Page added on January 31, 2016

Collapse Of Shale Gas Production Has Begun

This is a guest post by Steve St. Angelo of SRSroccoReport.Com. All opinions expressed in this post are his and do not necessarily reflect those of Ron Patterson.

The U.S. Empire is in serious trouble as the collapse of its domestic shale gas production has begun. This is just another nail in a series of nails that have been driven into the U.S. Empire coffin.

Unfortunately, most investors don’t pay attention to what is taking place in the U.S. Energy Industry. Without energy, the U.S. economy would grind to a halt. All the trillions of Dollars in financial assets mean nothing without oil, natural gas or coal. Energy drives the economy and finance steers it. As I stated several times before, the financial industry is driving us over the cliff.

The Great U.S. Shale Gas Boom Is Likely Over For Good

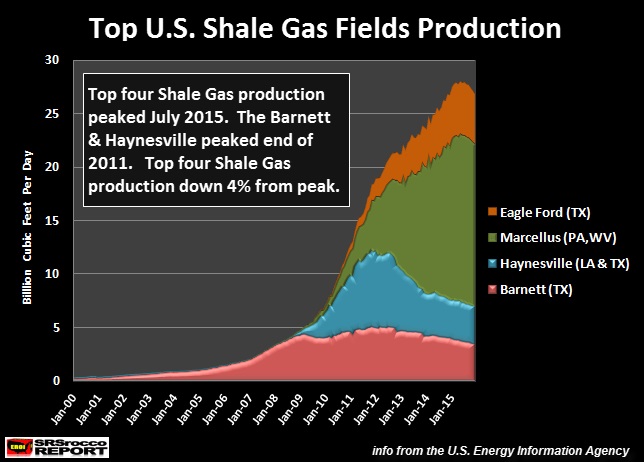

Very few Americans noticed that the top four shale gas fields combined production peaked back in July 2015. Total shale gas production from the Barnett, Eagle Ford, Haynesville and Marcellus peaked at 27.9 billion cubic feet per day (Bcf/d) in July and fell to 26.7 Bcf/d by December 2015:

As we can see from the chart, the Barnett and Haynesville peaked four years ago at the end of 2011. Here are the production profiles for each shale gas field:

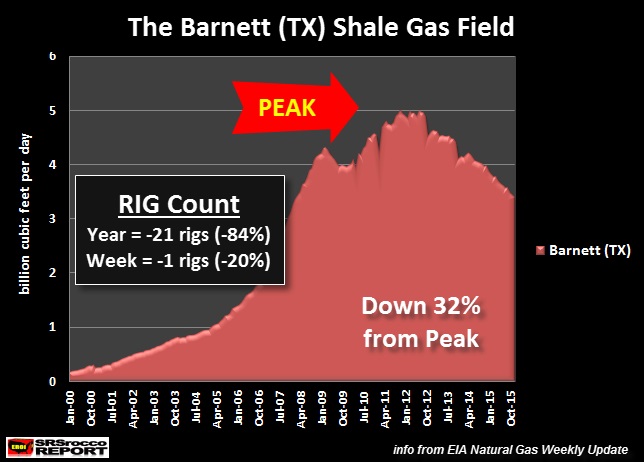

According to the U.S. Energy Information Agency (EIA), the Barnett shale gas production peaked on November 2011 and is down 32% from its high. The Barnett produced a record 5 Bcf/d of shale gas in 2011 and is currently producing only 3.4 Bcf/d. Furthermore, the drilling rig count in the Barnett is down a stunning 84% in over the past year.

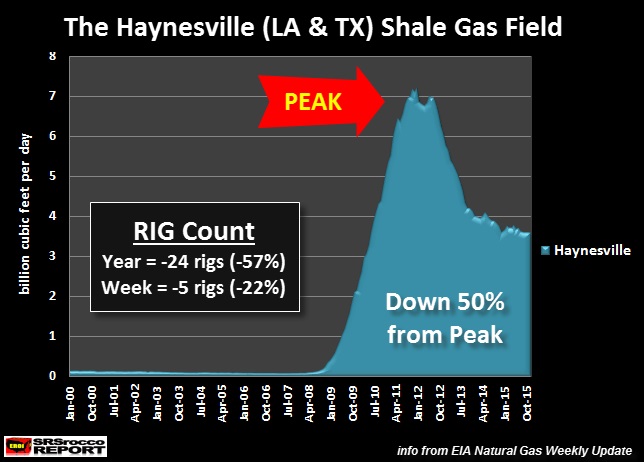

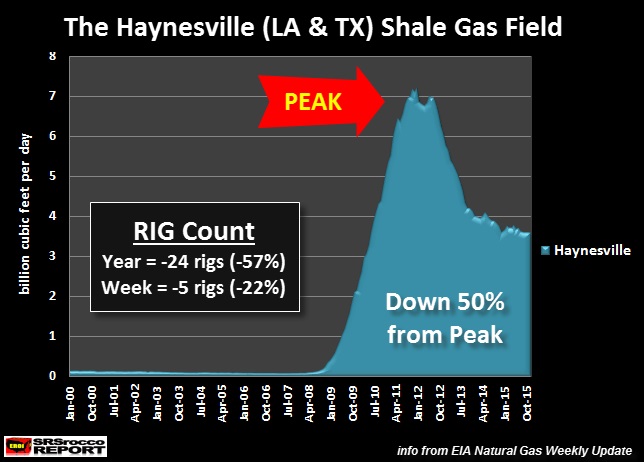

The Haynesville was the second to peak on Jan 2012 at 7.2 Bcf/d per day and is currently producing 3.6 Bcf/d. This was a huge 50% decline from its peak. Not only is the drilling rig count in the Haynesville down 57% in a year, it fell another five rigs this past week. There are only 18 drilling rigs currently working in the Haynesville.

