Page added on February 25, 2014

Beginning of the End? Oil Companies Cut Back on Spending

Steve Kopits recently gave a presentation explaining our current predicament: the cost of oil extraction has been rising rapidly (10.9% per year) but oil prices have been flat. Major oil companies are finding their profits squeezed, and have recently announced plans to sell off part of their assets in order to have funds to pay their dividends. Such an approach is likely to lead to an eventual drop in oil production. I have talked about similar points previously (here and here), but Kopits adds some additional perspectives which he has given me permission to share with my readers. I encourage readers to watch the original hour-long presentation at Columbia University, if they have the time.

Controversy: Does Oil Extraction Depend on “Supply Growth” or “Demand Growth”?

The first section of the presentation is devoted the connection of GDP Growth to Oil Supply Growth vs Oil Demand Growth. I omit a considerable part of this discussion in this write-up.

Economists and oil companies, when making their projections, nearly always make their projections depend on “Demand Growth”–the amount people and businesses want. This demand growth is seen to be rising indefinitely in the future. It has nothing to do with affordability or with whether the potential consumers actually have jobs to purchase the oil products.

Kopits presents the following list of assumptions of demand constrained forecasting. (IOC’s are “Independent Oil Companies” like Shell and Exxon Mobil, as contrasted with government owned companies that are prevalent among oil exporters.)

Thus, it is the demand constrained view of forecasting that gives rise to the view that OPEC (Organization of Petroleum Exporting Nations) has enormous leverage. The assumption is made that OPEC can add or subtract as much supply as much as it chooses. Kopits provides evidence that in fact the Demand view is no longer applicable today, so this whole story is wrong.

Thus, it is the demand constrained view of forecasting that gives rise to the view that OPEC (Organization of Petroleum Exporting Nations) has enormous leverage. The assumption is made that OPEC can add or subtract as much supply as much as it chooses. Kopits provides evidence that in fact the Demand view is no longer applicable today, so this whole story is wrong.

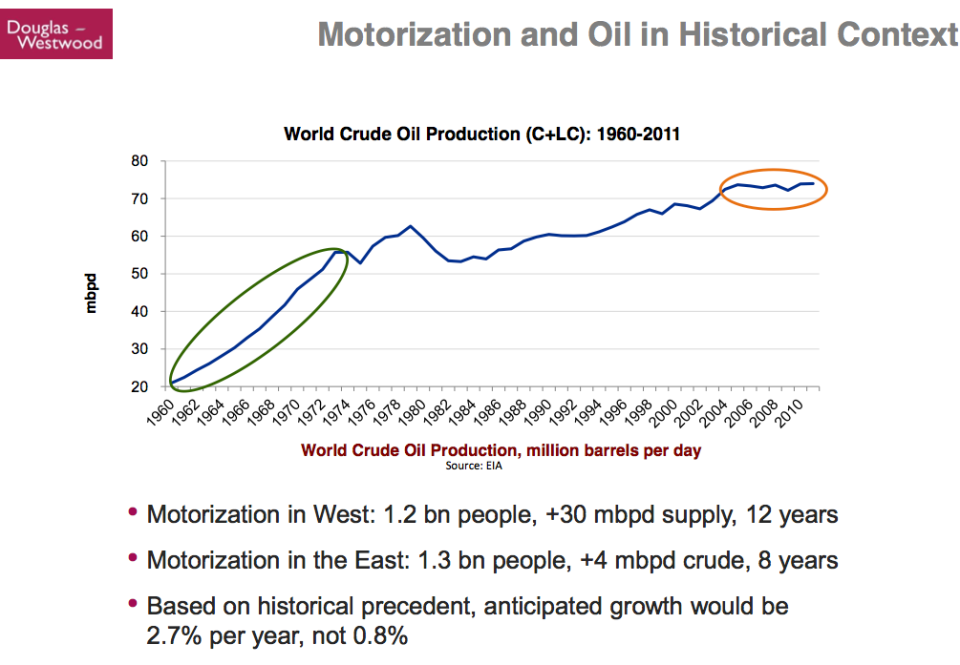

One piece of evidence that the Demand Model is wrong is the fact that world crude oil (including lease condensate) production has been nearly flat since 2004, in a period when China and other growing Eastern economies have been trying to motorize. In comparison, there was a rise of 2.7% per year, when the West, with a similar population, was trying to motorize.

Kopits points out that China’s big source of oil supply has been US main street: China bids oil supply away from United States, to satisfy its needs. This is the way that markets have made oil available to China, when world supply is not rising much. It is part of the reason that oil prices have risen.

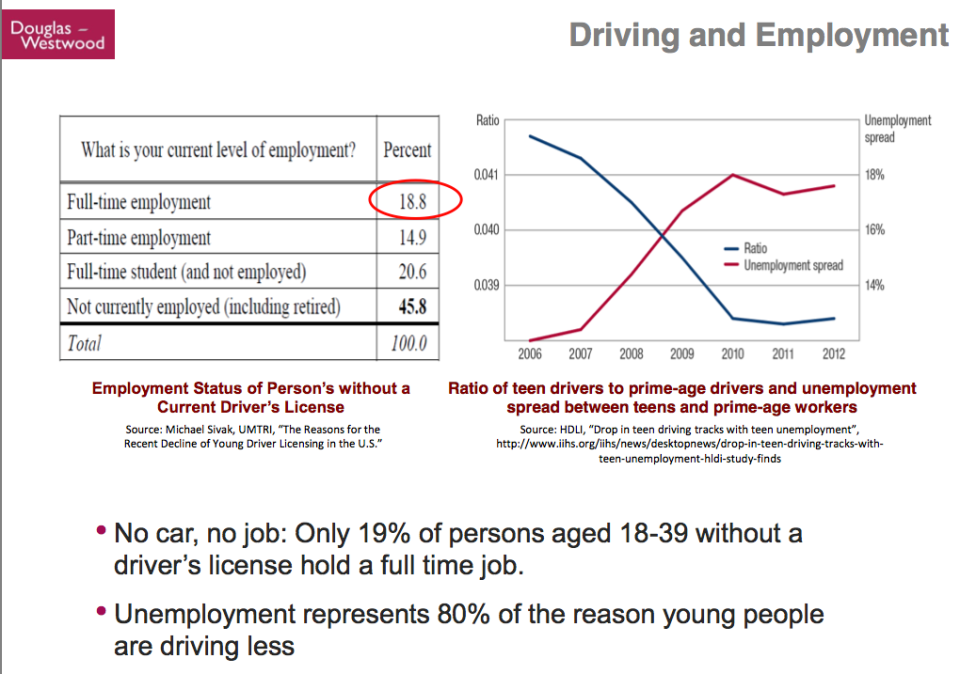

Another piece of evidence that the Demand Model is wrong relates to the assumption that social tastes have simply changed, leading to a drop in US oil consumption. Kopits shows the following chart, indicating that the major reason that young people don’t have cars is because they don’t have full-time jobs.

