Page added on January 20, 2017

Explorers in World’s Fastest-Growing Oil Market Seek Tax Breaks

Explorers in the world’s fastest-growing oil market are seeking lower taxes on crude produced domestically to encourage fresh drilling as India tries to reduce its dependence on energy imports.

State-run Oil & Natural Gas Corp. and the biggest private producer Cairn India Ltd. want Finance Minister Arun Jaitley to at least halve the tax on crude oil production in the federal budget due Feb. 1. India surprised some explorers last year with its 20 percent levy on crude produced locally, moving from a fixed charge. Companies pay more now with crude near $50 a barrel than they did under the old system when it was double the price.

“Globally, given the low oil price scenario, governments have provided incentives to stimulate and attract investments,” said Sudhir Mathur, interim chief executive officer at Cairn India. “In India, the cess rate of 20 percent acts as a disincentive to increase production and commit incremental investments.”

Attracting investments to boost output from local fields is key for Prime Minister Narendra Modi, who has made energy security a priority and set a target of cutting oil imports by 10 percent in the next five years. Reducing the levy will help explorers including ONGC and Cairn India, which Oil Minister Dharmendra Pradhan estimates will spend $25 billion by the end of this decade.

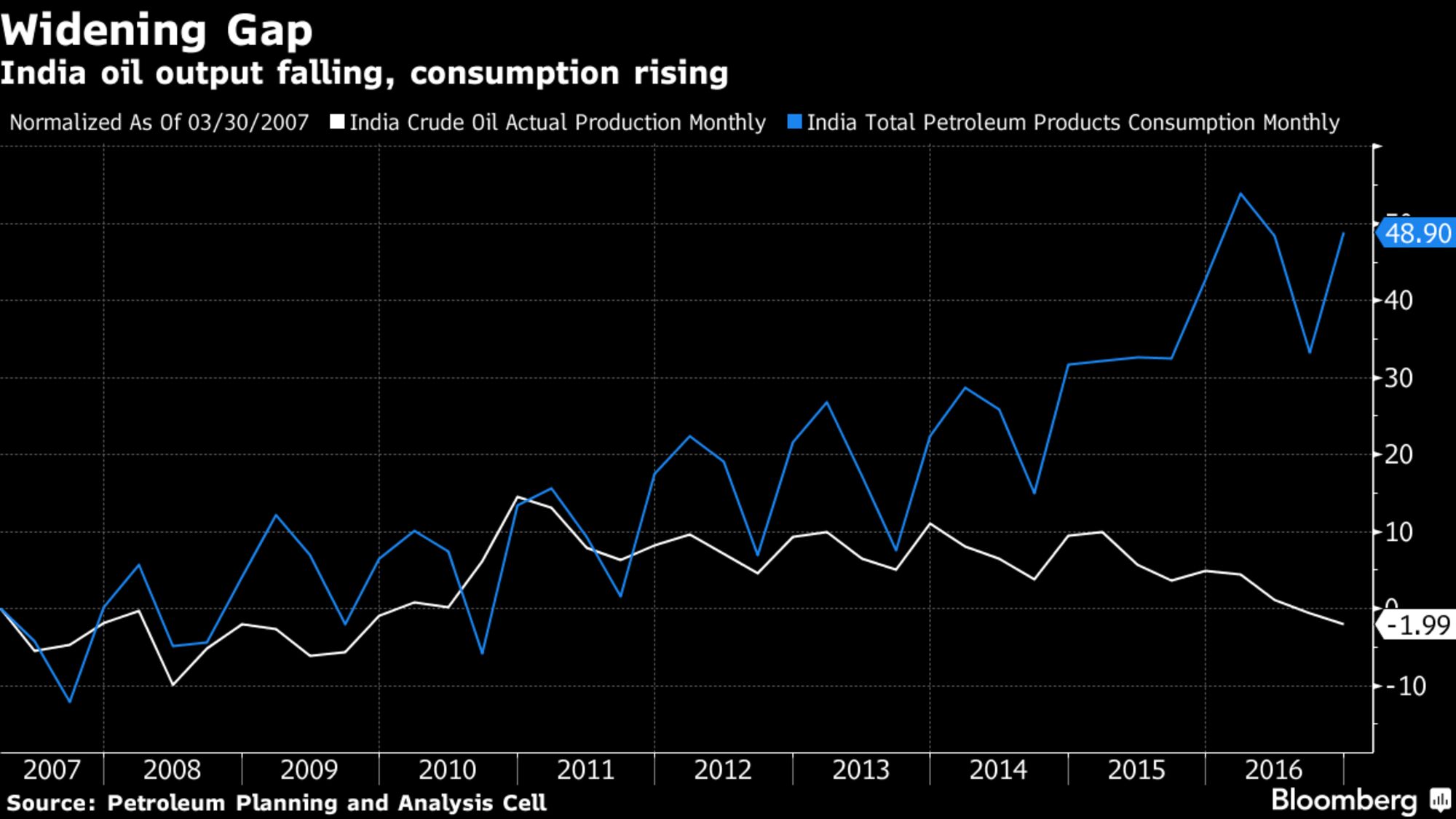

India’s hydrocarbon resources are highly undeveloped and production has been declining for the past several years, prompting the government to nudge companies to invest in reversing the fall and increase energy supplies.

