Oil's tipping point has passed

Re: Oil's tipping point has passed

I won’t guess about Damman Fld…don’t know any details. But I’ll assume yours is a more general question. And from there I’ll have to split my general answers between the US and the rest of the world.

Most here probably know that US operators are THE masters at squeezing out the last drops of oil. That’s why our average well produces less than 10 bopd. I suspect many expectations of increased oil production via EOR projects are much too optimistic. First, if there were an applicable production technique, such as water flooding, that would increase URR it would have been employed for decades. IMHO there is no big inventory of neglected US oil fields to exploit via EOR.

More expensive methods, such as horizontal drilling, might be applied now thanks to current oil prices. In several months I’ll drill a hz pilot well to test the potential recovery of additional reserves from a series of Texas fields that have produced over 4 billion bo. Typical recovery from these nearly depleted fields has been around 50%. If I’m very lucky I might get an additional 5% if my model works. But even then the method won’t be applicable to all the residual oil for a variety of reasons.

One of the major fields in the this trend is having a CO2 pipeline being built to it from a power plant about 100 miles away at a cost of $160 million. Obviously they expect to increase recovery enough to justify that cost. OTOH the govt is paying $120 million of that capex. Time will tell if their model is correct. CO2 EOR has always been a viable approach and has been successfully used when there was an economically available source. Unfortunately the vast majority of fields that might benefit don’t have an available source for the CO2. The best hope for such potential recovery may be combining the EOR effort with a sequestering requirement. A slow forward process and one that won’t increase US oil production significantly IMHO. Another hindrance is the abandonment of depleted wells. An EOR project might be economic at today’s prices if the wells still existed. But once plugged and abandoned the cost to redrill those wells along with the EOR costs kill the project.

Foreign fields have a much greater potential for enhanced recovery. Unfortunately the reason for that potential is also the stumbling block they face IMHO. In additional to lacking the infrastructure and service companies as we have stateside many of the NOC’s lack the financial incentive to exploit smaller reserves. As their major fields deplete that incentive should increase but I suspect that will be a slow and inconsistent transition. Additionally much of the US mineral rights are privately owned. Those folks have their own incentives to get wells drilled. Elsewhere those rights tend to be owned by the govts that don’t t end to be as aggressive leasing.

The individual wells in the fields that I’ll be trying my hz project produce just several bopd along with a significant amount of water that cost to dispose of. But at current oil prices those operators are making decent cash flow. But that’s revenue going into individual checking account with much of it earned through sweat equity. That business plan just doesn’t exist anywhere in the world to the degree it does in the US.

Most here probably know that US operators are THE masters at squeezing out the last drops of oil. That’s why our average well produces less than 10 bopd. I suspect many expectations of increased oil production via EOR projects are much too optimistic. First, if there were an applicable production technique, such as water flooding, that would increase URR it would have been employed for decades. IMHO there is no big inventory of neglected US oil fields to exploit via EOR.

More expensive methods, such as horizontal drilling, might be applied now thanks to current oil prices. In several months I’ll drill a hz pilot well to test the potential recovery of additional reserves from a series of Texas fields that have produced over 4 billion bo. Typical recovery from these nearly depleted fields has been around 50%. If I’m very lucky I might get an additional 5% if my model works. But even then the method won’t be applicable to all the residual oil for a variety of reasons.

One of the major fields in the this trend is having a CO2 pipeline being built to it from a power plant about 100 miles away at a cost of $160 million. Obviously they expect to increase recovery enough to justify that cost. OTOH the govt is paying $120 million of that capex. Time will tell if their model is correct. CO2 EOR has always been a viable approach and has been successfully used when there was an economically available source. Unfortunately the vast majority of fields that might benefit don’t have an available source for the CO2. The best hope for such potential recovery may be combining the EOR effort with a sequestering requirement. A slow forward process and one that won’t increase US oil production significantly IMHO. Another hindrance is the abandonment of depleted wells. An EOR project might be economic at today’s prices if the wells still existed. But once plugged and abandoned the cost to redrill those wells along with the EOR costs kill the project.

Foreign fields have a much greater potential for enhanced recovery. Unfortunately the reason for that potential is also the stumbling block they face IMHO. In additional to lacking the infrastructure and service companies as we have stateside many of the NOC’s lack the financial incentive to exploit smaller reserves. As their major fields deplete that incentive should increase but I suspect that will be a slow and inconsistent transition. Additionally much of the US mineral rights are privately owned. Those folks have their own incentives to get wells drilled. Elsewhere those rights tend to be owned by the govts that don’t t end to be as aggressive leasing.

The individual wells in the fields that I’ll be trying my hz project produce just several bopd along with a significant amount of water that cost to dispose of. But at current oil prices those operators are making decent cash flow. But that’s revenue going into individual checking account with much of it earned through sweat equity. That business plan just doesn’t exist anywhere in the world to the degree it does in the US.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: Oil's tipping point has passed

How much difference does Technology actually make? For example KSA closed their first oil field, Dammam, decades ago because production had fallen to uneconomic levels. A few years ago they decided to rework the field using new techniques like horizontal drilling to get more of the OIP (original oil in place) out because technology and higher price make doing so a paying proposition.

