Wow...how much does it take to produce a bbl of oil? Same old endless discussion/debate. First, lets get rid of the inflation of the $. Obviously if comparisons are being made over significant spans of time it has to be factored in.

Now the almost impossible # to come up with today: the industry is drilling as I type. Company X drilled 20 wells in the last 12 months and found 1 million bbls while spending $10,000,000. Company Y spent $100,000,000 to find the same million bbls. So $10/bbl vs $100/bbl. So easy call: just produce a list of every oil exploration company in the USA/world and how much they spent drilling wildcats for over the last 12 months and EXACTLY how much oil those wells discovered. I say EXACTLY because that is often a very difficult number to come up after the discovery well. And as those companies are providing all that propriatary data get the amount the spent drilling and completing. Hmm, what about over head costs?

And now there's Company Z that spent $10,000,000 to find the same 1 million bbls Company X found. But Company X is in West Texas and its well is flowing on its own. Company X's well is in the GOM in 7,000' of water and cost $40,000,000 for the floating platform the well was drilled from.

Surplus Energy Economics Blog

Re: Surplus Energy Economics Blog

Outcast_Searcher wrote:If person A buys a house or a car, it doesn't change the GDP, whether the money is borrowed or not. It's the production of the house or car that is measured in the GDP.

LOL, how many houses or cars would be produced without borrowing?

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Surplus Energy Economics Blog

ROCKMAN wrote:Wow...how much does it take to produce a bbl of oil? Same old endless discussion/debate.

You know as well as anyone that the exact cost doesn't matter, as long the selling price can cover it. Really, the energy required is a moot point as well, the whole thing has been a huge heat sink since the beginning. Drillers don't drill for energy, they drill for profit. Besides, to get something as portable and flexible as gas or diesel any other energy input would work fine.

Selling price is all that matters. With a high enough selling price the extra inputs, labor, material, overhead, etc, to tight oil, offshore, tar, arctic, whatever, are no object. And, low selling price is self-correcting. With a price too low drillers quit drilling or go belly up: voilá, the magic hand reduces supply, price goes up and supply increases—so far anyway. We've seen it a couple times, in the '70s and the 2010's. From (real) $20~ for 90 years, to $40~ post-OPEC, to $60-ish while LTO lasts.

The thesis of the thread is that the unprecedented and widespread prosperity and technological advance seen in the previous century were due to cheap energy of the $20/bbl (real) variety and negative growth and increasing debt since the OPEC repricing is due at least in part to the end of that cheap energy.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Surplus Energy Economics Blog

Pops wrote:The thesis of the thread is that the unprecedented and widespread prosperity and technological advance seen in the previous century were due to cheap energy of the $20/bbl (real) variety and negative growth and increasing debt since the OPEC repricing is due at least in part to the end of that cheap energy.

When you look at oil prices on an inflation-adjusted basis, the recent price of oil has been way below average, and the recent run up in oil prices has only taken it up to about the average price of oil over the last 50 years. Yes, there was a big spike in oil prices in 2008-9 when it hit ca. $175 bbl (inflation adjusted to 2021 dollars), but then the price of oil plunged to near record low. Over the last 50 years there is no real trend of increasing prices when you adjust everything for inflation.

crude-oil-price-history-chart

So what is the source of all the debt and slow economic growth? Look at the federal budget.....the record debt in Biden's budget is caused by a vast explosion of social welfare and entitlement spending......and the same thing has been going on for decades.

Oil is really a pretty small part of the economy. Its appears that when we get a huge surge in oil prices that it causes recessions, as happened during the Arab Oil embargo in the 1970s and again in 2008=9, but there doesn't seem to be a whole lot of correlation with the huge increases in debt or with the big decline in economic growth rates afflicting western economies.

M. King Hubbert was wrong---- everything isn't dependent on oil prices. Debt and growth rates are also affected by other things, including huge expansion of goverment social welfare spending

Cheers!

