I once read that the resource economy will act like a top that begins to wobble as it losses momentum. (For those of you born into the post-analog world, a top was a toy that was spun fast (by hand!) and balanced on it's point, sorta like spinning a basketball on your finger in a video game.)

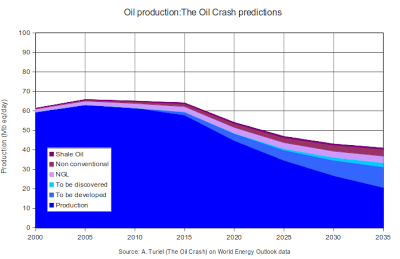

That seems like a good analogy to me and means there is no way to forecast price or demand or production at a particular time in the future except to say that the

trend will be lower production.

What does that mean for the price?

First, there will be fewer energy slaves available to the economy with lower oil production, that means less absolute production of physical stuff (as opposed to financial "stuff"). Because we will produce less of everything, our economy will be smaller (aside from the part siphoned off by the landlords) and in turn our individual budgets will shrink in real terms.

So what does

that mean?

I don't know. Like anything else, there has always been a range of price below which FF production wasn't profitable and above which it wasn't affordable, that won't ever change. Let's call it $80-$120 barrel US today, maybe that's right maybe wrong I don't know – but – I am certain it will be different in the future.

Because the lower limit must necessarily rise, I think, unless it doesn't. Maybe roughnecks will be happy to work for the equivalent of $2/hr and ROCK will be happy with $4, who knows, stranger things have happened. The upper limit to prices can also rise as the uses of oil with less utility are abandoned. That would initially free up some supply, like less driving has done in the US but decline will of course eventually catch up and the wastful uses (like those never traveled miles the last few years) will go away permanently.

Maybe at half today's production the price could be 10 times what it is today and the average income a tenth. ROCK could be fracing away at the north pole making $100 a month and vehicles might look more like one of those bike carts the kids ride in

P.S. Re: BS

All the BS about the "service" economy is just that, BS. Like the man said, you can make any -ism appear successful given enough free energy and the "service economy" -ism is the perfect example. A service economy is everyone working sales and no one working the line making product. There is no "there" in financialization, it's simply charging rent on the past: past capital formation, past land acquisition, past patent/information/copyright,

past "inheritance", even claiming genetic material as proprietary property. The increase in the rentier portion of the economy replacing the production economy is the biggest clue that the extractive, industrial, growth era is over. Profits from actual productive work (manufacturing) are falling and once again the "renting" of money, land, "information", etc is ascendant. Back in the day that was the basis of feudalism.

Some links on rent, PO, etc:

Slouching Towards Rentier-Capitalismhttp://www.nakedcapitalism.com/2013/01/ ... ether.htmlhttp://www.rooseveltinstitute.org/new-r ... -galbraithhttp://carnegieendowment.org/2012/04/03 ... world/a67mThe legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

The question I suppose is how long before the macro economic factors filter down and effect the micro decisions. The disconnect in various industries tends to lead to drastic crashes rather than moderate price increases. IMO the disconnect is what we see in the bubble economies we live in (and have lived in for some time).

The question I suppose is how long before the macro economic factors filter down and effect the micro decisions. The disconnect in various industries tends to lead to drastic crashes rather than moderate price increases. IMO the disconnect is what we see in the bubble economies we live in (and have lived in for some time).