Page added on September 11, 2017

Gail Tverberg: Why Oil Prices Can’t Bounce Very High; Expect Deflation Instead

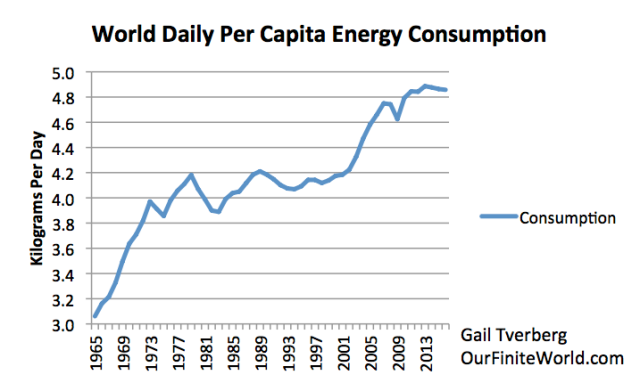

Economists have given us a model of how prices and quantities of goods are supposed to interact.

Figure 1. From Wikipedia: The price P of a product is determined by a balance between production at each price (supply S) and the desires of those with purchasing power at each price (demand D). The diagram shows a positive shift in demand from D1 to D2, resulting in an increase in price (P) and quantity sold (Q) of the product.

Unfortunately, this model is woefully inadequate. It sort of works, until it doesn’t. If there is too little of a product, higher prices and substitutions are supposed to fix the problem. If there is too much, prices are supposed to fall, causing the higher-priced producers to drop out of the system.

This model doesn’t work with oil. If prices drop, as they have done since mid-2014, businesses don’t drop out. They often try to pump more. The plan is to try to make up for inadequate prices by increasing the volume of extraction. Of course, this doesn’t fix the problem. The hidden assumption is, of course, that eventually oil prices will again rise. When this happens, the expectation is that oil businesses will be able to make adequate profits. It is hoped that the system can again continue as in the past, perhaps at a lower volume of oil extraction, but with higher oil prices.

I doubt that this is what really will happen. Let me explain some of the issues involved.

[1] The economy is really a much more interlinked system than Figure 1 makes it appear.

Supply and demand for oil, and for many other products, are interlinked. If there is too little oil, the theory is that oil prices should rise, to encourage more production. But if there is too little oil, some would-be workers will be without jobs. For example, truck drivers may be without jobs if there is no fuel for the vehicles they drive. Furthermore, some goods will not be delivered to their desired locations, leading to a loss of even more jobs (both at the manufacturing end of the goods, and at the sales end).

Ultimately, a lack of oil can be expected to reduce the availability of jobs that pay well. Digging in the ground with a stick to grow food is a job that is always around, with or without supplemental energy, but it doesn’t pay well!

Thus, the lack of oil really has a two-way pull:

(a) Higher prices, because of the shortage of oil and the desired products it produces.

(b) Lower prices, because of a shortage of jobs that pay adequate wages and the “demand” (really affordability) that these jobs produce.

[2] There are other ways that the two-way pull on prices can be seen:

(a) Prices need to be high enough for oil producers, or they will eventually stop extracting and refining the oil, and,

(b) Prices cannot be too high for consumers, or they will stop buying products made with oil.

If we think about it, the prices of basic commodities, such as food and fuel, cannot rise too high relative to the wages of ordinary (also called “non-elite”) workers, or the system will grind to a halt. For example, if non-elite workers are at one point spending half of their income on food, the price of food cannot double. If it does, these workers will have no money left to pay for housing, or for clothing and taxes.

[3] The upward pull on oil prices comes from a combination of three factors.

(a) Rising cost of production, because the cheapest-to-produce oil tends to be extracted first, leaving the more expensive-to-extract oil for later. (This pattern is also true for other types of resources.)

(b) If workers are becoming more productive, this growing productivity of workers is often reflected in higher wages for the workers. With these higher wages, workers can afford more goods made with oil, and that use oil in their operation. Thus, these higher wages lead to higher “demand” (really affordability) for oil.

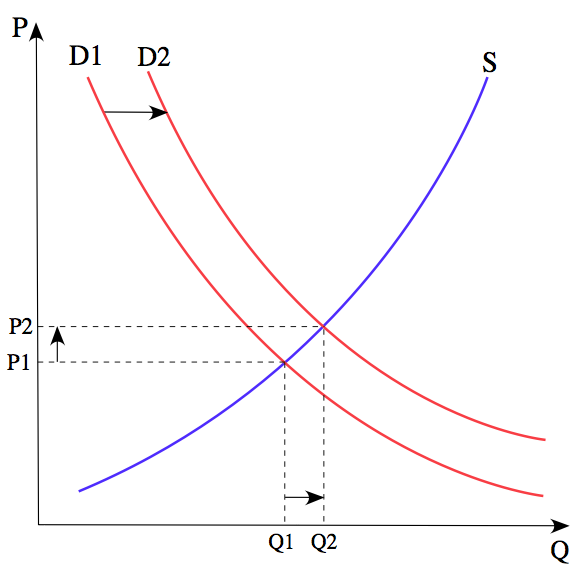

Recently, worker productivity has not been growing. One reason this is not surprising is because energy consumption per capita hit a peak in 2013. With less energy consumption per capita, it is likely that, on average, workers are not being given bigger and better “tools” (such as trucks, earth-moving equipment, and other machines) with which to leverage their labor. Such tools require the use of energy products, both when they are manufactured and when they are operated.

Figure 2. World Daily Per Capita Energy Consumption, based on primary energy consumption from BP Statistical Review of World Energy and 2017 United Nations population estimates.

