Page added on December 7, 2014

The EIA’s World Oil Production Numbers

The EIA has recently published their International Energy Statistics. Their stats include all liquids such as NGLs, biofuels and even refinery process gain. But I only track actual oil. The EIA does not track “Crude Only” so we are forced to track what they do track which is Crude + Condensate.

The EIA is about four months behind with their world petroleum data. All data in this report has data through August, 2014 and is in thousand barrels per day.

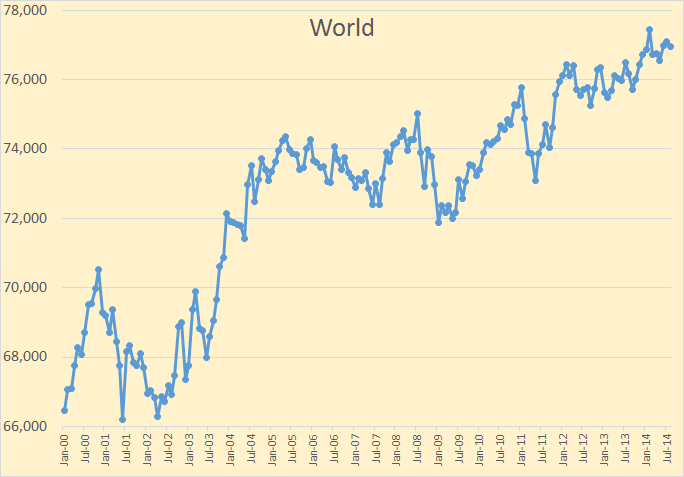

World C+C production was down 124,000 barrels per day in August. But according to the IEA it will be up considerably more in September.

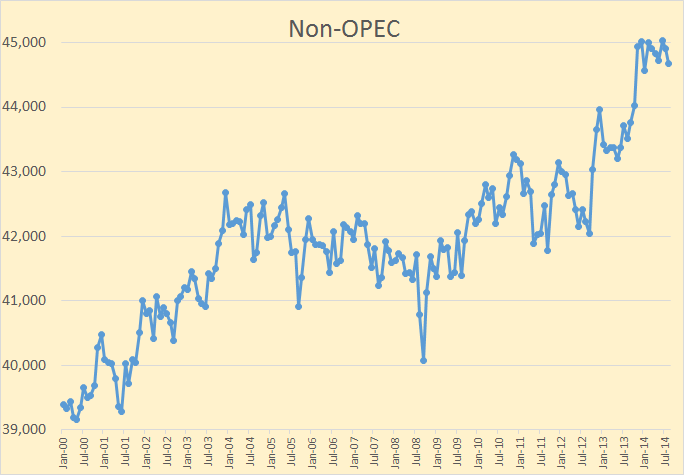

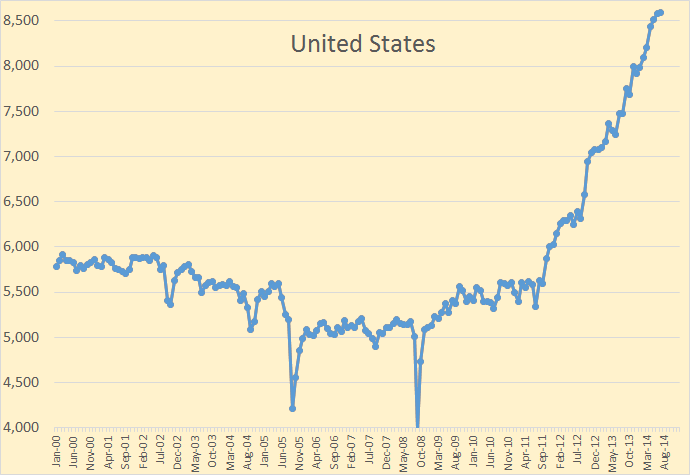

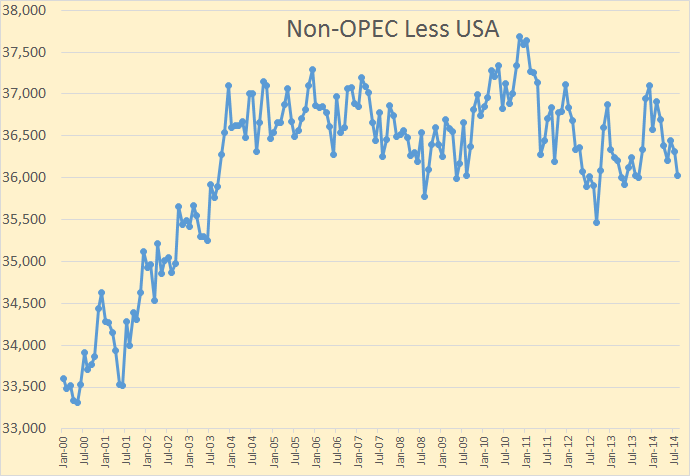

Non OPEC production shot up in November, 2013 but has made no progress since. Though US production has continued to climb, declines in the rest of the world have kept it from increasing.

Since that date, November 2013, US production is up 655,000 barrels per day through August.

But since that same date last November the rest of non-OPEC has is down 920,000 barrels per day. Non OPEC less USA is down 1,665,000 barrels per day since peaking in November, 2010.

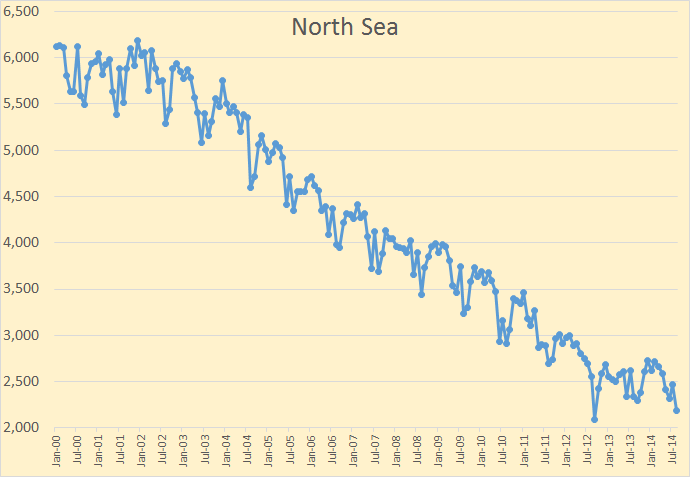

The North Sea, the combined production of Denmark, Norway and the UK, halted its decline in late 2012 but it now looks like it has started to decline again.

