Page added on February 26, 2014

When Will Peak Oil Actually Arrive? Costs Way Too High and Rising

When will Peak Oil actually arrive? There has been considerable debate on that point recently. Well if you are talking about “Conventional Crude Oil” it arrived in 2005. But in many cases unconventional crude oil works just as well so I think we must count that. I will comment on that at the end of this post below.

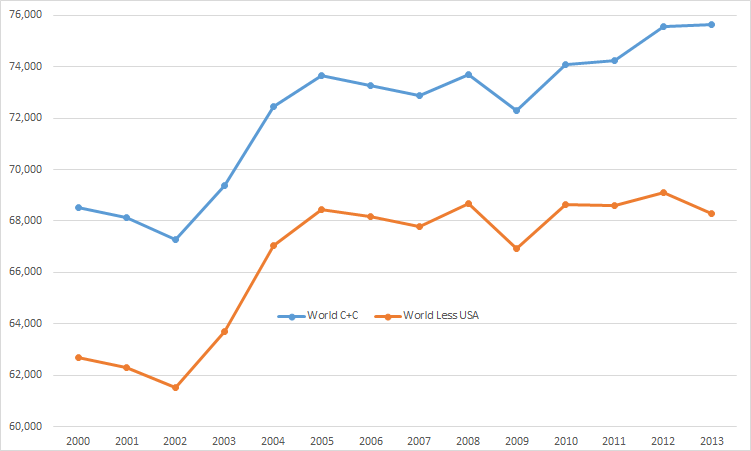

The chart below is kb/d with the last data point, 2013, is the average through October.

Averaging the first 10 months of 2013, World oil production was up only 66,000 barrels per day. And without the US LTO input, world production would have been down 807,000 barrels per day, lower than the 2005 level.

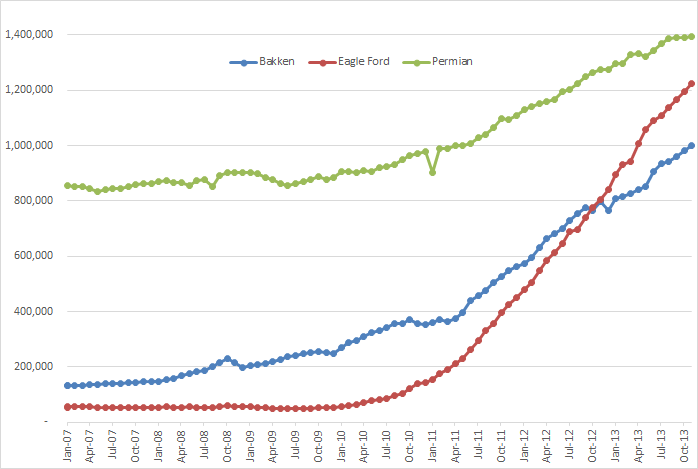

And it is all about LTO, primarily it is about three oil plays, the Bakken, Eagle Ford and the Permia.

The data for this chart was taken from the EIA’s Drilling Productivity Report. The data is through December 2013 but the last four months must be taken with a grain of salt. They are nothing but a wild guess from the EIA. For instance December production in the Bakken was down over 50,000 barrels per day but the this report has the Bakken up by over 20,000 bp/d. Not to worry however they will correct the data in three or four months.

I am not at all clear on what the Permian really is. That is, is it shale oil or is it a conventional field. The Permian Basin has been producing oil for 90 years. Now a lot of people are referring to it as “shale oil” But the Texas RRC does not use the word at all in their description of the Permian Basin. I think it is basically a conventional field. Perhaps there is a small part of it that is shale, after all, the Permian is many fields, not just one. But if some oil man could enlighten us on what the Permian really is, it would be greatly appreciated.

But many in the oil business are having second thoughts about shale oil.

Wells That Fizzle Are a ‘Potential Show Stopper’ for the Shale Boom

The average flow from a shale gas well drops by about 50 percent to 75 percent in the first year, and up to 78 percent for oil, said Pete Stark, senior research director at IHS Inc.

“The decline rate is a potential show stopper after a while,” said Stark, a geologist with almost six decades in the oil patch. “You just can’t keep up with it.”

