Page added on May 15, 2015

The Effects Of Increased Oil Well Efficiency

Summary

- Oil rig count has decreased significantly since the start of the oil crash.

- Yet despite this, oil production is still rising.

- Oil well efficiency gains can only last so long.

Introduction

Recently I have written several different articles on the effect of supply and demand on the current oil price situation. However, several people have pointed out that one factor I did not take into account was the increasing efficiency of oil wells. The goal of this article is to analyze the effect of increasing oil well efficiency on oil production.

Oil wells are a hole in the Earth designed to bring petroleum and hydrocarbons to the surface. Gas wells are wells designed to mainly bring gas to the surface. Oil wells vary widely in their costs and the amount of liquids that they are designed to successfully bring to the surface.

Oil Prices

As many of you guys have seen recently, oil prices have taken a major hit. While some people relate this to a variety of large-scale political facts – mainly from Saudi Arabia and Russia, in the end oil prices were caused by oversupply.

As you can see here, oil prices have taken a recent hit recently. The prices of Brent Crude remained stable above $100 per barrel for much of 2011 – 2014 minus a brief drop in 2012. However, starting in mid-2014 and continuing to the present day, oil prices have dropped rapidly from over $100 per barrel to lows of roughly $50 before recovering briefly.

World Fuels Production and Consumption – YIMG

As you can see here, the world production and consumption has remained relatively stable. The last time production significantly overwhelmed consumption was in 2012 when the oil price dropped briefly. Over the last few months, oil production has slightly outweighed consumption which has led to the present oil crash.

Oil Wells

I am sure many of guys have seen this image. This image as continued – and is still continuing. After reaching a peak of over 1600 oil rigs, the number of oil rigs has dropped rapidly. As of May 8, 2015, the number of North American rigs has dropped to 969 compared to the peak of over 1600 – a drop of almost 50%.

Oil Rig Count vs. Production – Wolfstreet

However, I am sure many of you guys have also seen this chart. Despite the rapid decline in the oil rig count, the oil production in the United States has increased significantly since the start of the crash rising almost a million barrels per day, a rise of almost 12%.

Oil Well Efficiency

The reason for this rapid increase in the oil production is due to producers trying to eek out as much production as they can from their wells.

Drilling Performance – Hess Corporation

As you can see in this chart from my article on Hess Corporation, overtime Hess Corporation along with other companies in the same both had experienced consistently increased drilling performance over the years. The result of this is new technology.

In fact, looking at just Hess Corporation, the company has managed to basically double its performance since 2011.

First Full Month Production Per Well – EIA

Looking at this chart from EIA at first full month’s production from Eagle Ford, we can see that while natural gas production has remained relatively constant, oil production for the well’s first month has gone up by a factor of roughly six since 2007.

Now obviously some of this can be attributed to larger wells – obviously overtime some companies would turn to larger more efficiency wells in order to save costs. However, a lot of this increase is due to more efficient technology.

Techniques

Fracking Drilling Technique – Fracking Boom

Different new techniques like fracking have resulted in an impressive amount of oil being lifted to the surface.

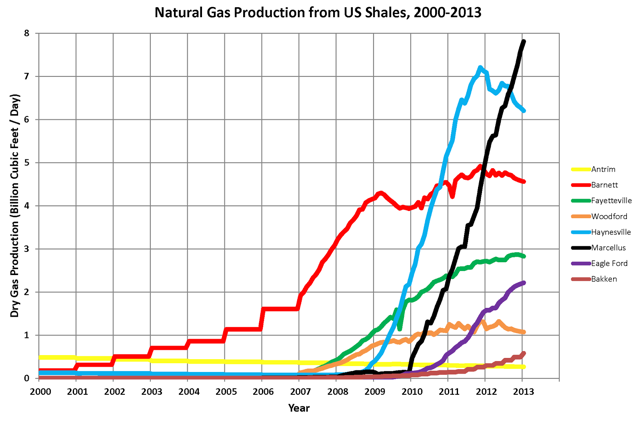

US Shale Natural Gas Production – Wikimedia

The results of such technologies are not to be trifled with. Looking at just dry natural gas production from US oil shale over the last decade and a half we see a significant uptick. Much of this uptick was a result of the 2008 oil crash.

In fact, current US natural gas production stands at roughly 80 billion cubic feet per day. Looking at the chart, just the increase from Marcellus currently covers roughly 10% of the US natural gas production.

Conclusion

Recently, oil prices has dropped significantly. The result of this drop has been many operators turning off rigs in an attempt to save money. This has resulted in an almost 50% decrease in the number of oil wells.

Yet oil production is still rising as a result of this crash. Part of the reason is because of increasing production from wells. Much of this increased production is the result of the new techniques and methods of efficiency.

Eventually, production can only become so much more efficient. At that point – once the supply and demand rebalance the declining rig count will affect the supply of oil. This decreased supply of oil will result in a recovery of oil prices.

