What Peak Oil Could Look Like

What Peak Oil Could Look Like

Obviously folks here aren't discussing peak oil much nowadays, all of has having survived both the fear mongering early in the century, the big let down as the US became the world's largest oil and gas producer much to the chagrin of the "experts" in the field, and being 4 years past the most recent one. I won't detail the claimed visions of what it was supposed to look like, everyone has seen me reference those hopes and dreams regularly, but I found this story this morning and thought to myself...now this....THIS might be what peak oil looks like. Cuba might have been another example, when the USSR cut them off way back when, but this example is current, and happening today, and no one has mentioned it. A relatively unimportant country, much like Cuba, but it might be safe to say that when these consequences arrive in the developed world, and won't go away, the peak oilers might finally be able to declare a belated victory.

When a country runs out of fuel.

When a country runs out of fuel.

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 9292

- Joined: Mon 28 Dec 2015, 17:10:26

Re: What Peak Oil Could Look Like

AdamB wrote:but it might be safe to say that when these consequences arrive in the developed world

That's a supply shock due to external factors.

When I envision peak oil for the west I always imagine higher and higher costs, yet no disruption in availability. Might I be wrong? Wouldn't be the first time.

- mousepad

- Tar Sands

- Posts: 814

- Joined: Thu 26 Sep 2019, 09:07:56

Re: What Peak Oil Could Look Like

mousepad wrote:AdamB wrote:but it might be safe to say that when these consequences arrive in the developed world

That's a supply shock due to external factors.

Sure. But as with Cuba, it can provide some micro economic insight as to what happens in a society when liquid fuels become scarce. Certainly at the macro level with the most recent peak oil in 2018, there has been no such consequences, but that is why micro and macro economics are taught as two different classes.

mousepad wrote:When I envision peak oil for the west I always imagine higher and higher costs, yet no disruption in availability. Might I be wrong? Wouldn't be the first time.

No, you aren't wrong. Higher and higher costs for a given volume is the resource cost curve side of the peak oil solution, but operating around it are both the demand response and price. So marginal cost goes up, and price begins to react first (higher), and then demand reacts (lower). Conservation and substitution become the game of the day. This describes most of the 1980's. But as I often say, the cure for high oil prices is high oil prices, and this is why, once demand slacks off in relation to a given price, the price reacts again, this time going back to the cost+profit of the marginal produced barrel (down). The price/demand/supply relationship is the devil's own Gordian knot as it were, avoided by peak oilers (or ignored altogether) because you can't talk about any 1 or 2 pieces of it, without having a concept that incorporates all 3. Usually the missing piece in anyone's peak oil concept is just hand waved away.

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 9292

- Joined: Mon 28 Dec 2015, 17:10:26

Re: What Peak Oil Could Look Like

I kind of think we are seeing it right now throughout the world. There should he no doubt that energy prices are influencing policy. It just reveals itself differently here and there.

We are in an early stage of decline. Think of it like stage 1 cancer.

We are in an early stage of decline. Think of it like stage 1 cancer.

-

Newfie - Forum Moderator

- Posts: 18507

- Joined: Thu 15 Nov 2007, 04:00:00

- Location: Between Canada and Carribean

Re: What Peak Oil Could Look Like

Glad to see you admitting that peak oil might actually happen.

I personally think that peak oil is far more likely to look like WWIII. I don't think all those wars in oil-rich countries happened for reasons entirely unrelated to oil. The last country left with significant oil reserves that doesn't already agree with the US foreign policy on oil, namely, selling as much oil as they possibly can, is Russia. (Iran may be no friend of the US but they're selling as much oil as they can anyway). And Russia has recently started a war, and the sanctions have made clear that there isn't any spare capacity once Russian oil is subtracted. So I reckon that WWIII is likely to start this year.

I personally think that peak oil is far more likely to look like WWIII. I don't think all those wars in oil-rich countries happened for reasons entirely unrelated to oil. The last country left with significant oil reserves that doesn't already agree with the US foreign policy on oil, namely, selling as much oil as they possibly can, is Russia. (Iran may be no friend of the US but they're selling as much oil as they can anyway). And Russia has recently started a war, and the sanctions have made clear that there isn't any spare capacity once Russian oil is subtracted. So I reckon that WWIII is likely to start this year.