Geologists Jeffrey Brown gives his take on all this:

The net increase in US Crude + Condensate production (C+C) from 2008 to 2013 was about 2.5 million barrels per day (mbpd), i.e., from 5.0 to 7.5 mbpd. I’m assuming that the decline rate from existing production rose from about 5%/year in 2008 to 10%/year in 2013 (as an increasing percentage of production comes from high decline rate tight/shale plays).

Let’s assume that we see another 2.5 mbpd increase in net production by 2018 (to 10.0 mbpd in 2018), and let’s work backwards from there. Let’s assume that the decline rate from existing production continues to increase at 1%/year per year, hitting 15%/year in 2018.

So the projected volumetric declines from existing wells would look like this:

2013: 7.5 x o.1 = 0.75

2014: 8.0 x 0.11 = 0.88

2015: 8.5 x 0.12 = 1.02

2016: 9.0 x 0.13 = 1.17

2017: 9.5 x 0.14 = 1.33

2018: 10.0 x 0.15 = 1.50

So, in round numbers and based on the above assumptions*, we would need about 7 mbpd of new production from 2013 to 2018, just to offset declines from existing wells. And we also need new production to show the net increase from 7.5 to 10.0 mbpd.

For example, the assumption is that we would need 0.75 mbpd from 2013 to 2014, to offset declines, plus another 0.50 for new production, for a required gross increase in production of about 1.25 mbpd from 2013 to 2014, to show a net increase of 0.50 mbpd.

So, based on all of the foregoing, in order to show a net increase of 2.5 mbpd from 2013 to 2018, I estimate that we would need on the order of 9.5 mbpd of new gross production through the end of 2018. Or, based on the foregoing, in five years we would need to basically do what it took the US oil industry decades to do, as we approached our 1970 peak rate of 9.6 mbpd.

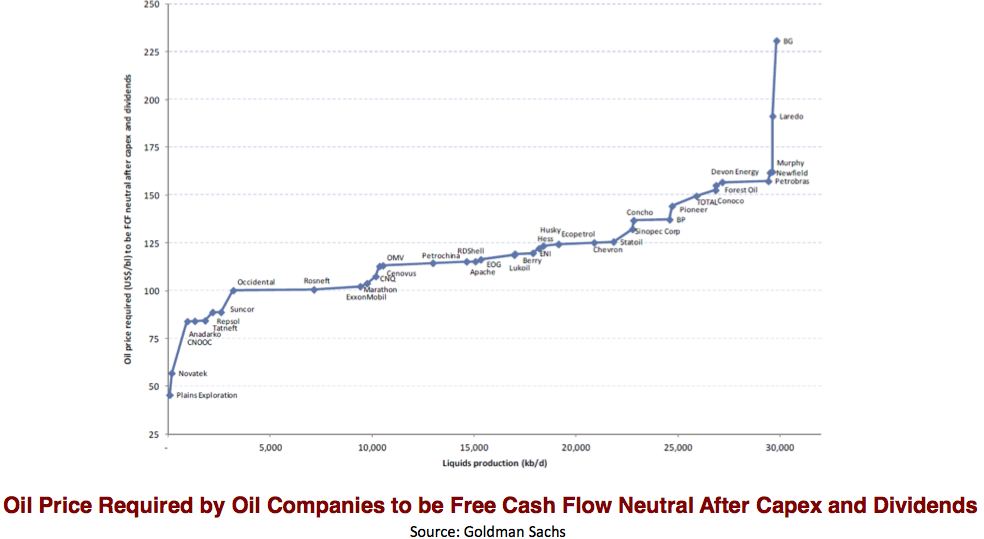

And everyone is complaining that it costs way too much these days to produce oil. Even Oman is saying the costs are way too high.

Gail Tverberg has strong opinions on this subject and dedicated her latest post to explaining in:

Beginning of the End? Oil Companies Cut Back on Spending

She says capex is way too high and uses data from Goldman Sachs to prove it.