43 Comments on "The Effects Of Increased Oil Well Efficiency"

Tom on Fri, 15th May 2015 9:05 pm

Apparently, the way to dramatically increase U.S.oil production is to send all drilling rigs to the barn.

Is it possible that more wells are being drilled from the same site, thus saving time in transporting the rigs to new locations? If so, wouldn’t this drain the sweeter areas faster? Of might longer horizontal wells with more frack stages being drilled, thus enhancing the production of such a well?

Either of these processes would increase efficiency of the wells drilled, but then there are all of the wells that are not being drilled due to lower rig count.

If, however, drilling is to occur in all those abandoned and drained oil fields, someone better start building a whole lot of new oil rigs and training a bunch of drillers (instead of sending them to the unemployment office).

Dredd on Sat, 16th May 2015 5:16 am

Reminds me of some of those executions where they mix the poisons incorrectly and the target dies in a vortex of contortions.

The PPP (poison peddling perverts) want to mix it up and watch the reaction of the planet the PPP has sentenced to death.

They still do not know that they are here too it would seem (You Are Here).

Boat on Sat, 16th May 2015 6:11 am

Efficiency is making huge impacts to Nat Gas and oil supplies in a variety of areas. The end result is over supply and this time it will last awhile.

shortonoil on Sat, 16th May 2015 7:34 am

If a shale well is not completed there is no oil, or gas coming out of it! The author seems to have missed that point. When the price collapsed last year there was some 3,000 uncompleted oil, and gas wells in the US. It is the rate of completions that determines production, not the rate that they are drilled. When completions catch up with previously drilled wells, and new wells are not being drilled production will fall – period.

The completely ignored reason that the shale industry is dying has to do with thermodynamics, not drilling efficiency. These wells hit the “dead state” very rapidly. That is, they go from acting as an oil well to becoming a liquid hydrocarbons well very soon after their production begins. Liquid hydrocarbons, or feedstocks have a limited market. The industry flooded the market with feed stock that now sits in tanks along the Gulf Coast. No one wants it, or can use it so the price for it crashed.

There are other reasons why the price plunged. The price of oil relative to its value to the economy hit an all time high in 2013. Historically, that has averaged about 6%, by 2013 it had risen to 12%. Oil had become over priced by 100%. It is certainly no mystery as to why prices collapsed, and it is no mystery as to why the shale industry is now on its death bed. The only mystery is why someone would believe that drilling efficiencies can change that?

http://www.thehillsgroup.org

eugene on Sat, 16th May 2015 7:51 am

In a desperate situation, many turn to delusional fantasy. Hitler, in his last days, was ordering around fantasy armies. We’re seeing a lot of this type thing now. Actually, it’s normal for many. Other, less “creative” thinkers will very willingly ride along with it.

I see it all over in things like “we need to stop using carbon right now”, “we need to go local/small”, “we need to go nuclear” and a whole range of other last minute desperate measures all while the climate is rapidly changing and the “government” (us) is plunging into ever more debt. And 1.5 million new people each week. Yep, I just know there’s a simple, easy way out of this.

Boat on Sat, 16th May 2015 8:22 am

How can you claim the shale industry is dying? They are just producing more with fewer rigs. The most efficient rigs and crews will be the ones that make the most money. There is no death of shale.

rockman on Sat, 16th May 2015 9:31 am

“Part of the reason is because of increasing production from wells. Much of this increased production is the result of the new techniques and methods of efficiency.” Complete and utter bullsh*t. Yes: the industry had a very successful learning curve from the initial drilling boom. A typical EFS well dropped from 30+ days to less than 15 days. And that’s despite longer laterals being drilled. And advancement in multistage frac’ng made those longer laterals much more productive. And those longer laterals made pad drilling more practical.

But that’s old news: those advances had already been achieved more than a year before the rig count crash. IOW there have been no significant increases in well productivity in more than a year. Unless one works in the oil patch, such as the Rockman, they might not be aware. And yes: the Rockman hasn’t been a shale player. But that doesn’t mean he hasn’t been constantly studying frac tech in conventional reservoirs. In fact just this week he began evaluating a tite conventional oil reservoir that contains 100 million bbls of residual oil at just a depth of 3500′.

But this is why they start those efficiency metrics years ago so they can capture the early gains. They want to give the impression that the efficiency gains are linear and will continue. And not only will they not continue but they’ve already maxed out some time ago. IOW they aren’t going to be drilling 5,000′ lateral EFS wells in 5 days. As the late BB King sang: “The thrill is gone”. LOL.

And everyone here should understand by now that the increased production seen during these early days of rig reductions is the result of the 6 month or so lag time between a rig moving off a well and initial production. Given that we still had a booming rig count as of last December it won’t be until this summer before we see the real effect of the rig decline in the production metric.

Save this article and read it again next December…you’ll get a good laugh. BTW if by some miracle we see booming oil prices again in the next 6 months: the lag time cuts both ways: we won’t see the increased production well into 2016.

Nony on Sat, 16th May 2015 10:48 am

A lot of the remaining “efficiency gain” is just based on “culling the herd”. Essentially, they cross out the marginal projects and keep the strong ones, since price is down. So now the average looks better. But it’s not any development.