But how much more oil will they ultimately recover from the field? How much could they have recovered using the old techniques if they had simply decided to convert the field over to a stripper well system like so many USA fields and kept just pumping it out slowly as OIP migrated through the reservoir rocks to the well bores?

The KSA case book which includes a number of fields including Damman is a well documented case history given much of the results of various techniques and studies has been published in SPE. In the case of Ghawar technology made all the difference. The large water influx that Ghawar ran into was driving water cut up rapidly. The advent of special processing for 3D seismic allowed for proper imaging of faults which were found to be conduits from the water leg into well bores. By avoiding these faults with well bores much of the water cut increase was avoided. As well using the MRC (maximum reservoir contact) wells which are long reach horizontals with a number of legs (up to about 10 km of total reservoir contact now in some wells) allowed for the wells to be produced at lower draw down pressure which means the risk of coning water is also lower. The implementation of SMART completions allowed for each individual sidetrack to be monitored for water influx. As the water cut increased in an individual sidetrack it could be shutoff so that overall water cut in the well did not increase rapidly. In order to keep production rates stable the use of expandable liners allowed for a replacement sidetrack to be drilled without losing tubing size. Note that recovery factors in some fields has been documented to have increased to 60% with ultimate recovery predicted based on models to be closer to 70%.

converting the wells to strippers would not prevent water influx so the life of wells in the KSA situation would probably have been decreased considerably.

No two fields are the same, however. There are fields onshore in the Golden Lane region of Mexico that were brought on stream in the first half of the twentieth century (some at very large rates back then) which have wells that are still producing at tens of barrels a day. No intervention was attempted in these fields and a number of wells are producing without downhole pumps or even tubing in the well. Given that these fields have pretty incredible reservoir properties it is unlikely that ultimate recovery will be affected to a large extent by applying modern technology but the speed of recovery and hence cashflow could be affected.

Reservoirs are often complex animals. Some have very large connected pore systems (eg. reefs), some have large unconnected pore systems (karsted carbonates), others have small well distributed pore systems with high permeability (well sorted beach sandstones) others have a variety of pore sizes with variable permeability and some have been affected by late diagenesis which can plug pore spaces and pore throats with clays or cements. There are a host of other differences such as drive mechanism (eg. solution gas drive, water drive), wettability (oil wet reservoirs behave differently than water wet reservoirs and sometimes through its history fields can see a change in wettability) and variable mobility ratios that all need to be taken into account when looking at enhanced recovery methods. The job is made even more difficult when you think that observations are all being made remotely and you really never know exactly what is happening in the subsurface. There is no one size fits all I'm afraid. I think it is dangerous to claim that ultimate recovery factor in any reservoir will never exceed a certain number as there is still research going on in this area. It's not easy due to the complexity and hence you do not tend to see new important technologies emerge all that often.

-

rockdoc123 - Expert

- Posts: 7685

- Joined: Mon 16 May 2005, 03:00:00

Re: Oil's tipping point has passed

Thanks Raify for your post. It provides further interesting information regarding the theme of this this thread.

As an outsider, the vast majority of my posts reflect reporting in the media. I've covered a wide range of topics but in this case, peak oil is not reported as much as say global warming. The number of PO articles are minuscule compared to AGW. When it is reported, it is usually not revealing the true situation. For instance, "peak oil is dead", "Have concerns over peak oil peaked?". The Murray and King article was not reported in the mainstream media.

As an insider, ROCKMAN has provided additional insights. He tells us that POD was known in the industry since the 70's. And

Murray and King also emphasis this point too but in relation to global warming and the economy.

"the economic pain of a flattening supply will trump the environment as a reason to curb fossil fuels"

ROCKMAN seems to be aware of the economic consequences:

And yet he still continues to operate in the industry as a private enterprise. That is quite admirable. How long do you think you can do this, ROCK? What was also interesting from ROCKMAN was that he will not pursue shale gas.

Do you have additional competition from the alternative energy industry? I saw this yesterday:

Shale Gas Won’t Kill Solar & Wind, Renewable Growth Unstoppable

So where do you see your operation in the years ahead?

As an outsider, the vast majority of my posts reflect reporting in the media. I've covered a wide range of topics but in this case, peak oil is not reported as much as say global warming. The number of PO articles are minuscule compared to AGW. When it is reported, it is usually not revealing the true situation. For instance, "peak oil is dead", "Have concerns over peak oil peaked?". The Murray and King article was not reported in the mainstream media.

As an insider, ROCKMAN has provided additional insights. He tells us that POD was known in the industry since the 70's. And

30 years ago Mobil management literally beat the fear of PO (reserve replacement problem) into us on a regular basis

Murray and King also emphasis this point too but in relation to global warming and the economy.

