Page added on March 30, 2014

Citigroup says the ‘Age of Renewables’ has begun

Investment banking giant Citigroup has hailed the start of the “age of renewables” in the United States, the world’s biggest electricity market, saying that solar and wind energy are getting competitive with natural gas peaking and baseload plants – even in the US where gas prices are said to be low.

In a major new analysis released this week, Citi says the big decision makers within the US power industry are focused on securing low cost power, fuel diversity and stable cash flows, and this is drawing them increasingly to the “economics” of solar and wind, and how they compare with other technologies.

Much of the mainstream media – in the US and abroad – has been swallowing the fossil fuel Kool-Aid and hailing the arrival of cheap gas, through the fracking boom, as a new energy “revolution”, as if this would be a permanent state of affairs. But as we wrote last week, solar costs continue to fall even as gas prices double.

Citi’s report echoes that conclusion. Gas prices, it notes, are rising and becoming more volatile. This has made wind and solar and other renewable energy sources more attractive because they are not sensitive to fuel price volatility.

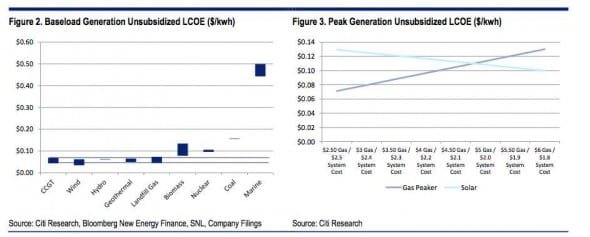

Citi says solar is already becoming more attractive than gas-fired peaking plants, both from a cost and fuel diversity perspective. And in baseload generation, wind, biomass, geothermal, and hydro are becoming more economically attractive than baseload gas.

It notes that nuclear and coal are structurally disadvantaged because both technologies are viewed as uncompetitive on cost. Environmental regulations are making coal even pricier, and the ageing nuclear fleet in the US is facing plant shutdowns due to the challenging economics.

“We predict that solar, wind, and biomass to continue to gain market share from coal and nuclear into the future,” the Citi analysts write.

Citi says the key metric in comparing power sources will be the levellised cost of energy (LCOE). “As solar, wind, biomass, and other power sources gain market share from coal, nukes, and gas, the LCOE metric increasingly becomes important to the new build power generation decision making,” it says.

(Citi defines LCOE as the average cost of producing a unit of electricity over the lifetime of the generating source. It takes into account the amount produced by the source, the costs that went into establishing the source over its lifetime, including the original capital expenditure, ongoing maintenance costs, the cost of fuel and any carbon costs. It also includes financing costs and ensuring that the project generates a reasonable internal rate of return (IRR) for the equity providers).

Here is the key graph on the current state of play, baseload generation and their renewable competitors to the left, and peaking gas and solar to the right.

On baseload, all renewables except marine beat coal and nuclear. Combined cycle gas just hangs on.

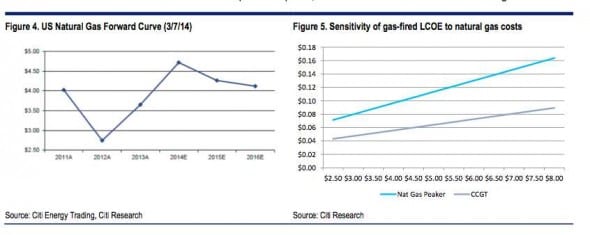

As for peaking plant, it depends on the gas prices, but these are rising and in some regions it is now back above its pre-GFC and fracking boom levels. The move to export LNG will likely cause a further increase in prices.

And here (below) is more on those gas prices. As can be seen, natural gas prices have nearly doubled in the past two years, and these have a direct correlation to the price of gas-fired electricity.

