Saudi Arabia and Russia Are at Odds on Almost Everything, Except Oil

byand

-

Two producers find common ground in seeking oil-price revival

-

Union could unravel if output curbs don’t counter shale surge

Saudi Arabia and Russia are at odds on pretty much everything: the war in Syria, policies on Iran, ties with Washington. But when it comes to propping up global oil prices, they’ve never been more aligned.

Just look at how the world’s two biggest oil producers united this month to tell markets they want to maintain output curbs for an extra nine months. Coordinated leaks and official statements from Riyadh and Moscow — circulated even before the Saudis sit down to agree the cuts with OPEC this Thursday — sent oil rallying more than 5 percent within days.

“It’s a question of two countries which are acutely dependent on oil,” said Igor Yusufov, who served as Russia’s energy minister from 2001-2004, the last time the nations cooperated on energy policy.

Their marriage of convenience was borne out of a shared urgency to stabilize the price of the commodity on which their economies, and political legitimacy, rely. In the process, Russia and Saudi Arabia are shifting the balance of power that drives the global energy market following years of waning influence from the Organization of Petroleum Exporting Countries.

Whether their alliance is strong enough to survive the test of time or unravels quickly depends heavily on how effective the anticipated extension of production cuts until March 2018 is at shoring up prices. The stakes are particularly high for Saudi Arabia as the U.S., a long-time loyal customer, cements itself as a rival producer.

The duo have compelling domestic incentives to make things work. Vladimir Putin is eager to spur the Russian economy, just emerging from a two-year recession, before he seeks re-election in March 2018. Saudi Prince Mohammed bin Salman, the royal responsible for engineering an unprecedented economic overhaul, needs a sturdier oil price to boost the valuation of Saudi Aramco ahead of an initial public offering later in the year.

Brent crude has risen from about $46 to $53 a barrel since the agreement to curb output by a total of 1.8 million barrels a day was first decided in the final weeks of last year. But it’s fallen 8 percent from a peak reached during the initial rush of enthusiasm, mostly because the global glut isn’t notably easing.

Shaky History

Frictions between the pair have already emerged. While Saudi Arabia quickly delivered a cut of 600,000 barrels a day, exceeding its pledge, Russia took almost four months before meeting its vow to cut half that amount. Riyadh has, at times, grown impatient with the pace of Moscow’s compliance, according to people familiar with the Saudi thinking.

If that sounds familiar it’s because the last time the Saudis and Russians were coordinating oil policy, a five-year stretch ending in 2004, their courtship eventually collapsed because Moscow failed to make good on the cuts it promised and Riyadh got frustrated.

That was before the U.S. shale oil industry shook the power balance in the global oil market and forced crude exporters worldwide to scramble to acclimatize. Since oil started crashing in mid-2014, they have confronted budget shortfalls that forced most to dip into oil savings and borrow money.

“The first driver is all about oil revenues,” said John Browne, the executive chairman of Russian billionaire Mikhail Fridman’s investment vehicle L1 Energy and former head of BP Plc. But there’s another motivation: leveraging “the geopolitical power of energy,” he said.

Oil-industry executives, analysts and energy officials monitoring both nations said beyond money, there are calculated political motives for ending a years-long rivalry over oil.

Diplomatic Tool

Riyadh, in particular, sees crude policy as a tool to influence Russian diplomacy in the Middle East, where the Saudis and the Russians are supporting opposing sides in the wars raging in Syria and Yemen. In a show of cooperation, Putin and Prince Mohammed held a face-to-face meeting on the sidelines of the G-20 in September in China.

Prince Mohammed told the Washington Post last month that the collaboration ultimately came down to Moscow’s camaraderie with Iran, a Saudi foe. “The main objective is not to have Russia place all its cards in the region behind Iran,” the 31-year-old said in that interview.

Moscow, meanwhile, is seeking a role in tumultuous Middle East for the first time since the Soviet Union collapsed in 1991, often clashing with the U.S.

For oil traders, the alliance has altered the playing field. After spending years hanging on every word of Middle Eastern oil officials on the sidelines of OPEC meetings in Viennese hotels, they’re now keeping closer watch of late-night comments out of the Kremlin.