Kopits makes a comparison of the role of oil in GDP growth to the role of water in plant growth in the desert. Without oil, there is less GDP growth, just as without water, a desert is starved for the element it needs for plant growth. Lack of oil can considered a binding constraint on GDP growth. (Labor availability might be a constraint, but it wouldn’t be a binding constraint, because there are plenty of unemployed people who might work if demand ramped up.) When more oil is available at a slightly lower price, it is quickly absorbed by markets.

“Supply Growth” is the limiting factor in recent years, because the amount of extraction is rising only slowly due to geological constraints and the number of users has risen to the point that there is a shortage.

Experience of Major Oil Producing Companies

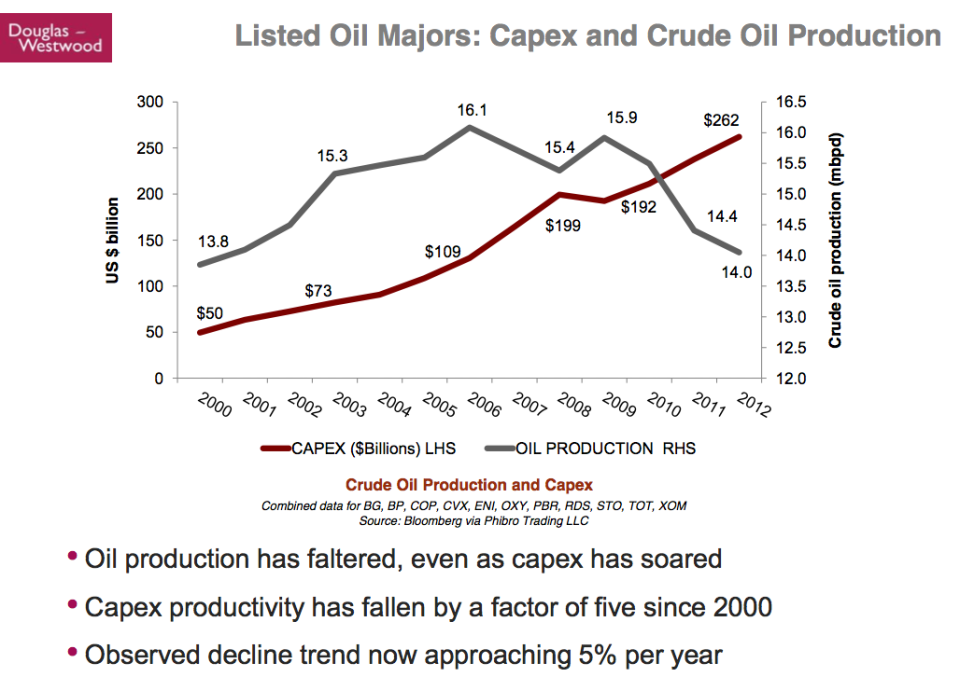

Kopits presents data showing how badly the big, publicly traded oil companies are doing. He looks at two pieces of information:

- “Capex” – “Capital expenditures” – How much companies are spending on things like exploration, drilling, and making of new offshore oil platforms

- “Crude oil production” –

A person would normally expect that crude oil production would rise as Capex rises, but Kopits shows that in fact since 2006, Capex has continued to rise, but crude oil production has fallen.

The above information is worldwide, not just for the US. At some point a person might expect companies to start getting frustrated–they are spending more and more, but not getting very far in extracting oil.