"the economic pain of a flattening supply will trump the environment as a reason to curb fossil fuels"

ROCKMAN seems to be aware of the economic consequences:

the current chatter about “US energy independence” only reinforces that pessimism.

And yet he still continues to operate in the industry as a private enterprise. That is quite admirable. How long do you think you can do this, ROCK? What was also interesting from ROCKMAN was that he will not pursue shale gas.

Which is why we’ve never drilled nor ever will drill the fractured shale plays.

Do you have additional competition from the alternative energy industry? I saw this yesterday:

Shale Gas Won’t Kill Solar & Wind, Renewable Growth Unstoppable

Rather than replacing renewables, the Citi analysts suggest that the shale gas industry will actually be dependent on the broader deployment of wind and solar for its future. That’s because gas will be priced out of the conventional market in the short term, but will then be required to fill in the gaps as wind and solar are deployed more widely, and coal generation is shut down.

So where do you see your operation in the years ahead?

Human history becomes more and more a race between education and catastrophe. H. G. Wells.

Fatih Birol's motto: leave oil before it leaves us.

Fatih Birol's motto: leave oil before it leaves us.

-

Graeme - Fusion

- Posts: 13258

- Joined: Fri 04 Mar 2005, 04:00:00

- Location: New Zealand

Re: Oil's tipping point has passed

Graeme – I’m not sure how admirable my efforts are…just a necessity of life. Geologists aren’t good for much else. LOL.

I’ve worked for public companies for half of my 38 years and booking proved reserves was always at the top of the priority list occasionally ahead of profitability. If I think the public has a blind spot it’s not understanding the absolute demand from Wall Street that companies exhibit “growth” which doesn’t always equate to profitability. Thus the activity in the shale trends. Without those plays I doubt half the public companies would still exist today. An extreme but classic example: I once drilled 4 horizontal wells into producing reservoirs for a small public company. It did not add $1 of new proved reserves but did increase the company’s total production rate by 400%. The effort actually reduced the company’s NPV (Net Present Value): it gained a bit of NPV by accelerating cash flow but not nearly enough to offset the $18 million costs of those wells. The company actually lost money by drilling those wells. Wall Street response: increased stock price from $0.75 to over $5 per share. And we didn’t lie: all the details were out lined (in small print) in the annual report. And yes, the company eventually defaulted on a $100 million bond and went bankrupt several years later.

This is why folks should be cautious equating stock value of the shale playing pubcos with the profitability of those plays. There is some profit to be had but I still contend the most profitable Eagle Ford Shale player to date has been Petrohawk. They amassed a large acreage position cheaply, drilled a few “seed wells” (that’s what we actually call them) and then flipped the entire company with all that undeveloped acreage for $12 billion. Most of the very profitable companies I’ve seen in the EFS play have never spent a dollar drilling a well: they either just bought acreage cheap and flipped it or used investor monies to drill without putting in their own capex.

How long in the game? Personally not much longer between being 62 yo and having MS. But generally in a longer time frame the US oil patch will have to shrink IMHO. The oily shale plays now and gas shales eventually when prices increase, will garner most of the future activity just because we lack any other significant trends. There may eventually be some more offshore activity in currently off limit areas as well as on the North Slope. But nothing of the magnitude of what we’ve developed over the last 60 years IMHO. Even the Deep Water GOM is getting a tad long in the tooth. Until recently I didn’t appreciate how some folks thought this was a new trend with huge future potential. The trend began developing over 30 years ago with more than 160 fields discovered to date. Consider that during the last 12 months of the 100 million acres in the offshore GOM, including large sections of the DW, offered for lease by the feds less than 6% even received a single bid. Big Oil long ago recognized the diminishing potential of US oil/NG and began their flight to foreign regions.

Speaking for the rest of the oil patch regarding competition from the alts: alts…what’s that? LOL. We compete against each other, Mother Earth and price volatility. Alts development isn’t even in our vocabulary when it comes to making business decisions. Consider the high level of drilling activity in Texas while at the same time having more wind power generation than any other state. In fact, as much capacity as the number 2 and 3 states combined with more huge projects in the planning stage. If we were to view anything else as potential competition it would be coal IMHO. Until recently there was a new coal-fired plant scheduled to be built, ironically, on top of a NG field I’ve been developing in Texas. It’s been suspended I suspect due to the continued completion of low NG prices. The plant wasn’t even going to use Texas coal/lignite: they had a 30 year contract to rail coal from Illinois to Texas.

There’s more oil/NG left to be developed in the US. But it will require a much smaller industry then we have today IMHO. The shale plays are providing a good bit of current activity since they are “cookie cutter” trends: little geologic input and just keep drilling on a fixed spacing protocol. But eventually you run out of those locations. The vast majority of shales have been proven to not be economically viable at today’s prices. The gas shales will regain significant activity when prices increase to at least $6/mcf IMHO. But there are a finite number of those locations to be drilled.