At a natural gas price of $US4.00/mmbtu, the LCOE of a gas peaker is $US0.10/kwh and a CCGT (combined cycle or baseload plant) is $US0.06/kwh. If Citi’s commodities team’s long-term gas price forecast of $5.50 is used, the implied LCOE is $0.12/kwh for natural gas peaker or $0.07/kwh for a CCGT plant.

“These numbers,” Citi says, “set the bar for alternative energy.

“Given the large expected increase in demand for gas, offset by production gains, gas prices are expected to rise over the long term. As a result, the bar for renewables and other fuel sources to cross continues to rise, thus making it easier for alternatives to gain market share.”

(Australia take note: its gas prices are already double the US price, which is why gas generation is being pushed out of the market. Coal, however, is recovering because the Australian government does not set strict emissions standards).

Financiers, in particular, are conscious about the volatility in US gas prices and the likelihood that they will rise. These are influencing where they are putting their money, and new “yieldco” financing facilities for solar and wind energy are making these technologies both cheaper and more attractive.

As for solar, costs are coming down. Citi says the base case LCOE for solar is 13c/kWh, the near-term upside in 11c/kWh and the long-term upside (2016) is 10c/kWh. (This is despite the fact that some power purchase contracts are being written as low as 4c/kWh or 5c/kWh, but those are helped by various tax rebates).

Citi says the outlook for solar LCOE is favourable, but the devil lies in the details. The system costs are comprised of module costs plus balance of systems (BOS) and these vary depend on end user, location, and other factors. As the table above shows, BOS costs are likely to fall sharply in the near term. (In Australia, for instance, balance of system costs are higher because so few large scale plants have been built).

Citi says the outlook for solar LCOE is favourable, but the devil lies in the details. The system costs are comprised of module costs plus balance of systems (BOS) and these vary depend on end user, location, and other factors. As the table above shows, BOS costs are likely to fall sharply in the near term. (In Australia, for instance, balance of system costs are higher because so few large scale plants have been built).

With a lower cost of capital solar becomes much less expensive to finance and develop. In general the growing financing market for solar has recognised the strong cash flow and low risk profile that is characteristic with solar projects.

“Solar is still early in the growth cycle and in many countries – Germany, Spain, Portugal, Australia, and the South-West US – residential scale solar has already competed with average residential electricity prices,” Citi writes.

“In 2013, solar was the second- largest source of new generation capacity behind natural gas – its prospects look bright in 2014 and beyond as costs continue to decline and improve the LCOE picture.

As for wind, it continues to reduce costs, but the most interesting development is the reduction in financing costs, thanks again to the “yieldco” phenomena.

“While LCOE may decline, the outlook for wind is also dependent on the wind levels in the areas it will be built and the cost of base load alternatives. With gas prices forecasted to rise, the LCOE of wind is becoming more competitive with CCGT alternatives. Despite this, many of the most attractive wind sites are in use and government incentives come into play which reduces the outlook for wind. ”

Citi, however, is downbeat on hydro, Geothermal, and marine energy sources because of physical limitations. “While hydro and geothermal are competitive from an LCOE basis, they require unique geological conditions and as a result, many of the remaining potential new sites have less attractive LCOEs,” it notes. Marine technologies appear to still be early in their development cycles with an uncertain roadmap.

Coal, it says, is basically priced out of the market. Environmental regulations means that the LCOE for new coal is around 15.6c/kWh, and it notes that coal only accounts for 2 per cent of the generation projects under development.

On nuclear, Citi says cost over-runs at the Vogtle plant under construction in Georgia – now slated to cost $15 billion, way above expectations – mean that nuclear is pricing itself out of the market. Citi puts its LCOE at 11c/kWh), which it said is relatively expensive, vs combined cycle gas plants and solar and wind. And it notes that while financing costs are inexpensive in the current monetary environment, this situation will not last.

