Page added on September 1, 2015

U.S. tight oil production decline

U.S. oil production has begun to drop in response to low oil prices, but not as dramatically as many had anticipated.

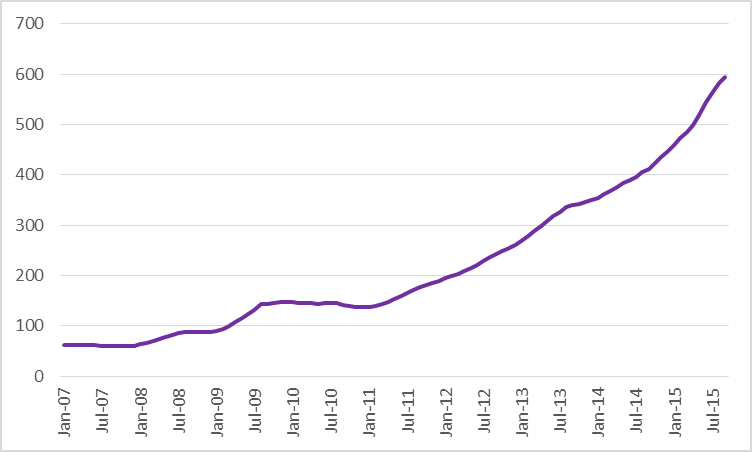

Oil companies have cut back spending significantly in response to the fall in the price of oil. The number of rigs that are active in the main U.S. tight oil producing regions– the Permian and Eagle Ford in Texas, Bakken in North Dakota and Montana, and Niobrara in Wyoming and Colorado– is down 58% over the last 12 months.

Nevertheless, U.S. tight oil production continued to climb through April. It has fallen since, but the EIA estimates that September production will only be down 7%, or about 360,000 barrels/day, from the peak in April.

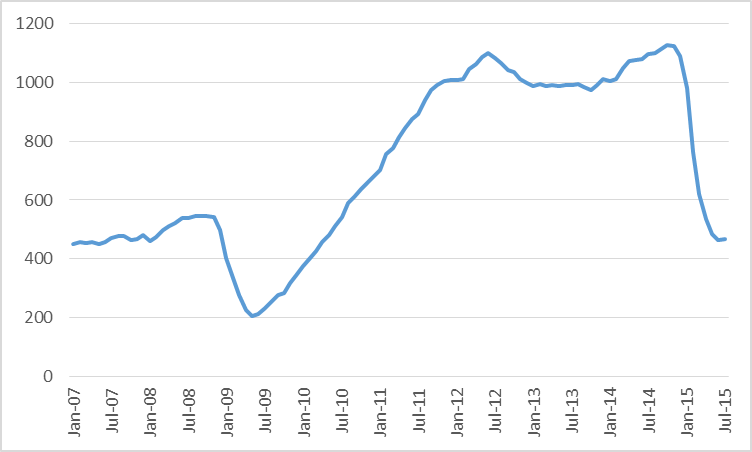

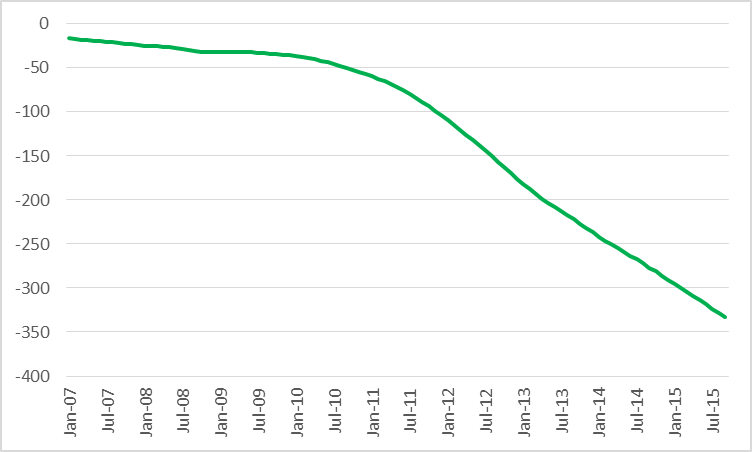

This is despite the fact that typically output from an existing well falls very quickly after it begins production. The EIA estimates that tight oil production from wells that have been in operation for 3 months or more has declined by 1.6 mb/d since April, as calculated by the sum of the EIA estimated monthly declines in legacy production from May to September.

Legacy production change (month-to-month production change, in thousands of barrels per day, coming from wells in operation 3 months or more) in counties associated with the Permian, Eagle Ford, Bakken, and Niobrara plays, Jan 2007 to Sept 2015. Data source: EIA Drilling Productivity Report.

