The bottlenecks in the Permian have created a widening chasm between not just Brent and WTI, but also WTI in Cushing or Houston and prices fetched for oil in the Permian basin.

Oil output continues to soar in West Texas, despite the fact that the region’s takeaway capacity is tapped out. The discount for Midland WTI relative to Houston has surpassed $10 per barrel. “We see further potential downside risks for Midland prices and differentials versus the [U.S. Gulf Coast] and Brent,” Bank of America Merrill Lynch said in a note.

The crude bottleneck could be temporary, however, with a series of new pipelines set to come online next year. That could narrow the discount and perhaps even eliminate it. Bank of America Merrill Lynch goes further, arguing that the export push could open up a premium for Permian oil. “Beyond 2019, excess Permian takeaway capacity could push the Midland-Cushing differential positive as take-or-pay commitments pull barrels directly to the USGC for export,” the bank said.

With more pipelines, the flood of oil will continue to expand, which could depress WTI even as the regional gap with Midland is eliminated. “Rising production in the Midwest (PADD 2), the Rockies (PADD 4), and Canada, and new inbound pipelines from the Permian could overwhelm Cushing once again, weakening WTI curve structure,” BofA Merrill Lynch wrote. “In turn, this shift could lead to a wider Brent-WTI spread in 2019 than the $6/bbl we are currently projecting.”

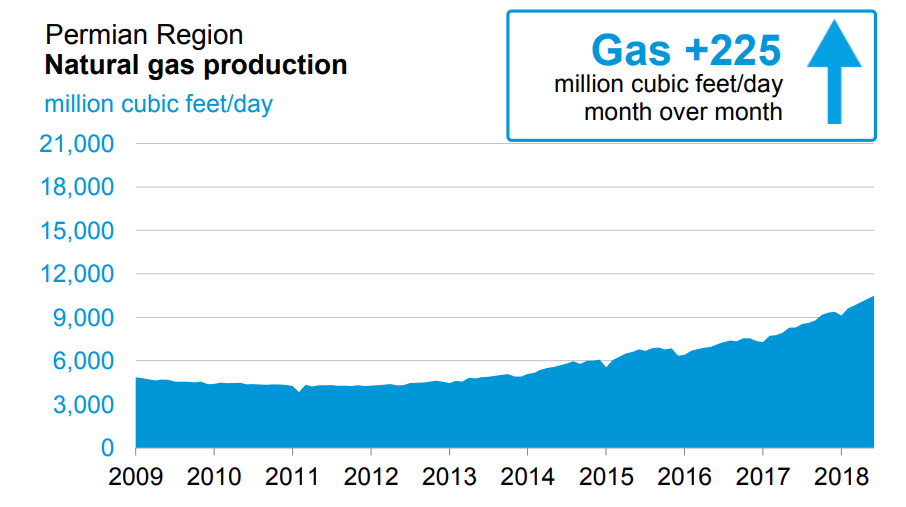

However, even as the oil bottleneck looks set to be resolved in the next 12 to 18 months, there is still the matter of finding an escape route for all of the natural gas produced in the Permian. Gas production has skyrocketed in tandem with oil – with output up more than 60 percent over the past decade – which is creating a new set of problems.

(Click to enlarge)

Just as with crude oil, producers are struggling to find capacity on the region’s gas pipelines to ship gas out of West Texas. “The ball has got to get rolling on these gas pipelines because my biggest worry is that gas can strain some of the other production if we are not careful,” Bill Ordemann, executive vice president at Enterprise Products Partners, said at the Hart Energy Midstream Texas Conference last week.

New pipeline capacity is needed, and ultimately, the volumes of gas coming out of the Permian will probably need to be exported, Ordemann said. “All and all, our view is it all has to be exported or the vast majority has got to be exported,” he said.

That means shipping natural gas to Mexico or through the Gulf of Mexico via LNG export terminals. But those projects are also facing some obstacles, including adequate capacity to distribute gas on Mexico’s side of the border, as well as the lengthy time it takes to build LNG export terminals.

As a result, the gas glut could crimp oil production. “[A] lack of takeaway capacity has also severely depressed spot prices for Permian gas, and expectations for continued production growth depressed 2019 prices to levels as low as $1.00 per MMBtu during May,” Bank of America Merrill Lynch wrote. “Collectively, these steeply discounted prices have caused some producers to question whether it makes sense to throttle back their drilling and completion (D&C) plans until sufficient takeaway capacity is in place and netbacks improve.”

LNG developers are building and expanding facilities on the Gulf Coast to ship out more gas.

Export infrastructure will also need to grow to handle more crude oil exports. As Bloomberg notes, that isn’t a problem right now. There is some 2 million barrels per day (mb/d) of export capacity, and expansions are on the way, with a high-profile buildup at Corpus Christi. There is room to ratchet up exports, particularly as new facilities come online, but the timing of such things is not always seamless.

