Suddenly Everyone Is Hunting Alternatives To US $

Re: Suddenly Everyone Is Hunting Alternatives To US $

"Why are major governments, corporations, think tanks and the Davos WEF all promoting a Zero Carbon global agenda to eliminate use of oil, gas, coal? They know that the turn to solar and wind-based electricity is impossible. It is impossible because of the demand for raw materials from copper to cobalt to lithium to concrete and steel exceeding global supply. It is impossible because of the staggering trillions in cost of battery backup for a “reliable” 100% renewable electric grid. It is also impossible without causing the collapse of our present standard of living and a breakdown of our food supply that will mean mass death from starvation and disease. All this for a scientific fraud called man-made global warming?..." https://www.globalresearch.ca/zero-carb ... on/5815361

-

Makati1 - Wood

- Posts: 7

- Joined: Wed 16 Sep 2015, 21:51:28

Re: Suddenly Everyone Is Hunting Alternatives To US $

Macron Makes 'No Apology' For China Trip Comments As EU Leadership Warms To 'Anti-US' Message

French President Emmanuel Macron's message of building "strategic autonomy" away from the United States - which to Washington's dismay he voiced loudly during his visit with Xi Jinping in China (at a very awkward moment too given Taiwan happenings) - is naturally gaining positive reception in Europe, where chair of the European Council Charles Michel hailed "a leap forward on strategic autonomy compared to several years ago."

...Macron's articulating a concept of strategic autonomy for Europe was 'enthusiastically endorsed' by Xi and the CCP, who have been focusing on the notion that the West is in decline while China rises, and that weakening the transatlantic relationship will accelerate this trend. "The paradox would be that, overcome with panic, we believe we are just America’s followers," said Macron

To be sure Macron is a gutless dog but he's laying the cards on the table now as he makes alliances with China, which by the way refuses to sanction Russia it's strategic Allie. So which will be the next major US Allie to turncoat? Can we imagine NATO pushing into the ukraine after this? Not with the French or the rest of Europe that is dependent on their gas. The whole US dominance meme is coming unglued. They are being shunned from the South America to the middle east to Europe.

China is literally surrounding Taiwan with warships and their warplanes now, a clear message of what is to come. What was the US military response? Nothing. 20 years ago there would have been a couple of CBGs on station there but the US military can ill afford that now with their aging fleet and the threat of the new hypersonic ship-killer missiles.

March 19, 2023 / 7:37 PM / CBS News

Admiral Samuel Paparo commands the U.S. Pacific Fleet, whose 200 ships and 150,000 sailors and civilians make up 60% of the entire U.S. Navy. We met him last month on the aircraft carrier USS Nimitz deployed near the U.S. territory of Guam...

Norah O'Donnell: You've been operating as a naval officer for 40 years. How has operating in the Western Pacific changed?

Admiral Samuel Paparo: In the early 2000s the PRC Navy mustered about 37 vessels. Today, they're mustering 350 vessels

This past August, when then-Speaker of the House Nancy Pelosi became the most senior U.S. political figure to visit Taiwan in 25 years, China called it a "blatant provocation."

The People's Liberation Army fired ballistic missiles into the sea around Taiwan and encircled the island with aircraft and warships.

Norah O'Donnell: So are Chinese warships now operating closer to Taiwan after Nancy Pelosi's visit?

Admiral Samuel Paparo: Yes.

https://www.cbsnews.com/news/u-s-navy-r ... 023-03-19/

Admiral Paparo seems a bit fatalistic in this interview, perhaps they should have questioned a politician instead, at least thy would have gotten some positive Spin.

China Unveils World’s 1st Carrier-Based Hypersonic Anti-Ship Missile

https://eurasiantimes.com/china-finally ... ypersonic/

The US Navy has tapped Lockheed Martin and Raytheon to begin developing their own prototypes of a ship-killing, air-launched hypersonic weapon with the companies producing preliminary designs by the end of 2024

https://breakingdefense.com/2023/03/hal ... ng-weapon/

Too little, too late...

French President Emmanuel Macron's message of building "strategic autonomy" away from the United States - which to Washington's dismay he voiced loudly during his visit with Xi Jinping in China (at a very awkward moment too given Taiwan happenings) - is naturally gaining positive reception in Europe, where chair of the European Council Charles Michel hailed "a leap forward on strategic autonomy compared to several years ago."

...Macron's articulating a concept of strategic autonomy for Europe was 'enthusiastically endorsed' by Xi and the CCP, who have been focusing on the notion that the West is in decline while China rises, and that weakening the transatlantic relationship will accelerate this trend. "The paradox would be that, overcome with panic, we believe we are just America’s followers," said Macron

To be sure Macron is a gutless dog but he's laying the cards on the table now as he makes alliances with China, which by the way refuses to sanction Russia it's strategic Allie. So which will be the next major US Allie to turncoat? Can we imagine NATO pushing into the ukraine after this? Not with the French or the rest of Europe that is dependent on their gas. The whole US dominance meme is coming unglued. They are being shunned from the South America to the middle east to Europe.