-

Doly - Expert

- Posts: 4366

- Joined: Fri 03 Dec 2004, 04:00:00

Re: What Peak Oil Could Look Like

Newfie wrote:I kind of think we are seeing it right now throughout the world. There should he no doubt that energy prices are influencing policy. It just reveals itself differently here and there.

We are in an early stage of decline. Think of it like stage 1 cancer.

Exactly right.

When it comes to what peak oil looks like, I think Dr. Colin Campbell had it right. He predicted that peak oil would manifest itself in a series of economic cycles......the economy would go from an oil "glut" with cheap oil to an oil shortage with prices spiking well above $100/bbl. This would cause economic contraction and a recession/depression, reducing demand for oil until the oil price collapses........then the economy would recover, and oil demand would recover and prices would rise until eventually you'd see oil prices spike above $100/bbl again, causing recession, causing a drop in oil demand....and the cycle would repeat

This happened in 2008 when oil prices spiked up to $140 bbl followed by the "Great Recession of 2009.

And here we again 14 years later.......and we see the second coming of $100/bbl oil is now on the verge of taking us into another global recession.

Following Dr. Campbell's model, I predict the world will now go into recession/depression, followed by an oil price collapse, followed by the end of the recession and another cycle of growth.

Dr. Colin Campbell predicted peak oil would look like a series of "boom to bust" economic cycles as the price of oil spiked higher during cycles of economic growth and then dropped again as oil demand dropped due to the economic contractions----

We had 14 years of pretty good economic times between the 2008-9 GREAT RECESSION and the recession/depression we are about to have. But the cycles don't have to be all the same size or the same duration. This recession could be even worse then 2008-2009, and subsequent cycles might come more rapidly or more slowly. We'll just have to get out our popcorn and watch to see how this peak oil stuff plays out.

Wow! This peak oil stuff is really exciting! I can't wait to see how this all turns out!!

CHEERS!

Never underestimate the ability of Joe Biden to f#@% things up---Barack Obama

-----------------------------------------------------------

Keep running between the raindrops.

-----------------------------------------------------------

Keep running between the raindrops.

-

Plantagenet - Expert

- Posts: 26619

- Joined: Mon 09 Apr 2007, 03:00:00

- Location: Alaska (its much bigger than Texas).

Re: What Peak Oil Could Look Like

Doly wrote:Glad to see you admitting that peak oil might actually happen.

Peak oil is a given. Just the way Hubbert described it. Just don't get confused by the bell shaped curve nonsense.

Doly wrote:I personally think that peak oil is far more likely to look like WWIII. I don't think all those wars in oil-rich countries happened for reasons entirely unrelated to oil. The last country left with significant oil reserves that doesn't already agree with the US foreign policy on oil, namely, selling as much oil as they possibly can, is Russia. (Iran may be no friend of the US but they're selling as much oil as they can anyway). And Russia has recently started a war, and the sanctions have made clear that there isn't any spare capacity once Russian oil is subtracted. So I reckon that WWIII is likely to start this year.

Could be. I'd rank it as a low probability though. It isn't as though the US and Canada have much in the way of concerns about North American supply certainly. And Russia isn't worried about oil for itself. Let the rest of the world invade the Middle East to get the stuff.

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 9292

- Joined: Mon 28 Dec 2015, 17:10:26

Re: What Peak Oil Could Look Like

Plantagenet wrote:Newfie wrote:I kind of think we are seeing it right now throughout the world. There should he no doubt that energy prices are influencing policy. It just reveals itself differently here and there.

We are in an early stage of decline. Think of it like stage 1 cancer.

Exactly right.

When it comes to what peak oil looks like, I think Dr. Colin Campbell had it right. He predicted that peak oil would manifest itself in a series of economic cycles......the economy would go from an oil "glut" with cheap oil to an oil shortage with prices spiking well above $100/bbl.

I wonder, did he put all those caveats in before, or after, he declared global peak oil in 1990?

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 9292

- Joined: Mon 28 Dec 2015, 17:10:26

Re: What Peak Oil Could Look Like

Doly wrote:I personally think that peak oil is far more likely to look like WWIII... So I reckon that WWIII is likely to start this year.

In 2008 Jason Bradford interviewed Jay Hanson of Dieoff.org fame. Jay Hanson believed the world would have a nuclear war. At the end of the interview (51:00 timestamp) Jason discussed the timeline. "10 to 14 years" was a provided by Jay Hanson. 2008 + 14 = 2022!

