Page added on December 9, 2014

Ten Reasons Why a Severe Drop in Oil Prices is a Problem

Not long ago, I wrote Ten Reasons Why High Oil Prices are a Problem. If high oil prices can be a problem, how can low oil prices also be a problem? In particular, how can the steep drop in oil prices we have recently been experiencing also be a problem?

Let me explain some of the issues:

Issue 1. If the price of oil is too low, it will simply be left in the ground.

The world badly needs oil for many purposes: to power its cars, to plant it fields, to operate its oil-powered irrigation pumps, and to act as a raw material for making many kinds of products, including medicines and fabrics.

If the price of oil is too low, it will be left in the ground. With low oil prices, production may drop off rapidly. High price encourages more production and more substitutes; low price leads to a whole series of secondary effects (debt defaults resulting from deflation, job loss, collapse of oil exporters, loss of letters of credit needed for exports, bank failures) that indirectly lead to a much quicker decline in oil production.

The view is sometimes expressed that once 50% of oil is extracted, the amount of oil we can extract will gradually begin to decline, for geological reasons. This view is only true if high prices prevail, as we hit limits. If our problem is low oil prices because of debt problems or other issues, then the decline is likely to be far more rapid. With low oil prices, even what we consider to be proved oil reserves today may be left in the ground.

Issue 2. The drop in oil prices is already having an impact on shale extraction and offshore drilling.

While many claims have been made that US shale drilling can be profitable at low prices, actions speak louder than words. (The problem may be a cash flow problem rather than profitability, but either problem cuts off drilling.) Reuters indicates that new oil and gas well permits tumbled by 40% in November.

Offshore drilling is also being affected. Transocean, the owner of the biggest fleet of deep water drilling rigs, recently took a $2.76 billion charge, among a “drilling rig glut.”

3. Shale operations have a huge impact on US employment.

Zero Hedge posted the following chart of employment growth, in states with and without current drilling from shale formations:

Figure 1. Jobs in States with and without Shale Formations, from Zero Hedge.

Clearly, the shale states are doing much better, job-wise. According to the article, since December 2007, shale states have added 1.36 million jobs, while non-shale states have lost 424,000 jobs. The growth in jobs includes all types of employment, including jobs only indirectly related to oil and gas production, such as jobs involved with the construction of a new supermarket to serve the growing population.

It might be noted that even the “Non-Shale” states have benefited to some extent from shale drilling. Some support jobs related to shale extraction, such as extraction of sand used in fracking, college courses to educate new engineers, and manufacturing of parts for drilling equipment, are in states other than those with shale formations. Also, all states benefit from the lower oil imports required.

Issue 4. Low oil prices tend to cause debt defaults that have wide ranging consequences. If defaults become widespread, they could affect bank deposits and international trade.

With low oil prices, it becomes much more difficult for shale drillers to pay back the loans they have taken out. Cash flow is much lower, and interest rates on new loans are likely much higher. The huge amount of debt that shale drillers have taken on suddenly becomes at-risk. Energy debt currently accounts for 16% of the US junk bond market, so the amount at risk is substantial.

Dropping oil prices affect international debt as well. The value of Venezuelan bonds recently fell to 51 cents on the dollar, because of the high default risk with low oil prices. Russia’s Rosneft is also reported to be having difficulty with its loans.

There are many ways banks might be adversely affected by defaults, including

- Directly by defaults on loans held be a bank

- Indirectly, by defaults on securities the bank owns that relate to loans elsewhere

- By derivative defaults made more likely by sharp changes in interest rates or in currency levels

- By liquidity problems, relating to the need to quickly sell or buy securities related to ETFs

After the many bank bailouts in 2008, there has been discussion of changing the system so that there is no longer a need to bail out “too big to fail” banks. One proposal that has been discussed is to force bank depositors and pension funds to cover part of the losses, using Cyprus-style bail-ins. According to some reports, such an approach has been approved by the G20 at a meeting the weekend of November 16, 2014. If this is true, our bank accounts and pension plans could already be at risk.1

Another bank-related issue if debt defaults become widespread, is the possibility that junk bonds and Letters of Credit2 will become outrageously expensive for companies that have poor credit ratings. Supply chains often include some businesses with poor credit ratings. Thus, even businesses with good credit ratings may find their supply chains broken by companies that can no longer afford high-priced credit. This was one of the issues in the 2008 credit crisis.