China is literally surrounding Taiwan with warships and their warplanes now, a clear message of what is to come. What was the US military response? Nothing. 20 years ago there would have been a couple of CBGs on station there but the US military can ill afford that now with their aging fleet and the threat of the new hypersonic ship-killer missiles.

March 19, 2023 / 7:37 PM / CBS News

Admiral Samuel Paparo commands the U.S. Pacific Fleet, whose 200 ships and 150,000 sailors and civilians make up 60% of the entire U.S. Navy. We met him last month on the aircraft carrier USS Nimitz deployed near the U.S. territory of Guam...

Norah O'Donnell: You've been operating as a naval officer for 40 years. How has operating in the Western Pacific changed?

Admiral Samuel Paparo: In the early 2000s the PRC Navy mustered about 37 vessels. Today, they're mustering 350 vessels

This past August, when then-Speaker of the House Nancy Pelosi became the most senior U.S. political figure to visit Taiwan in 25 years, China called it a "blatant provocation."

The People's Liberation Army fired ballistic missiles into the sea around Taiwan and encircled the island with aircraft and warships.

Norah O'Donnell: So are Chinese warships now operating closer to Taiwan after Nancy Pelosi's visit?

Admiral Samuel Paparo: Yes.

https://www.cbsnews.com/news/u-s-navy-r ... 023-03-19/

Admiral Paparo seems a bit fatalistic in this interview, perhaps they should have questioned a politician instead, at least thy would have gotten some positive Spin.

China Unveils World’s 1st Carrier-Based Hypersonic Anti-Ship Missile

https://eurasiantimes.com/china-finally ... ypersonic/

The US Navy has tapped Lockheed Martin and Raytheon to begin developing their own prototypes of a ship-killing, air-launched hypersonic weapon with the companies producing preliminary designs by the end of 2024

https://breakingdefense.com/2023/03/hal ... ng-weapon/

Too little, too late...

après moi le déluge

- theluckycountry

- Intermediate Crude

- Posts: 2343

- Joined: Tue 20 Jul 2021, 18:08:48

- Location: Australia

Re: Suddenly Everyone Is Hunting Alternatives To US $

Now this is interesting. I just made a small purchase on eBay from China and the paypal popup asked me if I wanted to pay in $US (where a fee would be incurred) or in $Oz, I have never seen that choice before? And of course I chose Oz dollars. So now it seems China has some direct currency swap going on with Australia, good news for us, no so for the people making a clip of $US trades.

après moi le déluge

- theluckycountry

- Intermediate Crude

- Posts: 2343

- Joined: Tue 20 Jul 2021, 18:08:48

- Location: Australia

Re: Suddenly Everyone Is Hunting Alternatives To US $

theluckycountry wrote:Now this is interesting. I just made a small purchase on eBay from China and the paypal popup asked me if I wanted to pay in $US (where a fee would be incurred) or in $Oz, I have never seen that choice before? And of course I chose Oz dollars. So now it seems China has some direct currency swap going on with Australia, good news for us, no so for the people making a clip of $US trades.

You are surprised that the overlords allow you to use their currency? I am surprised that the Brits have allowed the takeover of one of their subject states without a shot being fired, but they set the bar pretty low when they handed over Hong Kong. How are your Mandarin lessons coming along?

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 9292

- Joined: Mon 28 Dec 2015, 17:10:26

Re: Suddenly Everyone Is Hunting Alternatives To US $

So now it seems China has some direct currency swap going on with Australia, good news for us, no so for the people making a clip of $US trades.

It would seem that China is getting ready to challenge the USD. As long as the Yuan is pegged to the USD, not much will change. Watch for the blockade / invasion "reunification" of Taiwan and the USD-Yuan decoupling event.

"On a long enough time line, the survival rate for everyone drops to zero."

-

jato0072 - Lignite

- Posts: 307

- Joined: Wed 04 Aug 2021, 16:47:30

- Location: NV

Re: Suddenly Everyone Is Hunting Alternatives To US $

Monthly Post ecosophia

Dancing on the Brink

Neocon intellectual Francis Fukuyama insisted in a once-famous 1989 essay that having won the top slot, the United States was destined to stay there forever. He was of course wrong, but then he was a Hegelian and couldn’t help it. (If a follower of Hegel tells you the sky is blue, go look.) The ascendancy of one empire simply guarantees that other aspirants for the same status will begin sharpening their knives. They’ll get to use them, too, because empires invariably wreck themselves: over time, the economic and social consequences of empire destroy the conditions that make empire possible. That can happen quickly or slowly, depending on the mechanism that each empire uses to extract wealth from its subject nations.

