THE Electric Vehicle (EV) Thread pt 15

Re: THE Electric Vehicle (EV) Thread pt 15

Around 70 pct of human beings live on less than $10 daily and want to earn more. The other 30 pct are relying on them to earn and spend more because their own incomes and ROIs are dependent on increasing sales of goods and services.

To do that, costs for EVs have to drop to a tenth of their cost, energy returns have to rise to more than 15 to meet increasing resource and energy demand, and even higher to reverse diminishing returns.

To do that, costs for EVs have to drop to a tenth of their cost, energy returns have to rise to more than 15 to meet increasing resource and energy demand, and even higher to reverse diminishing returns.

-

ralfy - Light Sweet Crude

- Posts: 5600

- Joined: Sat 28 Mar 2009, 11:36:38

- Location: The Wasteland

Re: THE Electric Vehicle (EV) Thread pt 15

ralfy wrote:Around 70 pct of human beings live on less than $10 daily and want to earn more. The other 30 pct are relying on them to earn and spend more ...

You forgot to mention that the average debt per US citizen is $75,000. Savings per family, $11,000. So not only do they have collapsing incomes they have spent (wasted) several years of future savings into the bargain. I wonder how many new cars sold during the Great Depression? The only thing that saved the major car manufacturers was WWII when the government gave them lucrative contracts for tanks and all else. Somehow I don't see the battle fields of the future being populated by electric tanks

https://www.usdebtclock.org/

après moi le déluge

- theluckycountry

- Intermediate Crude

- Posts: 2326

- Joined: Tue 20 Jul 2021, 18:08:48

- Location: Australia

Re: THE Electric Vehicle (EV) Thread pt 15

theluckycountry wrote: Somehow I don't see the battle fields of the future being populated by electric tanks

Don't be so sure.....

The Russians recently sent troops into battle against the Ukrianians riding little electric golf carts

And the Chinese have developed a nifty little electric tank for their combat battalions.

Cheers!

Never underestimate the ability of Joe Biden to f#@% things up---Barack Obama

-----------------------------------------------------------

Keep running between the raindrops.

-----------------------------------------------------------

Keep running between the raindrops.

-

Plantagenet - Expert

- Posts: 26619

- Joined: Mon 09 Apr 2007, 03:00:00

- Location: Alaska (its much bigger than Texas).

Re: THE Electric Vehicle (EV) Thread pt 15

Boy I wish I had one of them when I was growing up, all I had was this

Mind you it went up and down the mountain trails all day on a tank of gas.

A kid up the road had one of these. Even cooler but you couldn't use it around the suburbs like mine. It was a beach toy.

Mind you it went up and down the mountain trails all day on a tank of gas.

A kid up the road had one of these. Even cooler but you couldn't use it around the suburbs like mine. It was a beach toy.

après moi le déluge

- theluckycountry

- Intermediate Crude

- Posts: 2326

- Joined: Tue 20 Jul 2021, 18:08:48

- Location: Australia

Re: THE Electric Vehicle (EV) Thread pt 15

https://www.businessinsider.com/electri ... ion-2024-1

Get away from me, reality!! You are biting!!

Kub, did you read this?

I was preaching this years ago already. At a time you were still arguing BIG EXPENSIVE LONG RANGE teslas being the answers to all our problems. I think it's time for you to adapt to reality, now.

https://www.businessinsider.com/ev-shop ... his-2024-3

EVs can be an important part of the fight against the climate crisis, but America's EV plan needs to lean into what these cars do well: short daily trips that can be taken in small, affordable cars.

Get away from me, reality!! You are biting!!

Kub, did you read this?

what these cars do well: short daily trips that can be taken in small, affordable cars

I was preaching this years ago already. At a time you were still arguing BIG EXPENSIVE LONG RANGE teslas being the answers to all our problems. I think it's time for you to adapt to reality, now.

https://www.businessinsider.com/ev-shop ... his-2024-3

Detroit finds itself selling big, expensive cars nobody really wants

- mousepad

- Tar Sands

- Posts: 814

- Joined: Thu 26 Sep 2019, 09:07:56

Re: THE Electric Vehicle (EV) Thread pt 15

mousepad wrote:Kub, did you read this?what these cars do well: short daily trips that can be taken in small, affordable cars

And nothing that can't be done cheaper with a hybrid or small gas car anyway. The whole EV car concept needs to be tossed in the bin just like the self-drive car concept has been. Electricity supply, that's the weak point. Gasoline supply has a very robust supply chain. It can suffer breakdowns all along it's length and still function normally as we have seen. When was the last time you couldn't get Gasoline? I have never in 60 years encountered a time I ran out, other than my own error to fill a tank. You see a hurricane coming, you fill up, if you're smart you fill up a couple of cans too. Let the power go out for a few days or a week or two, you're still on the road. Cyclones happen here all the time, and the odd tornado that knocked out power for a whole mountain of people, for a week and more! An EV? It becomes a driveway ornament.

https://www.youtube.com/watch?v=EBWlt3yqiCw

How do they clean up and get the power going again? Oil.

après moi le déluge

- theluckycountry

- Intermediate Crude

- Posts: 2326

- Joined: Tue 20 Jul 2021, 18:08:48

- Location: Australia

Re: THE Electric Vehicle (EV) Thread pt 15

How can you have an EV car revolution when you don't have EV makers?

Tesla Shares Plunge After Suffering First Q1 Delivery Decline Since 2020

Tesla shares are plunging heading into the cash open after the automaker reported Q1 deliveries and production that fell far below estimates. https://www.zerohedge.com/markets/tesla ... cline-2020

Sorry Adam_b, Sorry kub, PeakEV, come and gone, as predicted.

the-electric-vehicle-ev-thread-pt-14-t78588-480.html#p1493910

Now $166

Of course these are the prices after the 8x stock splits that were designed to hide the magnitude of the falls. Correcting for these shenanigans,

High- $3040

Current- $1300

Not a pretty picture is it. The price was actually lower in late 2022 but a rebound is normal after a massive collapse. Look at the rebound in the DOW after the 1929 collapse. Nothing goes straight up or straight down in the investment world.

Tesla Shares Plunge After Suffering First Q1 Delivery Decline Since 2020

Tesla shares are plunging heading into the cash open after the automaker reported Q1 deliveries and production that fell far below estimates. https://www.zerohedge.com/markets/tesla ... cline-2020

Sorry Adam_b, Sorry kub, PeakEV, come and gone, as predicted.

the-electric-vehicle-ev-thread-pt-14-t78588-480.html#p1493910

Peak EV, we have reached it boys and girls, the music has stopped and everyone is scrambling for the chairs, or the exits in this case. As always, the lowly consumer will be the big loser, from the aging ever depreciating golf cart in their driveway to the losses they experience in their pension from the ongoing collapse of the EV makers.