Never underestimate the ability of Joe Biden to f#@% things up---Barack Obama

-----------------------------------------------------------

Keep running between the raindrops.

-----------------------------------------------------------

Keep running between the raindrops.

-

Plantagenet - Expert

- Posts: 26619

- Joined: Mon 09 Apr 2007, 03:00:00

- Location: Alaska (its much bigger than Texas).

Re: Surplus Energy Economics Blog

Pops wrote:Outcast_Searcher wrote:If person A buys a house or a car, it doesn't change the GDP, whether the money is borrowed or not. It's the production of the house or car that is measured in the GDP.

LOL, how many houses or cars would be produced without borrowing?

So what? That doesn't change the definition of GDP. Throwing out strawmen doesn't clarify anything.

And in modern economies, the vast majority of folks are SHORT TERM thinkers, and thus couldn't buy a house or a car without borrowing. That doesn't change GDP's calculation either.

Given the track record of the perma-doomer blogs, I wouldn't bet a fast crash doomer's money on their predictions.

-

Outcast_Searcher - COB

- Posts: 10142

- Joined: Sat 27 Jun 2009, 21:26:42

- Location: Central KY

Re: Surplus Energy Economics Blog

Outcast_Searcher wrote:So what? That doesn't change the definition of GDP. Throwing out strawmen doesn't clarify anything

Where is the strawman? You brought up the "definition of GDP" as some sort of refutation of the premise, I merely showed how silly your argument.

The definition of GDP is irrelevant, it measures the same thing today as it did in 1960. Any change in GDP definition has only made it appear larger.

The fact remains that prior to 1985 or so GDP grew faster than debit. Since then debt has grown faster than GDP.

How about addressing the point rather than your typical ad homs?

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Surplus Energy Economics Blog

Pops wrote:Outcast_Searcher wrote:So what? That doesn't change the definition of GDP. Throwing out strawmen doesn't clarify anything

Where is the strawman? You brought up the "definition of GDP" as some sort of refutation of the premise, I merely showed how silly your argument.

The definition of GDP is irrelevant, it measures the same thing today as it did in 1960. Any change in GDP definition has only made it appear larger.

The fact remains that prior to 1985 or so GDP grew faster than debit. Since then debt has grown faster than GDP.

How about addressing the point rather than your typical ad homs?

If that's the way you're going to characterize things, I don't know how to help you.

If someone disagreeing with you is an "ad hom", seriously, get a grip.

Given the track record of the perma-doomer blogs, I wouldn't bet a fast crash doomer's money on their predictions.