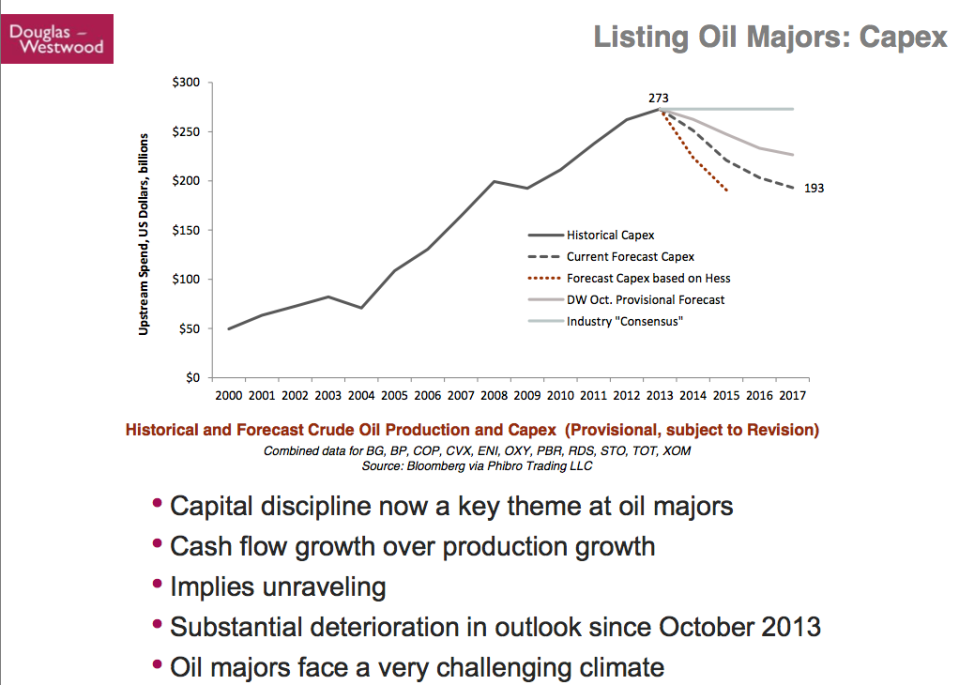

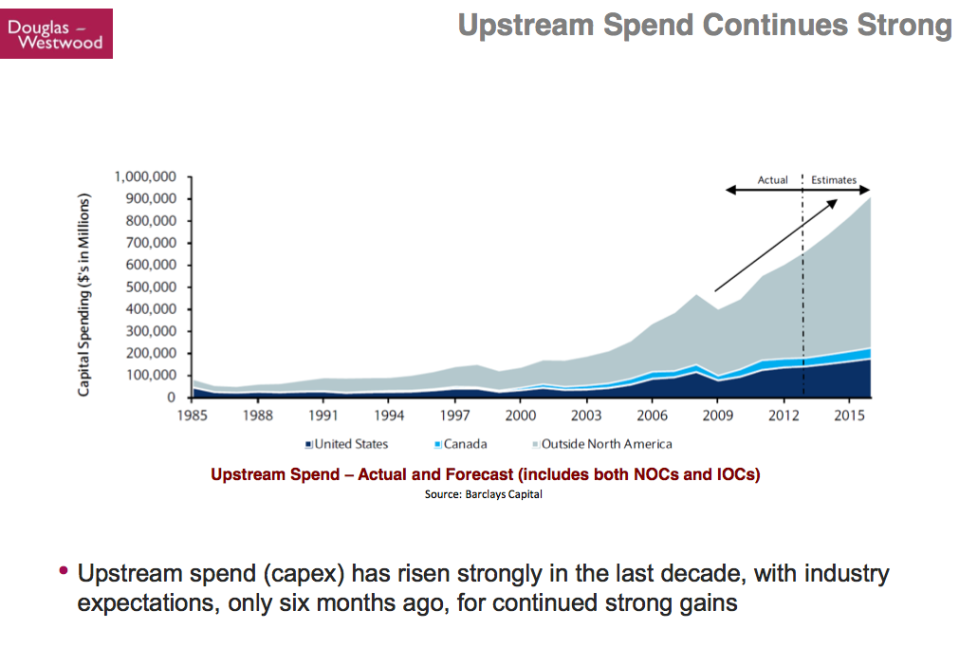

Kopits then shows another version of Capex history plus a forecast. (This time the amounts are labeled “Upstream,” so the expenditures are clearly on the exploration and drilling side, rather than related to refineries or pipelines.)

The amounts this time are for the industry as a whole, including “NOCs” which are government owned (national) oil companies as well as IOCs (Independent Oil Companies), both large and small. Kopits remarks that the forecasts shown were made only six months ago. When talking about the above slide Koptis says,

People in the industry thought, “Capex has been going up and up. It will continue to do very well. We have been on this trajectory forever, and we are just going to get more and more money out of this.”

Now why is that? The reason is that in a Demand constrained model for those of you who took economics–price equals marginal cost. Right? So if my costs are going up, the price will also go up. Right? That is a Demand constrained model. So if it costs me more to get oil, it is no big deal, the market will recognize that at some point, in a Demand constrained model.

Not in a Supply constrained model! In a Supply constrained model, the price goes up to a price that is very similar to the monopoly price, after which you really can’t raise it, because that marginal consumer would rather do with less than pay more. They will not recognize [pay] your marginal cost. In that model, you get to a price, and after that price, there is significant resistance from the consumer to moving up off of that price. That is the “Supply Constrained Price.” If your costs continue to come up underneath you, the consumer won’t recognize it.

The rapidly growing Capex forecast is implicitly a Demand constrained forecast. It says, sure Capex can go up to a trillion dollars a year. We can spend a trillion dollars a year looking for oil and gas. The global economy will accept that.

I quote this because I am not sure I have explained the situation exactly that way. I perhaps have said that demand had to be connected to what consumers could afford. Wages don’t magically go up by themselves (even though economists think they can).

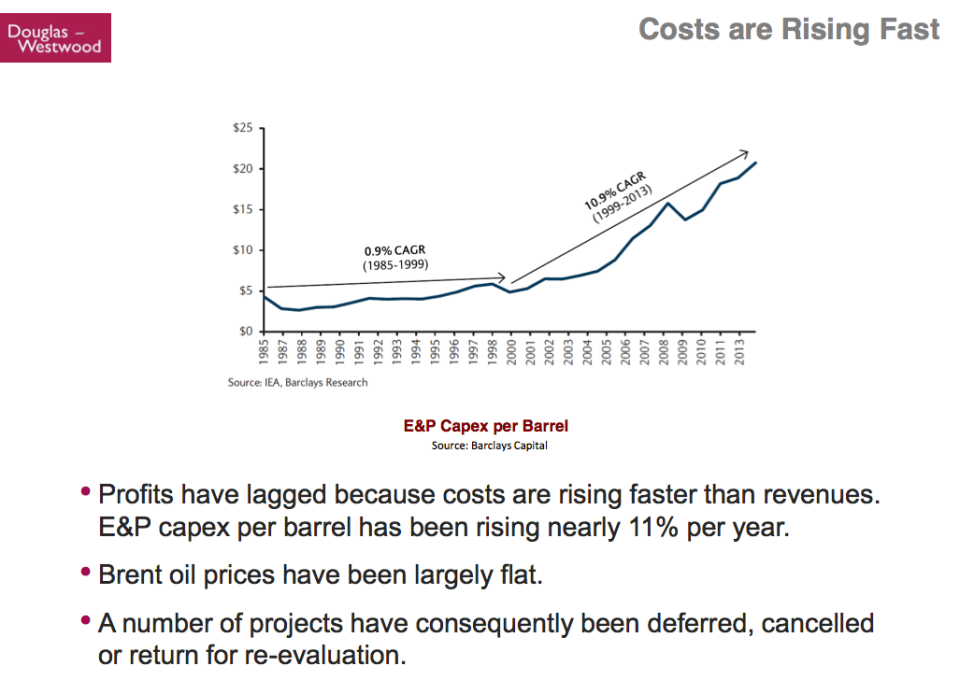

According to Koptis, the cost of oil extraction has in recent years been rising at 10.9% per year since 1999. (CAGR means “compound annual growth rate”).

Oil prices have been flat at the same time. On the above chart, “E&P Capex per barrel” is pretty much the same type of expenses as shown on the previous two charts. E&P means Exploration and Production.

