Page added on November 26, 2016

E is for EROEI

Understanding EROEI – or Energy Return On Energy Invested – should be on every school curriculum, but isn’t. Simply put, it’s the amount of energy we as a species can play with. Back in the days when you could poke a hole in the ground and oil would gush out of it skywards, getting hold of plenty of energy was easy. In fact, for every blob of oil you used for locating, drilling and transporting the stuff, you got between 100 and 200 similarly-sized blobs of the same quality back. The way this energy value was expressed was by way of EROEI; thus, sweet onshore crude oil could be said to have an EROEI of 100 to 200. These were the low hanging fruit days that made the 20th century boom.

Once all the low hanging fruit was gone we had to move a bit further up the tree. Oil and coal and natural gas were still abundant but they needed more work to get at. They also needed more processing, transporting and all the rest of it. Because of this, the net energy (i.e. energy return minus energy expenditure) available to us was lower. We invested one blob and got considerably less than 100 back. In other words, the energy we invested in unlocking fossil fuels needed to be higher just to get the same amount back that we were used to, meaning the EROEI was falling.

Of course, fossil fuels aren’t the only forms of energy. Nuclear was thought to have a high EROEI, but once you took into consideration the entire process of building the power stations, mining the uranium, decommissioning the plant and storing the waste, the EROEI shrivelled up like dead fish in the sun at Fukushima Beach.

Renewables also have relatively low EROEI values compared to early oil. Note, however, that EROEI has nothing to do with money. Getting EROEI mixed up with EROI (Energy Return on Investment) is a common mistake. One deals with the immutable laws of physics and the other deals with the infinitely manipulable world of finance – and only one of these sets of conditions is negotiable.

So what would be the average EROEI value of oil discovered today? Unfortunately nobody can seem to agree on an exact figure, but you can be sure that it’s a lot lower than 200. 20 perhaps. In fact many insist that fracked shale gas and tight oil have such a low EROEI they are only viable as a commercial operation when financed by Wall Street Ponzi schemes. Biofuels, such as ethanol, have disastrously low EROEI numbers – in many cases they are less than 1. When you put more energy into something than you get out of it then it can no longer be regarded as a fuel source. Nevertheless, biofuel volumes are often added to ‘total liquids’ figures, implying they are an oil substitute when clearly they are not.

People will often say that ‘the world is awash with oil’ because they see it on the news all the time. They see no reason to think scarcity exists – everywhere they look they see abundance. However, there’s a problem with this kind of thinking, and the problem is that our net energy levels are shrinking. Yes, shrinking! We can cover the world in wind turbines, solar panels and fracking wells, and we still can’t escape the shrinkage problem. We might be producing, say, ten million barrels of oil per day – which looks great on spreadsheets and in news articles – but what good is that if we are then spending the bulk of it to do more drilling to get at more oil that will have an even lower EROEI value?

Which leads us to the crux of the problem. The modern world was set up to run on high EROEI energy. Take a look around. All those roads, airports, microproccesor factories, mechanised agricultural systems, globalised supply chains and space programmes require a huge throughput of energy. But we are running out of high EROEI energy, and will soon have only low EROEI energy to play with. Which begs the question: at what average level of net energy will the modern world cease to be a viable option? In the past, when high energy fossil fuels were abundant, you could always throw more money and energy at problems and expect them to go away – and usually they did. But this option itself is now going away. What will we do?

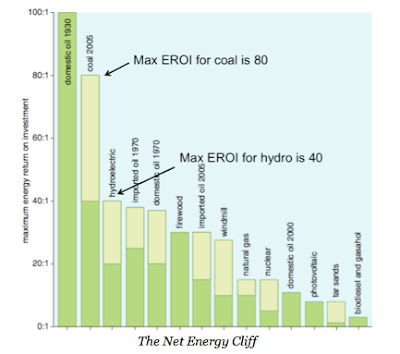

Here’s a chart showing estimated EROEI values for different energy sources (source unknown).