I’ve worked for public companies for half of my 38 years and booking proved reserves was always at the top of the priority list occasionally ahead of profitability. If I think the public has a blind spot it’s not understanding the absolute demand from Wall Street that companies exhibit “growth” which doesn’t always equate to profitability. Thus the activity in the shale trends. Without those plays I doubt half the public companies would still exist today. An extreme but classic example: I once drilled 4 horizontal wells into producing reservoirs for a small public company. It did not add $1 of new proved reserves but did increase the company’s total production rate by 400%. The effort actually reduced the company’s NPV (Net Present Value): it gained a bit of NPV by accelerating cash flow but not nearly enough to offset the $18 million costs of those wells. The company actually lost money by drilling those wells. Wall Street response: increased stock price from $0.75 to over $5 per share. And we didn’t lie: all the details were out lined (in small print) in the annual report. And yes, the company eventually defaulted on a $100 million bond and went bankrupt several years later.

This is why folks should be cautious equating stock value of the shale playing pubcos with the profitability of those plays. There is some profit to be had but I still contend the most profitable Eagle Ford Shale player to date has been Petrohawk. They amassed a large acreage position cheaply, drilled a few “seed wells” (that’s what we actually call them) and then flipped the entire company with all that undeveloped acreage for $12 billion. Most of the very profitable companies I’ve seen in the EFS play have never spent a dollar drilling a well: they either just bought acreage cheap and flipped it or used investor monies to drill without putting in their own capex.

How long in the game? Personally not much longer between being 62 yo and having MS. But generally in a longer time frame the US oil patch will have to shrink IMHO. The oily shale plays now and gas shales eventually when prices increase, will garner most of the future activity just because we lack any other significant trends. There may eventually be some more offshore activity in currently off limit areas as well as on the North Slope. But nothing of the magnitude of what we’ve developed over the last 60 years IMHO. Even the Deep Water GOM is getting a tad long in the tooth. Until recently I didn’t appreciate how some folks thought this was a new trend with huge future potential. The trend began developing over 30 years ago with more than 160 fields discovered to date. Consider that during the last 12 months of the 100 million acres in the offshore GOM, including large sections of the DW, offered for lease by the feds less than 6% even received a single bid. Big Oil long ago recognized the diminishing potential of US oil/NG and began their flight to foreign regions.

Speaking for the rest of the oil patch regarding competition from the alts: alts…what’s that? LOL. We compete against each other, Mother Earth and price volatility. Alts development isn’t even in our vocabulary when it comes to making business decisions. Consider the high level of drilling activity in Texas while at the same time having more wind power generation than any other state. In fact, as much capacity as the number 2 and 3 states combined with more huge projects in the planning stage. If we were to view anything else as potential competition it would be coal IMHO. Until recently there was a new coal-fired plant scheduled to be built, ironically, on top of a NG field I’ve been developing in Texas. It’s been suspended I suspect due to the continued completion of low NG prices. The plant wasn’t even going to use Texas coal/lignite: they had a 30 year contract to rail coal from Illinois to Texas.

There’s more oil/NG left to be developed in the US. But it will require a much smaller industry then we have today IMHO. The shale plays are providing a good bit of current activity since they are “cookie cutter” trends: little geologic input and just keep drilling on a fixed spacing protocol. But eventually you run out of those locations. The vast majority of shales have been proven to not be economically viable at today’s prices. The gas shales will regain significant activity when prices increase to at least $6/mcf IMHO. But there are a finite number of those locations to be drilled.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: Oil's tipping point has passed

ROCKMAN, Thank you very much for your generous and honest replies. They've been awesome! BTW, Hope your health is OK and you have a long, enjoyable, well-deserved retirement. You probably getting out at the right time.

The big message I take from your last reply is that activity in the oil patch will diminish. This is in contrast to what the industry PR machine is telling us. I understand that the industry is saying that oil,gas and coal will last (be dominant) well into 2040-2050's (e.g. Exxon).

The other interesting comment is that alt doesn't even exist in you vocabulary. This is understandable because it is growing from such a small base. But I also want to ask you whether you think that biofuels will ever compete with oil. I could have asked you last time but I didn't want to preempt it.

I just saw the following article this morning and I'd like to extract their comments regarding solar and wind grid parity.

Competition from renewables is coming even if it is not so visible to you at the moment.

The big message I take from your last reply is that activity in the oil patch will diminish. This is in contrast to what the industry PR machine is telling us. I understand that the industry is saying that oil,gas and coal will last (be dominant) well into 2040-2050's (e.g. Exxon).

The other interesting comment is that alt doesn't even exist in you vocabulary. This is understandable because it is growing from such a small base. But I also want to ask you whether you think that biofuels will ever compete with oil. I could have asked you last time but I didn't want to preempt it.

I just saw the following article this morning and I'd like to extract their comments regarding solar and wind grid parity.

