Page added on April 21, 2016

The $2 Trillion Project to Get Saudi Arabia’s Economy Off Oil

Early last year, at a royal encampment in the oasis of Rawdat Khuraim, Prince Mohammed bin Salman of Saudi Arabia visited his uncle, King Abdullah, in the monarch’s final days before entering a hospital. Unbeknown to anyone outside the House of Saud, the two men, separated in age by 59 years, had a rocky history together. King Abdullah once banned his brash nephew, all of 26 at the time, from setting foot in the Ministry of Defense after rumors reached the royal court that the prince was disruptive and power-hungry. Later, the pair grew close, bound by a shared belief that Saudi Arabia must fundamentally change, or else face ruin in a world that is trying to leave oil behind.

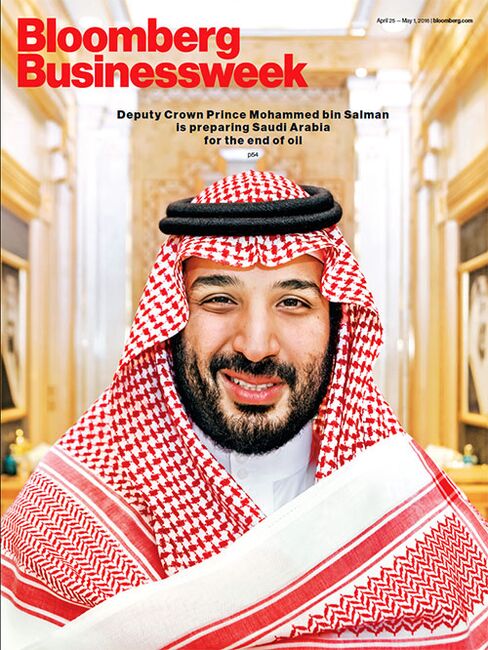

For two years, encouraged by the king, the prince had been quietly planning a major restructuring of Saudi Arabia’s government and economy, aiming to fulfill what he calls his generation’s “different dreams” for a postcarbon future. King Abdullah died shortly after his visit, in January 2015. Prince Mohammed’s father, Salman, assumed the throne, named his son the deputy crown prince—second in line—and gave him unprecedented control over the state oil monopoly, the national investment fund, economic policy, and the Ministry of Defense. That’s a larger portfolio than that of the crown prince, the only man ahead of him on the succession chart. Effectively, Prince Mohammed is today the power behind the world’s most powerful throne. Western diplomats in Riyadh call him Mr. Everything. He’s 31 years old.

“From the first 12 hours, decisions were issued,” says Prince Mohammed. “In the first 10 days, the entire government was restructured.” He spoke for eight hours over two interviews in Riyadh that provide a rare glimpse of the thinking of a new kind of Middle East potentate—one who tries to emulate Steve Jobs, credits video games with sparking ingenuity, and works 16-hour days in a land with no shortage of sinecures.

Last year there was near-panic among the prince’s advisers as they discovered Saudi Arabia was burning through its foreign reserves faster than anyone knew, with insolvency only two years away. Plummeting oil revenue had resulted in an almost $200 billion budget shortfall—a preview of a future in which the Saudis’ only viable export can no longer pay the bills, whether because of shale oil flooding the market or climate change policies. Historically, the kingdom has relied on the petroleum sector for 90 percent of the state budget, almost all its export earnings, and more than half its gross domestic product.

On April 25 the prince is scheduled to unveil his “Vision for the Kingdom of Saudi Arabia,” an historic plan encompassing broad economic and social changes. It includes the creation of the world’s largest sovereign wealth fund, which will eventually hold more than $2 trillion in assets—enough to buy all of Apple, Google, Microsoft, and Berkshire Hathaway, the world’s four largest public companies. The prince plans an IPO that could sell off “less than 5 percent” of Saudi Aramco, the national oil producer, which will be turned into the world’s biggest industrial conglomerate. The fund will diversify into nonpetroleum assets, hedging the kingdom’s nearly total dependence on oil for revenue. The tectonic moves “will technically make investments the source of Saudi government revenue, not oil,” the prince says. “So within 20 years, we will be an economy or state that doesn’t depend mainly on oil.”