The TSLA share price peak was in Nov 2021 @ $380. Today the price per share is $230 and trending down. A 40% loss in a time of rampant inflation! Oh and Tesla is the bright spot in the EV complex, many have gone to zero.

Now $166

Of course these are the prices after the 8x stock splits that were designed to hide the magnitude of the falls. Correcting for these shenanigans,

High- $3040

Current- $1300

Not a pretty picture is it. The price was actually lower in late 2022 but a rebound is normal after a massive collapse. Look at the rebound in the DOW after the 1929 collapse. Nothing goes straight up or straight down in the investment world.

après moi le déluge

- theluckycountry

- Intermediate Crude

- Posts: 2326

- Joined: Tue 20 Jul 2021, 18:08:48

- Location: Australia

Re: THE Electric Vehicle (EV) Thread pt 15

As usual, you are making up BS. EV sales continue to break records:theluckycountry wrote:Sorry Adam_b, Sorry kub, PeakEV, come and gone, as predicted.

Americans Buy Nearly 1.2 Million Electric Vehicles to Hit Record in 2023, According to Latest Kelley Blue Book DataAs the shift toward an electrified future continues, a record-breaking nearly 1.2 million U.S. vehicle buyers chose to go electric last year. Electric vehicles (EVs) represent the fastest-growing car sales category, holding a 7.6% share of the total U.S. vehicle market in 2023, up from 5.9% in 2022.

Specifically, in Q4 2023, EV sales hit a record for both volume and market share, with sales reaching 52% higher than in the fourth quarter of 2022.

Car and Driver: EV Sales Are Just Getting StartedLast year, U.S. sales of EVs were the highest ever, both in sheer numbers and as a percentage of the overall new-car market. Global sales: ditto. The EV Sales Tracker from EVadoption estimates nearly 1.2 million battery-electric vehicles and another 190,000 plug-in hybrids were sold in 2023, totaling 1.36 million vehicles. That's 8.8 percent of the total of 15.5 million, per Wards Intelligence—and it represents EVs' highest-ever share of new-car sales.

Moreover, 2024 is expected to set another new record for volume of EVs sold and their share of the total market. Colin McKerracher of Bloomberg projects 2024 EV sales in the U.S. at just under 1.9 million units, making up 13 percent of new-car purchases. This year should see fewer of the supply constraints that hobbled availability over the last four years.

More new vehicles with plugs are on sale in the U.S. this year than ever before. They'll sell better this year than they did last year.

January 2024 Breaks Global EV Sales RecordGlobal EV Sales Break Record For January

Rho Motion crunched the numbers and came up with a record breaking sales pace of 660,000 electric vehicles sold globally in January. That was 12 months ago, back in January 2023. This year’s January EV sales blew past that mark by 69% for a total of more than 1 million.

Global EV sales increase in 2024 YTD, BYD world’s top exporterCharles Lester, Leading EV Data Analyst at Rho Motion, said: “We’re encouraged to see the global EV sales steadily increasing year on year as the global market has grown by 32% so far in 2024. Relatively new regions to EVs such as Latin America and the SE Asia peripheries are rapidly expanding and we can expect these to be the fastest growing markets for some time to come.”

China was the strongest region for sales growth with the US and Canada not far behind. In 2024 year-to-date, China recorded a 34% increase in sales. China’s growing dominance in the EV space was highlighted by BYD overtaking Volkswagen as the country’s top-selling brand.

The oil barrel is half-full.

-

kublikhan - Master Prognosticator

- Posts: 5023

- Joined: Tue 06 Nov 2007, 04:00:00

- Location: Illinois

Re: THE Electric Vehicle (EV) Thread pt 15

kublikhan wrote:As usual, you are making up BS. EV sales continue to break records:theluckycountry wrote:Sorry Adam_b, Sorry kub, PeakEV, come and gone, as predicted.As the shift toward an electrified future continues, a record-breaking nearly 1.2 million U.S. vehicle buyers chose to go electric last year. ...

Specifically, in Q4 2023, EV sales hit a record for both volume and market share...Last year, U.S. sales of EVs were ...

Moreover, 2024 is expected to set another new record for

Sorry kub, we're not talking about last year here, last year is irrelevant outside of the fact that it was the peak of the EV boom. Sales? A lagging indicator driven by collapsing prices. This isn't 1999 where the collapse was a basic restructuring and profit taking exercise for the IT industry. Computers and mobile were destined to take their place in society because they were generating huge profits for everyone, a transition that began in the 1960's with the big mainframes. By 1999 many homes had a personal computer, I got my first in the mid 1990's, second hand they were cheap and reliable, businesses all used them, government relied on them and they were constantly upgrading flooding the secondhand market.

After 2000 the price of computers collapsed just like color TV prices collapsed in the 1970's here. There was a brief pause in sales because the public and private sector businesses had been sucked into upgrading in 1999 by the fake Y2K collapse meme. A great piece of marketing that was. I never fell for it myself, I never bothered upgrading. Then slowly sales took off again and today they are ubiquitous in every home and office.

Such is not the case with EV. They are a fucking millstone around the owners necks not an enhancement of their lifestyles. Did your insurance go through the roof if you bought a computer, No. Could you only use it for a few hours then had to recharge it while you twiddled your thumbs for hours, No. Did the mass uptake of computers require a trillion dollar upgrade to the national electricity grid and the installation of tens of thousands of charging stations all across the nation? No! Shall I go on...

There is no comparison between the technologies, only the bubbles. In 2023 the public and business reacted to the collapsing prices of EVs by buying at a faster rate, yes more were sold, the BS government propaganda machine egged that along. No gasoline vehicle sales by 2030~35? Sure sure, and I have a bridge to sell you. All that will be thrown in the bin in the decade to come, in fact many governments are already scaling back the target dates. Anyone who trusts what comes out of the mouths of their politicians at this point is beyond redemption I'm afraid. They are literally brain dead.

And here we are, the 4th month into 2024 and the entire EV industry outside of China is in collapse, going bankrupt, already bankrupt much of it. And China, with their cheap units? Oh like that means anything. Go and youtube up Chinese ghost cities if you want an insight into how much they care about malinvestment.

