Highlights

- This article analyses historical IEA forecasts of global energy consumption.

- Three major forecasting challenges are observed and briefly analysed:

- Overprediction of oil consumption

- Underprediction of coal consumption

- Underprediction of other renewables

Introduction

The International Energy Agency tackles a monumental task every year when compiling its World Energy Outlook report: forecasting global energy consumption over the next 2-3 decades.

Over the years, the IEA has taken quite a lot of flak from critics with 20/20 hindsight about fairly large deviations between forecasted and actual numbers. For example, the IEA failed to forecast the plateau in conventional oil production which started about one decade ago and generally underpredicted the expansion rate of modern renewables.

But just how large are these deviations? This article will take a quantitative look at 15 years of IEA World Energy Outlooks (available here) and compare the forecasts to actual data from the BP Statistical Review to get a clear picture. Each major energy category will be discussed separately.

Oil

IEA oil forecasts for oil over the past 15 years are shown below. It is clear that the general trend is one of substantial demand overprediction due to the failure to foresee the conventional oil plateau which started in the previous decade.

Recently though, the US shale revolution has led to a slight uptick in the demand outlook. The large drop in oil prices over the past few months confirm this sunnier outlook. Even though numerous commentators are now fearing another supply crunch due to insufficient exploration and instability in the Middle East, the fundamental fact remains that the world still has tremendous oil reserves which can be extracted at fairly low prices (see below).

Gas

The graph below shows that the IEA has generally done a good job at forecasting gas consumption. Fracking has recently further contributed to security of supply, thereby increasing the chances of a steady expansion over coming decades.

Coal

Despite receiving much less attention, the forecast error related to coal is substantially greater than that related to oil. As shown in the graph below, the IEA completely missed the Chinese coal explosion following China’s inclusion into the World Trade Organization in 2001.

The present outlook is for a marked slowdown in coal expansion, primarily due to developments in China related to pollution control, economic slowdown and a gradual shift away from energy intensive investment-driven growth. Unfortunately the fact remains that the world still has many poor countries that would gladly follow China’s rapid coal-fired investment-driven growth model. Ironically, strong consumer demand increases from China’s rapidly growing middle class will be one of the major drivers of coal consumption in poorer countries over coming decades.

Nuclear

The IEA nuclear forecasts shown below paint an interesting picture. Even though recent data clearly points to a contraction, the current forecast is quite optimistic.

The strong forecasted recovery in nuclear demand is again primarily attributed to China where nuclear is seen as an important wedge in the gradual reduction of coal’s dominance (below). China’s nuclear construction pipeline suggests that this should be a fairly accurate forecast.

Hydro

As shown below, the IEA’s hydropower forecasts have been reasonable, although the rapid expansion in China over recent years has also not been forecasted very accurately.

Other renewables

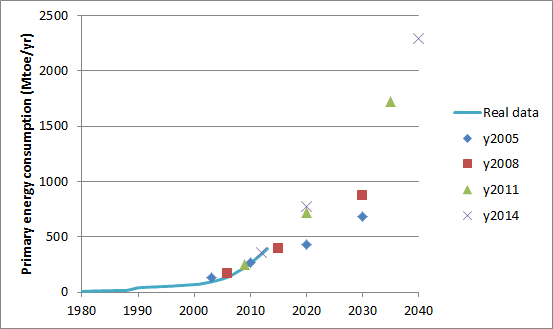

This category consists primarily of wind, solar, geothermal and biofuels. As shown below, the IEA has had to progressively increase its forecasts over time as favourable policy environments stimulated faster than expected deployment and subsequent cost declines.

As more information became available on the topic of modern renewables over the years, the IEA forecasts have gotten more consistent. For example, the forecasts for other renewables over the past three years are almost identical.

Conclusions

It is clear from this analysis that IEA is unable to foresee events that deviate strongly from the norm such as peak conventional oil, rapid shifts in global trade flows and unexpected energy policy developments. It would certainly be much more convenient if the world would stick to the norm more regularly, but, because it doesn’t, IEA forecasts should always be seen in the right perspective.

To summarize the forecasting challenges over the past decade, the difference between the 2020 forecasts from 2014 and 2004 are shown below.

Oil, coal and renewables other then hydro have proven to be the most difficult to forecast. Oil will likely continue to be a challenge as unconventional oil sources increase market share and the Middle East remains unpredictable. Coal underpredictions are likely to continue as environmental pledges and hopes meet the reality of billions of poor people striving to increase their quality of life. For other renewables, however, forecast accuracy will likely increase in the future as technical understanding grows and policy support mechanisms meet hard economic limits.

In the meantime, the unpredictability of global energy trends will give plenty of room for discussion and debate. In fact, the only forecast I can make with a high degree of certainty is that the topic of energy will only become more interesting over coming decades.

penury on Tue, 16th Dec 2014 11:32 am

If I remember correctly IEA is a .gov org

Anyone who wastes time reading their crap or looking at their charts deserves to be fed BS.

Apneaman on Tue, 16th Dec 2014 12:37 pm

Grid power is nice, but producing the electricity don’t mean shit if the delivery system has been left to rot.

