Page added on February 21, 2014

Why The Next Global Crisis Will Be Unlike Any In The Last 200 Years

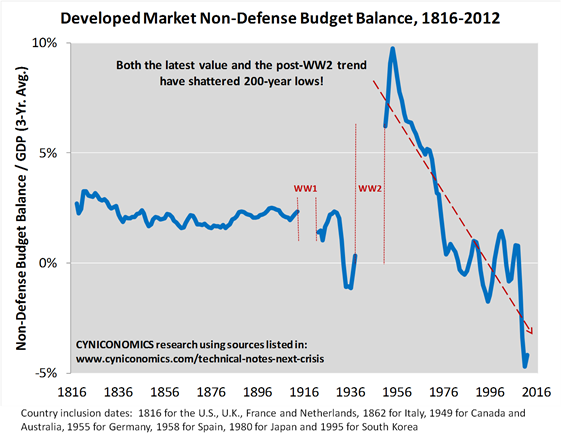

Sometime soon, we’ll take a shot at summing up our long-term economic future with just a handful of charts and research results. In the meantime, we’ve created a new chart that may be the most important piece. There are two ideas behind it:

1. Wars and political systems are the two most basic determinants of an economy’s long-term path. America’s unique pattern of economic performance differs from Russia’s, which differs from Germany’s, and so on, largely because of the outcomes of two types of battles: military and political.

2. The next attribute that most obviously separates winning from losing economies is fiscal responsibility. Governments of winning economies normally meet their debt obligations; losing economies are synonymous with fiscal crises and sovereign defaults. You can argue causation in either direction, but we’re not playing that game here. We’re simply noting that a lack of fiscal responsibility is a sure sign of economic distress (think banana republic).

Our latest chart isolates the fiscal piece by removing war effects and considering only large, developed countries. In particular, we look at government budget balances without military spending components.

(Military spending requires a different evaluation because it succeeds or fails based on whether wars are won or lost. Or, in the case of America’s adventures of the past six decades, whether war mongering policies serve any national interest at all. In any case, military spending isn’t our focus here.)

There are 11 countries in our analysis, chosen according to a rule we’ve used in the past – GDP must be as large as that of the Netherlands. We start in 1816 for four of the 11 (the U.S., U.K., France and Netherlands). Others are added at later dates, depending mostly on data availability. (See this “technical notes” post for further detail.) Here’s the chart:

Not only has the global, non-defense budget balance dropped to never-before-seen levels, but it’s falling along a trend line that shows no sign of flattening. The trend line spells fiscal disaster. It suggests that we’ve never been in a predicament comparable to today. Essentially, the world’s developed countries are following the same path that’s failed, time and again, in chronically insolvent nations of the developing world.

Look at it this way: the chart shows that we’ve turned the economic development process inside out. Ideally, advanced economies would stick to the disciplined financial practices that helped make them strong between the early-19th and mid-20th centuries, while emerging economies would “catch up” by building similar track records. Instead, advanced economies are catching down and threatening to throw the entire world into the kind of recurring crisis mode to which you’re accustomed if you live in, say, Buenos Aires.

How did things get so bad?

Here are eight developments that help to explain the post-World War 2 trend:

1. In much of the world, the Great Depression triggered a gradual expansion in the role of the state.

2. Public officials failed to establish a sustainable structure for their social safety nets, and got away with this partly by sweeping the true costs of their programs under the carpet.

3. Profligate politicians were abetted by the economics profession, which was more than happy to serve up unrealistic theories that account for neither unintended consequences nor long-term costs of deficit spending.

4. With economists having succeeded in knocking loose the old-time moorings to budgetary discipline (see first 150 years of chart), responsible politicians became virtually unelectable.

5. Central bankers suppressed normal (and healthy) market mechanisms for forcing responsibility, by slashing interest rates and buying up government debt.

6. Regulators took markets further out of the equation by rewarding private banks for lending to governments, while politicians and central bankers effectively underwrote the private bankers’ risks.

7. Monetary policies also encouraged dangerous private credit growth and other financial excesses, resulting in budget-destroying setbacks such as stagflation and banking crises.

8. Budget decisions were made without consideration of the inevitability of these setbacks, because economists wielding huge influence over the budgeting process (think CBO, for example) assumed a naïve utopia of endless economic expansion.

Sadly, all of these developments are still very much intact (excepting small improvements in budget projections that we’ll address next week). They tell us we’ll need substantial changes in political processes, central banking and the economics profession to avert the disaster predicted by our chart. And we’re rapidly running out of time, as discussed in “Fonzi or Ponzi? One Theory on the Limits to Government Debt.”