New Delhi-based ONGC is spending over $5 billion for its biggest development plan in a deep-sea block in the Bay of Bengal off the country’s east coast. Cairn India also plans to spend as much as $4 billion over the next few years to drill for oil.

Asia’s third-largest economy meets about 80 percent of its crude oil requirements through imports.

“We need some money to be left behind so that we are able to flow back into the investment cycle,” said A.K. Srinivasan, finance director at ONGC, the nation’s biggest explorer. “Otherwise there will be cash shortage. Already, we are going to run cash shortages.”

At a price of $55 a barrel, ONGC may have to pay about $11 as cess, compared with $9 when prices were $100 a barrel and the tax was fixed charge, he said. “With crude prices firming up, the cost impact of this tax is quite high.”

Brent oil prices have risen about 17 percent since the Organization of Petroleum Exporting Countries’ agreed in November to cut production for six months starting in January. The fuel traded above $100 as recently as September 2014.

Firming crude prices may also allow the government to reduce the levy on retail prices for gasoline and diesel, according to Dhaval Joshi, an analyst at Emkay Global Financial Services Ltd.

India didn’t pass on to consumers the entire benefit of crude’s price decline from July 2014, increasing excise duty on the two fuels nine times and mopping up about 960 billion rupees ($14 billion) in the previous two fiscal years.

The government may now look at easing prices as one way of cushioning the impact of its Nov. 8 ban on high-denomination currency notes, which impacted the rural population the most, as it prepares for five state elections this quarter.

The consumer price of diesel, the most-used fuel in the country, is at a record while that of gasoline is at the highest since August 2014, according to state-run fuel retailer Indian Oil Corp.’s website.

“Yes, taxes have come and we have not hidden it,” Pradhan, the oil minister, said in New Delhi on Jan. 16. “If the prices start pinching the consumers, we’ll see.”

11 Comments on "Explorers in World’s Fastest-Growing Oil Market Seek Tax Breaks"

rockman on Fri, 20th Jan 2017 5:30 pm

The trick to throwing in tax breaks is to cap them in a reasonable manner. Years ago (under President Clinton) the feds reduced royalties on new Deep Water GOM leases. It worked: a lot more drilling/production then would have happened otherwise. But given the many years between leasing and first production prices increased considerably. Pissed a lot of folks off. The leases should have had a floating royalty schedule to allow for such a development but they didn’t. Essentially an oversight between draft revisions. Some suspected intentional but given we had D POTUS Congress didn’t look too close.

Anonymous on Fri, 20th Jan 2017 5:34 pm

Explorers in World’s Fastest-Growing Oil Market Seek Tax Breaks

Mmmm, let’s fix this title up a little, make it more, truthful. Jewberg can only afford fake-news writers after all.

Explorers in World’s Fastest-Growing Oil Market seek SUBSIDIES.

Better….

Nony on Fri, 20th Jan 2017 5:44 pm

US rig count just went up 37 rigs. Holy shit.

http://www.reuters.com/article/us-usa-rigs-baker-hughes-idUSKBN1542GW

Nony on Fri, 20th Jan 2017 5:51 pm

Actually 35 rigs. Still, whisky tango foxtrot?

Boat on Fri, 20th Jan 2017 6:46 pm

Rock,

Coal use has dropped in TX with more to come.

http://tcaptx.com/policy-and-reform/report-on-the-ercot-market-wholesale-energy-prices-decline-in-2015-wind-power-share-increases

Are you ready to call the US increase in rigs and production a trend yet?

baha on Fri, 20th Jan 2017 8:06 pm

Oh, cry,cry,cry. I you need some power I can hook you up with solar. And I don’t need your stupid subsidies. I have a future.

rockman on Fri, 20th Jan 2017 10:45 pm

Boat – “Are you ready to call the US increase in rigs and production a trend yet?” Perhaps you haven’t been paying attention but the rig count trend has been increasing for quite a while. And no matter how many times you repeat it US oil production DATA has been on a slightly undulating plateau for the last year. The future trend? As I said earlier we can look back at the end of the year and see if that trend changed.

Sissyfuss on Fri, 20th Jan 2017 11:47 pm

You’re asking Boaty perhaps, Rock? Really?

rockman on Sat, 21st Jan 2017 10:02 am

Sissy – Just responding to the pirogue’s post. LOL.

“The Cajun pirogues are usually flat-bottomed boats. Pirogues are light and small enough to be easily taken onto land. The design also allows the pirogue to move through the very shallow water of marshes and be easily turned over to drain any water that may get into the boat.”

IOW a design that allows one to barely skim by when navigating difficult areas. LOL.

Sissyfuss on Sat, 21st Jan 2017 11:31 am

Oh, a boat designed to operate in a shallow manner.

Kenz300 on Sat, 21st Jan 2017 11:53 am

It is time to end all Fossil Fuel subsidies.