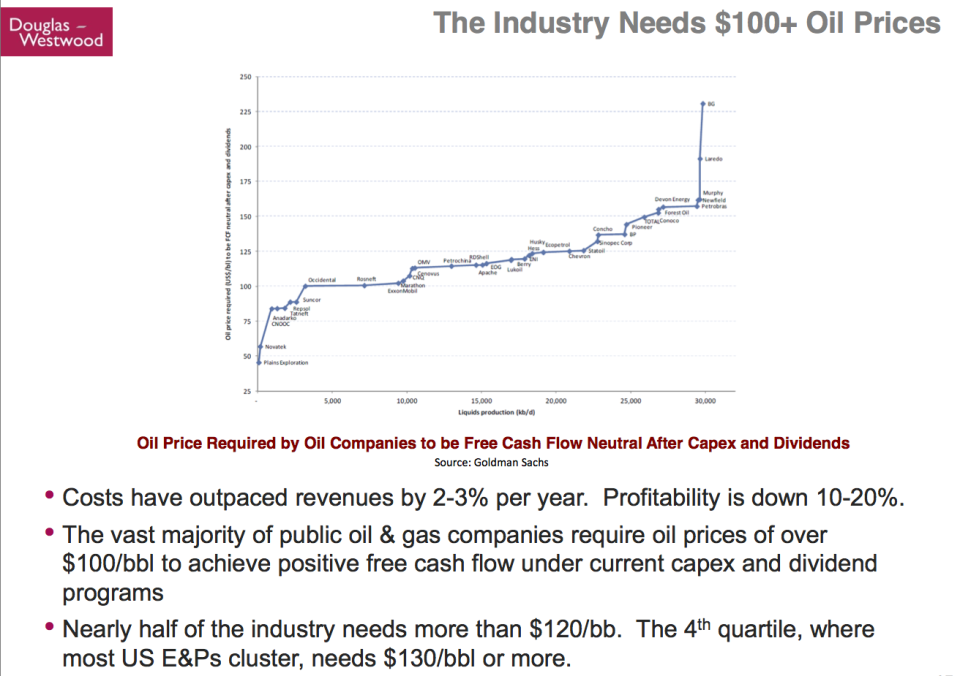

Kopits explains that the industry needs prices of over $100 barrel.

The version of the chart I have up is too small to read the names of individual companies. If you would like a chart with bigger names, you can download the original presentation.

Historically, oil companies have used a discounted cash flow approach to figure out whether over the long term, pricing for a particular field will be profitable. Unfortunately, this “standard” approach has not been working well recently. Expenses have been escalating too rapidly, and there have been too many new drilling sites producing below expectation. What Kopits shows on the above slide is the prices that companies need on different basis–a “cash flow” basis–so that each year companies have enough money to pay today’s capital expenditures, plus today’s expenses, plus today’s dividends.

The reason for using the cash flow approach is because companies have found themselves coming up short: they find that after they have paid capital expenditures and other expenditures such as taxes, they don’t have enough money left to pay dividends, unless they borrow money or sell off assets. Oil companies need to pay dividends because pension plans and other buyers of oil company stocks expect to receive regular dividends in payment for their equity investment. The dividends are important to pension plans.

In the last bullet point on the slide, Kopits is telling us that on this basis, most US oil companies need a price of $130 barrel or more. I noticed that Brazil’s Petrobas needs a price of over $150 barrel. (OSX, Brazil’s number two oil company, recently went bankrupt.)

In the slide below, Kopits shows how Shell oil is responding to the poor cash flow situation of the major oil companies, based on recent announcements.

Basically, Shell is cutting back. It no longer is going to tell investors how much it plans to produce in the future. Instead, it will focus on generating cash flow, at least partly by selling off existing programs.

In fact, Kopits reports that all of the major oil companies are reporting divestment programs. Does selling assets really solve the oil companies’ problems? What the oil companies would really like to do is raise their prices, but they can’t do that, because they don’t set prices, the market does–and the prices aren’t high enough. And the oil companies really can’t cut costs. So instead, they sell assets to pay dividends, or perhaps just to get out of the business. But is this sustainable?

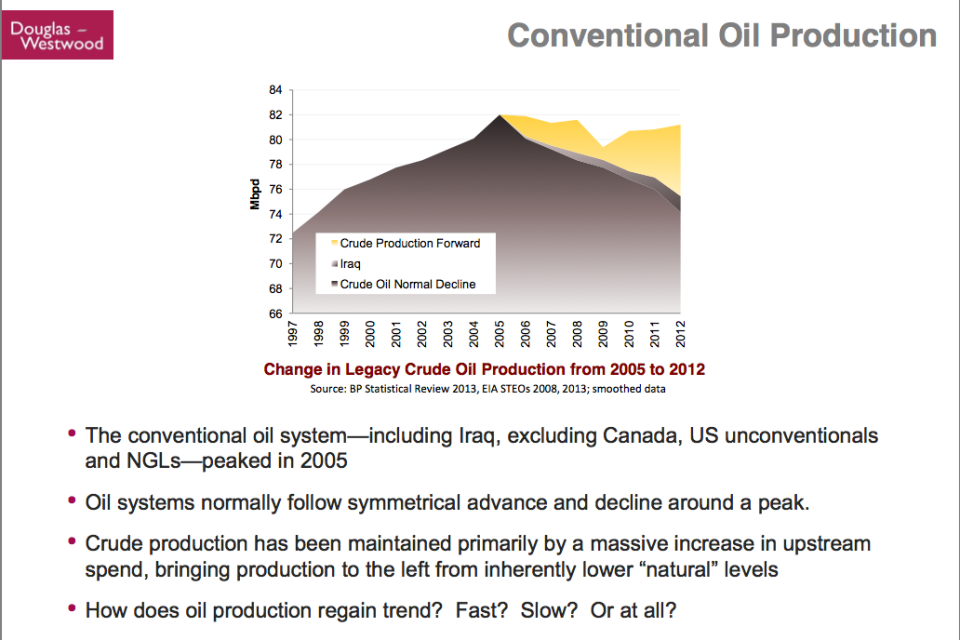

The above slide shows that conventional oil production peaked in 2005. The top line is total conventional oil production (calculated as world oil production, less natural gas liquids, and less US shale and other unconventional, and less Canadian oil sands). To get his estimate of “Crude Oil Normal Decline,” Kopits uses the mirror image of the rise in conventional oil production prior to 2005. He also shows a separate item for the rise in oil production from Iraq since 2005. The yellow portion called “crude production forward” is then the top line, less the other two items. It has taken $2.5 trillion to add this new yellow block. Now this strategy has run its course (based on the bad results companies are reporting from recent drilling), so what will oil companies do now?