My interpretation; the fracking boom bought us a little bit of time. We were also able to patch over the 2008 GFC. As soon as Russia invaded UA, I thought of Jason's interview and re-listened. I don't believe in specific predictions, but I think Jay Hanson was one of the best minds to come across Peak Oil and adjacent problems.

Reference Jason Bradford's 2008 interview with Dieoff.org's Jay Hanson

What will it look like? Some of my general thoughts:

Marginal 3rd world countries like Sri Lanka will collapse or have a series of simplification cycles (economic depressions) until populations are in balance with available resources. I would expect poor countries to experience famines. Over the years and decades, I imagine the list of "failed" or "poor" countries will get larger and larger. With so called major powers eventually succumbing to the forces of collapse (collapse defined as simplification forced by circumstance).

As for the price of fossil fuels, I can easily see the global market being dismantled and replaced with National or Regional cartels. I think commodity markets will eventually be dismantled and nations will resort to some type of command economy.

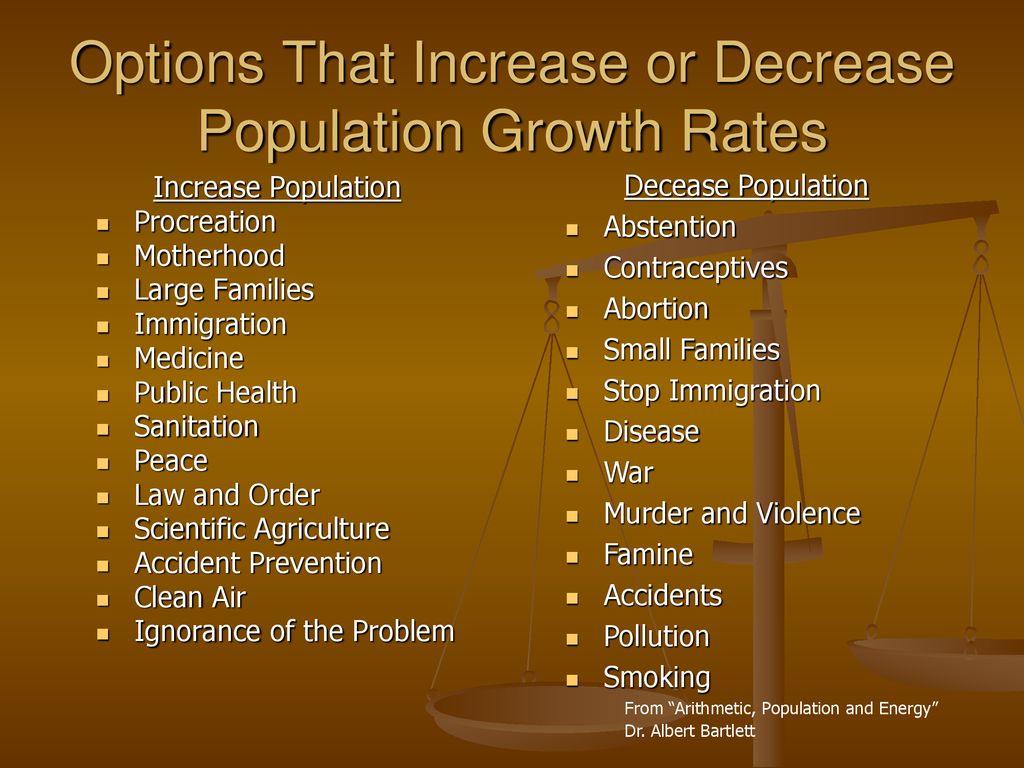

I also thought of Albert Bartlett's presentation, specifically this slide:

IIRC Albert said re Peak OIl: "Nature will choose from the right hand column."

Relax and enjoy the ride.

"On a long enough time line, the survival rate for everyone drops to zero."

-

jato0072 - Lignite

- Posts: 305

- Joined: Wed 04 Aug 2021, 16:47:30

- Location: NV

Re: What Peak Oil Could Look Like

Jato,

As those countries collapse their stressed populations will try to move to more favorable locations. I see a great northward migration from Africa and a Westward migration from the MidEast and possibly stans. That may well out considerable pressure in the EU. Initially there will be humanitarian relief efforts but that inly runs so deep.

