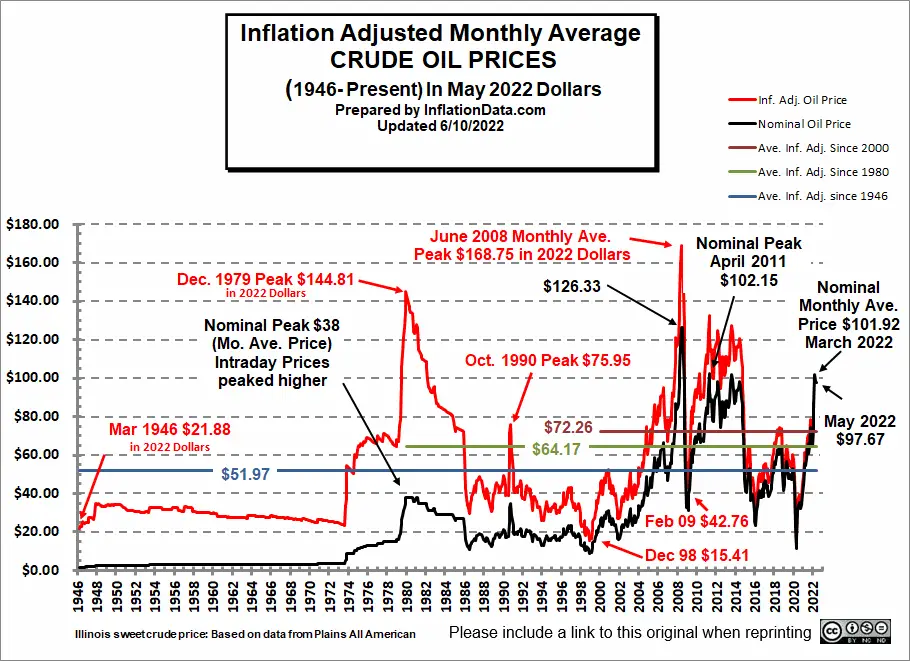

C8 wrote:AdamB wrote:Plantagenet wrote:Perhaps....at long last.......the world is at PEAK OIL.

CHeerS!

After 5 of them claimed this century and #6 in 2018 not having been relegated to just another bad call yet, it seems that it is a smooth move that you preceded your statement with "perhaps".

I hope you are right, I never want to see real Peak Oil in my life time......

Allegedly, you already have. 6 times. The current one has been going on for 4 years, and I dunno, live seems to have continued pretty well until Covid cocked everything up.

Ultimately, we might even see the end of globalization as it has been pitched to us for all of this century, and that might be a good thing as well, once all the growing pains shake out.

C8 wrote:...things that are often entertaining to think about online are hell in the real world. I am a big reader of history and am always aware that, for little fish like me, the vast expanse of mankind's journey has been extremely unkind.

I believe you are correct, but I would bet you would be hard pressed to find folks admitting it. Unless you originate from a 3rd World country perhaps, in which case you might have seen it up close and personal.

I would like to think that part of what we are going through now is a transition to something better for the developed world (the less developed world might never be better, and might just ship off malcontents to the developed world where they can succeed and leave their beginnings behind), in the form of cleaner energy, more acceptance that labor really is worth more and helps create a better society than turning everyone into financial service money handlers looking to make an easy buck, etc etc.

I remember my days of blue collar work, and I recall them with fondness. Came home smelling of hydrocarbon fumes at the end of the day, washed it all away, and completely forgot about it until the next day, and was happy each day for a job well done.

The white collar world is quite different nowadays than it was even as recently as the early 90's, moves faster, falls are more severe, and less....forgiving? Interesting? Anyway, nothing going on in the world right now is a surprise, but it is unsettling as it happens. Felt the same way when young in the 70's.