There is some genuine improvement of the cost side, but a lot of that is just based on low demand for frac trucks. It’s not a systemic improvement and may not last or at least won’t last if rates of use climb.

All that said, the example of shale gas is interesting. There volumes AND efficiency are up. But I just think natgas is a lot more plentiful and frack-horizontal drilling is much more suitable there (flows easier).

Boat on Sat, 16th May 2015 11:18 am

Roc But that’s old news: those advances had already been achieved more than a year before the rig count crash. IOW there have been no significant increases in well productivity in more than a year.

Those old advancements shook the world and they came at a handy time since our financial system was so riddled with corruption everything almost crashed.

GregT on Sat, 16th May 2015 11:33 am

It never ceases to amaze me how some people manage be so vociferous in their opinions, when they clearly do not have the foggiest idea of what they are talking about.

apneaman on Sat, 16th May 2015 12:19 pm

Don’t you need efficiency in the maintenance of the highway infrastructure too? Gots to make up for that 60 $billion$ shortfall or there won’t be any roads to drive those super efficient vehicles on, fueled by that efficiently extracted petroleum.

…………………………………….

Caltrans Releases Plans Detailing Critical Infrastructure

Funding Shortfalls Facing California’s Highway System

“The 2015 Ten-Year State Highway Operation and Protection Program (SHOPP) Plan outlines a strategy for improving roads, addressing major rehabilitation work on the state highway system and supporting Caltrans’ sustainability goal through projects that bring long-lasting and smart mobility improvements. The plan identifies approximately $8 billion annually needed to fund these necessary improvements and preventative maintenance activities over the next ten years. However, in light of a shortfall of approximately $5.7 billion per year in funding, the plan warns that the state highway system will deteriorate and necessitate much more expensive remedies in the future.”

http://www.dot.ca.gov/hq/paffairs/news/pressrel/15pr042.htm

rockman on Sat, 16th May 2015 3:15 pm

“Those old advancements shook the world and they came at a handy time since our financial system was so riddled with corruption everything almost crashed”. Actually most of the basic frac tech used in 2009+ was available in 2002 as well as hz drilling tech. But oil selling for $23/bbl at that time didn’t justify the effort. What came at “a handy time” to increase US oil production increases was $100+ oil prices. And along with the production boom came an increased oil bill for the US consumer of about about $500 BILLION PER YEAR. And for the world’s oil consumers: an addition $2 TRILLION PER YEAR transferred to the oil producers.

Not exactly “handy” for any one. Except the Rockman et al. BTW I haven’t mentioned it a while…thank all you oil consumers. The Rockman needed to monetize his 40 years of experience and cash out on the high side. In the oil consumption universe there will always be winners and losers. And that distinction will always be based upon the price of oil and not the volume produced. LOL.

Nony on Sat, 16th May 2015 4:31 pm

Interesting that it was so well known, yet not anticipated by people like Campbell, Deffeyes,Heinberg etc. in their early 2000s predictions. They had also predicted very high prices. So, why not predict the use of this technology on these formations?

In addition, many of the peaker types talked shale down as it was coming up (Rune, Picollo, Berman, Hamilton etc.). If the thing was so obvious then why did the miss it? Why underpredict the impact even when it was evident that the trend was occurring?

Davy on Sat, 16th May 2015 5:13 pm

NOo, could you please explain the prices you corns have predicted. These predictions were all over the spectrum. Why is it ok for your corn cabal to make erroneous predictions but not peakers? Are you bias NOo or a hypocrite?

Nony on Sat, 16th May 2015 5:45 pm

Davy, you just don’t pay attention. I have several times conceded this point. Even said it was one of the strongest peaker points (when we were at 100, the whole POD). You just don’t remember it since you don’t have a mind for detail.

P.s. But “POD” took a big haircut. And it is massively hypocritical to say how bad 100+ was, how it indicated depletion of cheap oil, and then not to conced the situation is less dire at 60.

Davy on Sat, 16th May 2015 6:06 pm

Fair enough NOo. Just nice to hear you say so. Go back to what you were doing.

Nony on Sat, 16th May 2015 6:38 pm

I worked out today, no booze, eating healthy, got vitamin Dshine.

Now I’m playing cards on the INternets.

Davy on Sat, 16th May 2015 6:51 pm

Good boy, Noo, relax. Take a break from the difficult task of defying reality to bash peakers. Tomorrow is another day and you can have at us then.

GregT on Sat, 16th May 2015 7:08 pm

Sign up on an internet dating site. Get out and meet some women. Stick to your NYR, and stop your addiction with messing with people on PO sites.

apneaman on Sat, 16th May 2015 7:31 pm

Corn Singles.com

James Tipper on Sun, 17th May 2015 12:19 am

Oh yea, who fucking cares about efficiency when the pricing doesn’t make sense?

http://www.wtrg.com/rotaryrigs.html

This is a helpful website I’ve found that details North American rig count and all it’s various forms. Wells are not being built because even if they were at peak efficiency the pricing doesn’t make sense. The world gov’t and international banks must subsidize and hurl money fast at this project however how disastrous is becomes.