-

Outcast_Searcher - COB

- Posts: 10142

- Joined: Sat 27 Jun 2009, 21:26:42

- Location: Central KY

Re: Surplus Energy Economics Blog

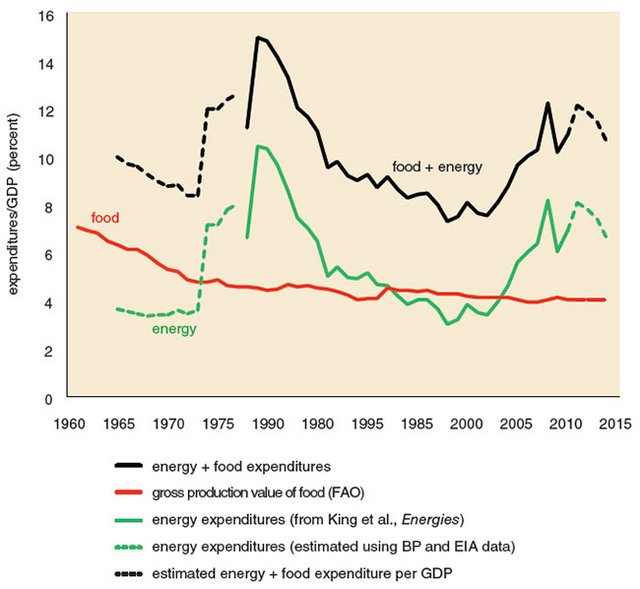

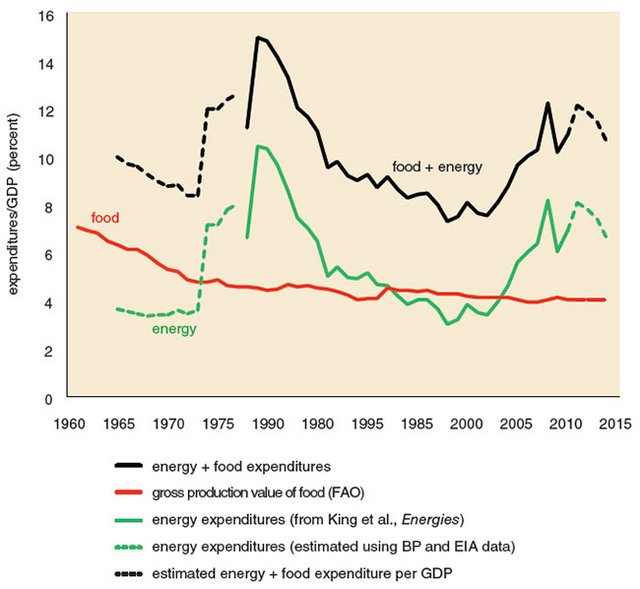

I've been doing a little light reading on energy cost vs GDP.

Charles Hall and Mike Aucott (2014) came up with 4% —energy cost a percentage of GDP— below which growth is robust and above which growth slows.

from their conclusion

If 4% is the line then we have been in a world of hurt since OPEC.

Here from the EIA (2018)

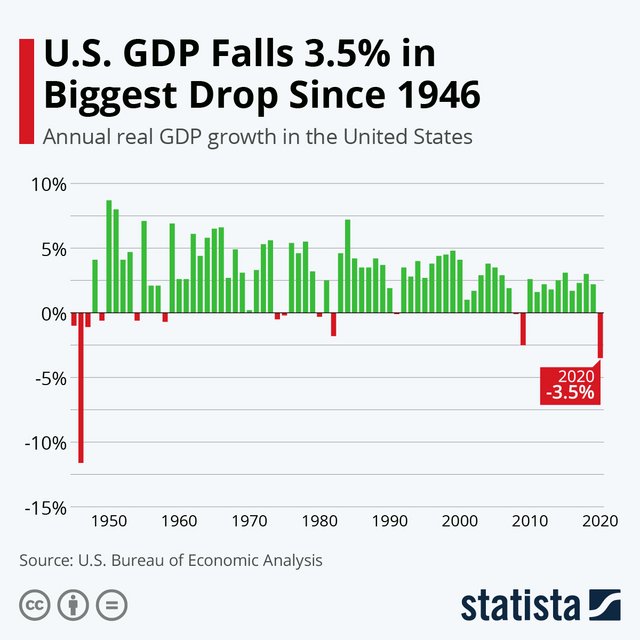

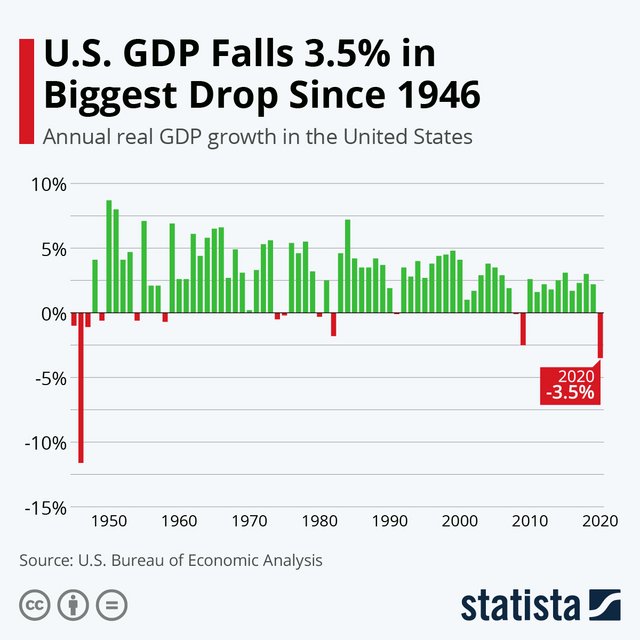

But even if the line is higher, say, 6% as it has been since 2000, the affect on GDP —outside the Banker's Bubble of the Oughties— has been fairly obvious. (ignore the headline here, look at growth since 2000 compared to last century)