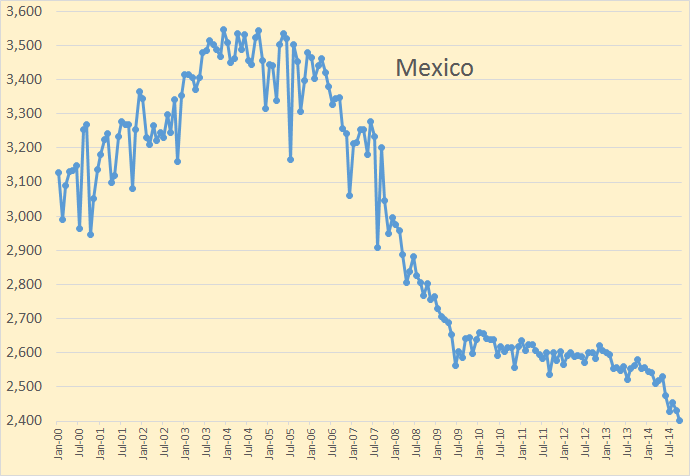

Mexico is always interesting. They halted their decline in 2009 and held that plateau for about three and one half years. But production has dropped 200,000 bpd since they fell off that plateau.

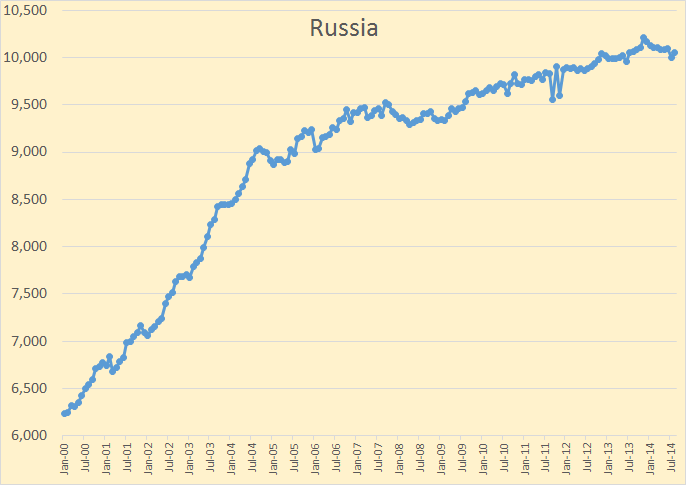

Russia is the world’s largest producer of Crude + Condensate.

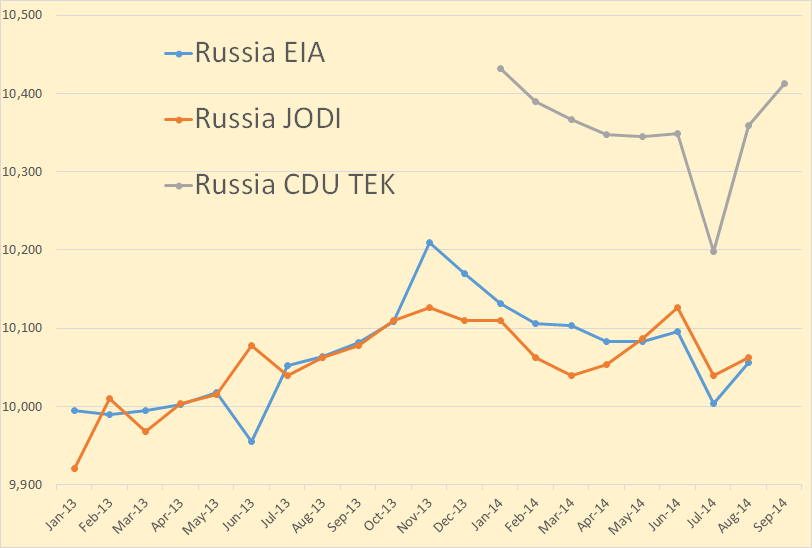

Here the EIA and JODI data is through August while the CDU TEK data is through Septmber. The CDU TEK numbers were in tons. I used 7.2 barrels per ton to convert to tons to barrels.

In order to get a better idea of what is happening in Russia I show only the last 20 months of production numbers. I have only January through September of the CDU TEK numbers, Russia’s official web site. They show only daily production so I have to average it to get monthly numbers. But I stopped collecting after September because I find the data worthless.

Everyone agrees July was a bad month for Russia. Wildfires closed down some pipelines. But Russia says they more than recovered in August. They have the August numbers 10,000 bpd above June. The EIA has Russian August numbers about 40,000 bpd be below June and JODI has them 64,000 bpd above their June production.

I don’t think much of the JODI numbers and even less of the CDU TEK numbers. Some may complain about the EIA numbers but they are the best we have regardless of their shortcomings.

Crude oil production in other nations of interest:

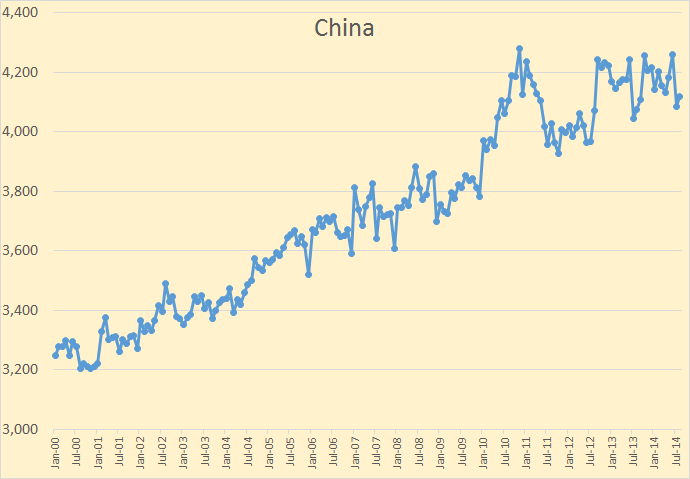

I believe China, the world’s fourth largest producer, has peaked. Any increase in consumption in China will have to come from imports.