Imagine a Saudi Arabia where the oil becomes more of a liability and a cost then what it’s worth. Where oil exporting nations pay more for subsidizing the industry then the profit in gov’t revenue they receive from it. Or if you look at private oil companies when these projects become not-profitable. It is true that private markets react faster than state run or public ones. No argument there. But the lightning speed at which banks are getting out of fracking and other short term oil projects should be a giant red flag and tombstone for the “future of energy independent America” as if such a thing was ever feasible except for in the American Exceptionalist idiot.

Tom S on Sun, 17th May 2015 6:24 am

Davy:

“NOo, could you please explain the prices you corns have predicted… Why is it ok for your corn cabal to make erroneous predictions but not peakers?”

Nobody can really be faulted for failing to predict oil prices. It’s almost impossible to do so. Who can tell what the Saudis are going to do a year from now? Who really knows whether the situation in Iraq will deteriorate further? Who knows when another war will erupt in the Middle East? All those things are unpredictable and would cause wild swings in prices. As a result, nobody can predict prices, so nobody should be faulted for failing to do so.

The problem, however, is that the doomsday sect gets things wrong which everyone else gets right. Doomers say things like “global shipping will collapse within the next couple of years”, and then the opposite happens. Doomers alone got it wrong. Their thinking is based upon some fundamental misconception, and nobody in the shipping industry thought that, and _only_ doomers got it wrong. Doomers are getting easy things wrong, where successful predictions are actually quite possible.

Also, doomers routinely say their predictions are absolutely certain. They say things like “it’s just a matter of basic thermodynamics” or whatever else, and then it doesn’t happen. They get things wrong even when they think it’s 100% certain.

These things seriously call into question whether this doomsday group has a correct understanding of these issues. It’s not just that they get prices wrong. They get EVERYTHING wrong, even when they’re 100% certain, and even when everyone else gets it right. This has happened over and over again.

Maybe you guys should re-consider whether you have a correct understanding of these issues. It doesn’t appear to me that experts about transportation networks, etc, are saying these things. They might have a better grasp of these issues than Gail the Actuary.

My fear is that you’re going to spend your whole lives preparing for doomsday, over and over again, year in and year out, and then it doesn’t happen. If you just like growing your own food, then great. However I hope you don’t make too many sacrifices.

-Tom S

Davy on Sun, 17th May 2015 6:40 am

Tommy S, the BAutopian spell is strong with you. These things work until they don’t. You are delusional to think this complexity can continue without disruption. You are ignorant of what significant disruption means to BAU. Just look at the mild disruption of 08 then magnify that 100 fold when global food and fuel shortages strike. You are one deluded puppy and a feel sorry for you because you are the type that will be swept away in the melee. The difference between you and me is I hope for better but accept the alternative. I am preparing as one should. Ask any Special Forces soldier how important prep is to his operations then get back to me. You are terrified of the possibility of collapse and choose to live in denial. I am rewarded nicely if I am wrong. You are crushed and chewed up by reality and the truth if you are wrong. I have the possibility of survival at least.

apneaman on Sun, 17th May 2015 7:06 am

Tom S says “It doesn’t appear to me that experts about transportation networks, etc, are saying these things.”

Did you not read the quote and link I posted above from the California transportation experts?

Basically it says there is not enough money to maintain the highways. A 75% short fall. Why do you think that is Tom? See Tom you come here claiming we are making shit up even when one of us has provided the evidence on this very thread. You just refuse to look at it and/or come up with your own special pleading and contorted interpretations. You ALWAYS do this and just keep claiming there is no evidence. Of course there isn’t…..you don’t want there to be any. Your a one trick pony Tom. Same shit different day.

Caltrans Releases Plans Detailing Critical Infrastructure

Funding Shortfalls Facing California’s Highway System

“The 2015 Ten-Year State Highway Operation and Protection Program (SHOPP) Plan outlines a strategy for improving roads, addressing major rehabilitation work on the state highway system and supporting Caltrans’ sustainability goal through projects that bring long-lasting and smart mobility improvements. The plan identifies approximately $8 billion annually needed to fund these necessary improvements and preventative maintenance activities over the next ten years. However, in light of a shortfall of approximately $5.7 billion per year in funding, the plan warns that the state highway system will deteriorate and necessitate much more expensive remedies in the future.”

http://www.dot.ca.gov/hq/paffairs/news/pressrel/15pr042.htm

Boat on Sun, 17th May 2015 9:38 am

Rock, So how long does a fleet of fracking equipment last and does it just get wore out or does fracking equipment get replaced because of the more efficient technology.

