Page added on April 13, 2017

Oil From the U.S. and Saudis: Top Buyers Get What They Want

Buyers in the world’s biggest oil market are finding they can almost always get what they want, at a time when they weren’t expected to get what they need.

Saudi Arabia, which is cutting output as part of a deal to ease a global glut, was said to supply customers in Asia with all the oil they sought for May, keeping with its strategy of largely sparing them from the curbs. Meanwhile, U.S. exports have surged to nations including China and South Korea while refiners in the region are also binging on African and European North Sea crude.

This free flow of oil signals the high value placed by producers on sales to Asia, which is the center of global demand growth. When the Organization of Petroleum Exporting Countries and its allies began implementing their output-cut agreement in January, regional buyers were concerned about losing access to the wide array of cargoes that were available over the past three years amid a global glut. Instead, the reductions have largely affected refiners in the Americas and Europe.

“There’s no shortage of crude for refiners in Asia,” said Peter Lee, a Singapore-based analyst at BMI Research. “Asia remains the single largest oil-importing region globally, and producers in the Middle East are prioritizing their sales to the region over European and U.S. markets even as the OPEC and non-OPEC producers’ pact remains in place.”

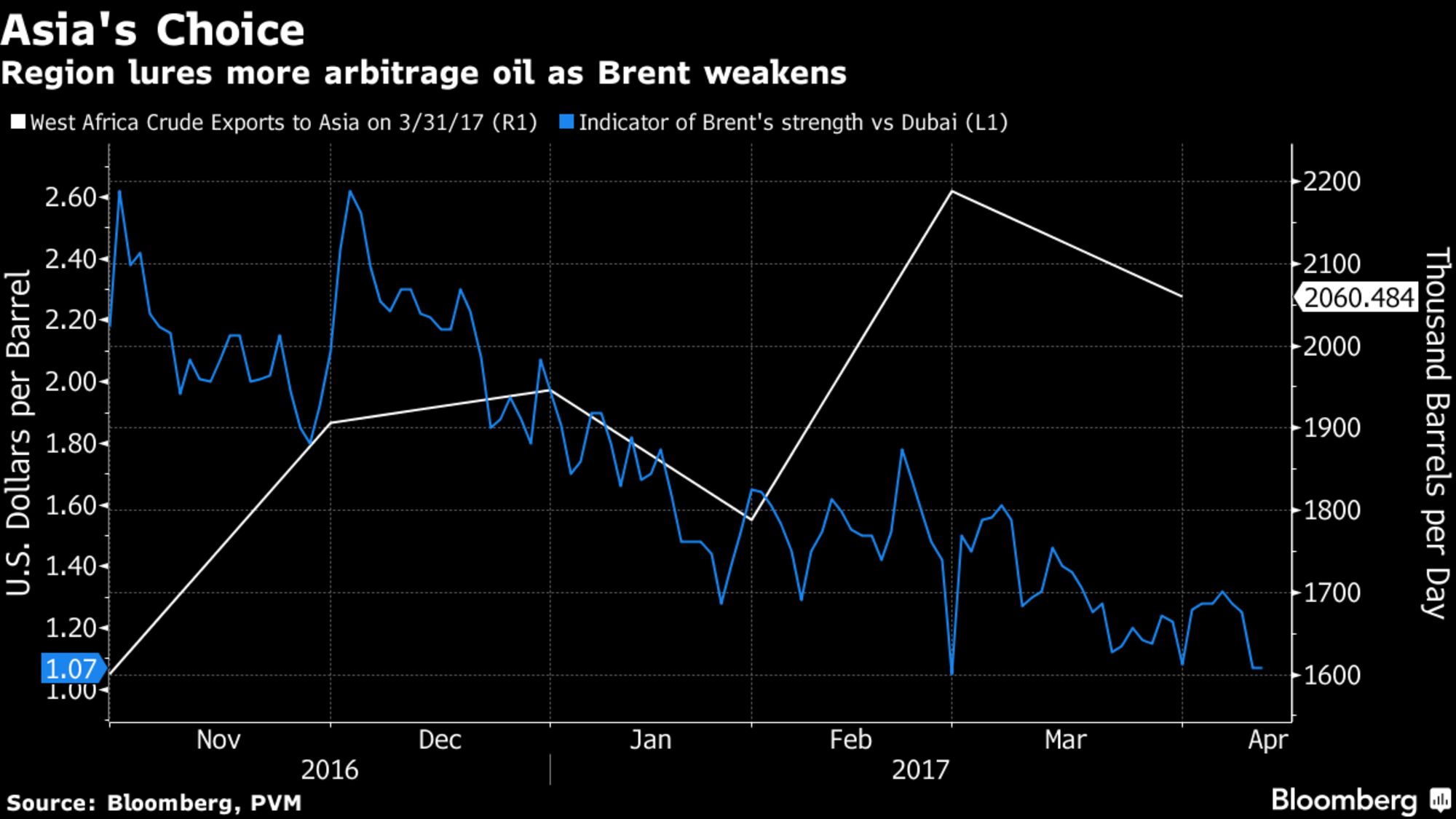

What’s more, the cuts have made supply from nations not part of the deal such as the U.S. more affordable. “Flows of oil from West Africa, the U.S. and North Sea are cost-competitive against Middle Eastern grades as OPEC, non-OPEC compliance to the supply cut has made Middle Eastern barrels more expensive,” said Lee.

Even during the times that Saudi Arabia, the world’s biggest crude exporter, has implemented limited supply cuts to some buyers in Asia, it has reduced cargoes of heavier varieties while providing more of the lighter grades that are similar to rival shipments from the U.S., Africa and Europe.

Other regions haven’t been so lucky. Saudi Arabia was said to maintain a 20 percent cut to at least one European refining company for a second month for February. U.S. imports of oil from the Middle East kingdom fell to the lowest level since December, according to preliminary data from the U.S. Energy Information Administration for the week ended March 31.

