Memories are short, and we often mistake prices of the last few years as indicative of the historical norm. Indeed, when it comes to the price of crude oil, most Americans would probably be surprised to learn that it is still well above the long-term historical average, once we adjust for price inflation. Contrary to the popular rhetoric, cheap and plentiful energy has been the norm for the United States economy. There is nothing “unnatural” or “dangerous” about giving Americans access to affordable energy.

Crude Oil Prices

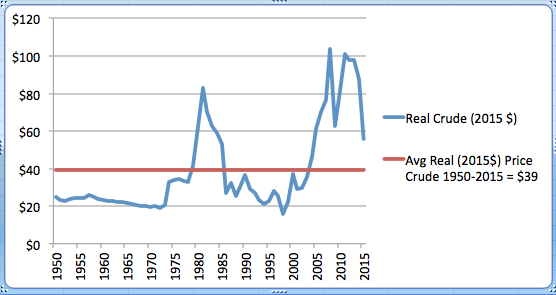

Figure 1 below shows the history of U.S. crude prices.

FIGURE 1: Real (Inflation-Adjusted) U.S. Crude Oil Prices, 1950-2015

SOURCE: EIA

SOURCE: EIA

Contrary to popular belief, oil is not “cheap” right now, compared to the historical average. Over the period 1950-2015, the average annual price of a barrel of crude would be $39, when put into 2015 dollars using the Consumer Price Index.

Yes, crude oil seems “cheap” lately, but’s that only because it has been historically very expensive since the mid-2000s. So we can see yet another problem with the argument that the U.S. government should raise the gas tax and/or impose a carbon tax now “while oil is cheap.”

Natural Gas Prices

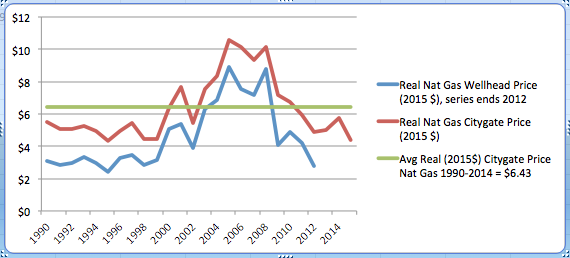

Figure 2 shows the historical pattern of natural gas prices:

FIGURE 2. Real Natural Gas Prices (Wellhead and Citygate), 1990-2015

SOURCE: EIA

SOURCE: EIA

Figure 2 shows the opposite story when it comes to natural gas. Here, the tremendous surge in output and consequent fall in price due (in large part) to innovations in hydraulic fracturing and horizontal drilling have pushed natural gas prices below their historical averages. Adjusted for inflation, natural gas prices are just about as low as they’ve been over the last 25 years.

Conclusion

Misled by the financial press, Americans probably think that oil prices are abnormally low, and that this somehow poses risks for the tepid economic recovery. On the contrary, the surge in U.S. oil output has merely pushed prices back toward their historical average, but they are still relatively high. If the government would pull back from the industry and let the market work, Americans would have access to plentiful and affordable energy that would fuel a vibrant economy.

ennui2 on Sat, 14th Nov 2015 8:40 am

“If the government would pull back from the industry and let the market work, Americans would have access to plentiful and affordable energy that would fuel a vibrant economy.”

Neocon wonk.

rockman on Sat, 14th Nov 2015 8:47 am

Obviously the NG average they show is BS. Look at the area above the “average” line and compare it to the area below the line: they are not equal. After another coffee I’ll run the actual average.

forbin on Sat, 14th Nov 2015 8:49 am

If the government would pull back from the industry and let the market work,

ok let the Fed stop QE support for the Banks……

oh deary me !