In Austrian business cycle theory, malinvestments are badly allocated business investments resulting from artificially low interest rates for borrowing and an unsustainable increase in money supply.

It was the recipe for the EV bubble. A bubble that burst last year.

Tesla: https://www.youtube.com/watch?v=oTPe154yXBU

The joke is that many believe Musk should step down as CEO of Tesla to save it, they clearly don't realize that the "prophet" of EV was the very reason for the companies success in the first place. Remove him and the faithful and their money go too.

après moi le déluge

- theluckycountry

- Intermediate Crude

- Posts: 2326

- Joined: Tue 20 Jul 2021, 18:08:48

- Location: Australia

Re: THE Electric Vehicle (EV) Thread pt 15

As usual, more BS. EV sales are up globally. US? EV Sales are up. Europe? EV Sales are up. Latin America? EV Sales are up. India? EV Sales are up. I know you have trouble with reading comprehension, but included in my previous posts were figures for this year. So I will post it again, plus other articles for this year:

January 2024 Breaks Global EV Sales RecordGlobal EV Sales Break Record For January

Rho Motion crunched the numbers and came up with a record breaking sales pace of 660,000 electric vehicles sold globally in January. That was 12 months ago, back in January 2023. This year’s January EV sales blew past that mark by 69% for a total of more than 1 million.

Tesla Rules In Europe — Europe EV Sales ReportSome 202,000 plugin vehicles were registered in February in Europe — which is +10% year over year (YoY).

Half of the European car market is already electrified, in some way. But for some to grow, others must come down, and diesel (-5% YoY) is the starkest example. Diesel vehicles had only 12% of the European passenger car market in February, a far cry from the 50% share it had in 2015 or the 55% average it experienced before that. At this rate, in this category, diesel will be dead by 2027, well before the 2035 ICE ban.

Global EV sales increase in 2024 YTD, BYD world’s top exporterMarch 13 - 2024- Charles Lester, Leading EV Data Analyst at Rho Motion, said: “We’re encouraged to see the global EV sales steadily increasing year on year as the global market has grown by 32% so far in 2024. Relatively new regions to EVs such as Latin America and the SE Asia peripheries are rapidly expanding and we can expect these to be the fastest growing markets for some time to come.”

China was the strongest region for sales growth with the US and Canada not far behind. In 2024 year-to-date, China recorded a 34% increase in sales. China’s growing dominance in the EV space was highlighted by BYD overtaking Volkswagen as the country’s top-selling brand.

Electric vehicle sales in India surged 42% YoY in FY2024Annual electric vehicle sales in India touched 1.67 million units in FY 2024, 42% up year-on-year.

Outlook

The report stated the EV sales in India grew tremendously in the last few months of FY2024. It expects this momentum to continue as the government has lined up EMPS (Electric Mobility Promotion Scheme) starting from April 1, 2024, along with FAME-III, which will soon be rolled out to accelerate EV adoption with suitable incentives across categories.

Chinese Electric Cars Flood The Brazilian Automotive MarketMarch 22, 2024 - Chinese automakers are making their way into Brazil’s electric car market, which has been dominated by American, European, and Japanese companies. BYD and GWM, China’s two largest electric car manufacturers, have announced investments of over $2.5 billion to begin local production in Brazil this year. These two companies will be utilizing former Ford and Mercedes factories that recently left Brazil. The Brazilian market will now have access to more affordable and simpler electric and hybrid cars from China, competing with Japan and Europe. According to the Brazilian Electric Vehicle Association, sales in the segment are expected to grow by more than 90% in 2023 compared to the previous year. Ricardo, who is also the president of the association, believes that the Brazilian market will continue to grow this year.

Brazil’s two largest car manufacturers, Volkswagen from Germany and General Motors, have also announced new investments worth billions of dollars. Volkswagen announced that it would invest $1.8 billion to modernize its facilities and start production of hybrid and electric cars in Brazil, while General Motors pledged to invest $4 billion in its production facilities in Brazil.

Hyundai IONIQ 5 sets new US sales record in March as EV sales surge 100%Hyundai’s IONIQ 5 just set a new March and Q1 sales record as EV sales climbed 100% last month. The company had its best-ever first quarter and March sales as demand for its EVs remains high.

Hyundai IONIQ 5 EV sets new March, Q1 US sales record

Hyundai continues building momentum in the US with its lineup of dedicated EVs, including the IONIQ 5, IONIQ 6, and Kona EV.

Despite rising competition and interest rates, the automaker achieved record-breaking March and Q1 sales. “Demand for our vehicles, especially EVs, remains high.”

The oil barrel is half-full.

-

kublikhan - Master Prognosticator

- Posts: 5023

- Joined: Tue 06 Nov 2007, 04:00:00

- Location: Illinois

Re: THE Electric Vehicle (EV) Thread pt 15

kublikhan wrote:As usual, more BS. EV sales are up globally. US? EV Sales are up. Europe? EV Sales are up. Latin America? EV Sales are up. India? EV Sales are up. I know you have trouble with reading comprehension, but included in my previous posts were figures for this year. So I will post it again, plus other articles [b]

Sometimes Lucky has a hard time letting go of outdated paradigms, even when presented with facts. For example he still believes shinny rocks outperform inflation.

PEACE

Cliff (Start a rEVOLution, grow a garden)

-

careinke - Volunteer

- Posts: 4696

- Joined: Mon 01 Jan 2007, 04:00:00

- Location: Pacific Northwest

Re: THE Electric Vehicle (EV) Thread pt 15

And as for your "sales are a lagging indicator", so you want to look at forward looking indicators now? Ok let's do that:

S&P: 2024 EV forecast: the supply chain, charging network, and battery materials marketS&P Global Mobility's 2024 global sales forecast projects battery electric passenger vehicles to be on track to post 13.3 million units worldwide for 2024 - accounting for an estimated 16.2% of global passenger vehicle sales. For reference, 2023 posted an estimated 9.6 million BEVs, for 12% market share.

$210 Billion of Announced Investments in Electric Vehicle Manufacturing Headed for the U.S.As the electric vehicle (EV) market continues to heat up, automakers are going all in on electrification. Vehicle manufacturers and battery makers plan to invest $860 billion globally by 2030 in the transition to EVs. Nearly a quarter, $210 billion, is expected to be invested in the United States, more than in any other country.