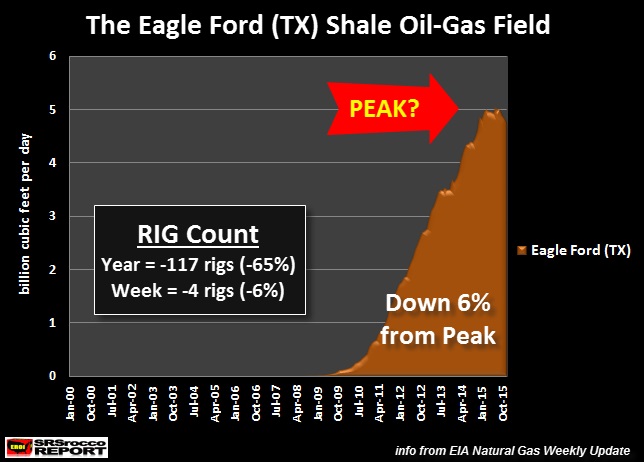

The EIA reports that shale gas production from the Eagle ford peaked in July 2015 at 5 Bcf/d and is now down 6% at 4.7 Bcf/d. As we can see, total drilling rigs at the Eagle Ford declined the most at 117 since last year. The reason the falling drilling rig count is so high is due to the fact that the Eagle Ford is the largest shale oil-producing field in the United States.

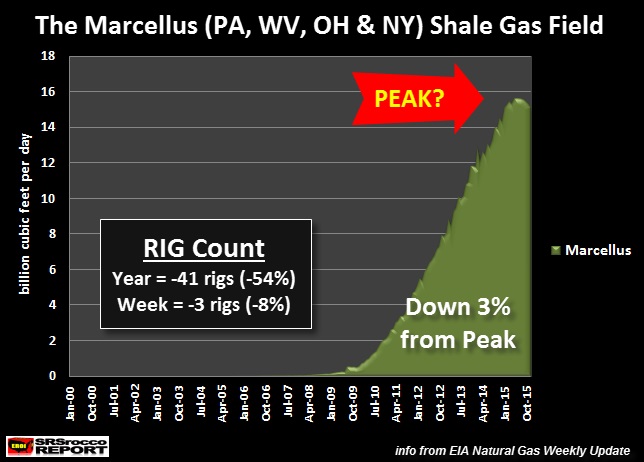

Lastly, the Mighty Marcellus also peaked in July 2015 at a staggering 15.5 Bcf/d and is now down 3% producing 15.0 Bcf/d currently. The Marcellus is producing more gas (15 Bcf/d) than the other top three shale gas fields combined (12.1 Bcf/d).

I have posted the Haynesville shale gas production chart below to discuss why U.S. Shale Gas production will likely collapse going forward:

What is interesting about the Haynesville shale gas field, located in Louisiana and Texas, is the steep decline of production from its peak. On the other hand, the Barnett (chart above in red) had a much different profile as its production peak was more rounded and slow. Not so with the Haynesville. The decline of shale gas production at the Haynesville was more rapid and sudden. I believe the Eagle Ford and Marcellus shale gas production declines will resemble what took place in the Haynesville.

All you have to do is look at how the Eagle Ford and Marcellus ramped up production. Their production profiles are more similar to the Haynesville than the Barnett. Thus, the declines will likely behave in the same fashion. Furthermore drilling and extracting shale gas from the Haynesville was a “Commercial Failure” as stated by energy analyst Art Berman in his Forbes article on Nov 22 2015:

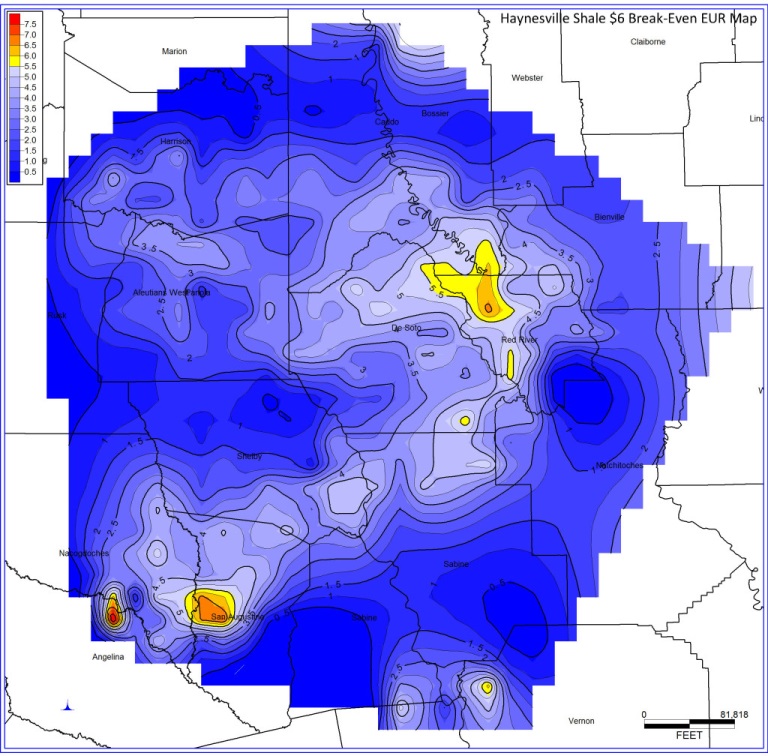

The Haynesville Shale play needs $6.50 gas prices to break even. With natural gas prices just above $2/Mcf (thousand cubic feet), we question the shale gas business model that has 31 rigs drilling wells in that play that cost $8-10 million apiece to sell gas at a loss into a over-supplied market.

At $6 gas prices, only 17% of Haynesville wells break even (Table 3) and approximately 115,000 acres are commercial (Figure 2) out the approximately 3.8 million acres that comprise the drilled area of the play.

The Haynesville Shale play is a commercial failure. Encana exited the play in late August. Chesapeake and Exco, the two leading producers in the play, both announced significant write-downs in the 3rd quarter of 2015.

Basically, the overwhelming majority of the shale gas extracted at the Haynesville was done so at a complete loss. So, why do they continue drilling and producing gas in the Haynesville?

The reason Art Berman states is this:

What we see in the Haynesville Shale play are companies that blindly seek production volumes rather than value, and that care nothing for the interests of their shareholders. The business model is broken. It is time for investors to finally start asking serious questions.

