Page added on August 19, 2017

Why Would Oil Demand Peak, Contrary to Peak Oil Supply?

The oil industry is quite familiar with the concept of a “Peak Oil Supply” but people find it hard to believe that there is another side of the theory, which is “Peak Oil Demand”. This article will examine why the concept of peak oil supply failed to materialize and why one should believe the concept of peak oil demand will materialize.

Peak Oil Supply Theory

Going back in history, the term “peak oil” was originally coined in the 1950s by M. King Hubbert who predicted that the US oil production would peak in 1970, and decline at the same rate as it arose. But in the history of the petroleum era, Matt Simmons will be remembered for calling attention to peak oil.

In reality, whenever oil prices abnormally elevate (1973, 1979, 2005, 2007, 2008, and then 2009-2014) due to a variety of reasons, the world often panics. Suddenly, the press is filled with articles regarding the shortage of oil (peak oil) and that oil prices will increase to $150 to 200/bbl. When oil prices collapse, the concept remains on the back burner.

The question that arises is, how come the peak oil supplies did not materialize in the first place? The simple answer is that the peak oil supplies theory was based on assumptions that no improvement in technology will take place over time.

The world is better off today than it was in the 1950s, contrary to the predictions of Peak Oil. The speedy technological advancements in 3-D, horizontal drilling, fracking and multi-completion has challenged the concept of Peak Oil. Since the middle of 2014, oil prices have been falling and reached $30 in January 2016, and are now hovering around $50/bbl. One obvious reason for this is the US shale oil and shale gas boom. We have witnessed a new supply stream that was previously locked under the huge shale basins around the world due to very low permeability, but is now available to meet global oil demand. The unlocking of these huge shale oil and gas and conventional discoveries in new frontier basins was possible due to technological advancements â horizontal drilling and fracking techniques. No one is talking about the peak oil supplies; rather, there is a debate going on as to when oil demand will peak.

Peak Oil Demand Theory

Contrary to peak oil supplies, peak oil demand is based on the assumptions of continuous technological improvements. It is also based on the fact that technological advancements are not only taking place in oil and gas industry, but also rapidly improving in other competing sources of energies like renewables.

Additionally, drastic structural changes in the auto-industry will hamper oil demand. Electric vehicles will be replacing ICEs. The vast availability of autonomous electric taxis will reduce the need to own personalized vehicles. According to a study done by Tony Seba, global oil demand will peak at 100 million barrels per day by 2020, dropping to 70 million barrels per day by 2030. An article published by Andreas and Salman (Wake up call for oil companies: electric vehicles will deflate oil demand) forecasts that EV’s will displace about 14 MMbd under reference case and 39 MMbd under high case in 2040.

Oil demand already peaked in North America in 2005 and Europe & Eurasia in 1979. Therefore, one argument against peak oil demand is that the fastest growing economies will need more energy, such as China, India and other emerging economies. This is why the concept of peak oil demand may never really happen, even beyond 2050. Such advocacy is based on the premises that these countries will do nothing to address the environmental issues and to honor their commitments to the Paris Accord.

Why would oil demand will peak?

In our opinion, oil demand will peak due to environmental commitments, the transformation of auto-industry and penetration of renewables.

Renewables and Cost

At the end of 2016, cumulative global wind power generation capacity increased to 486 gigawatts (GW), up from 24 GW in 2001. The substantial growth in renewable energy is associated with improvements in technology and falling cost. China’s wind energy capacity increased to 168 GW in 2016 up from 7 GW in 2007.

Solar capacity also increased to 200 GW in 2015 and within the next 4 years, BSW-Solar expects global solar PV capacity will more than double. According to BNEF, by the 2030s, wind and solar will be the cheapest forms of electricity in most of the world.

One ongoing initiative that will push peak oil demand realization is the push for electric vehicles. France & UK will ban all petrol and diesel vehicle by 2040 in favor of EVs and hybrid vehicles while Volvo is phasing out cars that every new model launched from 2019 will be an electric. Similar initiatives have been taken by other automakers. Electric vehicle sales in China jumped 70 percent last year.

The peak oil supplies never occurred due to the dynamic nature of oil and gas industry and continuous advancements in technology. The world in 2017 is much better than the one in 1950s. Both oil and natural gas reserves and life expectancy have improved despite substantial increases in production and consumption. Horizontal drilling, 3-D, multi-completion and hydraulic fracturing allow the recovery of oil and natural gas resources (shale, coal bed methane, and tight formations) which otherwise were uneconomical to produce.

