dashster wrote:AdamB wrote:ROCKMAN wrote:IMHO a great line atributed to Art Berman: “Shale is not a revolution–it’s a retirement party. Shale plays were not some great new idea. They became important only as more attractive plays were exhausted.”

From someone with a compromised view of the history of the oil industry, if he doesn't know that, he isn't really capable of discussing its future, or retirement.

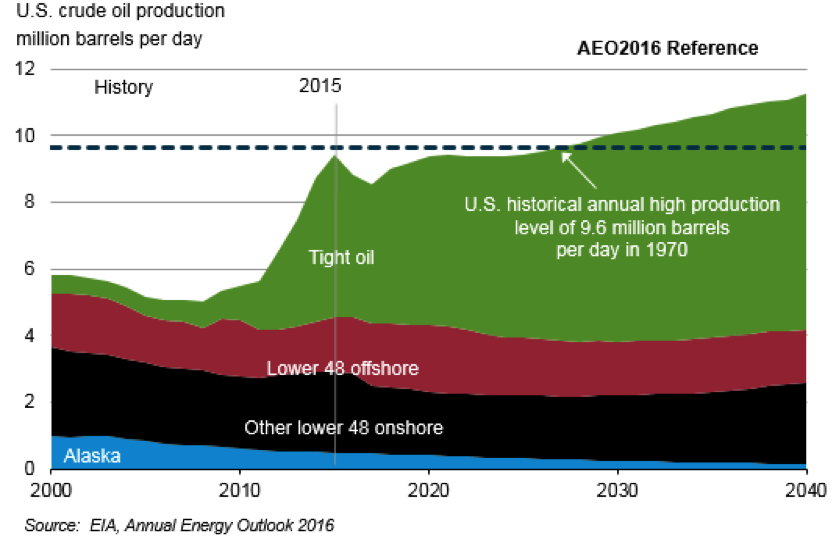

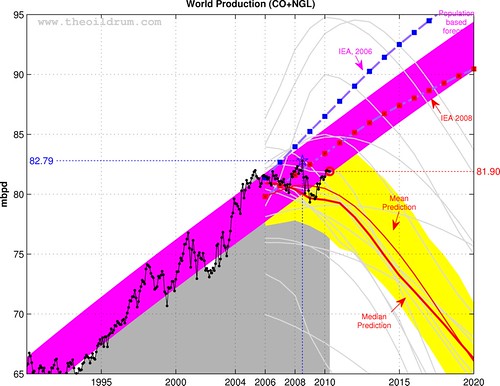

Even the EIA says it's a retirement party. The peak may have been been pushed out and lowered, but prior to the price collapse they had three scenarios in their forecasts which I assume can be categorized as expected, pessimistic, and extremely optimistic. The expected forecast had shale oil production peaking in 2019/2020. The production that has been the majority of the increase in world production for the last 7 years will peak in 2020. A cornucopian has to be pretty old to hang their hat on a 2020 peak.

That 2019/2022 peak for shale oil USA was projected when drilling was going on as fast as rigs were available. That stopped happening in the first half of 2015 and has fallen to quasi stable level now oriented around the actual current price. If the math I saw some weeks ago is accurate frackers will drill about the same number of new oil wells in 2016 that they drilled in 2010, far less than they drilled in 2012, 2013 or 2014. This not only makes the 2019-2022 peak production from fracking get delayed into the future, it also lowers the ultimate peak production because the the same volume is produced under the curve, but at a slower rate.