Page added on March 15, 2018

Projections For Peak Oil Demand Are Overblown

Listen to this podcast on our site by clicking here or subscribe on iTunes here.

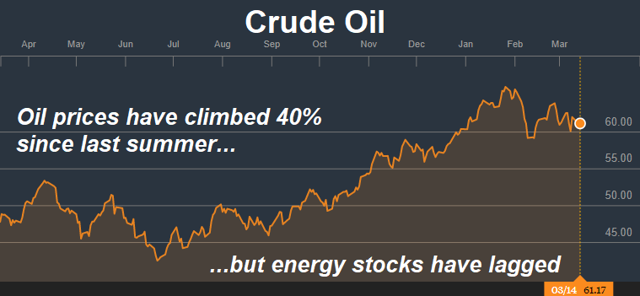

While oil prices trade above $60 a barrel, up over 40% from their June 2017 lows, energy stocks have languished. Why the disconnect, and will this persist?

This time on Financial Sense Newshour, we spoke with Dan Steffens from Energy Prospectus Group to get his outlook on the energy sector, US shale production, and concerns over peak oil demand.

US Shale Production Fears Overhyped

With both the EIA and IEA projecting for the US to produce more oil than Saudi Arabia next year, some are concerned that this will set a cap on oil prices and hamper gains for energy-producing companies as a whole.

This isn’t as big an issue as some fear, Steffens said, because demand for oil is going up by 1.5 million barrels a day per year, and he expects it to rise still higher from there.

Also, it’s important to keep in mind that shale oil production tends to drop off precipitously. Horizontal wells will decline at a 30-40 percent rate per year, Steffens noted.

“I think we’re going to see an increase in demand from the first quarter to the second quarter of about 2 million barrels a day as we come out of the winter driving season,” Steffens said. “I’ve been watching EIA for a long time… The math just doesn’t work. Sooner or later, you just can’t drill enough new wells to make up for the decline in older wells. I think that’s going to come into play in about a year or so.”

Further Catalysts for Energy Stocks

“The global economy’s growing,” he said. “We’re in an economy that is very dependent on a steady supply of this stuff, and we’re below the 5-year average on days of supply.”

There are also price catalysts to consider. While Steffens isn’t as worried about shale keeping a lid on prices, some are concerned about OPEC’s production cutback agreement expiring this year. This isn’t really a problem, however.

First, it would be a bad decision for the cartel to immediately start flooding the market with increased production. In addition, Steffens doesn’t think they have the excess production capacity. Those countries that can cheat would cheat, but that’s not what we’re seeing.

“I think they’ve learned their lesson,” Steffens said. “They were the biggest losers when the price went way below $40. I honestly think when they started this, they expected the price to level off at $60 for a while, and they thought that would be enough to put the fear of God in the shale players. But it’s just kept going, and they’ve lost.”

Are We At Peak Demand?

Some believe renewables and electric cars are going to eat up demand for oil, and the IEA has projected that sometime next decade, demand is going to peak.

This fear is also exaggerated, Steffens stated. Demand for electric cars is limited, as they are still too expensive, and the battery problem needs to be solved first before electric cars make a big dent in oil demand.

Currently, Steffens sees a lot of great value in energy stocks. The low tax rates have helped their bottom lines tremendously, and oil above $60 is supportive, he noted.

Demand for renewables “is going to increase, there’s no doubt about it,” Steffens said. “But the pie just keeps getting bigger… I think we’re going to be very happy we have the technology, because at some point in time, these shale plays are going to level off just like everything else. The shale is the source rock. After we pull the oil out of the source rock, there’s not a lot left.”

12 Comments on "Projections For Peak Oil Demand Are Overblown"

Duncan Idaho on Thu, 15th Mar 2018 11:03 am

“I still can’t see where the 2019 production comes from, if not the Permian (and I can’t see how exponential growth from a high starting point is possible there), and the downside risk from any geopolitical upset or major lost time incidents are growing. Venezuela could easily go to nearly zero in 2019, and UK, Norway, Mexico, most of Asia-Pacific (especially China) will likely lose more combined in 2019 than this year. Something that no-one has even properly considered is going to happen.”