The U-turn in relations comes after a decade of antagonism over energy policy, with Russia notably refusing to work with the Saudis to stabilize prices in 2008, when the price of a barrel of crude slid by more than $100 in five months.

Shifting Stakes

As recently as a meeting in Vienna in November 2014, then Saudi Oil Minister Ali Al-Naimi and Igor Sechin, a Putin ally who runs state-controlled oil giant Rosneft PJSC, clashed over how to manage oil production. Sechin had ruled out curbs, saying Russian companies would struggle to reduce output during the cold Siberian winter. Naimi didn’t hide his anger.

“It looks like nobody can cut, so I think the meeting is over,” he said, according to his memoirs.

The latest alliance has new faces: Russian energy minister Alexander Novak and Khalid Al-Falih, who succeeded Naimi after he retired in May 2016. About six months later, the two were key in getting about two dozen countries to trim production. They talk on the phone often and have held several joint press conferences. A number of times, including this month, they’ve coordinated statements and leaks to talk up oil prices.

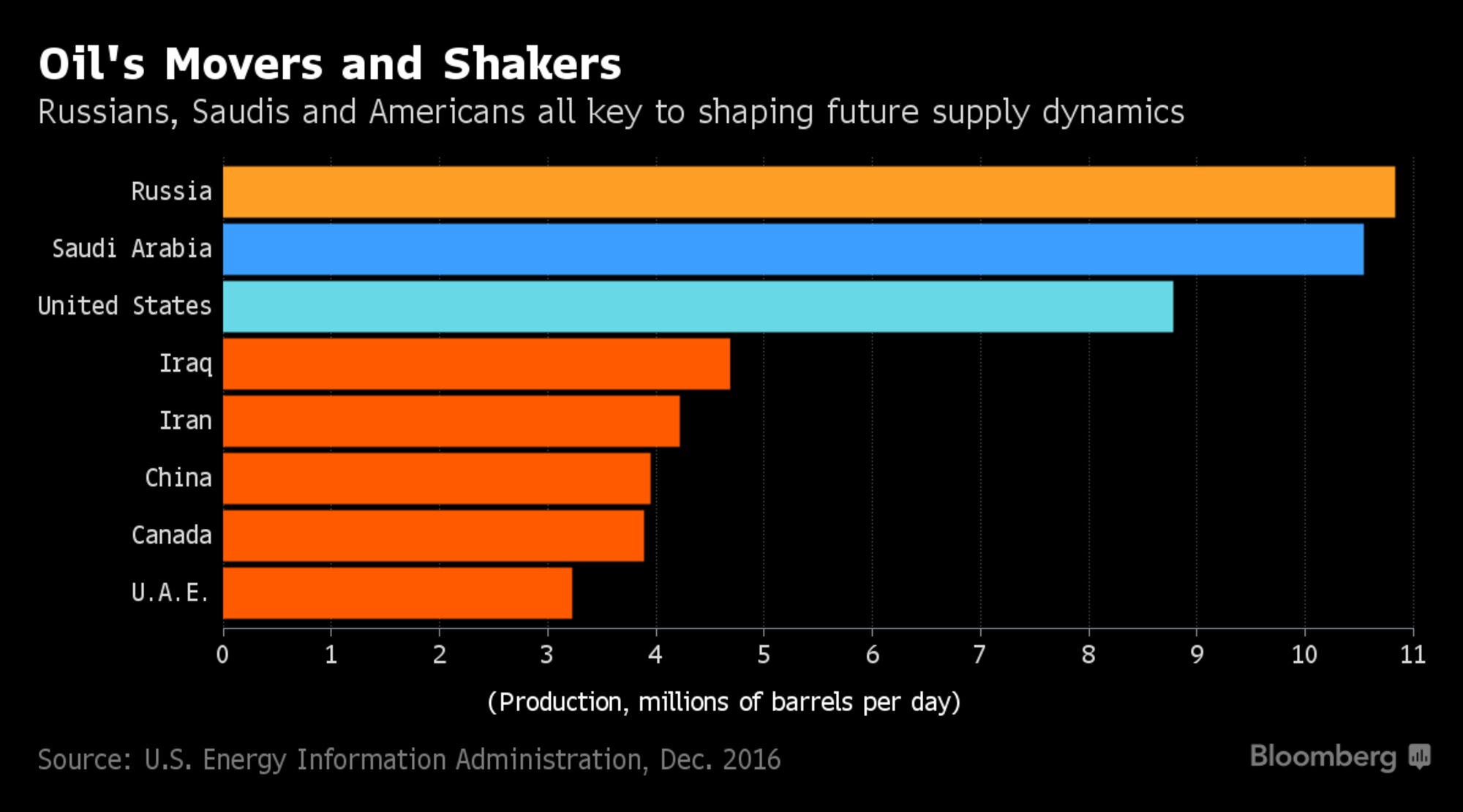

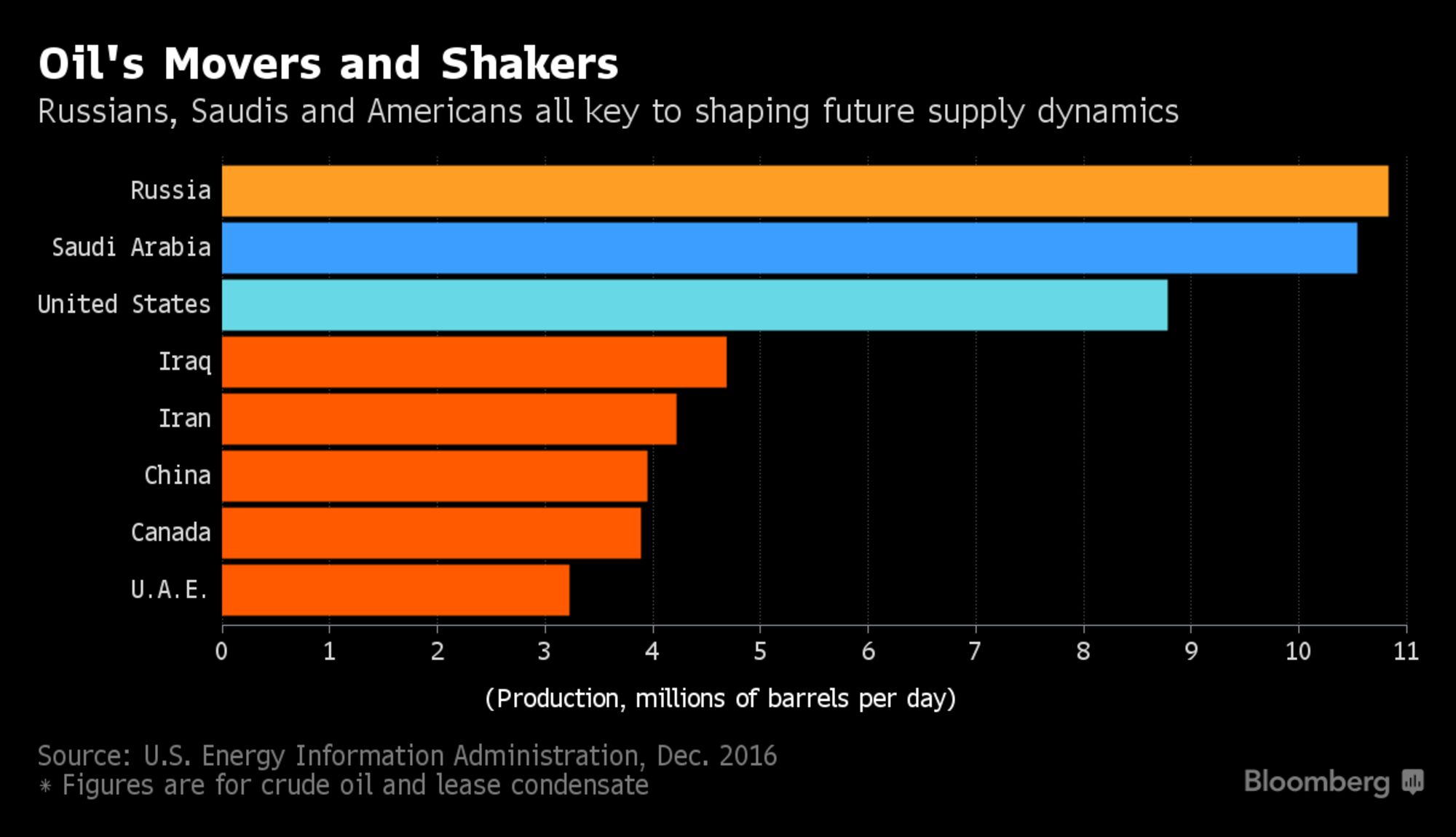

But the relationship could break down as quickly as it was forged. Shale production is surging so fast that America’s crude output is projected to reach records exceeding 10 million barrels a day next year, according to the Energy Information Administration. That’s more than Saudi Arabia is pumping at the moment.

The trend won’t do much to inspire Russian-Saudi symbiosis. In recent days, Sechin called on the Russian government to draw up a plan for an orderly exit from the cuts and pledged to be “ready for a competitive battle.” Rosneft had already warned in March of the “risk of a resumption in the price war.”