Chesapeake is one of the larger shale gas producers in the Haynesville as well as in the United States. According to its recent financial reports, Chesapeake received $1.05 billion in operating cash in the first three-quarters of 2015, but spent $3.2 on capital expenditures to continue drilling. Thus, its free cash flow was a negative $2.1 billion in the first nine months of 2015. And this doesn’t include what it paid out in dividends.

The same phenomenon is taking place in other companies drilling for shale gas in the other fields in the U.S. This insanity has Berman perplexed as he states this in another article from his site:

This has puzzled me because the shale gas plays are not commercial at less than about $6/mmBtu except in small parts of the Marcellus core areas where $4 prices break even. Natural gas prices have averaged less than $3/mmBtu for the first quarter of 2015 and are currently at their lowest levels in more than 2 years.

The reason these companies continue to produce shale gas at a loss is to keep generating revenue and cash flow to service their debt. If they cut back significantly on drilling activity, their production would plummet. This would cause cash flow to drop like a rock, including their stock price, and they would go bankrupt as they couldn’t continue servicing their debt.

Basically, the U.S. Shale Gas Industry is nothing more than a Ponzi Scheme.

The Collapse Of U.S. Shale Gas Production Even At Higher Prices

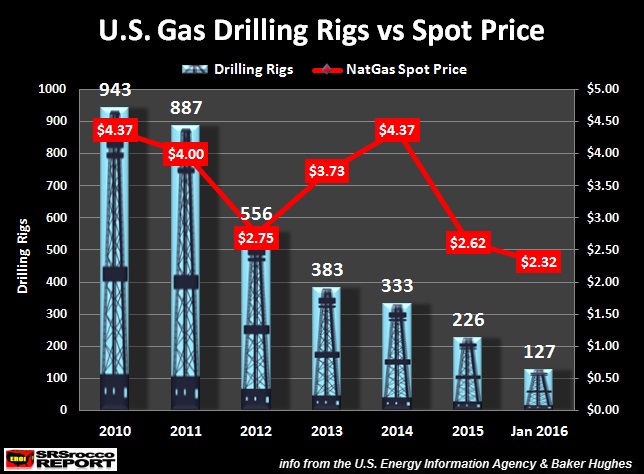

I believe the collapse of U.S. shale gas production will occur even at higher prices Why? Because the price of natural gas increased from $2.75 mmBtu in 2012 to $4.37 mmBtu in 2014, but the drilling rig count continued to fall:

As the price of natural gas increased from 2012 to 2014, gas drilling rigs fell 40% from 556 to 333. Furthermore, drilling rigs continued to decline and now are at a record low of 127. Just as Art Berman stated, the average break-even for most shale gas plays are $6 mmBtu, while only a small percentage of the Marcellus is profitable at $4 mmBtu.

Looking at the chart again, we can see that the price of natural gas never got close to $6 mmtu.. the highest was $4.37 mmBtu. Thus, the U.S. Shale Gas Industry has been a commercial failure.

Now that the major shale gas producers are saddled with debt and many of the sweet spots in these shale gas fields have already been drilled, I believe U.S. shale gas production will collapse going forward. If we look at the Haynesville Shale Gas Field production profile, a 50% decline in 4 years represents a collapse in my book.

The Two Nails In The U.S. Empire Coffin

As I stated in several articles and interviews, ENERGY DRIVES THE ECONOMY, not finance. So, energy is the key to economic activity. Which means, energy output and the control of energy are the keys to economic prosperity.

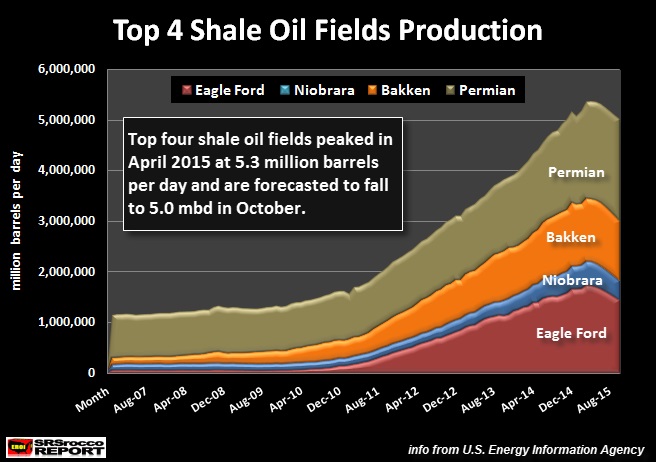

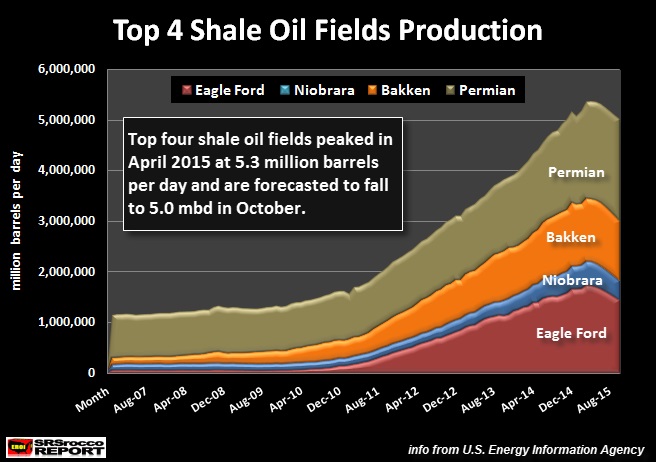

While the collapse of U.S. shale gas production is one nail in the U.S. Empire Coffin, the other is Shale Oil. U.S. shale oil production peaked before shale gas production:

This chart is a few months out of date, but according to the EIA’s Productivity Reports,domestic oil production from the top four shale oil fields peaked in April of 2015… three months before the major shale gas fields (July 2015).

Unfortunately for the United States, it was never going to become energy independent. The notion of U.S. energy independence was built on hype, hope and cow excrement. Instead, we are now going to witness the collapse of U.S. shale oil and gas production.

The collapse of U.S. shale oil and gas production are two nails in the U.S. Empire coffin. Why? Because U.S. will have to rely on growing oil and gas imports in the future as the strength and faith of the Dollar weakens. I see a time when oil exporting countries will no longer take Dollars or U.S. Treasuries for oil. Which means… we are going to have to actually trade something of real value other than paper promises.

