Saudi America Will Overtake Saudi Arabia As Top producer

Re: Saudi America Will Overtake Saudi Arabia As Top producer

Yeah SG is right Rockman. You're getting all complicated with this "Production will be X if Price is Y" stuff. Those kind of predictions are complicated. And boring too. In this day and age, we are overstimulated and have attention spans the size of a gnat. You have to be bold to capture our attention for more than a millisecond. Something like:

"Production in 5 years will be SHIT! The Economy will tank! Your Job? Gone!! Your House? Foreclosed! Your Car? Repoed! Your Wife? Mine Now! HAHAHAHA!!!"

"Production in 5 years will be SHIT! The Economy will tank! Your Job? Gone!! Your House? Foreclosed! Your Car? Repoed! Your Wife? Mine Now! HAHAHAHA!!!"

The oil barrel is half-full.

-

kublikhan - Master Prognosticator

- Posts: 5023

- Joined: Tue 06 Nov 2007, 04:00:00

- Location: Illinois

Re: Saudi America Will Overtake Saudi Arabia As Top producer

agramante wrote:The Hubbert linearization has been found to be unreliable too--by the time it becomes very accurate, you're so far past peak it almost isn't useful any more.

Deffeyes, using HL, predicted a global Crude + Condensate (C+C) peak between 2004 and 2008, most likely in 2005. Although he erroneously observed that we may have peaked earlier, he never backed away from what his model predicted, to-wit, a peak between 2004 and 2008.

While we have not yet seen a material decline yet in global C+C production, Deffeyes clearly nailed a major inflection point in global C+C production.

From 2002 to 2005, as global crude annual (Brent) crude oil prices doubled from $25 in 2002 to $55 in 2005, global C+C production increased at 3.0%/year (EIA).

From 2005 to 2012, as global annual crude oil prices doubled again, from $55 in 2005 to $112 in 2012, global C+C production increased at only 0.4%/year.

Furthermore, if we back out condensate, which is a byproduct of natural gas production, actual crude oil production (less than 45 API gravity crude), i.e., has probably not shown any material increase in global production for seven years.

In the same time frame that Deffeyes was predicting a global peak, Yergin was predicting a continued 3%/year rate of increase in production, presumably to infinity and beyond.

At a 3%/year rate of increase, global C+C production would have been at about 91 mbpd in 2012, versus the actual value of 75.6, a gap of about 15 mbpd.

- westexas

- Expert

- Posts: 248

- Joined: Tue 04 Jun 2013, 06:59:53

Re: Saudi America Will Overtake Saudi Arabia As Top producer

John - One option is to change the price assumptions. If you've read enough of my posts I don't consider such models are predictive tools. How well any model predicts a future outcome depends upon the correctness of the assumptions made. But they can be very useful in indicating what assumptions in the model are the most sensitive. That allows a much better indication of error potential. For instance if the EIA varied the decline rate of existing fields from one reasonable extreme to the other reasonable extreme. I suspect we would not find a very big significant change in the future production forecast. Probably similar results if you vary the future cost of drilling shale wells.

OTOH vary the price assumptions by 30% (IOW $60 to $120) in either direction and I suspect you’ll see a rather significant change in their future projection of production rates. No one can prove or disprove the EIA price model is correct. One might agree or disagree with it but that’s not proof. I’ve used geologic, engineer and economic models for 38 years to help me decide what to drill and not drill. And not once did any single model result determine whether I drill or not. But they do an excellent job of highlighting the critical risk factors. IOW what aspects require more diligence.

So…do you agree or disagree with the EIA price model? IOW do you think their prediction of future oil production rates is correct?

To answer your question I would present the range of outcomes created by varying the critical factors such as price assumption. Granted that wouldn't necessarily create a single number some folks might take comfort in. But, then again, I ain't their freakin' momma whose sole goal in life is to make them feel good by telling them there's no monster under the bed. LOL.