Issue 5. Low oil prices can lead to collapses of oil exporters, and loss of virtually all of the oil they export.

The collapse of the Former Soviet Union in 1991 seems to be related to a drop in oil prices.

Figure 2. Oil production and price of the Former Soviet Union, based on BP Statistical Review of World Energy 2013.

Oil prices dropped dramatically in the 1980s after the issues that gave rise to the earlier spike were mitigated. The Soviet Union was dependent on oil for its export revenue. With low oil prices, its ability to invest in new production was impaired, and its export revenue dried up. The Soviet Union collapsed for a number of reasons, some of them financial, in late 1991, after several years of low oil prices had had a chance to affect its economy.

Many oil-exporting countries are at risk of collapse if oil prices stay very low very long. Venezuela is a clear risk, with its big debt problem. Nigeria’s economy is reported to be “tanking.” Russia even has a possibility of collapse, although probably not in the near future.

Even apart from collapse, there is the possibility of increased unrest in the Middle East, as oil-exporting nations find it necessary to cut back on their food and oil subsidies. There is also more possibility of warfare among groups, including new groups such as ISIL. When everyone is prosperous, there is little reason to fight, but when oil-related funds dry up, fighting among neighbors increases, as does unrest among those with lower subsidies.

Issue 6. The benefits to consumers of a drop in oil prices are likely to be much smaller than the adverse impact on consumers of an oil price rise.

When oil prices rose, businesses were quick to add fuel surcharges. They are less quick to offer fuel rebates when oil prices go down. They will try to keep the benefit of the oil price drop for themselves for as long as possible.

Airlines seem to be more interested in adding flights than reducing ticket prices in response to lower oil prices, perhaps because additional planes are already available. Their intent is to increase profits, through an increase in ticket sales, not to give consumers the benefit of lower prices.

In some cases, governments will take advantage of the lower oil prices to increase their revenue. China recently raised its oil products consumption tax, so that the government gets part of the benefit of lower prices. Malaysia is using the low oil prices as a time to reduce oil subsidies.

Most businesses recognize that the oil price drop is at most a temporary situation, since the cost of extraction continues to rise (because we are getting oil from more difficult-to-extract locations). Because the price drop this is only temporary, few business people are saying to themselves, “Wow, oil is cheap again! I am going to invest a huge amount of money in a new road building company [or other business that depends on cheap oil].” Instead, they are cautious, making changes that require little capital investment and that can easily be reversed. While there may be some jobs added, those added will tend to be ones that can easily be dropped if oil prices rise again.

Issue 7. Hoped for crude and LNG sales abroad are likely to disappear, with low oil prices.

There has been a great deal of publicity about the desire of US oil and gas producers to sell both crude oil and LNG abroad, so as to be able to take advantage of higher oil and gas prices outside the US. With a big drop in oil prices, these hopes are likely to be dashed. Already, we are seeing the story, Asia stops buying US crude oil. According to this story, “There’s so much oversupply that Middle East crudes are now trading at discounts and it is not economical to bring over crudes from the US anymore.”

LNG prices tend to drop if oil prices drop. (Some LNG prices are linked to oil prices, but even those that are not directly linked are likely to be affected by the lower demand for energy products.) At these lower prices, the financial incentive to export LNG becomes much less. Even fluctuating LNG prices become a problem for those considering investment in infrastructure such as ships to transport LNG.

Issue 8. Hoped-for increases in renewables will become more difficult, if oil prices are low.

Many people believe that renewables can eventually take over the role of fossil fuels. (I am not of view that this is possible.) For those with this view, low oil prices are a problem, because they discourage the hoped-for transition to renewables.

Despite all of the statements made about renewables, they don’t really substitute for oil. Biofuels come closest, but they are simply oil-extenders. We add ethanol made from corn to gasoline to extend its quantity. But it still takes oil to operate the farm equipment to grow the corn, and oil to transport the corn to the ethanol plant. If oil isn’t around, the biofuel production system comes to a screeching halt.

Issue 9. A major drop in oil prices tends to lead to deflation, and because of this, difficulty in repaying debts.

