Page added on September 14, 2014

The Soft Patch In Oil Prices Is Here To Stay

Summary

- The world has been living with expensive oil for the past decade.

- Expensive oil is associated with higher capex on exploration and production.

- The current oversupply of oil is a secular, not a cyclical phenomenon: expect the soft patch in oil prices to persist.

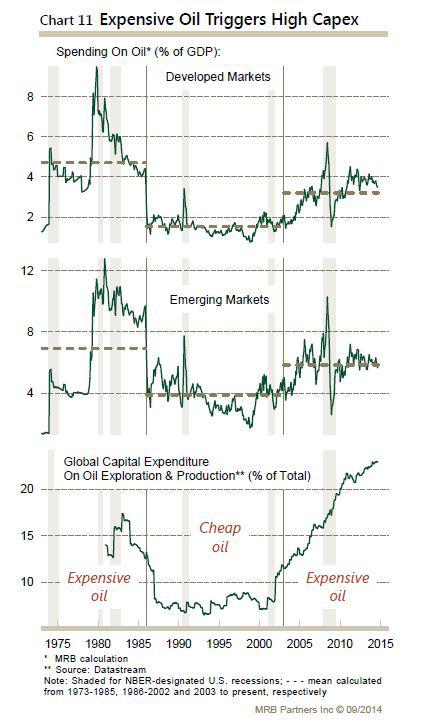

One good way of estimating whether oil is expensive or cheap is to take total oil consumption, multiply it by international oil prices, and express the result as a share of GDP. The result is a measure of “oil spend”, which, over the past 40 years has gone through three distinct phases.

After the 1973 oil crisis, oil spend spiked up, and while volatile, it averaged around 4.5% of developed country GDP for the next decade or so, which represented a period of “expensive” oil. The second phase kicked in as oil prices collapsed in 1986, and lasted about 17 years, with oil spend averaging around 1.5% of GDP. In other words, we were in a world of “cheap” oil. Over the past decade, the ratio is averaging 3.5%, taking us back to expensive oil.

Expensive oil triggers higher capital spending on oil exploration and production. In the earlier era of expensive oil, oil capex accounted for around 15% of global capex, currently it accounts for nearly a quarter. Unsurprisingly, during the cheap oil era, such capex shrank to just 5% of global capex.

The result of the increased capex is increased oil production, which is growing faster than oil demand. It turns out that the world wasn’t running out of oil, after all. It was running out of easy and cheap oil, but as the economics of the U.S. oil patch demonstrate, even the new and unconventional sources of supply are seeing production costs decline.

So it would appear that we are at the beginning of what could well be an extended patch of soft oil prices. Strong EM demand growth probably precludes a return to an era of overtly “cheap” oil, but don’t expect much upside from these levels. Indeed, there is plenty of oil that is being kept off the market by geopolitics, which, if conditions change, would return to the export channels, and imply an extended period of soggy oil prices.

27 Comments on "The Soft Patch In Oil Prices Is Here To Stay"

Nony on Sun, 14th Sep 2014 8:35 am

Cue Rock’s 90>>30 in 5, 4, 3, 2…

😉

paulo1 on Sun, 14th Sep 2014 8:37 am

re:

“The current oversupply of oil is a secular, not a cyclical phenomenon: expect the soft patch in oil prices to persist.”

rightttttt. I wonder if what he is smoking is illegal?

Paulo

peakyeast on Sun, 14th Sep 2014 8:49 am

Please remember that the way of calculating GDP has changed from something that might be indicative – to something that is pure fantasy.

I believe the 3.5% in the article does not correspond to 3.5% in 1973.

As Chris Martenson described it:

Richard Nixon bequeathed us the so-called “core inflation” measure, which strips out food and fuel, which, as Barry Ritholtz says, is like reporting inflation ex-inflation, while it was Bill Clinton who left us with the current tangled statistical morass that is now our official method of inflation measurement.

http://www.peakprosperity.com/crashcourse/chapter-16-fuzzy-numbers

rockman on Sun, 14th Sep 2014 9:28 am

Nony – Yes…such a funny article. During the 80’s and 90’s when we had the lowest oil prices (adjusted for inflation) in the last 40 YEARS we had the lowest global oil consumption in the last 35 years. Given that energy consumption is required to drive economic growth it would appear that

“cheap” oil corresponds to poor economic times while “expensive oil” corresponds to economic vitality. For the sake of the global economies let’s hope oil prices don’t fall any further and leads us back into a global depression just as $10/bbl oil did back in the mid 80’s. LOL.