The mechanism the United States used for this latter purpose was ingenious but even more short-term than most. In simple terms, the US imposed a series of arrangements on most other nations that guaranteed that the lion’s share of international trade would use US dollars as the medium of exchange, and saw to it that an ever-expanding share of world economic activity required international trade. (That’s what all that gabble about “globalization” meant in practice.) This allowed the US government to manufacture dollars out of thin air by way of gargantuan budget deficits, so that US interests could use those dollars to buy up vast amounts of the world’s wealth. Since the excess dollars got scooped up by overseas central banks and business firms, which needed them for their own foreign trade, inflation stayed under control while the wealthy classes in the US profited mightily from the scheme.

The problem with this scheme is the same difficulty faced by all Ponzi schemes, which is that sooner or later you run out of suckers to draw in. That happened not long after the turn of the millennium, and along with other factors—notably the peaking of global conventional petroleum production—it led to the financial crisis of 2008-2010. I don’t imagine it’s escaped the attention of my readers that since 2010 the United States has been lurching from one crisis to another. That’s not accidental. The wealth pump that kept the United States at the top of the global pyramid has been sputtering as a growing number of nations have found ways to keep a larger share of their own wealth. The one question left, as I noted back in the day, is how soon the pump would start to fail altogether.

Fast forward to last year. When Russia launched its invasion of Ukraine in February 2022, the United States and its allies responded not with military force but with punitive economic sanctions, which were expected to cripple the Russian economy and force Russia to its knees. Apparently nobody in Washington DC considered the possibility that other nations with an interest in undercutting the US empire might have something to say about that. Of course that’s what happened. China, which has the largest economy on Earth in purchasing-power terms, extended a middle finger in the direction of Washington DC and upped its imports of Russian oil, gas, grain, and other products. So did India, currently the third largest economy on Earth in the same terms; so did more than a hundred other countries.

Then there’s Iran. Most Americans are impressively stupid about Iran, so it’s probably necessary to cover some details here. Iran is the seventeenth largest nation in the world, more than twice the size of Texas and even more richly stocked with oil and natural gas. It’s also a booming industrial power. It has a thriving automobile industry, for example, and builds and launches its own orbital satellites. It’s been dealing with severe US sanctions since not long after the Shah fell in 1978, so it’s a safe bet that the Iranian government and industrial sector know every imaginable trick for getting around those sanctions.

Right after the start of the Ukraine war, Russia and Iran suddenly started inking trade deals right and left, to Iran’s great benefit. Pretty clearly one part of the quid pro quo was that the Iranians passed on their hard-earned knowledge about how to dodge sanctions to an attentive audience of Russian officials. With a little help from China, India, and most of the rest of humanity, the total failure of the sanctions followed in short order. At this point the sanctions are hurting the United States and Europe, not Russia, but the US leadership has wedged itself into a position from which it can’t back down. This may go a long way toward explaining why the Russian campaign in Ukraine has been so leisurely. The Russians have no reason to hurry. They know that time is not on the side of the United States.

For many decades now, the threat of being cut out of international trade by US sanctions was the big stick Washington DC used to threaten unruly nations that weren’t small enough for a US invasion or fragile enough for a CIA-backed regime change operation. Over the last year, that big stick turned out to be made of balsa wood, and snapped off in Joe Biden’s hand. As a result, all over the world, nations that thought they had no choice but to use dollars in their foreign trade are switching over to their own currencies, or to the currencies of rising powers. The US dollar’s day as the global medium of exchange is thus ending.

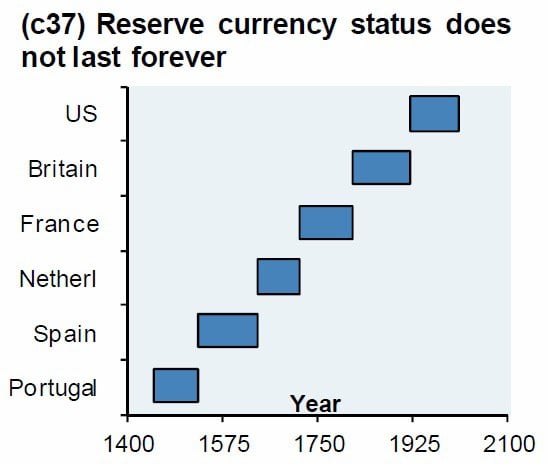

It’s been interesting to watch economic pundits reacting to this. As you might expect, quite a few of them simply deny that it’s happening—after all, economic statistics from previous years don’t show it yet! Some others have pointed out that no other currency is ready to take on the dollar’s role; this is true, but irrelevant. When the British pound lost a similar role in the early years of the Great Depression, no other currency was ready to take on its role either. It wasn’t until 1970 or so that the US dollar finished settling into place as the currency of global trade. In the interval, international trade lurched along awkwardly using whatever currencies or commodity swaps the trading partners could settle on: that is to say, the same situation that’s taking shape around us in the free-for-all of global trade that will define the post-dollar era.