For 80 years oil has underwritten the social compact on which Saudi Arabia operates: absolute rule for the Al Saud family, in exchange for generous spending on its 21 million subjects. Now, Prince Mohammed is dictating a new bargain. He’s already reduced massive subsidies for gasoline, electricity, and water. He may impose a value-added tax and levies on luxury goods and sugary drinks. These and other measures are intended to generate $100 billion a year in additional nonoil revenue by 2020. That’s not to say the days of Saudi government handouts are over—there are no plans to institute an income tax, and to cushion the blow for those with lower incomes, the prince plans to pay out direct cash subsidies. “We don’t want to exert any pressure on them,” he says. “We want to exert pressure on wealthy people.”

Saudi Arabia can’t thrive while curbing the rights of half its population, and the prince has signaled he would support more freedom for women, who can’t drive or travel without permission from a male relative. “We believe women have rights in Islam that they’ve yet to obtain,” the prince says. One former senior U.S. military officer who recently met with the prince says the royal told him he’s ready to let women drive but is waiting for the right moment to confront the conservative religious establishment, which dominates social and religious life. “He said, ‘If women were allowed to ride camels [in the time of the Prophet Muhammad], perhaps we should let them drive cars, the modern-day camels,’ ” the former officer says. Separately, Saudi Arabia’s religious police have been banned from making random arrests without assistance from other authorities. Attempts to liberalize could jeopardize the deal that the Al Saud family struck with Wahhabi fundamentalists two generations ago, but the sort of industries Prince Mohammed wants to lure to Saudi Arabia are unlikely to come to a country with major strictures on women. Today, no matter how much money there is in Riyadh, bankers and their families would rather stay in Dubai.

Many Saudis, accustomed to watching the levers of power operated carefully by the geriatric descendants of the kingdom’s founding monarch, were stunned by Prince Mohammed’s lightning consolidation of power last year. The ascendance of a third-generation prince—he’s the founder’s grandson—was of acute interest to the half of the population that’s under 25, particularly among the growing number of urbane, well-educated Saudis who find the restrictions on women an embarrassment. Youth unemployment is about 30 percent.

But supporting reform is one thing, and living it another. Public reaction to the economic reboot has been wary, sometimes angry. This winter, many Saudis took to Twitter, their favored means of uncensored discourse, to vent about a jump of as much as 1,000 percent in water bills and to complain about the prospect of Saudi Aramco, the nation’s patrimony, being sold off to finance the investment fantasies of a royal neophyte.

“We’ve been screaming for alternatives to oil for 46 years, but nothing happened,” says Barjas Albarjas, an economic commentator who’s critical of selling Aramco shares. “Why are we putting our main source of livelihood at risk? It’s as if we’re getting a loan from the buyer that we’ll have to pay back for the rest of our lives.”

Albarjas and other Saudi skeptics believe public investors, leery the state will always have other priorities for Aramco besides maximizing profits, will demand a steep discount to invest in its shares. They also wonder why Saudis should trust unaccountable managers of the sovereign wealth fund to bring in high returns any more than Aramco’s executives. The company’s size is staggering. It’s the world’s No. 1 oil producer, with the capacity to pump more than 12 million barrels a day, more than twice as much as any other company, and it’s the world’s fourth-biggest refiner. Aramco controls the world’s second-largest oil reserves, behind Venezuela; but in contrast to that country’s expensive-to-tap Orinoco Belt, the oil in Saudi Arabia is cheap and easy to obtain. Aramco is also one of the most secretive companies on earth—there are no official measures of financial performance.

Saudi Arabia’s economy will probably expand 1.5 percent in 2016, the slowest pace since the global financial crisis, according to a Bloomberg survey, as government spending—the engine that powers the economy—declines for the first time in more than a decade. The state still employs two-thirds of Saudi workers, while foreigners account for nearly 80 percent of the private-sector payroll. Some past diversification drives in Saudi Arabia have been conspicuous failures. The $10 billion King Abdullah Financial District, for example, begun in 2006, sits largely unleased. A ghostly monorail track snakes through some 70 buildings, including five brand-new glass-and-steel skyscrapers. Some construction workers abandoned the project recently, claiming they hadn’t been paid.