No clear idea on how Asia plays out. I still find the India/China/Pakistan triad very unstable.

But could take decades to evolve.

As those countries collapse their stressed populations will try to move to more favorable locations. I see a great northward migration from Africa and a Westward migration from the MidEast and possibly stans. That may well out considerable pressure in the EU. Initially there will be humanitarian relief efforts but that inly runs so deep.

No clear idea on how Asia plays out. I still find the India/China/Pakistan triad very unstable.

But could take decades to evolve.

-

Newfie - Forum Moderator

- Posts: 18507

- Joined: Thu 15 Nov 2007, 04:00:00

- Location: Between Canada and Carribean

Re: What Peak Oil Could Look Like

Plantagenet wrote:Newfie wrote:I kind of think we are seeing it right now throughout the world. There should he no doubt that energy prices are influencing policy. It just reveals itself differently here and there.

We are in an early stage of decline. Think of it like stage 1 cancer.

We had 14 years of pretty good economic times between the 2008-9 GREAT RECESSION and the recession/depression we are about to have. But the cycles don't have to be all the same size or the same duration. This recession could be even worse then 2008-2009, and subsequent cycles might come more rapidly or more slowly. We'll just have to get out our popcorn and watch to see how this peak oil stuff plays out.

CHEERS!

The way I see it the 1986 glut led to a period of cheap energy stretching from 1986-2004. This was followed by the 2005-2008 price spike that collapsed into the 2009 reset which led into the 2010-2014 Fracking boom. 2015-16 saw another glut drive prices down unsustainably low with 2017-2020 a small imitation of the 1986-2004 cheap energy period. Mid 2021-present mid 2022 has spiked us back up into the 2010-2014 price range but this cycle nobody is chanting "drill baby drill" in the political world like they were back in 2010-2014. For good or ill I expect that to change substantially after the mid term elections because people vote their pocket book and hope for better when times are rough. Jimmy Carter was a personable likable president, but the 1978-1980 oil prices killed his chances of reelection like roundup on a field of dandelions.

In any case my point was that the cycle length has been greatly shortened this time compared to the 1986-2004 eighteen year period of cheap energy down to 2015-2020 less than a third as long with five years of cheap energy.

On the gripping hand Fracking is not the only arrow left in the quiver. If oil were to remain in its present range for a few years lots of plans from the 2010-2014 period for things like running cheap Natural Gas through an F-T process to produce clean diesel fuel will be getting dusted off and if they get implemented quickly enough some of those facilities will actually be in operation before the price crashes again. Plans for widespread development of the Green River Kerogen rich shale using various methods. There were also a number of schemes for converting waste plastics into liquid fuels, and many others.

Once we actually pass peak and high prices become the "new normal" some and perhaps many of those alternative synthetic liquid fuel processes will become economically viable. This is one of those things that used to get me shouted down a lot with EROEI claims of expenses not being worth the effort involved. I have always disagreed with that POV for the simple reason that liquid fuels are deucedly useful and we have lots and lots of existing infrastructure to use liquid fuels. Heck the US Navy has now demonstrated the capability to use excess fission power in their new generation aircraft carriers to manufacture jet fuel using just sea water as feedstock. This would allow the Gerald Ford to supply both its own aircraft and its currently fossil fuel burning escort ships with synthetic fuel for all the gas turbine engines. Yes it would be more expensive than 'conventional' fuel, but because of the transport costs of keeping a string of oil tankers circulating between the task force and a friendly port where they can fuel up the actual price differential is a lot smaller than it is for the civilian market and has the added bonus of letting the navy claim to be carbon neutral by processing CO2 rich sea water into Diesel/Jet fuel length synthetic hydrocarbons.

Alfred Tennyson wrote:We are not now that strength which in old days

Moved earth and heaven, that which we are, we are;

One equal temper of heroic hearts,

Made weak by time and fate, but strong in will

To strive, to seek, to find, and not to yield.

-

Tanada - Site Admin

- Posts: 17056

- Joined: Thu 28 Apr 2005, 03:00:00

- Location: South West shore Lake Erie, OH, USA

Re: What Peak Oil Could Look Like

Tanada wrote:to manufacture jet fuel using just sea water as feedstock.