Today, nearly nine out of 10 onshore wells – natural gas and oil – require fracture stimulation to remain or become viable. And thanks to the emerging revolution in the development of U.S. shale gas, the technology is poised to play an even more important role moving forward – converting America’s massive, untapped energy potential into the reality of millions of well-paying jobs, billions in state and federal revenue, and a real path to a clean and affordable energy future. This is from haliburton itself. So Rock you call this old tech and haliburton calls fracking emerging….how do I get confused?

shortonoil on Sun, 17th May 2015 9:43 am

“These things seriously call into question whether this doomsday group has a correct understanding of these issues. It’s not just that they get prices wrong. They get EVERYTHING wrong, even when they’re 100% certain, and even when everyone else gets it right.”

That statement is unequivocally incorrect. Our Model has projected the historical price of crude with an average variance of $0.00 over the 1960 to 2009 period. It also projected the 2014 oil price decline a year in advance. We put this graph up in September of 2014:

http://www.thehillsgroup.org/depletion2_022.htm

“Maybe you guys should re-consider whether you have a correct understanding of these issues.”

If you are still attempting to count barrels in an attempt to gain some insight into future developments you are practicing an exercise in futility. Petroleum has never been used because it filled up containers with a black sticky goo. It has been used because it was able to power the world’s internal combustion engines; which is what drives the world’s economies. Petroleum has been the world’s premier energy source since its debut in 1859. Ignoring that aspect of petroleum ignores the main premise of the entire issue. The disposition of petroleum is entirely reliant on it ability to deliver energy to the economy; and that is declining at a precarious rate.

“My fear is that you’re going to spend your whole lives preparing for doomsday, over and over again, year in and year out, and then it doesn’t happen. If you just like growing your own food, then great. However I hope you don’t make too many sacrifices.”

Our Model determines two critical points in the life cycle of petroleum production. 2012, and 2030. 2012 was the energy half way point, the point where the non energy goods producing sector of the economy will never again be able to use all the petroleum that the industry produces. It is the point where it required one-half of the energy in a unit of petroleum to extract, process, and distribute it. It was the point when prices had to begin declining in association with production.

2030 is when the “average” barrel of petroleum will reach the “dead state”. The point where the “average” barrel of petroleum can no longer act as an energy source. Beyond that the “average” barrel has been reduced to at best a feedstock material; it would only serve to produce plastic pipe. We anticipate the the integrated global system that now produces the majority of the world’s oil will have, or shortly afterward will have, collapsed. Producers will no longer be able to make a profit, or have the funds to keep producing. It will designate the end of the oil age!

Such an event will have the most impact on civilization as has been seen since the fall of the Roman Empire. Planning for such an inevitable event can only be considered as prudent. Not planning for it can only be considered as foolish. Over the next five years it will become eminently obvious that the age of oil is coming to an end. The full magnitude of the outcome is yet unknown, the fact that it will occur isn’t! It is merely a matter of investing the time, and effort to grasp the situation that goes beyond ones’ preconceived notions of what the world should look like!

http://www.thehillsgroup.org

Davy on Sun, 17th May 2015 10:47 am

Shorts mention of a dead state around 2030 is an analysis point. In reality system dynamics says the systematic disturbance of a declining energy contribution will cause bifurcation much earlier than in 15 years.

The systematic descent impacts started around 2012. This happens to coincide with shorts half way point for oil mentioned in his above comment. This also occurs around the time the monitarization policies of the central banks hit diminishing returns and were scaled back.

We are now likely in a bumpy descent of an economy stagnating from a financial pullback and decreasing energy affordability of oil from depletion. The next stage is the entropic decay from these two foundational elements to BAU creating failures in other areas.

I am predicting food and fuel insecurity soon. The end game of BAU is near. I recommend preparing accordingly.

GregT on Sun, 17th May 2015 11:24 am

Tom, Tom, Tom,

The 2015 Container Shipping Outlook

According to AlixPartners’ 2015 Container Shipping Outlook1, the global container carrier industry remains challenged entering 2015. Traces of improvements are evident, but they are not significant; and the industry as a whole has yet to demonstrate the ability to sustain them. Operating improvements will likely continue to prove difficult to achieve amid flat or declining demand.

Significant increases in fuel costs during the past decade drove global carriers into a race to build and operate the largest, most-fuel-efficient vessels in order to drive down slot costs. As a result, carriers have taken on huge debt to match the similarly sized price tags of these assets. The market has seen a significant influx of supply as these megavessels came online, but demand has languished, causing a significant imbalance that has plagued carriers looking to right their balance sheets.

Carrier finances saw slight improvements in 2014 as earnings before interest, taxes, depreciation, and amortization (EBITDA) increased, operating expenses reduced, and working-capital management improved. In the same period, asset sales and refinancing initiatives meaningfully reduced leverage. Most carriers are finally reining in their capital expenses, indicating that the race to add larger and larger vessels may be coming to an end. Composite financial distress levels for the sector are only marginally improved year over year.