Kenz300 on Sun, 14th Sep 2014 10:03 am

It is time to end the oil monopoly on transportation fuels.

Bring on the electric, flex-fuel, hybrid, biofuel, CNG, LNG and hydrogen fueled vehicles.

Better yet cities need to encourage people to get out of their cars and walk more, bicycle more or use mass transit.

Climate change is real…. the sooner we transition to safer, cleaner and cheaper energy sources the better.

——————–

E-Bike Sales Are Surging in Europe – NYTimes.com

http://www.nytimes.com/2014/08/19/business/e-bike-sales-are-surging-in-europe.html?emc=edit_th_20140819&nl=todaysheadlines&nlid=21372621

———————-

The Truth Behind Big Oil Attacking Ethanol – YouTube

https://www.youtube.com/watch?v=s24qLH042C8

———————

How Fossil Fuel Interests Attack Renewable Energy

http://www.renewableenergyworld.com/rea/news/article/2014/05/how-fossil-fuel-interests-attack-renewable-energy

westexas on Sun, 14th Sep 2014 10:39 am

Michael C. Lynch, August, 2009:

http://www.nytimes.com/2009/08/25/opinion/25lynch.html?pagewanted=all

Oil remains abundant, and the price will likely come down closer to the historical level of $30 a barrel as new supplies come forward in the deep waters off West Africa and Latin America, in East Africa, and perhaps in the Bakken oil shale fields of Montana and North Dakota. But that may not keep the Chicken Littles from convincing policymakers in Washington and elsewhere that oil, being finite, must increase in price. (That’s the logic that led the Carter administration to create the Synthetic Fuels Corporation, a $3 billion boondoggle that never produced a gallon of useable fuel.)

Nony on Sun, 14th Sep 2014 10:43 am

I don’t think that 1985-2005 was a bad economic time for the U.S. or for the World. Just look at growth of GDP.

http://en.wikipedia.org/wiki/Gross_world_product

Nony on Sun, 14th Sep 2014 10:44 am

Never mind, you were agreeing with me. Tired. Working contract work.

Bob Owens on Sun, 14th Sep 2014 10:54 am

“It’s tough to make predictions, especially about the future.” by Yogi Berra. Indeed, predicting the future of oil prices has always met with failure and will continue to do so. There are just too many variables. So, everyone, stop worrying or thinking about it; you will be better off.

Davy on Sun, 14th Sep 2014 11:07 am

Bob, a volatile trend is obvious but you are correct about prices.

shortonoil on Sun, 14th Sep 2014 11:10 am

We post here at PO News, at our site, and occasionally at a few other places on the web. We have no predetermined agenda, and our only purpose is to keep the few that might by interested in what we are doing informed. We are essentially acting as a think tank, financed by a consulting group.

For the last year, every time we present our findings a few weeks, or even days later there is an avalanche of articles that pick up the same topic. Recently we have been discussing petroleum prices, and how they are influenced by energy dynamics. Inevitability the same topic will be rehashed by someone who attempts to reinterpret the subject applying something that they picked up in Econ 101.

The author here takes the typical economist’s approach; make a statement as if it is fact, and then base the conclusion on that; after presenting a labyrinth of squiggly lines to support it. The author says:

“The current oversupply of oil is a secular, not a cyclical phenomenon: expect the soft patch in oil prices to persist.”

” The current oversupply”; which we assume is his option? Apparently, from Econ 101, if the price is going down there is an oversupply. There is no consideration given, that perhaps, the value of the commodity to the end consumer has now exceeded its market price. If the quality of the commodity produced declines without reducing the price, the consumer will curtail his consumption, and the price will decline. That is not an oversupply. That is a change in the value of the commodity. We contend that is now what is happening in the oil market as the energy delivered to the end consumer declines.

