As I'm sure you know, what the EIA calls crude oil is actually crude oil (generally defined as 45 or lower API gravity oil) + condensate (a byproduct of natural gas production), AKA as C+C. The EIA does not appear to have recent data for US condensate production, but as noted the Texas RRC shows a very large increase in the ratio of Texas Condensate to C+C production, i.e., Texas condensate production accounted for an increasing percentage of Texas C+C production from 2005 to 2012 (11% to 15%). Condensate is basically natural gasoline, but it's not of much use for refining distillate products.

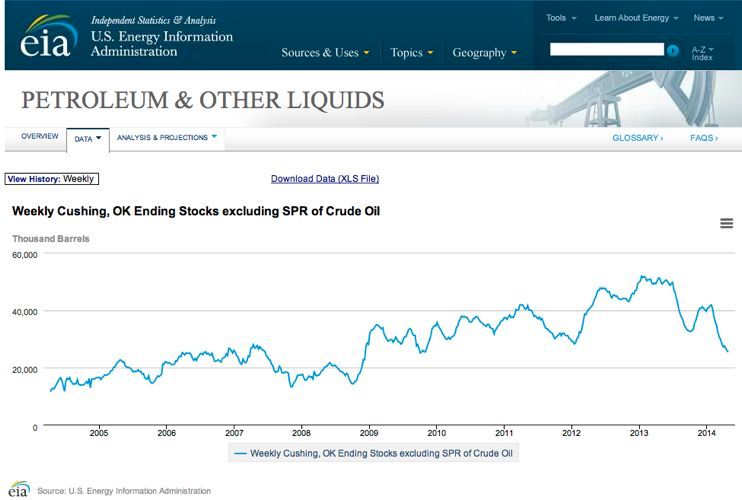

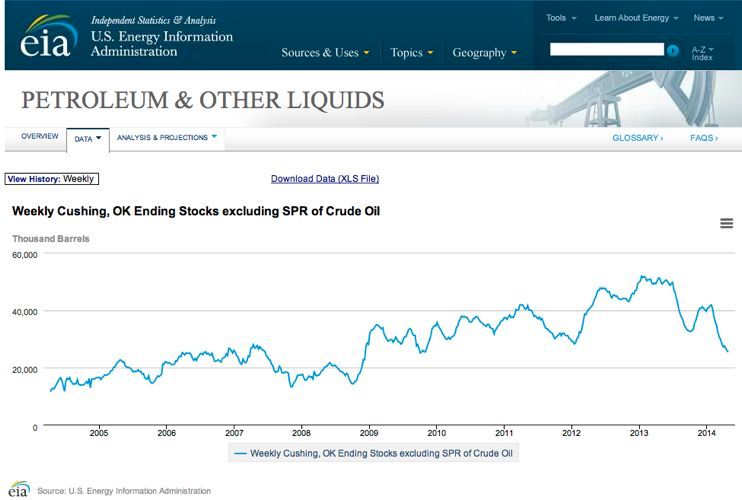

Note that US net crude oil imports remain quite high, given very high US C+C inventories, which, as noted above, suggests to me that most of the increase in US C+C inventories may be condensate.

Re: Global Data:

When one asks what the price of oil is, one gets the price of 45 or lower API gravity crude oil. When one asks for the volume of global oil production, one gets some combination of Crude Oil + Condensate + Natural Gas Liquids (NGL) + Biofuels + Refinery Gains. It’s analogous to asking a butcher the price of beef, and he gives you the price of steak, but if you ask him how many pounds of beef he has on hand, he gives you the total pounds of steak + roast + beef.

Shouldn’t the price be keyed to the actual volume of the product being priced?

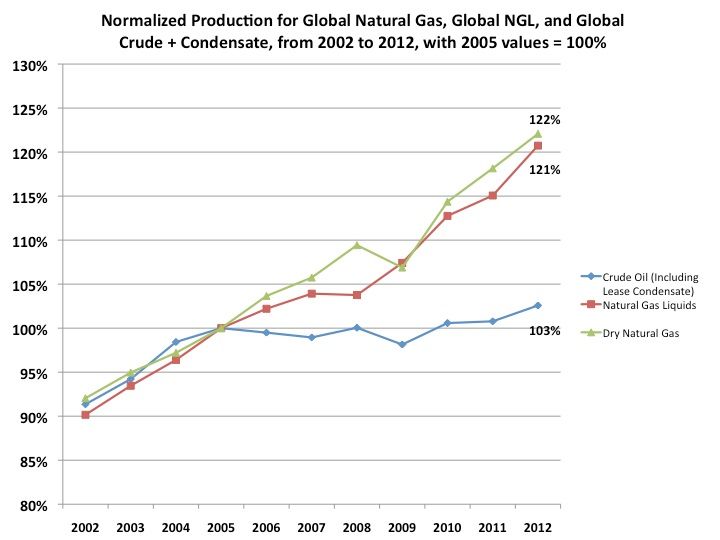

Global Crude + Condensate (C+C) production increased at about the same rate as global dry processed gas production from 2002 to 2005, but then we saw a significant divergence between the rates of increase in global gas production and in global C+C production from 2005 to 2012, 2.8%/year versus 0.4%/year respectively. Crude oil is generally defined as 45 or lower API gravity oil.