I believe U.S. oil production will decline 30-40% from its peak (9.6 million barrels per day July 2015) by 2020 and 60-75% by 2025. The U.S. Empire is a suburban sprawl economy that needs a lot of oil to keep trains, trucks and cars moving. A collapse in oil production will also mean a collapse of economic activity.

Thus, a collapse of economic activity means skyrocketing debt defaults, massive bankruptcies and plunging tax revenue. This will be a disaster for the U.S. Empire.

Lastly, it is hard to forecast how this unfolds, but the best plan of action is to be more self-sufficient in the country with wealth held in physical gold and silver.

63 Comments on "Collapse Of Shale Gas Production Has Begun"

ennui2 on Sun, 31st Jan 2016 2:12 pm

“The Two Nails In The U.S. Empire Coffin”

BIAS

Go Speed Racer on Sun, 31st Jan 2016 2:17 pm

Seems like price of oil went so low, that the producers reduced the drilling and pumping deliberately. Funny how nobody notices the yo-yo price of oil demonstrates ‘free market’ is not enough, and the price needs to be stabilized by government policies?

Boat on Sun, 31st Jan 2016 2:18 pm

Funny how this writer doesn’t know both oil and nat gas prices are down from over supply. Many on this site claim the MSM is often riddled with disinformation. Let me say this site is almost nothing but.

Apneaman on Sun, 31st Jan 2016 2:24 pm

Das Boat is a man of few words. Unfortunately he just keeps repeating them over and over and over.

Boat you got nuthing

https://youtu.be/j8nZBlPfR7Y?t=61

Boat on Sun, 31st Jan 2016 2:29 pm

apeman,

Stick to oil on an oil site and I wont have to comment about doomers. Sorry ape I don’t follow your most of your links. Unless you copy a section that grabs my attention. Another fire or doomer video won’t do it.

Apneaman on Sun, 31st Jan 2016 3:06 pm

Boat, it’s a site about oil depletion, says so right on the main page.

“Exploring Hydrocarbon Depletion”

“Welcome to PeakOil.com, an online community exploring oil depletion.”

There is also a drop down box on the main page for discussions on oil depletion related topics. I guess you missed all that eh?

We all know you don’t click on links that provide the evidence. La la la I’m not listening. That’s why you are considered the boards #1 retard.

Hydrocarbon Depletion – oil depletion

Hydrocarbon Depletion – oil depletion

Hydrocarbon Depletion – oil depletion

Hydrocarbon Depletion – oil depletion

Hydrocarbon Depletion – oil depletion

Nony on Sun, 31st Jan 2016 3:22 pm

1. Totally ignores price and low drilling rigs. Not to mention the low future STRIP for prices, which itself has dropped dramatically (even from a relatively low level) during 2015.

2. Ignores the stabilization in the Haynesville decline after 2014 (the anti-Hubbard, anti-Seneca shape)

3. Ignores the Utica completely. A gas play and in same DPR source as rest of his stuff. Note this play is up to about 3 BCF/d within last 3 years (and still rising), and many news articles about massive deep Utica wells in SE PA.

4. Ignores HOW Marcellus grew while the other plays declined (and price did): gas on gas competition.

5. Ignores low App pricing (even lower than strip) along with limits on transport out of basin.

6. Ignores the low heating demand this winter along with the flush storage. Nat gas is known to have weather variable demand. It is a basic feature of this commodity. Yet the peaker here decides to try to draw a long term inference from a few months slowdown.

7. Mixes in tight oil at the end for a general rant, when title is on gas.

8. Some confused “Empire” ranting. Didn’t we have a decaying empire before the shale boom too?

The whole thing is going to end up looking as silly as the other past peak gas calls:

*David Hughes predicting peak gas and 1.5 BCF/d declines (in 2006!)

*Berman predicting $8+ prices going forward (in 2010!)

*Deborah Rogers and NYT conspiracy theory stuff (in 2011, action taken by NYT ombudsman that stories were biased from peaker perspective)

*2013 Ugo Bardi call that US gas was declining

*Several calls last summer that US gas was in decline (it was not, the data series were amended to show that).

shortonoil on Sun, 31st Jan 2016 3:32 pm

David Hughes, Art Berman, Jean Leharrere, and many others, including ourselves stated that shale was not a sustainable industry. We even went so far as to provide an equation that could be calculated on the back of an envelope to prove it. (s = c*ln(T2/T1). Regardless, investors went ahead and dumped $1 trillion down a proverable rat hole.

To demonstrate what any dim witted mule already knew we now must bear with pages and pages of colored graphs, charts and everything short of 8 X 10 glossy photos. Shale looks as healthy as an opossum trying to cross the Major Deccan Highway at rush hour. Well, well, well color me surprised!

http://www.thehillsgroup.org/

yoananda on Sun, 31st Jan 2016 4:19 pm

what abour shale 2.0 revolution ?

Technological progress in big data analytics could create Shale 2.0 and bring US oil costs to $5-20 per barrel

http://nextbigfuture.com/2016/01/technological-progress-in-big-data.html

Michael Alt on Sun, 31st Jan 2016 4:27 pm

If you want a better and more indepth knowledge of what is happening in the Drill-bit Hydrocarbon world read:

The Domino Effect” by E.Russell Braziel. Just released this month. (hint: it is not peak oil or colapse of shale field production.)

shortonoil on Sun, 31st Jan 2016 4:43 pm

“Shale 1.0,” was sparked not by high prices—it began when prices were at today’s low levels—but by the invention of new technologies.”

Stopped right about there. Shale production was essentially nothing until oil hit about $60 in 2007. That new technology they talk about is 50 years old or more. There are limits set by the Laws of Physics that technology will never be able to get around. Shale production is constrained by those Laws, and it will be forever. Try Tom Whipple’s magic machines, the chances are better.

Apneaman on Sun, 31st Jan 2016 4:53 pm

Michael Alt, sounds like “Rusty’s” entire life/career/mortgage/status, etc relies on a shale 2.0 boom. No conflict of interest or bias there.