Above, Kopits shows evidence that many companies in recent months have been cutting back budgets. These are big reductions–billions and billions of dollars.

On the above chart, Kopits tries to estimate the shape of the downslope in capital expenditures. This chart isn’t for all companies. It excludes the smaller companies, and it excludes the National oil companies, so it is about one-third of the market. The gray horizontal line at the top is the industry consensus back in October. The other lines represent more recent estimates of how Capex is declining. The steepest decline is the forecast based on Hess’s announcement. The next steepest (the dotted gray line) is the forecast based on Shell’s cutback. The cutback for the part of the market not shown in the chart is likely to be different.

Oil and Economic Growth

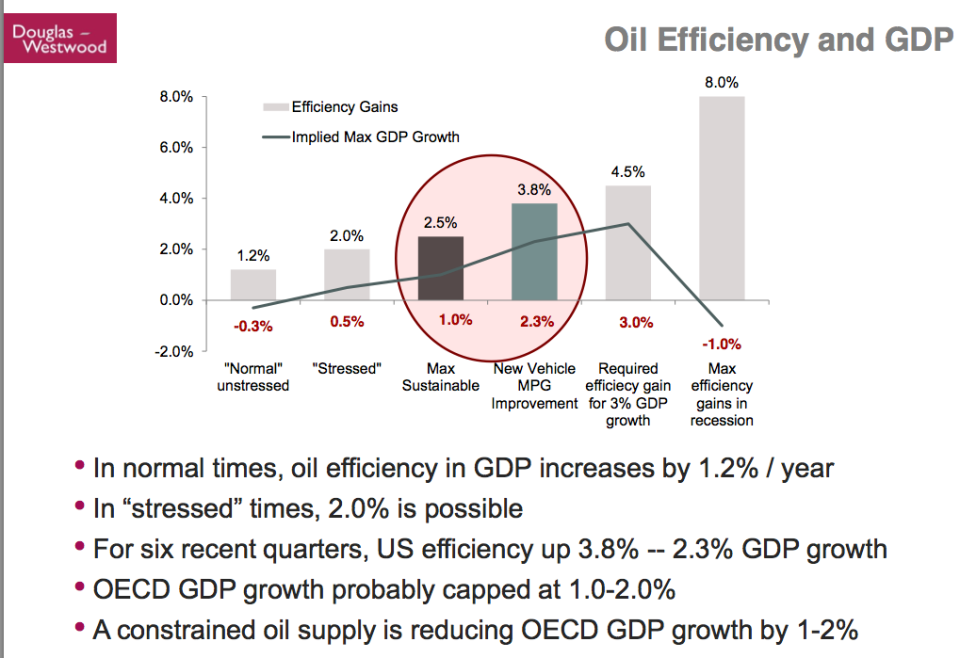

Kopits offers his view of how much efficiency can be gained in a given year, in the slide below:

In his view, the maximum sustainable increase in efficiency is 2.5% in non-recessions, but a more normal increase is 1% per year. At current oil supply growth levels, OECD GDP growth is capped at 1% to 2%. The effect of constrained oil supply is reducing OECD GDP growth by 1% to 2%.

In his view, the maximum sustainable increase in efficiency is 2.5% in non-recessions, but a more normal increase is 1% per year. At current oil supply growth levels, OECD GDP growth is capped at 1% to 2%. The effect of constrained oil supply is reducing OECD GDP growth by 1% to 2%.

Conclusions

While demand constrained models dominate thinking, in fact, a supply constrained model is more appropriate in recent years.

While demand constrained models dominate thinking, in fact, a supply constrained model is more appropriate in recent years.

We seem to be short of oil. Whenever there is extra oil on the market, it is quickly soaked up. Oil prices have not collapsed. No one is nervous about a price collapse.

China recently has been putting little price pressure on the market–its demand is recently less high. Kopits thinks China will eventually return to the market, and put price pressure on oil prices. Thus, oil price pressures are likely to return at some point.

Gail’s Observations

An obvious point, which I thought I heard when I listened to the presentation the first time, but didn’t hear the second time is, “Who will buy all of these assets on the market, and at what price?” China would seem to be a likely buyer, if one is to be found. But when several companies want to sell assets at the same time, a person wonders what prices will be available.

The new strategy is, in effect, maintaining dividends by returning part of capital. It is clearly not a very sustainable strategy.

It will take a while for these cut-backs in Capex expenditures to find their way through to oil output, but it could very well start in a year or two. This is disturbing.

What we are seeing now is a cutback in what companies consider “economically extractable oil”–something that isn’t exactly reported by companies. I expect that what is being sold off is mostly not “proven reserves.”

In this talk, it looks like lack of sufficient investment is poised to bring the system down. That is basically the expected limit under Limits to Growth.

In theory, if an expansion of China’s oil demand does bring oil prices up again, it could in theory encourage an increase in drilling activity. But it is doubtful that economies could withstand the high prices–they are already having problems at current price levels, considering the continued need for Quantitative Easing to keep interest rates low.

A recent news item was titled, G20 Finance Ministers Agree to Lift Global Growth Target. According to that article,

Mr Hockey said reaching the goal would require increasing investment but that it could create “tens of millions of new jobs”.

The cutback in investment by oil companies is working precisely in the wrong direction. If these cutbacks act to cut future oil extraction, it will bring down growth further.

27 Comments on "Beginning of the End? Oil Companies Cut Back on Spending"

Davy, Hermann, MO on Tue, 25th Feb 2014 12:44 pm

I am saying this like a broken record. If you include the oil industry in the new normal of a complex global interconnected world where global finance is the key factor in availability of investment capital you quickly realize energy is subject to finance first. Finance is the weak link to energy growth. The other factors to energy growth are in place. Financial health is not. We are one contagion away from multiple global financial bubbles bursting feeding back on each other. Confidence is liquidity and confidence at the moment is shaky. All it will take is a financial correction to raise interest rate and dry up liquidity to end the energy gold rush in unconventionals and further damage conventional production. Finance is the short term weak link. Longer term it is the declining energy gradient. It is already evident in a time of unprecedented economic conditions and accommodations of the trouble in the oil patch. What happens when the financial system has a correction or worse? Concerning a trigger for contraction, just because finance is the weak link does not mean it will be the wmd of our global system. It would be wonderful if it were just the financial system but it is multiple tipping points driving our complex global system to a break to a lower equilibrium. This will be the road to the unending decent of industrial man. We will not recover to the undulating peak we are at now when the next contraction hits. All systems cycle in a finite world. The possibility of collapse has never been higher. I am betting on the financial system but energy is the glass ceiling. These two critical elements are not mutually exclusive unfortunately. They will drive each other down along with the limit of growth and overshoot of our carrying capacity. This Ukraine and other situations could blow up but it is the system itself that is a bubble and could deflate.

rollin on Tue, 25th Feb 2014 1:17 pm

As I have stated before, there is almost no bang for the oil buck. We are barely keeping up with all these expenditures. Sure there are a few expensive projects that have not fully come on line yet, but they will not keep up with future depletion rates.

