mousepad wrote:noobtube wrote:That is a sign of how fast you are destroying your "wealth", not how much "wealth" you have.

No. GDP has nothing to do with wealth. It measures productivity.

How can GDP measure productivity when the standard of measurement keeps changing every year (the dolluh).

If the 1970 Dollar was the same in 2022, at least GDP would be useful from that standpoint. But, the US government changes the dollar every year (if not every 6 months). GDP is meaningless because there is no LEGAL definition of what a dollar is. Is it a dollar bill? Is it a Sacagawea? Is it a bank loan? Is it commercial paper? Is it a T-bill? Is it 4 quarters? Is it a bank draft? Is it a cash app? A dollar is whatever the Federal government wants it to be, from one day to the next.

I remember watching the movie Syriana (2005 with George Clooney), and the top Attorney made a joke about that. Or, watch Wall Street (1987) when Michael Douglas tries to explain to Charlie Sheen how the financial world really works. Or listen to Hal Holbrook's character in the same movie, when you first see him. I also like Jeremy Irons' final speech in Margin Call (2011). He should have said credit, not money. But, the point was made.

All this so-called productivity and wealth is nothing more than an illusion of prosperity. Things have been declining for decades. "We'll know our disinformation program is complete when everything the American public believes is false."-William J. Casey, CIA Director

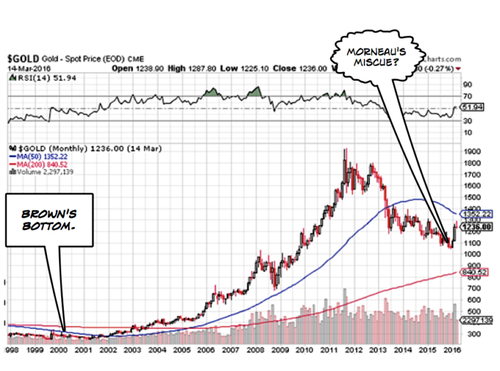

This is what happens when you abandon money (gold and silver) for a purely debt-based system.

mousepad wrote:noobtube wrote:That is why GDP has been and will always be an idiotic measure of productivity or "wealth." That is why the standard of living has gotten worse, while the government claims GDP has increased.

The most important factor in my opinion is QUALITY of LIFE, not Standard of Living. GDP is loosely coupled to standard of living, which is loosely coupled to quality of life. I'd rather have high QoL than high GDP. The US has high GDP, but should have much higher QoL for such a high GDP.

How can you use numbers to measure QUALITY of LIFE?

mousepad wrote:noobtube wrote:mousepad wrote:noobtube wrote:You need a stable form of payment

Exactly!!! And for that the $$$ has been pretty good. I hate the inflation them gov idiots are producing, but all-in-all it's stable enough to do serious business.

The dollar was stable up to the 1970s. If you call the dollar stable today, I would like to know what is your definition of stable.

I said "stable enough" to do serious business. There was always inflation, even before 1970

https://www.officialdata.org/us/inflation/

See, that's the thing. Who is doing business?

Top 12 in 1970 - GM / Exxon Mobil / Ford Motor / General Electric / IBM / Chrysler / Mobil / Texaco / ITT Industries / Gulf Oil / AT&T Technologies / U.S. Steel

Top 13 in 2020 Walmart / Amazon / Exxon Mobil / Apple / UnitedHealth Group / CVS Health / Berkshire Hathaway / Google / McKesson / AmerisourceBergen / Microsoft / Costco Wholesale / The Home Depot

Now, which economy looks like its doing serious business to you?

Was it the one from 1970, when the country was producing heavy industrial goods?

Or, was it the one from 2020, when the country sold cheap Chinese goods and focused on old and sick people?

mousepad wrote:noobtube wrote: But, a truly stable dollar would turn your world upside-down. 3rd-worlders would be the least of your problems, as you try to keep the lights on and fuel in your tank.

you're confusing me. Above you spend time explaining why inflation is bad, now you're telling me if the $$$ was stable I would be in a world of hurt?

Inflation is bad for those who work for a living and have to produce things people actually want.

But for social influencers, brand managers, relationship consultants, tech "workers", healthcare professionals, government employees, outside consultants, athletes, entertainers, and especially anyone in the FIRE sector (finance, real estate, insurance), inflation is fantastic.

Imagine if these people had to actually work for a living and the chaos that would result as they tried to find "real" jobs because they could no longer rely on inflation to get constant raises to pay ever-increasing prices from a steady decline in production.

The debt dollar is slowly killing the ability of the country to take care of itself because it has moved so far from reality, that people don't know what real money is anymore.