One of the interesting consequences of the shift now under way is a reversion to the mean of global wealth distribution. Until the era of European global empire, the economic heart of the world was in east and south Asia. India and China were the richest countries on the planet, and a glittering necklace of other wealthy states from Iran to Japan filled in the picture. To this day the majority of human population is found in the same part of the world. The great age of European conquest temporarily diverted much of that wealth to Europe, impoverishing Asia in the process. That condition began to break down with the collapse of European colonial empires in the decade following the Second World War, but some of the same arrangements were propped up by the United States thereafter. Now those are coming apart, and Asia is rising. By next year, four of the five largest economies on the planet will be Asian. The fifth is the United States, and it may not be in that list for much longer...

https://www.ecosophia.net/dancing-on-the-brink/

Dancing on the Brink

Neocon intellectual Francis Fukuyama insisted in a once-famous 1989 essay that having won the top slot, the United States was destined to stay there forever. He was of course wrong, but then he was a Hegelian and couldn’t help it. (If a follower of Hegel tells you the sky is blue, go look.) The ascendancy of one empire simply guarantees that other aspirants for the same status will begin sharpening their knives. They’ll get to use them, too, because empires invariably wreck themselves: over time, the economic and social consequences of empire destroy the conditions that make empire possible. That can happen quickly or slowly, depending on the mechanism that each empire uses to extract wealth from its subject nations.

The mechanism the United States used for this latter purpose was ingenious but even more short-term than most. In simple terms, the US imposed a series of arrangements on most other nations that guaranteed that the lion’s share of international trade would use US dollars as the medium of exchange, and saw to it that an ever-expanding share of world economic activity required international trade. (That’s what all that gabble about “globalization” meant in practice.) This allowed the US government to manufacture dollars out of thin air by way of gargantuan budget deficits, so that US interests could use those dollars to buy up vast amounts of the world’s wealth. Since the excess dollars got scooped up by overseas central banks and business firms, which needed them for their own foreign trade, inflation stayed under control while the wealthy classes in the US profited mightily from the scheme.

The problem with this scheme is the same difficulty faced by all Ponzi schemes, which is that sooner or later you run out of suckers to draw in. That happened not long after the turn of the millennium, and along with other factors—notably the peaking of global conventional petroleum production—it led to the financial crisis of 2008-2010. I don’t imagine it’s escaped the attention of my readers that since 2010 the United States has been lurching from one crisis to another. That’s not accidental. The wealth pump that kept the United States at the top of the global pyramid has been sputtering as a growing number of nations have found ways to keep a larger share of their own wealth. The one question left, as I noted back in the day, is how soon the pump would start to fail altogether.

Fast forward to last year. When Russia launched its invasion of Ukraine in February 2022, the United States and its allies responded not with military force but with punitive economic sanctions, which were expected to cripple the Russian economy and force Russia to its knees. Apparently nobody in Washington DC considered the possibility that other nations with an interest in undercutting the US empire might have something to say about that. Of course that’s what happened. China, which has the largest economy on Earth in purchasing-power terms, extended a middle finger in the direction of Washington DC and upped its imports of Russian oil, gas, grain, and other products. So did India, currently the third largest economy on Earth in the same terms; so did more than a hundred other countries.

Then there’s Iran. Most Americans are impressively stupid about Iran, so it’s probably necessary to cover some details here. Iran is the seventeenth largest nation in the world, more than twice the size of Texas and even more richly stocked with oil and natural gas. It’s also a booming industrial power. It has a thriving automobile industry, for example, and builds and launches its own orbital satellites. It’s been dealing with severe US sanctions since not long after the Shah fell in 1978, so it’s a safe bet that the Iranian government and industrial sector know every imaginable trick for getting around those sanctions.

Right after the start of the Ukraine war, Russia and Iran suddenly started inking trade deals right and left, to Iran’s great benefit. Pretty clearly one part of the quid pro quo was that the Iranians passed on their hard-earned knowledge about how to dodge sanctions to an attentive audience of Russian officials. With a little help from China, India, and most of the rest of humanity, the total failure of the sanctions followed in short order. At this point the sanctions are hurting the United States and Europe, not Russia, but the US leadership has wedged itself into a position from which it can’t back down. This may go a long way toward explaining why the Russian campaign in Ukraine has been so leisurely. The Russians have no reason to hurry. They know that time is not on the side of the United States.

For many decades now, the threat of being cut out of international trade by US sanctions was the big stick Washington DC used to threaten unruly nations that weren’t small enough for a US invasion or fragile enough for a CIA-backed regime change operation. Over the last year, that big stick turned out to be made of balsa wood, and snapped off in Joe Biden’s hand. As a result, all over the world, nations that thought they had no choice but to use dollars in their foreign trade are switching over to their own currencies, or to the currencies of rising powers. The US dollar’s day as the global medium of exchange is thus ending.

It’s been interesting to watch economic pundits reacting to this. As you might expect, quite a few of them simply deny that it’s happening—after all, economic statistics from previous years don’t show it yet! Some others have pointed out that no other currency is ready to take on the dollar’s role; this is true, but irrelevant. When the British pound lost a similar role in the early years of the Great Depression, no other currency was ready to take on its role either. It wasn’t until 1970 or so that the US dollar finished settling into place as the currency of global trade. In the interval, international trade lurched along awkwardly using whatever currencies or commodity swaps the trading partners could settle on: that is to say, the same situation that’s taking shape around us in the free-for-all of global trade that will define the post-dollar era.