” is a secular, not a cyclical phenomenon”, this is also stated without substantiation. Here the author presents the concept of “expensive oil” and its relation to capex. Capex, did indeed, increase considerably over the last decade. What the author fails to acknowledge is that even though capex has increased, its yield per $ in barrels has fallen dramatically over the same period. Rising capex with declining yield is an indication of resource constraint, which is not secular. Its is cyclical.

Our studies indicate that oil prices are a cyclical cycle, and they are in the part of the cycle where the price goes down. Our analysis indicates this will continue until the end of the oil age is reached.

http://www.thehillsgroup.org/

Plantagenet on Sun, 14th Sep 2014 11:14 am

An optimist is someone who sees a short term trend they like and imagines it will continue continue indefinitely.

Davy on Sun, 14th Sep 2014 11:20 am

Short said – ” The current oversupply”; which we assume is his option? Apparently, from Econ 101, if the price is going down there is an oversupply

Short, that is what Noo tells us all the time here on the PO forum and not to worry cause drill baby drill and frack’en away!

bobinget on Sun, 14th Sep 2014 11:31 am

Seeking Alpha will regret making such a sweeping statement. Like a errant violent police video this one will be used to ridicule.

There is one single reason the US and NATO is set to invest another 100 Billion fighting Mideast ideologies.

That reason as we all are aware is plain and simply control of oil supplies. One almost never hears oil as the main factor. Instead we hear of a tragic beheading of innocent noncombatant aid worker and journalists.

“One death is a tragedy. A million deaths, a statistic”

J. Stalin

http://www.wltx.com/story/news/nation/2014/09/13/pope-global-conflicts-have-become-world-war-iii/15579079/

The Pope said what few politicians dare to say, we are already in a world war. Religion, on all sides, hijacked as glue to pull disinherited, disaffected,

together in the Mideast and several African nations.

Back on topic: WE were using less oil because two highly mechanized wars were winding down.

“”The US Department of Defense (DoD) is the largest oil consuming government body in the US and in the world

“Military fuel consumption makes the Department of Defense the single largest consumer of petroleum in the U.S” [1]

“Military fuel consumption for aircraft, ships, ground vehicles and facilities makes the DoD the single largest consumer of petroleum in the U.S” [2]

According to the US Defense Energy Support Center Fact Book 2004, in Fiscal Year 2004, the US military fuel consumption increased to 144 million barrels. This is about 40 million barrels more than the average peacetime military usage.

By the way, 144 million barrels makes 395 000 barrels per day, almost as much as daily energy consumption of Greece.

The US military is the biggest purchaser of oil in the world”.

Oil consumption did fall, not in the US this year over last, but in war-zones. All that is changing.

Australia to the US we are gearing up for… at very least, a test of airpower against Militant-Islamic-Power.

Remember, these are folks who use religion to suppress masses not nurture.

steve on Sun, 14th Sep 2014 11:32 am

5 years before we have complete system shut down…the engine is running hot right now and soon it will freeze up for lack of oil….

Cloud9 on Sun, 14th Sep 2014 11:43 am

We are witnessing demand destruction. The assumption that full shelves imply ample supply is overlooking the fact that the consumer is being driven from the market place by price. Look at gasoline retail sales over the last dozen years and you will detect a discernable trend. Step back and look at the ten year Harpex and you will understand where we are and where this is going.

http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=A103600001&f=M

http://www.harperpetersen.com/harpex/harpexRH.do?timePeriod=Years10&&dataType=Harpex&floatLeft=None&floatRight=None

Perk Earl on Sun, 14th Sep 2014 1:50 pm

shortonoil and others; Gail posted on her site yesterday she is considering doing an article addressing dropping oil price. Once available I’ll post a link on this site.

shortonoil on Sun, 14th Sep 2014 2:09 pm

Something must have happened to Gail in childhood. She’s got common sense. I’ll look forward to what she has to say.

MD on Sun, 14th Sep 2014 3:36 pm

The “soft patch in oil price” is NOT here to stay.