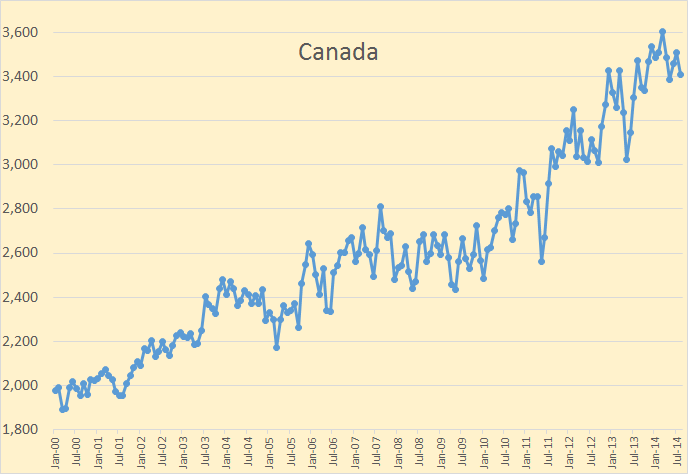

C+C production in Canada, the world’s fifth largest producer, has slowed. Canada’s peak depends entirely on the price of oil. If the price of oil goes up then Canada’s production will likely continue, though at a slow pace. But if prices stay low I expect Canada’s production to begin to decline.

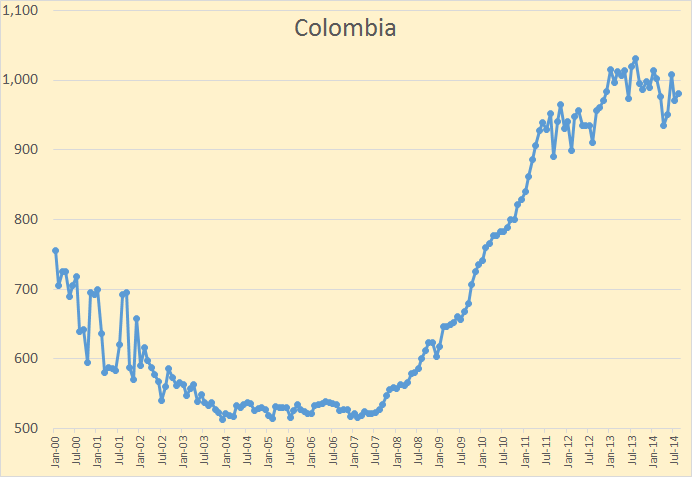

Colombia had a surge beginning in late 2007 but production seems to have peaked there also.

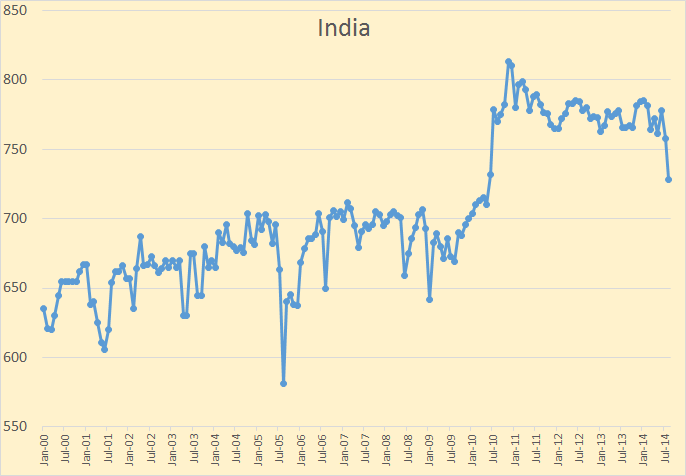

India seems to be having production problems as of late. With India’s population and economic problems they can ill afford a drop in oil production.

I have updated the pages Non-OPEC Charts and World Crude Oil Production by Geographical Area with the August production numbers.

49 Comments on "The EIA’s World Oil Production Numbers"

Plantagenet on Sun, 7th Dec 2014 1:11 pm

Interesting to see how world oil production has now risen significantly above the 2005-2009 production plateau that many thought was “peak oil” i.e. the peak in global oil production.

Northwest Resident on Sun, 7th Dec 2014 1:19 pm

What goes up must come down. Trite but true. It is a law of nature. With QE, ZIRP, all kinds of financial/economic manipulation, massive propaganda and China as the world’s designated growth engine, TPTB managed to produce one last frenetic burst of increased oil production. In the aftermath, we are left with a global economy that is in tatters, a stock market totally disconnected from reality and an environment in bad need of a detox. I personally doubt that there is enough stamina left in the global economy to produce another round of adrenaline induced production increase. Which means that we are floating in that nether world that exists between the fossil fuel driven civilization we are at the tail end of, and the energy deprived future of chaos that surely awaits. This IS the calm before the storm, to use another cliché which is also just as trite as it is true. A very rough ride downward awaits, I’m afraid.

tahoe1780 on Sun, 7th Dec 2014 1:26 pm

I wonder how the ratio of crude (defined how?)to condensate has changed over the past few years? As “Short” points out, how much of that production is NET to the end user?

westexas on Sun, 7th Dec 2014 1:39 pm

The EIA shows that global Crude + Condensate (C+C) production was up by 3% from 2005 to 2013. They show global dry gas production up 22% from 2005 to 2012 (2013 data not yet released).