While Saudi shipments to the Americas and Europe are curbed, U.S. crude exports in February reached a record high. U.S. cargoes flowing to China, Japan and Singapore totaled 11.41 million barrels that month, more than doubling from 5.63 million barrels in January, data released by the U.S. Census Bureau show.

“Asia remains the most attractive market for global suppliers due to the current open arbitrage,” said Den Syahril, a Singapore-based analyst at industry consultant FGE. “With supplies in the Atlantic rising faster than demand, it has created a supply push into Asia.”

The benchmark for Middle East supplies, Dubai crude, has strengthened relative to other markers as the region’s producers including Saudi Arabia shoulder most of the global output curbs. Dubai has averaged $1.35 a barrel higher than U.S. West Texas Intermediate so far this month, after flipping from a discount in December. Brent crude’s premium to Dubai has narrowed to the weakest since August 2015. The spread was at 95 cents at 10:56 a.m. Singapore time on Thursday.

4 Comments on "Oil From the U.S. and Saudis: Top Buyers Get What They Want"

rockman on Thu, 13th Apr 2017 9:06 am

Buyers in the world’s biggest oil market are finding they can almost always get what they want…if they are willing to pay the market price of oil. As far as “…at a time when they weren’t expected to get what they need.”: buyers never get what they “need”…they get what they can afford.

Every buyer that can afford the current price of oil is buying every bbl available at the price. Don’t want to accept that FACT? OK: post one story of any buyer that can afford the current oil price but can’t find any oil to buy.

The demand/supply is balanced today just as it was a year ago. Just as it was 5 years ago. Just as it was 10 years ago. Etc, etc, etc. Pricing forces the market into balance: buyers have the oil they can afford…not what they want or need. Just it is doing today as it did when oil hit $145/bbl.

The last period production was not controlled by pricing was in the 60’s when the Texas Rail Road Commission monthly set the amount of oil globally available by restricting production from Texas wells. But even then the buyers still set the price of oil: the highest bidder got what oil was on the market at a price it determined. Even though the TRRC was an effective “oil cartel” it couldn’t set the price of oil directly…just the amount in the market place. In reality the TRRC set production volumes based on what buyers were able to pay. If a number of buyers were not able to pay $X as they had previously the TRRC reduced the production to just supply those that could afford $X/bbl. This is why oil prices held stable through the 50’s and 60’s.