Proponents of renewable energy will say that we can simply swap out the old system for a new ‘clean and green’ one. We’ll all drive electric cars, live in solar cities and our lifestyles will not be much different to what they are today. This vision ignores many of the other limits to the system, and would still permit the continued destruction of the planet’s life support systems, albeit in a more ‘green’ fashion. That’s not to say that renewable energy isn’t extremely useful – especially in a locally-distributed way – just to recognise some of its limits.

On the other hand, fossil fuel dinosaurs claim that we should just go all-out for oil and gas and coal. If there’s such a thing as EROEI or global warming or acidifying oceans then they don’t want to hear it. We should be fracking the living daylight out of the planet, building pipelines and fighting wars to get ‘our’ oil out of the Middle East. These people are a type of modern day cargo cult and as such, are quite dangerous. Many of them are politicians and leading businessmen.

There’s a third category, too. The techno cornucopian optimists insist that a new technological breakthrough is just around the corner that will allow us to live like we do with no interruption to service. Haven’t you heard there’s a government conspiracy to cover up the availability of free energy? Or that if we can send robots up into space to mine comets for uranium we can have endless energy? Selling dreams is a profitable business, and the most successful of these people have MBAs and hire the best PR staffers. I myself once pretended to be one just for fun and have had several requests for an investment prospectus from people with money.

So what is likely to happen as these groups fight it out amongst each other while, all along, the needle on the global EROEI fuel tank moves into the orange zone? Perhaps it will be like the hand of God slowly turning down the dimmer switch on industrial civilisation. Because the more energy we USE simply to GET energy, the less energy is available for the rest of society to use. And this manifests itself in many different ways, but it all comes down to lower available net energy. Already we are seeing demand destruction and lower energy use as the former consumer classes struggle to be able to afford as many goods and the corresponding energy they use. Heavy goods vehicle traffic levels have fallen over 6% across the UK in the last decade, councils are turning off streetlights at night, and homeless levels in the US are spiking. Sweden is encouraging its citizens to refurbish goods instead of buying new ones, malnutrition in children is becoming common in the developed world and 30-something Britons possess half as much as 30-somethings did only 10 years ago [*See links below]. These are just some signs that the big squeeze is on, and it’s getting tighter and tighter with each passing year.

Links to articles:

HGV traffic levels falling across UK

Councils turning off streetlights

Number of homeless people over 50 in US spiking

Sweden encourages goods refurbishing

Malnutrition in UK children

30 something Brits have less than half of 40 somethings at same age

UK hits “Peak stuff”

If you’re under 30 – bad luck – you’re screwed

19 Comments on "E is for EROEI"

dave thompson on Sat, 26th Nov 2016 3:51 pm

This is a well written article and I would like to see this information more widely shared. The demand destruction biz at the end I disagree with, all the oil, gas and coal produced is burned up eventually. For those of you in the world that cannot afford to burn FF, there are others that can, will and do. The so called glut will (is?) going away and when it does the prices will go back up,crashing the economy sending us further on the roller coaster ride of depletion.

peakyeast on Sat, 26th Nov 2016 4:05 pm

I believe we saw this article a short while ago.

As I pointed out back then…

“Here’s a chart showing estimated EROEI values for different energy sources (source unknown).”

And then the chart shows EROI (and even is labeled Energy Returned on Investment).

“Note, however, that EROEI has nothing to do with money. Getting EROEI mixed up with EROI (Energy Return on Investment) is a common mistake. One deals with the immutable laws of physics and the other deals with the infinitely manipulable world of finance – and only one of these sets of conditions is negotiable.”

Yep – even this article does it – again. LOL…

rockman on Sat, 26th Nov 2016 5:29 pm

Peaky – And again a total misrepresentation of the EROEI to drill wells decades ago. The very high EROEI would represent the energy used to drill the DISCOVERY WELL…not all the DEVELOPMENTS WELLS. Yes: in the 40’s and 50’s much larger FIELDS were discovered in the onshore USA. Remember the Eagle Ford and Bakken are not FIELDS but TRENDS consisting of many fields.