Condensate, like NGL, is a byproduct of natural gas production, so it’s a very reasonable assumption that rising condensate production has accounted for all, or virtually all, of the post-2005 increase in global C+C production.

Texas accounted for 3% of 2013 global C+C production, but Texas RRC data indicate that the 2005 to 2013 increase in Texas condensate production alone would account for 12.5% of the increase in global C+C production from 2005 to 2013.

Apneaman on Sun, 7th Dec 2014 1:50 pm

Still playing that card eh Plant? How about an example of a known peak oil writer/blogger/analyst who said that it was anything other than peak conventional. What year did the change of what constitutes a barrel of oil to include the condensates happen? To what degree does that change the numbers? Been seeing a lot of redefining of standards from regulatory agencies; the last decade especially. Like in the ever shifting (always higher) safety margins and tolerances and operating life cycle in the warm N fuzzy nuclear industry.

Apneaman on Sun, 7th Dec 2014 1:52 pm

NUCLEAR:

Violations at Fla. plant highlight NRC concerns over flooding emergencies

http://www.eenews.net/stories/1060009671

Plantagenet on Sun, 7th Dec 2014 3:17 pm

@Apneaman —Still playing that card, eh?

Of course people who said the production peak from 2005-09 was “peak oil” were looking at conventional oil. They didn’t understand that unconventional oil would drive global oil production to the new highs we have seen.

Thats my point—the plateau from 2005-09 has definitely been surpassed, i.e. the world hasn’t reached peak oil yet.

Get it now?

Davy on Sun, 7th Dec 2014 3:47 pm

Planter, Everyone knows PO will be a rearview mirror event. Got it?

westexas on Sun, 7th Dec 2014 3:51 pm

Or, in the alternative, actual global crude oil production* (45 and lower API gravity crude) has peaked, while global natural gas production and associated liquids (condensate and NGL) have so far continued to increase.

*From all sources

Apneaman on Sun, 7th Dec 2014 5:38 pm

Get what plant? That a few years of debt fueled fracking helped kick the can? What is you are arguing? Barrel counts for a couple of years? The only reason peak oil was ever an issue of concern for most was because it is a civilization destroyer. Do you want to argue that a short, one time, period of very expensive (economically and environmentally)increase in production will save America from itself? The world? Just what do you claim this has accomplished? I get the impression that it’s all just some grade school pissing contest for you and or a way to distract yourself from the very painful bigger picture. The world is well into Overshoot on all fronts and there is no going back-ever.

Danlxyz on Sun, 7th Dec 2014 5:43 pm

Plant, you are right. It looks like in 2005 worldwide C+C Production was about 74 million bpd and in July 2014 it was about 77 million bpd. That 3 million is a 4% increase over 10 years.

But what about the cost? Does anyone have an idea what was spent over that 10 year period for capex? IIRC last year alone was around $700 billion.

Plantagenet on Sun, 7th Dec 2014 6:21 pm

@Davy:

Your suggestion that peak oil is a “rearview mirror event” is incorrect.

The whole idea of peak oil was originated by M. King Hubbert in 1956 when he PREDICTED that US oil production would peak about 1970. And it did.

Since then everyone from M. King Hubbert to the Club of Rome to the Association for the Study of Peak Oil (ASPO) has been making PREDICTIONS of when peak oil will occur. Most predictions pointed at ca. 2005, and oil production did plateau from 2005-2009.

But now we know those predictions were wrong—oil production today is significant higher then past predictions of peak oil.

Sure—oil production will peak some day at some level. But when? And how much? Those are important questions. The whole point of peak oil theory for the last half century has been a prediction that peak oil is coming.

Get it now?

Davy on Sun, 7th Dec 2014 6:43 pm

Planter, that is what I said. We will not know “the when” until it has already occurred. My point is we may be there very soon and not know it until later.

Another point is the peak is not as critical as the failure of oil production and the oil energy value to support growth. This slow economic hypoxiation is what is happening currently. This is why the global economy is one big mess. Systematically oil is not supporting growth where it should be in relation to population, debt creation, and societal unfunded liabilities. IOW oil and the economy are inadequate to the requirements of our complex society. That is a round-a-about way of saying we are systematically and globally at limits of growth and diminishing returns. We are screwed planter. Go it?

Plantagenet on Sun, 7th Dec 2014 7:25 pm

Hi Daver:

You are 100% right that we won’t know it is peak oil until after it happens.

However, the reason there are currently no good predictions of when peak oil will is because people like Dr. Hughes don’t understand the TOS systems well enough to make accurate predictions. They’ve attempted it, but they ‘ve been wrong and wronger—so far the TOS oil production has greatly exceeded all predictions.

JuanP on Sun, 7th Dec 2014 7:54 pm

Thanks to the author for this info and graphs. I would like to have a “World less USA” graph included in this report in the future. The fact that production outside the USA basically hasn’t increased in many years needs to be highlighted regularly, IMO.

GregT on Sun, 7th Dec 2014 8:32 pm

@Plant,

“Your suggestion that peak oil is a “rearview mirror event” is incorrect.”

“You are 100% right that we won’t know it is peak oil until after it happens.”

So Plant, have you made your mind up yet? Or are you still somewhat confused?

Dave Thompson on Sun, 7th Dec 2014 9:41 pm

The worst part of the “peak oil” story is that most consumers have no idea what we are facing in the here and now, let alone the near term future.

Northwest Resident on Sun, 7th Dec 2014 10:57 pm

I don’t think Plant gets it now.

tahoe1780 on Sun, 7th Dec 2014 11:58 pm

Westexas – Thank you. So it does look like the crude (<45 API) that actually feeds refineries peaked in 2005 and that the NET to end users probably declined. Good to know I can still fill my barbeque and cigarette lighter though.