(Statista 2021)

Others, like Bashmakov, I. (2007), and Fizan & Court (2016) Estimate the percentage of GDP spent on energy can be as high 11% and still have growth.

(ca 2010)

But the word invented to describe the period in the '70 above 6% or so energy expense was: Stagflation, not such a sweet word. And the period 2005-2015 was only not a depression because of massive influx of government borrowing.

I really like this idea. the energy cost, the GDP softening, the government borrowing binge... they all seem to correlate in my little brain.

Charles Hall and Mike Aucott (2014) came up with 4% —energy cost a percentage of GDP— below which growth is robust and above which growth slows.

from their conclusion

During earlier periods of consistent prosperity, the percentage was in the range of 3% or less. We compared these percent data with the year-over-year percent change in the gross domestic product. We found that these variables are correlated inversely and significantly.

If 4% is the line then we have been in a world of hurt since OPEC.

Here from the EIA (2018)

U.S. energy expenditures declined for the fifth consecutive year, reaching $1.0 trillion in 2016, a 9% decrease in real terms from 2015. Adjusted for inflation, total energy expenditures in 2016 were the lowest since 2003. Expressed as a percent of gross domestic product (GDP), total energy expenditures were 5.6% in 2016, the lowest since at least 1970.

But even if the line is higher, say, 6% as it has been since 2000, the affect on GDP —outside the Banker's Bubble of the Oughties— has been fairly obvious. (ignore the headline here, look at growth since 2000 compared to last century)

(Statista 2021)

Others, like Bashmakov, I. (2007), and Fizan & Court (2016) Estimate the percentage of GDP spent on energy can be as high 11% and still have growth.

(ca 2010)

But the word invented to describe the period in the '70 above 6% or so energy expense was: Stagflation, not such a sweet word. And the period 2005-2015 was only not a depression because of massive influx of government borrowing.

I really like this idea. the energy cost, the GDP softening, the government borrowing binge... they all seem to correlate in my little brain.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Surplus Energy Economics Blog

Pops wrote:I've been doing a little light reading on energy cost vs GDP.

Charles Hall and Mike Aucott (2014) came up with 4% —energy cost a percentage of GDP— below which growth is robust and above which growth slows.

from their conclusionDuring earlier periods of consistent prosperity, the percentage was in the range of 3% or less. We compared these percent data with the year-over-year percent change in the gross domestic product. We found that these variables are correlated inversely and significantly.

If 4% is the line then we have been in a world of hurt since OPEC.

Here from the EIA (2018)U.S. energy expenditures declined for the fifth consecutive year, reaching $1.0 trillion in 2016, a 9% decrease in real terms from 2015. Adjusted for inflation, total energy expenditures in 2016 were the lowest since 2003. Expressed as a percent of gross domestic product (GDP), total energy expenditures were 5.6% in 2016, the lowest since at least 1970.

But even if the line is higher, say, 6% as it has been since 2000, the affect on GDP —outside the Banker's Bubble of the Oughties— has been fairly obvious. (ignore the headline here, look at growth since 2000 compared to last century)

(Statista 2021)

Others, like Bashmakov, I. (2007), and Fizan & Court (2016) Estimate the percentage of GDP spent on energy can be as high 11% and still have growth.

(ca 2010)

But the word invented to describe the period in the '70 above 6% or so energy expense was: Stagflation, not such a sweet word. And the period 2005-2015 was only not a depression because of massive influx of government borrowing.