“Ultimately, everyone knows what the demographics imply for Saudi Arabia,” says Crispin Hawes, a managing director at Teneo Intelligence. “Those demographics don’t look any nicer now than they did 10 years ago. Without real fundamental economic reform, it is incredibly difficult to see how the Saudi economy can generate the employment levels it needs.”

Prince Mohammed won’t go into details about any planned nonoil investments, but he says the gargantuan sovereign fund will team up with private equity firms to eventually invest half its holdings overseas, excluding the Aramco stake, in assets that will produce a steady stream of dividends unmoored from fossil fuels. He knows that many people aren’t convinced. “This is why I’m sitting with you today,” he says in mid-April. “I want to convince our public of what we are doing, and I want to convince the world.”

Prince Mohammed says he’s used to resistance, hardened by bureaucratic enemies who once accused him of power-grabbing in front of his father and King Abdullah. He says he studies Winston Churchill and Sun Tzu’s The Art of War and will turn adversity to his advantage. It could all read as just another millennial’s disruption talk if the prince didn’t have a clear path to power or speak so freely in ways that shock the petro-political world order.

The likely future king of Saudi Arabia says he doesn’t care if oil prices rise or fall. If they go up, that means more money for nonoil investments, he says. If they go down, Saudi Arabia, as the world’s lowest-cost producer, can expand in the growing Asian market. The deputy crown prince is essentially disavowing decades of Saudi oil doctrine as the leader of OPEC. He scuttled a proposed freeze of oil production on April 17 at a suppliers’ meeting in Qatar because archrival Iran wouldn’t participate. Observers saw it as extremely rare interference by a member of the royal family, which has traditionally given the technocrats at the Petroleum Ministry ample room for maneuver on oil policy. “We don’t care about oil prices—$30 or $70, they are all the same to us,” he says. “This battle is not my battle.”

To interview the deputy crown prince, you don’t check in with the receptionist. The perimeter begins at a downtown Riyadh hotel, awaiting the call from the office of palace protocol. The evening of March 30 is spent on standby; the word comes at 8:30 p.m. Three Mercedes-Benzes arrive. Even headed to an interview about thrift, there’s no escaping decadence: The cars appear brand-new, with seats wrapped in plastic and safety belts that have never been used.

The caravan heads to the royal compound in Irqah, a cluster of palaces surrounded by high white walls where the king and some of his relatives live, including Prince Mohammed. Armed guards, checkpoints, and metal detectors are all bypassed. No one even checks IDs. In his office, Prince Mohammed wears a plain white gown and nothing on his head, revealing longish dark curls and a receding hairline—an informality that many Saudis would find endearing when official photos were later published online. A marathon discussion and interview begins, with him listening to questions in English and responding immediately in detail in Arabic. He repeatedly corrects his interpreter.

At 12:30 a.m., it’s dinnertime. The reporters are joined at the table by the prince’s economic team, including the chairman of Aramco; the chief financial regulator; and the head of the sovereign wealth fund. As conversation loosens over the meal, Prince Mohammed asks Mohammed Al-Sheikh, his Harvard-educated financial adviser and a former lawyer at Latham & Watkins and the World Bank, to give an update on Saudi Arabia’s fiscal condition.

During the oil boom from 2010 to 2014, Saudi spending went berserk. Prior requirements that the king approve all contracts over 100 million riyals ($26.7 million) got looser and looser—first to 200 million, then to 300 million, then to 500 million, and then, Al-Sheikh says, the government suspended the rule altogether.

A journalist asks: How much was wasted?

Al-Sheikh eyes a running recorder on the table. “Can I turn this off?” he says.

“No, you can say it on record,” Prince Mohammed says.

“My best guess,” says Al-Sheikh, “is that there was roughly between 80 to 100 billion dollars of inefficient spending” every year, about a quarter of the entire Saudi budget.

Prince Mohammed picks up the questioning: “How close is Saudi Arabia to a financial crisis?”

Today it’s much better, Al-Sheikh says. But “if you’d asked me exactly a year ago, I was probably on the verge of having a nervous breakdown.” Then he tells a story that no one outside the kingdom’s inner sanctum has heard. Last spring, as the International Monetary Fund and others were predicting Saudi Arabia’s reserves could stake the country for at least five years of low oil prices, the prince’s team discovered the kingdom was rapidly becoming insolvent. At last April’s spending levels, Saudi Arabia would have gone “completely broke” within just two years, by early 2017, Al-Sheikh says. To avert calamity, the prince cut the budget by 25 percent, reinstated strict spending controls, tapped the debt markets, and began to develop the VAT and other levies. The burn rate on Saudi Arabia’s cash reserves—$30 billion a month through the first half of 2015—began to fall.