That all changed in the 70’s when the TRRC could no longer control the amount of oil in the global market. At that time the supply/demand dynamic is more difficult to analyze. Did demand increase so quickly at a time when producers were delivering at the max rate possible? Or did demand hold at previous levels DESPITE producers increasing the price?

A bit of history. Can’t confirm the accuracy since there are few data bases available:

http://don.geddis.org/bets/peakoil/eia-doe-1960-2006.html

Oil prices adjusted for inflation

1960: $23/bbl

OPEC – 8.7 mm bopd

USA – 7.0 mm bopd

Global – 21 mm bopd

1970: $21/bbl

OPEC – 23.3 mm bopd

USA – 9.6 mm bopd

Global – 45.9 mm bopd

1980: $118/bbl

OPEC – 26.6 mm bopd

USA – 8.6 mm bopd

Global – 59.6 mm bopd

1985: $60/bbl

OPEC – 17.4 mm bod

USA – 8.9 mm bopd

Global – 54.5 bopd

1990: $48/bbl

OPEC – 23.2 mm bopd

USA – 7.4 mm bopd

Global – 60.5 mm bopd

1995: $27/bbl

OPEC – 26 mm bopd

USA – 6.6 mm bopd

Global – 62.3 mm bopd

2000: $38/bbl

OPEC – 29.3 mm bopd

USA – 5.8 mm bopd

Global – 68.4 mm bopd

2005: $50/bbl

OPEC – 31.2 mm bopd

USA – 5.2 mm bopd

Global – 73.5 bopd

I’ll let everyone spot the trends and correlations as they see fit. But notice that in 1970 when OPEC controlled slightly more of the global market then in 1980 the oil price was $21/bbl compared to $118/bbl ten years later.

Outcast_Searcher on Thu, 13th Apr 2017 12:01 pm

Oil is fungible. Modern financial markets exist. Supply and demand are a part of markets.

Why are articles like this even written?

deadlykillerbeaz on Thu, 13th Apr 2017 1:12 pm

You mean to tell me there is a market for oil? Holy Cow! You can’t make this stuff up. A demand for oil? You’re kidding! Who in God’s name would want oil?

Good Lord, there has to be something better.

During the fifties, farmers were buying all of the land they could, one of those investments where you can’t really go wrong. They were also buying mineral rights from other farmers. You know, mineral rights, staking claims, like the prospectors did in California, Idaho, Montana, the Treasure State, for gold and precious gems, potash and coal today.

It’s just not oil that is a sought after resource turned commodity, you know.

Fifty years later, those mineral rights brought in the bacon, the ship came to shore.

Claim jumpers, carpet baggers, swindlers just won’t go away no matter where you are.

Just on my two hour lunch. Hells Bells, arms dealers take a three hour lunch four times each day. After that lollapalooza, the are limousined to their private jets to the next art of the deal.

Everybody knows that.

That’s how humans do things. Herbert Hoover made his millions dealing metals. That’s how it is done. Not much of a politician, but a good man, so you can’t condemn Hoover for being an idiot.

That stuff is history. Today, in the extant world, we have Donald Trump. North Korea has Kim Jong-un, America has Kim Jong-trump, so it’s a wash. The orient is equal to the occident. The yin and yang are complete!

lol

Forget about those two imbeciles, oil is what counts.

And that’s the truth, a fact, Jack. Everybody wants oil, each and every day. Come on, ‘fess up, you count on it more than you’ll ever know.

Have a nice day!

BobInget on Thu, 13th Apr 2017 1:16 pm

Canadians, getting paid for their oil in USD.

Canadians pay for labor, royalties & taxes, material,

transportation in loonies.

Canadian oil prices not so bad

WCS has had the biggest jump percentage-wise since this time last year, crude up more than light oil in real terms. Most Canadian producers are making money at these levels, and continued pressure on share prices makes little sense.

And now for something (almost) completely different.

I have a theory why crude prices are being held back.

http://www.reuters.com/article/us-venezuela-politics-idUSKBN17F20E

The ‘plan’ (as I see it) is to further destabilize Venezuela by holding oil prices in check.

Two possible outcomes.

Oil production slows, denying domestic demand. Army fires live ammunition at angry protestors, it’s game over.

Regime change takes place, oil prices resume upward momentum.