Page added on March 31, 2016

The U.S. Is a Big Oil Importer Again

In the three months since the U.S. lifted its 40-year ban on crude oil exports, a curious thing has happened. Rather than flooding global markets, U.S. crude shipments to foreign buyers have stalled. At the same time, imports into the U.S. jumped to a three-year high in what looks to be a reversal of a yearslong decline in the amount of foreign crude brought into the American market.

As of March 25, the four-week average of imports was running at 7.9 million barrels a day, 9.8 percent higher than the year before. “That’s not a one-week blip,” says Tim Evans, an energy analyst at Citi Futures. “We’re seeing a consistent pattern.”

U.S. producers, who reaped the benefits of the shale revolution, no longer enjoy a steep price advantage over foreign rivals in selling to domestic refiners. Production has fallen by about 600,000 barrels a day from its peak of 9.6 million in 2015. Now refineries are buying foreign oil to replace the lost U.S. output—and, along with traders, are storing much of the less-expensive imported oil to sell when prices rise.

During the early years of the U.S. shale boom, the millions of barrels of light, sweet crude had one big problem: no affordable access to refiners on the coasts of Texas and Louisiana. To tap into the cheaper oil pooling in Oklahoma, pipelines that used to bring imported oil up from the Gulf were reversed to take shale oil down to the coast. Refiners in Philadelphia and New Jersey also began buying North Dakota crude instead of foreign oil, moving it by train across the country. By October 2014, U.S. imports had fallen by about 40 percent from a high in 2006.

Analysts say that West Texas Intermediate crude has to be $3 to $5 cheaper than imported oil to pay for those pipeline and transportation costs. From 2011 to 2014, U.S. oil was on average $12.61 cheaper than equivalent foreign oil. The discount slowly narrowed as pipeline projects were completed and U.S. crude began to flow more freely from the middle of the country down to the Gulf Coast. A week before the Senate approved lifting the export ban on Dec. 18, WTI traded around $3 below Brent. Over the next month, the discount disappeared, and, for the first time in six years, WTI traded at a premium to Brent for a few days in January. WTI is now less than a dollar cheaper than foreign barrels available on the Gulf Coast.

So refineries along the coasts are choosing to buy imports instead of WTI. One of the biggest winners is Nigeria, which is regaining lost market share. Imports from Nigeria surged to 559,000 barrels a day in mid-March, compared with an average of 52,000 for all of 2015. Refiners are also taking more heavy oil from Mexico and Venezuela. Not only is it about $9 a barrel cheaper than WTI, it’s also what U.S. refineries prefer to handle.

The irony of the shale boom, and all the light crude it unlocked, is that it came just as U.S. refiners were spending billions to process heavy oil. “In theory, there was always going to be a linkage between freeing up U.S. barrels and replacing them with foreign crude that U.S. refiners are better suited to run,” says Kevin Book, managing director at ClearView Energy Partners.

For some of the weakest U.S. producers with the highest costs, lifting the ban didn’t matter because they can’t compete on the global market, says Abudi Zein, co-founder of ClipperData, which uses customs data and ship-tracking information to estimate global oil flows. For U.S. producers with the highest costs, “they’ll never be able to export because all of a sudden they’re competing with Saudi Arabia and Iraq.”

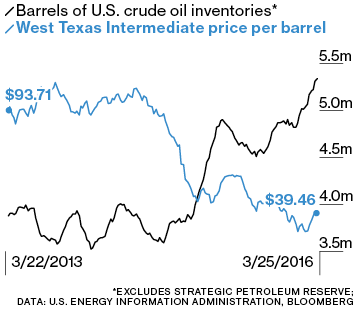

The U.S. is hoarding a lot of the imported oil. As of March 25, U.S. commercial crude inventories hit 534 million barrels. That’s near the all-time high in 1929, when U.S. commercial storage hit 545 million barrels, as huge oil finds coincided with the beginning of the Great Depression.

Today, with oil so cheap, producers and traders are opting to wait for prices to rise instead of selling, especially with the futures market signaling that oil prices will rise. Traders can lock in those prices by taking out a contract for delivery a few months down the road. A barrel of WTI for delivery in October is about $3.50 higher than the current price of about $39. That premium has dipped in recent months, but it’s still enough to pay for insurance and storage costs—with money left over.

“Putting away oil is one of the few risk-free plays in the world right now,” says Philip Verleger, an energy consultant and former director of the office of energy policy at the Department of the Treasury. Fears of a lack of storage space for oil haven’t come true. As of September 2015, the U.S. had 551 million barrels of working oil-storage capacity, 50 million more than it did two years before, according to government figures. Genscape, an oil-market-surveillance company, estimates that in the Midwest and the area along the Gulf Coast, the pace of construction has increased since September to about 574,000 barrels of new storage—big enough to hold a 747—a week.

The construction has helped keep leasing costs relatively low, says Ernie Barsamian, a principal at The Tank Tiger, a tank-storage broker. Average prices for a one-year lease of a storage tank run about 60¢ to 70¢ per barrel a month, he says. Barsamian estimates it costs about $40 to $50 a barrel to build a storage tank and that companies that own them can make their money back in five years or so.

As long as futures prices remain higher than current ones, the incentive will remain to pump oil and store it. That leaves the U.S. stuck in a strange pattern where “the higher inventories go, the more downward pressure that puts on near-term prices, which only increases the incentive to store it,” says Citi Futures’ Evans. The only way to break that cycle is for interest rates to rise, says Verleger, which would increase the financing costs to build storage tanks. “As long as money is cheap, it’ll make sense to build storage tanks in the U.S.”

14 Comments on "The U.S. Is a Big Oil Importer Again"

Rick Bronson on Thu, 31st Mar 2016 7:55 pm

It’s just a competition. OPEC countries cannot digest the fact that the unconventional sources like Shale Oil producing 5 million barrels and the Sands Oil producing another 3 million barrels.