According to the EIA, global gas production increased by 22% from 2005 to 2012, and I think it’s a reasonable assumption that condensate–a byproduct of natural gas production–increased by about the same amount, especially given the large increase in condensate production in the US.

The problem is that other than OPEC and Texas, no one appears to track crude versus condensate, but the Texas RRC shows that the Texas condensate to C+C ratio increased from 11% in 2005 to 15% in 2012. Note that OPEC, which accounted for 43% of global C+C production in 2012 showed no material increase in crude oil production from 2005 to 2012 (31 mbpd in both years).

If we cross correlate the OPEC (Crude only) and EIA (C+C) data bases for the OPEC 12 countries for 2005 to 2012, their Condensate/(C+C) Ratio doubled–from 3% in 2005 to 6% in 2012. OPEC accounted for 43% of global C+C production in 2012, which is a pretty good (and conservative) sampling of global crude and condensate production, especially when one considers the fact that the large increase in US condensate production would be in the remaining 57% of global C+C production.

In any case, the data bases that we have that track condensate versus crude, Texas RRC and OPEC/EIA, both show large increases in their Condensate/C+C Ratios from 2005 to 2012, 11% to 15% and 3% to 6% respectively.

If we extrapolated the OPEC crude versus C+C data, and assumed that OPEC was a representative sampling of global data, it would imply that global condensate production increased by about 2.1 mbpd from 2005 to 2012, which would account for all of the EIA’s reported 2 mbpd increase in global C+C production from 2005 to 2012.

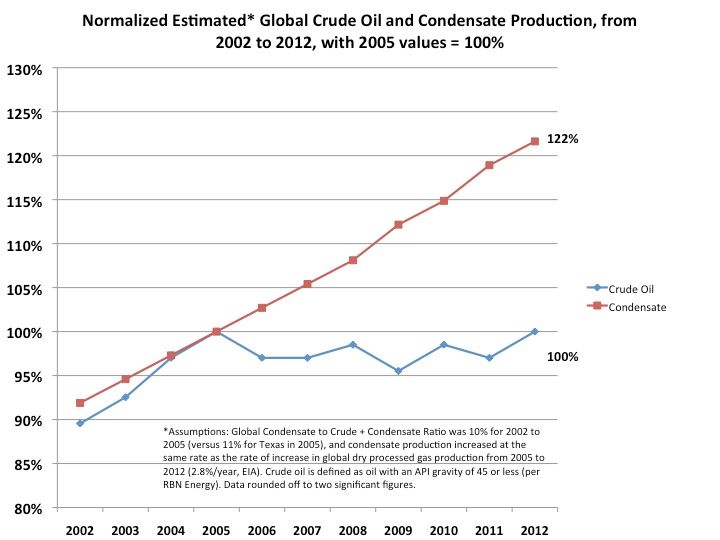

My approach has been to assume that the global Condensate/(C+C) Ratio was about 10% in 2005 (partly based on an RBN Energy estimate that put the ratio at about 11% in 2010), and I assumed that global condensate production (a byproduct of natural gas production) increased at about the same rate as the rate of increase in global gas production, from 2005 to 2012. Based on these assumptions, global condensate production would have increased from about 7.4 mbpd in 2005 to about 9.0 mbpd in 2012, an increase of 1.6 mbpd, accounting for virtually all of the EIA’s reported increase in global C+C production from 2005 to 2012.

Based on the foregoing, the global Condensate/(C+C) Ratio would have increased from about 10% in 2005 to 12% in 2012, versus 11% to 15% for Texas and versus 3% to 6% for OPEC. I estimate that actual global crude oil production averaged about 65 mbpd for 2006 to 2013 inclusive, versus 67 mbpd in 2005.

In other words, in my opinion global crude oil production probably peaked in 2005, but natural gas and associated liquids (Condensate & NGL) have (so far) continued to increase.

Following are estimated* values for global crude oil production (excluding lease condensate), 2002 to 2012, mbpd:

2002: 60

2003: 62

2004: 65

2005: 67

2006: 65

2007: 65

2008: 66

2009: 64

2010: 66

2011: 65

2012: 67

*Assumptions: Global Condensate to Crude + Condensate Ratio was about 10% for 2002 to 2005 (versus 11% for Texas in 2005), and condensate production increased at the same rate as the rate of increase in global dry processed gas production from 2005 to 2012 (2.8%/year, EIA). Crude oil is defined as oil with an API gravity of 45 or less (per RBN Energy). Data rounded off to two significant figures.

Kurt Cobb has written a good article on crude oil versus other liquids:

http://www.resilience.org/stories/2014- ... ak-in-2005