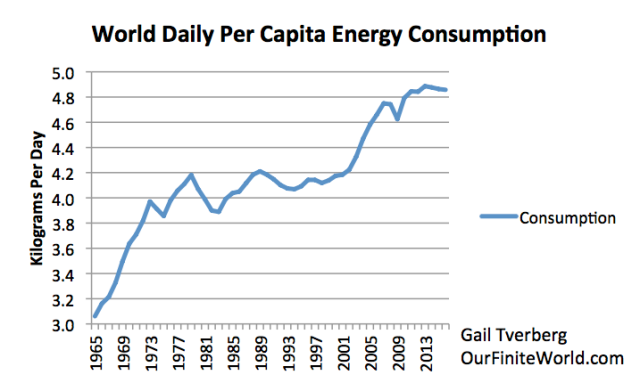

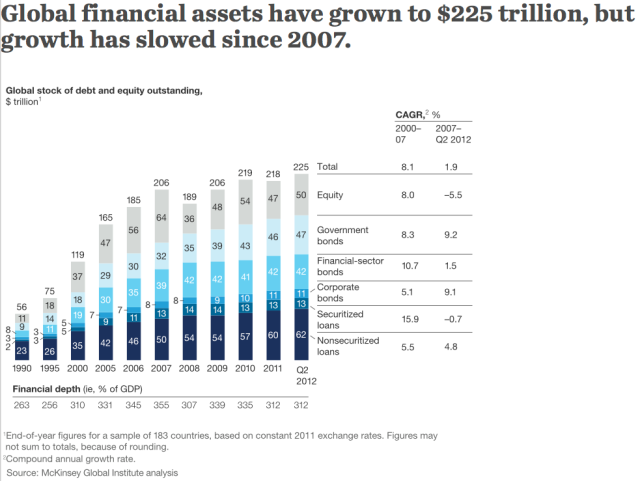

(c) Another “pull” on demand comes from increased investment. This investment can be debt-based or can reflect equity investment. It is these financial assets that allow new mines to be opened, and new factories to be built. Thus, wages of non-elite workers can grow. McKinsey Global Institute reports that growth in total “financial assets” has slowed since 2007.

Figure 3. Figure by McKinsey Global Institute showing that growth in debt in financial instruments (both debt and equity) has slowed significantly since 2007. Source

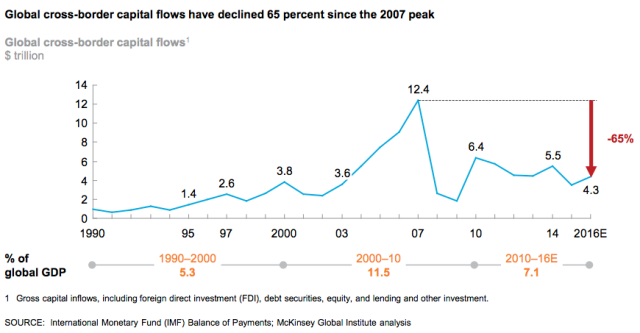

More recent data by McKinsey Global Institute shows that cross-border investment, in particular, has slowed since 2007.

Figure 4. Figure by McKinsey Global Institute showing that global cross-border capital flows (combined debt and equity) have declined by 65% since the 2007 peak. Download from this page.

This cross-border investment is especially helpful in encouraging exports, because it often puts into place new facilities that encourage extraction of minerals. Some minerals are available in only a few places in the world; these minerals are often traded internationally.

[4] The downward pull on oil and other commodity prices comes from several sources.

(a) Oil exports are often essential to the countries where they are extracted because of the tax revenue and jobs that they produce. The actual cost of extraction may be quite low, making extraction feasible, even at very low prices. Because of the need for tax revenue and jobs, governments will often encourage production regardless of price, so that the country can maintain its place in the world export market until prices again rise.

(b) Everyone “knows” that oil and other commodities will be needed in the years ahead. Because of this, there is no point in stopping production altogether. In fact, the cost of production is likely to keep rising, putting an upward push on commodity prices. This belief encourages businesses to stay in the market, regardless of the economics.

(c) There is a long lead-time for developing new extraction capabilities. Decisions made today may affect extraction ten years from now. No one knows what the oil price will be when the new production is brought online. At the same time, new production is coming on-line today, based on analyses when prices were much higher than they are today. Furthermore, once all of the development costs have been put in place, there is no point in simply walking away from the investment.

(d) Storage capacity is limited. Production and needed supply must balance exactly. If there is more than a tiny amount of oversupply, prices tend to plunge.

(e) The necessary price varies greatly, depending where geographically the extraction is being done, and depending on what is included in the calculation. Costs are much lower if the calculation is done excluding investment to date, or excluding taxes paid to governments, or excluding necessary investments needed for pollution control. It is often easy to justify accepting a low price, because there is usually some cost basis upon which such a low price is acceptable.

(f) Over time, there really are efficiency gains, but it is difficult to measure how well they are working. Do these “efficiency gains” simply speed up production a bit, or do they allow more oil in total to be extracted? Also, cost cuts by contractors tend to look like efficiency gains. In fact, they may simply be temporary prices cuts, reflecting the desire of suppliers to maintain some market share in a time when prices are too low for everyone.

(g) Literally, every economy in the world wants to grow. If every economy tries to grow at the same time and the market is already saturated (given the spending power of non-elite workers), a very likely outcome is plunging prices.

[5] As we look around the world, the prices of many commodities, including oil, have fallen in recent years.

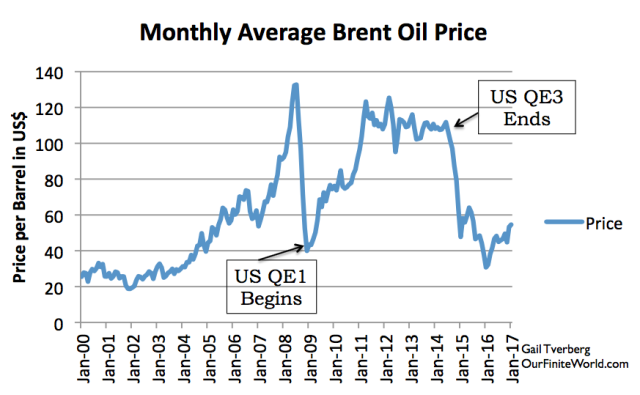

Figures 3 and 4 show that investment spending spiked in 2007. Oil prices spiked not long after that–in the first half of 2008.

Quantitative Easing (QE) is a way of encouraging investment through artificially low interest rates. US QE began right about when oil prices were lowest. We can see that the big 2008 spike and drop in prices corresponds roughly to the rise and drop in investment in Figures 3 and 4, above, as well.