Renewables, meanwhile, are steadily, predictably heading down the cost curve toward “grid parity,” that moment when they are competitive with coal and natural gas without subsidies. Residential solar is already there in many places:

In many countries — Germany, Spain, Portugal, Australia, and the South-West of the US — residential-scale solar has already reached ‘grid-parity’ with average residential electricity prices. In other countries grid-parity is not far away; we forecast that grid-parity will be attained by Japan in 2014-2016, South Korea in 2016-2020, and by the UK in 2018-2021.

Utility-scale solar won’t be far behind:

On our analysis utility-scale solar power will gain competitiveness with gas-fired power in the medium term in many regions, even if gas prices stay low. For regions with solar insolation of 1900 kWh/kW/year — as in the South-West US or Saudi Arabia — utility scale solar is already cheaper than gas-fired power at a natural gas price of $15/MMBtu, and by 2020 for a gas price of ~$6-8/MMBtu.

And wind power is competitive in a growing number of places as well:

Wind power is significantly cheaper than solar power, and in most countries wind delivers electricity at a far lower cost than the residential electricity price. On the utility scale, wind power is already competitive with gas-fired power in many regions. In the US, for example, wind power would be cheaper than gas-fired power at a natural gas price of under ~$6/MMBtu.

Many of the places where renewables are developing quickly are places where shale gas is expensive and will be slow to penetrate. This chart, which estimates when grid parity will arrive in various countries, is information-dense but worth examining closely:

Competition from renewables is coming even if it is not so visible to you at the moment.

Last edited by Graeme on Mon 01 Apr 2013, 18:23:53, edited 1 time in total.

Human history becomes more and more a race between education and catastrophe. H. G. Wells.

Fatih Birol's motto: leave oil before it leaves us.

Fatih Birol's motto: leave oil before it leaves us.

-

Graeme - Fusion

- Posts: 13258

- Joined: Fri 04 Mar 2005, 04:00:00

- Location: New Zealand

Re: Oil's tipping point has passed

Reading between the lines I think Rockman might be considered a bigger doomer than most of us.

Live, Love, Learn, Leave Legacy.....oh and have a Laugh while you're doing it!

-

Quinny - Intermediate Crude

- Posts: 3337

- Joined: Thu 03 Jul 2008, 03:00:00

Re: Oil's tipping point has passed

Another great example of how good the oil patch PR machine can be. Tell the truth but hide the details. Of course fossil fuels will be dominant for many decades. But not because we’ll have so much more reserves developed in the future but because we’ll have much less. And despite the absolute need society will not switch quickly enough (i.e. pay the premium) to support alt development enough to prevent fossil fuels, especially coal, from dominating our lives even more than they do now IMHO.

Doomer they may call me. But I think of myself as a realist with 38 years experience struggling to find the next well to drill. Add that to my “realistic” low opinion of mankind’s willingness to deal rationally with the energy situation. And I cannot escape such thoughts for a single day: I have a 12 yo daughter adopted in China 11 years ago who will deal with the repercussions her entire adult life. I won’t have to. You won't see me dwell on those feelings much in future posts. I would rather stick with cold, hard unemotional facts. Y’all will have to pick up my crappy attitude by reading between future lines. LOL.

Biofuels: I don’t have a good sense of their economic viability especially scaled up sufficiently to make a difference anytime soon. Lots of positive opinions are offered but I don’t care: show me a significant portion of motor fuels coming from biofuels without govt subsidies and I’ll become a believer. Likewise drop me a line when we exceed our 1971 peak and I’ll declare PO dead. Optimism rolls off me like water off a duck's back. I've spent almost 4 decades listening to geologists shine me on with their glorious expectations...I'm immune. LOL.

Wind and solar: bring it on. Today Texas is the number one wind generator in the country with more production than #2 and #3 combined. And bigger projects in the works. And Texas has more drilling rigs turning to the right than any other state. An odd combination of metrics, eh? Individual success stories are great and really standout. And, unfortunately, standout because of their uniqueness. Again, I slip back to my low expectations for the majority of our society to voluntarily start making the switch quickly and of significant magnitude.

No: I don’t foresee the alts providing as much competition to oil/NG as coal will in the future. If China hadn’t expanded coal sourced energy as they have I would be getting a better price for my oil today. The alts so far haven’t cost me a penny IMHO.

Doomer they may call me. But I think of myself as a realist with 38 years experience struggling to find the next well to drill. Add that to my “realistic” low opinion of mankind’s willingness to deal rationally with the energy situation. And I cannot escape such thoughts for a single day: I have a 12 yo daughter adopted in China 11 years ago who will deal with the repercussions her entire adult life. I won’t have to. You won't see me dwell on those feelings much in future posts. I would rather stick with cold, hard unemotional facts. Y’all will have to pick up my crappy attitude by reading between future lines. LOL.