Here's the patent for it.

https://patentyogi.com/aircraft/us-navy ... -carriers/

I'm wondering what a reasonable capacity of such a system would be on a ship. It's hard for me to believe it's anywhere close to be able to provide the needed volume for jets and even less so for other ships.

- mousepad

- Tar Sands

- Posts: 814

- Joined: Thu 26 Sep 2019, 09:07:56

Re: What Peak Oil Could Look Like

Plantagenet wrote: you'd see oil prices spike above $100/bbl again, causing recession,

I don't see why high oil price should cause recession. It's the rapid increase in price that's the problem (and to a certain degree also the rapid fall), not the high oil price in itself. It's the uncertainty and unpredictability that's an issue.

Stable high oil price will simply shift the economy and employment opportunities towards oil related businesses. There's no difference for GDP if pipes are manufactured for oil use or for some other use. There's no difference for GDP whether oil companies buy a new powerful computer or some other business does. There's no difference for GDP if the starbucks job gets eliminated and the oil field job is created instead.

- mousepad

- Tar Sands

- Posts: 814

- Joined: Thu 26 Sep 2019, 09:07:56

Re: What Peak Oil Could Look Like

mousepad wrote:Plantagenet wrote: you'd see oil prices spike above $100/bbl again, causing recession,

I don't see why high oil price should cause recession. It's the rapid increase in price that's the problem (and to a certain degree also the rapid fall), not the high oil price in itself. It's the uncertainty and unpredictability that's an issue.

Stable high oil price will simply shift the economy and employment opportunities towards oil related businesses. There's no difference for GDP if pipes are manufactured for oil use or for some other use. There's no difference for GDP whether oil companies buy a new powerful computer or some other business does. There's no difference for GDP if the starbucks job gets eliminated and the oil field job is created instead.

Thought of at the more macro level, you have just described what I have seen complete papers on, except being PhDs they needed pages and pages and used really big economic words.

The US, unlike the other oil/resource powerhouses of the world, is a diversified economy. Whereas in a Saudi Arabia, low oil prices take down the entire economy (or the Soviet Union), in the US, lower prices might harm a specific industry (in this case a free market driven, cyclic oil and gas industry that those of us who worked in it curse every time we get laid off), but there are plenty of others like petrochemicals and consumers and fuel that then are like WOO HOO!! and suddenly have cheaper input costs, and benefit. As one is harmed, another is given an advantage. It certainly makes sense without needing to write tomes on it, but you know publishing PhD's, they don't get credit for simple thoughts, they need charts and graphs and stuff proving how difficult it is for them to explain in order to justify their existence.

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 9292

- Joined: Mon 28 Dec 2015, 17:10:26

Re: What Peak Oil Could Look Like

Tanada wrote:Heck the US Navy has now demonstrated the capability to use excess fission power in their new generation aircraft carriers to manufacture jet fuel using just sea water as feedstock. This would allow the Gerald Ford to supply both its own aircraft and its currently fossil fuel burning escort ships with synthetic fuel for all the gas turbine engines. Yes it would be more expensive than 'conventional' fuel, but because of the transport costs of keeping a string of oil tankers circulating between the task force and a friendly port where they can fuel up the actual price differential is a lot smaller than it is for the civilian market and has the added bonus of letting the navy claim to be carbon neutral by processing CO2 rich sea water into Diesel/Jet fuel length synthetic hydrocarbons.

That would also be good from a military strategic and operational point of view by making the fleets more self-sufficient, which would have multiple benefits. I didn't know they could do that.

"Human stupidity has no limits" JuanP

- JuanP

- Heavy Crude

- Posts: 1957

- Joined: Sat 16 Aug 2014, 15:06:32

Re: What Peak Oil Could Look Like

mousepad wrote:Plantagenet wrote: you'd see oil prices spike above $100/bbl again, causing recession,

I don't see why high oil price should cause recession. It's the rapid increase in price that's the problem (and to a certain degree also the rapid fall), not the high oil price in itself. It's the uncertainty and unpredictability that's an issue.

Stable high oil price will simply shift the economy and employment opportunities towards oil related businesses. There's no difference for GDP if pipes are manufactured for oil use or for some other use. There's no difference for GDP whether oil companies buy a new powerful computer or some other business does. There's no difference for GDP if the starbucks job gets eliminated and the oil field job is created instead.