OTOH vary the price assumptions by 30% (IOW $60 to $120) in either direction and I suspect you’ll see a rather significant change in their future projection of production rates. No one can prove or disprove the EIA price model is correct. One might agree or disagree with it but that’s not proof. I’ve used geologic, engineer and economic models for 38 years to help me decide what to drill and not drill. And not once did any single model result determine whether I drill or not. But they do an excellent job of highlighting the critical risk factors. IOW what aspects require more diligence.

So…do you agree or disagree with the EIA price model? IOW do you think their prediction of future oil production rates is correct?

To answer your question I would present the range of outcomes created by varying the critical factors such as price assumption. Granted that wouldn't necessarily create a single number some folks might take comfort in. But, then again, I ain't their freakin' momma whose sole goal in life is to make them feel good by telling them there's no monster under the bed. LOL.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: Saudi America Will Overtake Saudi Arabia As Top producer

kublikhan wrote:Yeah SG is right Rockman. You're getting all complicated with this "Production will be X if Price is Y" stuff. Those kind of predictions are complicated. And boring too.

And form the basic component of economic theory. Damned if we want THAT sneaking into the bathhouse with the rest of us!

45ACP: For when you want to send the very best.

- John_A

- Heavy Crude

- Posts: 1193

- Joined: Sat 25 Jun 2011, 21:16:36

Re: Saudi America Will Overtake Saudi Arabia As Top producer

westexas wrote:In the same time frame that Deffeyes was predicting a global peak, Yergin was predicting a continued 3%/year rate of increase in production, presumably to infinity and beyond.

What is the fascination with Yergin? Claiming that some public policy book writing geek has anything near the geologic acumen of Deffeyes strikes me as extremely insulting to Deffeyes?

I'll give Deffeyes best right out of the box. Yergin writes a mean history book but that doesn't have much to do with using what method to predict what time series data.

How long of a plateau did Deffeyes say we would be in for?

45ACP: For when you want to send the very best.

- John_A

- Heavy Crude

- Posts: 1193

- Joined: Sat 25 Jun 2011, 21:16:36

Harvard Study: US to be #1 Producer of Oil at 16 MBPD in 17'

http://nextbigfuture.com/2013/07/harvar ... study.html

In a paper titled “The Shale Oil Boom: A U.S. Phenomenon,” [64 pages] Maugeri wrote that the unique characteristics of shale oil production are ideal for the United States -- and unlikely to be mirrored elsewhere in the world. These factors include the availability of drilling rigs, and the entrepreneurial nature of the American exploration and production industry, both critical for the thousands of wells required for shale oil exploitation.

Maugeri, author of a 2012 report forecasting rapid growth of global oil production and belying the notion that oil output has “peaked,” argues in his new paper that the boom in U.S. shale oil production is central to the overall U.S. oil surge. If oil prices remain close to today’s levels, total U.S. production of all forms of oil [all liquids includes natural gas liquids and ethanol] could grow from 11.3 million barrels per day to 16 million barrels per day by 2017.

"The human ability to innovate out of a jam is profound.That’s why Darwin will always be right, and Malthus will always be wrong.” -K.R. Sridhar

Do I make you Corny?

"expect 8$ gas on 08/08/08" - Prognosticator

Do I make you Corny?

"expect 8$ gas on 08/08/08" - Prognosticator

-

TheAntiDoomer - Heavy Crude

- Posts: 1556

- Joined: Wed 18 Jun 2008, 03:00:00

Re: Saudi America Will Overtake Saudi Arabia As Top producer

ROCKMAN wrote:John - One option is to change the price assumptions. If you've read enough of my posts I don't consider such models are predictive tools.

Well come on then, give us what you think IS a predictive tool! The suspense is killing me! I want to walk up to whoever is proclaiming the "US IS INDEPENDENT! US IS SAUD ARABIA!" and slap them upside the head and say " Yo! Fool! THIS is what you should be doing!"