Looking forward—and due to headwinds related to continued supply and demand imbalances—we expect carriers to struggle to improve financial performance. Recent decreases in bunker fuel prices are welcome but will likely not offer a permanent fix. Carriers looking to change their fortunes should focus on the container shipping business by continuing to divest of noncore assets and by closely scrutinizing the profitability of the markets they serve, the routes they sail, and the customers they conduct business with.

http://www.alixpartners.com/en/Publications/AllArticles/tabid/635/articleType/ArticleView/articleId/1590/Finding-Focus.aspx#sthash.XjKsYfa7.dpbs

GregT on Sun, 17th May 2015 11:31 am

My fear is that you’re going to spend your whole lives preparing for doomsday, over and over again, year in and year out, and then it doesn’t happen. If you just like growing your own food, then great. However I hope you don’t make too many sacrifices.

Why Tom, do you have a ‘fear’ of other people being prepared? Seems a little strange to me.

Northwest Resident on Sun, 17th May 2015 11:42 am

There are lots of Toms in this world. They are aware of the facts and on a subconscious level they know what is happening. But their psychological makeup prevents them from recognizing and dealing with reality. So, they do what nearly all people who live in denial do — they actively attempt to dispute and disprove the very reality that they are so terrified of. Some do it rudely (marmico), some do it humorously and occasionally with wit (Nony), some do it obnoxiously (Plant), some do it just plain ignorantly (cough, hack).

Speculawyer on Sun, 17th May 2015 12:22 pm

Congrats on cashing out on the high side, Rockman. You deserved it. And you’ve provided us all with a great amount of oil patch wisdom for which many of us are quite grateful to have learned.

Tom S on Sun, 17th May 2015 11:32 pm

Apneaman: That source claims that California has decided to under-spend on transportation infrastructure. That just has nothing to do with collapse and doesn’t even mention the possibility of collapse.

GregT: You are severely cherry-picking. Type in “shipping container growth” into google and click on any of the first 10 graphs which comes up, and it will show that shipping volume has increased tremendously in the last five years, precisely when it was supposed to have collapsed to zero. Shipping demand may taper off or languish this year (who knows) but for the last six years it has done the opposite of what doomers confidently predicted.

Shipping volume has grown rapidly for the last six years. A tapering off of that growth is _not_ collapse and certainly is not confirmation of what doomers had predicted.

NR: It is simply not a valid response to engage in the kind of pop psychoanalysis you are doing. That is a basic ad hominem error, and provides no explanation for why the predictions have all failed so badly.

Guys, I’m sorry, but this is just a classic unfalsifiable pseudoscientific group. This is just a textbook case of it. You guys interpret _anything_ as evidence in favor of this theory, which is just classic unfalsifiability and means it’s not even a valid theory. You are responding to any challenge to this point of view with reflexive pop psychoanalysis, which is a basic ad hominem logical error, and is not a valid response to the question of why the predictions have failed. This stuff is based upon severe misconceptions about transportation networks, the economy, etc. This stuff just does not satisfy the most elementary criteria of a valid theory.

I realize I’m wasting my breath here, but civilization is not collapsing for these reasons and you are going to throw your lives away on nothing. It has been ten years already. That is long enough. It is long overdue that you start asking why the predictions keep failing so badly. It is NOT a valid response to engage in rambling name-calling and pop psychoanalysis.

-Tom S

Tom S on Sun, 17th May 2015 11:49 pm

Hi short,

“Over the next five years it will become eminently obvious that the age of oil is coming to an end.”

I just want to be clear about things here. If oil prices do not decline to $12 per barrel over the next five years, then that means your theory was incorrect. Is that the case?

I’m just speaking hypothetically here. If, in five years, the price of oil has not declined to $12 per barrel, then that means there is something wrong with your theory. Is that right?

I’m not trying to group you in with everyone else. I just want to make sure that not every outcome is treated as confirmation of the theory.

-Tom S

apneaman on Mon, 18th May 2015 12:31 am

Tom If you have evidence to present then present it. I’m well aware of how google works. I notice that the only link you ever provide is usually to your own blog. You are your own source lol. Whenever I make an assertion I almost always provide back up – not tell people they can find it on google. A little vague and amateurish don’t ya think? That’s like handing in an essay to your professor and the reference page just has the words “Google it”.

BTW Tommy boy whatever is in those alleged containers does not seem to be contributing to the 70% consumer economy. Maybe like all the unsold cars it is sitting in a warehouse collecting dust. Appearances must be kept up?

Major U.S. Retailers Are Closing More Than 6,000 Stores

http://www.zerohedge.com/news/2015-05-02/major-us-retailers-are-closing-more-6000-stores

2015 Store Closing Roundup: Radio Shack, Wet Seal, Sears, Target, etc.

U.S. Retail Chain Store Closing Plans and Total Numbers – U.S. and Global

http://retailindustry.about.com/od/USRetailStoreClosingInfoFAQs/fl/All-2015-Store-Closings-Stores-Closed-by-US-Retail-Industry-Chains_2.htm

Tom S on Mon, 18th May 2015 1:01 am

Hi Apneaman,

“Whenever I make an assertion I almost always provide back up – not tell people they can find it on google.”