Davy on Mon, 8th Dec 2014 6:30 am

DaveT said – consumers have no idea

DaveT, I am not the board expert on PO. What I can relate is my understanding of it. I look at it systematically as one of two vital elements to industrial man’s activity. Healthy oil and healthy economy are absolutely vital to healthy economic activity. Oil is pervasive in every aspect of this economic activity. This economic activity is the primary driver of healthy oil production. PO and the economy are symbiotic and codependent. This is where the corn based econ 101 board academics get lost is through a decouple of the two. Oil to them is just another variable in the economy.

My point of view sees our current situation as either in PO or approaching PO. Both are systematically disruptive. If the human body goes to high altitude there are side effects. Many people get altitude sickness for example. This is called Hypoxia and the board corns would scold me for using word salad when I mention this but this is what is occurring as we approach PO. We have compensated for it globally and systematically by debt and wealth transfer.

This systematic situation is more broadly in the situation of limits of growth in diminishing returns facing capacity overshoot. The healthy oil and economy relationship is required not only on supporting each other it is vital to the combat entropic decay. Entropic decay is winning a battle over growth because of limits of growth and diminishing returns. At the point when we need a healthy oil/economy engine it is losing the oxygen needed to battle entropic decay. This entropic decay is not only physical it is in the dimension of structures and relationships of command/control and social.

There is so much talk about PO but the real issue is approaching PO with accelerating limits of growth, diminishing returns, and population overshoot. If this were not enough our climate is destabilizing and ecosystems are in decline with localized failures. This is a recipe for descent, contraction, and or collapse.

The key question from the human time value point of view is when. If a serious crisis is 10 or more years out this condition is not considered worth mitigation by GP & TPTB. If this is 3-5 yrs the macro cognitive dissonance of industrial man’s subconscious is disturbed. IOW the human element that drives economic activity called confidence is affected. We are closing in on just such a disruptive period. I call it the bumpy descent.

westexas on Mon, 8th Dec 2014 7:49 am

Tahoe,

IMO, the authors of the various “Peak Oil Theory is Dead” articles are taking a counterfactual position, in that the data strongly suggest that actual global crude oil production (45 and lower API gravity crude oil) virtually stopped increasing in 2005, while global natural gas production and associated liquids (condensate & NGL) have so far continued to increase.

Two relevant charts (waiting on EIA global gas data for 2013 update):

http://i1095.photobucket.com/albums/i475/westexas/Slide1_zps45f11d98.jpg

http://i1095.photobucket.com/albums/i475/westexas/Slide2_zpse294f080.jpg

toms2 on Mon, 8th Dec 2014 8:30 am

Apneaman:

“Still playing that card eh Plant? How about an example of a known peak oil writer/blogger/analyst who said that it was anything other than peak conventional.”

That’s the thing about the peak oil movement: it badly revises its own history and avoids any memory of its prior mistakes.

Who even remembers the Simmons-Tierney bet? The natural gas cliff? The Olduvai Gorge? Twilight in the desert? All those were badly failed predictions, which were widely accepted among peak oilers.

When the predictions fail, as they invariably do, they are forgotten about within the peak oil movement. Sometimes they are forgotten about the very day afterwards (Simmons-Tierney bet). Nobody ever asks what went wrong.

You want an example of a peak oiler who was talking about unconventional? How about Colin Campbell, who is the father of the modern peak oil movement and who coined the term “peak oil”. He always predicted that ALL oil would peak and start declining in the mid-2000s. Furthermore, almost every newsletter and prediction from ASPO showed ALL oil declining. Most of the graphs from that era explicitly included unconventional oil, tar sands, NGL, arctic, and so on. In fact, many of Colin Campbell’s graphs were labelled “ALL HYDROCARBONS”.

All that is never discussed now. Instead it’s conveniently revised away…

-Tom S

ghung on Mon, 8th Dec 2014 9:03 am

TonS – So are you saying these predictions were off in terms of timing, or are you saying we aren’t on the edge of a peak of economically recoverable petroleum? Just asking, because it’s always easier to sit in the cheap seats and cherry-pick erroneous predictions using your remarkable hind-sight.

I’ve always considered most of these predictions to be simplistic, as are your assertions that peak oilers are just wrong. There was no way any of us could predict the extreme measures economies could/would take to extend and pretend, substituting $trillions of QE, etc., to offset declining petroleum-enabled production and growth.

A little clarification please. Is the economic utility of petroleum providing the overall benefits to societies it did in the past, or are we reaching the end of oil’s miraculous stimulus to growth?

Dave Thompson on Mon, 8th Dec 2014 9:07 am

Davy. Good overview, “a bumpy descent” will be the easy way down IMHO. A nightmarish crash is also a possibility and just as probable if not more so.

Davy on Mon, 8th Dec 2014 10:27 am

Yea DaveT, I am trying to be an optimistc doom BTW that is an incongruous juxtaposition but you get the point.

Northwest Resident on Mon, 8th Dec 2014 10:32 am

“That’s the thing about the peak oil movement: it badly revises its own history and avoids any memory of its prior mistakes.”

And THAT is the thing about the “Cornucopian movement”, if we can call it that. From what I’ve seen, the ONLY thing that Cornies have to crow about these days is incorrect predictions made by Peak Oil notables long ago. Which, given the fragile economic and energy situation the world finds itself in due to Peak Oil related issues, is a little pathetic. You don’t find Peak Oil advocates sitting around crowing about all the failed Cornucopian predictions from days long past (and there are plenty of them) — we have far better things to focus on. Cornucopians PROVE they are on the losing side of the argument every time they point to a long-ago incorrect prediction and to their best Bart Simpson giggle.

Apneaman on Mon, 8th Dec 2014 11:25 am

toms2

I’m not clear what exactly your getting at. Are you saying their dates were wrong or that peak oil is not an issue or something else? Predicting specific dates is always tricky and none to wise imo, but the trend is clear. A incorrect date does not cancel out reality. Moving the goal posts, like counting condensates as oil, makes it easier to obscure the truth which is why they did it. The opponents of peak oil are more inconsistent and contradictory than anyone: it’s not happening, it’s not that bad, new technology will save us, your bic lighter is oil too, etc, etc. Anything to prolong the illusion that everything is fine and sooth one’s anxiety. Denial, minimizing, rationalizing, anger at the messenger are all common responses to cognitive dissonance. Everyone does this to some degree and in small doses it can be helpful, but it has proved devastating for societies. Deadly for global industrial man.