If oil prices rise, so do food prices, and the price of making most goods. Thus rising oil prices contribute to inflation. The reverse of this is true as well. Falling oil prices tend to lead to a lower price for growing food and a lower price for making most goods. The net result can be deflation. Not all countries are affected equally; some experience this result to a greater extent than others.

Those countries experiencing deflation are likely to eventually have problems with debt defaults, because it will become more difficult for workers to repay loans, if wages are drifting downward. These same countries are likely to experience an outflow of investment funds because investors realize that funds invested these countries will not earn an adequate return. This outflow of funds will tend to push their currencies down, relative to other currencies. This is at least part of what has been happening in recent months.

The value of the dollar has been rising rapidly, relative to many other currencies. Debt repayment is likely to especially be a problem for those countries where substantial debt is denominated in US dollars, but whose local currency has recently fallen in value relative to the US dollar.

Figure 3. US Dollar Index from Intercontinental Exchange

The big increase in the US dollar index came since June 2014 (Figure 3), which coincides with the drop in oil prices. Those countries with low currency prices, including Japan, Europe, Brazil, Argentina, and South Africa, find it expensive to import goods of all kinds, including those made with oil products. This is part of what reduces demand for oil products.

China’s yuan is relatively closely tied to the dollar. The collapse of other currencies relative to the US dollar makes Chinese exports more expensive, and is part of the reason why the Chinese economy has been doing less well recently. There are no doubt other reasons why China’s growth is lower recently, and thus its growth in debt. China is now trying to lower the level of its currency.

Issue 10. The drop in oil prices seems to reflect a basic underlying problem: the world is reaching the limits of its debt expansion.

There is a natural limit to the amount of debt that a government, or business, or individual can borrow. At some point, interest payments become so high, that it becomes difficult to cover other needed expenses. The obvious way around this problem is to lower interest rates to practically zero, through Quantitative Easing (QE) and other techniques.

(Increasing debt is a big part of pumps up “demand” for oil, and because of this, oil prices. If this is confusing, think of buying a car. It is much easier to buy a car with a loan than without one. So adding debt allows goods to be more affordable. Reducing debt levels has the opposite effect.)

QE doesn’t work as a long-term technique, because it tends to create bubbles in asset prices, such as stock market prices and prices of farmland. It also tends to encourage investment in enterprises that have questionable chance of success. Arguably, investment in shale oil and gas operations are in this category.

As it turns out, it looks very much as if the presence or absence of QE may have an impact on oil prices as well (Figure 4), providing the “uplift” needed to keep oil prices high enough to cover production costs.

Figure 4. World “liquids production” (that is oil and oil substitutes) based on EIA data, plus OPEC estimates and judgment of author for August to October 2014. Oil price is monthly average Brent oil spot price, based on EIA data.

The sharp drop in price in 2008 was credit-related, and was only solved when the US initiated its program of QE started in late November 2008. Oil prices began to rise in December 2008. The US has had three periods of QE, with the last of these, QE3, finally tapering down and ending in October 2014. Since QE seems to have been part of the solution that stopped the drop in oil prices in 2008, we should not be surprised if discontinuing QE is contributing to the drop in oil prices now.

Part of the problem seems to be differential effect that happens when other countries are continuing to use QE, but the US not. The US dollar tends to rise, relative to other currencies. This situation contributes to the situation shown in Figure 3.

QE allows more borrowing from the future than would be possible if market interest rates really had to be paid. This allows financiers to temporarily disguise a growing problem of un-affordability of oil and other commodities.

The problem we have is that, because we live in a finite world, we reach a point where it becomes more expensive to produce commodities of many kinds: oil (deeper wells, fracking), coal (farther from markets, so more transport costs), metals (poorer ore quality), fresh water (desalination needed), and food (more irrigation needed). Wages don’t rise correspondingly, because more and more labor is needed to provide less and less actual benefit, in terms of the commodities produced and goods made from those commodities. Thus, workers find themselves becoming poorer and poorer, in terms of what they can afford to purchase.

QE allows financiers to disguise growing mismatch between what it costs to produce commodities, and what customers can really afford. Thus, QE allows commodity prices to rise to levels that are unaffordable by customers, unless customers’ lack of income is disguised by a continued growth in debt.