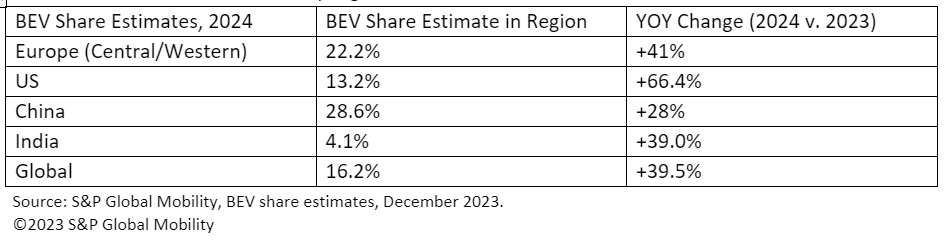

Major markets are forecast for most of this volume, though smaller markets will also see modest increases. Forecasted BEV share by region is as follows:

Global EV market forecasted to reach 17.5 million units with solid growth of 27% in 2024Canalys forecasts light vehicle sales in Greater China to grow 1% to 22.7 million units in 2024. EVs are projected to reach 9.1 million units, taking up 40% of total sales. Drops in battery cost will further drive BEV sales in the compact and subcompact vehicle market.

“Appealing new EVs were launched at the end of 2023, setting the stage for 2024,” noted Alvin Liu, Analyst at Canalys. “EVs are the core growth driver for the vehicle market in Greater China. EVs from Chinese carmakers, which are expected to take up 78% of the market in 2024, are pulling ahead, widening the user experience gap compared to internal combustion engine (ICE) vehicles. The latest battery technologies and improving infrastructure address charging anxiety. The formation of charging ecosystems, such as NIO’s Battery Swap Alliance, Mercedes-Benz and BMW’s Super Charging Network and Lotus’s Flash Charging Alliance, will further grow BEVs’ market share. However, maintaining a growth rate of over 50% this year is impossible as EVs have reached a critical mass and convincing the remaining EV skeptics will be a growing challenge.”

Canalys predicts that the 2024 European light vehicle market will sustain a growth of 2% to 3%, with EVs taking up 24.2% of the market share, shipping 3.9 million units. “Europe’s EV market has started transitioning from policy-driven to product-driven in 2024, a necessary phase in the industry’s transformation,” stated Jason Low, Principal Analyst at Canalys. “The subsidy restriction will slow down EV demand and the looming price war will threaten not just EV goals but carmakers’ electric transition confidence. To counter such challenges, carmakers in Europe are set to make the EV market more affordable by releasing new models such as the KIA Niro EV, BMW IX2, Renault 5, Citroen e-C3 and others. European carmakers should be aware of Chinese carmakers eyeing Europe, as they are expected to deploy similar product and pricing strategies while continuing their efforts to establish local production in the region, like that of BYD, SAIC and other positive OEMs.”

Canalys predicts that in 2024 the North American EV market will grow 26.8% to 2.2 million units but with the lowest EV penetration at 12.5%, compared to Greater China and Europe. “In 2024, EV product range will expand, covering mini vehicles, full-size SUVs and pickups, effectively broadening EVs’ target user range, supported by a unified charging standard as more OEMs join Tesla's North American Charging Standard (NACS), addressing some of the EV sales obstacles.”

How US EV investments have rocketed in a year – in numbersManufacturers have invested billions in US EV and EV battery factories in the last year – here’s how it breaks down.

US EV investments

Since President Joe Biden signed the IRA into law, manufacturers have made more than $92.4 billion of concrete investments in EV and EV battery factories in the US.

And in the same time frame, more than 80,000 new direct US EV-related jobs have been announced. Some of these new jobs are for facilities that are already operating, and others are based on company announcements and are in the pipeline.

EDF researchers also noted rapid growth in US production capacity over the last six months. By 2026, US EV manufacturing facilities will be able to make about 4.7 million new passenger EVs annually – that represents 36% of all new vehicles sold last year. And by 2027, US facilities alone will be able to produce enough batteries to supply 12.2 million new passenger EVs each year, which represents 95% of new vehicles sold last year.

Long-Term Electric Vehicle Growth Outlook Remains Strong Due to Structural TailwindsJan 18, 2024 - The long-term growth outlook for EVs also remains strong, supported by a range of factors. For example, automakers and battery producers are working hard to introduce new battery technologies that can bring more range and faster charging at a lower cost. As the future of mobility becomes increasingly electric, companies throughout the entire EV supply chain stand to potentially benefit.

Key Takeaways

* Global EV sales are forecast to grow 5x from 13.6 million units in 2023 to nearly 67 million units by 2035, representing a compound annual growth rate (CAGR) of 14.2%.2

* Supportive policies by both governments and traditional automakers underpin the robust long-term growth outlook.

* Expectations for the commercialization of next-generation battery technologies are also key to strong EV sales forecasts, and developers are making strides on semi-solid-state prototypes.

EVs Could Surpass a 50% Share of Global Light-Duty Vehicle Sales By 2032

The market share for EVs in the light-duty vehicle segment could grow from an estimated 17% in 2023 to more than 60% by 2035.4 The strong long-term growth outlook is supported by a range of factors, including supportive government policies in major auto markets. Many countries have set targets for partial or complete bans on sales of new internal combustion engine (ICE) vehicles. Germany is targeting new sales to be 100% zero-emission vehicles like battery or fuel cell EVs by 2030, while the U.S. is aiming for 50% of sales to come from EVs or hybrids by the end of the decade.5 The European Union has proposed an ICE ban starting in 2035, and China is also aiming for new sales to be 100% electrified by the same year.

Furthermore, automakers continue to invest heavily into electrifying their fleets. Original equipment manufacturers (OEMs) have announced more than $500 billion worth of investments towards meeting their electrification targets, even when factoring in a slight slowdown due to headwinds in 2023. For example, in April 2023, Kia and Honda increased their 2030 EV production targets to 1.6 million units and 2 million units annually, respectively. Toyota is targeting 1.5 million battery EV sales annually by 2026.

Next-Gen Battery Technologies are Moving Closer to Commercialization

Expectations for technology advancements also support the long-term outlook of growing EV sales, with battery producers making significant strides on next-gen solid-state batteries.

As seen in the table below, several key battery developers are already working on semi-solid-state or solid-state prototypes, though mass commercialization is likely years away. Ganfeng started production on semi-solid-state prototypes in May 2023, with an initial annual production output of 4GWh. QuantumScape is developing a battery that could support a 400-mile range and a 15-minute charge, and the company is targeting the production of prototypes by 2025. Automakers are also making advancements. In September 2023, Toyota published its advanced battery technology roadmap, which shows its solid-state lithium-ion batteries could be ready for commercial use by 2027-28. The solid-state technology could improve Toyota’s EV cruising range by 20% and offer a charging time of 10 minutes or less.