-George Kaplan

MASTERMIND on Thu, 15th Mar 2018 11:16 am

This blog has become so fake that the truth actually bothers people..

Boat on Thu, 15th Mar 2018 12:44 pm

The oil drum was the popular site that wrote off oil/fracking years ago and then shut down due to oops we were wrong. Fast forward 5 years and a new crop of doomers claim gloom and doom as the world stays supplied with oil inspite of OPEC yanking over 2 mbpd out of the market. Those pesky Texas frackers continue to do exceptional work keeping the world fed and build out of renewables going.

BobInget on Thu, 15th Mar 2018 2:03 pm

With a bit of help from Canada, ME, Africa and S. America. ” Texas frackers continue to do exceptional work keeping the world fed and build out of renewables going”.

If/when imports fall below 7 MB p/d “we will see”.

Boat on Thu, 15th Mar 2018 10:37 pm

Bob,

That’s a US net 3.5 mbpd and dropping. The rest of the oil imports are refined and sold as products. That’s thanks to fracking that gave us cheap Nat gas to refine it with. Check out the eia. All the data is there.

Boat on Thu, 15th Mar 2018 10:43 pm

Bob

How much of those imports are shipped in by the country who owns the refinery. We let them pollute and use our tech for a cut in the form of taxes. I’d kick their ass out.

Boat on Thu, 15th Mar 2018 10:49 pm

Bob

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WTTNTUS2&f=W

Look at bottom of the chart. Total imports. Hit the history button.

MASTERMIND on Thu, 15th Mar 2018 10:57 pm

Boat

The US Shale Business is “not profitable” and can’t fund itself whether oil is at 100 or 50 dollars a barrel

https://imgur.com/a/t7ulB

World’s No.1 Oil Trader: U.S. To See Final Oil Output Spike In 2018

https://oilprice.com/Energy/Oil-Prices/Worlds-No1-Oil-Trader-US-To-See-Final-Oil-Output-Spike-In-2018.html

Chevron CEO warns US shale oil alone cannot meet the world’s growing demand for crude

https://www.cnbc.com/2017/05/01/us-shale-cannot-meet-the-worlds-growing-oil-demand-chevron-ceo-warns.html

The IEA is grossly overestimating shale growth

https://oilprice.com/Energy/Oil-Prices/The-IEA-Is-Grossly-Overestimating-Shale-Growth.html

The Shale Gas Revolution Is A Media Myth

https://oilprice.com/Energy/Natural-Gas/The-Shale-Gas-Revolution-Is-A-Media-Myth.html

Peak U.S. Shale Could Be 4 Years Away

https://oilprice.com/Energy/Crude-Oil/Peak-US-Shale-Could-Be-4-Years-Away.html

Oil discoveries in 2017 hit all-time low –Houston Chronicle

https://www.chron.com/business/energy/article/Oil-discoveries-in-2017-hit-all-time-low-12447212.php

MASTERMIND on Thu, 15th Mar 2018 10:59 pm

Hey bob read this…Just ignore boat he is a dumb fat dough boy from TexASS!

https://imgur.com/a/OB1w6

Boat on Thu, 15th Mar 2018 11:11 pm

Mm

You lost credibility on your links. I don’t waste my time. You joined mak. Didn’t think it was possible to be that out of touch.

MASTERMIND on Thu, 15th Mar 2018 11:18 pm

Boat

All my links are mainstream and reliable sources. You are so fake that the truth really bothers you….

MASTERMIND on Thu, 15th Mar 2018 11:19 pm

Boat

As M. King Hubbert (1956) shows, peak oil is about discovering less oil, and eventually producing less oil due to lack of discovery.

https://imgur.com/a/6dEDt

IEA Chief warns of world oil shortages by 2020 as discoveries fall to record lows

https://www.wsj.com/articles/iea-says-global-oil-discoveries-at-record-low-in-2016-1493244000

Saudi Aramco CEO sees oil shortage coming as investments, oil discoveries drop

https://www.reuters.com/article/us-aramco-oil/aramco-ceo-sees-oil-supply-shortage-as-investments-discoveries-drop-idUSKBN19V0KR

Peak Oil Vindicated by the IEA and Saudi Arabia