Page added on November 15, 2016

What the End of the Age of Oil Will Mean to the Global Economy

Imagine a world of 50% annual inflation, resource wars that span the globe and energy prices skyrocketing as oil reaches $200 a barrel.

This is what the “peak oil” theory predicted. And it shaped the opinions of scientists, policymakers and the general population for decades.

Recent history has shown, however, that the peak oil theory is dead wrong. It seems like the future will be shaped by the very opposite: peak demand.

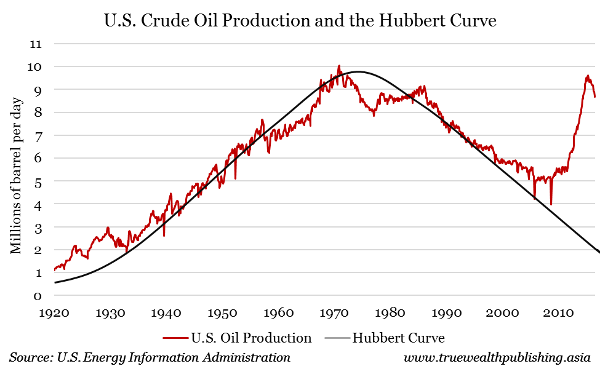

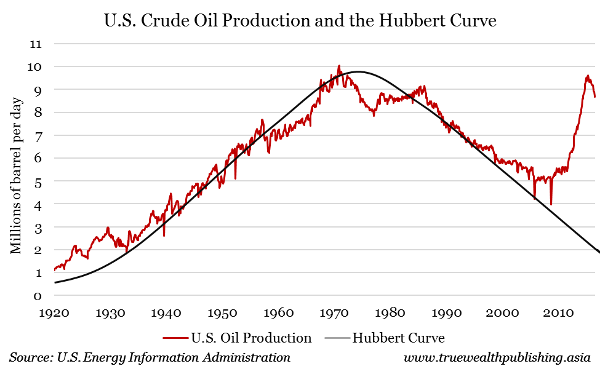

Peak oil first gained popularity through a paper by U.S. geologist M. King Hubbert in 1956. Hubbert anticipated that U.S. oil production would max out in the 1970s before declining. Global oil production would last until the year 2000 before falling away.

Hubbert’s theories were based on trends found in individual oil wells and oil fields. He noticed that oil obtained from these wells rose, peaked and depleted in the shape of a bell curve. He extended that same principle to global petroleum reserves.

When U.S. oil production did indeed peak in the early 1970s, “Hubbert’s peak” won broad popularity. Petroleum consumers all over the world started to panic. The consequences of peak oil would be huge: skyrocketing gasoline prices, rampant inflation and fear that the world would be dominated by the biggest oil-producing countries.

Proponents of peak oil thought that the world’s oil production had hit its maximum and was on terminal decline. Their fear was that soon there would be no more oil to take out of the ground. They felt that this end of oil could happen within 30 to 50 years.

While supply dwindled away, demand for energy would only grow as the world’s population expanded. This would cause oil-poor nations’ economies to crash while oil-rich countries would become increasingly powerful. Energy demand and petroleum prices would rise to unsustainable levels.

Fearing a future with less oil and higher energy prices, governments and entrepreneurs soon began research on renewable, alternative energy sources.

But peak oil is no longer a threat. Those who planned for a future based on this theory, including investors, governments and energy companies, must face a new reality. The global economy will be dictated by falling oil demand, not falling oil production.

Peak demand has a large effect on oil companies and their investors. There has been more discussion of “stranded assets” (oil and gas reserves that might remain untouched because of uneconomical returns).

Oil companies may be faced with large writedowns in the near future, as the price of extraction causes in-ground assets to stay there. If that happens, shares in many oil companies may become poor investments.

But the bigger problem of peak demand and stranded assets may be the geopolitical impact, according to the WEC report. Peak demand could destabilize entire countries, especially because a good portion of the world’s oil & gas reserves are owned by governments. Countries such as Saudi Arabia, Russia and Iran could be in big trouble if their economic lifeblood runs dry.

Saudi Arabia has already started to act. The Saudi government declared its intentions to diversify its oil-based economy earlier this year. Crown Prince bin Salman has even said, “Within 20 years, we will be an economy or state that doesn’t depend mainly on oil.”

Russia has so far refused to show any signs of diversifying its oil-centric economy. Russia could be in terminal trouble with peak demand.

So what can you do? It may be too early to sell your oil stocks. But, be aware that the global economy is changing. Although the global economy has been influenced by fossil fuel demand for a long time, it’s transitioning to a world where falling oil demand and new energy technology are the name of the game.