On the bright side, a fiscal disaster should help trigger the needed changes. Every kick of the can lends more weight to the view expressed by some that the debt super-cycle – including public and private debt – needs to go the distance, eventually reaching a Keynesian end game of massive collapse. At that time, we would expect a return to old-fashioned, conservative attitudes toward debt.

As for the chart, it helps to flesh out a handful of ideas we’ve been either writing about or thinking of writing about. We’ll return to it in future posts, including one drilling down to the individual country level that we’ll publish soon.

21 Comments on "Why The Next Global Crisis Will Be Unlike Any In The Last 200 Years"

MSN fanboy on Fri, 21st Feb 2014 7:41 pm

What stops all these countries just announcing A DEBT JUBLIEE..

clifman on Fri, 21st Feb 2014 7:50 pm

Interesting chart and analysis. Surely they’re on to something. But no mention of energy whatsoever. Surely they’re missing something…

Northwest Resident on Fri, 21st Feb 2014 8:27 pm

Where’s the chart that shows the rise and fall of Ponzi schemes? That’s all we need to understand the current situation.

MSN: What stops all these countries just announcing A DEBT JUBILEE. — One man’s debt is another man’s asset. The ones holding most of the assets these days are the 1% financial honchos. The ones holding all the debt are the 99%. Somewhere, a one-percenter is sipping champagne on his multi-million dollar yacht, smoking a Cuban cigar while hot babes wait on him hand and foot, and he’s chuckling to himself thinking, “Debt jubilee — ha! You gotta be kidding me.”

rockman on Fri, 21st Feb 2014 8:53 pm

Let’s take a very simplistic example: the US debt. So the US declares all debts are voided. Yeah….no more paying the interest on those bonds. Of course, those interest payments we keep aren’t enough to run the govt…we still need to borrow. So there’s the big fat question: would the world keep buying our bonds because we just defaulted? Maybe…we would be debt free and a good risk. If one assumes we won’t default again. But if we did I think most wouldn’t expect it to happen for a good bit down the road.

But then there’s the second question: would the folks that just got stiffed on their loans have much capital to lend? I don’t know the numbers but I would guess a fair bit of the monies going into all bonds these days are a recycling of that interest being repaid. And beyond that if the folks losing those interest payments depended on that income to help run their economies wouldn’t they have to divert a fair bit of their residual capital to support their economies and thus reduce the lending pool even further.

Not paying off a debt sounds great. But what about them dang unintended consequences?

Northwest Resident on Fri, 21st Feb 2014 9:17 pm

Let’s make it simple. Why will the next global crisis be unlike any other in the last 200 years? Because:

1) We have many billions more people than we had during any other major crises of the last 200 years

2) We have strip-mined huge percents of our resources and they are either gone forever or reduced to next-to-nothing

3) We are already so deep in trillion$ of debt that we will NEVER pay it off, or even be able to keep up with the interest payments. We are Flat Ass Broke — and there aren’t any resources or people left to exploit to turn a big profit. We’ve totally, completely exploited the entire planet already — there is almost nothing left to make a lousy buck on these days.

4) We have poisoned the atmosphere, the oceans, the lakes and rivers and the farmland with our chemicals. We have left a toxic slime trail that wraps around planet earth many times over. We have almost certainly started a chain of events that will lead to massive climate changes in the coming years. We partied hard, and in so doing, we trashed the planet.

In previous collapses, the people of the world had something to wake up to, an planet with enough resources and natural sustenance to enable a kick start of another period of economic growth. Today, we don’t have anything to wake up to except the vomit and feces left over from the lunatic binge.

Simple.

Norm on Fri, 21st Feb 2014 9:38 pm

What he said.

andya on Fri, 21st Feb 2014 10:15 pm

200 years is not a long enough timeline.

J-Gav on Fri, 21st Feb 2014 11:04 pm

As Michael Hudson has often said, a debt jubilee would be a fine idea at this juncture. What I don’t see is how ONE country could do it without all the others doing the same thing … and that gets rather complicated. Why? Well, because most of the creditors are part of the Western elite corporate/bankster club if you follow my drift …

J-Gav on Sat, 22nd Feb 2014 12:08 am

So, back to the article …

Northwest – “Lunatic binge” is pretty good shorthand I’d say, for what we’ve seen over the last 35 years or so. We could easily take it further back in time of course, depending on the criteria for what is ‘lunatic.’ What used to qualify doesn’t anymore in our age of anything (everything?)goes.