One of the interesting consequences of the shift now under way is a reversion to the mean of global wealth distribution. Until the era of European global empire, the economic heart of the world was in east and south Asia. India and China were the richest countries on the planet, and a glittering necklace of other wealthy states from Iran to Japan filled in the picture. To this day the majority of human population is found in the same part of the world. The great age of European conquest temporarily diverted much of that wealth to Europe, impoverishing Asia in the process. That condition began to break down with the collapse of European colonial empires in the decade following the Second World War, but some of the same arrangements were propped up by the United States thereafter. Now those are coming apart, and Asia is rising. By next year, four of the five largest economies on the planet will be Asian. The fifth is the United States, and it may not be in that list for much longer...

https://www.ecosophia.net/dancing-on-the-brink/

après moi le déluge

- theluckycountry

- Intermediate Crude

- Posts: 2343

- Joined: Tue 20 Jul 2021, 18:08:48

- Location: Australia

Re: Suddenly Everyone Is Hunting Alternatives To US $

That was a good article by JMG.

"On a long enough time line, the survival rate for everyone drops to zero."

-

jato0072 - Lignite

- Posts: 307

- Joined: Wed 04 Aug 2021, 16:47:30

- Location: NV

Re: Suddenly Everyone Is Hunting Alternatives To US $

jato0072 wrote:That was a good article by JMG.

I agree, very well written. I checked out JMG's home page, interesting credentials.

Peace

Cliff (Start a rEVOLution, grow a garden)

-

careinke - Volunteer

- Posts: 4696

- Joined: Mon 01 Jan 2007, 04:00:00

- Location: Pacific Northwest

Re: Suddenly Everyone Is Hunting Alternatives To US $

jato0072 wrote:That was a good article by JMG.

Once a discredited peak oiler, always a discredited peak oiler. Falling for nonsense so easy to spot as it was happening means everything you claim afterwards must be questioned for "are they being as ignorant and ill-informed as they were last time they were peddling snake oil ideas".

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 9292

- Joined: Mon 28 Dec 2015, 17:10:26

Re: Suddenly Everyone Is Hunting Alternatives To US $

De-dollarization kicks into high gear

https://thecradle.co/article-view/24080 ... -high-gear

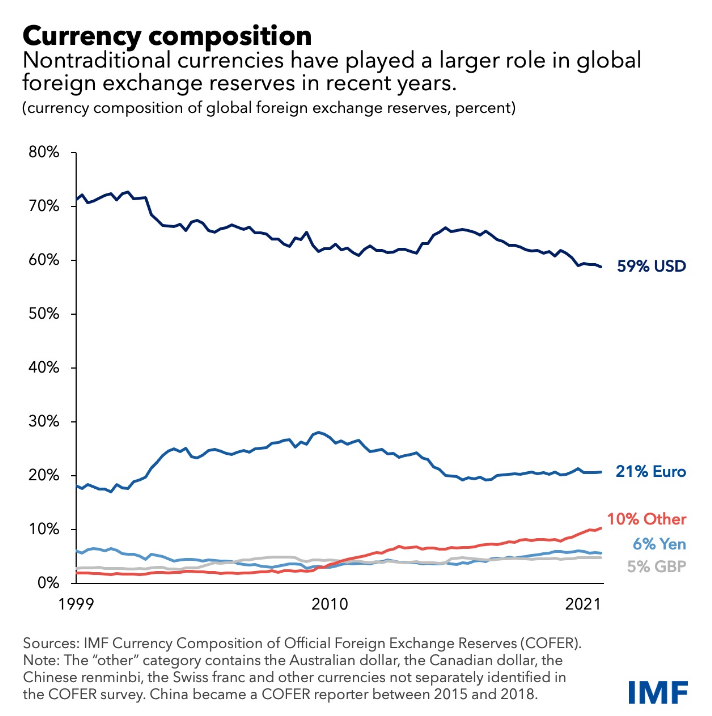

It is now established that the US dollar’s status as a global reserve currency is eroding. When corporate western media begins to attack the multipolar world’s de-dollarization narrative in earnest, you know the panic in Washington has fully set in.

The numbers: the dollar share of global reserves was 73 percent in 2001, 55 percent in 2021, and 47 percent in 2022. The key takeaway is that last year, the dollar share slid 10 times faster than the average in the past two decades.

Now it is no longer far-fetched to project a global dollar share of only 30 percent by the end of 2024, coinciding with the next US presidential election.

The defining moment – the actual trigger leading to the Fall of the Hegemon – was in February 2022, when over $300 billion in Russian foreign reserves were “frozen” by the collective west, and every other country on the planet began fearing for their own dollar stores abroad.

There was some comic relief in this absurd move, though: the EU “can’t find” most of it.

https://www.intellinews.com/the-eu-can- ... es-271253/

Now cue to some current essential developments on the trading front.