23 Comments on "What the End of the Age of Oil Will Mean to the Global Economy"

dave thompson on Tue, 15th Nov 2016 8:12 pm

The peak demand vs peak oil argument again? No mention of net user, available and affordable expanding the economy energy.

Shortend on Tue, 15th Nov 2016 8:22 pm

Can’t wait for the end of the oil age…

A new adventure to experience on the horizon of transformational life here on Earth.

Our purpose here was to alter complexity and provide a step for the stage of creativity.

Great going guys!

Trying to put a positive spin on it all

Apneaman on Tue, 15th Nov 2016 8:56 pm

One of the worst things that will happen when the oil age ends will be no more Nutella. Sadly, the Heroin of nutty sugary palm oil snack spreads has a supply chain that is only feasible with bunk fuel & diesel.

Nutella – Supply Chain

https://open.sourcemap.com/maps/57d0ca4d9ca3b16d44e95d80

Nutella is the crack cocaine of nutty spreads – make a good bartering item post collapse. You could probably trade it for some real food or sexual favors…maybe even with a girl.

joes on Tue, 15th Nov 2016 11:54 pm

If its that good, ill just eat it thanks

makati1 on Wed, 16th Nov 2016 12:26 am

“What the End of the Age of Oil Will Mean to the Global Economy”

It will mean the END of the global economy.

LMAO

Go Speed Racer on Wed, 16th Nov 2016 12:51 am

I like the part with 50% inflation. It will make my home loan balance look cheap.

However the price of food will be so high,

that I’ll have to eat blackberries from the woods.

Cloggie on Wed, 16th Nov 2016 4:10 am

Oil and other carbon fuel are like he steam train… they come and they disappear in the fog of ages. Humanity will soldier on.

http://images.angelpub.com/2009/29/2498/wind-energy-growth-forecast.jpg

http://rameznaam.com/wp-content/uploads/2014/09/Wind-Market-Growth.png

Dredd on Wed, 16th Nov 2016 4:17 am

“Imagine a world of 50% annual inflation, resource wars that span the globe and energy prices skyrocketing as oil reaches $200 a barrel.” – The Street

Then imagine that as a comparitively small problem (The Authoritarianism of Climate Change – 2).

Cloggie on Wed, 16th Nov 2016 4:18 am

It will mean the END of the global economy. LMAO

You have to say that, because otherwise you would look pretty silly there in your pennies-on-the-dollar apartment in third world city Manila.

All dressed up and nowhere to go.

Waiting for Godot.

https://en.wikipedia.org/wiki/Waiting_for_Godot

You can come home now makati, the show has been called off. The world is going to survive you. We’re not even going to have WW3.lol

makati1 on Wed, 16th Nov 2016 6:54 am

Cloggie, come here and see for yourself what the rest of the world is really like. Bet you have never been anywhere that is different than your little imagined world. Certainly not in the last 10 or 20 years. Probably never.

I have no interest in going to the U$ again. It is well on it’s way to financial ruin, civil war, or some other self-inflicted disaster. The Ps has a good president finally, and I plan to stay here where it is safe and the people are sane.

You’re really getting senile. Do they have psychiatric homes for people like you in that postage stamp country? You need to apply. LMAO

Revi on Wed, 16th Nov 2016 7:01 am

The article above is really ridiculous. Of course we will hit “peak demand”. What does that mean anyway? The economy will not be demanding as much oil when it crashes?

The fact is that we are hitting a point past which we can’t afford to get the stuff out of the ground and continue to run the things we are running. Take driving around in cars and air travel for example. Are they really a good use of the oil we have left? I know they are fun, but really? Could we use what’s left to keep eating, for example?

rockman on Wed, 16th Nov 2016 9:20 am

Revi – “…peak demand”. What does that mean anyway?”. Exactly. Seems like we have to beat this dead horse again every month or so. Back to the basic question: what is PD and how is it measured? Obviously it can’t be how much oil the consumers WANT to consume. Essentially that almost infinite. When you look at the verbiage used by folks talking about PD it’s seems clear they are talking about how much oil consumers are actually buying. Which is essentially how much the can afford to buy since the economies always want more and more energy.

Thus there are two limits to PD: how much oil is available for production and how much oil can the economies afford to buy. But those aren’t independent dynamics. Obviously when oil prices were higher the KSA wasn’t producing at its max capacity: the buyers couicouild afford to buy more oil at those prices. And it shouldn’t be a shock that at much lower prices the consumers can afford that extra production.