U.S. Electrical Grid Gets Less Reliable as Outages Increase and R&D Decreases

Since 1995, electrical grid power outages have steadily increased as R&D in new technologies steadily decreased.

http://tli.umn.edu/blog/security-technology/u-s-electrical-grid-gets-less-reliable-as-outages-increase-and-rd-decreases/

http://www.infrastructurereportcard.org/energy/

Dredd on Tue, 16th Dec 2014 1:47 pm

Energy can neither be created nor destroyed (1st Law of Thermodynamics).

“Evaluating Fifteen Years of IEA Energy Forecasts”

Some body in Oil-Qaeda is playing word games again.

Speculawyer on Tue, 16th Dec 2014 2:09 pm

They were probably optimistic on nuclear considering that climate change would push nations to reduce carbon usage. However, Fukushima REALLY threw a monkey wrench into that idea.

I suspect nuclear will make a come-back eventually. It is certainly growing fast in China. As Fukushima fades and climate change worries grow, nuclear will again be adopted. And that is good, IMHO, at long as it is done VERY carefully and we continue going full-steam ahead on the other non-carbon sources (solar PV, onshore wind, CSP, geothermal, hydropower, offshore wind, biomass, etc.)

Dredd on Tue, 16th Dec 2014 2:22 pm

Speculawyer,

“I suspect nuclear will make a come-back eventually. It is certainly growing fast in China.”

Yep.

It is part of their population reduction plan … like Fukushima.

Davy on Tue, 16th Dec 2014 2:37 pm

Sure Spec, just take some more debt and we will have a regular NUK Renaissance. Plenty of debt going around in our infinite growth economy.

MSN Fanboy on Tue, 16th Dec 2014 4:38 pm

4th gen thorium for the win!

We just need to build x amount with x amount of money and x resource base lol

Be careful what you wish for, if there is one resource worse than oil…

Radiation trumps climate change. Then it is bye bye humanity.

rockman on Tue, 16th Dec 2014 5:26 pm

What’s interesting about their predictions, such as future oil consumption: look at the slight decrease in global consumption after 2008. Not a big prediction miss for sure. But do you know that oil consumption during 2009 was done at an average price of $58/bbl for the year…about $40/bbl less then the average price during 2008.

To be clear: according to the IEA in 2008 when the average oil price for the year was $99/bbl the world consumed 31.303 billion bbls of oil. And in 2009 when the average price of oil for the year was $58/bbl the world consumed 31.007 billion bbls of oil. So the world consumed about 300 million bbls of oil less over a 12 month period when it sold for $40/bbl less than it did during the previous 12 month period.

Does anyone want to guess what the IEA predicted in early 2008 what the average price of oil would be in 2009? Go ahead and guess…make my day. LOL.

Kenz300 on Tue, 16th Dec 2014 6:51 pm

The cost of production keeps going up……..

Shale, tar sands and deep water all require higher prices going forward……….

Something has got to give…….

rockman on Wed, 17th Dec 2014 8:39 am

Ken – Actually the cost of new production will be heading down now. That might sound odd but think about it: the high cost per bbl of production from the shales was justified by the high price of oil. As pointed out before there is no single price at which shale wells are or aren’t economic: that number depends upon the particulars of each well. There will be shale wells economic at $60/bbl and wells that will only be economic to drill at $100/bbl.

Obviously wells that require much more than $60/bbl to justify drilling won’t spud. The wells that are drilled this coming year will cost much less per bbl of production then wells drilled the previous year. Which also means fewer wells will be drilled and thus less production added. But that added production will cost less to develop for a simple reason: if it doesn’t cost last then it has been then some wells won’t be drilled.

As an example I’m beginning to work on a new deep NG play in Texas. The price of NG hasn’t gone up but the cost should go down thanks to the fact the rigs I’ll need used to be drilling the Eagle Ford Shale and thus were going for a premium price. I’m not sure yet how low rig rates will go but they will definitely decrease as well as many of the other drilling components. I won’t be selling my NG for more but lower costs will make such prospects more economic.

PeterEV on Wed, 17th Dec 2014 11:07 am

With respect to Figure 8.3, the graph depicts Kerogen Oil costing $60 to $100 per barrel to produce. My understanding is that the costs were well above $100 per barrel and that Shell was having the devil of a time producing anything because the Kerogen was not uniform in targeted layers and areas.

Does anyone have any better information?

Apneaman on Wed, 17th Dec 2014 12:18 pm

Last I heard everyone gave up on that wax. Too much energy too produce. I imagine some will never give up trying or dreaming.

Shell Abandons Oil-Shale Project In Colorado After Pumping Millions Into Exploration

http://www.huffingtonpost.com/2013/09/25/shell-abandons-oil-shale_n_3991716.html

desertrat on Wed, 17th Dec 2014 1:03 pm

As soon as I see “kerogen” in an article, mine eyes roll back in my head, and I start speaking in tongues.

Desert

PeterEV on Wed, 17th Dec 2014 3:10 pm

So the $60 to $100 estimate above is bogus? What does that say about the other estimates?