The Saudis reworked their remaining ancient inferior fields (Khurais, Shaybah &Nayyim, AFKL, and Haradh) yet production still slipped in the face of record high crude prices.. That is the true measure of the supply/demand equation.

The fields were only “inferior” for the oil and gas technology applied thirty or forty years ago. The progress made with MRC wells, SMART completions, expandable liners etc. put those fields on an equal level playing field with the others.

The Saudis were still in the process of commissioning these fields when oil first ran to $140 but they said during that whole period there was no shortage of oil on the market. Their view was that the price was artificially high as they were not being called on for additional volumes. Their voiced concern all along has been there was and is lots of oil in the market and additional volumes they might add would serve to create a dissasterous crash which is not in anyone’s best interest as was witnessed by the crash in '08.

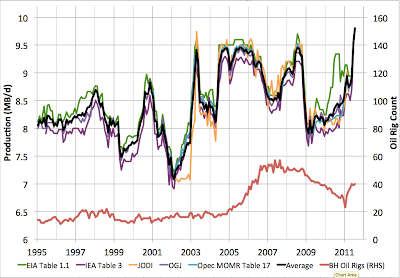

"Capacity" is mostly meaningless, a function of past performance and future dreams. Past performance on a yearly basis (since 2005 and the beginning of the peak plateau) has been less than 9 mbpd. "Capacity" is all about good intentions and does not take into account price, porosity, permeability, geographic accessibility, refinery loses, rotten eroei.

It is pretty clear that regardless of all your bluster you actually understand very little about the oil industry. Spare capacity refers to what volumes can be brought on-stream in very short order and almost zero cost. For that definition to hold the wells must have already been drilled and the water and gas handling capacity in place as well as the appropriate amount of space available in existing processing plants and pipelines. As an example volumes from Khurais could not have been classified as spare capacity if the Saudis had not drilled the scores of necessary MRC wells and built additional water and gas handling capacity. Capacity absolutely does take into account porosity, permeability, geographic accessibility, refinery loses etc. It was deemed economic or they wouldn’t have already spent the hundreds of millions of dollars necessary for wells and facilities.

As long as you don't subscribe peak oil, you will continue to willfully confuse the supply/demand and price correlation and makes claims for "capacity" that just make no sense. Demand is down because supply at the price the world can afford is not available.That is peak oil. The world has begun to grasp the "oil expense indicator". You should consider it also

Well I was on the record back in 2005 here speaking to my understanding of peak oil and giving background models with supporting graphs for when I thought we would reach peak globally and the uncertainties involved, so I’m hardly someone who doesn’t subscribe to the theory. Indeed, as I’ve pointed out here a few times I was exposed to it more than forty years ago at University by two professors, one who was at the AAPG conference when King Hubbert first broached the subject to a large and disbelieving audience and the other who worked with Hubbert for many years at the Shell Research Centre. Peak oil by definition is the point at which production reaches its maximum point and is not defined as you imply. Demand is down for a number of reasons that aren’t necessarily dependant on current oil price. Demand on oil was higher a few years back when oil was at $130 than it is currently at $86. If the economy is booming then there will be demand for oil. The economy is tied to oil very strongly but not exclusively.

Exactly. And so the remaining expensive "capacity" will mostly never be produced.

Again you are showing your lack of understanding as to what spare capacity is. The capital associated with accessing it has already been spent…it just has to be turned on which would mean there is a slight increase in overall variable operating costs which are insignificant.

What will be your excuse when they surpass that record?

What will be your excuse when they surpass that record?