Al-Sheikh finishes his fiscally mortifying report. “Thank you,” the prince says.

A second interview, on April 14, takes place at King Salman’s farmhouse in Diriyah, on the outskirts of Riyadh. When the Mercedes caravan gets snarled in freeway traffic, a call from the front seat produces a police escort out of thin air. The reporters pull into a narrow lane running along a high wall that looks like the mud-brick bulwark of a desert castle. The property, where King Salman and his son have offices, sits atop a small hill in the heart of the Al Sauds’ ancestral lands.

This time the prince talks about himself. Growing up, he says, he benefited from two influences: technology and the royal family. His generation was the first on the Internet, the first to play video games, and the first to get its information from screens, he says. “We think in a very different way. Our dreams are different.”

His father is an avid reader, and he liked to assign his children one book per week, and then quiz them to see who’d read it. His mother, through her staff, organized daily extracurricular courses and field trips and brought in intellectuals for three-hour discussions. Both parents were taskmasters. Being late to lunch with his father was “a disaster,” the prince says. His mother was so strict that “my brothers and I used to think, Why is our mother treating us this way? She would never overlook any of the mistakes we made,” he says. Now the prince thinks her punishments made them stronger.

The prince had four older half-brothers he looked up to, he says. One was an astronaut who flew on the space shuttle Discovery, the first Arab and Muslim to reach outer space. Another is the respected deputy oil minister. A third became a university professor with a Ph.D. from Oxford in political science, and the fourth, who died in 2002, founded one of the largest media groups in the Middle East. All of them worked closely with King Fahd because he was their father’s full brother, the prince explains, “which allowed us to observe and live” the heady atmosphere of the royal court.

Prince Mohammed saw two possible versions of himself: one who pursued a vision of his own, and one who adapted to the court as it was. “There’s a big difference,” he says. “The first, he can create Apple. The second can become a successful employee. I had elements that were much more than what Steve Jobs or Mark Zuckerberg or Bill Gates had. If I work according to their methods, what will I create? All of this was in my head when I was young.”

In 2007, Prince Mohammed graduated fourth in his class from King Saud University with a bachelor’s degree in law. Then the kingdom came knocking. He resisted at first, telling the director of the Bureau of Experts, which serves as the cabinet’s legal adviser, that he was off to get married, earn a master’s degree overseas, and make his fortune. But his father urged him to give the government a chance, and Prince Mohammed did so for two years, focusing on changing certain corporate laws and regulations that “I had always struggled with.” His boss, Essam bin Saeed, says the prince showed a restless intellect and no patience for bureaucracy. “Procedures that used to take two months, he’d ask for them in two days,” says Saeed, who now works as a minister of state. “Today, it’s one day.”

In 2009, King Abdullah refused to approve Prince Mohammed’s promotion, in theory to avoid the appearance of nepotism. A bitter Prince Mohammed left and went to work for his father, then governor of Riyadh. He stepped into a viper’s nest. As Prince Mohammed tells it, he tried to streamline procedures to keep his father from drowning in a sea of paperwork, and the old guard rebelled. They accused the young prince of usurping power by cutting off their contact with his father and took their complaints to King Abdullah. In 2011, King Abdullah named Prince Salman defense minister but ordered Prince Mohammed never to set foot inside the ministry.

The prince worried his career was over. “I’m saying to myself, ‘I’m in my 20s, I don’t know how I fell into more than one trap,’ ” he says. But given how things have turned out, he’s grateful. “It’s only by coincidence I started working with my father—all because of King Abdullah’s decision not to grant my promotion. God bless his soul, he did me a favor.”

The prince resigned his government post and went to work reorganizing his father’s foundation, which builds housing, and started his own nonprofit aimed at fostering innovation and leadership among Saudi youth. In 2012 his father became crown prince. Six months later, Prince Mohammed was named his chief of court. Gradually, he worked his way back into King Abdullah’s good graces, taking on special assignments for the royal court that called for sharp elbows.