We would do better to invest in renewables and use the electricity to produce liquid fuels where they are necessary.

rockman on Tue, 25th Feb 2014 2:33 pm

“…Kopits reports that all of the major oil companies are reporting divestment programs. Does selling assets really solve the oil companies’ problems? …So instead, they sell assets to pay dividends, or perhaps just to get out of the business. But is this sustainable?”

I wish he had gotten into the details of what class of assets are being sold off. Again, a pubco’s value is largely determined by growth in its reserve base: who is going to pay more for a stock then the last buyer if a company’s value is decreasing? No one is going to bid up the price based on how profitably a company is drilling because no one in the public has access to that info. In the end it almost always about booked reserves.

So one might expect a company to sell UNDRILLED assets. Not only gain some revenue but cut the outflow of capex. But IMHO when a pubco starts selling proved producing reserves in the ground that’s an indication of very desperate move. They might sell to gain revenue for paying dividends but who is going to hang onto stock when a company is decreasing its future cash flow? So OTOH Shell XOM et al might sell their undeveloped assets but would be also looking to buy producing assets in order to replace produced reserves they are unable to do so with the drill bit. They might include some of the producing wells in those sales packages but only to make them more marketable. Finance folks are much more likely to fund an acquisition if some existing cash flow comes along with it.

Makati1 on Tue, 25th Feb 2014 2:39 pm

rollin, there are no ‘renewables’ without oil. And exchanging electricity for liquid fuel is a negative activity. Tech is not going to prevent the end of our way of life. Not even close.

CAM on Tue, 25th Feb 2014 2:41 pm

Looks like the “depletion curve” is becoming more precipitous!

ghung on Tue, 25th Feb 2014 2:56 pm

Taking the overview here, everything seems to be pointing in the wrong direction relative to industrial society’s ability to maintain itself. Our energy situation continues into negative territory when confronted with future demand. Overall claims on resources, both real and financial, are increasingly out of balance with reality while the very environment in which these things occur is becoming progressively less favourable.

All-the-while, human expectations are out of the bounds which will allow these promises we make to ourselves, collectively, to be kept. We are in a surreal age when the inertia in our systems is being misrepresented and confused as progress. There is no progress if our condition is viewed from a whole systems perspective. None of our so-called gains such as tight oil can be considered as actual gains when consequences are factored in. Indeed, virtually everything we do, have been doing, adds to the deficit, fouls the only nest we have. In short, overshoot on a massive, planet-wide scale.

Only time and nature are left to sort out the details of the decline which we’ve so thoroughly baked into the future. We aren’t in control; never have been.

Dave Thompson on Tue, 25th Feb 2014 3:11 pm

The oil companies know what is going on. Most on this page know also. The general populace is still being led to believe that we are on the way to energy independence and the salvation of the American motoring way.

Davey on Tue, 25th Feb 2014 3:14 pm

Dave only good thing about the snowing of the general public is it will prevent a loss of confidence that may buy us some time to implement bottom up lifeboat strategies

Kenz300 on Tue, 25th Feb 2014 3:19 pm

Wind, solar, wave energy, geothermal and second generation biofuels made from algae, cellulose and waste are the future……..

Biofuels can now be made from waste or trash. Every landfill can be converted to produce local energy, biofuels and recycled materials for new products.

The big oil majors hate this because they want to continue their centralized distribution model. Smaller decentralized local energy production does not fit their current business model.

Oil companies need to wake up and change their business models. They need to become energy companies and not just oil companies.

BP had it right a decade ago when they promoted their slogan “Beyond Petroleum”. Too bad they changed their leadership and their direction.

Davey on Tue, 25th Feb 2014 3:24 pm

Kenz you are as bad as me about being a broken record. I am stuck on finance and systems theory you renewables. Until renewables can produce renewables without fossil fuel energy and products the case is closed

Northwest Resident on Tue, 25th Feb 2014 3:32 pm

When institutional and retail investors put down their monthly subscriptions of Forbes, Bloomberg and other “everything is coming up roses” news sources for oil production and look out the window, they will see a long line of oil companies — public and private — marching down the road with their heads hung low, waving white flags. And then they will know what we all know, and what the oil companies have long known but strived to hide. That is, the game is OVER. We didn’t win — nature and physical constraints did. When that realization hits enough people, economic collapse will immediately go critical mass. Panic and chaos on epic scales. The crazies will be in the streets and people will be running for their lives. Coming soon to a theatre near you.

sunweb on Tue, 25th Feb 2014 3:50 pm

Is it both demand and supply growth as a description of at least oil (energy source) is not other finite natural resources?

In the beginning, there is “low hanging fruit” with high EROI and costs that are low and profits high. It starts with low demand but grows encouraged both by the industry itself and the natural inclination of all species to grow into the available energy source in its environment.

Cars, multiple cars, muscle cars, SUV, trucking, shipping, SSTs, industrial agriculture, and more and more people, infrastructure upon infrastructure. Remember 30 cent gas prices? https://www1.eere.energy.gov/vehiclesandfuels/facts/2012_fotw741.html

Housing/settlement/suburb patterns, all the goodies to fill the homes, city blocks with buildings filled at the bottom with stores and above with residences that are the size of small rural towns of yesteryear. Honest but useless manufacturing jobs, honest but frivolous service jobs, massive bureaucracies.

At some cross-over time (2005), the “low hanging fruit” peaks, EROI begins to reduce dramatically, costs grow and profits diminish. Supply becomes the search in the bottom of the barrel for sources with at least a modicum of positive EROI – fracking, tar sands, deep ocean drilling. High costs demand high prices per barrel. High prices per barrel limit demand because of high costs for energy. All this comes with the “unintended consequences of massive environmental damage of the earths support systems for life and threats for life itself.