With that kind of capex required how can anyone make any money? In fact a lot of companies are losing money:

World’s largest drilling company posts huge loss

And if that isn’t enough the per barrel marginal cost of non Non-OPEC oil, last May, was $104.50. It is likely over $110 per barrel today.

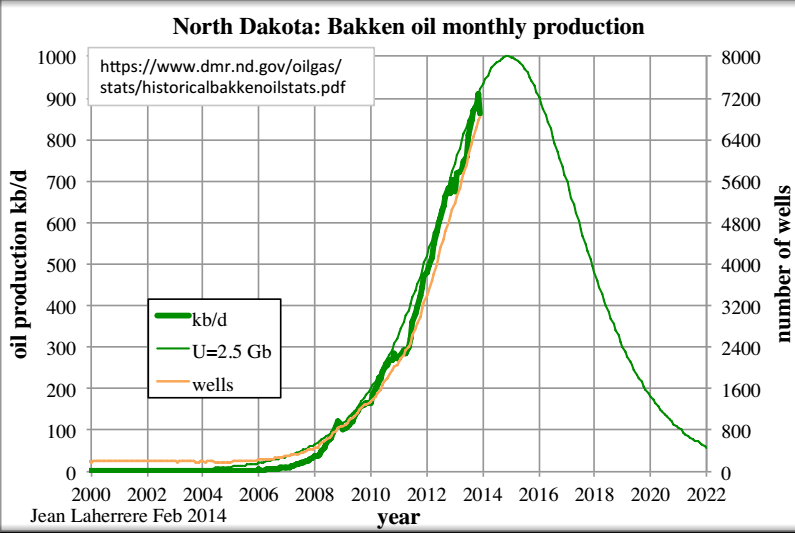

Jean Laherrere has updated his projection for Bakken Production based on the latest December data. He sees the Bakken peaking toward the end of 2014.

But when will crude oil, or C+C peak. We can only guess. It is a little like predicting the weather, like saying there is a 50% chance of rain tomorrow. I will give my peak oil prediction in the same manner but with increasing probability as we move further along the calendar. My opinion is:

There is a 10% chance that the peak was in 2013

There is a 25% chance that oil will peak in 2014 or before.

There is a 40% chance that oil will peak in 2015 or before.

There is a 70% chance that oil will peak in 2016 or before.

There is a 90% chance that oil will peak in 2017 or before.

27 Comments on "When Will Peak Oil Actually Arrive? Costs Way Too High and Rising"

meld on Wed, 26th Feb 2014 11:48 am

I think the Oil companies are doing a great job at the moment at keeping the price as low as it is. It’s actually in the best interests of oil firms to produce less oil so the supply goes down and price goes up. They could cut production in half, charge ten times as much and be laughing. Of course that would mean global anarchy, revolutions and the collapse of society, but it goes to show these oil men aren’t as “evil” as people try to make out.

Having said that, is keeping the current system going for as long as possible a good or bad thing. Objectively it’s a good idea to let it collapse, subjectively it could quite possibly mean the death of myself and my family….tough call haha!

Aaron on Wed, 26th Feb 2014 12:03 pm

As we know the oil companies are curtailing investment – they will wait for the next price jump before developing fields which are unprofitable under current circumstances – which makes perfect business sense.

When we have the next jump in price, I see no reason why we can’t pay $130-160 a barrel, and BAU can continue eating its way through the next oil slice. People say we can’t stand such prices but there is no evidence of that. The spike to $147 was correlated with recession but that doesn’t prove causation.

Don’t get me wrong, I want BAU to end for the sake of the climate and environment, but I doubt it will end in the short-term timescales posited on here.

westexas on Wed, 26th Feb 2014 12:10 pm

In regard to oil prices, the monthly Brent price was above $100 for six months in 2008.

From February, 2011 to February, 2014, the monthly Brent price has been above $100 for 35 out of 36 months.

Cloud9 on Wed, 26th Feb 2014 12:17 pm

Phase shifts occur very rapidly. In 2007 Zimbabwe was printing one dollar notes. In 2008 they were printing fifty trillion dollar notes. Lite sweet crude peaked in 2005. Two years later the economy tanked. Oil is the life blood of the system. Pull it out and we run into Liebig’s Minimum.