As the prince privately began planning for his father’s eventual reign, the king came to him with a huge assignment: Clean up the Ministry of Defense. Its problems had defied solutions for years, the prince says. “I told him, ‘Please, I don’t want this.’ He shouted at me and said, ‘You’re not to blame. I’m the one to blame—for talking to you.’ ” The last thing Prince Mohammed wanted at the time was more powerful enemies. The king issued a royal decree naming the prince supervisor of the office of defense minister and member of the cabinet.

He brought in Booz Allen Hamilton and Boston Consulting Group and changed the procedures for weapons procurement, contracting, information technology, and human resources, says Fahad Al-Eissa, director general of the defense minister’s office. Previously, the legal department had become “marginalized,” which resulted in bad contracts that became “a big source of corruption,” Al-Eissa says. The prince strengthened the law department and sent back dozens of contracts for revision. Many weapons purchases had been misconceived and inappropriately vetted, with no clear purpose. “We are the fourth-largest military spender in the world, yet when it comes to the quality of our arms, we are barely in the top 20,” Al-Eissa says. So the prince created an office to analyze arms deals.

He also started spending a few days a week at King Abdullah’s palace. He tried to push through several new reforms. “It was very difficult to do with the presence of a number of people,” he says. “But I remember to this day there’s nothing I discussed with King Abdullah that he didn’t give the order and implement.”

Less than a week after King Abdullah died and King Salman took the throne, he issued a decree naming Prince Mohammed defense minister, chief of the royal court, and president of a newly created council to oversee the economy. Three months later, the king replaced his half-brother as crown prince—a former intelligence chief who’d been appointed deputy crown prince by King Abdullah just two years earlier—and placed his nephew and son in the line of succession. The king’s decree said the move had been approved by a majority of the Al Saud family’s Allegiance Council. Prince Mohammed was given control over Saudi Aramco by royal decree 48 hours later.

The prince divides his time between his father’s palaces and the Defense Ministry, working from morning until after midnight most days. Courtiers claim his relationship with the crown prince, Mohammed bin Nayef, is good; they have neighboring camps at the royals’ desert encampment. Prince Mohammed takes frequent meetings with the king and spends long sessions with consultants and aides poring over economic and oil data. He also greets foreign dignitaries and diplomats and is the main prosecutor of Saudi Arabia’s controversial war in Yemen against Iran-backed Houthi rebels. For all the prince’s talk of thrift, the war has cost a fortune. “We believe that we are closer than ever to a political solution,” he says about the conflict. “But if things relapse, we are ready.”

He’s awakened most mornings by his kids, two boys and two girls, ranging in age from 1 to 6. That’s the last he sees of them. “Sometimes my wife gets upset with me because I put so much pressure on her for the programs that I want them to have,” he says. “I rely mainly on their mother for their upbringing.” Prince Mohammed has only one wife and isn’t planning on marrying more, he says. His generation isn’t so into polygamy, he explains. Life is too busy, compared with past eras when farmers could work a few hours a day and warriors could “take spoils once a week and had a lot of spare time.” Working, sleeping, eating, and drinking don’t leave a lot of time to open another household, he says. “It’s tough [enough] living with one family.”

In Prince Mohammed, the U.S. may find a sympathetic long-term ally in a chaotic region. After President Obama met the prince at Camp David last May, he said he found him “extremely knowledgeable, very smart, and wise beyond his years.” The prince visited Obama at the White House in September to air his disapproval of the U.S.-brokered nuclear deal with Iran, and the two men were likely to meet again on April 20 when Obama visits King Salman in Riyadh.

In March, Republican Senator Lindsey Graham of South Carolina met Prince Mohammed in Riyadh with a delegation from Congress. The prince emerged wearing his traditional gold-laced robe and red headdress and confided to Graham that he wished he’d worn something else. “He said, ‘The robe does not make the man,’ ” Graham says. “He obviously understands our culture.” Graham says the men spoke for an hour about the “common enemies” that Israel and Saudi Arabia have in Islamic State and Iran; innovation and Islam; and, of course, the epic economic changes. “I was blown away; I couldn’t get over how comfortable meeting him was,” says Graham. “What you have is a guy who sees the finite nature of the revenue stream and, rather than panicking, sees a strategic opportunity. His view of Saudi society is that basically it’s now time to have less for the few and more for the many. The top members of the royal family have been identified by their privilege. He wants them to be identified by their obligations instead.”