And it is a mad scramble to maintain what everyone believes is the norm, should be the norm, has to be the norm because the reality is to tough to wrap our minds around.

Overshoot with a human face.

rockman on Tue, 25th Feb 2014 3:54 pm

I couldn’t find the article where Warren suggests not only NOT buying a subscription to Forbes et al for investment advice but to avoid listening to anything those “experts” have to say especially on a daily basis:

“Games are won by players who focus on the playing field — not by those whose eyes are glued to the scoreboard,” writes Buffett. “If you can enjoy Saturdays and Sundays without looking at stock prices, give it a try on weekdays.”

Buffett says that for “the nonprofessional” (that’s the rest of us), there’s no need to be picking winners in the stock market, or hiring someone else to do it either. And you should definitely ignore people on TV who try to predict broader market conditions.

shortonoil on Tue, 25th Feb 2014 4:15 pm

As is often the case when viewing petroleum production from an economic perspective, differentiating between cause, and effect becomes indistinguishable. The (Controversy: Does Oil Extraction Depend on “Supply Growth” or “Demand Growth”?) leads to the comparison of two independent variables. Whether you put the “Supply” or the “Growth” variable on the X axis is a matter of opinion. The reason for this ambiguity is that there is a third controlling variable that is not included in the equation; energy!

Petroleum is used primarily as an energy source. The “Controversy” can only be settled by identifying its energy delivery capabilities. Petroleum that only supplies a small amount of energy to the system will only generate a small demand for its production, and visa-verse. The ETP model is just such an method for evaluating the “Supply”, “Demand” relationship.

The ETP model predicts that a point will be reached when the price of petroleum will no longer be sufficient to cover the its full life cycle production costs, including replacement of reserves. This point is reached when the energy cost to extract, process and distribute a unit of petroleum becomes greater than the energy delivered to the end consumer. It is the energy half way point for petroleum production. According to the model that occurred in 2012. It was the point where the petroleum production system became a larger user of the energy that comes from petroleum than was the general economy. From that point forward petroleum energy production can no longer grow. Although when measured from a volumetric perspective it could if the per unit energy delivery was declining, which is what is happening.

One of the ironies of the petroleum depletion event is that the petroleum industry will see declining profits in the face of increasing per unit price. Because petroleum is a critical, and probably irreplaceable, extractive commodity its depletion will turn many of the established principals of economics upside down. For more information visit our website.

http://www.thehillsgroup.org/

Nony on Tue, 25th Feb 2014 5:16 pm

1. The problems of the majors are very interesting, but may not be those of the industry. Sometimes they are; sometimes they aren’t. Independents or state oil companies may have different issues. So, we just have to be careful to watch for what we are talking about. Issues with the industry overall or “is Exxon fat”.

The slide showing CAPEX versus production is a little confusing as crude oil production is shown in bbls while CAPEX is in dollars. If you showed production in dollars (or just showed percent revenue being CAPEX), we might see a different story. Also, the production numbers will be affected somewhat by acquisitions/divestitures. Not saying for sure this changes the story, but just watch out.

The declining CAPEX spend by the majors may not be industry-wide. If it is difficult to add up CAPEX for the minors (e.g. if they are private), perhaps you could look at service companies as a proxy. Perhaps it’s just a change in they type of investments or who makes them. An analogy might be pharma companies cutting internal R&D or getting out of chemical entity research. But of research still going on, but now performed by small biotechs. IOW, the smaller companies are better (less fat, more nimble, less political) at going after opportunities and the big companies are better at developing them, marketing them, scaling up.

At the end of the day, what matters for CAPEX decisions is if the opportunity is worth the cost. It seems like the story is that the majors are not getting results from their megaprojects.

I agree that cutting CAPEX and selling assets to pay dividends is not a good long term strategy for a company to stay around. But perhaps it is the responsible thing to do for shareholders.

These things seem like they go in cycles: conglomerate versus spinout. There have been times in the industry before where oil companies sold themselves, cut themselves apart, went LBO, etc. Also times when they consolidated.

I’m also interested (for the majors) in what are the trends with respect to vertical integration/disintegration. Spinning off refineries, spinning off gas stations, spinning off chemical divisions. What are the independents doing (are they becoming more vertical or staying as E&P companies?) Also what are the trends in terms of exploration divisions (owning your own rigs and fracking versus outsourcing it.)

Nony on Tue, 25th Feb 2014 5:21 pm

Another factor to consider is US versus ROW for capital spend. Perhaps the story is declining spend in ROW and increasing in the US. Essentially because this is where the opportunities are (more). [For various reasons including regulatory, expertise, geology.] If the independents are US only and the majors are internations, then looking at the declining CAPEX of the majors, may just reflect how ROW CAPEX is going down. If you graphed US-only CAPEX for the majors, perhaps it is going up.

Arthur on Tue, 25th Feb 2014 7:55 pm

Oil goes, gas comes.

Northwest Resident on Tue, 25th Feb 2014 8:16 pm

Nony — Maybe this will answer your question, and add some perspective to your optimistic “perhaps it (CAPEX) is going up”.

In 2015, Shell will pay more in dividend than it generates in cash!

And while that can be seen as simply a business decision, or even merely a way to make investors happy, you do have to wonder what the future holds for what has been one of the biggest global companies for a long time – and for its investors.

Here are a few details:

• Shell to cut investments by 20% in 2014

• They put their Alaska projects “in the freezer”, at a cost of €5 billion

• They quit a gas-to-liquids (i.e. diesel) plant in Louisiana

• from last year – Shell wrote down €2 billion in US shale assets (not sit on them for a while, or try to sell them, just write off as a clean loss)

Moreover, Shell is urged to keep out of the Arctic too by principled investors. So where should the company turn to make a buck?

The RTLZ guys were asking why Shell’s shares price didn’t plummet when this became known, and they had a few interesting suggestions:

• Investors are short sighted and happy with a bit of cash in hand

• Investors think that if oil is that scarce, prices will soon surge

• Investors see that climate rules will force 80% of remaining oil to stay in the ground as stranded assets.

Now, I don’t know about you, but when I go through numbers and data this way for a few hours, I get a queasy feeling that maybe things are not nearly as positive as we are made to think (or should I say even worse than we already figured), and not just decades from now, but in the near future. If a company like Shell essentially starts to wind down its core business, in the sense that business has been focused to a large extent on exploring as much as producing, what does that mean? Investors may hold on to shares a while longer because they’ve been promised large(r) dividends, but why hold on after that?