“Financing cost are likely to rise which would hurt the LCOE attractiveness of a high construction cost generating source like nuclear,” Citi says. “As a result, we do not expect nuclear to effectively compete on economic merits. Despite this LCOE dynamic, there is merit to increasing fuel diversity and supporting lower carbon generation. “

18 Comments on "Citigroup says the ‘Age of Renewables’ has begun"

Dave Thompson on Sun, 30th Mar 2014 1:09 pm

Citigroup and renewables, whats not to believe?

meld on Sun, 30th Mar 2014 1:41 pm

Now we face another decade of people wondering why things are getting more expensive and their quality of life falling dramatically. If you believe this shit you get everything coming to you in spades.

Davy, Hermann, MO on Sun, 30th Mar 2014 1:44 pm

ARTICLE SAID – Investment banking giant Citigroup has hailed the start of the “age of renewables” in the United States, the world’s biggest electricity market, saying that solar and wind energy are getting competitive with natural gas peaking and baseload plants – even in the US where gas prices are said to be low.

ARTICLE SAID – It notes that nuclear and coal are structurally disadvantaged because both technologies are viewed as uncompetitive on cost. Environmental regulations are making coal even pricier, and the ageing nuclear fleet in the US is facing plant shutdowns due to the challenging economics.

I see a 5 year golden age of solar and wind. It will be subject to financial situations and PO dynamics. The cost of money and availability of capital will be the key drivers in the future and the trend is definitely uncertain. IMHO the trend is towards scarcity of capital and higher cost of money. AltE technology has a large upfront cost so it is particularly vulnerable to changes in the economic environment. Investment decisions are more difficult because of worries over rate of returns over the long payback periods. As the market penetration of AltE increases so must the expensive changes to the grid and or on demand fossil fuel sources. In my mind the one bright spot is the increasingly affordable use by residential users of solar. This is truly a micro grid situation. Get the power right to the end user. Create pockets of power in neighborhoods for sharing and help in a crisis. It is a great way of solar system owners to trade and barter power availability in a crisis. The direct use of solar power is the best in the form of hot water heating. We need to avoid conversion power loss where possible. Mechanical wind and solar uses should be a high priority. There should be a bigger push for solar cooking and solar home heating with panel heating. The simple, low tech, low cost products are or best hope for increased resiliency and sustainability in the coming energy decent. Large scale, complicated, and expensive AltE power sources may be shut out in a contraction. The results in huge macro investments wasted by a society at limits of growth and overshoot.

We as a society must be very careful with mothballing coal and nuclear. The huge embedded cost have been made. If society has an economic contraction or correction the investment capital needed for new power source and infrastructure buildout will not be there. The last thing we need in a crisis situation is power shortages and an unreliable grid. We should balance AltE and traditional power sources. I am all for lowering carbon. In my mind the real reductions in carbon will come with an economic correction and or contraction. If the decent is going to be gentle and the landing soft we better not allow greed and wishful thinking cloud our judgments and cause market distortions and set us up for shortages.

Davy, Hermann, MO on Sun, 30th Mar 2014 1:51 pm

ARTICLE MENTIONED – levellised cost of energy (LCOE). (Citi defines LCOE as the average cost of producing a unit of electricity over the lifetime of the generating source. It takes into account the amount produced by the source, the costs that went into establishing the source over its lifetime, including the original capital expenditure, ongoing maintenance costs, the cost of fuel and any carbon costs. It also includes financing costs and ensuring that the project generates a reasonable internal rate of return (IRR) for the equity providers).

I am surprised this has not been dealt with more on this site. I am curious if anyone here finds it useful or just another gimmick with the lobby of plenty and technological exuberance.

bobinget on Sun, 30th Mar 2014 3:01 pm

Take salt out of seawater, generate usable hydrogen fuel with cheap solar= World Peace.

Imagine yourself in charge of refueling the principal

utility in your region. Guessing wrong in the futures markets loses your job. What if a plan to build out a solar (or wind) BASE power plant in your area, financed entirely by bond issues and serviced by what your employers normally pay monthly for fossil fuel were presented. A thirty year FIXED rate, the same payment year after year guaranteed by rate payers

and happily invested in by tax free munis.