Changing the royal optics in a country where thousands of Al Sauds live opulently off the national coffers won’t be easy, but Prince Mohammed is willing to try. “The opportunities we have,” he says, “are much bigger than the problems.”

32 Comments on "The $2 Trillion Project to Get Saudi Arabia’s Economy Off Oil"

IanC on Thu, 21st Apr 2016 4:16 pm

It’s awesome to look at how opulently they live off of our addiction to oil. Please send these pictures to the masses of Americans searching between couch cushions for spare change to fill up their old cars with the gas these guys are selling. Gross!

geopressure on Thu, 21st Apr 2016 4:27 pm

IanC; you seem to have a problem with people selling their property at fair market value…

Davy on Thu, 21st Apr 2016 4:45 pm

It is well know that above a threshold of satisfied needs increasing levels of wealth are in fact diminishing returns on happiness. Eventually the wealthy become prisoners of their possessions. That is a generalization of course because psychopathic greed drives in the other direction. Wealth levels can never be satisfied for these individuals.

peakyeast on Thu, 21st Apr 2016 4:56 pm

They will probably diversify their economy by building the Arabian Alps inside a gigantic fridge that runs on … oil…

Its a great idea now that Davos seems to have some problems with enough snow…

geopressure on Thu, 21st Apr 2016 5:06 pm

Are the Saudi’s displaying signs of psychopathic greed?

It seems to me that they distribute a great portion of their revenues back to their citizens…

—

I think they are simply trying to run a country & navigate the treacherous waters of geopolitics without loosing their heads…

geopressure on Thu, 21st Apr 2016 5:08 pm

In my opinion, people who settle for just enough to satisfy their needs do so because they lack the intellectual power achieve more…

peakyeast on Thu, 21st Apr 2016 5:48 pm

@geo:

Here is the top 10 regrets of the dying:

1. I never pursued my dreams and aspirations.

2. I worked too much and never made time for my family.

3. I should have made more time for my friends.

4. I should have said ‘I love you’ a lot more.

5. I should have spoken my mind instead of holding back and resenting things.

6. I should have been the bigger person and resolved my problems.

7. I wish I had children.

8. I should have saved more money for my retirement.

9. Not having the courage to live truthfully.

10. Happiness is a Choice, I wish I knew that earlier.

If you think money beyond what you need makes you clever…. then its really sad.

But perhaps if one is stupid enough to believe in an afterlife ala the pharaos it can make some sense albeit all evidence points to the contrary.

HARM on Thu, 21st Apr 2016 6:01 pm

The Saudi economy is *already* diversified. They export copious amounts of hate, misogyny, terror, religious intolerance, fundamentalism and ignorance.

Looks like a sustainable business model to me!

Plantagenet on Thu, 21st Apr 2016 6:11 pm

The end of oil in Saudi is coming sooner than Prince Muhammad thinks.

geopressure on Thu, 21st Apr 2016 6:24 pm

I don’t think that money beyond one’s needs makes one clever…

I think that one must be clever in order to obtain money beyond their needs (or lucky)…

—

That is a good post though, by the way…

geopressure on Thu, 21st Apr 2016 6:27 pm

All Saudi needs is a Petrochemical Industry to hook them up with some CO2 & Ghawar will be producing like it is brand new all over again…

Which, no doubt is why they are making a huge push to develop a petrochemical industry of late…

makati1 on Thu, 21st Apr 2016 6:35 pm

Another joke from the soon to be gone country of Saudi Arabia. Camels replace Lamborghinis by 2025, I think. Or they can use the camels to put them like ox carts. LMAO

More Bloomberg bullshit and dreams of the elite, and the elite wannabees, that BAU will continue in a resource scarce, climate changing world of debt, war and chaos. Not going to happen.

peakyeast on Thu, 21st Apr 2016 6:36 pm

@geo: Btw. Sorry for the tone geo – it wasnt my intention. And I highly value your contributions on this blog.

makati1 on Thu, 21st Apr 2016 6:37 pm

Geo, GREED is killing the planet and you. It is a lust after power and an addiction to want more than you could possible need. All billions do is tempt you to meddle in affairs that are none of your business, like Soros and Gates.