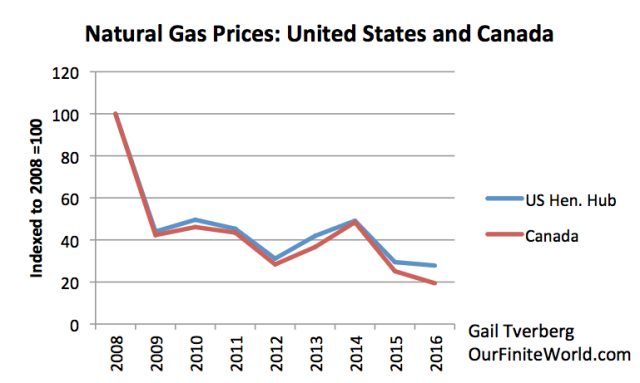

If we look at commodities other than oil, we often see a major downslide in prices in recent years. The timing of this downslide varies. In the US, natural gas prices fell as soon as gas from fracking became available, and there started to be a gas oversupply problem.

I expect that at least part of gas’s low price problem also comes from subsidized prices for wind and solar. These subsidies lead to artificially low prices for wholesale electricity. Since electricity is a major use for natural gas, low wholesale prices for electricity indirectly tend to pull natural gas prices down.

Figure 6. Natural gas prices in the US and Canada, indexed to the 2008 price, based on annual price data provided in BP Statistical Review of World Energy, 2017.

Many people assume that fracking can be done so inexpensively that the type of downslide in prices shown in Figure 6 makes sense. In fact, the low prices available for natural gas are part of what have been pushing North American “oil and gas” companies toward bankruptcy.

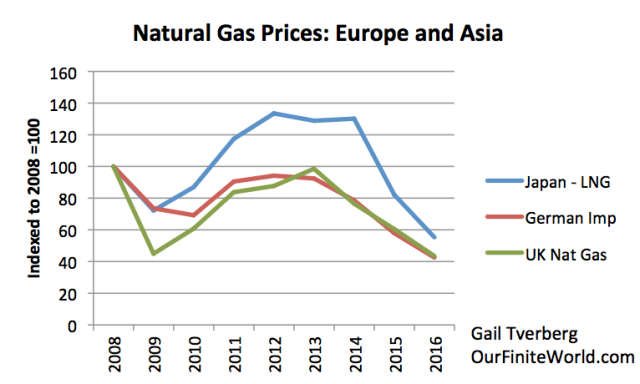

For a while, it looked like high natural gas prices in Europe and Asia might allow the US to export natural gas as LNG, and end its oversupply problem. Unfortunately, overseas prices of natural gas have slid since 2013, making the profitability of such exports doubtful (Figure 7).

Figure 7. Prices of natural gas imports to Europe and Asia, indexed to 2008 levels, based on annual average prices provided by BP Statistical Review of World Energy, 2017.

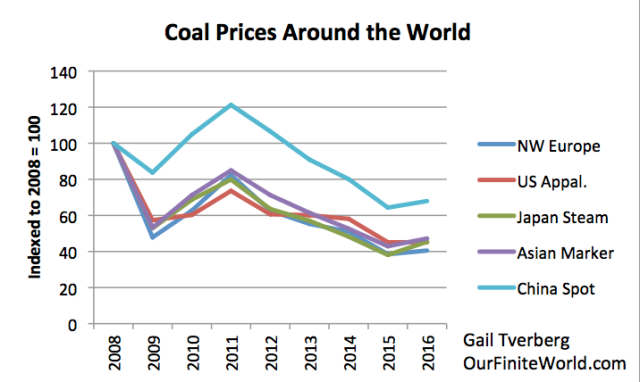

Coal prices have followed a downward slope of a different shape since 2008. Note that the 2016 prices range from 32% to 59% below the 2008 level. They are even lower, relative to 2011 prices.

Figure 8. Prices of several types of coal, indexed to 2008 levels, based on annual average prices provided by BP Statistical Review of World Energy, 2017.

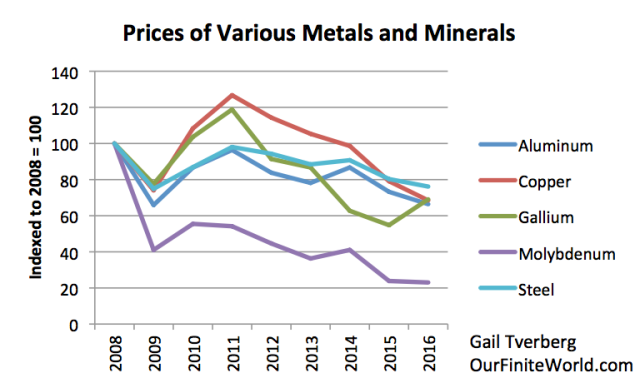

Figure 9 shows the price path for several metals and minerals. These seem to follow a downward path as well. I did not find a price index for rare earth minerals that went back to 2008. Recent data suggested that the prices of these minerals have been falling as well.

Figure 9. Prices of various metals and minerals, indexed to 2008, based on USGS analyses found using this link: https://minerals.usgs.gov/minerals/pubs/mcs/

Figure 9 shows that several major metals are down between 24% and 35% since 2008. The drop is even greater, relative to 2011 price levels.

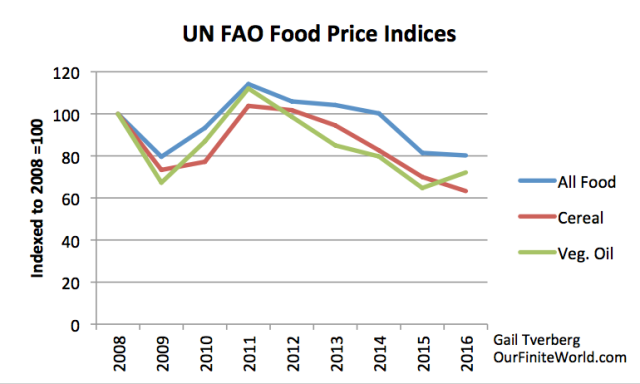

Internationally traded foods have also fallen in price since 2008.

Figure 10. Food prices, indexed to 2008 levels, based on data from the United Nations’ Food and Agricultural Organization.

In Item [4] above, I listed several factors that would tend to make oil prices fall. These same issues could be expected to cause the prices of these other commodities to drop. In addition, energy products are used in the production of metals and minerals and of foods. A drop in the price of energy products would tend to flow through to lower extraction prices for minerals, and lower costs for growing agricultural products and bringing products to market.