If you have a grain of sense you will never tell your employers who will see one additional highly paid position redundant, yours.

Word leaks out however. The trick here is to open an entirely new position within the solar (wind is also solar) complex. Buying and selling power across time zones.

Instead of taking bribes, (collage scholarships, wedding receptions, for your nine girls) from mom and pop gas,

coal, distribution companies you seek ‘closer relations’

with “Big Solar” and Wall Street Banksters who stand to make big bucks shepherding your companies bond issues.

Banks are already seeing green in Green. A few big

German, US conglomerates like Siemens, General Electric are spending billions to improve efficiency

of turbines and solar. New materials available today

on a commercial basis are already reducing energy needed to filter ocean water and fuel up that locomotive or bus.

Plantagenet on Sun, 30th Mar 2014 3:57 pm

Its the age of “all of the above”.

Renewables have a place, just like NG, nukes, and oil.

paulo1 on Sun, 30th Mar 2014 4:05 pm

I think we need simple localized solutions. Having said that the energy demands of a large city are beyond that. Good luck for those who live in high rises. I wouldn’t want to depend on large complex solutions and big finance to keep the water flowing and the elevators working. Look at Detroit, and that is minor compared to real decline. Someone will have to pay for it and if many more folks lose their jobs then the whole damn system will start to sputter.

Paulo

Boat on Sun, 30th Mar 2014 4:08 pm

Renewables have done well with mandates rebates and support. From what I read the overwhelming feeling is investments will go down without government support.

shortonoil on Sun, 30th Mar 2014 4:39 pm

“It also includes financing costs and ensuring that the project generates a reasonable internal rate of return (IRR) for the equity providers).”

Without trade you have no economy! Trade is dependent on the ability to transport goods and services, and petroleum provides the majority of the world’s transportation fuel [which is not likely to change in the foreseeable future]. Because of depletion, petroleum ability of power the world’s transportation fleet is declining, and by our calculations that is presently happening at about 3% per year [that rate will increase with time]. Petroleum has been responsible for world economic activity for the last century (that can be seen in graph# 25 of our study). As the petroleum depletion process continues the economy it supports will also decline. When petroleum, as the world’s principal energy source comes to an end, so also will the economy it built and powered.

Citi is talking about hi-tech solutions to the energy problem. That will require a complex economy to service it. That complex economy is not likely to exist in a few decades. Whatever energy sources that are present when the oil age comes to an end will be utilized, but they will mainly be those that will be maintainable by the local communities that they are supplying. It is obvious from this article that Citi (and most others) have little appreciation for the impact that petroleum depletion is going to have.

http://www.thehillsgroup.org

Davey on Sun, 30th Mar 2014 5:01 pm

Short – Great angle on the energy predicament. My feelings exactly

shortonoil on Sun, 30th Mar 2014 7:21 pm

“Short – Great angle on the energy predicament. My feelings exactly”

I took apart a piece of electronic equipment a while ago, I found parts from 23 different countries in it. It would be hard to keep a pencil sharper running without the global trade system we now have. The depletion event will insure that will be degrading along with our petroleum supply.

http://www.thehillsgroup.org/

*If anyone has tried to access our site in the last 12 hours and got a “Server not found error”, our host has been moving it off shore. They didn’t say why. It is supposed to be back up shortly>

Kenz300 on Sun, 30th Mar 2014 7:31 pm

Quote — “Gas prices, are rising and becoming more volatile. This has made wind and solar and other renewable energy sources more attractive because they are not sensitive to fuel price volatility.

Citi says solar is already becoming more attractive than gas-fired peaking plants, both from a cost and fuel diversity perspective.”

——————

The transition to safer, cleaner and cheaper alternative energy sources……………..

Wind, solar, wave energy, geothermal and second generation biofuels made from algae, cellulose and waste are the future.