Over 70 percent of trade deals between Russia and China now use either the ruble or the yuan, according to Russian Finance Minister Anton Siluanov.

Russia and India are trading oil in rupees. Less than four weeks ago, Banco Bocom BBM became the first Latin American bank to sign up as a direct participant of the Cross-Border Interbank Payment System (CIPS), which is the Chinese alternative to the western-led financial messaging system, SWIFT.

China’s CNOOC and France’s Total signed their first LNG trade in yuan via the Shanghai Petroleum and Natural Gas Exchange. [France? Those turncoats are at it again.]

Russia and Bolivia’s bilateral trade now accepts settlements in Boliviano. That’s extremely pertinent, considering Rosatom’s drive to be a crucial part of the development of lithium deposits in Bolivia. [Now that's interesting, Elon might have to go hat in hand to Russia to build his batteries. It's advantageous for any nation to sell its resources in it's own currency, You get product like oil from Russia and all you have to do is print the money, you don't have to go scrabbling in the war chest for $US]

Notably, many of those trades involve BRICS countries – and beyond. At least 19 nations have already requested to join BRICS+, the extended version of the 21st century’s major multipolar institution...

https://thecradle.co/article-view/24080 ... -high-gear

https://thecradle.co/article-view/24080 ... -high-gear

It is now established that the US dollar’s status as a global reserve currency is eroding. When corporate western media begins to attack the multipolar world’s de-dollarization narrative in earnest, you know the panic in Washington has fully set in.

The numbers: the dollar share of global reserves was 73 percent in 2001, 55 percent in 2021, and 47 percent in 2022. The key takeaway is that last year, the dollar share slid 10 times faster than the average in the past two decades.

Now it is no longer far-fetched to project a global dollar share of only 30 percent by the end of 2024, coinciding with the next US presidential election.

The defining moment – the actual trigger leading to the Fall of the Hegemon – was in February 2022, when over $300 billion in Russian foreign reserves were “frozen” by the collective west, and every other country on the planet began fearing for their own dollar stores abroad.

There was some comic relief in this absurd move, though: the EU “can’t find” most of it.

https://www.intellinews.com/the-eu-can- ... es-271253/

However, according to recent reports, the EU legal enforcement authorities have only been able to identify €33.8bn of the €250bn held in Europe, which has been frozen. The remaining funds have not been found and presumably remain under Russian control.

Now cue to some current essential developments on the trading front.

Over 70 percent of trade deals between Russia and China now use either the ruble or the yuan, according to Russian Finance Minister Anton Siluanov.

Russia and India are trading oil in rupees. Less than four weeks ago, Banco Bocom BBM became the first Latin American bank to sign up as a direct participant of the Cross-Border Interbank Payment System (CIPS), which is the Chinese alternative to the western-led financial messaging system, SWIFT.

China’s CNOOC and France’s Total signed their first LNG trade in yuan via the Shanghai Petroleum and Natural Gas Exchange. [France? Those turncoats are at it again.]

Russia and Bolivia’s bilateral trade now accepts settlements in Boliviano. That’s extremely pertinent, considering Rosatom’s drive to be a crucial part of the development of lithium deposits in Bolivia. [Now that's interesting, Elon might have to go hat in hand to Russia to build his batteries. It's advantageous for any nation to sell its resources in it's own currency, You get product like oil from Russia and all you have to do is print the money, you don't have to go scrabbling in the war chest for $US]

Notably, many of those trades involve BRICS countries – and beyond. At least 19 nations have already requested to join BRICS+, the extended version of the 21st century’s major multipolar institution...

https://thecradle.co/article-view/24080 ... -high-gear

après moi le déluge

- theluckycountry

- Intermediate Crude

- Posts: 2343

- Joined: Tue 20 Jul 2021, 18:08:48

- Location: Australia

Re: Suddenly Everyone Is Hunting Alternatives To US $

theluckycountry wrote:It's one thing for a nation like Brazil or Saudi Arabia to thumb it's nose at the "Rule based order" of the $US, it's quite another when a stalwart of the coalition of the willing puts out rhetoric like this.

You really think the cheese eating surrender monkeys can be a stalwart anything?

theluckycountry wrote: I think beneath the surface there is a lot of anger in Europe because it was sucked into this phoney war in the ukraine.

I think that when a war starts in Europe it was serious enough to drive long term holdouts Finland and Sweden to the NATO ranks so fast it would make a kangaroo's head spin. As far as cheese eating surrender monkeys they have already demonstrated that you don't trust them when it comes to things of importance, the Brits still have their lackey nations to draw upon for help but that isn't worth much either, having let some of them devolve into Chinese dependent states.

Russia has demonstrated it can't fight its way out of a wet paper bag, having been gutted from the inside by the oligarchs. While they might be capable of invading and holding insignificant small islands like Bali or Australia, whatever fear a coward might have over the whole affair is just that, fear from folks who can't figure out how to stand on their own two feet in the first place. The Kiwis would undoubtedly do just fine, they have demonstrated fierce resolve when it comes to backing up overlords like the Chinese but their local neighbors...well....they seem to fit more into the French mold.