Now if Iraq & Iran ramps the capacity, the other OPEC countries will still accept it as they are conventional crude oil coming from vertically drilled fields.

But whether the conventional oil can compensate for the Shale & Sands oil needs to be seen. If this happens, we can accept that Peak Oil is false.

But then how long will that capacity be sustained and how much depletion happens is a big question.

rockman on Thu, 31st Mar 2016 8:34 pm

Sorry…I just don’t have the stomach to address the extreme level of bullshit coming out of Bloomberg any more. Hopefully most here readily see what have to deliberate misrepresentation. No one working for this organization is that ignorant.

makati1 on Thu, 31st Mar 2016 8:35 pm

Fraking and tar sands are never going to be a significant player in the oil game again. Not profitable. Becoming ecologically questionable by more and more countries. A one time bubble blown to cover the contracting American economy. Nothing more.

makati1 on Thu, 31st Mar 2016 8:38 pm

Rockman, I have given up on ALL Us based or owned ‘news’ sources. The lies are becoming blatant and the obfuscation is obvious. I always check the ownership of a new source before I read it or consider it as truth.

Boat on Thu, 31st Mar 2016 8:40 pm

Rick,

World consumption of oil continues to grow. This is lower cost producers taking market share from higher cost producers during a glut.

Peak oil is a decade away at minimum. The question is whether conventional oil has really peaked.

antaris on Thu, 31st Mar 2016 9:01 pm

Boat may finally be coming out of the closet

Anonymous on Fri, 1st Apr 2016 4:41 am

Wow, when did they ‘stop’ being a big importer? Musta missed that one somehow….

Davy on Fri, 1st Apr 2016 6:16 am

If you want to read a funny:

“Saudi Arabia Plans $2 Trillion Megafund for Post-Oil Era: Deputy Crown Prince”

http://www.bloomberg.com/news/articles/2016-04-01/saudi-arabia-plans-2-trillion-megafund-to-dwarf-all-its-rivals

“Saudi Arabia is getting ready for the twilight of the oil age by creating the world’s largest sovereign wealth fund for the kingdom’s most prized assets. Over a five-hour conversation, Deputy Crown Prince Mohammed bin Salman laid out his vision for the Public Investment Fund, which will eventually control more than $2 trillion and help wean the kingdom off oil. As part of that strategy, the prince said Saudi will sell shares in Aramco’s parent company and transform the oil giant into an industrial conglomerate. The initial public offering could happen as soon as next year, with the country currently planning to sell less than 5 percent.”

rockman on Fri, 1st Apr 2016 6:29 am

mak – “…tar sands are never going to be a significant player in the oil game again.” The Alberta oil sands are still a very significant players TODAY. Alberta oil is still the largest source of imported oil for the US and I’ve seen no one speculate that it won’t continue to be so indefinitely. In fact with the lower oil price I suspect any plans to build out infrastructure to export Canadian oil to other countries has been muted. Thus the Canadians seem are more tied to US exports then they have been. And, of course, the US will continue to be a major oil importer from somewhere.

Remember that much of the current production is coming from fully developed projects. Development of new projects will certainly be impeded by the lower oil price. But I’ll remind everyone again that the first 1 million bbls per day from the oil sands was developed when prices were at the current level.

The oil sands aren’t going to disappear and neither is the US thirst for imported oil.

rockman on Fri, 1st Apr 2016 6:36 am

Davy – The logic flaws of that plan will hopefully be obvious to most here. Such as the fact that at current price levels the KSA is running a budget deficit. Difficult to add to the fund when you’re currently sucking that titty dry due to the low oil price. LOL. And of course selling shares of ARAMCO brings in an immediate chuck of cash but it also represents a transfer of a certain amount of future revenue out of the KSA. Unless, of course, the kingdom expects folks to invest in ARAMCO and get nothing in return.

makati1 on Fri, 1st Apr 2016 7:11 am

Rockman, when the price drops another $10 or more, and the banks have no more money to lend the system, what them? I see the tar sands dead by 2020. In fact, I see the whole capitalist system wiped out by the coming debt tsunami or at least reduced to an anemic shadow of itself. The dominoes have begun to fall.

Think Weimer Republic. The Central Banks cannot print forever. And printing is ALL that has prevented the collapse. If you cannot see the crumbling all around you, you are in deep denial like a few others on here who want to believe in the oil faeries.

If you are smart, I think you should dump all of your oily investments and retire. New Zealand is the place of choice for the financially able, it seems. Do you own gold? Better to get out now before the doors are slammed shut and the riots begin.

We will live to see the end of the Age of Petroleum. Wait and see.

Meanwhile, I’ll read the comments of the unicorn huggers and the techie dreamers and laugh.

practicalmaina on Fri, 1st Apr 2016 2:21 pm

Rockman what is going to happen to the razor thin margins if tar sands when more major coal company’s go under and natural gas demand increases to make up for it. Or with major has producers like Chesapeake in trouble.

In my humble opinion we were lied to while the rest of the world made moves. Europe is going to begin receiving 24 hour a day solar from huge scale thermal solar projects in northern Africa very soon.

practicalmaina on Fri, 1st Apr 2016 2:24 pm

Rockman, how does it not make sense, you are a dessert nation with abundant sunlight. Your primary domestic oil demands are for ac and desalination, why the hell would you not take advantage of all of your resourses, like Texas did with wind.

practicalmaina on Fri, 1st Apr 2016 2:25 pm

They still have a huge wealth fund made up of assets from all over the world. Wall street may feel the pain when they realize they should liquidate it all to prepare for their future of living in a country that gives new meaning to hot as hell.