Conclusion: EV Growth Outlook Remains Strong

The long-term EV growth outlook remains positive due to structural tailwinds from government and corporate efforts. Additionally, technology advancements and expansions to the EV charging network can help address the top three factors that influence EV purchasing decisions – cost, charging infrastructure availability, and driving range. As the EV industry continues to mature, companies throughout the EV value chain are poised to potentially benefit, from lithium miners to battery producers and EV manufacturers.

The oil barrel is half-full.

-

kublikhan - Master Prognosticator

- Posts: 5023

- Joined: Tue 06 Nov 2007, 04:00:00

- Location: Illinois

Re: THE Electric Vehicle (EV) Thread pt 15

Toyota Has A 'We Told You' Moment As Stock Climbs 32% Year To Date

Note: This story comes from insideevs, a very pro EV website. Kudos to them for reporting the facts as ugly as they are. As for Toyota's "working behind the scenes to bring fully electric cars to market in 2026", well considering how quickly Ford and VW and others have backed away I wouldn't be holding my breath. Read the full article by all means, for brevity I cut out the obvious distractions like Elon Musk blaming everyone but the tooth fairy for his lack of sales.

https://insideevs.com/news/714827/toyot ... ares-drop/While everyone continues to disparage Tesla after its disappointing Q1 2024 sales performance, the market is favoring Toyota even more. The Japanese automaker’s share prices are up 32% year to date, whereas Tesla is down 33%...

Comparing the two head-to-head is unfair, of course, they’re not direct rivals. Tesla is a different beast, selling only battery electric vehicles, whereas Toyota offers everything from a gas-guzzling Land Cruiser to the Prius Prime plug-in hybrid and the lackluster bZ4x electric crossover. (EV)

But many experts consider that the EV industry here in the U.S. is past its first- and second-wave early adopter phase. The next wave of EV buyers want affordable EVs priced under $30,000, and they don’t want to worry about charging and range. That's exactly where Toyota's hybrids come into the picture. (Gasoline Powered)

Here’s a solid take from market analysis firm TipRanks this morning:

Naturally, the price war is helpful for TM stock for two main reasons. First, the reason for any price war centers on a lack of demand. It’s an especially powerful dynamic when Tesla—the EV market leader—is the one initiating the bitter competition. If it was an upstart entity looking to make a name for itself, that’s understandable.

Tesla? The company shouldn’t need to resort to such tactics because it has tremendous social cachet. So, something must seriously be wrong with the broader EV market.

While carmakers rush to build affordable EVs to thwart Chinese automakers's potential attempt to penetrate the U.S. market with irresistibly cheap EVs, Toyota can just continue doing what it does best. That includes selling conventional hybrids, PHEVs, and gas-powered models while working behind the scenes to bring 10 new pure electric cars to the market by 2026.

Note: This story comes from insideevs, a very pro EV website. Kudos to them for reporting the facts as ugly as they are. As for Toyota's "working behind the scenes to bring fully electric cars to market in 2026", well considering how quickly Ford and VW and others have backed away I wouldn't be holding my breath. Read the full article by all means, for brevity I cut out the obvious distractions like Elon Musk blaming everyone but the tooth fairy for his lack of sales.

après moi le déluge

- theluckycountry

- Intermediate Crude

- Posts: 2326

- Joined: Tue 20 Jul 2021, 18:08:48

- Location: Australia

Re: THE Electric Vehicle (EV) Thread pt 15

careinke wrote:

Sometimes Lucky has a hard time letting go of outdated paradigms, even when presented with facts. For example he still believes shinny rocks outperform inflation.

PEACE

Thu 04 Apr 2024

Re: THE Precious Metals: Gold Thread 2023 (Merged)

theluckycountry wrote: US Gold price now $2300, due for a correction perhaps? We holders of the metal don't like to see it go up too far too fast but perhaps this is just a catchup with the insane inflation we've all just lived through. That's a trend I became aware of long ago, Gold follows inflation, with a lag.

I posted that earlier inke, it's a principle I have stated many times. You understand what my post says don't you? It says the opposite to what you claim I believe.

I know I know, you have your moments, and I'll cut you some slack this time too since ShiteCoin is doing what it always does, following the techie stocks down. Yes, it's a stock now basically, it's Saylor's MicroStrategy et al. https://finance.yahoo.com/quote/MSTR?.tsrc=fin-srch

You know he's been a Huge inside seller don't you. You must have read my post on it? That company is toast. Makes you wonder why he's selling out given that it now hodls 1% of all BT...

Hint: He knows a lot more about BT than careinke ever will.

après moi le déluge

- theluckycountry

- Intermediate Crude

- Posts: 2326

- Joined: Tue 20 Jul 2021, 18:08:48

- Location: Australia

Re: THE Electric Vehicle (EV) Thread pt 15

70 pct of human beings live on less than $10 a day and want to earn more to attain basic needs plus wants. The other 30 pct are counting on them to do that because their own income and ROIs are based on increasing sales and use of goods and services.

Meanwhile, the biosphere on which the material resources and energy used to produce those goods and services remains limited and driven by diminishing returns. Those affect not just the minerals needed to make EVs but even the fossil fuels.

With that, in order to attain basic needs the world population will need the equivalent of an additional Earth. To attain wants, including the use of EVs for personal travel, around three more.

Meanwhile, the biosphere on which the material resources and energy used to produce those goods and services remains limited and driven by diminishing returns. Those affect not just the minerals needed to make EVs but even the fossil fuels.

With that, in order to attain basic needs the world population will need the equivalent of an additional Earth. To attain wants, including the use of EVs for personal travel, around three more.

-

ralfy - Light Sweet Crude

- Posts: 5600

- Joined: Sat 28 Mar 2009, 11:36:38

- Location: The Wasteland

Re: THE Electric Vehicle (EV) Thread pt 15

kublikhan wrote:EV sales are up globally. US? EV Sales are up. Europe? EV Sales are up.

Some 202,000 plugin vehicles were registered in February in Europe — which is +10% year over year (YoY).

YOY, so frigging what. Today... EV Sales Nosedive in EU https://www.youtube.com/watch?v=f5uwmOqU36s

Ford EV unit’s pretax losses expected to jump to more than $5bn as US electric vehicle sales growth slows to 2.7% https://www.theguardian.com/business/20 ... -truck-suv

What happened to the 8% lol. Sorry, the EV dream you were promised is currently unavailable.