In the interim, both oil and gas prices in Midland will continue to suffer from bottlenecks. Oil is starting to be shipped via truck from West Texas to the Gulf Coast, a costly and inefficient mode of transport. Still, it makes some sense, if the producer can still make a profit after covering for the additional transport cost. But even there, bottlenecks could emerge. “Producers are said to be paying $15/bbl to ship oil by truck from the Permian to the U.S. Gulf Coast. However, this cost is not static. A shortage of truckers and trucks, coupled with accelerating 2H18 production, suggests that truck transport will get even tighter and become more expensive in the coming months, weighing on Midland pricing,” BofA Merrill Lynch said.

The bottom line is that the region will suffer from growing pains and discounts for the next year or so, dividing up the industry between the “Haves” and “Have Nots.” Those companies with contracts to ship their oil and gas on pipelines are doing well, while smaller E&Ps scrambling to secure pipeline space or lining up convoys of trucks are going to take a big financial hit.

By Nick Cunningham of Oilprice.com

Outcast_Searcher on Wed, 13th Jun 2018 3:43 pm

Since when is having to adapt to or make allowances for unexpected abundance a “crisis”?

If the worst thing that happens is oil production from the Permian is slower than it could be, meaning it lasts longer, how is that a “crisis”?

Besides, if there is enough financial incentive, let’s not pretend another pipeline can’t be built, or another solution can’t be found.

Next the Cassandras will be telling us it’s a “crisis” that signs are the US economy is strengthening. If the cries for doom via traditional channels are so incredible that the audience is yawning, by all means, try a different story, even if it doesn’t make much sense.

twocats on Wed, 13th Jun 2018 4:05 pm

OS – outright senescence.

There is a “Call on the Permian” right now – and if not met with a RAPID enough increase – could easily lead to oil prices shooting up another $10 a barrel. Not saying they can’t do it – but there’s been a lot of chatter about bottlenecks for at least weeks if not months.

Brent/WTI had begun stabilizing around $75/65 marks. They’ve withstood the Iran nonsense. And are currently dealing with the Venezuela reality. Now there is an OPEC disagreement (SA vs almost everyone).

Essentially this is leading to a sudden “Call on OPEC”. Saudi Arabia and Russia are signalling increases – so that should easily avoid any crises – but if the world didn’t have such willing friends as SA and Russia the global economy could have been in a serious situation. Again assuming bottlenecks are about to crimp increases.

twocats on Wed, 13th Jun 2018 4:08 pm

Granted that might have only driven prices to the 85/75 range. But its very very unclear where the breaking point is for the world economy AT THIS POINT IN THE BUSINESS CYCLE – already the 2nd longest (?) expansion on record. We are into vastly uncharted territory here regarding what the economy can withstand in terms of price inflation.

Roger on Wed, 13th Jun 2018 6:13 pm

President Trump is calling for more oil…and SA and Russia are agreeing. The (blame) game is on….everyone seeking to avoid blame for the vicious price spike that’s just around the corner.

As impressive as the Permian’s performance has been, it won’t make up for what’s happening in Venezuela.

Don Zenga on Wed, 13th Jun 2018 9:33 pm

BP has released the Energy Stats.

Renewables increased by 69.4 MTOE while Natgas increased by 82.7 MTOE and Oil Consumption by 64.5 MTOE.

In overall energy scenario, renewables (excluding Hydro) have 3.6% share in 2017, which is up 0.4% from the 3.2% in 2016.

Still only the Solar PV is included and the Solar Thermal may be excluded since its more in an informal sector. This stats also excludes the Wood and Animal waste used for cooking/heating in many developing countries as this belongs to informal sector and is not traded.

The trick employed to show the increase in Oil consumption is in the fine print.

Production sheet says

” Excludes liquid fuels from other sources such as biomass and derivatives of coal and natural gas.”

Consumption sheet says

” * Inland demand plus international aviation and marine bunkers and refinery fuel and loss. Consumption of biogasoline (such as ethanol), biodiesel and derivatives of coal and natural gas are also included.”

That means the Natgas used in Gas to Liquids and Coal used in Coal to Liquids are included in Oil Consumption in addition to including Biofuels.

Natgas Production (3164.6) – Natgas Consumption (3156.0) = 8.5 MTOE

Coal Production (3768.6) – Coal Consumption (3731.5) = 37.1 MTOE

and the difference is actually allocated to Oil Consumption showing a big increase of 64.5 MTOE.

But the actual increase in Oil Production is just 10 MTOE despite a big increase in automobile fleet and many consumers trading cars for crossovers. That means we are coming close to peak oil production though the consumption is increasing by clubbing other sources into Oil.

By the same count, Coal consumption increased only 1 %, but the production increased 3.2% which means that extra 2.2% is probably moved to Oil in Coal to Liquids conversion.

Similarly Natgas consumption increased only 3 %, but the production increased 4 % which means that extra 1 % is probably moved to Oil in Natgas to Liquids conversion.

So Oil is acting as a Thief in grabbing some from other fossil fuels without producing of its own.

Anonymous on Thu, 14th Jun 2018 7:19 pm

Build more pipes. Duh.

This is Texas. It’s still America there.