Once commodity prices (including oil prices) fall to levels that are affordable based on the incomes of customers, they fall to levels that cut out a large share of production of these commodities. As commodity production drops to levels that can be produced at affordable prices, so does the world’s ability to make goods and services. Unfortunately, the goods whose production is likely to be cut back if commodity production is cut back are those of every kind, including houses, cars, food, and electrical transmission equipment.

Conclusion

There are really two different problems that a person can be concerned about:

- Peak oil: the possibility that oil prices will rise, and because of this production will fall in a rounded curve. Substitutes that are possible because of high prices will perhaps take over.

- Debt related collapse: oil limits will play out in a very different way than most have imagined, through lower oil prices as limits to growth in debt are reached, and thus a collapse in oil “demand” (really affordability). The collapse in production, when it comes, will be sharper and will affect the entire economy, not just oil.

In my view, a rapid drop in oil prices is likely a symptom that we are approaching a debt-related collapse–in other words, the second of these two problems. Underlying this debt-related collapse is the fact that we seem to be reaching the limits of a finite world. There is a growing mismatch between what workers in oil importing countries can afford, and the rising real costs of extraction, including associated governmental costs. This has been covered up to date by rising debt, but at some point, it will not be possible to keep increasing the debt sufficiently.

The timing of collapse may not be immediate. Low oil prices take a while to work their way through the system. It is also possible that the world’s financiers will put off a major collapse for a while longer, through more QE, or more programs related to QE. For example, actually getting money into the hands of customers would seem to be temporarily helpful.

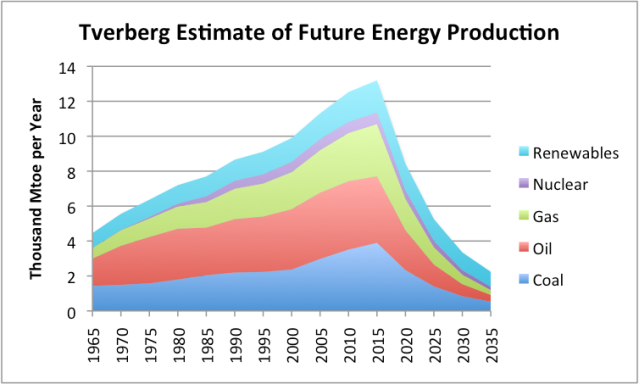

At some point the debt situation will eventually reach a breaking point. One way this could happen is through an increase in interest rates. If this happens, world economic growth is likely to slow greatly. Oil and commodity prices will fall further. Debt defaults will skyrocket. Not only will oil production drop, but production of many other commodities will drop, including natural gas and coal. In such a scenario, the downslope of all energy use is likely to be quite steep, perhaps similar to what is shown in the following chart.

Figure 5. Estimate of future energy production by author. Historical data based on BP adjusted to IEA groupings.

14 Comments on "Ten Reasons Why a Severe Drop in Oil Prices is a Problem"

Makati1 on Tue, 9th Dec 2014 7:53 am

Seems to me that these are 10 positive situations, not negative. Time to collapse the system while there is still an earth where humans can live.

shortonoil on Tue, 9th Dec 2014 7:55 am

This article was posted on Zero Hedge yesterday. The comments it produced were revealing, to say the least. It is amazing that we live in a world powered by petroleum, and at the same time have such a significant number of people who apparently have absolutely no comprehension of its production, distribution, and marketing. Solving our energy dilemma is not likely to happen with a population that is embedded in myth, biased opinion and general ignorance.

rockman on Tue, 9th Dec 2014 8:05 am

shorty – You mean like the guy I heard long ago spouting off about motor fuel costs: “We don’t need any more damn oil wells…what we need more gasoline wells.” Unfortunately that is a true story.

Kenz300 on Tue, 9th Dec 2014 9:30 am

Low oil prices will be a net positive for the world economy suffering from the effects of the Great Recession. Global GDP will grow faster with lower oil prices.

Russia, Iran, Venezuela, and other oil producing countries, shale producers, tar sands developers and deep water drillers will all be hurt as costly and risky projects are put on hold. This will slow future future increases in production.

As the world GDP begins to recover (boosted by low oil prices) over the next year demand will rise and OPEC producers will agree on a volume cut as long as there is shared sacrifice among them and other producers.

KSA will not do it alone……. until other OPEC countries agree to cut production there will be not be a cut by KSA.