OK, here:

http://cdn.theatlantic.com/static/mt/assets/business/clarksons-container-growth7.jpg

That shows that shipping container volume had been growing by 10.8% per YEAR, which is the opposite of the collapse which doomers had predicted.

“Appearances must be kept up?”

That is exactly the kind of unfalsifiability I was talking about. If shipping containers are down one year, it’s a sign of collapse. If shipping containers are UP, then it’s also a sign of collapse (“appearances must be kept up”). In which case, the theory is unfalsifiable and does not meet the minimal criteria of a valid theory.

“2015 Store Closing Roundup: Radio Shack, Wet Seal, Sears, Target, etc.

U.S. Retail Chain Store Closing Plans and Total Numbers – U.S. and Global”

Again, that is exactly the kind of unfalsifiability I was talking about. You are interpreting ANYTHING as evidence in favor of your theory. You are interpreting store closings from horribly obsolete stores such as “Radio Shack”, “Sears”, etc, as evidence of your theory. Again, that violates falsifiability.

You are also severely cherry-picking again. Radio shack may be down, but purchases through Amazon are up. There have ALWAYS been store chains that are shrinking, while others are growing. If you count something that is always happening as evidence in favor of your theory, then (once again) your theory is not falsifiable and fails the most elementary criteria of a valid theory.

“I notice that the only link you ever provide is usually to your own blog.”

That’s because this stuff is so obviously wrong to actual experts that they don’t even take it seriously. They don’t even mention it.

-Tom S

apneaman on Mon, 18th May 2015 1:57 am

“Appearances must be kept up?”

Tom that symbol at the end ???? is called a question mark. That means it is not a statement or assertion. Questions are neither true or false. Calling a question unfalsifiable is nonsensical. Your trying to straw man me Tom. Tricky Tom.

“actual experts” what ones Tom? dismissiveness (your so wrong it’s not worth my time) vagueness and appeals to authority (unnamed untitled experts). Also stop saying “my theory” that’s another little trick you like to play. Find an error with a blog commenter and claim it disproves all the evidence that many professionals have been presenting for years on peak oil or run away climate change or economic collapse. That is the real cherry picking.

What about this expert Tom. Professor Sergey Kirpotin director of the BioClimLand Centre of Excellence for Climate Change Research in Tomsk. He has a name and a title and publishes his data. What do you say Tom? Is he just another Doomer?

Carbon time-bomb in Siberia threatens catastrophic climate change

A DEVASTATING and sudden acceleration of climate change which is currently being sparked could result in “awful consequences”, a leading scientist has warned.

http://www.express.co.uk/news/nature/576581/Climate-change-global-warming-Siberia-weather-shift?utm_content=buffer61b75&utm_medium=social&utm_source=twitter.com&utm_campaign=buffer

apneaman on Mon, 18th May 2015 3:44 am

Tom what would you suggest this staggering number of consumer citizens with no jobs is evidence of? I know your favorite expert econo priests have tried to explain it away, but only the faithful such as yourself actually believe in that pseudo social science anymore. Maybe those shipping containers are full of blank SNAP cards?

33% of Americans out of workforce, highest rate since 1978

“The number of Americans aged 16 and older not participating in the labor force hit 92,898,000 in February, tying December’s record, according to data released by the Bureau of Labor Statistics (BLS).”

“The last time the labor participation rate dropped below 63 percent was 37 years ago, in March 1978 when it was 62.8 percent.”

http://rt.com/usa/238697-americans-labor-jobs-report/

apneaman on Mon, 18th May 2015 3:56 am

Tom S, what’s it all mean Tom? What is your theory?

……………………………………………….

Dismal Retail Sales Numbers Suggest Recession Likely Underway: Overall +0.0%, YoY +0.9%, Department Stores -2.2%

“Autos are now the only thing keeping retail sales positive year-over-year. And auto sales are driven by subprime loans. How long is this party going to last?

Who wants a car, needs a car, can afford a car, and can get a car loan?

Retail Sales Flashbacks

January 14 – Economists Still Upbeat: Retail Sales Drop Seen as “Blip”

February 13 – Economists Blame Weather: Retail Sales “Unexpectedly” Decline; December Revised Lower, GDP Estimates Follow.

April 14 – Experts Confounded: Retail Sales Rise First Time in Four Months, But Weaker Than Expected.”

http://globaleconomicanalysis.blogspot.jp/2015/05/dismal-retail-sales-numbers-suggest.html

Davy on Mon, 18th May 2015 5:13 am

Tommy Boy, you sound scared and worried. You are desperately trying to prove us wrong but you really have little to support your claims. You are trying to discredit the doomers but you have little to show us. What you show us can be applied back on you and your message. I call it flip logic or message vagueness.

My point with my doom salad is to elicit concern. We have profound issues with our basic foundational support primarily with oil and the financial system. The global ecosystem is in decline and failing in multiple locals. Climate is showing sign of destabilization. We are not collapsed as a global human system and global ecosystem but we show every indication we are in a collapse process not a growth process.