Biofuels: I don’t have a good sense of their economic viability especially scaled up sufficiently to make a difference anytime soon. Lots of positive opinions are offered but I don’t care: show me a significant portion of motor fuels coming from biofuels without govt subsidies and I’ll become a believer. Likewise drop me a line when we exceed our 1971 peak and I’ll declare PO dead. Optimism rolls off me like water off a duck's back. I've spent almost 4 decades listening to geologists shine me on with their glorious expectations...I'm immune. LOL.

Wind and solar: bring it on. Today Texas is the number one wind generator in the country with more production than #2 and #3 combined. And bigger projects in the works. And Texas has more drilling rigs turning to the right than any other state. An odd combination of metrics, eh? Individual success stories are great and really standout. And, unfortunately, standout because of their uniqueness. Again, I slip back to my low expectations for the majority of our society to voluntarily start making the switch quickly and of significant magnitude.

No: I don’t foresee the alts providing as much competition to oil/NG as coal will in the future. If China hadn’t expanded coal sourced energy as they have I would be getting a better price for my oil today. The alts so far haven’t cost me a penny IMHO.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: Oil's tipping point has passed

ROCKMAN, Thanks again for your informative insights. I understand that we will have much less because that is what this thread is all about. We will not only have much less oil but also much less gas and coal. Peak oil has passed, peak gas and coal around 2020 (see Energy Watch Group courtesy of Arthur75 in Laherrere thread). So fossil fuels will not be dominant for decades. I sincerely hope that the world will switch to renewables quickly not only for environmental reasons but energy too. We will have no choice. Government policy is now urgently required to push renewables.

I have been trying to follow the biofuel story. My present understanding is that they will not be competitive until around 2020 or earlier.

I will be following the growth of all renewables worldwide with interest. Our future will depend on their rapid growth. Fingers crossed.

I have been trying to follow the biofuel story. My present understanding is that they will not be competitive until around 2020 or earlier.

Biofuel prices are anticipated to drop even further in coming years. A recent report by the Department of Energy’s Biomass Program (seen below) anticipates that the cost of producing biofuels could drop as low as $2.32 per gallon by 2017. In comparison, the US Energy Information Administration forecasts that the production cost of motor gasoline will be $3.65 per gallon by 2017 (both figures are not-weighed for inflation). Although these figures are subject to great variation by many confounding variables, it is probable that biofuels will be cost competitive within the decade.

I will be following the growth of all renewables worldwide with interest. Our future will depend on their rapid growth. Fingers crossed.

Human history becomes more and more a race between education and catastrophe. H. G. Wells.

Fatih Birol's motto: leave oil before it leaves us.

Fatih Birol's motto: leave oil before it leaves us.

-

Graeme - Fusion

- Posts: 13258

- Joined: Fri 04 Mar 2005, 04:00:00

- Location: New Zealand

Re: Oil's tipping point has passed

Graeme – The wording can be tricky. By dominant I’m not necessarily referring to what percentage of our energy mix will come from fossil fuels but how critical future shortages and higher energy costs will affect the world’s economies. Given my firm belief that switching to alts will go much slower than many expect it implies an ever increasing dependency on an ever decreasing commodity. In that sense dominance doesn’t imply a majority share but rather disproportionate and huge negative impact. As the old joke goes: falling off a 20 story building isn’t so bad. It’s that sudden stop that’s the problem.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: Oil's tipping point has passed

I disagree. It's abundantly clear that fossil fuels will not be available after 2020. I also know that that it is possible to switch by then. I think quite a lot of people are aware of this so the change may be faster than you think. Both of us can observe the changes over the next decade to see who is right.

Human history becomes more and more a race between education and catastrophe. H. G. Wells.

Fatih Birol's motto: leave oil before it leaves us.

Fatih Birol's motto: leave oil before it leaves us.

-

Graeme - Fusion

- Posts: 13258

- Joined: Fri 04 Mar 2005, 04:00:00

- Location: New Zealand

Re: Oil's tipping point has passed

Graeme - "It's abundantly clear that fossil fuels will not be available after 2020". I can't be reading you correctly: do you believe we'll have no fossil fuels being produced in just 7 years? Dang...I might just fight my MS long enough to make you eat them words, cowboy!. LOL.

Yes...many things are possible. And many of those are improbable. And that's why they have horse races...to settle the questions.

Yes...many things are possible. And many of those are improbable. And that's why they have horse races...to settle the questions.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: Oil's tipping point has passed

Graeme wrote:I disagree. It's abundantly clear that fossil fuels will not be available after 2020. I also know that that it is possible to switch by then. I think quite a lot of people are aware of this so the change may be faster than you think. Both of us can observe the changes over the next decade to see who is right.

LOL, April Fools? You can't be serious? I think a major transition has begun, but you can't honestly believe that fossil fuels won't be available after 2020?

"The human ability to innovate out of a jam is profound.That’s why Darwin will always be right, and Malthus will always be wrong.” -K.R. Sridhar

Do I make you Corny?

"expect 8$ gas on 08/08/08" - Prognosticator

Do I make you Corny?