If U.S. producers can’t be persuaded to limit supply alongside the Saudis and Russians, the resulting battle for market share could “destroy the market,” Yusufov, the former Russian minister, warned.

Sissyfuss on Sun, 21st May 2017 9:38 am

Bloomporn.

bobinget on Sun, 21st May 2017 10:29 am

Bob: May I add Venezuelan to that “movers and shakers” list?

China: No, you may not, at this time. We, with the help of the US are busy destabilizing VE. We are nearly there.

A few more months of deep summer weather and we have them where we want them.

Bob: Won’t the US step up and save the biggest stash of oil remaining in the hemisphere? (for the US?)

China: We believe The White House, Dept. of State are overburdened with more pressing matters; Syria, Iraq-Iran, Sudan, Libya, Yemen, Saudi Arabia, Nigeria etc.

China will take advantage today to secure Venezuela’s oil for the remainder of the Century.

Thank you for your time, Bob

GregT on Sun, 21st May 2017 10:33 am

Bloomborg,

Resistance is futile, you will be assimilated.

Cloggie on Sun, 21st May 2017 10:45 am

First US offshore wind farm began producing electricity earlier this month:

https://deepresource.wordpress.com/2017/05/21/u-s-builds-first-offshore-wind-farm/

GregT on Sun, 21st May 2017 11:16 am

“First US offshore wind farm began producing electricity earlier this month:”

You might want to take a gander at the video linked in that piece Cloggie.

Cloggie on Sun, 21st May 2017 11:20 am

https://deepresource.wordpress.com/2017/05/21/assessment-us-offshore-wind-potential/

Assessment of US offshore wind energy potential. The good news: more than 2,000 GW or twice the current US electricity consumption.