“Biography

E. Russell (“Rusty”) Braziel is one of the most respected authorities in the field of energy information and markets. With an extensive trading and analytics background in the markets for natural gas, natural gas liquids and crude oil, he is uniquely qualified to interpret the economic, commercial and pricing consequences of the shale revolution.

Rusty is president and CEO of RBN Energy, a leading energy consultancy providing analysis and advisory services, best known for its rock-music themed Daily Energy Post, a blog that goes deep into the details about energy market trends, the mechanics of how energy markets function, and the workings of economic and operational energy models.

Rusty spent 20 years with Texaco (now Chevron), serving as Vice President of Natural Gas Marketing and Trading and Manager of NGL Supply. Subsequently he was Vice President of Business Development for The Williams Companies, President of Altra Energy Technologies and co-owner of Bentek Energy. Mr. Braziel holds BBA and MBA degrees in business and finance from Stephen F. Austin University. In 2014 he was named Stephen F. Austin Distinguished Alumni.”

Oh and look at the positive reviews – all from other predators who have just as much to lose as Rusty when the debt party ponzi scheme is over. Of course old Harold Hamm has already lost a shit load – Ba ha. By all means Michael Alt, refi the house, cash in the kids college fund and invest heavily in their promises. Many already have and you can find some of them living under an overpass and ask them how they feel about the shale miracle/boom/revolution 2.0.

“Review

“This book lays out how energy markets work in the real world. Braziel has lived these markets, and has successfully stitched together what has happened over the past five years to oil and gas production, infrastructure and prices. Then using the Domino Effect concept, he lays out what is likely to happen next. This is a must-read for anyone involved in energy markets.”

Harold Hamm, Founder, Chairman and Chief Executive Officer, Continental Resources

“Braziel has been dead right about energy markets. If you were paying attention to Rusty, nothing about today’s oil and gas prices would be a shock, or even much of a surprise. It all follows a completely rational, even predictable blueprint. In The Domino Effect, he explains how that works and why. In today’s markets, you’ve got to understand energy. This book lays it all out in a framework that makes basic, common sense, whether you are from the oil patch or Wall Street.”

James Cramer, host of CNBC’s Mad Money and a co-founder of TheStreet, Inc.

“Rusty has applied his rigorous approach to market analysis to the newly developed unconventional shale boom in North America. His keen insights into the seemingly benign differences between conventional and unconventional developments highlight the significant and extraordinary factors that must be taken into consideration when evaluating market fundamentals.”

J. Mike Stice, Dean, College of Earth and Energy, University of Oklahoma; Access Midstream Partners

CEO (retired)

“Finally we have a book that explains what is going on in today’s energy markets. Since the onset of the shale era, energy markets have experienced tumultuous change and volatility. All this disruption may have seemed random, but in reality the changes have followed a discernable pattern of supply growth, infrastructure development and price impact. In the Domino Effect, Braziel lays this pattern bare for all to see. If you want to understand energy markets, this book is required reading.”

Michael N. Mears, Chairman and Chief Executive Officer, Magellan Midstream Partners”

http://www.amazon.com/The-Domino-Effect-Russell-Braziel/dp/0692503013

shortonoil on Sun, 31st Jan 2016 5:13 pm

“The Domino Effect

The shale revolution triggered The Domino Effect, a cascading series of events that has profoundly transformed energy markets, reshaped major related industries and remodeled the global economic and geopolitical landscape. This book presents a unique, integrated perspective on natural gas, crude oil and natural gas liquids that is vital to understanding energy prices, product flows, infrastructure, equity values and the global energy economy.

Innovative analysis provides energy producers, marketers, end users, financiers, and investors with a framework for understanding the tectonic shift in global supply and demand that will continue to drive energy markets for decades to come. The Domino Effect also delivers high-level insights into exploiting the extraordinary investment, trade and career opportunities that will continue to be opened by the shale revolution.”

We believe that what will be driving the oil markets over the next decade will be the $39 trillion in additional debt formation that will be required to maintain sufficient production to service the world’s economy.

http://www.zerohedge.com/news/2016-01-31/time-panic-nigeria-begs-world-bank-massive-loan-dollar-reserves-dry

Venezuela, Nigeria…. next? Brazil, Canada, Russia, Saudi Arabia?

http://www.thehillsgroup.org/

yoananda on Sun, 31st Jan 2016 5:20 pm

@short

“Stopped right about there. Shale production was essentially nothing until oil hit about $60 in 2007.”

yeah, I know, but still, the rest of the article is interresting. Forget about this 1st claim (I did the same).

Boat on Sun, 31st Jan 2016 5:21 pm

apeman,

When are you going to explore hydrocarbon depletion?

There is an oversupply of nat gas and prices tanked in N America. This is in spite of tremendous growth. This trend will continue.Almost all the new growth is from fracking. These are facts period. There is no depletion story going on at this time. Decades into the future? Maybe.

Fracked oil is a different story. Price and technology came together and made drilling viable in areas where it wasn’t viable before in the US. But fracking is more expensive so areas around the world are now producing oil cheaper than frackers can and are gaining market share. But once again this is not a story of depletion doomerism from at this time. This is a story of price and which producers world wide can survive low prices and maintain market share.

Apneaman on Sun, 31st Jan 2016 5:38 pm

Das Boat, have you ever listened to rockman and others lie him on these boards? He has been drilling for decades and confirms what anyone can look up online – minor bump from tweaking decades old technology. Even when the people who work in the field tell you this you choose to cling to the industry sales pitch. And as always you ignore the ever growing amount of debt and bankruptcies that it took to pull it off. Wait till April fool, when it’s time to go over the books again. Gonna be a blood bath. Debt to Shale was like steroids to bodybuilders – lots of short term gains – looks really good, but in the end your dick stops working, your liver fails and you die. It was like America itself – big and bold and loud, but comparatively short lived. A flash in the pan. Whatever drips your dopamine Das boat – that’s the real meaning of life.