Unfortunately, I don’t believe that the next global crisis will “trigger the needed changes,” as the article suggests. Nobody knows exactly what it will trigger but I doubt that most of it will be “needed.”

Harquebus on Sat, 22nd Feb 2014 12:28 am

Excellent post Northwest Resident.

Northwest Resident on Sat, 22nd Feb 2014 12:32 am

J-Gav — Some see a total collapse of our technologically advanced and financially defrauded Western Civilization as exactly what is “needed”. Some think a swift and punishing judgment of humanity for the havoc and destruction it has wreaked upon planet as earth as exactly what is “needed”. From my perspective, what is needed is whatever it takes to redirect humanity onto a sustainable course that holds nature to be cherished and maintained, not something to be “conquered” and twisted to suit our short-term desires. To satisfy that need, unfortunately, may require what is referenced in my points one and two. No way we are going to do it voluntarily except on an individual by individual basis. Too many greedy, selfish, sociopathic vested interests at this point.

Makati1 on Sat, 22nd Feb 2014 2:52 am

Nuff said above…

Jimmy on Sat, 22nd Feb 2014 4:00 am

Why the need to only analyses non Defence spending? Defence spending doesn’t apply to your little dream science charts? Zerohedge is BS.

BS in. BS out.

I don’t think many of those gold loving Austrian’s down at zerohedge ever took a physics course?

FriedrichKling on Sat, 22nd Feb 2014 8:14 am

Well said, Northwest Resident

Davy, Hermann, MO on Sat, 22nd Feb 2014 10:03 am

@msn – What stops all these countries just announcing A DEBT JUBLIEE?

A debt jubilee is an outcome not a policy. Our current interconnected complex global economic system cannot function with such a policy. In any case our system is based on debt. Fiat money comes into existence by the issuance of debt by banks. So when you debt jubilee it is really “let’s start over” or you are further saying lets collapse. We will see a steady erosion of the stability of the system with the resulting bankruptcies worldwide. If these bankruptcies reach a critical point the global economic system will lock up and confidence will end. Liquidity is confidence. Liquidity is what allows trade. One party trusting another party. One party delivering a product and the other party delivering payment. It is not possible to reboot such a system through a debt jubilee. There are no accepted procedures like we have now with the clearing houses of trade. A small country like Greece could do it by leaving the Euro and going it alone. The result would be dramatic and very difficult with no guarantees of improvement.

@gav – @Northwest – “Lunatic binge” is pretty good shorthand I’d say, for what we’ve seen over the last 35 years or so. We could easily take it further back in time of course, depending on the criteria for what is ‘lunatic.’ What used to qualify doesn’t anymore in our age of anything (everything?)goes.

We definitely are in a new normal. We grew out of the old normal which had reached a climax in 2008. What we are seeing is a bubble and the bubble is our Global society and its economy. This bubble is in a predicament of diminishing returns approaching the limits of growth. We are at a “peak everything”. W have a population in overshoot to a recognized sustainable carrying capacity. The next global crisis is now and it did not end in 2008. It instead was rebundled and sold to the global society to restore confidence. This “rebundle” is nothing more than a Ponzi scheme of debt and unfunded liabilities. The Ponzi scheme is working now by a wealth transfer from the productive middle class to a parasitic global upper class through a global policy of monetizing debt. This is nothing more than a house of cards with the social fabric. The bottom of the house of cards being weakened to support a financial sector and global wealthy group. The financial segment is 4 times its optimum size. This Financial segment of the economy has become parasitic to real wealth creation. This financial segment by receiving the flows first from the monetizing of the central banks takes a cut off the top by a carry trade of low cost money making a higher return. The money is flowing into risky and exotic investments. It is being further leveraged and rehypothecated making the global system further brittle and distorted. This resulting economic system is riddled with market distortions, manipulation, and corruption. Bad investments are being made and then saved from failure by global governments in an orgy of moral hazard. The moral hazard is further strengthened by the revolving door of the connected in a system of leadership and patronage. Again, this is a bubble and We as humans are the bubble. When one gets to peak everything there is nowhere to go but down for everything. It is part of the laws of thermodynamics. What we are seeing currently is entropic decay but with a momentum sustaining the system. The parasitic decay of the bottom by the top is nothing more than a racket of deception. It can keep going for some time. If you think you can end it at this point and return to what we had you are mistaken. Many posts on Zero Hedge argue this. All system systems cycles. We are at the top of a cycle in a population overshoot with diminishing returns to further growth. Society is faced with a predicament that cannot be solved. We will break to a lower equilibrium probably very soon due to this bubble bursting from financial stress and or an energy trap shock.

indigoboy on Sat, 22nd Feb 2014 12:12 pm

I think Northwest Residents comment at 9:17pm, takes the prize. But I would add one thing more.