Half of the European car market is already electrified, in some way.

In some way? kub must mean the manufacturing and retail outlets have electric lighting.

Brazil’s two largest car manufacturers, Volkswagen from Germany and General Motors, have also announced new investments worth billions of dollars.

Ahhh, Crystal ball sales added.

Lets face it, last December was the peak of sales globally, and since then they have TANKED! Here read the burb from an EV fanboi site.

Global Electric Vehicle sales have increased by around a third in early 2024 compared to the same period last year, according to data complied by EV research house, Rho Motion.

EV sales total 1.9m globally so far in 2024 compared to 1.5m the same period in 2023.

Always comparing sales with "The same time last year". But their chart doesn't lie. Check it out.

https://ukinvestormagazine.co.uk/wp-con ... raphic.jpg

BYD’s Q1 EV sales drop 43%, ceding world’s biggest EV seller title to Tesla.

https://www.motorfinanceonline.com/news ... -to-tesla/Despite experiencing a Q1 decline, BYD still demonstrated a 13.4% year-on-year increase in sales compared to the corresponding period last year.

There it is again, YOY. Like the 43% collapse in sales doesn't matter.

02 April 2024 How reports of slowing electric vehicle sales have been greatly exaggerated

Global battery EV sales have surged past 10 million over the past 12 months...

By Q4 they'll be looking back 2 years. What happened a year ago is irrelevant to the corporations now collapsing into bankruptcy.

après moi le déluge

- theluckycountry

- Intermediate Crude

- Posts: 2326

- Joined: Tue 20 Jul 2021, 18:08:48

- Location: Australia

Re: THE Electric Vehicle (EV) Thread pt 15

Lucky, as has been explained to you numerous times, car sales tend to peak late in the year and then fall at the start of the year. This is not just EV cars, this happens in the general car market as well.

If you were only looking at the change from December to January, you might conclude something awful just happened to the economy or car market. But this is just the regular old seasonal variation in the automotive market. Now of course there could be other factors at play that make the drop bigger in some years than others: Unusually big end of year discounts in December, expiring incentives, interest rate moves, etc.

Ignorance is bliss I guess. Electrified in this context means the car had some degree of electric drive. Meaning we are not just talking about BEV, but also PHEV(plug in hybrid), HEV(full hybrid), MHEV(mild hybrid). I know you prefer to dumb everything down to two car types: ICE and not ICE. But out in the real world there are many different types of electrification. And in Europe, if you add together BEV and all of the various types of hybrid cars, they make up over half of the market. Crazy huh?theluckycountry wrote:In some way? kub must mean the manufacturing and retail outlets have electric lighting.Half of the European car market is already electrified, in some way.

Volvo sees record sales in March boosted by electric SUV salesIn March, electrified car sales made up about 63% of total European car sales.

Again, all car sales fall from end of year to the start of the new year. This happens every year for all car sales, including ICE. That's why they look at YOY figures. For example, here's what all car sales looked like in the US from December 2023 to January 2024:theluckycountry wrote:There it is again, YOY. Like the 43% collapse in sales doesn't matter.

USA - Automotive sales volume, 2024US automative sales volume

Dec 2023 1,454,597

Jan 2024 1,082,620

If you were only looking at the change from December to January, you might conclude something awful just happened to the economy or car market. But this is just the regular old seasonal variation in the automotive market. Now of course there could be other factors at play that make the drop bigger in some years than others: Unusually big end of year discounts in December, expiring incentives, interest rate moves, etc.

And yet companies are still plowing hundreds of billions into EVs. Clearly they see potential in this market segment that you do not.theluckycountry wrote:By Q4 they'll be looking back 2 years. What happened a year ago is irrelevant to the corporations now collapsing into bankruptcy.

Long-Term Electric Vehicle Growth Outlook Remains Strong Due to Structural TailwindsAutomakers continue to invest heavily into electrifying their fleets. Original equipment manufacturers (OEMs) have announced more than $500 billion worth of investments towards meeting their electrification targets, even when factoring in a slight slowdown due to headwinds in 2023. For example, in April 2023, Kia and Honda increased their 2030 EV production targets to 1.6 million units and 2 million units annually, respectively. Toyota is targeting 1.5 million battery EV sales annually by 2026.

Conclusion: EV Growth Outlook Remains Strong

The long-term EV growth outlook remains positive due to structural tailwinds from government and corporate efforts. Additionally, technology advancements and expansions to the EV charging network can help address the top three factors that influence EV purchasing decisions – cost, charging infrastructure availability, and driving range. As the EV industry continues to mature, companies throughout the EV value chain are poised to potentially benefit, from lithium miners to battery producers and EV manufacturers.

The oil barrel is half-full.

-

kublikhan - Master Prognosticator

- Posts: 5023

- Joined: Tue 06 Nov 2007, 04:00:00

- Location: Illinois

Re: THE Electric Vehicle (EV) Thread pt 15

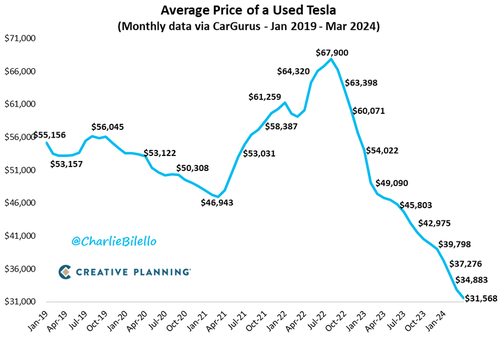

Preceding the overall peak of the EV complex, what we now simply refer to as PeakEV, there were other peaks, such as this telling one.

An absolute collapse in the used price of the market leader's cars. It's no secret that if you go to a car dealership and want to trade in your Tesla you'll be turned away (here in Australia) or offered a very lowball price (elsewhere). No different than if you took in a horse or a generator set as a trade in.

Note in the chart that the collapse began Before Tesla began slashing prices of it's new cars. The chart is from the story "Musk Says Reuters Is "Lying" About Tesla's Plans To Scrap Model 2"

Well why would it be a lie? Everyone else is scrapping plans to build new EV and scaling back production. If he didn't he'd be an idiot. And he's anything but an idiot.