Rockman wrote:How well any model predicts a future outcome depends upon the correctness of the assumptions made. But they can be very useful in indicating what assumptions in the model are the most sensitive. That allows a much better indication of error potential. For instance if the EIA varied the decline rate of existing fields from one reasonable extreme to the other reasonable extreme. I suspect we would not find a very big significant change in the future production forecast. Probably similar results if you vary the future cost of drilling shale wells.

Considering how well they are hitting on all the other things people require of their oil models, do you think there is a chance they have already done this, or do you know that they have..or haven't? Seems like a perfectly good idea, sensitivity analysis.

Rockman wrote:So…do you agree or disagree with the EIA price model? IOW do you think their prediction of future oil production rates is correct?

I don't think anyone can predict oil prices. Them, you, me, I think the entire game is a fools errand with as much chance of success as calling the stock market numbers next week.

Rockman wrote:To answer your question I would present the range of outcomes created by varying the critical factors such as price assumption. Granted that wouldn't necessarily create a single number some folks might take comfort in. But, then again, I ain't their freakin' momma whose sole goal in life is to make them feel good by telling them there's no monster under the bed. LOL.

Nope. Your job is to get that oil and gas out of the ground and make darn sure that the pension funds invested in your business keep bringing in those returns so us not quite yet retired types can move to Florida in style when the time comes!

45ACP: For when you want to send the very best.

- John_A

- Heavy Crude

- Posts: 1193

- Joined: Sat 25 Jun 2011, 21:16:36

Re: Harvard Study: US to be #1 Producer of Oil at 16 MBPD in

There is already a thread on just this study someplace else. The guy has been lambasted pretty well for math errors too, using him to defend corny ideas goes into the same poor quality bin as using Ruppert to defend peak oil ideas.

45ACP: For when you want to send the very best.

- John_A

- Heavy Crude

- Posts: 1193

- Joined: Sat 25 Jun 2011, 21:16:36

Re: Saudi America Will Overtake Saudi Arabia As Top producer

Yeah I was making a little jokeJohn_A wrote:And form the basic component of economic theory. Damned if we want THAT sneaking into the bathhouse with the rest of us!

Rockman nailed it when he said we want a single feel good number to comfort us.

Rockman nailed it when he said we want a single feel good number to comfort us.Yeah I agree predictions are very tough. That's one reason I don't rag on people when their predictions don't happen. What did people expect, they had a crystal ball and could predict the future?John_A wrote:I don't think anyone can predict oil prices. Them, you, me, I think the entire game is a fools errand with as much chance of success as calling the stock market numbers next week.

The oil barrel is half-full.

-

kublikhan - Master Prognosticator

- Posts: 5023

- Joined: Tue 06 Nov 2007, 04:00:00

- Location: Illinois

Re: Saudi America Will Overtake Saudi Arabia As Top producer

kublikhan wrote:Yeah I agree predictions are very tough. That's one reason I don't rag on people when their predictions don't happen. What did people expect, they had a crystal ball and could predict the future?John_A wrote:I don't think anyone can predict oil prices. Them, you, me, I think the entire game is a fools errand with as much chance of success as calling the stock market numbers next week.

People like the comfort of their one number, off in the future there somewhere, issued by an authority figure or another. And are so upset when they realize they've been fooled, but it was them demanding it.

45ACP: For when you want to send the very best.

- John_A

- Heavy Crude

- Posts: 1193

- Joined: Sat 25 Jun 2011, 21:16:36

Re: Saudi America Will Overtake Saudi Arabia As Top producer

John – “…give us what you think IS a predictive tool” + “I don't think anyone can predict oil prices” = no predictive tool. See…you answered your own question. One is free to guess what future oil prices might be but no one can offer such predictions as fact.