Gary on Sun, 31st Jan 2016 6:01 pm

Just because an author posts lots of graphs and charts does not mean they know how to interpret them. First, Nat Gas production is declining in many other plays because it was/is so cheap to produce Marcellus Gas. However, the approx. $1.50 pricing is too low to even make money there, so thus production is declining in the Marcellus. Declining volume is indeed the correct response to low prices, which is suppose to happen to balance supply and demand. There are two reasons why low prices have not balanced the market quickly. First, hedges paid them more money than the posted Henry Hub prices. Yes, Angelo, that is why they kept producing at a low price; because they were going to take advantage of all the volume at hedge prices. Secondly, many of these companies have MVC ( Min vol contracts) with pipeline carriers. They had to pay for specified volumes even if they failed to deliver. That is at the heart of the Ukraine/Russian debate at the moment.

There is no question the USA has plenty of Nat Gas, only a question at what price. If indeed we need at least $6.50 to deliver supplies, then we still have some of the cheapest Nat Gas in the World. Many developed economies were paying much more than that for years and their economies did not collapse.

I suspect this article is more about scaring people from investing in oil at a time that shorts need to cover. I noticed you chose to use CHK as an example, which currently has a 40% short position. That certainly would result in a catastrophe if people found a new interest in Nat Gas in 2016.

makati1 on Sun, 31st Jan 2016 6:25 pm

Too bad all of the “intelligent” commenters on here have wasted their lives learning about how to scam the market and make a killing without a days labor of their own. What good will knowing all this be when the SHTF and there is no oil industry/stock market/economy? Barring those few who actually work in the oil industry and get their paychecks from the results of their knowledge, the rest deserve to lose their shirts. And will, along with everything else they think they own. Anyone “investing” in oil at this time is a fool and deserves what is coming.

Gary on Sun, 31st Jan 2016 6:38 pm

Hey Apneaman, Give us some insight into the article, not a vague response to plus a book !!!!

Danny on Sun, 31st Jan 2016 6:47 pm

The reason the Marcellus is down is because the price is down, drilling has stopped. The wells are not depleting, quite the opposite, they are maintaining, this is the mother load. 2018 will have 30 Bcf a day being pumped out of here, we’re waiting on infrastructure, get your stories right!

Gary on Sun, 31st Jan 2016 7:00 pm

I love the disconnect Makati. You desire for all oil companies to go Bankrupt but want the oil workers to keep earning their well deserved pay.

Your last sentence warning people NOT to invest in oil, when stock prices have dropped 60-90%,only supports my previous comments.

shortonoil on Sun, 31st Jan 2016 7:06 pm

Some people just can’t seem to get their head wrapped around the fact that shale industry is a dead man walking.

Gary on Sun, 31st Jan 2016 7:10 pm

I agree Danny, the Marcellus has and can deliver more Gas than we need. That is the problem. The productivity of the Marcellus grew 450% since 2008.

Infrastructure is only part of the problem. We are going to move Marcellus gas to “where”? We need demand for the Gas first. That is where Mexican and LNG exports come in. We need to get that demand first. So far, it has been to drill first, and worry about demand later. That model has not proven successful.

Apneaman on Sun, 31st Jan 2016 7:16 pm

Hey Gary, I’ll respond however the fuck I like. How’s that work fer ya asshole?

bug on Sun, 31st Jan 2016 7:23 pm

Danny and gary, what is all this we and we’re?

“We’re waiting on infastructure”

“We need demand for the gas first”

“We need to get that demand”

Are you owners of this gas?

If you are a regular citizen, that gas is not yours, the oil/gas company owns it to sell.

If you are an investor, I guess you may have dividend coming or some stake.

If the Broncos win, do you say “we won”

if you are not on the team?

Apneaman on Sun, 31st Jan 2016 7:35 pm

bug, shale tards are emotional hometeam creatures.

makati1 on Sun, 31st Jan 2016 7:53 pm

Gary, you read into my comment what YOU want to see, not what I wrote. I merely said that those who support the oil/gas business because they actually work in it are different from the leeches who want to make their living by betting on oily stocks and living off of others efforts.

And, yes, I would like to see the end of the stock market and the petroleum age asap. Is that clear enough?

Boat on Sun, 31st Jan 2016 7:54 pm

apeman,

Das Boat, have you ever listened to rockman and others lie him on these boards? He has been drilling for decades and confirms what anyone can look up online – minor bump from tweaking decades old technology.

Rock and I have a disagreement about a bump and a tweak in tech causing the sudden rise in fracking. No big deal. Go read the history of fracking research. There are timelines as drill bit tech matured, the horizontal lines themselves/length and placement, improvements in the amount of pressure, the list of changes goes on and on. If you go to and read the drilling sights there are changes all the time. But your right, fracking wasn’t invented in 2002. I would never call the Rock a liar. I leave that rude behavior for you and Gregt.

Shale fracking was making 10’s of billions before the price dropped. I am not responsible for continued investment after profits were gone. When prices go back up I am sure billions will be made again. The Middle East might push that back for years or decades.

Cloud9 on Sun, 31st Jan 2016 8:13 pm

The Hirsh Report published in 2005 predicted peak oil within 20 years of publication. Lloyd’s 360 Risk Insight White Paper, p.13 puts peak some time before 2020. The 2010 Bundeswehr Transformation Centre study put consensus for peak in 2020., p.97 Now shale has peaked in mid 2015. So, should we expect the wheels to start coming off in the next four years?

GregT on Sun, 31st Jan 2016 8:21 pm

“I would never call the Rock a liar. I leave that rude behavior for you and Gregt.”

You really are completely irrational Boat. It is you that is calling Rockman out, both Apnea and myself are not.

Apneaman on Sun, 31st Jan 2016 8:27 pm

Das Boat, you’re sure are you? Therein lies your weakness.

A Glimpse Of Things To Come: Bankrupt Shale Producers “Can’t Give Their Assets Away”

http://www.zerohedge.com/news/2016-01-20/glimpse-things-come-bankrupt-shale-producers-cant-give-their-assets-away

In The Shale Patch: 42 Bankruptcies, And Counting

http://www.energyfuse.org/in-the-shale-patch-42-bankruptcies-and-counting/

How much of those billions was made flipping leases?