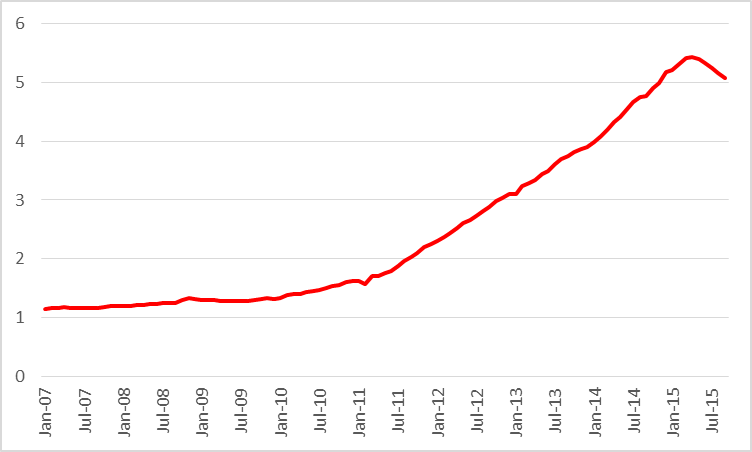

One would think that these decline rates from existing wells and the drop in the number of rigs drilling new wells would mean that production would have fallen much more dramatically. Why didn’t it? The answer is that there has been a phenomenal increase in productivity per rig. For example, the EIA estimates that operating a rig for a month in the Bakken would have led to a gross production increase of 388 barrels/day two years ago but can add 692 barrels today.

A key factor in the productivity gains is that companies are finding ways to complete wells faster, so that more wells can be drilled each month from the same number of rigs. For example, The Barrel reports that Occidental Petroleum “has seen a 40% decrease in spud to rig release time in the Wolfcamp area of its Permian holdings from 43 days in 2014 to 26 days in March this year with a target of eventually reaching 16 days.”

The modest drop in U.S. production has been enough to start to bring inventories down. U.S. crude oil stocks last week were down more than 30 million barrels from April. But that still leaves them way above normal.

The drillers’ cash flow is assisted not only by the improvements in efficiency just mentioned but also by the fact that the drop in demand for rigs means companies are seeing drops in day rates and other costs. Even so, major shale producers like EOG, Whiting, Pioneer, and Devon reported before-tax losses each of the last two quarters.

West Texas Intermediate averaged $53/barrel the first six months of this year. Last week it went as low as $38 before rebounding back to $45 by the end of the week.

Losing money is obviously not a sustainable business model, yet inventories have to come down further. Meanwhile, elsewhere in the world, Iraq oil production is up half a million barrels a day from a year ago, and Iran hopes to raise oil production by up to a million barrels a day once sanctions are lifted. Economic prospects for China, the world’s second-biggest oil consumer after the United States, are cloudy.

Another part of the adjustment process is also underway, coming from the big cuts in capital expenditures for exploration and production for more conventional oil fields. This will also affect supply, but with significantly longer lead times than is the case of production of tight oil.

Gains in efficiency, lower costs of inputs, and, in the case of production outside the United States, appreciation of the dollar have all helped lower the marginal cost of producing oil. Even so, the current price is well below the marginal cost, meaning one of two things has to happen. Either the price must rise or output from the higher-cost producers must fall further.

16 Comments on "U.S. tight oil production decline"

rockman on Tue, 1st Sep 2015 4:20 pm

Lag time…lag time…lag time. And lets not forget that wells put online during 1/2H2015 will still suffer the high decline rate that’s been well established. And unlike previous periods that production won’t be replaced as happened when we had 1600 rigs running.

Speculawyer on Tue, 1st Sep 2015 4:37 pm

Yep. The Wall Street traders seem to think that drilling, fracking, and completing wells can be done as fast as they buy & sell stocks. There will eventually be a drop in production and the price will go back up a bit.

The people that are gonna get hurt are all the rubes out there buying gas guzzler vehicles because oil is cheap right NOW who will have trouble making those loan payments when gas prices go back up.

GregT on Tue, 1st Sep 2015 4:49 pm

What’s with you people? Oil is not cheap right now. It is still almost twice as expensive as historical inflation adjusted prices during non-recesionary periods going back for over 100 years.

Plantagenet on Tue, 1st Sep 2015 5:31 pm

The EIA estimates global oil production exceeds demand by about 3 million bbls per day, with Iran about to bring another million bbls per day to the market

The small drop in U.S. TOS production won’t end the oil glut.