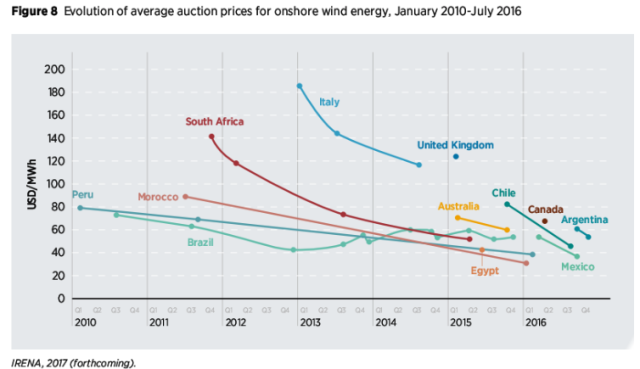

One surprising place where prices are dropping is in the auction prices for the output of onshore wind turbines. This is a chart shown by Roger Andrews, in a recent article on Energy Matters. The cost of making wind turbines doesn’t seem to be dropping dramatically, except from the fall in the prices of commodities used to make the turbines. Yet auction prices seem to be dropping by 20% or more per year.

Figure 11. Figure by Roger Andrews, showing trend in auction prices of onshore wind energy from Energy Matters.

Thus, wind energy purchased through auctions seems to be succumbing to the same deflationary market forces as oil, natural gas, coal, many metals, and food.

[6] It is very hard to see how oil prices can rise significantly, without the prices of many other commodities also rising.

What seems to be happening is a basic mismatch between (a) the amount of goods and services countries want to sell, and (b) the amount of goods and services that are truly affordable by consumers, especially those who are non-elite workers. Somehow, we need to fix this supply/demand (affordability) imbalance.

One way of raising demand is through productivity growth. As mentioned previously, such a rise in productivity growth hasn’t been happening in recent years. Given the falling energy per capita amounts in Figure 2, it seems unlikely that productivity will be growing in the near future, because the adoption of improved technology requires energy consumption.

Another way of raising demand is through wage increases, over and above what would be indicated by productivity growth. With globalization, the trend has been to lower and less stable wages, especially for less educated workers. This is precisely the opposite direction of the change we need, if demand for goods and services is to rise high enough to prevent deflation in commodity prices. There are very many of these non-elite workers. If their wages are low, this tends to reduce demand for homes, cars, motorcycles, and the many other goods that depend on wages of workers in the world. It is the manufacturing and use of these goods that influences demand for commodities.

Another way of increasing demand is through rising investment. This can eventually filter back to higher wages, as well. But this isn’t happening either. In fact, Figures 3 and 4 show that the last big surge in investment was in 2007. Furthermore, the amount of debt growth required to increase GDP by one percentage point has increased dramatically in recent years, both in the United States and China, making this approach to economic growth increasingly less effective. Recent discussions seem to be in the direction of stabilizing or lowering debt levels, rather than raising them. Such changes would tend to lower new investment, not raise it.

[7] In many countries, falling export revenue is adversely affecting demand for imported goods and services.

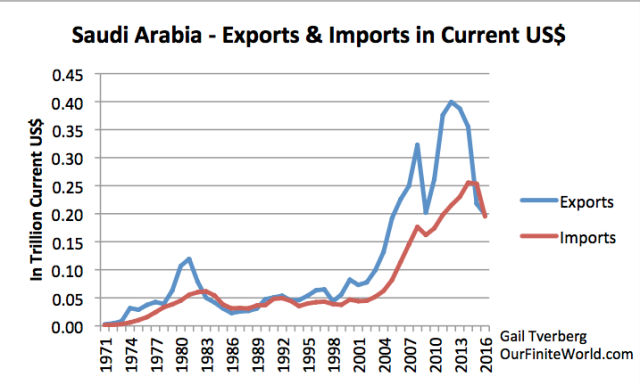

It is not too surprising that the export revenue of Saudi Arabia has fallen, with the drop in oil prices.

Because of the drop in exports, Saudi Arabia is now buying fewer imported goods and services. A person would expect other oil exporters also to be making cutbacks on their purchases of imported goods and services. (Exports in current US$ means exports measured year-by-year in US$, without any inflation adjustment.)

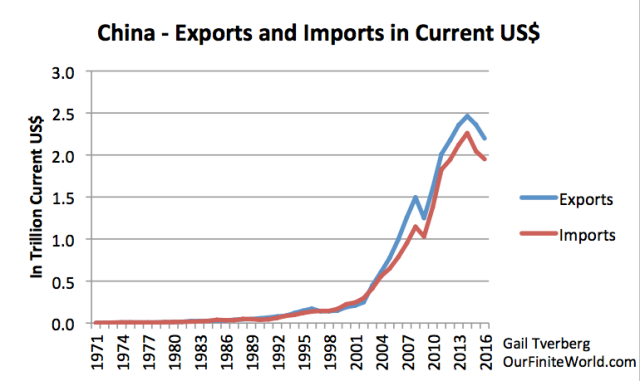

It is somewhat more surprising that China’s exports and imports are falling, as measured in US$. Figure 13 shows that, in US dollar terms, China’s exports of goods and services fell in both 2015 and 2016. The imports that China bought also fell, in both of these years.

Figure 13. China’s exports and imports of goods and services on a current US$ basis, based on World Bank data.

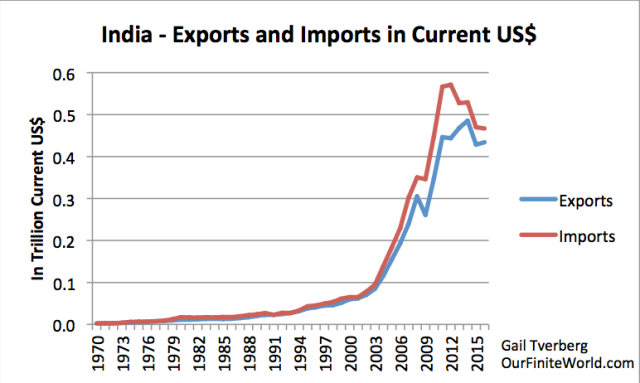

Similarly, both the exports and imports of India are down as well. In fact, India’s imports have fallen more than its exports, and for a longer period–since 2012.

Figure 14. India’s exports and imports of goods and services in current dollars, based on World Bank data.