The “bad” news: most of it will be floating wind turbine technology, not yet researched very much. Most waters are too deep for monopile based solutions.

You might want to take a gander at the video linked in that piece Cloggie.

I did, with “half an eye”.

Apparently I missed something and I am sure you are going to tell me what that might be.

Cloggie on Sun, 21st May 2017 11:35 am

Norway is in a similar situation as the US: bordering the ocean with deep waters. They have one of more floating wind turbines:

https://www.youtube.com/watch?v=06D4LvU-CG8

Upbeat assessment potential floating wind turbines:

https://deepresource.wordpress.com/2017/05/21/floating-wind-turbines/

Anonymouse on Sun, 21st May 2017 1:27 pm

I think what he is telling you is, you always post videos or w/o ever watching them and what they have to say, nor are capable of drawing any kind of meaningful conclusions from them.

In this example it only took the amerikaners 10 years to install 5 whole FRENCH made wind turbines. Nor did you notice the corporations in charge, gave themselves a guaranteed 3.5% increase every year for 20 years for the power.

And more to the point, just what IS the point of your stupid comment clog-fraud? This jewberg article is a bunch of their usual nonsense about Russia and Saudi Arabia, and OIL. Not the, slow moving, inefficient amerikan empire and their (one) expensive wind power pilot project.

rockman on Mon, 22nd May 2017 10:41 am

Actually a much larger (50 turbines/150 MW) offshore wind farm was permitted more the 6 years ago off the Texas coast. But it was unable to compete with our huge onshore wind development. That development which lead to the state ranking as world class.