But those big old fields didn’t recover all that oil from that single discovery well. It took many dozens, and in some cases many hundreds of individual wells, in a single field. There were many tens of thousands of wells in Texas that individually did not recover 400,000 bbls of oil as some EFS wells will let alone DW GOM wells that will recover 10+ million bbls EACH.

Here’s chart that is sure to shock everyone. What would you guess the highest bbl per day per oil in the US was since the early 50’s: 400 bopd? 600 bopd, more? It must have really been high if the typical EROEI FOR EVERY OIL WELL in the US, right?

The US peak bbls/day/well was in 1971. Wait for it…wait for it…less then 20 bopd per well. Scan down this article for the chart:

http://www.ogj.com/articles/print/volume-112/issue-11/drilling-production/new-well-productivity-data-provide-us-shale-potential-insights.html

And want some official numbers from the Texas Rail Road Commission going back to 1935:

http://www.rrc.state.tx.us/oil-gas/research-and-statistics/production-data/historical-production-data/crude-oil-production-and-well-counts-since-1935/

Throughout the boom times in Texas oil exploration during the 30’s tbru 50’s when all those huge EROEI wells were drilled the AVERAGE production PER WELL was less the 25 BOPD.

Take these stats in for a moment. In 1953 there were 142,000 wells in Texas that produced 1 BILLION BBLS OF OIL that year. But that was only 19 bopd per well. And each one of those wells took as much energy to drill as it took to drill each field’s discovery well. You wanna guess how much energy it took to drill and complete 142,000 wells?

How many times have you read some MORON spouting off about how easy oil was to find in those “low hanging fruit” days of super high EROEI’s? Morons that didn’t take 60 seconds to do a web search to get the FACTS. All they do is repeat what every other moron writes. Oil was never easy to find…never. But in the old days if you did get really f*cking lucky and drilled a discovery it was much larger then the typical discovery made today. Bigger discoveries that took a sh*t load of development wells to produce.

A sh*t load of development wells that took an even bigger sh*t load of energy to drill. LOL

dave thompson on Sat, 26th Nov 2016 5:31 pm

Good point peakyeast, I did not notice that error, however, the chart shows ratios of energy extraction/net energy. I have seen this before too. The chart should read as “EROEI”.

Cloggie on Sat, 26th Nov 2016 6:05 pm

The diagram in the article reads “net energy cliff”, but that term is reserved for another diagram:

http://resourceinsights.blogspot.nl/2008/09/net-energy-cliff.html

Furthermore the values for EROEI displayed in the diagram are deceptive and variable and change in time, for instance as a function of technological progress or decay of the quality of fossil fuel.

Hydro=40 is way too low. Once you have build a hydro-power station no further energy inputs are necessary and you can harvest ad infinitum, apart from maintenance, potentially with no limit for the value of EROEI.

EROEI of solar panels is very dependent on location, provided you assume a fixed lifetime of say 30 years.

peakyeast on Sat, 26th Nov 2016 6:31 pm

@rock: Thanks a lot !! I love your comment.

Just one slight problem: The ogj.com link seems to require a subscription.

But the rrc.state.tx link is nice – and funny(to a silly foreinger) that its the “railroad commission of texas” publishing these things.

Interesting to see the average bpd settling at about 6.5 and then shooting back up to 10-14 bpd in 2014.

Anonymous on Sat, 26th Nov 2016 6:57 pm

Love how this topic always send the rockman over the energy cliff. I know, rocky, only MONEY matters, not energy, or resources. Dollar bills, with dead slave-owning presidents on them. Thats the only metric that will ever matter. Unlike oil, or oil-like substitutes, the uS ‘fed’ has infinite reserves of dollars yet to print. TexASS? Not so much.

Energy in vs Energy Out. Clearly only a moron counts net energy available to society. ‘Real(oil) men'(tm), only look at their bank accounts and size of their backyard compared to everyone else.

peakyeast on Sat, 26th Nov 2016 7:02 pm

@cloggie: The solar panels I have purchased has an energy payback time of 2 years according to the documentation.