Richard E. Krueger on Thu, 21st Apr 2016 6:44 pm

The United States of America takes a lowly backseat to Saudi Arabia! American leadership is dumb as dirt, while Saudi leaders are wise, shrewd and very smart. Long live the beautiful country of Saudi Arabia and its beautiful, loving people. Salam,

Denial on Thu, 21st Apr 2016 6:57 pm

@ Geo…..really they just need some Co2 and poof they have tons of oil again? It is not what I have read; I hear that there oil wells are much different than say in the U.S and have different formations etc…so that it won’t work in Saudi land….

@ Peak I read your list and all sound good except 7 and 8 seem very contradictory in a peak oil world…..I don’t wish I put a ton more into the stock market!!! what a crock of shit that is……to have more money for retirement means to do all the other things on your list say not to!! Almost all retirement programs today are bankrupt!!! That is why we have the FED manipulating the system so badly…younger people are force fed this crap so many times and it always makes me angry!! Lies Lies……lies….

geopressure on Thu, 21st Apr 2016 9:46 pm

Nope, CO2 will work just fine in their formations…

Survivalist on Thu, 21st Apr 2016 10:00 pm

So Saudi Arabia is gonna get off oil by investing a couple trillion dollars and getting by on the investment returns. What could possibly go wrong? I suppose when the king and his crew flee to Europe at least they’ll have some cash stashed around the globe instead of having all their eggs in invested in refineries in the desert. Didn’t they just pull a bunch of cash out of the market to pay for their budget short fall? And now the big idea is to sell refining assets and put money back into the market. Smooth move exlax.

Apneaman on Thu, 21st Apr 2016 10:02 pm

As Oil Prices Fall, Saudi Arabia Borrows $10 Billion to Stay Afloat

Saudi Arabia is borrowing $10 billion from a range of US, European and Asian banks, as the kingdom attempts to fill a record $98 billion budget deficit amid dropping oil revenues.

The loan is Saudi Arabia’s first international debt issuance in 25 years, which came as the country’s main source of revenue fell 23% last year. The lead arrangers, each contributing around $1.3 billion, include the Bank of Tokyo-Mitsubishi, HSBC and JPMorgan. The loan has been provided despite a sharp downgrade recently in Saudi Arabia’s creditworthiness.”

Read more: http://sputniknews.com/world/20160421/1038357537/saudi-arabia-10bn-loan.html#ixzz46WLHwEtA

Denial on Thu, 21st Apr 2016 10:40 pm

So…..you are saying there is plenty of cheap oil in the ground for the foreseeable future? I see a country that is very nervous about their reserves and is acting accordingly.

Denial on Thu, 21st Apr 2016 10:44 pm

Richard E. Krueger…….isn’t that the name from nightmare on elm street? hmmmm does not seem like a muslim name…by the way….why are all the contributors on here white males from north america? Is there a European version of this….I know Mak is from the phillipeans but it is a very homogenous group on here for the most part.

joe on Thu, 21st Apr 2016 11:26 pm

Im sorry, the Saudis plan to own the worlds biggest companies as a way to survive peak oil? Heres one to consider, idiots, companies need oil! Iphones sales are slipping, as are most, computer chip sales are down, commodities are down, population is growing, yet land is not growing, the world is heating up. We need 4 Saudi Arabias of oil to keep supplies in stable growth, right now tight oil is suppling a stagnant market. In high demand cycles, profit taking will cap the economic benefits of extracting oil, unless we committ the sin of messing with the philosophy of capitalism and introduce maxiumum profit margins but tax incentives for drilling. Urgh, how socialist!

Joe Nader on Fri, 22nd Apr 2016 1:45 am

the end of the evil kingdom is coming soon. The end to those arabs that spread their hate, evilness, and clown religion is coming soon. These arabs are born lazy and have no will to improve, progress or invent. They want the easy life

Apneaman on Fri, 22nd Apr 2016 2:35 am

The Implosion of the House of Saud

“The Panama Papers psyops revealed that – ailing – King Salman of Saudi Arabia is among a roast of notorious offshore profiteers «in relation» to «associates».