Imagine how much more wind power if they were spending the same money putting turbines on the coast. Like one of the biggest in the country on the S Texas shoreline. The 30 MW offshore east coast capacity compares to the Texas onshore nameplate capacity of 20,000 MW. Even that one wind farm on the coast (operating for more then 6 years now) makes the east coast project look puny: The Papalote Creek Wind Farm in San Patricio County is an array of 196 wind turbines that can produce 380 MW of power. And how do the locals like having it “ruin the views”: The wind farm has added more than $500 million in value to the property tax base of San Patricio County and local school districts.

Those 380 MW cost $460 million to install vs. $300 million to install those 30 MW. Not that it was ever a real contest…but I think Texas won:

The Papalote Creek project provides enough clean wind power to supply about 114,000 homes while avoiding more than 684,000 tons of carbon dioxide emissions and saving half of a billion gallons of fresh water every year compared with a conventional fossil fuel plant. A fossil fuel plant that would been built to meet our booming demand had this wind farm not been built.

As we say in Texas: It ain’t braggin’ if it’s true. LOL.

Cloggie on Mon, 22nd May 2017 10:47 am

Here is a form of renewable energy generation you probably never heard of, with inexhaustible potential: Ocean Thermal Energy Conversion (OTEC):

https://deepresource.wordpress.com/2017/05/22/ocean-thermal-energy-conversion-otec/

What you need is a vertical ocean temperature gradient of 25 degr Celcius. Has been tested among others in Hawaii in the nineties.

Electricity prices as low as 7 cent/kWh are feasible.

Cloggie on Mon, 22nd May 2017 11:30 am

100% solar car tested on the streets of Eindhoven, my home town:

https://deepresource.wordpress.com/2017/05/22/netherlands-family-will-test-solar-family-car/

Warning: contains graphic 100% intentional teaser directed against rockman.lol

rockman on Mon, 22nd May 2017 1:33 pm

Hmm…here’s some details about that first offshore wind form that they might have forgotten to mention in the video:

So why all the local resistance delaying the project for many years? And apparently the basis most most of the lawsuits wasn’t over ruining the view but what the locals would be FORCED to pay for the electricity: Deepwater signed an agreement with National Grid to sell the power from the wind farm off Block Island, at an initial price of 24.4¢/kW·h.

So the folks representing the state’s electricity consumers made it very clear: they don’t want the f*cking electricity at the price they are being FORCED to pay…which obviously is higher then what they are paying now.

“The permitting process for the project has been highly controversial, with the Rhode Island Public Utilities Commission (RIPUC) initially rejecting the agreement price with National Grid as being excessive to Rhode Island’s electricity rate payers. However the state law concerning the “commercial reasonability” of contract pricing was changed. After continuing controversy and appeals, the Rhode Island Supreme Court ruled in July 2011 to uphold the RIPUC decision. Opponents of the project raised issue about the contract pricing with FERC in August 2012, but FERC in October of the same year issued a decision that they would not act on the complaints. On May 11, 2015 a new complaint was filed with FERC alleging that the power purchase agreement with National Grid violates the Public Utilities Regulatory Policy Act of 1978 and further alleging that the RIPUC violated the Federal Power Act and the Supremacy Clause of the U.S. Constitution. However, Deepwater Wind maintains that there is no support for any of these claims and that FERC should promptly deny the new complaint in its entirety.”

And why is it operating now: in July 2016 FERC issued the final order forcing the RI consumers to pay the 24.4¢/kW·h rate. Which is 40% higher the average rate for all sectors in the state…17.05¢.

So there’s the great future of offshore winds farms: economic to develop if local consumers are forced to pay much higher prices then they are currently.

That’s certainly something to brag about. BTW the electric rate average for all sectors in Texas is 8.63¢. And for industrial users… 5.5¢. I imagine that’s one reason so many industries are relocating to Texas. Including a few from Europe.