As GHung has told ud his panels from – I think it was 1970 – are still going strong.

I makes me hope and think that the EROEI on the panels are above 15. Then there is the inverters, framing, wiring and so forth to drag it down again.

How much? I have no clue!

rockman on Sat, 26th Nov 2016 7:38 pm

Peaky – “It is the oldest regulatory agency in the state and one of the oldest of its kind in the nation. The Texas Legislature established the commission in 1891 to regulate the booming railroad industry. The commission began to regulate oil production in the early 20th century as the industry started to boom in Texas. By the mid-1930s, Texas flooded world markets with so much oil that its price plummeted globally, prompting the federal government to impose limits on production at each well, a responsibility granted to the Railroad Commission in Texas.

The commission had exceptionally strong influence over world oil prices from the 1930s through the 1960s but was displaced by OPEC after 1973. In 1984, the federal government assumed regulation of railroads, trucking and buses, but the Railroad Commission kept its name. The TTRC has an annual budget of $79 million and focuses entirely on oil, gas, mining, propane and pipelines, setting monthly production quotas.

In 2013, a bill to reform the agency and update its name failed to pass the Texas legislature.”

We are a sentimental lot. LOL. And yes: anytime the TRRC decides it can force Texas operators to reduce the production rates of their oil wells.

dave thompson on Sat, 26th Nov 2016 9:08 pm

Rockman;”The commission had exceptionally strong influence over world oil prices from the 1930s through the 1960s but was displaced by OPEC after 1973″. My understanding was that the US hit peak oil production in 1970 and the Texas RR commission no longer had any pull on world oil price.

GregT on Sat, 26th Nov 2016 10:13 pm

@peaky,

“The solar panels I have purchased has an energy payback time of 2 years according to the documentation.”

I guess that all depends on how far down the rabbit hole one is willing to look, and/or how one defines energy invested.

rockman on Sat, 26th Nov 2016 11:50 pm

Dave – “My understanding was that the US hit peak oil production in 1970 and the Texas RR commission no longer had any pull on world oil price.” What the commission had control over was the amount of oil Texas wells were allowed to produce. It did so by setting the “oil allowable” every 30 days: what % of a well’s production capability it could legally produce. Since Texas was essentially the global oil exporter at the time this exerted a great deal of influence on global oil prices. Which is why you see very stable oil prices for most of the period prior to the 70’s: the price of oil was exactly what the state of Texas wanted.

And the commission still has that power: it still sets the allowable every month. But since the early 70’s (can’t find the exact year) it has set the allowable at 100% every month.

dave thompson on Sun, 27th Nov 2016 12:59 am

Here is a graph showing the history of US imports. http://www.financialsense.com/sites/default/files/users/u131/images/2012/COM-US-net-imports-of-crude-oil-Alert-11302012.jpg

dave thompson on Sun, 27th Nov 2016 1:02 am

Clearly the TRRC has had no control over price for a very long time.

peakyeast on Sun, 27th Nov 2016 3:42 am

@GregT: It is always good to have a healthy critical view on things.

Since this was one of their primary advertisement points for this particular panel I will assume they have actually tried to be reasonable. Of course, it would be better if they actually showed the detailed calculation.

Cloggie on Sun, 27th Nov 2016 4:07 am

For me the solar panels were a part of my pension plan. Since it is not possible to pay your electricity bill 25 years in advance while you still have the money, and I have zero faith in the value of funds, bonds and the rest of the paper IOUs, anticipating a financial collapse, I had these panels installed. I would have bought them even if they had an EROEI value of 1. Panels give you a feeling of security and preparedness.