On the other hand, “Peak Oil Demand” will likely to happen during the next 10-15 years, driven by continuous improvements in technology in renewable sources of energy, penetration of EVs, autonomous vehicles, energy efficiency, and environmental pressure of the Paris accord. There is no doubt that like coal, oil demand would peak, but there is a diversion of opinion about its timing. Some believe that peak oil demand may hit in 2025, others believe in 2040, while others think that even it may not hit beyond 2050.

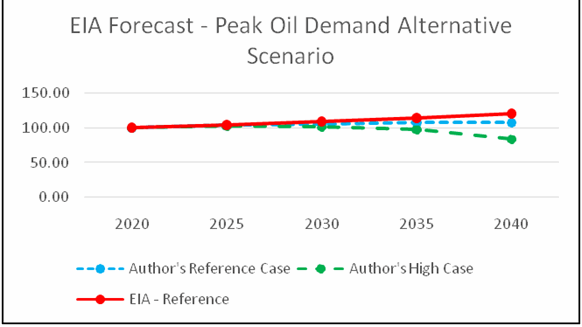

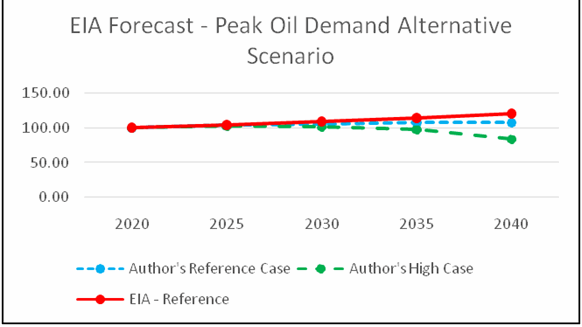

We have used the forecast highlighted in the paper “Wake up call for oil companies: electric vehicles will deflate oil demand” and used EIA reference case (IEO-2016) and the IEA 2015 current policies global oil demand forecast highlighted in “Should oil companies reconsider long-term upstream investment?” Both the agencies have predicted that global oil demand in 2040 is expected to reach about 121 MMbd, suggesting peak oil demand may not occur until at least 2040. Two possible scenarios are highlighted in the following graph.

In the reference case, due to penetration on EV, hybrid, fuel cells and autonomous vehicles expected to displace 13.8 MMbd, oil demand will peak in 2035. In the high case, auto-industry is expected to displace about 39 MMbd in 2040, and peak is expected to take place in 2025.

Peak oil demand is, therefore, quite possible to occur before 2030. Oil companies who are still betting on oil demand to grow beyond 2050 need to reassess their investment strategy.

7 Comments on "Why Would Oil Demand Peak, Contrary to Peak Oil Supply?"

Davy on Sat, 19th Aug 2017 6:33 am

More techno confusion and affordability fantasies that allow some to fail to see how peak oil dynamics work. I agree peak oil is dead in the sense of the concept of a decade ago. I say dead but I am referring to dead in the sense of short term relevance. Peak of any resource is a physical reality on a finite planet. Peak oil dynamics argues there is economic and social issues connected to the whole interaction of oil to civilization. We are governed by limits and the weakest links. This peak oil dynamics says peak demand may come from a declining global economy also. This is something rarely considered except by the fringe crowd of doomers.

It is always assumed by techno optimist that we will have growing growth. This is a constant and given and one I say makes them science deniers. The economy is the weakest link in this whole equation but one that may not be a problem for years. It consists of so much human nature and unachieved techno development we just don’t know how this is going to unfold so the default is it will unfold as it has always unfolded. Of course this is with selective memory. That is considered gospel 101.

The other issue that is now clouding peak demand is the whole fake green renewable thing. Renewables and EV’s are still in their infancy with the hardest parts ahead technically. Add to that the possibility of economic decline killing off any and all of this techno revolution. It is not gospel that the economy will be there to power a renewable transition/transformation. Currently fake green EV’s are significantly fossil fuel driven albeit we must continue to invest in them “INCASE” renewables do become significant and partially decouple from a FF grid. They are really our only hope and likely a false one. Our biggest challenge ahead is liquid fuels for transport and heavy work. Maybe at some point we can take EV’s off a fossil fuel dominated grid. They are not there yet so let’s not call them green. Let’s not call renewables like wind and solar green “YET” until they get past the stage of being fossil fuel created in a fossil fuel culture.