My job? Remember the premise of the question: my job is that of Supreme Leader of the IEA. I would not be a kind and coddling ruler. I would beat the crap out of the public weekly with “tough love”. Unlike Jack I wouldn’t care if the public can’t handle the truth. I’m not their momma…I’m their living god. LOL

My job? Remember the premise of the question: my job is that of Supreme Leader of the IEA. I would not be a kind and coddling ruler. I would beat the crap out of the public weekly with “tough love”. Unlike Jack I wouldn’t care if the public can’t handle the truth. I’m not their momma…I’m their living god. LOL

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: Saudi America Will Overtake Saudi Arabia As Top producer

ROCKMAN wrote:John – “…give us what you think IS a predictive tool” + “I don't think anyone can predict oil prices” = no predictive tool. See…you answered your own question. One is free to guess what future oil prices might be but no one can offer such predictions as fact.

I don't think anyone does. The people who do this for a living, including those using many of the ideas you have expressed, are quite careful to explain that in their CYA writeups.

Rockman wrote:My job? Remember the premise of the question: my job is that of Supreme Leader of the IEA. I would not be a kind and coddling ruler. I would beat the crap out of the public weekly with “tough love”. Unlike Jack I wouldn’t care if the public can’t handle the truth. I’m not their momma…I’m their living god. LOL

I wonder how Tyrant ROCK at IEA would work, everything I've ever seen Fatih do or say sure looks like nice, gentle, pappa bear kind of pablum.

45ACP: For when you want to send the very best.

- John_A

- Heavy Crude

- Posts: 1193

- Joined: Sat 25 Jun 2011, 21:16:36

Re: Harvard Study: US to be #1 Producer of Oil at 16 MBPD in

It's on 'Saudi America' thread. It doesn't matter if your the biggest producer if you burn all that and a hell of a lot more. (Besides the flash in the pan aspect of this).

- SeaGypsy

- Master Prognosticator

- Posts: 9284

- Joined: Wed 04 Feb 2009, 04:00:00

Re: Saudi America Will Overtake Saudi Arabia As Top producer

Probably a lot like modeling how a spider's web will cope with a hailstorm. In the end all we can do is watch, if we care enough.

Seems to me TPTB are dead keen to keep the price where NA tight plays are still feasible. Call this what you will, but I suspect the destabilization of the middle east could be as much about NA & Russia as ELM bearing down (like the bear- )

Seems to me TPTB are dead keen to keep the price where NA tight plays are still feasible. Call this what you will, but I suspect the destabilization of the middle east could be as much about NA & Russia as ELM bearing down (like the bear- )