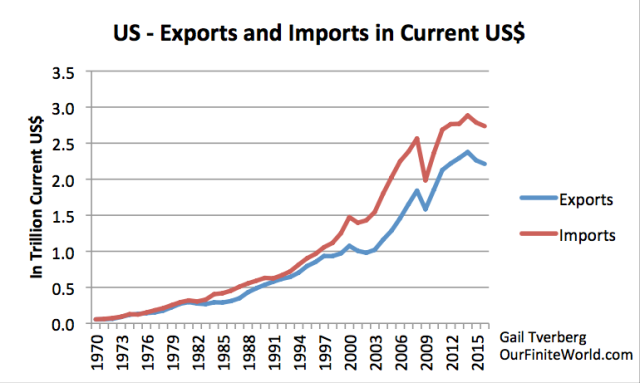

The imports of goods and services for the United States also fell in 2015 and 2016. The US is both an exporter of commodities (particularly food and refined petroleum products) and an importer of crude oil, so this is not surprising.

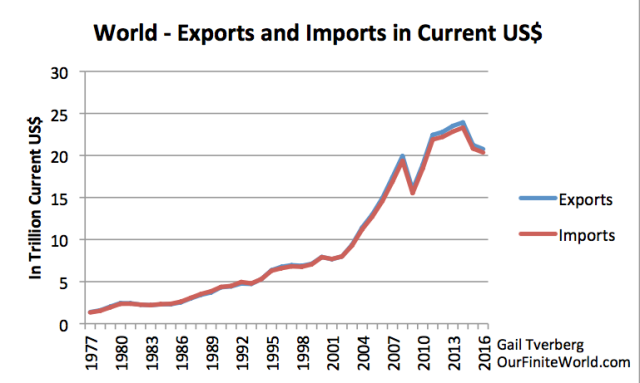

In fact, on a world basis, exports and imports of goods and services both fell, in 2015 and 2016 as measured in US dollars.

[8] Once export (and import) revenues are down, it becomes increasingly difficult to raise prices again.

If a country is not selling much of its own exports, it becomes very difficult to buy much of anyone else’s exports. This impetus, by itself, tends to keep prices of commodities, including oil, down.

Furthermore, it becomes more difficult to repay debt, especially debt that is in a currency that has appreciated. This means that borrowing additional debt becomes less and less feasible, as well. Thus, new investment becomes more difficult. This further tends to keep prices down. In fact, it tends to make prices fall, since new investment is needed to keep prices level.

[9] World financial leaders in developed countries do not understand what is happening, because they have written off commodities as “unimportant” and “something that lesser-developed countries deal with.”

In the US, few consumers are concerned about the price of corn. Instead, they are interested in the price of a box of corn flakes, or the price of corn tortillas in a restaurant.

The US, Europe and Japan specialize in high “value added” goods and services. For example, in the case of a box of corn flakes, manufacturers are involved in many steps such as (a) making corn flakes from corn, (b) boxing corn flakes in attractive boxes, (c) delivering those boxes to grocers’ shelves, and (d) advertising those corn flakes to prospective consumers. These costs generally do not decrease, as commodity prices decrease. One article from 2009 says, “With the record seven-dollar corn this summer, the cost of the corn in an 18-ounce box of corn flakes was only 14 cents.”

Because of the small role that commodity prices seem to play in producing the goods and services of developed countries, it is easy for financial leaders to overlook price indications at the commodity level. (Data is available at this level of detail; the question is how closely it is examined by decision-makers.)

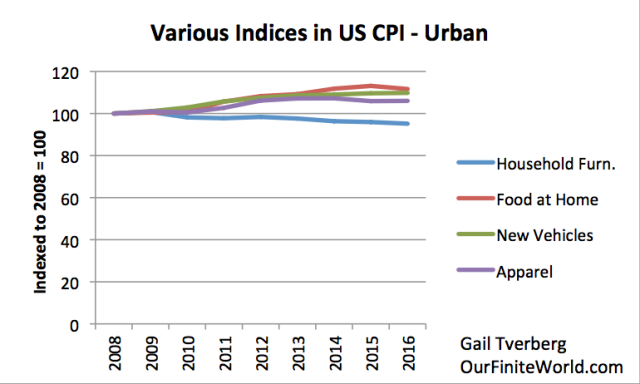

Figure 17. Various indices within US CPI Urban, displayed on a basis similar to that used in Figure 7 through 11. In other words, index values for later periods are compared to the average 2008 index value. CPI statistics are from US Bureau of Labor Statistics.

Figure 17 shows some components of the Consumer Price Index (CPI) on a basis similar to the trends in commodity prices shown in Figures 7 through 11. The category “Household furnishings and operations” was chosen because it has furniture in it, and I know that furniture prices have fallen because of the growing use of cheap imported furniture from China. This category shows a slight downslope in prices. The other categories all show small increases over time. If commodity prices had not decreased, prices of the other categories would likely have increased to a greater extent than they did during the period shown.

[10] Conclusion. We are likely kidding ourselves, if we think that oil prices can rise in the future, for very long, by a very large amount.

It is quite possible that oil prices will bounce back up to $80 or even $100 per barrel, for a short time. But if they rise very high, for very long, there will be adverse impacts on other segments of the economy. We can’t expect that wages will go up at the same time, so increases in oil prices are likely to lead to a decrease in the purchase of discretionary products such as meals eaten in restaurants, charitable contributions, and vacation travel. These cutbacks, in turn, can be expected to lead to layoffs in discretionary sectors. Laid off workers are likely to have difficulty repaying their loans. As a result, we are likely to head back into a recession.

As we have seen above, it is not only oil prices that need to rise; it is many other prices that need to rise as well. Making a change of this magnitude is almost certainly impossible, without “crashing” the economy.

Economists put together a simplified view of how they thought supply and demand works. This simple model seems to work, at least reasonably well, when we are away from limits. What economists did not realize is that the limits we are facing are really affordability limits, and that growing affordability depends upon productivity growth. Productivity growth in turn depends on a growing quantity of cheap-to-produce energy supplies. The term “demand,” and the two-dimensional supply-demand model, hide these issues.

The whole issue of limits has not been well understood. Peak Oil enthusiasts assumed that we were “running out” of an essential energy product. When this view was combined with the economist’s view of supply and demand, the conclusion was, “Of course, oil prices will rise, to fix the situation.”

Few stopped to realize that there is a second way of viewing the situation. What is falling is the resources that people need to have in order to have jobs that pay well. When this happens, we should expect prices to fall, rather than to rise, because workers are increasingly unable to buy the output of the economy.