So what we have is techno confusion and socialized habituation to a status quo that is not a constant but considered a constant. Sure status quo techno optimistic cornucopians will always point to destructive change but it is always a productive kind. Embrace change they say but they will not allow for destructive change of the kind that is decay and decline. We are talking a kind that may be a paradigm shift and the end of a civilization. Price/Value, Cost/benefit and efficiency/resilience are so often confused because a techno optimistic cornucopian will look for the best in all of the above dismissing the negatives. They dismiss or discount tradeoffs. They speak with the word “will” instead of “maybe”. They never admit unlikely. They also never consider the wisdom of “less” or saying “no”. Techno optimistic cornucopians are all about the extremism of development. We will do it because we can. We will dash any pessimism as counterproductive. The money will be found because it always has been found.

There is a lot of oil out there but can we produce it productively. When I say productively I do not only mean at a profit in a currently repressed and managed economic system of easing based on debt. We must also look at scientific parameters of EROI and we must ask systematic questions of integrity of our foundational support. We then must ask “for what?” as a metaphysical question of meaning and ethics. This is a multidimensional exercise in choosing value in a world of ascending levels of abstraction.

Don’t think for a moment that Ponzi economics continue forever. Don’t believe that substitution is a constant because intelligence is infinite. At some point intelligence fools itself. We are on a finite planet and that planet is being exhausted. We are a bubble civilization and we play Ponzi games. These are serious games but we pretend they are OK because of a tendency towards moral hazard. A moral hazard of lies and deception. These are a product of sloth and greed. If you are a techno optimistic cornucopian hyping something be honest because I will spit on you with honesty and you will taste my saliva.

Cloggie on Sat, 19th Aug 2017 7:21 am

Absolutely correct. With just two or three of those…

https://deepresource.wordpress.com/2017/06/08/gemini-wind-farm-live-data/

… can a country like Holland power its entire fleet of 8 million private cars, if they were e-vehicles. Calculation here:

https://deepresource.wordpress.com/2017/05/22/wind-power-and-electric-vehicles/

In 5 years time Holland will have 4.5 GW offshore wind power installed, where 1.5 GW would suffice to fuel cars.

The trains already run for 100% on wind (well, book-wise that is).

https://deepresource.wordpress.com/2017/01/09/dutch-rail-runs-100-on-wind-power/

The frontal assault against fossil fuel is in full swing in NW-Europe and the rest will follow.

Rigzone is correct.

rockman on Sat, 19th Aug 2017 8:45 am

“…how come the peak oil supplies did not materialize in the first place?…the peak oil supplies theory was based on assumptions that no improvement in technology will take place over time.” No, that wasn’t the primary incorrect assumption. It was the assumption that oil prices WERE NOT going to increase to record levels. Horizontal drilling and frac’ng had been developed years before the Eagle Ford and Bakken booms began. What was required was higher oil prices to justify widespread application of known tech.

Hz drilling was fundamental in the hottest oil play on the planet a decade before the EFS and B took off: the Austin Chalk, a carbonate shale in Texas. And frac’ng shales? In 1978 the Rockman pumped a 500,000# frac into another carbonate shale in Texas…the Edwards Formation. And it had a similar motivation: record high oil prices at that time.

While there has been tweaking of frac’ng and hz drilling in the last 10 years there has been no significant NEW tech developed in the industry for decades.

Harquebus on Sat, 19th Aug 2017 5:17 pm

Those that deny ‘peak oil’ do not understand it.

GregT on Sat, 19th Aug 2017 6:06 pm

Hubbert was very clear that there were other sources of oily stuff in shale and tar sands. His peak prediction was for conventional plays, which did peak in the early 2000s, just as he predicted that they would. The increases in the production of shale oil and tar sands were a result of high prices, not advanced technologies.

More of the usual misdirection from RigPorn.

GregT on Sat, 19th Aug 2017 6:10 pm

“… can a country like Holland power its entire fleet of 8 million private cars, if they were e-vehicles.”

And where do you believe tha those 8 million e-vehicles will come from Cloggie? They don’t exactly grow on trees, and they are not made out of electricity.

Boat on Sat, 19th Aug 2017 11:59 pm

rock,

“While there has been tweaking of frac’ng and hz drilling in the last 10 years there has been no significant NEW tech developed in the industry for decades”.

If the many facets of oil drilling and fracking had not improved dramatically since 1978 let alone 2014 US oil would be a much smaller player. Every year there are improvements, “significant” is in the eye of the beholder.