- SeaGypsy

- Master Prognosticator

- Posts: 9284

- Joined: Wed 04 Feb 2009, 04:00:00

Re: Saudi America Will Overtake Saudi Arabia As Top producer

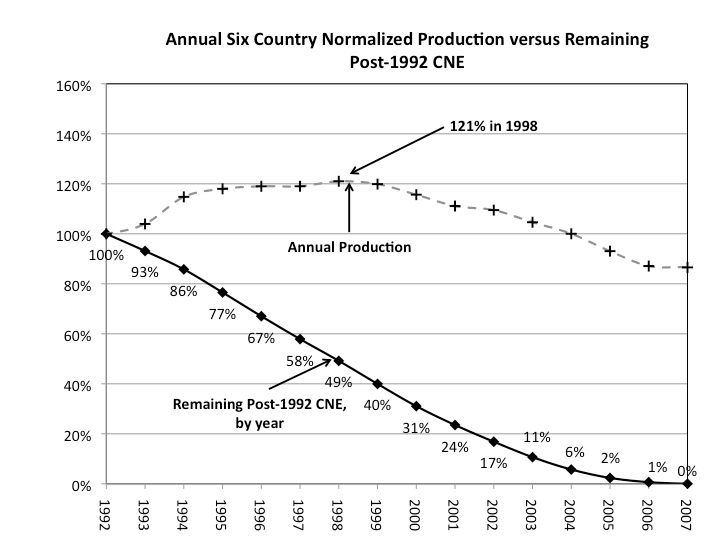

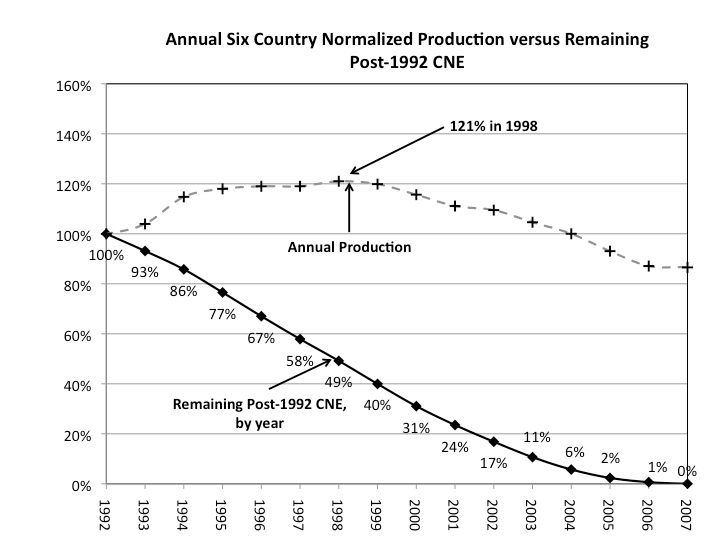

Good News & Bad News Regarding Production Increases Vs. CNE Depletion, Re: Six Country Case History

Definitions:

CNE = Cumulative Net Exports (Total Petroleum Liquids, BP Data Base)

Six Country Case History: Six major net oil exporters that have hit, or approached, zero net oil exports

(UK, Indonesia, Egypt, Vietnam, Argentina, Malaysia)

Good News: Production increased by 21% from 1992 to 1998 (3.2%/year)

Bad News: The six year post-1992 CNE depletion rate was 12%/year.

Definitions:

CNE = Cumulative Net Exports (Total Petroleum Liquids, BP Data Base)

Six Country Case History: Six major net oil exporters that have hit, or approached, zero net oil exports

(UK, Indonesia, Egypt, Vietnam, Argentina, Malaysia)

Good News: Production increased by 21% from 1992 to 1998 (3.2%/year)

Bad News: The six year post-1992 CNE depletion rate was 12%/year.

- westexas

- Expert

- Posts: 248

- Joined: Tue 04 Jun 2013, 06:59:53

Re: Saudi America Will Overtake Saudi Arabia As Top producer

Every once in a while I ask and given its relevance to this thread I will ask here.

Does anyone have an up to date list of oil producing countries showing when each of them hit peak (for those which have passed peak)?

Does anyone have an up to date list of what countries are still exporting in excess of 100,000 bbl/d of crude oil or distillate products?

I ask for the first list at least once a year because I think it will show the trend of how much of the world is still producing greater volumes compared to those producing less in spite of high prices.

Does anyone have an up to date list of oil producing countries showing when each of them hit peak (for those which have passed peak)?

Does anyone have an up to date list of what countries are still exporting in excess of 100,000 bbl/d of crude oil or distillate products?

I ask for the first list at least once a year because I think it will show the trend of how much of the world is still producing greater volumes compared to those producing less in spite of high prices.

Alfred Tennyson wrote:We are not now that strength which in old days

Moved earth and heaven, that which we are, we are;

One equal temper of heroic hearts,

Made weak by time and fate, but strong in will

To strive, to seek, to find, and not to yield.

-

Tanada - Site Admin

- Posts: 17056

- Joined: Thu 28 Apr 2005, 03:00:00

- Location: South West shore Lake Erie, OH, USA

Re: Saudi America Will Overtake Saudi Arabia As Top producer

Re: Tanada

EIA Production Data* for 2002 to 2012: http://www.eia.gov/cfapps/ipdbproject/i ... &unit=TBPD

EIA Consumption Data for 2002 to 2012: http://www.eia.gov/cfapps/ipdbproject/i ... &unit=TBPD

*Total petroleum liquids + other liquids (primarily biofuels, not really a factor for the net oil exporters)

If you shoot me an email, I can send you data files, with 2002 to 2012 data, for the (2005) Top three net exporters, (2005) Top five net exporters, (2005) Top 33 net exporters, for Chindia and for the (2004) Seven major net exporters in the Americas (all based on above EIA data tables). The ECI ratio is the ratio of the above production numbers to the consumption numbers. I define GNE (Global Net Exports) as the combined net exports from the (2005) Top 33 net exporters. CNI = Chindia's Net Imports.