If we look back at what happened historically, there have been many situations in which economies have collapsed. In fact, this is probably what we should expect as we approach limits, rather than expecting high oil prices. If collapse should take place, we should expect widespread debt defaults and major problems with the financial system. Governments are likely to have trouble collecting enough taxes, and may ultimately fail. Non-elite workers have historically come out badly in collapses. With low wages and high taxes, they have often succumbed to epidemics. We have our own epidemic now–the opioid epidemic.

29 Comments on "Gail Tverberg: Why Oil Prices Can’t Bounce Very High; Expect Deflation Instead"

Mick on Mon, 11th Sep 2017 3:17 pm

Shorts etp model came to that conclusion years ago it’s taken her this long to work it out for her self

Antius on Mon, 11th Sep 2017 3:23 pm

We are heading for another great depression. That is what this article tells us. From the look of the graphs here, it won’t be a long time coming. If not this year, then next. All time liquid fuels peak will occur at the same time.

Davy on Mon, 11th Sep 2017 3:42 pm

Depression depends on how fast we go down and how that decline will influence demand destruction benefits as well as detriments. We might just wind down a civilization in a slow motion of canibalization. Of course to a point because at some point the social and economic fabric will tear. The unlucky “miserable” will get kicked under the bus as those who are connected prosper on their economic flesh. This goes for nations too. Those furthest from the core will be discarded.

Boat on Mon, 11th Sep 2017 4:33 pm

As long as energy stays in the range of prices like the last couple of years I don’t see much of a recession if any.

Geopolitics could cause an energy spike but that’s a guessing game. On the electricity side of energy prices should remain stable to drop as new utility scale solar and new wind are now cheaper than coal and nat gas. There are significant price drops yet to come as tech advances.

On the FF side of energy nat gas will grow where there isn’t enough wind. Oil demand will keep growing but even the Russian oil giant predicts $40-$43 oil for 2018 because the glut persists.

No fear 4 years ago, no fear this or next year.

In the meantime tech keeps advancing in the energy industry and the battery/storage/electric car industry.

Boat on Mon, 11th Sep 2017 4:39 pm

Mick on Mon, 11th Sep 2017 3:17 pm

“Shorts etp model came to that conclusion years ago it’s taken her this long to work it out for her self”

Short also said demand would be down or gone….Still waiting.

Antius on Mon, 11th Sep 2017 4:41 pm

Boat, commodity prices always drop before a recession. Couple that with the fact that global investment has stalled for several years and global trade is now falling. It is difficult to interpret these things in any other way.

Wind and solar are not cheap. These things must be run in conjunction with NG or coal power plants. Unless they are cheaper than the fuel they save, they push up total cost.

Sissyfuss on Mon, 11th Sep 2017 4:46 pm

Boaty, you’re an optimistic capitalist which these days makes you an oxymoron. Plus you seem to be a moron addicted to Oxys.

Letstupidpeopledie on Mon, 11th Sep 2017 6:17 pm

Typical gibberish from her as usual. Citing Wikipedia and a source of information remove all credibility from her writing. I could go through her post and point out many logical flaw there is but I don’t care about her.

MASTERMIND on Mon, 11th Sep 2017 6:53 pm

Conventional Oil Peaked in 2006 –IEA-EIA-NATURE

http://imgur.com/a/uCz7V

http://www.nature.com/nature/journal/v481/n7382/full/481433a.html

New Oil discoveries by scientists have been declining since 1965 and last year was the lowest in history –IEA

http://imgur.com/a/W60yn

We have been draining our oil reserves by consuming more oil than we discover since the 1980’s – ASPO

http://imgur.com/a/uJ0Rg

Aging giant oil fields produce more than half of global oil supply and are already declining as group – CSM-HOOK 2009

https://www.csmonitor.com/Environment/Energy-Voices/2013/0412/The-decline-of-the-world-s-major-oil-fields

Saudi Arabian oil reserves are overstated by 40% – Wikileaks

https://www.theguardian.com/business/2011/feb/08/saudi-oil-reserves-overstated-wikileaks

IEA Chief warns of world oil shortages by 2020 as discoveries fall to record lows-WSJ

https://www.wsj.com/articles/iea-says-global-oil-discoveries-at-record-low-in-2016-1493244000

Saudi Arabia’s Energy Minister Warns of World Oil Shortages Ahead– WSJ

https://www.wsj.com/articles/saudi-minister-sees-end-of-oil-price-slump-1476870790

UAE warns of world oil shortages ahead by 2020 due to industry spending cuts

http://www.arabianindustry.com/oil-gas/news/2016/nov/6/more-spending-cuts-as-uae-predicts-oil-shortages-5531344/

Saudi Aramco CEO believes oil shortage coming despite U.S. shale boom– FOX NEWS/REUTERS

http://www.foxbusiness.com/markets/2017/07/10/saudi-aramco-ceo-believes-oil-shortage-coming-despite-u-s-shale-boom.html

https://www.reuters.com/article/us-aramco-oil/aramco-ceo-sees-oil-supply-shortage-as-investments-discoveries-drop-idUSKBN19V0KR

Halliburton CEO says oil will spike due to oil shortages by 2020 after Industry Cuts -BLOOMBERG

https://www.bloomberg.com/news/articles/2017-07-12/halliburton-sees-2020-oil-spike-after-industry-cuts-2-trillion

Total CEO warns we are going to have oil shortages around 2020 due to lack of investment

http://www.boursorama.com/actualites/je-suis-convaincu-qu-on-va-manquer-de-petrole-selon-le-pdg-de-total-patrick-pouyanne

9b2d911a65572f5f989a74319b68d296

Chevron CEO warns US shale oil alone cannot meet the world’s growing demand for crude-NBC NEWS

https://www.cnbc.com/2017/05/01/us-shale-cannot-meet-the-worlds-growing-oil-demand-chevron-ceo-warns.html

HSBC Global Bank warns 80% of the worlds conventional fields are declining and world oil shortages by 2020

https://www.research.hsbc.com/R/24/vzchQwb

UBS Global Bank warns of industry slowdown and world Oil Shortages by 2020

http://www.telegraph.co.uk/finance/newsbysector/energy/oilandgas/12136886/Oil-slowdown-to-trigger-supply-crisis-by-2020-warns-bank.html

IEA Forecasts worldwide Oil Shortages and Sharp Price Rise by 2020 -NASDAQ

http://www.nasdaq.com/article/iea-forecasts-oil-shortages-and-sharp-price-rise-by-2020-cm757712