Documents: Leaked Industry E-Mails and Reports

Over the past six months, The New York Times reviewed thousands of pages of documents related to shale gas, including hundreds of industry e-mails, internal agency documents and reports by analysts. A selection of these documents is included here; names and identifying information have been redacted to protect the confidentiality of sources, many of whom were not authorized by their employers to communicate with The Times.

http://www.nytimes.com/interactive/us/natural-gas-drilling-down-documents-4.html#document/p54

Apneaman on Sun, 31st Jan 2016 8:35 pm

Greg, Boat always switches to his morality scolding when he’s stumped. What else can he do when he ain’t got any facts or data and has nothing to dispute the mounds of evidence presented here that all is not well? His other often played card is “it’s just capitalism” or some variation of the human nature/the way it’s always been argument. True, but that’s not an actual argument against depletion,, declining net energy and the continuing collapse of industrial civ. It’s a change of subject to sooth the dissonance – poor boaty.

geopressure on Sun, 31st Jan 2016 9:15 pm

Short:

“Stopped right about there. Shale production was essentially nothing until oil hit about $60 in 2007. That new technology they talk about is 50 years old or more.”

—

Yes, Fracking is an old technology…

Yes, Directional Drilling is an old technology…

However, the perfection of these two technologies & their combination to turn tight source rocks into PAY is rather new… It started in the Barnett Shale with Mitchell Energy in/around 2005 & then spread to oilier plays… It was first thought that the fractures would be too small for crude oil molecules to navigate through, so operators mainly focused on gas to begin with… The average oil molecule is an order of magnitude larger than a gas molecule…

—

So, basically the author is correct…

geopressure on Sun, 31st Jan 2016 9:26 pm

I’m not a big fan of Shale Oil/Gas… If one wants to make money in the oil & gas industry, they need to learn how to find conventional oil… That’s where the money is…

Andrew Rickard on Sun, 31st Jan 2016 9:42 pm

Shale oil and gas are here to stay. The use of fracturing and horizontal drilling are not new. The new technologies surround zonal isolation, allowing more stages in horizontal completions. E ven stage fracturing was the predominant completion technique in the lante 70s and 1980s. New tools have allowed more stages to be utilized in longer laterals.

Peak oil is here for $20 oil. We can fill our pools with it at $100. The true market price for oil should fe found to be $50-70 with shale producing the market balance barrels.

Saudi Arabia saw an opportunity to kill shale oil thinking it would shut off at $65 and get to hurt Iran, Russia and renewables all with one shot. What they failed to account for was many of the $65/bbl costs had already been spent in leasehold and long term drilling contracts with rig companies. The actual cost to produce the wells once capital has been spent amounts to less than $10/barrell and does not significantly differ from country to country. So that investors would continue to pump at low prices can not only be expected but is demanded by their creditors. Capital investment is declining rapidly. Production from existing wells will decline. These are facts. The price will rise to the market price(without interference) to 50-70 in 1-3 years. Higher price will spur investment to increase supply.

Those of you waiting for it to end, go ahead and hold your breath, you won’t be missed. Technology will continue to push down the cost of development and production as inflation tries to push it up. Oil will be here as long as the aggregate cost of the energy is less than other options.

Andrew Rickard on Sun, 31st Jan 2016 9:56 pm

And yes gas follows the same rules. When gas goes to $7 we will be digging in the Haynesville.

Just a question, suppose you just spent $30 million on term leases and had to establish production to maintain the leases, would you drill a few wells per year to maintain your lease/mineral reserves.

This is a little more complex than most of the poster’s seem to understand. Yes they will lose money today to maintain rights to what may be worth many times more than that in the future

Andrew Rickard on Sun, 31st Jan 2016 10:09 pm

And while I’m on a rant, drilling rigs or the efficiency of drilling rigs has nothing to do with productivity of a well. Drilling rigs drill holes.

The geologic target is number 1 in a productive well

Completion design is #2

Production and the hard work people do getting it out of the ground is the third part of a productive well.

Apneaman on Sun, 31st Jan 2016 10:14 pm

Andrew, thank you for the industry cheerleading, but I just don’t see it. I do see massive debt much of which will never be repaid and the bankruptcies are increasing. I see plenty of excuse making (Saudi’s), whining, victim card playing and all round desperation desperation. Not a self supporting part of the industry. Fergetabout even talking externalities with cheerleaders.

Oil plunge sparks calls for Congress to act

http://thehill.com/homenews/senate/265304-oil-plunge-sparks-calls-for-congress-to-act

‘Frack now, pay later,’ top services companies say amid oil crash

http://www.reuters.com/article/us-fracking-halliburton-schlumberger-nv-idUSKCN0QC0F220150807

makati1 on Sun, 31st Jan 2016 10:14 pm

Andrew … No, they are not “here to stay” no matter how much you hope they are. If there is no financial system to support them, they will disappear. Ditto if there is no profit in their recovery and use. The ability of consumers to consume is disappearing fast, or haven’t you noticed?

No, prices will not rise as before. There has been a line crossed where higher energy prices means financial collapse for the economy and a reset to a much lower level of consumption and lifestyle, not more of the same.

The Age of Hydrocarbons will end long before the supply of hydrocarbons runs out. The financial system to recover and use them is disintegrating in front of your eyes but you don’t want to see it, apparently. Me, I wouldn’t want to throw my money into the hydrocarbon rat hole. I like to sleep at night. LOL

Bloomer on Sun, 31st Jan 2016 10:19 pm

Not oil shale wells are created equal. Some are sustainable while others are not at these lower oil prices and therefore will be shut in.

Lots of focus today on aggregate shale production, what’s not being considered is the depletion of conventional oil. Almost all of the giant oil fields are in decline. Yes the existing oil in these fields in some cases can be extracted faster (more straws) and produce more, but this will only hasten their enviable demise.

makati1 on Sun, 31st Jan 2016 10:29 pm

Facts to support my claim:

“Death Throes Of The Bull”

“The Shipping News Says the World Economy Is Toast”

“Baltic index continues fall to new record low”

“European Union could ‘fall apart within months'”

“Crushed Currency, Oil, Domestic Demand Broadside Small Businesses in Canada, Worst since March 2009”

“Watch The Wafers—-The Global Semi-Conductor Demand Has Collapsed”

“The Big-Oil Bailouts Begin”

“Just 15% of US oil production is hedged in 2016: IHS”

” Chevron posts first loss since 2002 on crude oil plunge”

“Coal bankruptcies won’t reduce America’s supply glut”

“These energy companies are running low on cash”

“Rig Count Update: Moment of Truth for the Permian Basin?”