The fossil fuel industry had focused on reducing competition from alternatives…… now they are eating their own…….

The greed is good gang wants it all ……. no matter what it does to the planet……

Northwest Resident on Tue, 9th Dec 2014 9:38 am

ZH commenters, most of them, tend to be real knuckle draggers as far as I can tell. There are a few exceptions. If anyone wants to experience just how sexist, crude and ignorant the dregs of American male society can be, ZH comments section is a great place to get your first sampling. It’s like hanging out at a working class two-bit strip club and overhearing the conversations in the dank and dimly lit surroundings. For being such a good source of financial news and opinion, I wonder how their comments section ended up becoming such a low-class forum for stupid one-liners and ignorant grunts. I’ve been tempted to join up and comment a few times on ZH, but the sheer stupidity of the comments that mine would have been mixed in with discouraged me from proceeding.

Rita on Tue, 9th Dec 2014 11:43 am

To avoid a speedy collapse some capitalist states may turn into communist style centralised economies. Oil rationing is mentioned as a response tool in the energy security strategy of EU released during the summer. Hospitals, firefighters, police would have priority among the users.

marmico on Tue, 9th Dec 2014 11:50 am

Unfortunately that is a true story.

Unfortunately, a forty year vet in the oil patch didn’t know that the U.S. consumes ~135 (3.2) billion gallons (barrels) of gasoline annually and postulated that consumption had declined by 66% between 2006 and 2014. That is a true story.

Northwest Resident on Tue, 9th Dec 2014 11:50 am

Rita — I’m pretty sure that the U.S. Federal Government, states, police departments, Homeland Security, National Guard and U.S. Military have detailed plans written up and sitting in a Top Secret hard drive or file cabinet that deal with just that subject.

Dragon Oil on Tue, 9th Dec 2014 12:07 pm

The price of crude oil the general public sees is a lie. Oil companies never see these prices. I live and work in Oklahoma as a geologist. The price always quoted is the futures price. Knock off $3.50 from thatfor the “posted price”. The state takes another 7.2% off the remaining price. Mineral owners take somewhere between 25 and 18.75% off that. Oil and gas don’t climb out of the ground by themselves. Oil has to be pumped out usually with salt water. 3-4% more off the price. Say the future price quoted is $60/bbl. After all the stuff that goes to “others”, working interest owners are seeing about $40/bbl. Horizontal drilling and fracking into low volume low relativr permeability traps is totally unreasonable at those prices. Metaphorically speaking the date is late February 1983/1986. Get ready for the crash.

GregT on Tue, 9th Dec 2014 12:21 pm

Rita,

“To avoid a speedy collapse some capitalist states may turn into communist style centralised economies.”

Free market capitalism ended when the US government bailed out the corrupt ‘too big to fail’ banks. We already have a centralized economy when the taxpayers are bailing out the corporations.

Davy on Tue, 9th Dec 2014 12:44 pm

Right Greg, that is why the corns Marm-a-NOo have augments that lack validity. These boys are well supported and have expert arguments but for a different age that is no longer. Before the new normal and the newer normal part II there was a market based capitalism that was run by the rule of law. Fairness dominated and corruption and manipulation were at a minimum. What we have today is social and economic repression by the 1%ers, politicians, and industrialist all backed up by paramilitary police, intelligence services, and the military. This is not your granddaddies capitalism.

marmico on Tue, 9th Dec 2014 2:46 pm

Isn’t X-mas 2014 fantastic? Every day gasoline consumers save $2 at the pump for every $1 the federal government gives to food stamp recipients. That would be 4 bucks a day for food for the poor and dispossessed.

Pimps like rockman make me want to puke.

GregT on Tue, 9th Dec 2014 3:12 pm

^^^^ Bad batch of blow? ^^^^

Davy on Tue, 9th Dec 2014 6:33 pm

One thing is for sure Marm the 1%ers getting the QE stamps could give a rat’s ass about gas prices. Many don’t even fill their car up. IMA if they do they charge it to the company credit card and could care less about the price. The poor will get a boost in their confidence but in reality they are bending over for the big boys (without lube). The big boys will suck all that disposable income in like a vacuum and the poor will just be poor with an 85 inch flat screen and an unpaid cable bill.