Energy watchdog warns oil and electricity shortages could develop as investment falls –NBC NEWS https://www.cnbc.com/2017/07/10/watchdog-warns-of-oil-and-electricity-shortages-as-investment-falls.html

Wood Mackenzie warns of oil supply crunch and world oil shortages around 2020-OILPRICE

http://oilprice.com/Energy/Crude-Oil/The-Next-Oil-Price-Spike-May-Cripple-The-Industry.html

Why investors’ should brace for a devastating oil shortage ahead around 2020-MARKET WATCH

http://www.marketwatch.com/story/why-investors-should-brace-for-a-devastating-oil-shock-ahead-2017-07-03

German Government (leaked) Peak Oil study concludes: oil is used directly or indirectly in the production of 90% of all manufactured products, so a shortage of oil would collapse the world economy & world governments/democracies

https://www.permaculture.org.au/files/Peak%20Oil_Study%20EN.pdf

The Oil Age may come to an end for a shortage of oil. ~ Saudi Oil Minister Sheikh Yamani

Boat on Mon, 11th Sep 2017 7:11 pm

antis,

“Wind and solar are not cheap. These things must be run in conjunction with NG or coal power plants. Unless they are cheaper than the fuel they save, they push up total cost”.

World wide solar and wind gain 1 percent of the electrical market per year. 2017 will do the same. And yes renewables are just 10 percent of the market. Those are just the numbers. Optimistic because I look out 30 years, I see the trend.

FF is not cheap which is why coal will lose even more market share. I am a realist knowing renewables will have drop even more in price to gain market share much faster than 1 percent. I can’t speak for the world but the US has nat gas from coast to coast which easily ramps up and down to accommodate renewables. Coal does not.

Fred on Tue, 12th Sep 2017 1:39 pm

Quite a few words and energy went into saying that you can’t have infinite growth on a finite planet.

Pat on Tue, 12th Sep 2017 8:59 pm

really dont agree to what headline says, instead the oil prices to soon skyrocket to 100 and break previous highs. the shortages of oil will bigin 2020..

____________________________________________ on Tue, 12th Sep 2017 10:19 pm

Where was your deflation for the last 100 years? No such thing as deflation when money is fiat and debt. Debt and fiat are opposite of money.

rockman on Wed, 13th Sep 2017 12:00 pm

“I expect that at least part of gas’s low price problem also comes from subsidized prices for wind and solar. ” Really??? What part: 0.01%? Did anyone bother to look at the graph and notice NG prices collapsed by the end of 2008. And what % of US electricity was generated by alts during 2008? All one has to do is look at the Marcellus Shale production going forward (increasing from very little to almost 20% of US production. That should clue everyone to why prices fell.

So Pat, you don’t agree with the headline. Neither do I but for a very different reason. And no: I don’t agree with your expectation of very high that can persist very long. Just as the $146/bbl spike could not be maintained by the economy very long.

My disagreement with the emphasis of the title is that the current oil price is high. Is it “very high”? Depends on you definition of “very”. But even taking into account inflation the current price is about 3X higher then it was in 1998 and about 40% higher then the early 2000’s. And historically it is still significantly higher the the weighted average price of oil for the last 70 years.

Which makes me question her entire analysis because it doesn’t appear to explain the current relatively high price of oil. In fact it should be indicating oil would be selling for half if not less then the current price.

denial on Wed, 13th Sep 2017 7:53 pm

yes i too wonder how do you have deflation in a system that prints money? And a system that can manipulate anything that it wants with a push of a button…want oil prices to go up viola

want debt to go away viola….yes maybe eventually the system will crash but it make take a lot longer than you think….I have been hearing of this massive crash since 2005….where is it?1!

Gail now says it is coming in 2017…..we shall see 2017 is almost over…

Boat on Wed, 13th Sep 2017 8:26 pm

Gail will adjust her numbers then preach fear and doom. There is a market for it.

MD on Thu, 14th Sep 2017 1:44 am

Gail just seems to get lost in her analysis, repeatedly, with a healthy dose of confirmation bias thrown in.

Cloggie on Thu, 14th Sep 2017 2:04 am

Quite reading total amateurs like Heinberg and Tverberg.

makati1 on Thu, 14th Sep 2017 2:47 am

Don’t like what they are telling you, Cloggie? Another case of killing the messenger? LOL

Cloggie on Thu, 14th Sep 2017 3:31 am

Don’t like what they are telling you, Cloggie? Another case of killing the messenger?

It is not a matter of liking, it is just that they are talking rubbish. I was a Heinberg groupie too between 2007-2012. But according to him by 2017 industrial civilization would be in a state of severe decline and nothing like that happened.

What is really happening in 2017 is rapid price decline and market acceptance of renewable energy sources world-wide and low ff prices. In other words, Heinberg was wrong and tried to portray his ecological-fundamentalist position as an inevitability.

It isn’t.

I was in 2007-2012 exactly where many of you folks still are, but I have moved on after new data came in.

[Shrug]

Fortunately I didn’t move to Manila or Missouri or the Appalachians or the Canadian jungle, so my change of mind comes with less loss of face.

The only loss of face I had was telling my client in 2007 that in a decade (now) “Jan Modaal” (Dutch Joe Sixpack) would not be driving a car anymore.lol

Fortunately I haven’t seen that client in many years, so he can’t make fun of me, not in my face.

Davy on Thu, 14th Sep 2017 5:06 am

“Another case of killing the messenger? LOL”

Exactly makat, I shot down your message and it is flopping in the muck. Cloggie is easy to kick down, LMFAO, any little thing I say requires cloggie 4 paragraphs. Watch this hey cloggie “we saved your ass twice…” LOL. Cloggie has to pump and dump a lot of history revisions and fantasy future out to keep people straight on exactly what is in his head. Makat, just goes to Zerohedge and picks the worst anti-American stories. Sometimes makat does not even link his message of hate, he just types in titles. Long lists of titles like that means thing are worse. You know with these binary types more bad means more bad so these guys dump quite a lot of shit. You guys are fruit loops. Two old guys wasting away, LOL.

Antius on Thu, 14th Sep 2017 6:58 am

” It is not a matter of liking, it is just that they are talking rubbish. I was a Heinberg groupie too between 2007-2012. But according to him by 2017 industrial civilization would be in a state of severe decline and nothing like that happened.”