-GM, Honda scrap plans to co-develop 'affordable' sub-$30,000 EVs

-Shares of Renault jumped 5% in early deals Tuesday, hours after cancelling plans to publicly list its new electric vehicle

-Ford said customers in North America are unwilling to pay a premium for an EV. The company, in turn, is postponing about $12 billion in EV

-General Motors will scrap production of its top-selling electric vehicle, the Chevy Bolt

-GM CEO Calls It QUITS on EVs, PHEVs Are Back On The Table

-Volkswagen cuts EV output in Germany as demand craters

Don't believe the Lies, look what's before your very Eyes.

An absolute collapse in the used price of the market leader's cars. It's no secret that if you go to a car dealership and want to trade in your Tesla you'll be turned away (here in Australia) or offered a very lowball price (elsewhere). No different than if you took in a horse or a generator set as a trade in.

Note in the chart that the collapse began Before Tesla began slashing prices of it's new cars. The chart is from the story "Musk Says Reuters Is "Lying" About Tesla's Plans To Scrap Model 2"

Well why would it be a lie? Everyone else is scrapping plans to build new EV and scaling back production. If he didn't he'd be an idiot. And he's anything but an idiot.

-GM, Honda scrap plans to co-develop 'affordable' sub-$30,000 EVs

-Shares of Renault jumped 5% in early deals Tuesday, hours after cancelling plans to publicly list its new electric vehicle

-Ford said customers in North America are unwilling to pay a premium for an EV. The company, in turn, is postponing about $12 billion in EV

-General Motors will scrap production of its top-selling electric vehicle, the Chevy Bolt

-GM CEO Calls It QUITS on EVs, PHEVs Are Back On The Table

-Volkswagen cuts EV output in Germany as demand craters

Don't believe the Lies, look what's before your very Eyes.

après moi le déluge

- theluckycountry

- Intermediate Crude

- Posts: 2326

- Joined: Tue 20 Jul 2021, 18:08:48

- Location: Australia

Re: THE Electric Vehicle (EV) Thread pt 15

There was a spike in all used car prices(including ICE) during 2021-2022 because of COVID supply chain disruptions. This affected EV and ICE alike. However now prices are coming down:

Used-Vehicle Wholesale Prices Give Up 55% of Pandemic Spike: Historic Plunge after Crazy Spike

In addition, there is a price war going on in the new EV market. Of course, this affects used EV prices as well. Personally I think EV prices coming down is a good thing. EVs have always been too expensive for my taste.

The exact same sort of thing that is going on with the other clickbait headlines you posted. For example, "GM CEO Calls It QUITS on EVs" Sounds bad for EVs right? EV fanboys obviously must have missed this little nugget eh? But what did the GM CEO actually say? She said they are pushing out some of their EV production plans, but still plan to be out of the ICE market by 2035. Now that is quite a bit different from the clickbait headline you posted.

Same deal with the rest of your clickbait. Let's take a look at the end of the GM Bolt next. "GM is pulling the plug on the Bolt. Take that EV fanbois! More proof we hit PeakEV!" Actually, no. The GM bolt is selling very well. But it's batteries are dated by this point. So they are switching to a new updated platform:

Ok, so maybe the EV haters got a little excited about the supposed death of EVs at GM. What about Ford? Surely Ford is leading the way on pulling the plug on EVs, right? No. Let's take a look at Ford's EV plans:

So it seems the clickbait articles about Ford walking away from EVs were greatly exaggerated as well. Do you see what I am saying Lucky? You should really take your own advice and stop with your knee-jerk reactions to every clickbait article or youtube link you see foretelling the death of EVs. The truth of the matter is not what the clickbait would have you believe.

Used-Vehicle Wholesale Prices Give Up 55% of Pandemic Spike: Historic Plunge after Crazy Spike

In addition, there is a price war going on in the new EV market. Of course, this affects used EV prices as well. Personally I think EV prices coming down is a good thing. EVs have always been too expensive for my taste.

Electric vs. Gas Cars: Is It Cheaper to Drive an EV?Sticker prices for electric vs. gas cars

According to data from Cox Automotive (parent company of Kelley Blue Book), the average price paid for a new EV has fallen significantly—in September 2023, it came down by $14,300 over the prior year. This amounted to a cost of just $2,800 more than the average paid for a new gas-powered vehicle. And with the EV market growing rapidly, the price margin is expected to shrink even more in the coming years as manufacturers produce more affordable models and improve battery technology, the most expensive part of an EV.

And read past the clickbait headline to see what the car companies are actually doing. I clicked on one of your clickbait headlines in the past that said something like "EV Sales are DEAD!" Then I actually read the article and it said: "The EV growth rate is lower than automotive companies were forecasting." Well that doesn't exactly make people's clicking fingers twitch like "EV sales are DEAD!" now does it?theluckycountry wrote:-GM, Honda scrap plans to co-develop 'affordable' sub-$30,000 EVs

-Shares of Renault jumped 5% in early deals Tuesday, hours after cancelling plans to publicly list its new electric vehicle

-Ford said customers in North America are unwilling to pay a premium for an EV. The company, in turn, is postponing about $12 billion in EV

-General Motors will scrap production of its top-selling electric vehicle, the Chevy Bolt

-GM CEO Calls It QUITS on EVs, PHEVs Are Back On The Table

-Volkswagen cuts EV output in Germany as demand craters

Don't believe the Lies, look what's before your very Eyes.

The exact same sort of thing that is going on with the other clickbait headlines you posted. For example, "GM CEO Calls It QUITS on EVs" Sounds bad for EVs right? EV fanboys obviously must have missed this little nugget eh? But what did the GM CEO actually say? She said they are pushing out some of their EV production plans, but still plan to be out of the ICE market by 2035. Now that is quite a bit different from the clickbait headline you posted.

GM still planning to end gas-powered vehicle sales by 2035 -- CEOGeneral Motors CEO Mary Barra said Wednesday the Detroit automaker still plans on moving to all electric vehicle sales by 2035 even as it has recently delayed some EV production.

Will GM's Shifting Hybrid Strategy Disrupt Its EV Business Plans?What Was Actually Said

GM's existing EV strategy is not, in fact, changing. Barra doubled down on "eliminating tailpipe emissions from light-duty vehicles by 2035" in yesterday's investment call. In fact, the plan for 2024 hasn't changed a bit. This year, GM plans to launch gas-powered, non-hybrid Chevy Equinox, Traverse,Tahoe, andSuburban SUVs as well as an updated GMC Acadiaand next-generationBuick Enclave for the 2024 model year. Additionally, on the all-electric front, the automaker has plans to introduce or expand production of its Silverado EVandGMC Sierra EV pickup trucks, the all-new Equinox electric SUV, and luxurious Cadillac Escalade IQandCelestiq (along with the existing Lyriq).