2005 to 2012 ECI data:

Top Three: 4.7 to 3.7

Top Five: 4.4 to 3.5

Top 33: 3.7 to 3.2

At an ECI ratio of 1.0, production = consumption and net exports = zero.

2005 to 2012 GNE/CNI data:

9.5 to 5.0

At a GNE/CNI ratio of 1.0, China & India would theoretically consume 100% of the combined net oil exports from the Top 33 net exporters in 2005.

The above Six Country case history slide is taken from the following paper (which only has data through 2011):

http://peak-oil.org/2013/02/commentary- ... ity-index/

A key point that almost everyone is missing is what I estimate to be huge rates of depletion in Global post-2005 CNE (post-2005 Cumulative Net Exports from top 33 net exporters) and in Available CNE (Global CNE available to importers other than China & India).

westexas At aol dot com

EIA Production Data* for 2002 to 2012: http://www.eia.gov/cfapps/ipdbproject/i ... &unit=TBPD

EIA Consumption Data for 2002 to 2012: http://www.eia.gov/cfapps/ipdbproject/i ... &unit=TBPD

*Total petroleum liquids + other liquids (primarily biofuels, not really a factor for the net oil exporters)

If you shoot me an email, I can send you data files, with 2002 to 2012 data, for the (2005) Top three net exporters, (2005) Top five net exporters, (2005) Top 33 net exporters, for Chindia and for the (2004) Seven major net exporters in the Americas (all based on above EIA data tables). The ECI ratio is the ratio of the above production numbers to the consumption numbers. I define GNE (Global Net Exports) as the combined net exports from the (2005) Top 33 net exporters. CNI = Chindia's Net Imports.

2005 to 2012 ECI data:

Top Three: 4.7 to 3.7

Top Five: 4.4 to 3.5

Top 33: 3.7 to 3.2

At an ECI ratio of 1.0, production = consumption and net exports = zero.

2005 to 2012 GNE/CNI data:

9.5 to 5.0

At a GNE/CNI ratio of 1.0, China & India would theoretically consume 100% of the combined net oil exports from the Top 33 net exporters in 2005.

The above Six Country case history slide is taken from the following paper (which only has data through 2011):

http://peak-oil.org/2013/02/commentary- ... ity-index/

A key point that almost everyone is missing is what I estimate to be huge rates of depletion in Global post-2005 CNE (post-2005 Cumulative Net Exports from top 33 net exporters) and in Available CNE (Global CNE available to importers other than China & India).

westexas At aol dot com

- westexas

- Expert

- Posts: 248

- Joined: Tue 04 Jun 2013, 06:59:53

Re: Saudi America Will Overtake Saudi Arabia As Top producer

westexas--

You're undeniably the expert here. When I called Hubbert linearization unreliable, I was thinking of an old Oil Drum post by Robert Rapier:

http://www.theoildrum.com/node/2357

where he concludes that the method is shaky for predicting Qt, because peak production need not occur at precisely 50% of Qt. Which is one more reason why it's so difficult to predict what Saudi Arabia's Qt will be, for example.

You're undeniably the expert here. When I called Hubbert linearization unreliable, I was thinking of an old Oil Drum post by Robert Rapier:

http://www.theoildrum.com/node/2357

where he concludes that the method is shaky for predicting Qt, because peak production need not occur at precisely 50% of Qt. Which is one more reason why it's so difficult to predict what Saudi Arabia's Qt will be, for example.