For sake of argument let’s assume global production is at or very close to max. If so even if prices dropped 50% and the consumers could afford to buy more they couldn’t… production has maxed out.

So if consumers aren’t able to buy more oil at least in the short term wouldn’t that put us at PD? And in the longer terms? It seems clear that with the collapse of the rig count and cancelation of $trillions in drilling capex it seems likely little new production capacity will come on line. But as we all know depletion, like rust, never sleeps. Without replacing 100% of production that capacity will decline.

Which actually doesn’t guarantee higher oil prices. Hypothetical: max global oil production capacity drops 10 mm bopd to 85 mm bopd. Would that forces prices to $100/bbl? If the global economy can’t afford to pay more then $45/bbl for those 85 mm bopd then the price of oil will be $45/bbl. Of course if there are economies that can afford a higher price they’ll get the 85 mm bopd.

Which explains why producers today have no choice but to sell as much oil as possible st $45/bbl in order to max their revenue.

Today the world is producing a record volume of oil. But even at $45/bbl there are still economies that can’t afford the current price. Which is understandable: oil prices ARE NOT CHEAP. They are just cheaper then they were a couiple of years ago. But still higher then they were 10+ years ago. In fact almost 3X what they were in 1998.

Thus IMHO, thanks the modulation effect of pricing, whatever the global oil consumption might be at any point in time demand is at its max. Which means that in theory we could be at PD today. Which seems to imply that PD and PO will occur on that same relatively unimportant date.

penury on Wed, 16th Nov 2016 9:33 am

What will the end of the age of oil mean? I have no idea what they are talking about. So what? Do they infer that no replacement has been found? When energy dies so does the world as we know it. What comes next? Something else. Maybe living in caves with torches for light. maybe something else. But reaqlly, is anyone or any grop of people really looking at the end of oil? In my opinion people are only looking at dreams which make them the kings of the universe.

rjk on Wed, 16th Nov 2016 3:30 pm

Rockman, As someone who has long read your stuff and notes your oil experience, I hesitate to disagree with you, but I don’t believe that oil is too dear now. You haven’t taken the real rate of inflation into account when comparing oil over different time spans – would have to be at least 5% in most countries. I think all economies can afford to pay more before it really hurts. Oil is probably about 12 to 15 times cheaper than a cup of coffee or soft drink on a comparable quantity basis. Huge amounts of discretionary spending in countries could be foregone if it became vital to buy oil. With something like 22,000 ships plying the seas every day at lot of what they are carrying should be made at the destination countries. Much of the airline travel, over 30,000 aircraft movements a day is holiday travel and at very low prices and the traveller could afford to pay more. Try comparing the price of a gallon of oil with a gallon of most other substances and it is far too CHEAP.

rockman on Wed, 16th Nov 2016 4:55 pm

rjk – I don’t think we’re in much disagreement. “…but I don’t believe that oil is too dear now.” Nor do I…for some economies. But if you’re a Greek the price is very “dear”. And I almost always use inflation adjusted oil prices…was just in a hurry this time. Here’s one set of data for the last 70 years:

http://www.macrotrends.net/1369/crude-oil-price-history-chart

Notice that the current price of oil is higher then it has been for more then 50 of those 70 years. And more the 2X as much as the average for the first 30 years. And higher the the majority of the last 40 years.

So one can use any qualifier they want…dear, cheap etc. But it doesn’t change the stat even adjusted price: tyhe current price of oil is significantly higher then the WEIGHTED AVERAGE of oil over the last 7 decades.

“Try comparing the price of a gallon of oil with a gallon of most other substances and it is far too CHEAP.” I agree: oil is RELATIVELY CHEAP compared to other commodities. And is RELATIVELY F*CKING EXPENSIVE compared to water. LOL.

rjk on Wed, 16th Nov 2016 5:54 pm

Rockman, If you think the price of oil is higher, shouldn’t it be anyway? The more oil you produce and transport the more tanks, pipelines, tankers and other facilities are needed plus the on going rust and corrosion and continual maintenance that is needed through out the production system. Surely this cost has to be passed on in the oil price. I read where those GOSPS in Saudi Arabia require 20,000 h.p.motors and have to process the oil/water liquid at over 2000 p.s.i. again, I should imagine their oil cost is not as low as often reported. As far as oil being more expensive than water, I don’t know whether that is a bit of humour on your part but where I live you can pay $3.60 for a 600 ml bottle of water. Always enjoy your oil knowledge and views.

Newfie on Wed, 16th Nov 2016 8:09 pm

B— S—!