The fossil fuel industry will not go away quietly but they will slowly become a smaller part of the energy mix. Fossil fuels keep getting more expensive and cause environmental damage every year while wind and solar costs keep dropping…….

Climate Change is real….. the sooner we transition to safer, cleaner energy sources the better.

Bandits on Sun, 30th Mar 2014 9:10 pm

“Cleaner, safer and cheaper energy sources”…….

“Climate change is real”………

———————–

Okay, fracking everything in sight, deep water drilling, tar sands, arctic exploration, heavy contaminated oil, ethanol………

Most are totally delusional. Without so called clean alternatives we would not be burning everything we can right now. Alternatives are enabling BAU, they support it and contribute DIRECTLY to the continuing rise is CO2 concentrations. Unless you sequester the amount of FF your so called clean machine would have burned you are ADDING to the problem.

Simply put what you don’t burn, simply means the other Joe down the road will.

Without FF,s electric cars, solar and wind turbines would never have been an “alternative”. The supporters of a brave new world powered by alternatives are jackasses who can see past the end of their noses. They are about building monuments (stone heads) and are totally enslaved in a cargo cult of believing in the arrival of more technology.

Kenz300 on Sun, 30th Mar 2014 9:22 pm

Once the 40 year or more costs to clean up Fukishima are in and calculated we will begin to see the true cost of nuclear energy. As the oceans continue to be poisoned……..

Chernobyl was never cleaned up……. just build a cover and walk away…….. and the costs continue to add up…

The cost of fossil fuels and the damage of climate change induced weather events will make clear the true cost of fossil fuels.

The sooner we transition to safer, cleaner and cheaper alternative energy sources the better.

The energy transition tipping point is here – SmartPlanet

http://www.smartplanet.com/blog/the-take/the-energy-transition-tipping-point-is-here/?tag=nl.e660&s_cid=e660&ttag=e660&ftag=TRE4eb29b5

J-Gav on Sun, 30th Mar 2014 10:43 pm

Citi to the rescue … right … another (un)officially bankrupt gang giving advice on how to (not) solve the problems they helped to create.

Kenz300 on Sun, 30th Mar 2014 11:28 pm

Quote — “In 2013, solar was the second- largest source of new generation capacity behind natural gas – its prospects look bright in 2014 and beyond as costs continue to decline and improve the LCOE picture.”

——————————-

Solar and wind use is growing around the world…….

Every coal fired plant shut down and replaced with solar or wind power is a good thing !

Bandits on Mon, 31st Mar 2014 1:12 am

“Solar and wind use is growing around the world……”

——————-

You just don’t get it. We are burning at PEAK right now. We are burning every bit of FF we can lay our hands on and you say you care about CO2. Gee what a hypocrite. Alternatives are not contributing ANYTHING towards cleaner air, it is the exact opposite.

Renewables are the absolute last gasp at retaining the world created by FF’s. They are allowing us to burn as much as humanly possible while we continue to grow populations and infrastructure to support them. All this does is make the devastation complete when the music stops.

Makati1 on Mon, 31st Mar 2014 2:31 am

J-Gav, you beat me to the comment. All of the comments taking investment and payback into account are still not seeing the picture clearly. I know everyone here has some investment in the capitalist system, as do I, indirectly, but that system is NOT going to make it many more years into the future. Certainly not decades. It was built on cheap plentiful energy. It will end when that energy gets too expensive to maintain the system. We see it now with trillions printed annually to make up for the ongoing energy loss.

Anyone who who believes that his/her stocks, IRAs, 401ks, mutual funds, etc., are actually going to provide their retirement is badly deluded. Ditto that big house they bought as an ‘investment’. As for the social safety nets like SS, the Meds, etc, those too will be gone eventually. They may just freeze in place until they will not even buy a loaf of bread, but they will disappear.

Citi, HSBC, Goldman Sacs, etc. are all bankrupt. They have no credibility in any area. When the collapse happens, there is going to be a lot of suicides, and they will not all be bankers. Or so it seems to me.