Northwest Resident on Mon, 8th Dec 2014 11:36 am

“Predicting specific dates is always tricky and none to wise imo, but the trend is clear.”

If Peak Oil predicting was a dartboard game, we would be looking at a dartboard with dozens of darts sticking in the two or three circles surrounding the bullseye, and maybe one or just a few exact bullseyes. In other words, those predictions may not have hit dead center, but they were very, very close and definitely pointed in the right direction. Watching cornies snort and snicker about all the darts that failed to hit exact dead center makes me wonder if they don’t have something else better to be spending their time thinking about.

GregT on Mon, 8th Dec 2014 12:09 pm

toms2 is in a state of denial guys, he has a few more steps until he reaches acceptance. I know I didn’t reach the acceptance stage until after a bout of denial myself. I’m sure that most here have gone through similar stages.

Perk Earl on Mon, 8th Dec 2014 1:19 pm

http://www.bloomberg.com/energy/

ck. out the new oil prices:

WTI -2.48 to 63.36

Brent -2.65 to 66.42

I finally got my wireless modem to work again. Usually when it goes out I just unplug the back power cord, replug and it powers up just fine. This time I needed to disconnect it from the battery back up power source for 10 plus seconds, then replug and zingo the stupid AT&T wireless crap works again for probably another 15 minutes!

Apneaman on Mon, 8th Dec 2014 4:15 pm

Energy

Jeff Rubin: Why I’ve finally thrown in the towel on the TSX

“When OPEC’s decision to keep output quotas unchanged triggered the current slide in oil prices, energy investors around the world began pointing to any number of conspiracy theories that would explain why the oil cartel wouldn’t move to safeguard prices. Just why anyone would think it’s incumbent on the lowest cost producers in the world, such as Saudi Arabia, to cut production remains unclear.”

http://www.theglobeandmail.com/report-on-business/industry-news/energy-and-resources/why-ive-divested-from-the-oil-sands/article21987623/

Davy on Mon, 8th Dec 2014 5:43 pm

Marm-a-NOo, your favorite, Gail Tverberg, has a new post:

Ten Reasons Why a Severe Drop in Oil Prices is a Problem

http://ourfiniteworld.com/2014/12/07/ten-reasons-why-a-severe-drop-in-oil-prices-is-a-problem/#more-39431

I was thinking you guys needed an update on what is going on in the oil markets.

toms2 on Mon, 8th Dec 2014 7:57 pm

ghung:

“it’s always easier to sit in the cheap seats and cherry-pick erroneous predictions using your remarkable hind-sight”

I said in advance, in 2005, that civilization is not collapsing for these reasons. Ocean shipping would not end, the electricity grid wouldn’t cease functioning, and so on. I thought there might be very gradual declines in worldwide oil production, but it wouldn’t cause collapse.

NR:

“In other words, those predictions may not have hit dead center, but they were very, very close and definitely pointed in the right direction.”

In my opinion, the predictions were way off. The predictions included things like the collapse of civilization, permanent power black-outs worldwide, an end to ocean shipping, re-localization because of failing transportation networks, sharp declines in natural gas production, declines in oil production from KSA, worldwide die-off, and so on. Those predictions were all very wrong. For example, the US now produces more than 4x the amount of natural gas which Hubbert thought it would produce by now.

Apneaman:

“I’m not clear what exactly your getting at. Are you saying their dates were wrong or that peak oil is not an issue or something else?”

I’m saying that the predictions issued by peak oilers were quite wrong, which seriously calls into question whether their ideas are even correct. Obviously, oil will peak and decline some day. However the ideas from the peak oil movement for predicting when that will occur, and what the consequences will be, are mistaken.

I don’t know when oil will start declining. I don’t think there’s any reliable way of predicting oil production more than 5 years out. However, I would guess that oil will start declining before 2030, and it will cause the following: 1) a large increase in oil prices; 2) a recession; and 3) a _very_ gradual transition to electrified transportation.

There is no chance these things will cause the collapse of civilization, in my opinion.

-Tom S

Davy on Mon, 8th Dec 2014 8:22 pm

Tommy, said – I would guess that oil will start declining before 2030, and it will cause the following: 1) a large increase in oil prices; 2) a recession; and 3) a _very_ gradual transition to electrified transportation.

There is no chance these things will cause the collapse of civilization, in my opinion.

Tommy, if you could picture me scratching my head….that is what I am doing.

GregT on Mon, 8th Dec 2014 9:45 pm

Tom,

1) How do you figure a large increase in oil prices? Prices can only go as high as what society can pay. 2008 for example.

2) We are already in a global recession, and many countries are already in depression.

3) Where exactly do you believe over 1 billion electric vehicles will come from, and how exactly do you imagine them being powered. Our electric grids are already maxed out.

marmico on Mon, 8th Dec 2014 10:35 pm

Which, given the fragile economic and energy situation the world finds itself in due to Peak Oil related issues, is a little pathetic

Meanwhile, the December 8, 2014 EIA Drilling Productivity Report estimates that January 2015 U.S. oil production in the shale plays rose by 116,000 barrels per day. Peak what?

Tverberg, I thought her latest missive would be entitled: 17 Days Until Rudolph the Red Nosed Reindeer Took an Erratic Turn after Being Blinded by Natural Gas Flares in the Bakken Causing Santa’s Sleigh to Strike a Brittle Transformer Box Plunging the U.S. Electrical Grid into Total Darkness Forever. 🙂

antaris on Mon, 8th Dec 2014 11:15 pm

Marm

All it would take is a winter like last year, coupled with an ice storm just like Quebec had some years back and you could have your Christmas brown or black out.