- agramante

- Peat

- Posts: 131

- Joined: Fri 31 May 2013, 23:06:39

Re: Saudi America Will Overtake Saudi Arabia As Top producer

If Robert had modeled the Lower 48, instead of Texas, he would have found close agreement between a pre-1970 HL prediction and the actual Lower 48 peak, although the EUR estimate would be too low, because of the tight/shale plays.

I think that the strength of the HL method is that an assumption of a parabolic production curve tends to be a reasonably accurate assumption for modeling the rise, and inevitable subsequent decline, of the large conventional oil fields in a region.

So, while price driven intense drilling efforts in post-crude oil oil peak regions like the US may result in an "Undulating Decline" pattern in crude oil production, it seems unlikely that the 1970 annual US crude oil peak will be exceeded, but time will tell.

Bottom line in my opinion is that the HL method seems to be a reasonably accurate method for predicting major inflection points in production in most (but not all) regions. Using the HL method, in early 2006, in my first essay on the topic of net exports, when I introduced the ELM concept (and focused on the top three net exporters), I concluded that there was no way that global net exports could keep increasing at anything like the current rate. At the 2002 to 2005 rate of increase in combined net exports from the top three at the time (Saudi Arabia, Russia, and Norway), their combined net exports would have risen from 18.6 mbpd in 2005 to 29 mbpd in 2012. The actual value (EIA) in 2012 was 17.3. Saudi net exports have been below their 2005 rate for seven straight years. Russian net exports stopped increasing in 2007, and as expected Norway's net exports continued to decline.

I think that the strength of the HL method is that an assumption of a parabolic production curve tends to be a reasonably accurate assumption for modeling the rise, and inevitable subsequent decline, of the large conventional oil fields in a region.

So, while price driven intense drilling efforts in post-crude oil oil peak regions like the US may result in an "Undulating Decline" pattern in crude oil production, it seems unlikely that the 1970 annual US crude oil peak will be exceeded, but time will tell.

Bottom line in my opinion is that the HL method seems to be a reasonably accurate method for predicting major inflection points in production in most (but not all) regions. Using the HL method, in early 2006, in my first essay on the topic of net exports, when I introduced the ELM concept (and focused on the top three net exporters), I concluded that there was no way that global net exports could keep increasing at anything like the current rate. At the 2002 to 2005 rate of increase in combined net exports from the top three at the time (Saudi Arabia, Russia, and Norway), their combined net exports would have risen from 18.6 mbpd in 2005 to 29 mbpd in 2012. The actual value (EIA) in 2012 was 17.3. Saudi net exports have been below their 2005 rate for seven straight years. Russian net exports stopped increasing in 2007, and as expected Norway's net exports continued to decline.

- westexas

- Expert

- Posts: 248

- Joined: Tue 04 Jun 2013, 06:59:53

Re: Harvard Study: US to be #1 Producer of Oil at 16 MBPD in

TheAntiDoomer wrote:http://nextbigfuture.com/2013/07/harvard-has-new-us-shale-oil-study.htmlIn a paper titled “The Shale Oil Boom: A U.S. Phenomenon,” [64 pages] Maugeri wrote that the unique characteristics of shale oil production are ideal for the United States -- and unlikely to be mirrored elsewhere in the world. These factors include the availability of drilling rigs, and the entrepreneurial nature of the American exploration and production industry, both critical for the thousands of wells required for shale oil exploitation.

Maugeri, author of a 2012 report forecasting rapid growth of global oil production and belying the notion that oil output has “peaked,” argues in his new paper that the boom in U.S. shale oil production is central to the overall U.S. oil surge. If oil prices remain close to today’s levels, total U.S. production of all forms of oil [all liquids includes natural gas liquids and ethanol] could grow from 11.3 million barrels per day to 16 million barrels per day by 2017.

Reminds me of

http://www.davidstrahan.com/blog/?p=1570

http://www.davidstrahan.com/blog/?p=1576

-

ralfy - Light Sweet Crude

- Posts: 5600

- Joined: Sat 28 Mar 2009, 11:36:38

- Location: The Wasteland

Who is online

Users browsing this forum: No registered users and 235 guests