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 9292

- Joined: Mon 28 Dec 2015, 17:10:26

Re: Suddenly Everyone Is Hunting Alternatives To US $

Makati1 wrote:"Why are major governments, corporations, think tanks and the Davos WEF all promoting a Zero Carbon global agenda to eliminate use of oil, gas, coal? They know that the turn to solar and wind-based electricity is impossible. It is impossible because of the demand for raw materials from copper to cobalt to lithium to concrete and steel exceeding global supply. It is impossible because of the staggering trillions in cost of battery backup for a “reliable” 100% renewable electric grid. It is also impossible without causing the collapse of our present standard of living and a breakdown of our food supply that will mean mass death from starvation and disease. All this for a scientific fraud called man-made global warming?..." https://www.globalresearch.ca/zero-carb ... on/5815361

When I see a fearful post like this it makes me think of the markets. I think of why solar stocks are so cheap right now, when the very future that you describe says that they should be expensive. Because, even if they are a con, you describe that con happening.

They are so cheap because the overall sentiment doesn't believe in the solar future. But if the solar future is true, they are so undervalued that you would be a fool not to buy them now. And, of course, you aren't saying buy them now because you are afraid.

Let me just say, if anyone is trying to manipulate the situation, you are. The Illuminati have nothing on you. The way you have succeeded in manipulating John Q Investor is amazing. The markets bear your story out.

The only thing is, your manipulation will only hold as long as earnings don't add up. Solar will have to prove itself. The war in Europe pretty much guarantees that investment will be up enough to drive solar stocks somewhere. Solar should be a part of the alternative to cheap Russian natural gas. There should be some marginal gain that is sustained over time from that alone, even without the rest of the changeover.

It doesn't have to be the biggest part, only a part. Investment in it should go up enough, soon enough, that the doubt you portray will probably be openly laughed at in a manner that it isn't today because people still entertain the idea that the status quo will always remain, and that solar will go nowhere. As far as that goes, your fear is actually an expression of the status quo. It says how much the status quo doesn't like change.

It's very hard to shed the status quo, even when it has already ended. You are right, it hasn't quite yet. It is still easy to doubt the future. People are creatures of habit, after all.

Last edited by evilgenius on Sat 29 Apr 2023, 10:30:11, edited 2 times in total.

-

evilgenius - Intermediate Crude

- Posts: 3731

- Joined: Tue 06 Dec 2005, 04:00:00

- Location: Stopped at the Border.

Re: Suddenly Everyone Is Hunting Alternatives To US $

The USD has been sliding down for some time. It won't last forever. The current geopolitics and woke capture of our institutions in the US should be enough to accelerate the demise of the USD. That is why I posted “How did you go bankrupt?" Two ways. Gradually, then suddenly.” ― Ernest Hemingway... up above. We are still in the gradual phase, but perhaps moving to the (relatively) sudden phase???

Link to International Monetary Fund article, June 2022

"On a long enough time line, the survival rate for everyone drops to zero."

-

jato0072 - Lignite

- Posts: 307

- Joined: Wed 04 Aug 2021, 16:47:30

- Location: NV

Re: Suddenly Everyone Is Hunting Alternatives To US $

jato0072 wrote:

Doesn't look much "sudden" about hunting for alternatives at all. Doomers have always had this natural instinct to pimp scenarios and then tell you to be afraid of them, because they are. I'm not referring to you Jato (depending on your peak oil history which I am unfamiliar with, but I do remember your handle from way back) but those...others...who seem to only, and always, be afraid. Doesn't matter of what, peak oil, currency collapses, the inadequacy of their own nation which they project onto others, but the constant always seems to be the fear.

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 9292

- Joined: Mon 28 Dec 2015, 17:10:26

Re: Suddenly Everyone Is Hunting Alternatives To US $

"De-Dollarization Is Happening at a ‘Stunning’ Pace, Jen Says"

https://www.bloomberg.com/news/articles ... e-jen-says

Related:

"A new world order? BRICS nations offer alternative to West"

https://www.dw.com/en/a-new-world-order ... a-65124269

"'It's not a pretty picture': Russia's support is growing in the developing world"

https://www.msn.com/en-us/news/other/it ... r-AA19fI0a

https://www.bloomberg.com/news/articles ... e-jen-says

Related:

"A new world order? BRICS nations offer alternative to West"

https://www.dw.com/en/a-new-world-order ... a-65124269

"'It's not a pretty picture': Russia's support is growing in the developing world"

https://www.msn.com/en-us/news/other/it ... r-AA19fI0a

-

ralfy - Light Sweet Crude

- Posts: 5603

- Joined: Sat 28 Mar 2009, 11:36:38

- Location: The Wasteland

Re: Suddenly Everyone Is Hunting Alternatives To US $

ralfy wrote:"De-Dollarization Is Happening at a ‘Stunning’ Pace, Jen Says"

https://www.bloomberg.com/news/articles ... e-jen-says

Related:

"A new world order? BRICS nations offer alternative to West"

https://www.dw.com/en/a-new-world-order ... a-65124269

"'It's not a pretty picture': Russia's support is growing in the developing world"

https://www.msn.com/en-us/news/other/it ... r-AA19fI0a

Thank goodness that peak oil 5 years ago isn't the problem!!