I really like this idea. the energy cost, the GDP softening, the government borrowing binge... they all seem to correlate in my little brain.

When in the real world, GDP is growing faster than inflation claiming a big slump in GDP isn't credible (re real GDP being positive), why should we believe what you post on this subject?

https://www.bea.gov/data/gdp/gross-domestic-product

https://www.usinflationcalculator.com/i ... ion-rates/

Because you have been getting emotional recently, perhaps? That's not at all a good criteria, BTW.

Given the track record of the perma-doomer blogs, I wouldn't bet a fast crash doomer's money on their predictions.

-

Outcast_Searcher - COB

- Posts: 10142

- Joined: Sat 27 Jun 2009, 21:26:42

- Location: Central KY

Re: Surplus Energy Economics Blog

Outcast_Searcher wrote:[Because you have been getting emotional recently, perhaps? That's not at all a good criteria, BTW.

So all you have is ad hom?

Of course I've never claimed that the GDP number itself was negative, the idea is that GDP minus all the government, private, corporate debt used to prop up the GDP is a negative number. And part of the reason is that a cost of energy higher than a mere few percent of GDP is too high for growth like the good olde days— though there are certainly other limits being reached as well.

So aside from ad hom you did manage to misstate the premise in order to attack it, what is that called again?

Such a waste of time. So off you go to the ignore list with StarvingLion and all the other misfit toys, ta ta.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Surplus Energy Economics Blog

Pops wrote:Outcast_Searcher wrote:[Because you have been getting emotional recently, perhaps? That's not at all a good criteria, BTW.

So all you have is ad hom?

Of course I've never claimed that the GDP number itself was negative, the idea is that GDP minus all the government, private, corporate debt used to prop up the GDP is a negative number. And part of the reason is that a cost of energy higher than a mere few percent of GDP is too high for growth like the good olde days— though there are certainly other limits being reached as well.

So aside from ad hom you did manage to misstate the premise in order to attack it, what is that called again?

Such a waste of time. So off you go to the ignore list with StarvingLion and all the other misfit toys, ta ta.

So if all you have is my pointing out you're getting emotional is to call it "ad hom" multiple times, why not come up with a better argument?

But if putting me on your ignore list lets you say "I win" in some politically correct way in your own mind, have fun with that.

You must be right, if your feelings are hurt, as the politically correct left wing, which you generally hew to, says so.

Given the track record of the perma-doomer blogs, I wouldn't bet a fast crash doomer's money on their predictions.

-

Outcast_Searcher - COB

- Posts: 10142

- Joined: Sat 27 Jun 2009, 21:26:42

- Location: Central KY

Re: Surplus Energy Economics Blog

So I've been reading more of the blog mentioned in the title and the blogger repeatedly mentions Energy Cost of Energy, which is the same thing as EROI except that investment is expressed as a fraction of total energy produced rather than a ratio of energy produced per unit investment—if I have that right.

I was confused with his pronouncements that this energy cost was great in 1949 at 1%, OK in 1990 when at 2.9% but is now much higher at 12% and causing trouble.

The energy expended in refining alone is between 10% and 15%, and has gotten better over time. Refining LTO would seem less intensive than heavier crudes simply because the percentage light fractions requires less heat to distill—but that is just a guess.

So I asked in the comments where I might go to marvel over his "model" and recieved no direct response. I noticed another similar question and someone, apparently a regular reader, responded that "Dr. Tim" "has not revealed his exact methodology for calculating ECoE".

So there you go, no sign of a "report" for sale tho, LOL

I assume if he's looking at anything it is energy portion of GDP as Hall etc reported in the paper I linked earlier. Also in that quote was the paper of Fizaine / Court (2016) that indicated a energy share of GDP of 11% as a cut off point.