What did you think it would look like? Gail correctly predicted the large drop in oil prices before they actually happened and provided a convincing explanation as to why. Whilst I do not blindly accept everything she says, she is one of the most qualified risk analysts in the oil & gas industry.

“What is really happening in 2017 is rapid price decline and market acceptance of renewable energy sources world-wide and low ff prices. In other words, Heinberg was wrong and tried to portray his ecological-fundamentalist position as an inevitability.”

It isn’t just renewable energy prices that are declining. It is the price of every commodity. Note: I am talking about prices, not costs of production. This is a sure indicator of weak demand for all physical goods at a global level. Commodity price deflation tends to precede recession. The scale of deflation that we are seeing is indicative of something much worse. Here is data on total world exports produced the World Bank:

https://data.worldbank.org/indicator/NE.EXP.GNFS.CD

Not exactly reassuring is it? There’s more. Here is central government debt-GDP ratio for China:

https://fred.stlouisfed.org/series/DEBTTLCNA188A

Here, for the US:

https://fred.stlouisfed.org/series/GFDEGDQ188S

Here for the UK:

https://fred.stlouisfed.org/series/GGGDTAGBA188N

This is debt-GDP ratio, not total debt. That look’s even worse. Now consider what might happen if the current underinvestment in the oil sector leads to a modest price increase in 2020? What would happen if US tax receipts fail to rise fast enough? At present, tax receipts show persistent growth. But I can’t help but notice that those receipts are increasing arithmetically, rather than geometrically.

https://www.thebalance.com/current-u-s-federal-government-tax-revenue-3305762

In 2012-13, they rose by a healthy 13.3%. In 2013-14: 8.9%; 2014-15: 7.6%; 2015-16: 5.5%; 2016-17: 5.9%. This suggests that increases in tax revenues are struggling to keep pace with increasing debt levels. There are other things that could prick the bubble as well. A slight rise in US interest, for example. The decline in the value of the dollar reduces the spending power of the US consumer and raises the risk of debt defaults, pressure on the domestic economy and downward pressure on tax income.

The bottom line is the global economy is not in a healthy state, with strong indications of a crisis ahead.

Davy on Thu, 14th Sep 2017 7:24 am

“The bottom line is the global economy is not in a healthy state, with strong indications of a crisis ahead.”

I think that statement is a modest and sober take on things. I wonder why it is so hard for some to admit we have hard times ahead at some unknown time and to some unknown degree. These hard times could start anywhere but some places obviously are more likely to have issues. The obvious part of our situation is decline can be seen everywhere currently. Science and common sense are screaming a crisis of some sort ahead. To deny this is either subterfuge or delusion.

Antius on Thu, 14th Sep 2017 8:12 am

China looks like it could easily be the flashpoint for the next crisis. A debt-GDP ratio approaching 300% and still growing fast. What’s more, Chinese exports have been on a declining trend since 2013. This indicates that the stimulus provided by that debt is weak:

https://fred.stlouisfed.org/series/XTEXVA01CNM667S

China’s energy consumption shows clear signs of levelling off since 2013. This is a sure sign of cooling economic growth.

https://yearbook.enerdata.net/total-energy/world-consumption-statistics.html

Energy production is declining. This is especially true of coal, the key electricity fuel to industry.

https://yearbook.enerdata.net/total-energy/world-energy-production.html

Rising electricity consumption is a key indicator of economic growth. Growth is continuing on a declining trend. Consumption is flat from 2013 onwards, with a slight upturn in 2016.

https://yearbook.enerdata.net/electricity/electricity-domestic-consumption-data.html

Cloggie doesn’t have to believe me. He can search the data himself and draw his own conclusions.

Davy on Thu, 14th Sep 2017 8:44 am

I see it too Antius, China is the driver of growth when it declines so does the whole world. The rest of the world has been stagnant except for maybe insignificant countries like the Phillipines.

Antius on Thu, 14th Sep 2017 9:51 am

Perhaps the 2016 5% upturn in Chinese electricity consumption will precede an increase in economic growth. Or perhaps it is an anomaly caused by overproduction of electricity infrastructure. Time will tell.

Antius on Thu, 14th Sep 2017 10:56 am

These two graphs demonstrate exactly why the Chinese are attempting to displace the dollar as the unit of exchange for global trade.

The first graph shows Chinese, US and Indian GDP on a PPP basis. China overtook the US in 2013 and GDP would appear to be on a strong upward trajectory with no levelling off in sight.

https://data.worldbank.org/indicator/NY.GDP.MKTP.PP.CD?locations=US-CN-IN&view=chart

In current US dollars, the Chinese economy shows clear signs of slowdown.

https://data.worldbank.org/indicator/NY.GDP.MKTP.CD?locations=US-CN-IN&view=chart

This is clearly a problem for the Chinese as it makes imports relatively expensive. Imports include manufactured engineering goods from places like Germany and US, but more importantly commodities and increasingly, oil. China’s own production is now past peak and rapidly declining.

The weakening position of Chinese GDP in dollars is likely due to a weakening position of the Yuan relative to the US dollar. That would make sense. The Yuan has recently gained value against the dollar (over 2017).

https://www.xe.com/currencycharts/?from=USD&to=CNY&view=10Y

This suggests that Chinese GDP in dollars should bounce up somewhat in 2017 figures. However, the rising value of the Yuan will continue to suppress Chinese exports and this will have a downward impact on real GDP growth rates and energy consumption. We won’t know for at least another year.

Antius on Thu, 14th Sep 2017 11:07 am

The Euro has been appreciating against the Yuan of late. This tells us that the collapse in Dollar-Yuan exchange rates is due to the collapse in value of the dollar in recent months.

http://www.xe.com/currencycharts/?from=EUR&to=CNY&view=10Y

GregT on Thu, 14th Sep 2017 11:11 am

“The bottom line is the global economy is not in a healthy state, with strong indications of a crisis ahead.”

The bottom line is that the global economy entered into the Great Recesssion in or around 2008. The global economy has not recovered from that recesssion, or we wouldn’t still be hearing about the recovery each and every, single, day. The catalyst for the Global Financial Crisis was bad debt. U.S. federal government debt alone, has doubled since the crisis began.

Just like alternate energy will not solve the predicaments caused by a surplus of energy, more debt will not solve the crisis caused by excessive debt. The humans are insane.