Boat on Tue, 1st Sep 2015 5:54 pm

Greg-T

My brother and I were driving and celebrated with a cigar, gas was at $3.00 down from $3.80. Filled up today at $2.16. It might not be cheap but it’s time for another cigar.

apneaman on Tue, 1st Sep 2015 6:10 pm

Next time light it up while pumping the gas.

tita on Wed, 2nd Sep 2015 1:18 am

The drop of US oil rig count only began in november 2014, while the effects on production where seen starting june 2015. There is a 7-9 months lag time between the two events. The lowest rig count was in early june 2015. That means that the full drop in production won’t be seen before the first months of 2016. But what is sure is that US oil prod will continously drop now.

Truth Has A Liberal Bias on Wed, 2nd Sep 2015 3:09 am

It’ll be along time before Iran puts a another million barrels a day on the market. I suggest by the time it does USA LTO will be down a million. Sanctions on Iran took about 750,000 barrels a day off the market. Given the disrepair of their fields I think it’ll be all they got to get the 750G back. Naturally Plant grasped at the million number because it’s been mentioned by idiots who know nothing and it gives Plant an opportunity to say ‘glut’ in a sentence which is about all he’s really good for. I suggest the average IQ of frequent posters on this site is in the sub 80’s range. Typical dumb ass ‘merikans.

Also please note that Plant left a comment at 5:31 Pm central time. I believe he has frequently stated he is in India which is 10 and a half hours ahead so once again Plant is in India, awake at 4am local time and with nothing better to do than troll PeakOil.com

WHAT A FUCKING LOSER TROLL!!

GregT on Wed, 2nd Sep 2015 3:16 am

“It might not be cheap but it’s time for another cigar.”

Saving 20 bucks or so on a tank of gas that is helping contribute to the future misery of your children, is certainly a great reason to fill your lungs with smoke.

Good for you Boat, you deserve it!

Plantagenet on Wed, 2nd Sep 2015 7:46 am

Bias is totally delusional and can’t even tell time

It is currently 6:12 pm here in New Delhi which makes it 4:32 am back in Alaska.

Bias— that means the big hand is at 12 minutes and the little is a bit past the sixth hour mark

Get it now?

Hahahahshahahsh!!!!! CHEERS!

BobInget on Wed, 2nd Sep 2015 8:51 am

The U.S. government just made its largest renewable energy purchase to date.

The U.S. Navy has invested an undisclosed amount in the Mesquite solar farm in sun-rich Arizona, allowing for an expansion of the facility that is anticipated to make it the world’s largest solar farm.

As the Climate News Network’s Paul Brown reports, the farm — located about 40 miles west of Phoenix — will provide 210 megawatts of direct power, a third of the energy needed to power 14 Navy and Marine Corps sites. The solar farm, slated to go online next year, is expected to save the Navy “at least” $90 million in energy costs over the course of the 25-year contract with Sempra U.S. Gas and Power, which operates it.

The Mesquite facility, which completed its first phase of buildout in late 2012, has a potential capacity of 700 megawatts, which would power up to 260,000 homes. It requires no water to operate and reduces greenhouse gas emissions, according to Sempra.

The investment marks a big step toward the Department of Defense’s Congress-mandated goal to either produce or procure 25 percent of its total energy needs from renewable sources by 2025, the Navy announcement noted.

Meanwhile, India has also set its sights on creating the world’s largest solar farm. The country announced last month that it will build a 750-megawatt plant on 1,500 acres of barren, government-owned land in the northeastern Madhya Pradesh state. The plant, however, is not expected to be in operation until 2017.

The increased interest in solar energy comes amid a new report from the Paris-based International Energy Agency showing that the cost of producing electricity from solar and other renewable sources has decreased “significantly” in recent years; they are no longer “cost outliers” when compared to fossil fuels, Bloomberg reports.

mo on Wed, 2nd Sep 2015 8:52 am

Having fun ripping each other?

BobInget on Wed, 2nd Sep 2015 9:05 am

In 30 minutes the all important EIA repore is

due. Here’s the link;

http://www.eia.gov/petroleum/supply/weekly/

If the repore is bullish look for oil to close the day around $53. Bearish $40. keep in mind these are NOT current oil prices.

BC on Wed, 2nd Sep 2015 11:32 am

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=1Khe

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=1Khp

Above is US gasoline to working-class wages adjusted for core CPI and the US$. Gasoline is at the same price as the previous two recessions, but that’s just a coincidence, surely.

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=1Khj

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=1Kho

Same vs. all wages and salaries.

Recessions are great for “gluts”. 🙂

Revi on Thu, 3rd Sep 2015 12:56 pm

What goes up must go down.

Kenz300 on Fri, 4th Sep 2015 9:20 am

High cost producers don’t go broke on day one……

they keep spending the banks money until the banks stop lending….