And of course, as Shell goes, so do Exxon and BP and all the other former greats. And with them the carbon that built our world. It wasn’t just carbon, it was increasing amounts of it. And cheap.

http://www.theautomaticearth.com/debt-rattle-feb-25-2014-bombshell/

Nony on Tue, 25th Feb 2014 9:02 pm

Investors did not punish the stock because they think returning cash to stockholders will allow greater returns than having management invest it. Yeah, it’s a step in the direction of harvesting the business. Or at least being less growth oriented. Maybe the markets think CLR and EOG can deploy capital more effectively than BP and XOM.

Nony on Tue, 25th Feb 2014 9:04 pm

In terms of things being “less rosy than portrayed”, it all depends on your prior. If you think that people are thinking everything is perfect, well sure…they need an awakening. But if you are one of those mid-2000s, TOD-is-dead, Campbell/Simmons/Gail/Deffenwhateverhisnameis, doomer types: well, maybe you need a re-evaluations.

Middle course, middle course.

Northwest Resident on Tue, 25th Feb 2014 9:59 pm

Nony — Doomer types would tend to disagree, and most likely point out that it is the people who constantly gloss over the reality of the rapidly depleting oil situation that exists today as being the ones who need to re-evaluate.

See article just posted on peakoil titled “Clouds on the horizon for fracking companies?” Where does the optimistic middle ground exist given that set of facts?

shortonoil on Tue, 25th Feb 2014 11:25 pm

One of the few remaining plays in hydrocarbons that still has the potential to bring significant returns for the investor is condensates. Condensate production is not the same as conventional crude production, and has a much higher risk factor. Condensates are not a liquid in the reservoir, they are a one phase gas where the heavier fractions condensate out of the fluid as the reservoir pressure declines. Wells are usually pumped in a manner that the temperature of the reserve stays fairly constant, at about 420 deg K.

When the pressure falls to the dew point (saturation pressure), usually about 500 to 750 psi the heavy fractions condensate around the well bore, and the well dies from condensate clogging. Some of the larger condensate fields such as the Arun, in Indonesia, and the Shtokmonavskyoe in Russian have been producing for more than 25 years. The much smaller US fields like the Eagle Ford will decline much faster being that they are gas drive wells. The key to finding lucrative fields is the the determination of the constitute gas, (rich condensate, or lean) and having, an understanding the PVT curves of the fields production. Of course, prying the PVT curves out of the dying hands of the producers is easier said than done! But that information is critical to making informed decisions.

Investing in condensates requires much more knowledge than looking at the profit and loss sheets of producers. Wells can blossom for a very short period, and then decline at catastrophic rates. It is not an investment category for widows and orphans. If you can’t afford to lose your investment, condensates should be avoided!

http://www.thehillsgroup.org/

Nony on Wed, 26th Feb 2014 12:42 am

Is “NGL” = “condensate”?

rockman on Wed, 26th Feb 2014 3:25 am

Nony – No. NGL’s are hydrocarbons on the light end of the range. Search the term and you’ll see the H/C ratios. We use a “JT plant” at the well site to pull the NGL’s out of the gas. Or send the rich gas to a plant that does the separation and the NG seller gets a percentage of those sales.

Condensate is not as easy to define. In Texas the same liquid hydrocarbon that would be classified as condensate might be classified as oil in La. In fact, production from the same well in Texas might be called condensate initially but in time as the reservoir pressure changes it might be classified as oil. Even the API gravity of the liquid does determine the classification. In one state a 42 API liquid might be called “oil” while a heavier weight 38 API might be classified as condensate.

Feemer on Wed, 26th Feb 2014 3:59 am

Unfortunately for our environment this means we will start extracting more tar sands and methane hydrate (fracking in the US will be declining by 2017 or will have already is my guess). I still think we have a couple of years left until the economy and well, everything starts imploding because it doesn’t have cheap oil. My advice would be to store some water and food for supply disruptions, but i think the more realistic of us know that things could get really bad and completely collapse. How could it not when we use oil to grow food? Oil to mine/ship coal for electricity?

Northwest Resident on Wed, 26th Feb 2014 6:48 am

I guess that oil companies cutting back on spending is nothing new. Oil and NG development has always been a boom/bust business, as far as I can tell. What makes it different and more threatening now than in prior times is that we in fact are barely keeping the world supplied with oil today as it stands, and the only way we’re able to avoid shortfalls is by fracking. But fracking as we know is subject to very high decline rates, forcing ever more holes to be drilled at ever greater expense. In a global economy that is stretched to the limit by too-high oil prices and by all the financial fraud that is used to compensate for those too-high prices, when oil companies start throwing in the towel, we know that something has to give. In the past, we still had enough “proven reserves” that meant something, oil companies could take a break, wait for demand and prices to go back up, then they got back to work in a more or less normal economic environment. That normal economic environment is long gone, and so are all the proven reserves that meant something. All that’s left is deepwater and unconventional — the very bottom of the barrel. Shortfalls are on the horizon. This is the twilight age for oil companies, and for the civilization that was built on the oil those companies provided.

rockman on Wed, 26th Feb 2014 1:15 pm

NR – “I guess that oil companies cutting back on spending is nothing new”. A reminder for other folks what we’ve discussed before: the vast majority of this “new” production is coming from trends that have been known for decades. And we’re using tech to develop them that was also available for a long time. I wasn’t kidding about geologists having file cabinets full of drilling projects that weren’t viable at the time due to low prices. I have one project I designed almost 30 years ago sitting there. And if NG gets above $8/mcf or so I’ll dig it out….assuming I haven’t reached room temperature at that time. LOL.

The point being is that we’ve had $90+/bbl oil for a while. That spurred development of known projects that could be justified at that price. But there’s still a finite number of wells that can be drilled at any specific price. When oil was $30/bbl we drilled every project that made sense until we ran out of them. Same dynamic with $100/bbl oil: we’ll drill every one that makes sense at that price. But that inventory will get depleted. There will be a day in the future when there are no more viable locations to drill in the Bakken and Eagle Ford if oil prices remain where they are. Perhaps we’re already starting to see that factor kick in. Add the increased debt load of many pubcos along with more difficulty accessing capex and it wouldn’t be surprising to see us moving into that second half of the bell curve where activity continues to decrease until the parameters change.