rockman on Sat, 14th Nov 2015 11:40 am

OK: based on several inflation adjusted NG price charts and eyeballing it (couldn’t find data in Excel)the average piece of NG between 1990 and today is about $3/mcf. But that’s the well head price…not the price business and residential users pay. Those stats show even a bigger pile of horse sh*t presented in this piece. I had seen the story a year ago: there has been a huge disconnect growing between wellhead prices and residential prices. I don’t know where they got their bullsh*t City Gate price from (less then $6/mcf in 2014 compared to the EIA number that’s almost 2X) but here’s what the EIA shows for residential NG prices for the last 25 years: from 1990 to 2006 it jumped from $6/mcf to $14/mcf. That corresponds to the increase in wellhead price. Then decreased but for the last 4 years has averaged around $11/mcf. IOW the current residential price is 5X higher then the current spot price at the Henry Hub in S.La…the benchmark for the US NG WELLHEAD PRICE.

Almost no one here but the Rockman cares about wellhead NG prices. The rest are concerned about what they pay for NG delivered by their utility company. This ties into the other article about the increased costs to the consumers that the EPA may be bring about. Substituting NG for coal is great for the environment. But the cost of that transition is born by the utility companies which means it’s passed on to the consumers.

Tossing out low wellhead NG price as an indication of cheap energy to the consumer is a blatant misrepresentation of the reality.

eugene on Sat, 14th Nov 2015 12:07 pm

“Just letting the market work” gave us the dot com and housing bubbles which almost destroyed us. Written by a sociopath who believes in “turn me loose” and to hell with anyone or anything else. I don’t know where the “correct” balance is but is sure isn’t in turn the market loose. Theory of the market is one thing but human behavior is another. There’s an element of the human animal that will destroy everything to get what they want. Whatever it is, they will never have enough.

Boat on Sat, 14th Nov 2015 12:09 pm

Rock,

It would be interesting to know the costs for infrastructure for these utilities as they transition from coal to nat gas and whether profits have remained the same for the utilities.

This transition is labor intensive and expensive but a defiantly cheaper fuel over years if you account for heath care, coal ash ponds, mountain top removal etc.

Plantagenet on Sat, 14th Nov 2015 12:14 pm

There is no need to “turn the market loose. We’ve got “plentiful and affordable” energy now. In fact, there is so much oil on the marketl that we are in an oil glut.

Cheers!

Nony on Sat, 14th Nov 2015 12:14 pm

Rock, you’re the one making errors.

http://www.eia.gov/dnav/ng/hist/n3050us3A.htm

EIA data shows city gate for 2014 as $5.71.

The green line average for NG also passes the eye test. It is CITY GATE average. Just read a little more carefully and post a little less hastily.

Boat on Sat, 14th Nov 2015 12:15 pm

eugene,

Don’t blame the markets for human mistakes. Regulations are manipulated constantly and greed won. More skin in the game by home owners and lenders got out of whack. These things are fixable.

Joe D on Sat, 14th Nov 2015 12:15 pm

The author Robert P Murphy has written support of Intelligent Design theory and expressed skepticism of biological evolution. Murphy has expressed skepticism about evolution, asserting that he “can literally prove evolution is false”.

https://en.wikipedia.org/wiki/Robert_P._Murphy

Boat on Sat, 14th Nov 2015 12:20 pm

Nat gas by state history

http://www.eia.gov/dnav/ng/NG_PRI_SUM_A_EPG0_PG1_DMCF_A.htm

BobInget on Sat, 14th Nov 2015 12:22 pm

Point of information.

Why is this Web site called peakoil.com ?

Simply put: Is there more or less oil and gas available today then in 1990?

Is it easier to find gas and oil today ?

Do we use more or less gas and oil today then 10 years ago ? 20 ? Last week?

EIA has been saying storage is fuller then any time since 1935. How many cars and trucks were in service 80 years ago ? Fewer then the billion we have today i’ll betcha.

Davy on Sat, 14th Nov 2015 12:26 pm

Eugene, markets are nearly pure moral hazard anymore. We used to have some control back before Clinton gutted Glass-Steagall.