Davy, Hermann, MO on Wed, 26th Feb 2014 12:18 pm

@meld, the oil companies and Wall Street do a good job of manipulating the oil market that is for sure. Yet, there are issues out of anyone’s direct control. The geographical difficulties of new oil sources are weighing on prices. Regional instability is an increasingly influencing prices away from North America. The cost of the exploration we see from recent articles here is significantly on the rise. I would argue we will see a dangerous effect on drilling activity when interest rates rise. I ask all of you where interest rates can go when they are near zero now. I wish I had more data on the environmental regulation costs that are creeping into fracking which probably aren’t yet excessive but could be. The sovereign oil nationals especially in the ME and Venezuela have huge social cost that require higher oil prices. Oil price is influenced by so many issues globally both directly and indirectly. Again Folks, look to finance to be the next big volatility hurdle for oil companies to overcome with price. I say overcome because as most understand price fluctuation makes planning large investments problematic. We know this could go two ways either a damaging contraction leads to lower prices but higher prices eventually. I am saying this because lower prices destroy production and price will eventually respond to the negative supply demand fundamental on the upside. It may also be the case of relatively high prices in relation to the economic situation. A finance system that has had a major correction will lack liquidity so oil price per unit could be relatively higher in relation to a deflated money supply. We could see continued inflationary pressures due to monetization and devaluation by the central banks raising the price. As you all know oil is a global commodity and because of this its price is governed by multiple regional and global issues. Witness the blown predictions in the past by so many people.

rockman on Wed, 26th Feb 2014 12:38 pm

“They could cut production in half, charge ten times as much and be laughing.” Doesn’t work that way. I sell my oil to an oil buyer. He posts the price he’ll pay. If I decide to sell half my oil that month the price doesn’t change. But if enough oil producers cut their production in half then prices would eventually increase. At which time I would sell every bbl I could. And so would most other producers. For proof all one need do is look at the record global oil production rate at the same time as we’ve reached a record high 12 month average in oil prices. But this theory also assumes I could live with the reduced cash flow until prices increased. Very few operators have that option. The bust in NG prices back at the end of ’08 proved that. The vast majority of the shale gas players kept producing as much as possible even when prices had dropped 75% from the high. A great deal of NG in east Texas was sold at prices below the actual development costs. But for most companies the need for cash flow exceeded the need for profitability.

“People say we can’t stand such prices but there is no evidence of that. The spike to $147 was correlated with recession but that doesn’t prove causation.” The history is rather indisputable IMHO. High oil prices in the early 80’s caused the world to reduce oil consumption by 3 BILLION bbls per year. That reduced the price of oil by 70%. The price spike of 2008 caused a much smaller drop in consumption and resulted in prices dropping about 30%. But the prices still leveled out at 300% higher than just 10 years prior. Whether one can technically call the economic slump the world has experienced with “cheap” $100/bbl oil a recession or not it’s rather difficult to say the high price hasn’t had a significant negative impact on the system. The oil consuming economies are spending over $400 BILLION more per year for oil today than they were just 10 years ago. Or to put it into another perspective: since oil prices began ramping up the world over the last 10 years we’ve spent about $5 trillion MORE for oil. It’s difficult IMHO to consider that ADDITIONAL COST hasn’t had a significant impact whether one classifies any period during that time as a recession or not.

Dave Thompson on Wed, 26th Feb 2014 1:21 pm

Conventional oil has peaked, what keeps the numbers up is a combination of french fry oil,moonshine and magic beans.

mo on Wed, 26th Feb 2014 1:50 pm

Would like to see the charts on China’s oil consumption.what’s really driving the price increase since they use more and more oil every year. Their per capata consumption is what 2.5 to3 barrels and ours is about 20. Seems they can afford the extra price per barrel where any increase really puts the hurt on us(and I’m talking about the average Joe who has to make a living going back and forth to work eating up more money just on transportation

keith on Wed, 26th Feb 2014 2:22 pm

I’m confused, conventional oil is what we built modern civilization on, if it peaked in 2005. Then everything else is just slowing down the slide.

meld on Wed, 26th Feb 2014 2:25 pm

Of course you are right rockman, I was being somewhat facetious as usual.

meld on Wed, 26th Feb 2014 2:33 pm

@ Aaron

“The spike to $147 was correlated with recession but that doesn’t prove causation”

The term “correlation does not prove causation” gets bandied around everywhere on the internet as some kind of argument. That particular point of view is a very useful backstop to make sure that when someone observes the amount of butterflys increasing in the world and the oil supply increasing at the same time they don’t start coming up with theories on how butterfly wing dust is somehow the reason behind the oil supply increase.