"expect 8$ gas on 08/08/08" - Prognosticator

-

TheAntiDoomer - Heavy Crude

- Posts: 1556

- Joined: Wed 18 Jun 2008, 03:00:00

Re: Oil's tipping point has passed

ROCKMAN wrote:Graeme - "It's abundantly clear that fossil fuels will not be available after 2020". I can't be reading you correctly: do you believe we'll have no fossil fuels being produced in just 7 years? Dang...I might just fight my MS long enough to make you eat them words, cowboy!. LOL.

Yes...many things are possible. And many of those are improbable. And that's why they have horse races...to settle the questions.

Yes you are right. You are not reading me correctly. I said after 2020 (not at 2020) because that is when gas and coal will peak according to the Energy Watch Group. There is a tail which is not going to last as long as 2040 if you read the Exxon forecast. I believe the EWG and not Exxon.

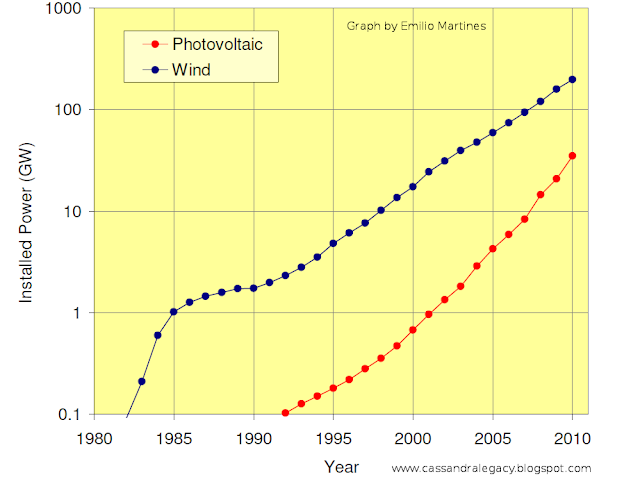

Solar and wind are growing exponentially as I pointed out in other threads. I'll re-post reference here in case you missed it.

Look at the data in the figure above, kindly provided by Emilio Martines, member of ASPO-Italy. The growth of photovoltaic and wind energy has been impressively fast during the past 2-3 decades. The log scale evidences the exponential growth of both technologies. There are no signs of slowdown, so far, despite recessions and the bad state of the economy. According to the graph, wind power grows of a factor 10 in less than 10 years, PV power takes little more than 5 years. At these rates, both wind and PC could reach the goal of one installed terawatt (TW) each around 2020.

resilience

So I'll repeat, provided solar and wind continue to grow at same rate everywhere, they will reach the required current amount of 2TW for global electricity supply by 2020.

And read this analysis of solar by Citigroup.

Human history becomes more and more a race between education and catastrophe. H. G. Wells.

Fatih Birol's motto: leave oil before it leaves us.

Fatih Birol's motto: leave oil before it leaves us.

-

Graeme - Fusion

- Posts: 13258

- Joined: Fri 04 Mar 2005, 04:00:00

- Location: New Zealand

Re: Oil's tipping point has passed

Thanks for the clarification. Expectations vary. I’m extremely confident oil and especially NG will be producing significant quantities post 2040. But not as much as today. Thus I also expect coal will more quickly replace oil/NG than the alts. Don’t know about the EWG but I wouldn’t believe XOM if they said 2 + 2 = 4. LOL. As far as the alts increasing exponentially that’s easy when you start at an insignificant level. IOW very easy to double when you start at 2%. Not so easy when you’re at 25%. Unfortunately I’m just as confident we’ll burn more coal with less regard about AGW then we have today.

But these are all just opinions that can’t be proved today. And everyone is quit welcome to theirs IMHO. Time will tell which opinions were valid. Fortunately if I’m wrong I won’t be around to have my words tossed back at me.

But these are all just opinions that can’t be proved today. And everyone is quit welcome to theirs IMHO. Time will tell which opinions were valid. Fortunately if I’m wrong I won’t be around to have my words tossed back at me.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: Oil's tipping point has passed

Hey ROCK, If the switch to renewables (solar/wind) is going to occur at an exponential rate, you will be alive to see it in about 10 years. I should be too and like peak oil we can look back in a rear-view mirror to see what has happened. Like the chinese say, these are interesting times.

Human history becomes more and more a race between education and catastrophe. H. G. Wells.

Fatih Birol's motto: leave oil before it leaves us.

Fatih Birol's motto: leave oil before it leaves us.

-

Graeme - Fusion

- Posts: 13258

- Joined: Fri 04 Mar 2005, 04:00:00

- Location: New Zealand

Re: Oil's tipping point has passed

It would be nice to have another 10 years to complain but I'm not counting on it. LOL. I think you're beginning to grasp the depth of my pessimism. I don't think the free market system will support a continued exponential growth in the alts. And I don't think the govt is capable of instituting a support effort that will be very effective. I think I can confuse folks sometimes as to what I think is important and what is absolutely critical changes we need to see in energy policies. But I don’t let that temper my expectations. Consider AGW for example. I understood the potential impact over 40 years ago as an earth science major. Studying the geologic record made it easy to appreciate. And I know how important it is to reduce the production of GHG.