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 9292

- Joined: Mon 28 Dec 2015, 17:10:26

Re: Suddenly Everyone Is Hunting Alternatives To US $

jato0072 wrote:[img] “How did you go bankrupt?" Two ways. Gradually, then suddenly.” ― Ernest Hemingway." We are still in the gradual phase, but perhaps moving to the (relatively) sudden phase???

Quite.

Here is a good overview on the process I think, from bitcoin.com of all places.

3 Major Signs That Precede the Fall of World Reserve Currencies

The story of reserve currencies is long and stretches far back into ancient times. As modern history shows, however, the average lifespan of fiat reserve assets is just around 100 years. This means that even the U.S. dollar’s period of dominance is probably nearing its end very soon, statistically speaking. But it’s not mere guesswork, as there are distinct patterns that emerge prior to the fall of any world reserve currency. In this exploration, three of the most common will be highlighted.

Bad Omens

To understand the end of any currency’s reserve status, it’s important to be familiar with beginnings, as the former is informed by the latter. A good example of this is the case of the British pound, which prior to becoming a reserve currency was turned from silver to paper with the creation of the Bank of England. The bank was created in the wake of crushing military defeat at the hands of France, and England wished to finance the creation of a more powerful navy. The central bank was thus given sole ability to issue paper currency. War and empire building would similarly play a leading role in the British pound’s consequent fall from grace. Two other common factors emerging prior to the death of reserve currencies are increased spending and easy credit, and sanctions on free trade.

War and Empire Building

In each case where a reserve currency has gained and lost status as such, war and conquest have played an extremely centralized role. The Portuguese succession crisis of 1580 caused by the battle of Alcácer Quibir, meant the end of the country’s already struggling empire. Increased reliance on finance from conquered lands, excessive taxation and a shriveling domestic economy resulted in the fall of Portugal’s various currencies from world reserve grace. Spanish money would then swoop in, assuming prominence in the context of a dynastic merger with Portugal known as the Iberian Union (1580-1640). As one struggling spice empire builder thus joined a stronger one, money such as Spain’s escudo gained worldwide reserve status and, as with Portugal, colonialism’s bloody legacy of expansion and monopolistic dominance of trade routes made this possible.

(Sounds a bit like the UK joining the US sphere of influence)

Further in the article below

Reckless Spending and Easy Credit

Trade Wars and Sanctions

https://news.bitcoin.com/3-major-signs- ... urrencies/

après moi le déluge

- theluckycountry

- Intermediate Crude

- Posts: 2343

- Joined: Tue 20 Jul 2021, 18:08:48

- Location: Australia

Re: Suddenly Everyone Is Hunting Alternatives To US $

And going a little deeper into the subject

The Retirement of Sterling as a Reserve Currency after 1945: Lessons for the US Dollar?

https://www.researchgate.net/publicatio ... _US_Dollar

The Retirement of Sterling as a Reserve Currency after 1945: Lessons for the US Dollar?

https://www.researchgate.net/publicatio ... _US_Dollar

après moi le déluge

- theluckycountry

- Intermediate Crude

- Posts: 2343

- Joined: Tue 20 Jul 2021, 18:08:48

- Location: Australia

Re: Suddenly Everyone Is Hunting Alternatives To US $

Pakistan Wants To Pay In Chinese Yuan For Russia’s Crude Oil

I thought they were a staunch alli? Rats leaving a sinking ship it seems.

https://oilprice.com/Latest-Energy-News ... e-Oil.html

I thought they were a staunch alli? Rats leaving a sinking ship it seems.

Pakistan is desperate to import energy at low costs after it was outspent on the market last year when oil and gas prices surged while its foreign exchange reserves dwindled. The country has a currency swap with China, which would make it easier to pay for crude than using the little U.S. dollar reserves it has.

https://oilprice.com/Latest-Energy-News ... e-Oil.html

après moi le déluge

- theluckycountry

- Intermediate Crude

- Posts: 2343

- Joined: Tue 20 Jul 2021, 18:08:48

- Location: Australia

Re: Suddenly Everyone Is Hunting Alternatives To US $

The U.S. dollar has become the largest Ponzi Scheme in human history. It had a good run, longer than most other empire's currency. Nothing can fix it now, collapse has already started.

Peace

Peace

Cliff (Start a rEVOLution, grow a garden)

-

careinke - Volunteer

- Posts: 4696

- Joined: Mon 01 Jan 2007, 04:00:00

- Location: Pacific Northwest

Who is online

Users browsing this forum: No registered users and 15 guests