A prudent course of action calls for determining the risks and doing risk management. We should try to determine a where, when, and how we may see our vital support systems decay or fail. We should prepare a plan for this decay and failure. What could be more basic than that? This is something insurance companies do. It is something a Special Forces unit would prepare for. It is basic common sense of someone with maturity and foresight.

Tom, you are wasting your breath and our time. It is OK to entertain you with a small amount of our time. It is OK for us to debate with you but you are obviously in cognitive dissonance. I am more than willing to listen to the cornucopians and their BAUtopian hopium. That is some Davy doom salad speak. In plain English show me real optimism and supportable facts that all is well. Don’t show me distorted, manipulated, and goal seeking. We doomers here are smart enough to know we smell a rat with BAUtopianism. We know the authorities are in a broad based lie.

Tommy Boy, why don’t you get back to us when you have real and solid optimism. Get back to us when you can make a contribution. You have not shown us anything worth our time. You are just being a troll type trying to discredit our legitimate search. The onus is on the cornucopains to prove their vision of a future is safe and secure. There is too much at stake.

If the corns cannot provide us with a safe future then plan B’s are in order. If these plan B’s do not include the system as a whole IOW the global system that supports all our locals then we must plan lifeboats for our locals. Since time is short and preparations short term and longer term action is warranted.

Your act of saying no effort need be made is dangerous. In fact it is morally wrong to mislead people not to be concerned for their safety and security. You are preaching a story that may leave people hungry, cold, and exposed to hardship or worse possibly death. Preparations for the dangers ahead is hurting no one. These activities are good solid activities that are far better than poor attitudes and lifestyles of many of the BAUtopians who would rather play with their toys thrill seeking.

It is one thing to be a corn and admit the dangers ahead then be honest and say I want to enjoy may last days. I have no interest in prep because I feel there is no use. That is a legitimate attitude. Where these attitudes are wrong is to enjoy life and say there are no problems all will be well. That attitude is delusional and dangerous. This is precisely the general attitude we are trying to change.

Those who don’t know better can’t be blamed. The deception in the system is so great from the mainstream media effort at selling a message that is at all levels of society. Tommy Boy, you are wrong to try to discredit us so I am discrediting you as a shame and a fake. Climb back into your hole and leave us be here.

Tom S on Mon, 18th May 2015 5:46 am

Davy,

“Preparations for the dangers ahead is hurting no one.”

Sure. But maybe you should just stockpile a couple of years of canned food and then leave it at that and enjoy your life. You have a lot to lose if you sacrifice everything and then collapse doesn’t happen. Collapse isn’t going to happen overnight anyway.

“Climb back into your hole and leave us be here.”

Okay. I’ll leave you be.

-Tom S

marmico on Mon, 18th May 2015 5:54 am

Autos are now the only thing keeping retail sales positive year-over-year

What a crock of shit! Shedlock is a doofus. He could have just as easily said Food Services & Drinking Places are now the only thing keeping retail trade positive year-over-year.For instance. Retail trade ex-gasoline stations is up +3.6% year over year.

Hotel occupancy is booming, revenue passenger air miles are at record levels.

Davy on Mon, 18th May 2015 6:04 am

Tommy, who is saying sacrifice everything? I think your problem is you are too lazy to do anything or unable to do anything. This causes you to criticize others who are proactive and able to do something. Dooming is recognizing we are not safe. This is generally a pessimistic attitude. The prepping is the optimistic response that has actual benefits and also the placebo of giving one a degree of peace of mind.

The sacrificing everything you mention is only the case from those who may take drastic actions that puts them and their family at financial or bodily risk. People take drastic actions for a whole host of reasons singling out prepping is a poor choice. If someone is taking drastic action to go discover gold I would agree with you. For the most part prepping involves good solid constructive activities. These include staying healthy, growing food, and changing people attitudes and lifestyles. What is wrong with that Tommy?

No, Tommy you are a duck out of your water on this one. You can argue the particulars of a situation we say points to collapse but you say is not a danger. I accept that but coming on here and saying all is well and you should do nothing is delusional and dangerous. You are wrong Tommy and should be ashamed of yourself for using your own insecurities to influence other not to prep so you feel less cognitive dissonance.

Davy on Mon, 18th May 2015 6:13 am

Captain Marm is back in port and in the saloon drinking his hopium brew and spouting off the hole in his face. Captain when you can come on here and show us unequivocally everything is fine then I will worship your false god. In the meantime will you explain why the fed can’t raise rates? Can you explain how all the debt is going to be managed let alone be paid off? What about all the unfunded liabilities at every level. Are you going to tell me climate change is not real? Tell me there is no cold war and geopolitical dangers in the ME.

The captain is a drunkard and a blowhard. Where you been lately captain? You been too depressed to muster your rants. Even drunkards sober up eventually for various reasons. Now you’re back on the sauce and back on PO board stirring shit up. The NOo will be happy he has been all alone here fighting to keep the lie alive. He will appreciate the help from his drunkard buddy.