The House of Saud used British Virgin Islands shell companies to take out at least $34 million in mortgages for lavish houses in London and «a luxury yacht the size of a football field». And yet Western corporate media has given it a glaring pass. Quite predictable: House of Saud notables feature heavily among prime Western vassals.

As it stands, a major disconnect is also in effect. The House of Saud is busy spinning the need for austerity at home even as it is now positioned as the world’s third-largest spender on weapons, ahead of Russia.

«Austerity» is a bit rich when I revealed earlier this year that the House of Saud not only unleashed an oil price war – against Russia, Iran and the US shale oil industry – but also was busy unloading at least $1 trillion in US securities on the market to balance its increasingly disastrous budget.”

more

http://www.strategic-culture.org/news/2016/04/14/the-implosion-of-the-house-of-saud.html

peakyeast on Fri, 22nd Apr 2016 5:28 am

@Denial:

It is not my list. – It is a list made from what actual real people lying on their death-bed has said.

Which means that getting children was something happening maybe 30 years ago – and the same with their pensions.

IOW: They were not in the same way staring down the abyss as we are today.

Rafiqi AlMajideee on Fri, 22nd Apr 2016 7:03 am

All the best Prince Mohammad. May the breeze blow softly on your back…..

makati1 on Fri, 22nd Apr 2016 7:23 am

Denial, I’m also from the US. I just decided it is not where I wanted to be when the SHTF. I see the Philippines as having better chance of pulling thru than the Imperial Police State, although some flag waving Ozark redneck wannabees think different.

Mohammad Hanif on Fri, 22nd Apr 2016 9:41 am

Selling Saudi assets specially oil companies will be a great blunder.A big chunk of this money will land the private accounts of the Royal family and the rest will be utilized in western banks. Then will come a revolution and Saudi assets will be ceased alongwith the exodus of the Royals to western Europe…..Not worth the excercise in futility.

joe on Fri, 22nd Apr 2016 10:52 am

Saudi is a nation of 30 million people and growing, believe it or not Wikipedia says their per capita gdp is $58,000! Since 90% of that comes from oil and thus Aramco, and the king owns Aramco, the king alone feeds and clothes 30 million people, right?

Wrong. Without billions of US aid, the king of Arabia would be crucified because 1. Hes not a hasimite, 2. The corruption of his house, and their attack on America in 9-11 ensures that when America no longer needs their oil, the Saudis will be poor in friends, and the Arabs will look for a new hand to feed them.

The old fight between Iran and Turkey will return. Europe will back the Turks, Iran will be backed by Russia and China, but nobody will care because no oil will flow out, only hordes of economic migrants.

With tight oil still not disappearing and Saudis actively threatening America not to release the 28 pages of the 9-11 report which officially has the worlds worst kept secret in it, then America may not need the Saudis for much longer. The New New World Order will emerge from the house of Bush legacy.

geopressure on Fri, 22nd Apr 2016 2:16 pm

Joe:

The world currently produces +/-95 Million BOPD. In a few years the world will need 100 Million, then 105 & 110 Million…

This demand will be very difficult to meet without Saudi Arabia, wouldn’t you agree???

Oil is a GLOBAL Commodity & it is priced on the margins…

It does not matter if the US actually buys Saudi oil or not, what matters is that Saudi Oil is able to reach market so that Somebody can buy it…

People buy the political talk of the US being able to support their own oil needs do not understand the way that the system works…

geopressure on Fri, 22nd Apr 2016 2:18 pm

If the world needs 100,000,000 BOPD, but there is only 99,999,999 BOPD available, then you have a problem.

The Price of ALL the oil produced goes up, not just the oil from here or there…

Anonymous on Fri, 22nd Apr 2016 4:36 pm

Jewberg, always happy to help try and polish americas most vile and important puppet states image. Since the real media has been pretty relentless in shining a light on the house of Saud’s greed and support for uS global hegemony, a media-op designed to show a new ‘forward’ looking and more egalitarian(though completely subservient to washingdum and Tel Aviv of course), saudi arabia suddenly appears. Imagine that. Or is about too…..maybe….someday. Possibly.

Either way, the spin, and turd polishing machine in Jew York is working overtime on this one to convince anyone still listening that those ‘sauds’ are fiscally prudent, and hey, even (kind of)reform-minded lot. LoL. Who knew?

Sure they are. Where can I pick up my new bridge Jewberg?