Boat on Sat, 14th Nov 2015 12:33 pm

Fuel oil in comparison.

http://www.eia.gov/dnav/pet/pet_cons_821dst_dcu_nus_a.htm

rockman on Sat, 14th Nov 2015 12:34 pm

Nony – Go piss one the EIA…not me. Here are it’s OFFCIAL RESIDENTIAL NG PRICES that I used:

http://www.eia.gov/dnav/ng/hist/n3010us3A.htm

It would appear you have no f*cking idea what “City Gate” prices are. LOL.

rockman on Sat, 14th Nov 2015 12:44 pm

Boat – I can’t even make a guess of the total infrastructure cost for all the utilities/consumers to transition to NG. Here’s the cost of just one small part of just one company to transition in just one of their plants:

Duke Energy to build and operate a 550-mile interstate natural gas pipeline in eastern North Carolina to meet the region’s rapidly growing demand for natural gas.

Called the “Atlantic Coast Pipeline,” it also is expected to serve as a key infrastructure engine. Duke Energy will build North Carolina’s second major interstate natural gas pipeline.

The pipeline has an estimated cost of between $4.5 billion and $5 billion, an initial capacity of 1.5 billion cubic feet of natural gas per day, and a target in-service date of late 2018.

Nony on Sat, 14th Nov 2015 12:44 pm

Rock, there are several different time series:

*wellhead (on the chart)

*city gate (on the chart)

*residential (brought into the discussion only BY YOU)

Please stop posting without reading. Look at this link and read carefully, to see the different data series.

http://www.eia.gov/dnav/ng/ng_pri_sum_dcu_nus_m.htm

The article’s chart clearly labeled what it was discussing: wellhead and citygate.

YOU are confused in trying to equate residential with city gate. The sub $6 for 2014 city gate is CORRECT, correct, correct.

marmico on Sat, 14th Nov 2015 12:57 pm

2015 real residential natural gas prices are about average for the 1967-2015 period and slightly below average for the 1980-2015 period.

http://www.eia.gov/forecasts/steo/realprices/

Apneaman on Sat, 14th Nov 2015 1:06 pm

boat, if there were no humans, would the the markets still exist? How did the markets come to be? Have they always existed and we just happened to find them on an archaeological dig one day? OR are they just another ever changing institution that certain powerful people made up out of whole cloth? Me thinks we just made it up. Not actually real. Worshiped just like all the other magical non existent “forces” we make up. Apes are to blame for all of it. It’s not religion, it’s not the markets, it’s not the commies, it’s not the jihadists, it’s not the capitalists, it’s greedy, rapacious, emotion driven, suicidal apes.

shortonoil on Sat, 14th Nov 2015 1:08 pm

This is a repost from:

“11/08/15 PO News

Oil company defaults are coming

1979 wasn’t a bad year. The richest oil producing nation on earth wasn’t borrowing money to pay its bills, and Venezuela had toilet paper. The majors hadn’t just canceled $200 billion in projects, and they weren’t laying off 100,000s. The petroleum industry hadn’t doubled its debt over the previous 6 years.

Oil was selling for $12.64/ barrel, which inflation adjusted is $41.46 in 2015 dollars. Less than today’s $44. They were selling oil for less than they are today, and not losing their shirts in the process. At least a third of the world’s producers are now pumping oil for below its full life cycle production cost. World inventories have reached all time highs, and profit per barrel all time lows. Something here just doesn’t add up?”

The writers of this article have completely ignored the fact that production costs have grown. From 1970 to 2015 they have increased by 547% in energy terms. Making statements like $39 has been the average over X years is completely useless unless the cost of production has been factored into it. The article is just another disingenuous attempt to keep their hand in the investors pocket!

http://www.thehillsgroup.org/

Boat on Sat, 14th Nov 2015 1:28 pm

Apeman,

Yea, it takes humans to have markets. At some point humans saw something other humans had and traded for it. Money just made it easier. Bingo a market. Not much has changed.

rockman on Sat, 14th Nov 2015 3:55 pm

Nony – Please stop posting without reading. My discussion was focused on wellhead prices and residential prices. In particular the big increase in residential prices in recent years despite near record low wellhead NG prices. Please try to stay up with the adults. LOL.