The base assertion is ridiculous at best.

Price will be volatile, and currency dependent.

So much bullshit analysis out there. Good grief.

MD on Sun, 14th Sep 2014 3:39 pm

Gail continues to attempt to subdue the future by application of her actuarial tables when in reality there is no way to predict future volatility. -No way-.

It’s an uncharted voyage from here out, and it’s gonna get stormy.

Mike999 on Sun, 14th Sep 2014 5:29 pm

Yes, that is demand destruction at work.

Only, a sucker buys a standard gas engine these days. The smart buyer is preparing for shortages, and saving money.

Harquebus on Sun, 14th Sep 2014 5:46 pm

It matters not. Global debt can never be repaid and economic collapse will destroy all but the most productive oil producers.

Perk Earl on Mon, 15th Sep 2014 12:26 am

http://www.bloomberg.com/energy/

Looks like the soft patch is getting softer as oil is already being traded down today, the 14th;

WTI -1.11 to $91.16

& Brent -.54 to $96.57 ?!

Davy on Mon, 15th Sep 2014 6:37 am

Well put MD, descent involves randomness of dysfunction and abandonment. Chaos infects the whole system with these entropic decay elements. This is why I repeat that managed de-growth is not possible only the management of the descent within de-growth. Predictive abilities here on out are going to be very difficult.

shortonoil on Mon, 15th Sep 2014 7:02 am

“It matters not. Global debt can never be repaid and economic collapse will destroy all but the most productive oil producers.”

For those not paying attention, oil futures have been in backwardation for three years. The reason for that is because the traders look at the rate of change of supply to the rate of change of demand to determine prices. Apparently, they all use the same algorithm. Demand has not kept up with supply because the value of oil to the end consumer is declining. Supply has increased because central bank policies have allowed the financing of otherwise irrational investments. Shale is a good example of using a pyramid debt scheme based on artificially cheap money to finance production. Also remember, that bitumen production began its rapid increase after Greenspan loosened monetary policy. The world has been flooded with cheap credit that can not be repaid.

The laws of physics are now in the process of usurping the financial kings. The declining world economy has put about every major corporation, and sovereign state in some kind of financial difficulty. Debt formation has increased world wide by 40% in six years. This has led to massive instability around the world, and hinges are being sprung on every front. Expect volatility in the oil markets as a result of increasing financial stress, and its corresponding geo-polictical backlash. But volatility is not a trend, and the long term trend for oil prices is down as depletion continues its relentless march toward its completion.

We now have some kind of handle on the shelf life of expanded production based on artificially debased money. It appears to be about three years. We could categorize this as the “Peak Greed” indicator, and it represents the point where the forward momentum of the economy is overtaken by the reality of resource constraints. It represents the point where manipulating the money supply has no further effect on production. From this point forward we will not see an increase in production from the high production cost sources. Ultra deep water, arctic, shale, and bitumen production will soon begin their downward leg into terminal decline!

http://www.thehillsgroup.org/

Davy on Mon, 15th Sep 2014 7:31 am

Short this is profoundly important information. In the last year we have seen discussions here on PO evolve. We have seen the cornucopian comments and articles on this forum dissolve when put under the microscope of analysis. I have the feeling 3-5 years is the scope of the converging PO dynamics with financial realities. Thank you for the kind of clarification needed to support these predictions. It is anyone’s guess how this will shake out but it is hard to argue with laws of nature.

sparks on Mon, 15th Sep 2014 8:45 pm

Short said: “Supply has increased because central bank policies have allowed the financing of otherwise irrational investments.”

This statement is the quintessential distillation of our current world energy situation. This is what needs to be proclaimed from the rooftops. This is also the great sleight of hand that makes one wonder: Might the OECD governments and central banks actually be that aware and calculating? After all, maintenance of the status quo equates to the very survival of the gov and banking sectors. Alas, as Short also so astutely states of the short-term expanded production, “It represents the point where manipulating the money supply has no further effect on production.” All the ink spilled on this topic will amount to little more, and no less, than these two statements. Truly brilliant.