The world now consumes 95 million barrels per day of oil, up from 86 million b/d in 2008 and a 11% rise even amid the worst economic times since the 1930s.

Over 90 million cars are sold each year, nearly all of them running on oil.

China is planning to build 500 million barrels of strategic crude oil reserve space by 2020.

Etc, etc.

makati1 on Wed, 16th Nov 2016 8:43 pm

Newfie, buying and using are two totally different things. How long do you think China and other countries can ‘store’ more and more oil? Forever? LMAO The crash is coming. Be patient.

fags on Wed, 16th Nov 2016 9:33 pm

I will make a hiv infested nutty spread out of fags like Apneafag and feed it to all my concubines. I’ll cook it for a few hours though

Sissyfuss on Wed, 16th Nov 2016 9:51 pm

Gee, you seem a little queer, fags.

rockman on Wed, 16th Nov 2016 10:06 pm

rjk – “Sorely this cost has to be passed on in the oil price.” Dang, how I wish that had been true during my 40 year career. Every bbl I’ve sold was at the market price at that time. Right now I’m selling some Texas crude to a La refinery. The LLS (Light Louisiana Sweet) benchmark last March averaged $42.23/bbl. That’s what the refinery was paying: I sold at that price or I had to keep it in my tanks and shut my wells in. And it didn’t make any difference if it cost $15 or $100 per bbl to drill and complete those wells: I got paid $42.23/bbl. Didn’t the refinery take into account my investment? Hell, not only did it not know what those well cost but it didn’t care.

In fact forget what it cost to drill the wells compared to today’s LOWER price. Real life in the oil patch: I spend $10 million to drill, complete and produce a well and then I sell every bbl for $120/bbl. But ultimately the well only generates $6 million worth of oil: I lose $4 million. The refiner still doesn’t care if I make a profit or not: it will pay me the going market rate and not one penny more.

No company ever has or ever will pass on its costs to the consumers. The system doesn’t work like that…ever. But that should be obvious by the number of shale players that have declared bankruptcy.

And you need to lay off that fancy-pants water: I pay $0.84 per bbl for my municipal water. And that includes delivery right to my home…to my faucet. LOL.

“I should imagine their oil cost is not as low as often reported.”. It’s very difficult for you civilians to get you heads around the lifting cost per bbl of oil produced. You can’t help but compare it to the price per bbl of oil. Those are two very separate dynamics. I’ll give an example one more time: a KSA field is making just 20,000 bopd…small by global standards. But don’t think of a $42/sales price: that’s 7.3 mm bbls per year.

Now about your 20,000 h.p.motors and all the rest of the production infrastructure: that is not part of you lifting cost, the LOE…Lease Operating Expense. They are capex costs. IOW those are sunk investments that have no bearing on the LOE. Your LOE is just your electricity costs (or even free if you’re using casing head NG to supply your energy), chemicals to separate the oil/water emulsion and labor costs.

So back to your 7.3 million bbls per year. If you’re spending $1 million per month for the LOE I outlined above that seems pretty high in my opinion. But let’s stick with it: that $12 million per year to produce the field. Thus:

$12,000,000/7,300,000 bbls = $1.64/bbl.

I have one field where my cost is $0.50/bbl…and 85% of the production is water. Think about the hundreds of thousands of US stripper wells that average less than 15 bopd. And they are still commercial to produce at the current LOWER oil price.

Yes: if oil prices fell to $10/bbl every one of my oil wells would still generate a positive cash flow. IOW I would still be a profitable oil producer. Even if I never recover 100% of my total capex investment.

I know that might sound confusing but think on it. If it helps: at $10/bbl I may never drill another FUTURE WELL. But that has no bearing on my continuing to produce EXISTING WELLS.

makati1 on Wed, 16th Nov 2016 11:10 pm

Sissy, fags sounds like a teenybopper in mommy’s basement who got his supper taken away because of his dirty mouth. lol

Wolfie52 on Fri, 18th Nov 2016 7:07 pm

I do find it funny, that now that PO has been debunked, people talk about it like that is all the media talked about for years. I didn’t find out about it at all via the “media”, MSM or not. It was all but IGNORED until after the recent shale boom…like they finally sighed, “whew! We dodged a bullet there, so now we can talk about it.”

How about this analogy: It is like the drunk who wouldn’t acknowledge his alcoholism for decades, then gives up drinking. Then he starts telling everyone he knows that he was an alcoholic but is now sober WHEW, WHAT A RELIEF!…yet in a week, or month or maybe a year, he is drinking heavier than ever.