AdamB wrote:Of course the nominal price of oil today is far more than yesteryear. The real price of oil, now, is similar to what it was from 1860 through about 1880.

Not sure of the relevance. As I mentioned the price was low for 90 years aside from the wars, a time of great growth and prosperity.

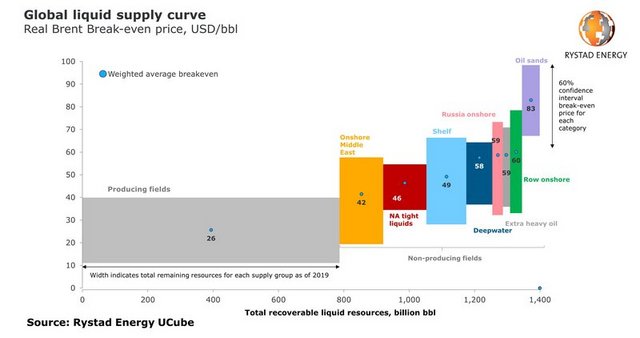

And while neither a geologist nor economist pays attention to the practical aspects of WHY existing production costs more than yet to be found or even yet to be developed resources, it is because existing production is a sunk capital argument, and new production is not.

Note, Rystad says new mideast oil is $45/ bbl—cost. So no, the price isn't the same.

Production being more expensive isn't the variable to keep an eye on. The cost of the marginal barrel, for a given demand is. Right now, my estimate is that this number is somewhere in the range of $25-$30/bbl.

Discounting DUCs, shut-in, storage, politics etc, which I don't watch TBH, actual new production is minimum $45/bbl per Rystad.

The good news I guess is that Rystad thinks the cost of LTO is down to $45 from $80 not long ago. I certainly don't know, guess we'll see how the new owners make out.

1. In real terms oil prices today are about the same as they were between 1860-1880.

2. Because of inflation, in nominal terms, tomorrow is a given to be more expensive in most everything.

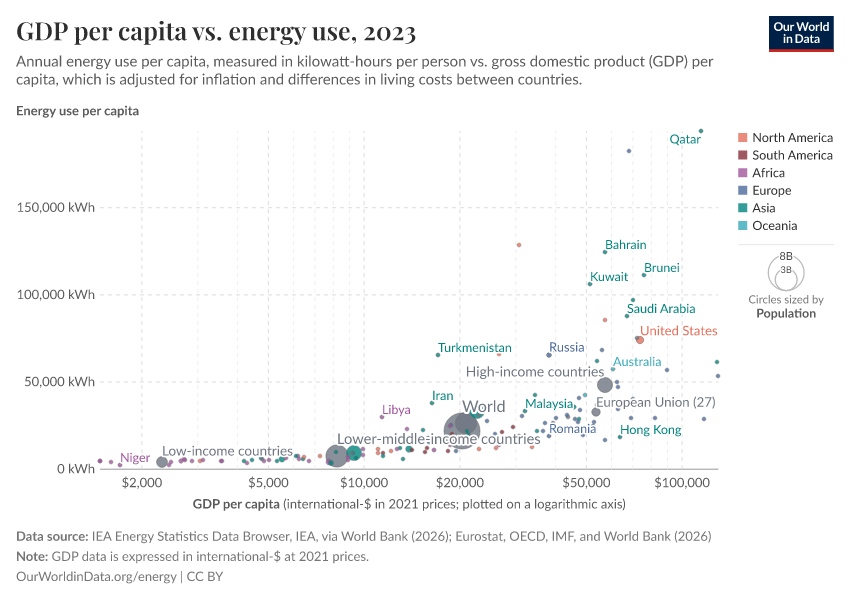

3. GDP is GDP, and growth stopping has been a staple of peak oil dogma since they began declaring it in the modern era, circa 1990. In some cases, it was claimed that what Helicopter Ben did could NOT make more oil, and therefore could NOT save the world. And here we are 13 years later, and everyone needs to take with a grain of salt any of the proposed mechanisms from those days being rinsed, recycled and repeated.

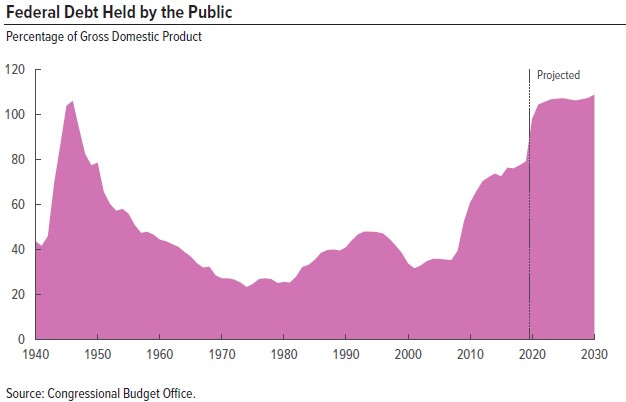

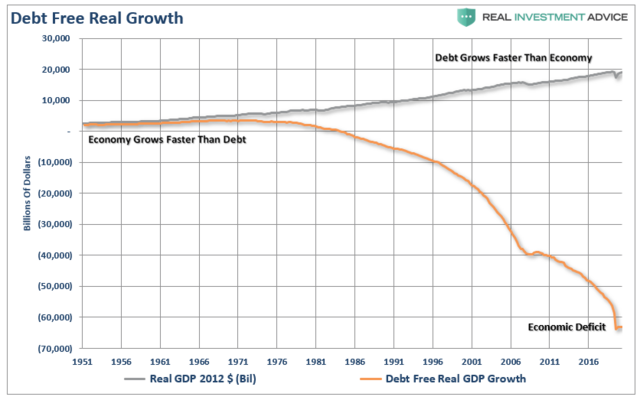

4. Growing debt is bad, and masks all sorts of things.

5. I don't know what renewables will do, other than I like my solar panels and my EVs and the effect they have on my discretionary budget that means there is "growth" in my discretionary income because of it.

1. In 1880 oil was for lighting. The Model T didn't show up until 1908. Today oil is for pretty much everything.

2. See the picture, real oil price averaged $20/bbl or less for 50 years, as mentioned, right up until OPEC and the US conventional peak— in 90 years it only exceeded $30 during the world wars. That is selling price, not cost.

3. GDP does not exist in a vacuum. If I told you my disposable income was rising $1,000 every year and by the way, my debt was rising $4,000 every year, would you think the two unconnected?

4. Agree.

5. I'm amazed at how fast the price of RE is coming down. I'm more optimistic than ever that RE will save our bacon... well maybe not our bacon but at least save our gruel.

(hacks) etc.

I've pretty well given up on specialists in this area. Lots of well credentialed people predicted imminent doom over the years. And lots of well credentialed people poo-pooed the idea of peak conventional as well. The various "agencies" have been all around, the IEA was correct apparently in 2010 tho:

Crude oil output reaches an undulating plateau of around 68-69 mb/d by 2020, but never regains its all-time peak of 70 mb/d reached in 2006

(

Wayback Machine)

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)