Considering no changes for 2024's plan, any potential new hybrid trims or models will come next year or later, and as additions to, not replacements for, its overall BEV plan. "Our forward plans include bringing our plug-in hybrid technology to select vehicles in North America."

Same deal with the rest of your clickbait. Let's take a look at the end of the GM Bolt next. "GM is pulling the plug on the Bolt. Take that EV fanbois! More proof we hit PeakEV!" Actually, no. The GM bolt is selling very well. But it's batteries are dated by this point. So they are switching to a new updated platform:

Why General Motors is pulling the plug on the Chevy BoltThe Chevy Bolt EV, released in late 2016, and the larger EUV (Electric Utility Vehicle), introduced in 2021, are both being axed—but not for lack of demand. Sales of the mass-market models have been clocking record highs. However, the battery cells in the cars are now outdated, Barra said.

A brief explainer of the problem with Bolt EV and EUV batteries

The batteries in the Bolt line of EVs have an older design and chemistry. More recent EV models, such as the GMC Hummer and Cadillac Lyriq, are fitted with GM’s Ultium architecture. The cost of these newer battery packs are nearly 40% lower than those in the Chevrolet Bolt EV.

Ok, so maybe the EV haters got a little excited about the supposed death of EVs at GM. What about Ford? Surely Ford is leading the way on pulling the plug on EVs, right? No. Let's take a look at Ford's EV plans:

Ford Updates EV, Hybrid Plans, Readies Manufacturing PlantsAPR 4, 2024 -

* Ford continues to invest in a broad set of EV programs as it works to build a full EV line-up. In parallel, Ford is expanding its hybrid electric vehicle offerings. By the end of the decade, the company expects to offer hybrid powertrains across its entire Ford Blue lineup in North America

* Equipment installation is underway at the Tennessee Electric Vehicle Center assembly plant at BlueOval City, which aims to begin customer deliveries of Ford’s next-generation electric truck in 2026

* Expansion progresses at Ohio Assembly Plant in Avon Lake, to produce an all-new electric commercial vehicle for Ford Pro customers beginning mid-decade; construction progressing at BlueOval Battery Park Michigan, and BlueOval SK joint venture battery plants in Tennessee and Kentucky

* Ford reiterates commitment to its Oakville, Ontario, assembly plant as the company retimes the launch of its all-new three-row electric vehicles to 2027

* Design work continues on future EVs, including a flexible small and affordable EV platform by a skunkworks team in California

Ford Motor Company said today it is retiming the launch of upcoming electric vehicles at its Oakville, Ontario, assembly plant while continuing to build out an advanced industrial system to produce its next-generation electric vehicles, including greenfield construction and conversion of existing assembly plants.

The company continues to invest in a broad set of EV programs as it works to build a full EV line-up. These initiatives support the development of a differentiated and profitably growing EV business over time while Ford serves customers with the right mix of gas, hybrid and electric vehicles based on demand today. In parallel, Ford is expanding its hybrid electric vehicle offerings. By the end of the decade, the company expects to offer hybrid powertrains across its entire Ford Blue lineup in North America. In the first quarter of 2024, Ford’s electric vehicle sales increased by 86% and hybrid sales rose 42% versus a year ago.

“As the No. 2 EV brand in the U.S. for the past two years, we are committed to scaling a profitable EV business, using capital wisely and bringing to market the right gas, hybrid and fully electric vehicles at the right time,” said Jim Farley, Ford president and CEO. “Our breakthrough, next-generation EVs will be new from the ground up and fully software enabled, with ever-improving digital experiences and a multitude of potential services.”

So it seems the clickbait articles about Ford walking away from EVs were greatly exaggerated as well. Do you see what I am saying Lucky? You should really take your own advice and stop with your knee-jerk reactions to every clickbait article or youtube link you see foretelling the death of EVs. The truth of the matter is not what the clickbait would have you believe.

The oil barrel is half-full.

-

kublikhan - Master Prognosticator

- Posts: 5023

- Joined: Tue 06 Nov 2007, 04:00:00

- Location: Illinois

Re: THE Electric Vehicle (EV) Thread pt 15

Rivian Stock Gets a Rare Double Downgrade. EV Demand Is a Problem. https://www.barrons.com/articles/rivian ... e-3538c0eb

EV demand has peaked. Their share price has collapsed because investors have seen through the fanboi happy talk. All the EV makers are collapsing, it's a rout! A Bust!

The big collapses actually happened last year where Rivian fell from an all time high of $129 to $12 in April 2023. That was around the time rate of sales increase Peaked. Sales were still increasing, but at an ever slower rate. Now of course sales are miserable and getting worse. None of this has stopped the EV faithful from proclaiming the future is still bright but only a fool would put a cent in any of these. And the cars? What use is a new EV if the manufacturer is bankrupt and can't honor warranty. Think about that before you waste $50,000 on an electric toy car.

Lucid motors has collapsed from $55/share to $2 and change. A disaster, but predictable.

Fisker, down from $18 to 29 cents. These are the big players in the US EV market. There is no coming back from these lows, it's over, with bankruptcy court the next port of call. Were looking at a DotCom bust here folks. My sympathies for all those who have lost fortunes in this debacle.

EV demand has peaked. Their share price has collapsed because investors have seen through the fanboi happy talk. All the EV makers are collapsing, it's a rout! A Bust!

The big collapses actually happened last year where Rivian fell from an all time high of $129 to $12 in April 2023. That was around the time rate of sales increase Peaked. Sales were still increasing, but at an ever slower rate. Now of course sales are miserable and getting worse. None of this has stopped the EV faithful from proclaiming the future is still bright but only a fool would put a cent in any of these. And the cars? What use is a new EV if the manufacturer is bankrupt and can't honor warranty. Think about that before you waste $50,000 on an electric toy car.

Lucid motors has collapsed from $55/share to $2 and change. A disaster, but predictable.

Fisker, down from $18 to 29 cents. These are the big players in the US EV market. There is no coming back from these lows, it's over, with bankruptcy court the next port of call. Were looking at a DotCom bust here folks. My sympathies for all those who have lost fortunes in this debacle.

après moi le déluge

- theluckycountry

- Intermediate Crude

- Posts: 2326

- Joined: Tue 20 Jul 2021, 18:08:48

- Location: Australia

Who is online

Users browsing this forum: No registered users and 175 guests