Northwest Resident on Mon, 8th Dec 2014 11:20 pm

toms2 — Those predictions will come true. Just takes a little longer than originally projected. Nobody guessed that TPTB would buy a little more since 2008 with many trillions in unpayable debt and total perversion of the stock market. But they did. It has worked well. But it is a short term, buying time strategy.

Northwest Resident on Mon, 8th Dec 2014 11:23 pm

Speaking of power blackouts.

The Dimming Bulb

Lots of stats, graphs and satellite images, along with a reasoned discussion that argues the world’s electrical grid is already “on the blink”.

http://www.doomsteaddiner.net/blog/2014/12/07/the-dimming-bulb/

Northwest Resident on Mon, 8th Dec 2014 11:56 pm

marmico — A title like that would be more appropriate for something I would write. Gail tends to stick to the facts. Me, I’m a color commentator!

Hey, I know you’re hanging on tight to that $130 billion in gasoline savings, thinking that all the happy consumers around the world will take their little slice of that savings to go forth and spend spend spend. How about we revisit that theory after the Christmas shopping retail numbers come in? If your theory is correct, this should be a really gung-ho spending season for consumers looking to unload all that spare cash. If after Christmas, the retail numbers are way down as they were after Black Friday, and we see another round of Sears, Target and other big retailers closing their doors, then we can probably assume that the $130 billion savings on gas wasn’t all that it was cracked up to be. Fair enough?

toms2 on Tue, 9th Dec 2014 12:27 am

Hi GregT,

“How do you figure a large increase in oil prices? Prices can only go as high as what society can pay. 2008 for example.”

Society could pay far more for oil than it paid in 2008. Prices for oil could easily approach $200/bbl and stay there until society switched to priuses and EVs.

“We are already in a global recession, and many countries are already in depression.”

Some countries are in recession, particularly in Europe. If oil peaked and started declining right now, the recession could worsen in those places.

“Where exactly do you believe over 1 billion electric vehicles will come from”

I think the 1 billion electric vehicles will come from the same place that the 1 billion gasoline-powered vehicles would have come from. They will be manufactured. If a civilization has the ability to manufacture 1 billion gasoline-powered cars, then it also has the ability to manufacture 1 billion EVs because they’re not much more difficult or expensive to make.

When EVs are mass-manufactured on the scale of conventional cars, I think their total cost of ownership will be only modestly higher than a conventional car is now.

A few people who can barely afford any car now, will be priced out of the car market, and will be forced to rely on public transportation, electric mopeds, bicycles, etc.

“and how exactly do you imagine the EVs being powered. Our electric grids are already maxed out.”

I think EVs will be powered by a mixture of coal, gas, nuclear, hydro, windmills, and solar panels. I think the proportion of renewable energy will increase significantly in coming decades, but coal and gas will still predominate for at least the next 30-40 years.

The electricity grid can be expanded. It’s expanded based upon need.

-Tom S

toms2 on Tue, 9th Dec 2014 12:30 am

Most importantly, I think all these things pose no danger of collapse. As an energy source becomes scarcer, the economy sacrifices the least important uses of it first. The economy would sacrifice discretionary travel long before it sacrificed anything essential. Since the vast majority of oil is spent on discretionary travel, the economy has a very long way to go before anything essential is sacrificed.

The economy has vastly more oil than is required to carry out essential functions like tractors, food transportation, mining equipment, maintenance of electricity grids, and so on. The economy is nowhere near collapse because of shortage of oil. I think the economy could withstand an 80% reduction in oil supplies within 10 years with no risk of collapse, although it would impose severe hardships upon some people.

Peak oil poses no risk of collapse. There may be threats to civilization, like nuclear war and other things, but peak oil isn’t one of them.

-Tom S

GregT on Tue, 9th Dec 2014 12:41 am

Tom,

Our scientific community has already informed us that we need to reduce all fossil fuel usage by 70% by 2030, if we hope to have a 50/50 chance of averting global catastrophic runaway climate change. 2030 is only 16 years from now.

Even if that were not the case, all of the techno fixes that you are dreaming about also require finite resources. At best, you are talking about a temporary bandaid solution that does not address population overshoot, or environmental destruction.

GregT on Tue, 9th Dec 2014 12:49 am

Tom,

According to the US congress, the economy would have collapsed in 08, and there would have been ‘blood in the streets’, if 4.3 trillion dollars was not spent bailing out the ‘too big to fail’ banks.

According to some here, we hadn’t even reached ‘peak oil’ yet. Only a high price of $147 per barrel.

Perk Earl on Tue, 9th Dec 2014 1:11 am

Below is my response to Gail’s latest article:

http://ourfiniteworld.com/2014/12/07/ten-reasons-why-a-severe-drop-in-oil-prices-is-a-problem/comment-page-2/#comments

“Once commodity prices (including oil prices) fall to levels that are affordable based on the incomes of customers, they fall to levels that cut out a large share of production of these commodities.”

Great article, Gail! The above is exactly what I’ve been trying to tell people who think these low oil prices are great – that low oil prices risks future supply. We are in effect being cut off from our beloved supply of oil by way of declining net energy. It’s not something that can be averted when relying on a finite resource in which crude oil extraction has not risen much since 05. Other oils have gone up to help continue growth but they are oil extenders only as Gail points out at a high price.

Next stop, Palukaville with “Debt related collapse: oil limits will play out in a very different way than most have imagined, through lower oil prices as limits to growth in debt are reached, and thus a collapse in oil “demand” (really affordability). The collapse in production, when it comes, will be sharper and will affect the entire economy, not just oil.”

We are quickly approaching collapse. I don’t know the exact timing, but each of these events that take place, like the recent oil price drop are indicative of peak oil. It’s happening, it’s just not collapsed yet.

toms2 on Tue, 9th Dec 2014 1:22 am

GregT,

“Our scientific community has already informed us that we need to reduce all fossil fuel usage by 70% by 2030, if we hope to have a 50/50 chance of averting global catastrophic runaway climate change.”

