOG Resources’ premium wells earn a minimum after-tax rate of return of 30% at $40 oil and Devon estimates that it has 30,000 potential locations in both the STACK and Delaware plays that are profitable around current prices, and these drillers see no reason to slow down.

Still a well-oiled market

Consumers are devouring oil this year. However, that hasn’t moved the needle on crude prices since shale drillers are unveiling gusher after gusher, which is keeping oil storage tanks filled to the brim. While some weaker producers have tapped the brakes on new drilling because prices have come in under expectations, many others are still accelerating. That’ll likely keep a lid on oil prices in the near-term, which could keep most oil stocks at bay. Though, given the returns some top-tier producers can earn, they still have the potential to fuel healthy growth for their investors at the expense of their weaker peers.

18 Comments on "Global Oil Demand is Surging But That’s Still Not Enough to Fix the Oil Market"

tita on Mon, 18th Sep 2017 11:19 am

“Last quarter, for example, demand grew by 2.3 million barrels per day (Bpd)”

The yearly demand growth for 2017 is expected at 1.6 million barrels per day… If the author has no knowledge on simple numbers, I don’t think that the rest of the article is worth reading.

Sissyfuss on Mon, 18th Sep 2017 11:57 am

Consider the source,FOOL.COM.

Cloggie on Mon, 18th Sep 2017 12:12 pm

I wonder how a “fixed oil market” looks like. How high must the oil price be in order for the oil market to be fixed.

Apneaman on Mon, 18th Sep 2017 1:01 pm

Last time I checked the humans added 80 million new cancer cells a year, so won’t that in itself push some demand?

Say there’s average working human who has no choice but to continue in their job.

If their only choices are to give up high dollar steak and craft beer and a great portion of unnecessary consuming or no money for fuel to go to work, which choice will most humans make? What will they give up before they give up the car & gas? Pretty much everything IMO.

rockman on Mon, 18th Sep 2017 1:53 pm

“Crude remains stubbornly low”. And once more the need to offer a simple FACT: the current price of oil is higher then it averaged for 71 of the last 87 years. And more then 2X higher then it was during the end of the 1990”s. The problem isn’t the price of oil: it’s the relatively few economicly viable projects at the current price of oil. The lower price from 2 years ago requires more bbls recovered from a well drilled today then the same one drilled in 2014. Which is why the EROEI of newer wells have increased significantl.

https://www.google.com/amp/s/amp.businessinsider.com/real-adjusted-oil-prices-since-1861-2016-1

TommyWantsHisMommy on Mon, 18th Sep 2017 3:22 pm

How the heck are electric cars/trucks going to replace the petrol? You would think there will be an electricity shortage/battery shortage–charger shortage? Still trying to figure out where you park hundreds of electric vehicles as they charge..huge charging parks? In 10 years what percentage of autos/trucks will be electric? 10%? 50%? 1%? zero because we have went mad max fury road?

pat on Tue, 19th Sep 2017 7:02 am

the oil shortages begin from 2018 and the prices to go to moon in 2020. the factors, depletion, declining eroei, totally dead new oil investment, exploration etc and rising unprecedented global oil demand all to take oil to new highs. the shale boom is all but only retirement party, whats left is black glue and the low hanging fruits gone long ago.

Davy on Tue, 19th Sep 2017 7:12 am

Pat, maybe but we still have to consider demand destruction from a declining economy despite what the bulls say. All is not well.

Cloggie on Tue, 19th Sep 2017 8:22 am

How the heck are electric cars/trucks going to replace the petrol? You would think there will be an electricity shortage/battery shortage–charger shortage?

By making far more miles per day (the car), so far fewer cars can make many more miles.

Autonomous cars coming to the rescue.

By adding the car fleet to public transport, the car remains affordable… in that you have to share it with many more.

#TimeSharing

https://deepresource.wordpress.com/2017/05/16/by-2030-you-wont-own-a-car/

rockman on Tue, 19th Sep 2017 9:57 am

Pat – “the oil shortages begin from 2018 and the prices to go to moon in 2020. the factors, depletion, declining eroei…” And no exploration investments, surging global demand, “black glue” and no more “low hanging fruit”.

OK let’s take those point by point. First there will be no oil shortages in 2020 or even 2030. There will sufficient oil to be purchased by those who can AFFORD the price at that time. Just as there was no shortage when oil was $100/bbl or even when it peaked at $146/bbl. And yes: there will be those who cannot afford to buy much oil at those prices…just as there were millions who couldn’t afford to buy much if any oil when it was selling for less then $20/bbl in the late 90’s.

Depletion? Yes, been going on since Cop. Drake drilled that first well over 100 years ago. Nothing new there. Declining EROEI? That will be a function of further oil prices. When prices boomed about 10 years the EROEI decreased because those higher prices allowed wells with lower recoveries to be economical. IOW it allowed previous known but uneconomical projects to be developed. And since oil prices have declined the EROEI of projects being drilled today have increased significantly compared to several years ago. But that also means fewer economical projects to be developed. IOW lower future EROEI’s will represent more economical viable projects to be developed and thus more oil reserves to be added to the global supply.