Makati1 on Wed, 26th Feb 2014 2:44 pm

And when the petrodollar is sidelined by the non-dollar trading that is building around the world, THEN American’s will really feel the pain. More and more countries are moving away from the USD. Even the IMF is proposing a basket of currencies as the trade basis, with the USD only one of maybe 7 or more currencies in the basket. When countries no longer need the dollar as part of their international trade, and especially for oil, the s–t will really hit the fan.

shortonoil on Wed, 26th Feb 2014 3:32 pm

“When will Peak Oil actually arrive?” When you read into the article you soon find out that the author is discussing Peak Liquid Hydrocarbons. They then go on to say, “But in many cases unconventional crude oil works just as well so I think we must count that.” But, liquid hydrocarbons at standard reference points of pressure and temperature range from pentane (C5) to huge molecules such as the C30 groups. Now, if you want to drive your car down the road a mile will it take the same amount of these various hydrocarbons to get you there? If you go to our site and look up graph#20, API vs Exergy, you will see that pentane delivers 107,559 BTU/gal. Dodecane (diesel fuel) delivers 132,162 BTU/gal. Obviously, a gallon of diesel fuel will take you further than a gallon of pentane. These hydrocarbons are only equivalent if you are measuring them by the gallon (on a volumetric bases).

If you get a copy of our 57 page study (we sat down and added all these differences up) you will find that the increase in volume from the production of liquid hydrocarbons has not been sufficient to account for the decline in their quality since conventional crude peaked in 2005.

Whether or not Peak Oil has actually arrived depends on whether you want to count barrels, or if you want to power a civilization. Some people may have trouble making that distinction. We don’t!

http://www.thehillsgroup.org/

Northwest Resident on Wed, 26th Feb 2014 3:39 pm

If we hit Bakken peak later this year as is being widely predicted/anticipated, we’ll be in for a wild ride down the back half of that production curve. As far as I know, there is no new or existing production that can be ramped up to compensate for the loss. We’re barely keeping up with global minimum requirements for oil right now. Take away Bakken production, and we have the inevitable: shortfall. If we get a shortfall, then I imagine they’ll print a few trillion more USD to pump into the system and I know the propaganda machines will kick into even higher gear — but an oil shortfall anywhere in the world is going to be very difficult to gloss over or hide. Any shortfall in oil production will be a shockwave felt around the world. And it looks like we aren’t far away from that first shortfall. Tighten those seatbelts — it is going to be a wild ride!

MSN on Wed, 26th Feb 2014 5:06 pm

We are experiencing peak lite now 🙂 I like that.. lite lite lite 😀

Peak oil will occur as an inflection between price and what consumers can pay. We have seen since 2008 the pauperization of middle classes and the increasing polarized society we are inheriting. (In the past this has lead to revolution of its own)

This is the true definition of peak oil for you doomers…

(And the collapse thereafter)

When a family of 4 who are middle class cant afford to keep a small car that can achieve 55 mpg. Then we will know we have hit the brick wall… at whatever price that is.

Ta da… right now people can still afford gas guzzlers and multiples of them on their drive.

We can safely bet peak oil max isn’t for a while then, but peak oil lite is. Kind of like going down a slide, as you move down you get poorer.

R

meld on Wed, 26th Feb 2014 8:57 pm

@ Shortonoil – Thanks for that info. I’m glad someone is looking into that particular side of things. I may be mad but it seems like a tank of fuel doesn’t seem to get me as far as it did in the 90s, does what you say have anything to do with this or am I just paranoid?