OTOH I don’t give a crap about what I or anyone else thinks should be done when it comes to expectations. I base them on of how I think societies will respond. And I have poor expectations. Driving in this morning I was thinking about your exponential growth of alts. I don’t have time to dig the numbers out (if they are even available) but I suspect we’ve seen an exponential growth in coal-fired plants in China in recent years and have good reason to expect it to continue. Likewise we’ve had a nice uptick in domestic oil production thanks to unconventional reservoirs. But chasing oil for almost 4 decades also teaches me such gains are not sustainable. Likewise we’ve had a nice stabilization in gasoline consumption. Great that per capita stats are down. But we still consume 25% more today than when the country got that big wake-up call back in the late 70’s. Likewise we’ve spent $trillions (in borrowed monies future generations will have to repay) and countless lives protecting foreign oil resources.

IOW even with a tremendous amount of past motivation we are where we are today with regards to energy policies. With this history I see very little reason to expect a significant change in our path.

OTOH I don’t give a crap about what I or anyone else thinks should be done when it comes to expectations. I base them on of how I think societies will respond. And I have poor expectations. Driving in this morning I was thinking about your exponential growth of alts. I don’t have time to dig the numbers out (if they are even available) but I suspect we’ve seen an exponential growth in coal-fired plants in China in recent years and have good reason to expect it to continue. Likewise we’ve had a nice uptick in domestic oil production thanks to unconventional reservoirs. But chasing oil for almost 4 decades also teaches me such gains are not sustainable. Likewise we’ve had a nice stabilization in gasoline consumption. Great that per capita stats are down. But we still consume 25% more today than when the country got that big wake-up call back in the late 70’s. Likewise we’ve spent $trillions (in borrowed monies future generations will have to repay) and countless lives protecting foreign oil resources.

IOW even with a tremendous amount of past motivation we are where we are today with regards to energy policies. With this history I see very little reason to expect a significant change in our path.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: Oil's tipping point has passed

Well Graeme that explains it, here all this time I took you for an extreme corny but you're an extreme doomer!

My WAG way back was for peak about now and a bumpy ride downslope as economics and geology duke it out with anthropology. Indications are that is about right as far as it goes (falling discoveries, difficult oil, high price, All-The-Above energy policy, etc) but I'm hoping for a gentle slope and long tail, which compared to zero oil before 2040 is downright unicorn-ish.

My WAG way back was for peak about now and a bumpy ride downslope as economics and geology duke it out with anthropology. Indications are that is about right as far as it goes (falling discoveries, difficult oil, high price, All-The-Above energy policy, etc) but I'm hoping for a gentle slope and long tail, which compared to zero oil before 2040 is downright unicorn-ish.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Oil's tipping point has passed

Graeme is not a doomer. He's a technofix optimist who is pushing a narrative of "the stone age didn't end because of a lack of stones".

"If the oil price crosses above the Etp maximum oil price curve within the next month, I will leave the forum." --SumYunGai (9/21/2016)

-

ennui2 - Permanently Banned

- Posts: 3920

- Joined: Tue 20 Sep 2011, 10:37:02

- Location: Not on Homeworld

Re: Oil's tipping point has passed

Rockdoc and/or Rockman,

Ghawar is a critical field to everyone. I understand technology has allowed them to increase their watercut and avoid a steep decline. So, assume they can get up to a 70% cut, how close are they to that and, once reached, how will that affect the decline rate? Would it be like Cantarell?

Ghawar is a critical field to everyone. I understand technology has allowed them to increase their watercut and avoid a steep decline. So, assume they can get up to a 70% cut, how close are they to that and, once reached, how will that affect the decline rate? Would it be like Cantarell?

- seahorse3

- Lignite

- Posts: 375

- Joined: Tue 01 Mar 2011, 16:14:13

Re: Oil's tipping point has passed

ennui2 wrote:Graeme is not a doomer. He's a technofix optimist who is pushing a narrative of "the stone age didn't end because of a lack of stones".

That is almost right except that I am a little like ROCKMAN. I don't see the switch occurring fast enough to avoid environmental catastrophe. We also have to extract CO2 from air. No sign of that happening either. However, we have 20-30 years to do this so it is still possible. I just saw a survey reported in NYT, which indicates that most Republicans want action on climate change! Is a miracle going to happen?

Human history becomes more and more a race between education and catastrophe. H. G. Wells.

Fatih Birol's motto: leave oil before it leaves us.

Fatih Birol's motto: leave oil before it leaves us.

-

Graeme - Fusion

- Posts: 13258

- Joined: Fri 04 Mar 2005, 04:00:00

- Location: New Zealand

40 posts

• Page 2 of 2 • 1, 2

Return to Peak oil studies, reports & models

Who is online

Users browsing this forum: No registered users and 9 guests