But no free lunch: those lower EROEI’s and additional oil reserves will come with the trade off of higher oil prices. As far as global upstream oil investments being “dead” during the bottom of the oil price crash upstream oil investments in 2016 defined to $434 billion according to the IEA. A big decrease from previous years but hardly “dead”. And if oil prices significantly increase as you predict it will bring about a big increase in capex thanks to the lower EROEI as a result of those higher oil prices.

By “black glue” I assume you’re referring to heavy oil reserves such as the Canadian oil sands and Venazuelan reserves. Both are critical to the refining industry since those low API gravity oils are REQUIRED to blend with the high API gravity oils that are become all the more common as the shale plays continue to developed especially as there’s a resurgence due to the higher oil prices you are predicting. I’ve explained in detail before but in case you missed: the refineries use “blended oil” with a very narrow range around 32 API. And that REQUIRES oils with API’s in the low 20’s to blend with the light oils/condensates with 40+ API’s. IOW without that “black glue” US refineries would be hurt.

No more “low hanging fruit”. I’ve explained in detail numerous times so I won’t take up space doing it again. When the Rockman began 40 years ago there was no “low hanging fruit”…IOW easily discovered oil reserves. And in the years previous there were no easily discovered oil reserves. In reality the exploration success rate in the last decade or so has never been higher. And that has been due to huge advances seismic technology. What has changed significantly over the last 50 years or so is the size of the yet to be discovered oil fields especially onshore. Those giant fields discovered in the good ole days of “low hanging fruit” required a lot of dry holes in order to be located. If you could look at a map showing all wells drilled (dry holes and producers) you would see tens of thousands of dry holes in those “big field” trends.

So there you go: each of your points clarified. Feel free to ask for more details if needed

Cloggie on Tue, 19th Sep 2017 10:11 am

Hear, hear, Rockman. Agree with every word. This is why I lost interest in oil and peak oil, because there will be sufficient left to carry out the energy transition. And oil folks like Rockman will enable that transition by supplying the world with the final round in the oil cafe, before it closes down for ever.

Boat on Tue, 19th Sep 2017 10:43 am

Davy on Tue, 19th Sep 2017 7:12 am

Pat, maybe but we still have to consider demand destruction from a declining economy despite what the bulls say. All is not well.

When does this demand destruction start? Wouldn’t metrics like vehicles purchased and miles driven need to drop? How about oil itself, when are fewer barrels actually sold. Or better yet a declining btu use. Do you have any proof of any dropping global trends?

____________________________________________ on Tue, 19th Sep 2017 2:12 pm

Hey fagtards.

http://www.telegraph.co.uk/science/2017/09/18/immediacy-threat-climate-change-exaggerated-faulty-models/

Ain’t I’ve been saying?

rockman on Tue, 19th Sep 2017 3:41 pm

Cloggie – “And oil folks like Rockman will enable that transition by supplying the world with the final round in the oil cafe…” Not the Rockman: when he hits 67 next spring he’s calling it quits. After that he’ll be focusing on putting up his solar panels to run his AC during the day and driving less the 2,000 miles per year. And all the while his wife expanding her vegatable patch. So f*ck all you fossil fuel hogs. LOL.

But setously, good luck. You younger farts are going to need it: most of the Rockman’s peers, who make up the vast majority of the experienced oil patch, are all shifting towards bug out mode. For us the next boom is too far down the road to be of any interest. Most used this last boom to finish off retirement plans. This last bust came as no surprise to most of us. It was only a question of exactly when.

Cloggie on Tue, 19th Sep 2017 4:26 pm

@rockman – I remember vividly the socalled “autoloze zondagen” (carfree sundays) in 1973, when Holland, together the US were singled out by ME oil producers for an oil boycott, because of our support for Israel:

https://www.youtube.com/watch?v=PL0UP7ktqyw

Perhaps it would be beneficial to every now and then have these consumption restrictions imposed on us once again, since everybody is taking energy supply for granted.

Sissyfuss on Tue, 19th Sep 2017 8:21 pm

Dear ____________________, Can I call you _______? Your clickbait article is hidden behind a paywall which raises my suspicions and my hackles simultaneously. Ooh, some British scientists came out with a new study telling us BAU has been saved. And this will negate the voluminous studies that 97% of climate scientists agree with. Trashing a troll is such a waste of time so let me just say that your moniker is as empty as your premises. I hear not so Breitbart calling you, please answer.

Boat on Tue, 19th Sep 2017 9:00 pm

clog,

“Perhaps it would be beneficial to every now and then have these consumption restrictions imposed on us once again, since everybody is taking energy supply for granted”.

Taken for granted my ass. A couple decades of conflict with multiple countries to keep that oil flowing.

Anonymous on Thu, 21st Sep 2017 10:16 pm

Those record wells are all BOE numbers. The DVN well is 50% oil. The CLR well is even less (actual bo is 1000/d). I don’t remember exactly but think the EOG wells are about 50% oil as well.

Also, you really can’t look at overall populations or trends based on monster wells. You have to look at the average well. (They have been good, but nothing like this silly Fool article.)