First of all, the phrase "spike in oil prices" actually means a rapid upward movement in oil prices.....so you are essentially agreeing with me that a rapid gain in oil prices is a problem.

Second----the reason that high oil prices cause recessions is that high oil prices cause inflation. When oil prices jump upwards it also causes price increases in everything else that needs oil and gasoline to function....i.e. recreational travel, business travel, freight deliveries, shipping, grocery prices, restaurant prices, construction, etc. etc.

When everything costs more due to inflation, people will buy fewer goods and purchase fewer services. That drop in consumer activity directly leads to recession. Right now about half the people in the US live paycheck to paycheck....that means that if their weekly gasoline bill doubles (as has happened in the last year), then they have to cut back on buying everything else, causing a drop in profits for companies throughout the rest of the economy, i.e. a recession.

Just watch.....we're about to get a recession soon in the US economy due to inflation, with the spike in oil prices over the last year being a fundamental reason we've got such high inflation.

Cheers!

Never underestimate the ability of Joe Biden to f#@% things up---Barack Obama

-----------------------------------------------------------

Keep running between the raindrops.

-----------------------------------------------------------

Keep running between the raindrops.

-

Plantagenet - Expert

- Posts: 26619

- Joined: Mon 09 Apr 2007, 03:00:00

- Location: Alaska (its much bigger than Texas).

Re: What Peak Oil Could Look Like

Plantagenet wrote:Second----the reason that high oil prices cause recessions is that high oil prices cause inflation.!

Hard to say.

Economic activity is a function of available energy.

However there's no requirement that available energy needs to decline with increase in price. It's the roller coaster that makes the recession, not the high price.

- mousepad

- Tar Sands

- Posts: 814

- Joined: Thu 26 Sep 2019, 09:07:56

Re: What Peak Oil Could Look Like

mousepad wrote:Plantagenet wrote:Second----the reason that high oil prices cause recessions is that high oil prices cause inflation.!

Hard to say.

Economic activity is a function of available energy.

Except for when I trade you $50 for a used air compressor and other than us meeting in a parking lot somewhere nearby to do the exchange, doesn't have much to do with "energy" at all. And this is economic activity.

Wrap your mind around an idea....there are only 2 things in our human universe that are completely relevant. Physics, as it defines the rules of the universe, and the will of man. Put another way, economics. Micro or macro, rational actors or not, what humans CHOOSE to do is the social science of economics. Often denigrated for being a social science, and yet equally important in trying to understand why, and when, and even how things happen. Energy is just a part, and an important one in terms of how humans have gone from H/G to apex predator, but the good news is that thermodynamics is the part of physics that has quite a bit to say about how we use energy and what happens to it when we do, and energy isn't going anywhere any time soon, even if we humans want to whine because our use of it has changed, is changing, and will continue to change with time.

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 9292

- Joined: Mon 28 Dec 2015, 17:10:26

Re: What Peak Oil Could Look Like

AdamB wrote:mousepad wrote:Plantagenet wrote:Second----the reason that high oil prices cause recessions is that high oil prices cause inflation.!

Hard to say.

Economic activity is a function of available energy.

Except for when I trade you $50 for a used air compressor and other than us meeting in a parking lot somewhere nearby to do the exchange, doesn't have much to do with "energy" at all. And this is economic activity.

That's true. Economic activity was probably the wrong term. Is productivity the right one?

- mousepad

- Tar Sands

- Posts: 814

- Joined: Thu 26 Sep 2019, 09:07:56

Re: What Peak Oil Could Look Like

mousepad wrote:AdamB wrote:mousepad wrote:Plantagenet wrote:Second----the reason that high oil prices cause recessions is that high oil prices cause inflation.!

Hard to say.

Economic activity is a function of available energy.

Except for when I trade you $50 for a used air compressor and other than us meeting in a parking lot somewhere nearby to do the exchange, doesn't have much to do with "energy" at all. And this is economic activity.

That's true. Economic activity was probably the wrong term. Is productivity the right one?

Not sure. Economic activity by my definition is human activity, all of us making choices within whatever system we exist within. Trading a currency for a product, or trading my horse for your virgin daughter to be my bride. Economic activity is...non-familial human interaction?

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 9292

- Joined: Mon 28 Dec 2015, 17:10:26

58 posts

• Page 1 of 3 • 1, 2, 3

Who is online

Users browsing this forum: No registered users and 271 guests