I’ve read the IPCC report, and I just looked through it again right now. It claims that CO2 emissions must stop growing and start declining by 2040 (scenario B1), in order to limit global warming to 2C. If we don’t limit CO2 emissions and just continue with BAU, then temperatures will increase by 4C by 2100.

I think only very few climate scientists are talking about “runaway” climate change, although I know James Hansen says that.

“all of the techno fixes that you are dreaming about also require finite resources.”

They are finite, but they are not scarce.

…Certainly, we should make tremendous efforts to reduce both carbon emissions and population growth. We agree on those points.

I’m only saying there’s no imminent collapse of civilization because of energy decline.

-Tom S

Davy on Tue, 9th Dec 2014 6:12 am

Tommy, you show a very real lack of understanding of what is called systematic risk. Your lack of understanding comes with the failure to see life is multifaceted and multi-dimensional with both linear and nonlinear causality. There is causes and effects with consequences and unintended consequences. There are cycles within cycles as ecosystems overlap. These sub layers of ecosystems having some independence and some codependence to other ecosystems. All ecosystems are part of the earth’s great ecosystem and then beyond to the solar system and galaxy.

My point is without placing man in his place in that ecosystem with codependence to other ecosystems you will be unable to distinguish converging and or reinforcing feedbacks within ecosystems and between. This is highly important now because we are in or approaching a broad condition of limits of growth with diminishing returns with man’s ecosystem in carrying capacity overshoot. This situation is destabilizing all other ecosystems we share space with in earth’s ecosystem. Within man’s ecosystem we have two critical elements oil and our global financial arrangement.

These two components of man’s ecosystem are absolutely vital and codependent. Economist and cornucopian fail to fully acknowledge there codependence. With the mentioned limits of growth, diminishing returns, and carrying capacity overshoot man must have a healthy and growing energy sector and economy. These two vital areas can fluctuate within a safe range. The issues now with these two vital components are excessive debt and depletion.

The financial system is struggling with debt. Most economic issues today are related to this excessive debt and its relation to our actual physical wealth. Many social ills are related to economic issues. The other critical element oil is in the medium to late stages of depletion. Oil’s cost and quality of energy delivered to economic activity is in a steady decline. The real issue is converging systematic nature of economic and oil stresses.

Systematically the approach to a critical condition is an issues. We are seeing contagions and negative feedbacks from this condition. These negative conditions are system wide but also between oil and the economy. IOW we are approaching a bifurcation event. The key issues is time. Will this be over 10 years or under. This is profoundly important to human time value. The shorter this break period the more critical the ability to mitigate. Little effort is made on long term issues when society is preoccupied with short term issues.

This failure to prepare for and mitigate problems causes them to converge and compound. We are seeing multiple predicaments of problems that are unsolvable. We are nearing a tipping point but that time frame is currently beyond prediction although oil’s depletion can be scientifically projected and serves as a good benchmark. The economy being governed by human nature is anyone’s guess but it appears to be rapidly destabilizing. How much debt is possible? How big can bubbles grow?

Finally the degree and duration of this tipping point is critical. Will we have a recession, depression, and or collapse to a much lower level of economic activity. We just don’t know this outcome. The danger of any break is the dangerous reliance all local have with the complex global. Food and goods are dangerously produced just-in-time and shipped vast distances in complex conditions. A bifurcation of any kind will damage this complex relationship. Food and liquid fuels insecurity and shortages are very dangerous outcomes. There is no historic examples for our condition. We are facing an unknown blinded by denial and delusional growth fantasies.

GregT on Tue, 9th Dec 2014 6:21 am

Tom,

Have you seen this:

http://www.youtube.com/watch?v=iSsPHytEnJM

The IPCC is a governmental body, not a group of scientists. I have read many of the scientists that contributed data to the committee, say that the report has been watered down or conservatively edited.

James Hansen was the scientist that originally came up with a safe limit for global mean temperature rise. His limit was 1 degree C, not 2. It was the IPCC that raised the limit, not the scientific community.

There is no consideration given in the report for a runaway event. 2 degrees is believed by many to give us a 50/50 chance of such an event. 4 degrees C equates to global mass extinction. We are currently on the trajectory for a 6 degree Celsius global mean temperature rise.

Climate change is also occurring much more rapidly than the models have predicted. By the time that the data has been compiled, edited, and released, it is already outdated.

If you really want to know what is occurring and why, there are plenty of resources on the net, written by many of the scientists themselves. I personally wouldn’t trust a governmental panel as far as I could throw it. Governments are not in the habit of releasing factual information.

There unfortunately is more than only an imminent threat of societal collapse, there is an immanent threat of ecosystems collapse. Ocean acidification will also reach a tipping point, which threatens to kill off the phytoplankton in our oceans. Phytoplankton are responsible for 50% of all oxygen generated on the planet. Some 30% comes from the world’s forests. The northern forests in Russia and North America are being wiped out as we speak at an unprecedented rate. There are over a million hectares of standing dead pine forests in British Columbia alone, and growing. The threat of firestorms like those seen in Russia a few years back, is huge.

We are at a crossroads right here, right now. The choices we make in the next few years will determine our children’s futures. It is already too late to stop climate change. It may very well be too late to stop catastrophic runaway climate change. Their world will not be nearly as hospitable as ours has been. The choices we make now will determine what percentage of them will have their lives cut short, or if any of them will survive at all.

Davy on Tue, 9th Dec 2014 6:35 am

Greg, my opinion is an economic crisis is the only option to mitigate AGW. BAU cannot grow anymore. Lifestyles and attitudes can only be changed by crisis. This crisis could be initiated by economic reform. There is no saving the economic system now with debt and oil depletion. An economic crisis will set the descent in motion. The degree and duration are unpredictable. This is a dangerous prescription but the only sound path. It is going to happen anyway. The big question is when. I would say not soon enough for AGW. Either way population is facing a bottleneck.