Davy on Sun, 27th Nov 2016 4:57 am

Relative value of investments can and should be looked at in different ways in regards to a collapse process risk management. One way is to ask ourselves is the economy going to remain constant as so many people default to. Most people today when they make their predictions or assumptions discount an economic decline. Academics, economist, and greenies are horrible in this respect. Greenies assume all this shiny new alternative energy infrastructure will be built because it is being built now and the cost/benefit is actually even improving. In this case these greenies forecasting an alternative energy transition are reaching with some serious assumptions yet to be realized. The economy is fragile and without a healthy economy there will be no energy transition.

If one assumes an economic decline then investing in panels now is a good investment from another point of view. Alternative energy may not be a valid energy transition reality but it still is a great personal investment in regards to so many other modern investments physical and abstract. In some ways depending on the way you look at value it does not matter the payback time because there may not be an economy as we now it in just a few years. Panels are physical wealth that does not evaporate in a financial collapse like financial instruments will.

We need to address this idea in relation to society also. If we are in a collapse process where global productive abilities are soon going to be reduced significantly then does it matter solar’s payback or EROI? In relation to current economic realities if those realities are set to profoundly change then this value judgment just got turned on its head. Anything we build out physical and with a future will have a value in collapse. Things like high speed trains that will not survive an economic decline will not. Skyscrapers that will not be maintainable will not. A Chinese factory producing Barbie dolls will not. You see my thinking.

The same can be said about items with duel uses and salvage. Let’s say a large solar farm becomes a stranded asset in a collapse situation because the grid is unable to manage the power for whatever reason. We can then say that stranded asset can be salvaged and turned into smaller components of a stand-alone system. Wind farms could become self-contained industrial areas for production of some kind of manufacturing process. Solar thermal would be great for metal recycling. If you have the right people these technologies can be adapted, salvaged and cannibalized and remain viable. Let’s talk salvage and cannibalization of financial instruments? That sounds a bit scarier.

Relative value changes if you assume the global economy is heading into a collapse process. Your value of products is different if you view the economy as a constant or in growth. If you go predicting out to 2040 a status quo view of the world these things take on a different meaning than if you view the status quo as greatly altered in as little as 5 years. If you are assuming a decline process of deflation/inflation in a dangerous modern form of stagflation and or hyperinflation then a product’s value is altered. This situation is the reason folks like me with decline/decay assumptions feel modern life to be surreal. Relative value and utility can change quickly. The car culture could be localized within months. Consumerism ended in weeks. Your paper wealth could become highly valuable as toilet paper overnight. If you ever shit in the woods without a roll you know what I mean.

Cloggie on Sun, 27th Nov 2016 5:21 am

Still need to be convinced that after a financial collapse the entire economy will be frozen. Russia had a financial collapse in 1998…

https://en.wikipedia.org/wiki/1998_Russian_financial_crisis

…but after a few years they recovered.

If you really want to be cynical you could even argue that a financial collapse will force the old timers to rise up from their lazy chairs and get some work done.

A financial collapse means that you don’t have the savings you once thought you had, but you still have your hands, legs and brains to get solid work done, probably against much lower pay.

The meaning of a financial collapse is vastly overrated; in reality the world keeps soldiering on and imbalances and bubbles are flushed from the system.

And yes, a Big Reset will come with hardship.

Davy on Sun, 27th Nov 2016 5:39 am

UUH, where is it written that the USSR is the blue book of financial collapse? Let’s look back at all human civilizations and make some judgments. That does not look pretty does it? Are ANY still in operation today? The USSR dissolved into a growing global system. What happens when states and systems fail in a declining global system? It’s called negative feedbacks. Let’s go one step further and realize just how far into potential overshoot humans are today with a hyper complex just-in-time civilization with a foundational energy source in decline with little more than desperate hope of substitution. Alternatives to our fossil fuel culture are desperate if one sees how far they have come doing so little and how far they must go. Technology is a dead end because it eventually becomes circular in destructive attempts at its own construction or IOW a house of cards. Let’s acknowledge just how unsustainable and without resilience this global civilization is we have today if the “IFS” are wrong. Let’s also acknowledge just how possible those “IF’s” are. In that case I think your ass should be puckering and not producing flatulence.