Hard to know what the effective energy share of GDP is though isn't it? In 2018 for example, the US spent a total of $1.3 Trillion on energy, or 6.3% of GDP of roughly $20 trillion. But in the same year, fiscal 2018 the federal government injected into the economy $1.2 Trillion, consumers borrowed another half a Trillion, and corporations borrowed another half trillion. All of which increased GDP to one extent or another.

https://www.thebalance.com/national-deb ... ts-3306287

https://www.spglobal.com/en/research-in ... ay-in-2019

http://css.umich.edu/factsheets/us-ener ... -factsheet

I was confused with his pronouncements that this energy cost was great in 1949 at 1%, OK in 1990 when at 2.9% but is now much higher at 12% and causing trouble.

The energy expended in refining alone is between 10% and 15%, and has gotten better over time. Refining LTO would seem less intensive than heavier crudes simply because the percentage light fractions requires less heat to distill—but that is just a guess.

So I asked in the comments where I might go to marvel over his "model" and recieved no direct response. I noticed another similar question and someone, apparently a regular reader, responded that "Dr. Tim" "has not revealed his exact methodology for calculating ECoE".

So there you go, no sign of a "report" for sale tho, LOL

I assume if he's looking at anything it is energy portion of GDP as Hall etc reported in the paper I linked earlier. Also in that quote was the paper of Fizaine / Court (2016) that indicated a energy share of GDP of 11% as a cut off point.

Hard to know what the effective energy share of GDP is though isn't it? In 2018 for example, the US spent a total of $1.3 Trillion on energy, or 6.3% of GDP of roughly $20 trillion. But in the same year, fiscal 2018 the federal government injected into the economy $1.2 Trillion, consumers borrowed another half a Trillion, and corporations borrowed another half trillion. All of which increased GDP to one extent or another.

https://www.thebalance.com/national-deb ... ts-3306287

https://www.spglobal.com/en/research-in ... ay-in-2019

http://css.umich.edu/factsheets/us-ener ... -factsheet

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Surplus Energy Economics Blog

Reading a different blog this morning, UK-centric The Consciousness of Sheep. The author is an economist but surprisingly doesn't subscribe to the typical economist's dismissal of energy as merely another input to production.

The post I was reading Seeing the harness but not the horse concerned itself with surplus energy and equated 2 of the 3 great industrial revolutions as actually surplus energy revolutions. The first, coal, ushered in economic growth where there had never been much before and began displacing human and horsepower through steam then electricity. The second, oil, eliminated horsepower with ICEs, highways cheap transport. But unfortunately the 3rd revolution, computerization, didn't provide a great leap in surplus, cheap energy. Only an increase in productivity—and we all know where that goes.

But this passage really struck me,

The post I was reading Seeing the harness but not the horse concerned itself with surplus energy and equated 2 of the 3 great industrial revolutions as actually surplus energy revolutions. The first, coal, ushered in economic growth where there had never been much before and began displacing human and horsepower through steam then electricity. The second, oil, eliminated horsepower with ICEs, highways cheap transport. But unfortunately the 3rd revolution, computerization, didn't provide a great leap in surplus, cheap energy. Only an increase in productivity—and we all know where that goes.

But this passage really struck me,

Marx’s economics is all the more disappointing because he came so close; but still ended up dangerously removed from how an economy really works. What Marx got right is that there must be some input to the productive process which is paid less than the value it generates in order for profit to be extracted. Unfortunately, Marx’s political outlook – together with an unhealthy fixation on a simplistic version of Darwin’s evolution – pushed him into the belief that that input was “socially necessary” labour power; a concept he had refined from David Ricardo.

...Marx would have been wrong to view the machinery as the source of value. What he – and generations of economists down the years – missed was something so obvious that it went unnoticed. If, as Marx correctly reasoned, there was some input to production that cost far less than the value it provided, would that input not be one of the cheapest? Both capital and labour are expensive. Coal, on the other hand, was relatively cheap.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

33 posts

• Page 2 of 2 • 1, 2

Return to Peak oil studies, reports & models

Who is online

Users browsing this forum: No registered users and 61 guests