Where do I get your 57 page study from out of interest.

andya on Wed, 26th Feb 2014 8:58 pm

When will peak oil actually arrive? Hurry up already, I’m getting bored with waiting, and the boy who cried wolf ended up getting killed by the wolves.

shortonoil on Wed, 26th Feb 2014 9:41 pm

“Where do I get your 57 page study from out of interest.”

Hopefully it will be available at the site sometime this week, or early next. Some of the folks who helped create it wanted more time for distribution to their own clients. It was originally intended to be used as a sales tool for for the consulting wing of our group. I’ve had to bow to their requests, they are part owners. Just chief cook, and bottle washer here!

“When will peak oil actually arrive? Hurry up already, I’m getting bored with waiting, and the boy who cried wolf ended up getting killed by the wolves.”

It already has. If you follow the world financial press it is pretty obvious that the clue and bailing twine are wearing thin. The reason we haven’t seen the bottom drop out from below us is because petroleum allowed for the formation of a gigantic amount of capital inventory over the last century. We are now existing off that capital stock. Once it is gone, it won’t be replaced.

GregT on Wed, 26th Feb 2014 10:02 pm

“We can safely bet peak oil max isn’t for a while then, but peak oil lite is. Kind of like going down a slide, as you move down you get poorer.”

More like going off of a ski jump. For a while you are still going up, until gravity takes over, and you quickly realize that the ground is 2000 feet below, coming up faster and faster, and there is nothing that you can do about it.

Northwest Resident on Wed, 26th Feb 2014 10:07 pm

“We are now existing off that capital stock. Once it is gone, it won’t be replaced.”

That sends shivers up and down my spine.

ronpatterson on Wed, 26th Feb 2014 10:12 pm

@shortonoil You wrote:”When you read into the article you soon find out that the author is discussing Peak Liquid Hydrocarbons.”

No, I am the author and I was talking about Crude+Condensate only. I never talk about Peak Liquid Hydrocarbons!

You wrote:”But, liquid hydrocarbons at standard reference points of pressure and temperature range from pentane (C5) to huge molecules such as the C30 groups.”

I really don’t give a damn about other liquid hydrocarbons I was talking only about unconventional crude! That is deepwater oil, shale or Light Tight Oil and tar sands oil. That works just as well, or almost just as well at making gasoline and diesel.

All I ever post about, or talk about is C+C. When C+C peaks that is, or will be, peak oil. I don’t follow all liquids which includes ethanol and bottled gas.

ronpatterson on Wed, 26th Feb 2014 10:48 pm

Again @Shortoil:

The Official definition of unconventional oil from Wikipedia:

1 Sources of unconventional oil

2 Defining unconventional oil

2.1 Extra heavy oil and oil sands

2.2 Shale Oil

2.3 Oil shale

2.4 Thermal depolymerization

2.5 Coal and gas conversion

I don’t know of any oil coming from from Thermal whatever that word is, and I don’t think we get any oil these days from coal. But most also include ultra deep water oil in the “unconventional” category. The word simply means crude oil from unconventional sources.

JB on Thu, 27th Feb 2014 12:51 am

Ron, OK, the price of gasoline is down. But could there be other reasons for that, like oil companies cutting out some of the profits because they cut out exploration and development? Or third world currencies collapsing which funnels more oil to developed countries? I can’t agree that unconventional fuels work just as well.

GregT on Thu, 27th Feb 2014 2:23 am

JB,

The price of gasoline is down? Compared to when?

JB on Thu, 27th Feb 2014 10:20 pm

Compared to 2-3 years go, at least in my area (Northern Indiana). Down by 20-30 cents/gal.

Nony on Fri, 28th Feb 2014 6:12 pm

NR: I think the peak will be much more plateauish in the Bakken than people are assuming. When you’ve seen someone like DC model it, you start to understand. This is a lot more like mining for coal than drilling for oil. There’ll be constant well dug and then the downspacing, sweet spot running out will start, but it will be more like moving out of the rich vein of an ore rather than stopping finding fields in a trend. For all intensive purposes, the continuous middle Bakken layer is more like a single field than a trend.

GregT on Tue, 4th Mar 2014 6:59 pm

🙄