Apneaman on Sat, 14th Nov 2015 4:19 pm

Damn boat if only you had told me years ago, it would have saved me reading the likes of Niall Ferguson, David Graber,John Kenneth Galbraith and many others. Gee whiz boat you sure is smart.

Nony on Sat, 14th Nov 2015 6:24 pm

Rock: Here is what you said:

“I don’t know where they got their bullsh*t City Gate price from (less then $6/mcf in 2014 compared to the EIA number that’s almost 2X)”

Here is the EIA source that clearly shows city gate price for 2014 was 5.71.

http://www.eia.gov/dnav/ng/hist/n3050us3A.htm

Boat on Sat, 14th Nov 2015 6:43 pm

Apeman,

Sorry you wasted so much time. Think of it this way. Most knowledge is wasted and a waste of time. Trillions invested over generations and all gonna go down with climate change. Glad to see your like the rest of us. A wasted life. lol

shortonoil on Sun, 15th Nov 2015 4:43 pm

“Nony – Please stop posting without reading.”

Then you be the one to take the time to teach him (lol)

GregT on Sun, 15th Nov 2015 5:09 pm

Back stirring shit up again so soon Nony? I thought you promised for the third time in a year to stop. You ever wonder why you got banned from those other sites? Or do you really still believe that you have something meaningful to contribute?

marmico on Sun, 15th Nov 2015 5:27 pm

Good job, Nony. 🙂

Drop back once in a while to unequivocally demonstrate that Rockman is a bloviating, blathering blowhard.

claman on Sun, 15th Nov 2015 5:45 pm

Plant said :There is no need to “turn the market loose. We’ve got “plentiful and affordable” energy now. In fact, there is so much oil on the marketl that we are in an oil glut.”

It’s completely incredible that the doomers and corners on this site can’t agree about how much usable oil we got left. Both sides claim to be experts, yet nobody seems to neither understand nor being able to defy the opponents point of view.

There’s got to be some undeniable statistical facts that would show how the situation is in real life.

GregT on Sun, 15th Nov 2015 7:53 pm

“It’s completely incredible that the doomers and corners on this site can’t agree about how much usable oil we got left.”

It’s even more completely incredible that after the amount of time you have spent here claman, you would make such an uninformed statement as the one above.

The amount of usable oil available isn’t the question. It is the price of that oil, and the affordability of that oil to our economies that is in question. All barrels of oil are not equal.

Planter is being purposefully misleading. She has had this explained to her a hundred different times, in a hundred different ways, yet she still continues to play her little oil glut game. She obviously isn’t overly intelligent.

Besides, we can’t burn known reserves anyways. We have more than enough fossil fuel reserves left to render our planet unrecognizable in the not so distant future.

onlooker on Sun, 15th Nov 2015 9:09 pm

“Drop back once in a while to unequivocally demonstrate that Rockman is a bloviating, blathering blowhard.”

Rockman is one of the most expert posters on this site. Your disparaging remarks reflect upon you in a most negative way.

GregT on Sun, 15th Nov 2015 9:50 pm

“Your disparaging remarks reflect upon you in a most negative way.”

I second that onlooker. The Rockman’s interests would be better served by spreading the cornucopian blather that blowhards like marmi-noo continue to spew, instead of being honest.

Boat on Mon, 16th Nov 2015 2:18 am

GregT,

Just because the fact that there is plenty of oil does not make it cornucopian. Affordable oil is a matter of opinion. World production, consumption of oil continues to grow 1-2 million barrels per year on a pretty consistent basis for decades. The per capita of oil vrs population is correct in that population outgrows the per person use of oil but in my view most of the population growth is in underdeveloped countries who have a much lower per capita oil use anyways.

There is no misinformation in these facts, only your misreading of them.