Don’t you find it a bit unnerving when you draw an analogy with yeast in a vat of grape juice? It takes yeast about 20 days to devour most of the sugar, quadruple in population, and pollute their own environment with toxic alcohol.

It took humanity about 200 years,….. but we got there in the end.

RICHARD RALPH ROEHL on Sun, 23rd Feb 2014 12:05 am

200 Earth years? More like two years.

As usual… nothing specifically mentioned about the EXPONENTIAL growth of the human baboony population on Mother Earth, the HOST ORGANISM that sustains human civilization.

Yesss… Mother Earth, an orb of FINITE space and FINITE resources. EXPONENTIAL growth in a closed looped system (Earth) is suicide. It is EXTINCTION.

Makati1 on Sun, 23rd Feb 2014 3:05 am

Richard, the number if people on the globe is NOT as important as the 1 billion wasters who inhabit the Western countries. The US is 5% of the population (<320M) yet we 'use' 30+% of the world's resources. Europe is not much better. Ditto Japan, and the other Western 'wannabees'.

The other 7B did NOT dump hundreds of thousands of different man-made chemicals into the ecosystem. They did not build the nuclear plants, the highways systems, the dependence on oil, the 'for profit', debt based, money system, or the many other things the West is using to rape and pillage and kill the very system we need to survive. We Westerners are to blame for the situation, not 3rd world countries that have ALWAYS had a Western Master. And, can you blame china for wanting what the West has? Or India? We flaunt it everywhere and wonder why we are hated.

Davy, Hermann, MO on Sun, 23rd Feb 2014 12:56 pm

My BS spam filter kicked on and it detected a distorted and subjective statement. Likely driven by a hatred of a system not understood. Digested into a propaganda statement akin to a North Korean news cast. A sad testament to someone fixed in blame and complain. An attitude that has no future in a world that looks for answers in these times of crisis.

Richard, the number if people on the globe is NOT as important as the 1 billion wasters who inhabit the Western countries. The US is 5% of the population (<320M) yet we 'use' 30+% of the world's resources. Europe is not much better. Ditto Japan, and the other Western 'wannabees'.

The other 7B did NOT dump hundreds of thousands of different man-made chemicals into the ecosystem. They did not build the nuclear plants, the highways systems, the dependence on oil, the 'for profit', debt based, money system, or the many other things the West is using to rape and pillage and kill the very system we need to survive. We Westerners are to blame for the situation, not 3rd world countries that have ALWAYS had a Western Master. And, can you blame china for wanting what the West has? Or India? We flaunt it everywhere and wonder why we are hated.

bobinget on Sun, 23rd Feb 2014 4:10 pm

It’s all the fault of oil companies;

http://www.bbc.co.uk/news/business-26225135

Argentina tries to delay $1.3bn repayment to creditors

19 February 2014 Last updated at 02:28 GMT

Argentina has petitioned the US courts to try to stall a $1.3bn (£0.8bn) repayment to its creditors.

If the petition to the Supreme Court is not successful, the country risks triggering a default and debt crisis.

The money is owed to creditors who refused to participate in a debt restructuring process arising from the country’s $100bn default 12 years ago.

Most bondholders agreed to accept a hefty discount on what they were owed, but those who held out are demanding to be repaid in full.

President Cristina Fernandez de Kirchner has said her government will honour payments to those who accepted the debt swaps, but will pay nothing to the creditors who held out, including hedge funds NML Capital and Aurelius Capital Management.

She has described the hold-out creditors as “vulture funds”.

The move by Argentina reignites investors’ worries about a new debt crisis in the country.

Last month, Argentina saw its currency devalued by 17%.

Argentina has already defaulted on its debt three times in its history. The last occasion, in 2002, brought the country to its knees.

Meanwhile, inflation is 25% and the peso fell 19% in January.

The president has blamed supermarkets and oil companies, as Nigel Cassidy reports.

bobinget on Sun, 23rd Feb 2014 4:25 pm

I guess you could call me a Vulture Capitalist.

I’ve made bets Argentina’s oil company ‘ERF’ with aid and funding from foreign oil companies will successfully exploit Argentina’s vast shale resource.

The long term plan of President Cristina Kirchner, making Argentina energy independent , perhaps by 2020 is a huge gamble. My investment is safe, for now at least, while the resources are being prepared for slaughter or ‘harvest’ you pick.

As of now everything rides on tight oil and gas in Argentina.