“Investment in the US oil industry hasn’t been this weak in decades”

“Consumers don’t see need for smartwatches”

“Japan power use drops to 17-year-low amid slower economic growth”

“Gerald Celente: Get Prepped For Global Systemic Collapse”

“U.S. GDP fizzles in the fourth quarter”

http://ricefarmer.blogspot.fr/

Only the most recent events…

twocats on Sun, 31st Jan 2016 11:06 pm

Mak – I’m not convinced either way, but don’t you think there’s a possibility they find a way to clear out the trash (bankruptcies, complete capitulation, S&P down to 1,000, whatever), bail-out the remaining oil giants (who agree to acquire the abandoned assets of the trash as a favor), and then make one more go towards a new peak somewhere around 2018. It’s likely that production will continue to fall and that demand will trend slightly up to flat. At some point, late 2016, early 2017, those trendlines are likely to cross. Then there’s the question of whether they’ll be able to make the new peak. Just a hypothetical; I’m not committed to it.

Truth Has A Liberal Bias on Sun, 31st Jan 2016 11:37 pm

Perhaps Nony will write an article that fixes all the short comings he noted. Then perhaps we can make some real progress. However I doubt Nony will do anything at all. Which makes him a useless retard as usual.

GregT on Mon, 1st Feb 2016 12:05 am

“but don’t you think there’s a possibility they find a way to clear out the trash ”

How about a one world government/financial system? It just might work.

geopressure on Mon, 1st Feb 2016 2:13 am

Citigroup said that going long on oil is ‘the trade of the year for 2016’… & they are correct…

makati1 on Mon, 1st Feb 2016 3:04 am

GregT, it might, but I don’t think that will ever happen. Much as TPTB have been working to make it so, it appears that the world is fragmenting more than ever in the decline. How do you herd 7,200,000,000+ cats? LOL

Apneaman on Mon, 1st Feb 2016 3:10 am

Arkansas Frackquake Victims Commiserate With Oklahomans As Fracking Wastewater Injection Continues, Risking Deadly Earthquakes

http://www.desmogblog.com/2016/01/26/arkansas-frackquake-victims-commiserate-oklahomans-fracking-wastewater-injection-continues-risking-deadly-earthquakes

onlooker on Mon, 1st Feb 2016 3:47 am

“GregT, it might, but I don’t think that will ever happen. Much as TPTB have been working to make it so, it appears that the world is fragmenting more than ever in the decline. How do you herd 7,200,000,000+ cats?” Yes and becoming more unruly, aware of the Cabal/Elite and maybe most important the centralized structure or Command and Control network that the Elite need to control the masses of the world is dependent upon a functioning economy and sufficient energy sources. Also, with the economies faltering people are less apt to obey and listen to the Cabal as they are not tangibly much invested anymore in the Status quo.

rockman on Mon, 1st Feb 2016 6:57 am

Overall not a bad article IMHO. But he still makes the same dumb statement so many do: “The Haynesville Shale play needs $6.50 gas prices to break even.” And then accuses some companies of intentionally making bad investments. No one drills a Haynesville well based on $6.50/mcf. They run the economics based on current pricing…just as virtually every operator does in every play be it oil, NG, unconventional/conventional and onshore/offshore. There are Haynesville wells (and Marcellus et al) worth drilling at $2.50/mcf. And there are such wells not worth drilling at $10/mcf. There is no such thing as a “breakeven price” for a typical Haynesville well (or any other play) because there is no such thing as a typical Haynesville well: each perspective location is evaluated based upon its unique potential. For instance there were many Eagle Ford wells that would not have “broke even” even if oil had sold for $1,000/bbl. Yes: not a typo: I meant ONE THOUSAND DOLLARS PER BBL. Like the handful of EFS wells the produced less than 5,000 bo. Just as there are EFS wells that would have made a profit had oil been $35/bbl…just not as many with $95/bbl oil.

Which is why there are still oil/NG shale wells being drilled today with more in the future…just not nearly as many if prices were a lot higher. Again I understand why some folks use such generalizations. Which is OK as long as they understand numerous examples can be presented to show the error of such statements. Of course is someone wants to present a weighted average of such stats that would be great. But as of today I’ve seen no one publish such documentation: just generalizations that don’t fully capture the exact nature of the dynamics.

Davy on Mon, 1st Feb 2016 7:14 am

“Andrew … No, they are not “here to stay” no matter how much you hope they are. If there is no financial system to support them, they will disappear.” Well, if there is no financial system to support shale operations there will be no industrial food production either. That is a drastic statement and typical extreme cheerleading which is no different than the industry’s cheerleading agenda.

Shale is likely here to stay for a while at some level and all indications are in a downward trend. I think gas especially is going to be around longer due to its nature as a captive energy source. Shale resources are obviously a high price source that is being diminished in the demand and supply destruction cycle we appear to be in currently but there is just far too much out there to disappear.

We appear to be in a descent process with an unknown time frame. There are more and more indications this is more than just a business cycle downturn. This type of descent process will transition to a new and different reality eventually if this is truly systematic with unstoppable momentum. Will that be martial law or state controlled production as a next step? Will energy sources be producing within a different financial reality eventually?

Oil is absolutely vital to the current status quo. There are no plan B’s currently for the end of globalism but there will likely be ad hoc developments of a system that lands hard into a new reality. Yes, we may see a total collapse and eventually it appears likely but this could be decades away.

What is increasingly apparent is globalism at the level we are at today is unsustainable and decaying. This points to something lower in complexity, connectivity, and intensity. This will have to involve economic abandonment and with abandonment population and consumption rebalance. Time frame is still uncertain because we have had no events yet that would indicate a future direction. We may not be far away from a marker event. Maybe by the end of the year we will know more.